Executive summary:

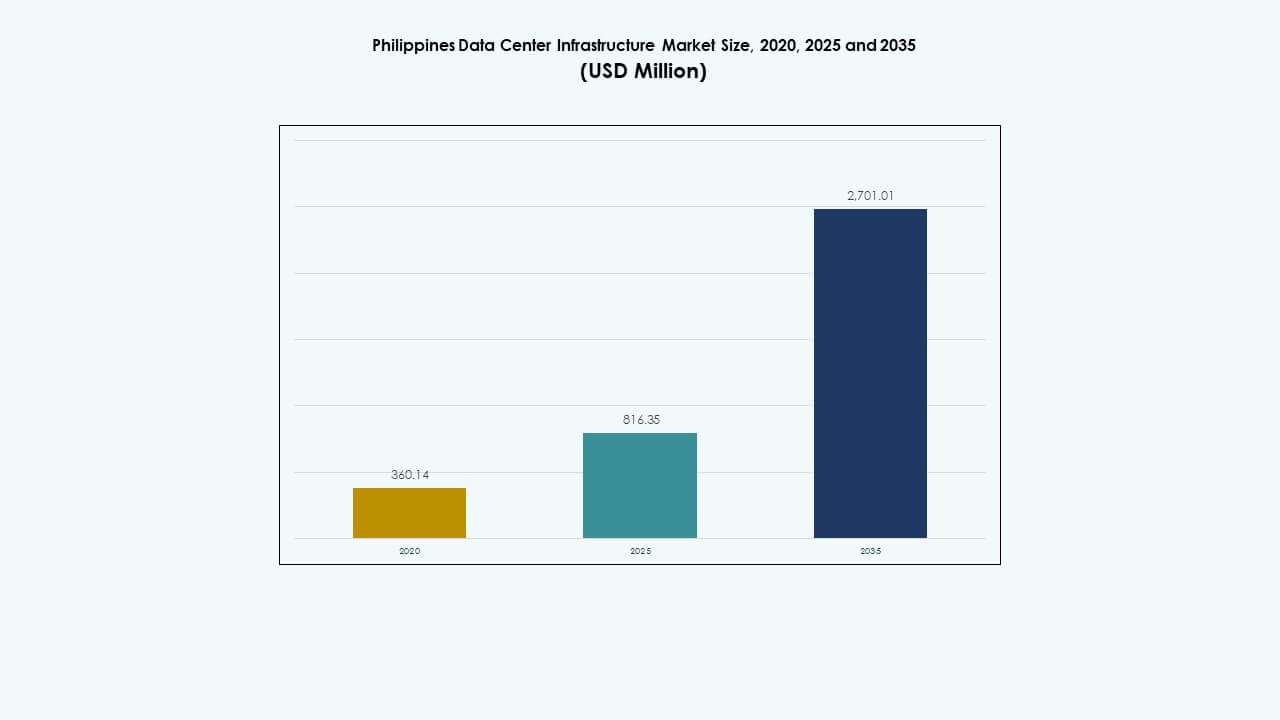

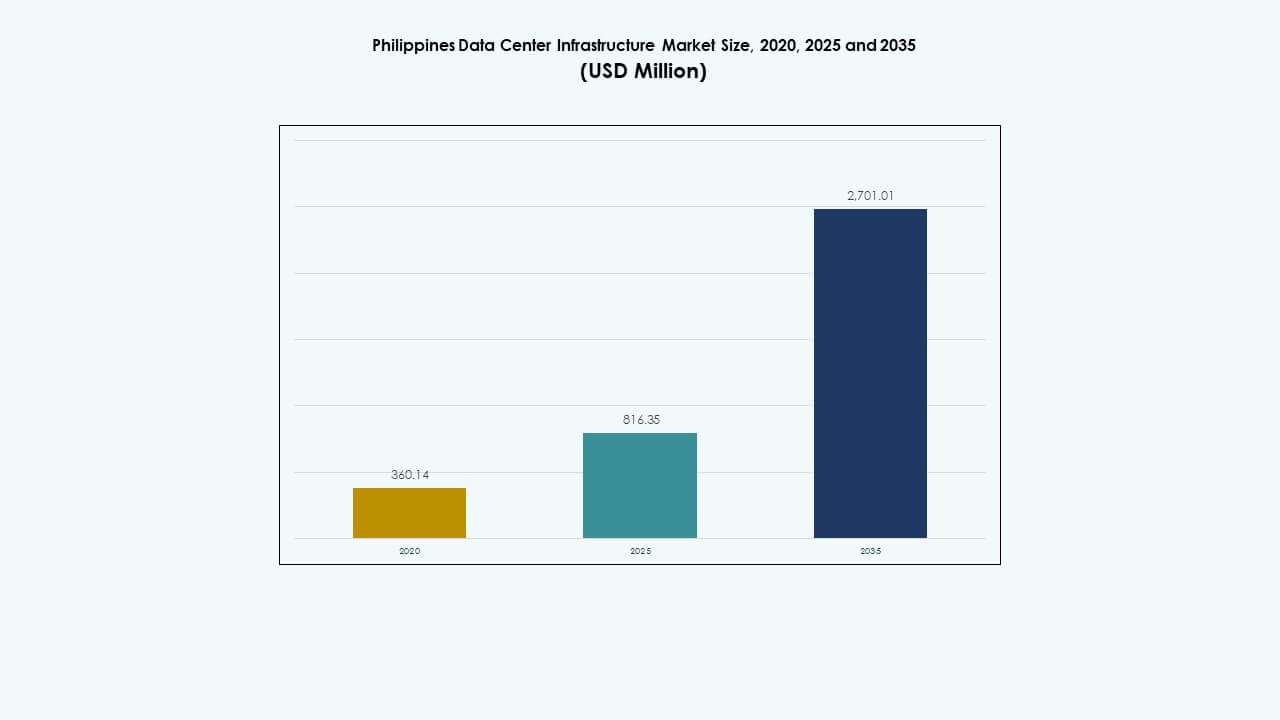

The Philippines Data Center Infrastructure Market size was valued at USD 360.14 million in 2020 to USD 816.35 million in 2025 and is anticipated to reach USD 2,701.01 million by 2035, at a CAGR of 12.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Philippines Data Center Infrastructure Market Size 2025 |

USD 816.35 Million |

| Philippines Data Center Infrastructure Market, CAGR |

12.61% |

| Philippines Data Center Infrastructure Market Size 2035 |

USD 2,701.01 Million |

The market grows due to strong cloud adoption, enterprise digitization, and telecom network expansion. Businesses shift workloads to local data centers to meet latency and compliance needs. Innovation in power, cooling, and modular design improves efficiency and uptime. Hyperscale and colocation demand reshapes infrastructure planning. For investors, the market offers stable returns through long-term contracts. It supports digital transformation across finance, retail, and public services.

Metro Manila leads due to high enterprise density, strong fiber connectivity, and colocation demand. Central Luzon emerges as a key growth area due to land availability and industrial zones. Visayas, led by Cebu, gains traction from IT services and regional enterprises. Mindanao shows early growth driven by public sector digitization. These regions shape a balanced expansion path for national infrastructure development.

Market Drivers

Market Drivers

Rapid Cloud Adoption and Digital Government Programs Accelerating Infrastructure Investment Across the Country

Cloud migration, fintech expansion, and e-government platforms are creating strong demand for data center capacity. Government-backed digitalization frameworks drive rapid enterprise cloud shifts. Public and private sectors need scalable, low-latency infrastructure for real-time applications. Edge deployment grows to meet local traffic demands. Strategic alliances with telecom firms enhance last-mile connectivity. Infrastructure providers invest in secure, modular designs. The Philippines Data Center Infrastructure Market is a focal point for regional data localization. Enterprises pursue compliant hosting models to reduce cross-border risks. Investors see high potential for ROI in this digital-first economy.

- For example, ePLDT’s VITRO Sta. Rosa officially launched in July 2024 with 50 MW IT capacity. It is the Philippines’ first AI-ready hyperscale data center, designed to support cloud adoption and high-density workloads.

Strategic Enterprise Transformation Fueling Demand for Energy-Efficient and High-Density Infrastructure

Enterprise cloud transformation is pushing demand for energy-efficient, high-density facilities. Financial services and e-commerce players lead with rapid digital adoption. The market supports hybrid cloud architectures and AI workloads. Operators deploy advanced UPS and BESS systems to ensure energy stability. Rising rack power density shifts focus toward liquid and immersion cooling. High availability zones are emerging in key industrial hubs. It strengthens disaster recovery strategies for multinationals. The Philippines Data Center Infrastructure Market benefits from regulatory clarity around cloud data compliance. Foreign investors and global cloud players expand footprint through local partnerships.

- For instance, PLDT has publicly stated long‑term plans to expand its data center capacity toward 500 MW in the Philippines, with ePLDT operating the country’s largest data center portfolio under the VITRO brand. Industry reports also indicate that total installed data center capacity across all operators in the Philippines is estimated at around 560 MW by 2025, reflecting cumulative market capacity rather than a single company’s achievement.

Rising Edge Computing Deployments Driving Infrastructure Expansion in Secondary Cities and Industrial Hubs

Edge computing growth is reshaping infrastructure deployment models across the country. Demand surges for latency-sensitive applications in logistics, fintech, and retail. Edge sites support smart city deployments and real-time analytics. Fiber rollouts in provincial capitals improve edge access feasibility. Modular systems enable faster deployment in emerging cities. It enhances business continuity for regional operations. Government initiatives promote industrial development in new zones. Tier III ready edge facilities emerge near ports and airports. The Philippines Data Center Infrastructure Market gains from this urban-industrial synergy.

Regulatory Support, Land Availability, and Green Energy Policies Supporting Long-Term Investment

The national government backs infrastructure expansion through investment incentives and regulatory easing. Tax breaks and land-use clearances attract global operators. Renewable energy mandates encourage solar and hydro-powered data centers. Green building codes push sustainable design integration. Long-term leases and REIT frameworks attract institutional investors. Power utility partnerships stabilize energy provisioning. The Philippines Data Center Infrastructure Market aligns with sustainability targets and regional resilience goals. Data centers become integral to disaster recovery, e-commerce, and financial services.

Market Trends

Expansion of Build-to-Suit and Modular Factory-Built Facilities for Flexible and Scalable Deployments

Operators are embracing modular, prefabricated designs to fast-track deployments. Build-to-suit facilities reduce construction risk and allow customization. Containerized units and factory-built modules improve site installation timelines. Flexible layouts meet hyperscale and enterprise needs. Prefab components streamline civil works, electrical setup, and mechanical systems. Vendors offer integrated power-cooling enclosures with tested interoperability. The Philippines Data Center Infrastructure Market benefits from this modular scalability. Modular builds also enhance asset reusability across sites. Operators scale capacity faster while managing upfront costs.

Rising Integration of Liquid Cooling and AI-Ready Infrastructure for Next-Generation Workloads

Data centers are adopting advanced cooling to manage increasing rack densities. Liquid cooling enables efficient heat removal in AI and HPC deployments. Facilities upgrade to support high-performance GPUs and AI accelerators. Cold plate and immersion systems gain traction across new builds. Design-build firms integrate AI-optimized power and thermal management systems. Server architecture evolves to support AI and big data use cases. It supports sustainable AI expansion. The Philippines Data Center Infrastructure Market sees early adoption in fintech and telecom clouds.

Deployment of Renewable Energy Integration and Microgrids in Power-Hungry Urban Facilities

Energy-intensive workloads push operators to integrate renewables into their energy mix. Onsite solar, battery storage, and hybrid microgrids improve reliability. Colocation firms enter PPAs with renewable suppliers. Grid instability in peak seasons raises interest in independent energy systems. Green energy-backed certifications influence client preferences. Battery storage systems smooth power variability and reduce reliance on diesel gensets. It improves both cost-efficiency and sustainability compliance. The Philippines Data Center Infrastructure Market shows rising investment in low-carbon infrastructure.

Greater Focus on Regional Edge Nodes and Smart City Infrastructure for Distributed Services

Smart city projects and IoT growth accelerate the deployment of regional data nodes. Edge data centers support real-time data processing in smart transport and utilities. Local governments invest in ICT zones across secondary provinces. Industrial estates demand low-latency services near logistics hubs. Local caching and regional CDN nodes improve content delivery. Mobile operators co-locate small edge clusters in 5G base stations. It enhances service agility. The Philippines Data Center Infrastructure Market evolves into a distributed, hybrid edge-core architecture.

Market Challenges

Energy Infrastructure Bottlenecks, Power Stability Risks, and Delayed Grid Connections in Urban Areas

Power availability remains a key concern across metro zones. Grid congestion delays new project connections. Long permit cycles slow electrical integration. Diesel backup dependency persists in several urban areas. High electricity tariffs impact operating costs. Renewable integration faces land and grid constraints. Unscheduled outages affect uptime SLAs. Power-intensive AI workloads worsen strain on legacy systems. The Philippines Data Center Infrastructure Market must overcome power-related challenges to scale sustainably.

Limited Skilled Workforce, High Land Costs, and Complex Permitting Impede Rapid Expansion

Data center development faces land acquisition and permitting hurdles. Key metro areas have limited low-cost land zoned for industrial ICT use. Permitting and local clearances extend project timelines. Skilled labor for MEP and IT integration is limited. Operators must import or train specialists. Talent shortages raise project CAPEX and deployment risks. Lack of certified design-build firms limits modular rollout scale. The Philippines Data Center Infrastructure Market needs coordinated training, policy clarity, and faster clearance frameworks.

Market Opportunities

Market Opportunities

Government E-Governance Push and Telco Partnerships Unlock New Site Opportunities in Emerging Regions

Digital public services, smart cities, and education platforms increase demand for regional hosting. Partnerships with telecom operators create backbone infrastructure in non-metro zones. Local governments support ICT investment through land grants and permits. Cloud adoption in healthcare and education adds workload variety. The Philippines Data Center Infrastructure Market gains edge growth momentum in tier-two locations. Greenfield sites allow energy-efficient designs and scalable formats.

Sustainability Mandates and Investment Incentives to Accelerate Green Infrastructure and Foreign FDI

Government pushes for energy efficiency unlock foreign green finance. REIT structures and tax incentives attract hyperscale builders. Sustainable procurement criteria favor green-certified facilities. Carbon credits and ESG-linked lending reduce financing risks. It accelerates infrastructure modernization and Tier III+ upgrades. The Philippines Data Center Infrastructure Market is positioned to attract ESG-focused capital through clean builds.

Market Segmentation

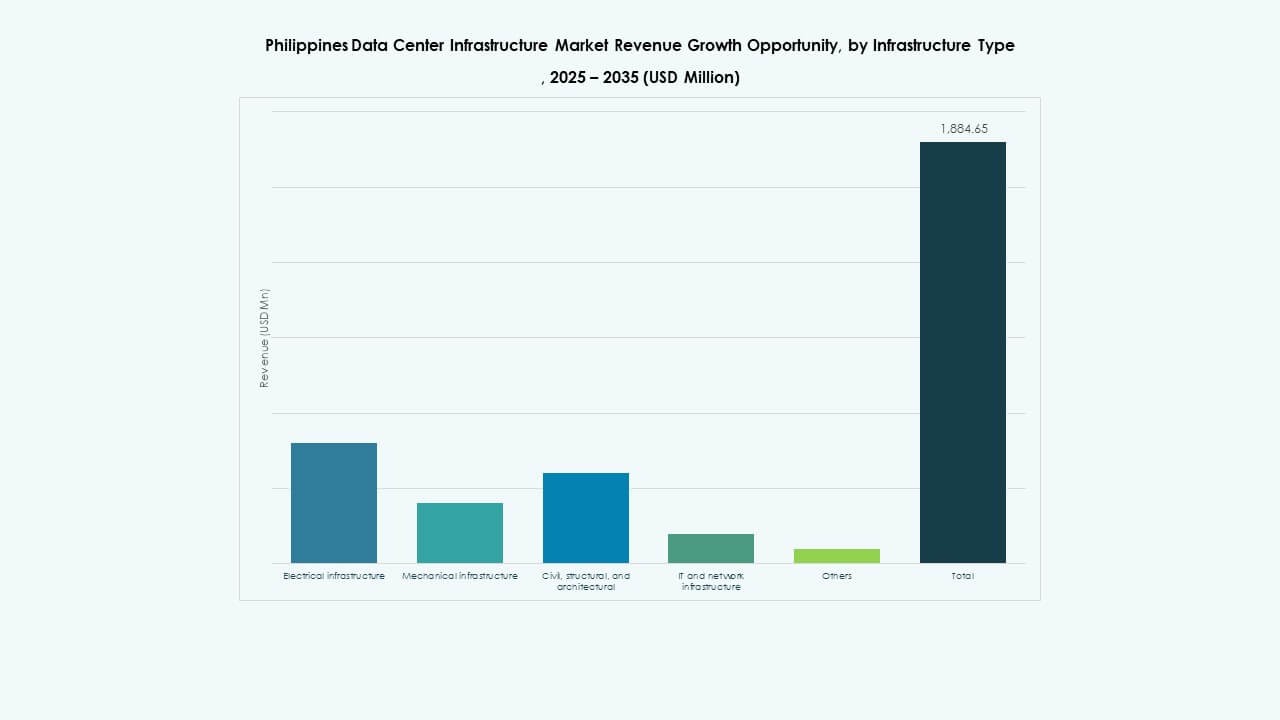

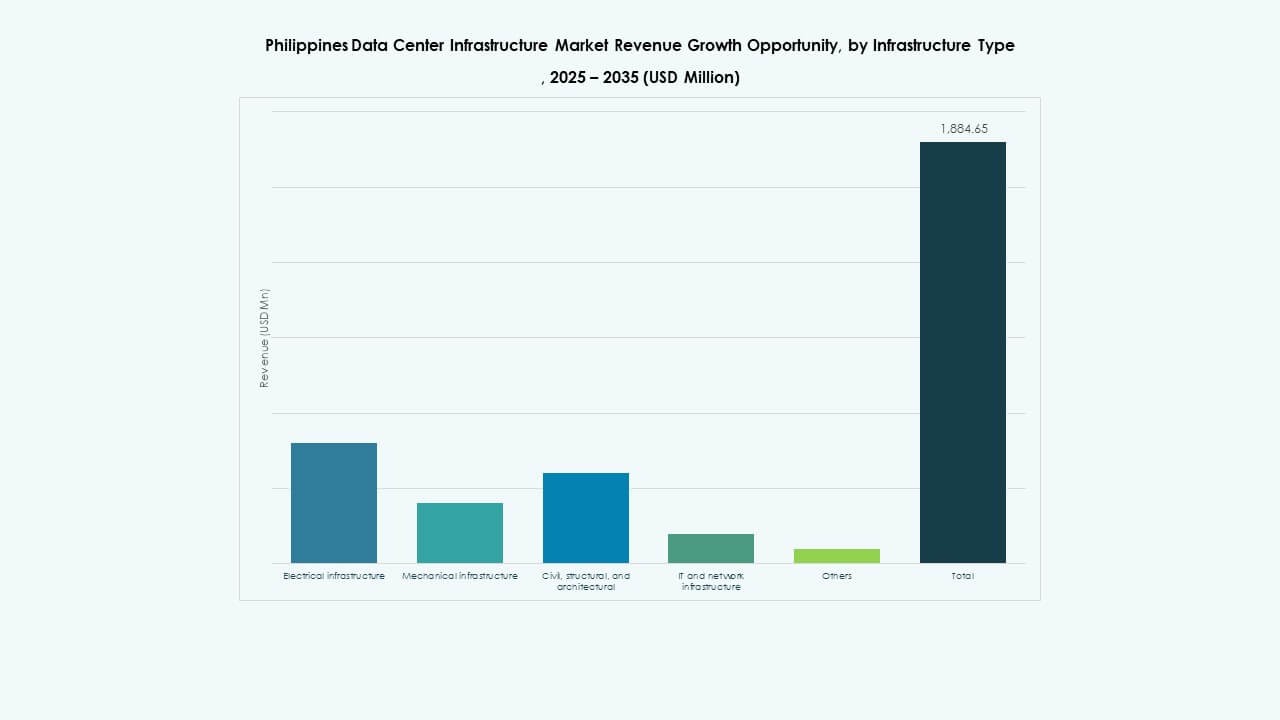

By Infrastructure Type

The Philippines Data Center Infrastructure Market is segmented into electrical, mechanical, civil/structural, IT & network infrastructure, and others. Electrical infrastructure holds a dominant share due to power-intensive operations. IT and network infrastructure also grows with rising enterprise workloads. Mechanical infrastructure gains attention from cooling upgrades. Structural investments remain critical for seismic resilience. Modular civil builds offer flexibility in greenfield locations.

By Electrical Infrastructure

The uninterruptible power supply (UPS) segment leads due to rising uptime standards and hybrid energy integration. Power distribution units follow as high-density designs evolve. Battery energy storage systems grow due to renewable integration efforts. Grid connection upgrades remain essential in new economic zones. Transfer switches and switchgears help in load balancing. Utility service deals shape capacity planning in urban hubs.

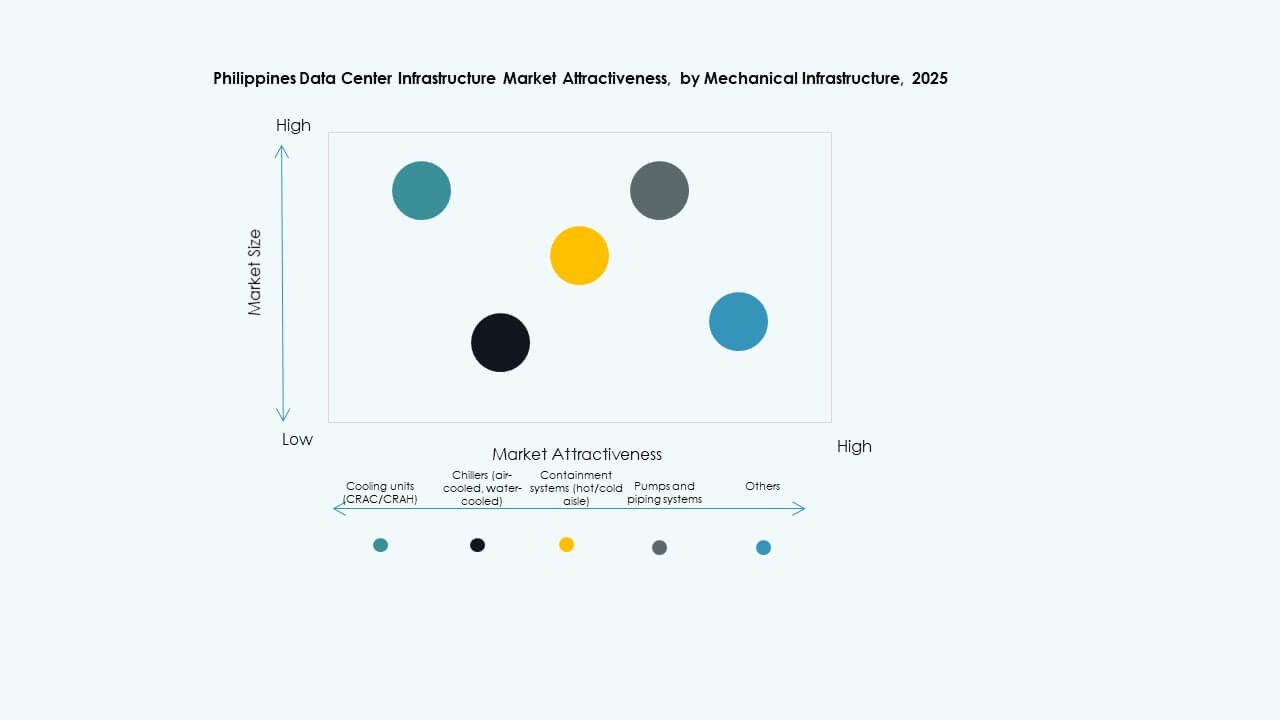

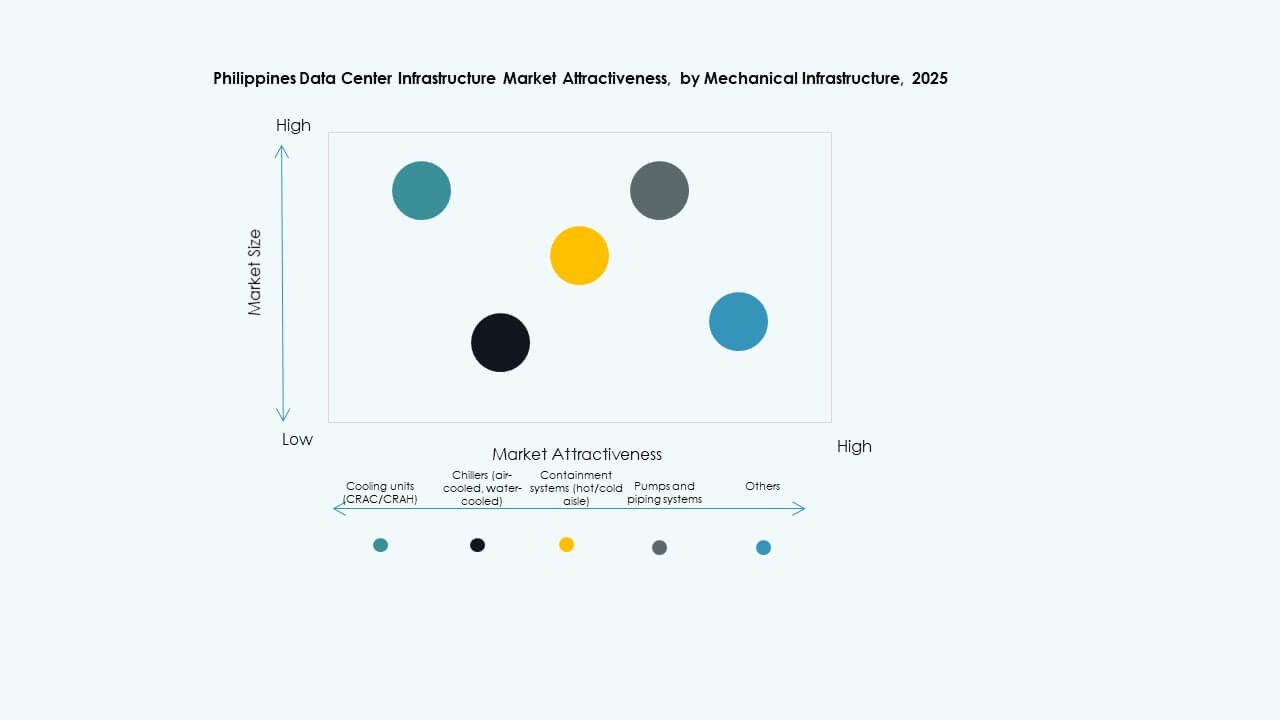

By Mechanical Infrastructure

Cooling units dominate the mechanical segment with growing heat loads. Chillers and containment systems support optimized airflow in confined spaces. Liquid and immersion cooling adoption is growing among AI and HPC workloads. Modular pumps and piping systems improve efficiency and lower CAPEX. Secondary cities deploy smaller, modular systems for edge setups.

By Civil / Structural & Architectural

Superstructure and building envelope upgrades dominate civil investments in hyperscale projects. Raised flooring and modular ceilings support flexible airflow. Seismic zones require reinforced foundations and structural resilience. Site preparation in greenfield zones remains cost-efficient. Modular buildings enable phased capacity deployment across expanding campuses.

By IT & Network Infrastructure

Networking equipment and servers account for the largest share. AI deployments push adoption of high-density racks and GPU clusters. Fiber connectivity and cabling upgrades support edge computing growth. Enclosure systems ensure physical security and efficient airflow. Storage grows as digital content and cloud backup demands rise.

By Data Center Type

Colocation data centers lead the market share due to growing enterprise outsourcing. Hyperscale growth is accelerating with cloud players entering the Philippines. Edge data centers gain traction in logistics and retail sectors. Enterprise-owned sites remain in banking and telecom verticals. Retrofit projects drive modernization of older facilities.

By Delivery Model

Design-build or EPC remains the most adopted delivery model for large-scale projects. Turnkey and modular factory-built formats grow in edge and remote site projects. Construction management remains critical in compliance-heavy builds. Retrofit solutions help in cost-effective modernizations. Fast deployment models attract cloud-native enterprises.

By Tier Type

Tier III data centers dominate the market with balanced cost and uptime. Tier IV adoption is rising in financial and public sector facilities. Tier II still exists in legacy enterprise facilities but faces phase-out. Tier I sites are rare and not preferred for mission-critical workloads.

Regional Insights

Regional Insights

Metro Manila – 54% Share, National Capital Region Dominates with Dense Network and Colocation Demand

Metro Manila remains the epicenter of the Philippines Data Center Infrastructure Market with over 54% share. Quezon City, Makati, and Taguig lead due to enterprise clustering, financial hubs, and telecom density. Strong fiber backbone and skilled workforce support hyperscale and colocation developments. Real estate availability for industrial use remains a constraint, pushing demand to fringes.

- For example, STT GDC Philippines completed a 1.2MW Tier III data center in Makati City, supporting approximately 100 racks with loads up to 12kW per rack.

Central Luzon – 25% Share, Emerging Zone with Industrial Growth and Land Availability

Central Luzon holds nearly 25% market share, led by Clark Freeport and Subic. Land availability and government incentives attract hyperscale builders. Industrial estates and airport connectivity favor edge deployments. Infrastructure investment in power and connectivity grows. The region is poised for long-term data infrastructure growth.

Visayas and Mindanao – 21% Share Combined, Early Growth with Public Sector and Edge Use Cases

Visayas and Mindanao collectively hold around 21% share. Cebu leads in the Visayas with enterprise demand and rising fintech activity. Davao and Cagayan de Oro show early investment interest. Local governments support digital infrastructure expansion. Public sector digitization and education services drive regional hosting needs. Edge facilities are emerging to reduce latency in underserved regions.

- For example, ePLDT VITRO Cebu 2 delivers 8MW fully built-out power across 5,855 square meters of whitespace, accommodating full cabinets, cages, and suites with 2N redundancy in UPS, cooling, and standby power.

Competitive Insights:

- ePLDT Inc.

- ST Telemedia Global Data Centres

- Equinix, Inc.

- Bee Information Technology

- Huawei Technologies Co., Ltd.

- Dell Inc.

- Schneider Electric

- Vertiv Group Corp.

- IBM

- Cisco Systems, Inc.

The Philippines Data Center Infrastructure Market features a mix of domestic providers and global infrastructure leaders. ePLDT and ST Telemedia lead with established hyperscale and colocation footprints. Equinix leverages its global interconnection ecosystem to attract high-value enterprise clients. Huawei, Dell, and Schneider Electric supply core equipment, including UPS, cooling, and modular solutions. Vertiv and Cisco dominate in power management and network systems, respectively. IBM and Bee Information Technology compete in enterprise cloud and integration services. Market competition focuses on Tier III-ready builds, energy-efficient systems, and fast deployment models. Strategic alliances with telecom carriers and utility firms strengthen operator positioning. It reflects a shift toward high-density, resilient, and scalable infrastructure to serve evolving enterprise workloads. Players compete on uptime guarantees, regional coverage, and compliance-driven designs tailored to Philippine regulations.

Recent Developments:

- In December 2025, A-FLOW launched ML1, its first data center in the Philippines, representing a joint venture effort to expand the country’s digital capacity through this new facility.

- In June 2025, Equinix completed the acquisition of three carrier-neutral data centers from Total Information Management (TIM) in Makati and Cavite, marking the company’s entry into the Philippines market and enhancing its digital infrastructure footprint.

Market Drivers

Market Drivers

Market Opportunities

Market Opportunities Regional Insights

Regional Insights