Executive summary:

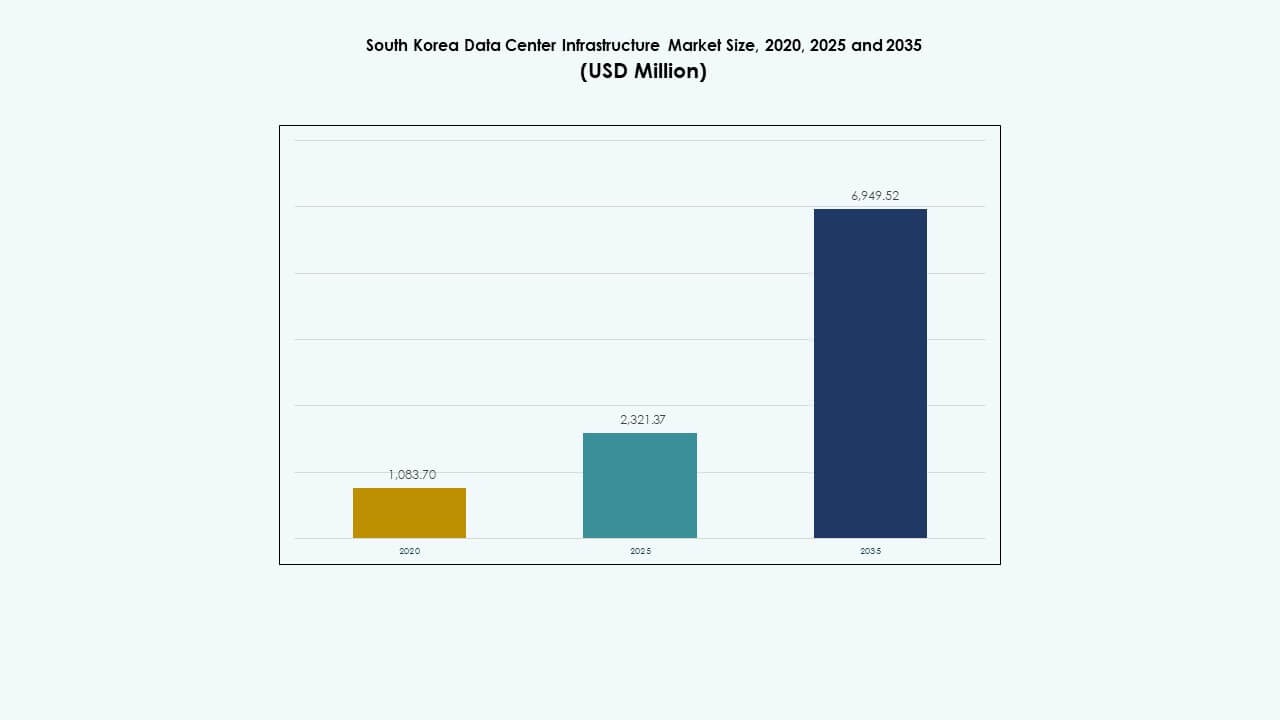

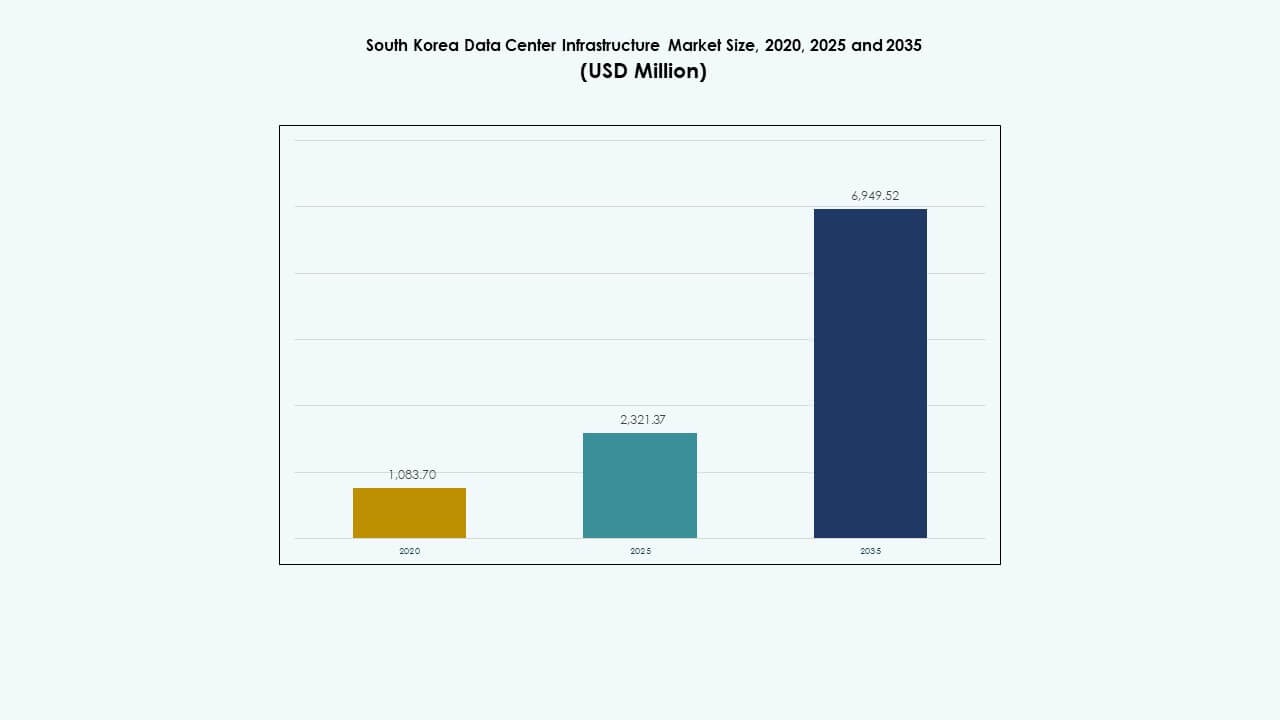

The South Korea Data Center Infrastructure Market size was valued at USD 1,083.70 million in 2020, grew to USD 2,321.37 million in 2025, and is anticipated to reach USD 6,949.52 million by 2035, at a CAGR of 11.49% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| South Korea Data Center Infrastructure Market Size 2025 |

USD 2,321.37 Million |

| South Korea Data Center Infrastructure Market, CAGR |

11.49% |

| South Korea Data Center Infrastructure Market Size 2035 |

USD 6,949.52 Million |

The market is advancing rapidly due to widespread AI adoption, high-density computing needs, and national support for digital transformation. Businesses prioritize modular designs, green energy integration, and edge capabilities to meet real-time data demands. Continuous innovation in cooling, power delivery, and smart monitoring is reshaping infrastructure models. The market holds strategic importance for investors seeking long-term returns in AI, telecom, and hyperscale cloud ecosystems.

The Seoul Capital Area leads due to dense enterprise presence, financial institutions, and existing hyperscale data centers. Incheon and Gyeonggi are emerging as expansion zones with better grid access and land availability. Regional hubs like Busan and Daejeon support edge computing and regional workload distribution, helping decentralize infrastructure and reduce urban stress.

Market Drivers

Market Drivers

Surging Cloud Adoption and Strong Government Support for Digital Infrastructure Modernization

Cloud service expansion drives large-scale data center investment. Major cloud providers, including Naver Cloud and KT, invest in hyperscale facilities. South Korea’s Digital New Deal promotes data localization and public cloud transformation. The government allocates significant funding to support AI, 5G, and smart city platforms. These initiatives demand scalable digital infrastructure. Investors see long-term value in this regulatory-backed ecosystem. The South Korea Data Center Infrastructure Market benefits from policy alignment and rising data processing needs. It remains a strategic asset for digital services. It supports resilient infrastructure growth across industries.

- For instance, Naver Cloud’s Gak Chuncheon data center spans a gross floor area of about 46,850 m², roughly the size of seven soccer fields, and supports around 100,000 server units. The facility showcases large‑scale infrastructure capacity and reinforces South Korea’s position in advanced cloud and AI computing. This project highlights robust investment in hyperscale digital infrastructure.

Rapid Rise of AI Workloads and Demand for High-Density Computing Environments

AI applications create demand for GPU-powered compute racks and high-density cooling systems. Enterprises adopt AI for natural language processing, computer vision, and predictive analytics. This shift requires dense server configurations and robust power delivery. South Korea’s tech ecosystem pushes hyperscalers to enhance rack densities beyond 50 kW. Liquid and immersion cooling systems gain adoption to manage thermal loads. Operators also upgrade UPS and power distribution units for load balancing. The South Korea Data Center Infrastructure Market supports these deployments with modular designs. It enables AI scalability within space-constrained urban zones. It aligns with global trends in compute intensity.

Growing Edge Deployments to Meet Latency-Sensitive Application Demands

Emerging applications like autonomous vehicles, AR/VR, and telemedicine rely on low-latency data access. Urban edge facilities reduce backhaul traffic and enhance response times. Telecom operators deploy MEC (multi-access edge computing) nodes across city networks. 5G networks boost demand for localized compute zones. Government-backed smart factory zones further accelerate edge deployments. IT infrastructure providers expand compact, prefabricated units near user clusters. The South Korea Data Center Infrastructure Market supports distributed data management. It offers growth pathways beyond traditional core facilities. It reflects changing infrastructure patterns driven by application proximity.

- For instance, SK Telecom advances 5G multi‑access edge computing deployments integrated with urban networks to support low‑latency services and align with national 5G rollout targets. These urban edge facilities reduce backhaul traffic, enhance application response times, and improve service quality for real‑time use cases.

Corporate Sustainability Goals Driving Green Infrastructure and Renewable Integration

Enterprises prioritize sustainability, influencing infrastructure procurement decisions. LEED-certified data centers gain traction across financial and telecom sectors. Operators deploy liquid cooling, energy-efficient HVAC systems, and DCIM tools for energy optimization. South Korea’s RE100 commitment accelerates renewable energy sourcing in digital facilities. Naver’s Gak Data Center uses geothermal cooling and solar rooftops. Corporates set net-zero goals, aligning digital assets with ESG standards. The South Korea Data Center Infrastructure Market supports green construction frameworks. It becomes a core tool in corporate decarbonization strategy. It supports responsible digital expansion aligned with climate policies.

Market Trends

Market Trends

Increased Use of Modular Construction for Speed, Flexibility, and Cost Efficiency

Modular and prefabricated builds reduce lead times and on-site complexity. Operators prefer factory-built units for repeatability and quality control. Modules integrate mechanical, electrical, and IT systems for plug-and-play deployment. Projects achieve faster time to market, often under 12 months. Vendors offer customized pods with scalable capacity from 500 kW to 5 MW. Telecom and edge applications particularly benefit from this approach. Local firms partner with global modular solution providers. The South Korea Data Center Infrastructure Market adopts modular strategies for high-speed expansion. It supports rollout across secondary cities and smart industrial zones.

Rising Investment in Smart Infrastructure for Real-Time Monitoring and AI-Driven Optimization

Operators deploy smart sensors, BMS, and DCIM platforms to monitor and control infrastructure in real time. AI tools predict failure patterns, optimize power usage, and improve cooling efficiency. Smart grid integration enables dynamic power management with load forecasting. Data centers use ML-based thermal mapping to balance airflow and reduce hotspots. Robotics assist in physical maintenance and environmental checks. Remote operations minimize staffing needs at hyperscale sites. The South Korea Data Center Infrastructure Market advances smart infrastructure adoption. It enables high resilience and operational efficiency across digital campuses.

Shift Toward Multi-Tenant Facilities Amid Rising Demand for Scalability and Flexibility

Colocation demand grows due to cost efficiency, flexibility, and compliance. Enterprises prefer shared facilities for rapid expansion and managed services. Large players like Digital Realty and Equinix expand footprints in Seoul and Incheon. Domestic operators also increase floor space and power capacity to attract enterprise tenants. Hybrid cloud models fuel interconnection demand within these facilities. High-speed cross-connects support cloud-to-cloud and on-premises integration. The South Korea Data Center Infrastructure Market adapts to multi-tenant strategies. It supports dynamic capacity models for varying enterprise workloads.

Focus on Water-Efficient and Heat Reuse Technologies for Urban Compliance and ESG Reporting

Urban data centers face scrutiny over water and heat emissions. Operators deploy closed-loop cooling systems and air economization to reduce water intensity. Heat reuse technologies distribute excess thermal output to nearby residential and commercial buildings. Seoul-based facilities integrate heat exchange units into district heating networks. This approach supports regulatory compliance and urban sustainability plans. Real-time metrics track water use effectiveness (WUE) alongside traditional PUE. The South Korea Data Center Infrastructure Market adopts water-wise strategies. It aligns with dense city infrastructure needs and ESG disclosures.

Market Challenges

Market Challenges

Limited Land Availability and Power Access in Urban Zones Restrict Large-Scale Facility Expansion

Land scarcity in major urban regions limits greenfield developments. Permitting complexities delay site approvals, especially near residential areas. Power availability constraints worsen deployment timelines. Grid congestion in Seoul and Incheon regions restricts MW-scale expansion. Operators face rising costs for land acquisition and substation upgrades. Local zoning codes also restrict building heights and emissions. These constraints slow hyperscale growth in key cities. The South Korea Data Center Infrastructure Market must adapt to vertical builds, retrofits, and rural expansion. It reflects infrastructure stress in urban cores.

Cybersecurity, Regulatory Compliance, and Talent Shortages Create Operational Uncertainty

Growing cyber threats require layered security across physical and digital assets. Operators must comply with evolving data sovereignty and privacy laws. Financial and public-sector tenants demand strict compliance verification. Shortage of certified professionals in critical infrastructure roles worsens downtime risks. High OPEX and training gaps reduce operational efficiency. Strict ESG reporting also increases compliance costs. The South Korea Data Center Infrastructure Market faces operational strain from these factors. It demands strategic workforce and policy alignment to maintain resilience.

Market Opportunities

Surging AI and High-Performance Computing Demand Creates New Design and Investment Models

AI workloads and HPC clusters demand innovative facility designs with high-density racks and power draw. Operators develop AI zones within existing facilities and greenfield builds. Vendors offer immersion-cooled racks and smart power modules to serve such workloads. The South Korea Data Center Infrastructure Market supports this shift by enabling compute-intensive zoning and energy optimization.

Expansion into Secondary Cities Offers Potential for Edge and Modular Infrastructure Growth

Urban congestion drives development toward Busan, Daejeon, and Gwangju. These regions offer grid capacity and land at competitive rates. Modular and prefabricated designs support fast deployment. The South Korea Data Center Infrastructure Market finds growth in decentralized, edge-aligned regional builds.

Market Segmentation

Market Segmentation

By Infrastructure Type

The South Korea Data Center Infrastructure Market is dominated by electrical infrastructure, which accounts for the largest share. Strong power reliability requirements drive growth in uninterruptible power supply systems and energy-efficient battery storage. IT and network infrastructure also show strong growth with increasing AI and HPC deployments.

By Electrical Infrastructure

Uninterruptible power supply (UPS) and power distribution units hold dominant positions due to high reliability needs. Battery energy storage systems are rapidly growing due to sustainability goals. The market benefits from smart grid support and renewable energy backup designs.

By Mechanical Infrastructure

Cooling units and containment systems dominate mechanical infrastructure spending. Liquid cooling systems are gaining traction to support high-density computing. Chillers and precision air conditioners remain essential for stable thermal environments.

By Civil / Structural & Architectural

Superstructure and modular building systems form the core of civil infrastructure deployment. Demand for modular steel frames and raised flooring systems supports flexible capacity expansion. These systems reduce lead times and enable quick retrofits.

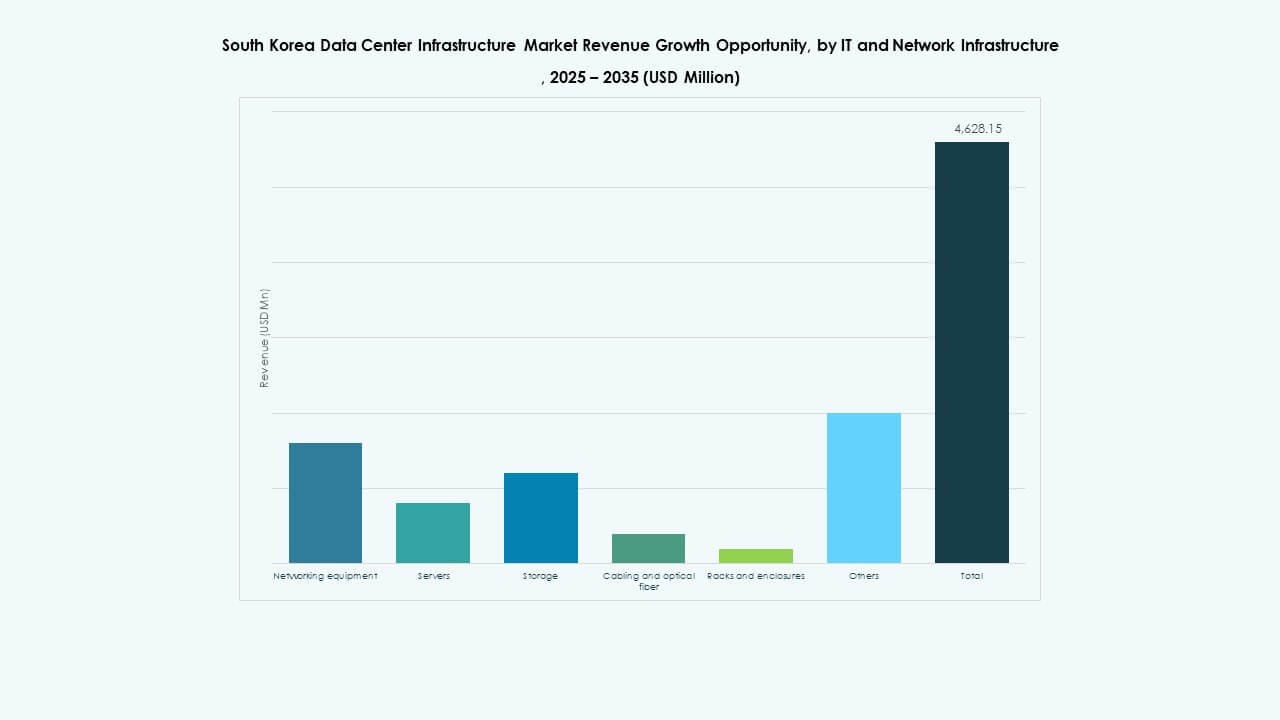

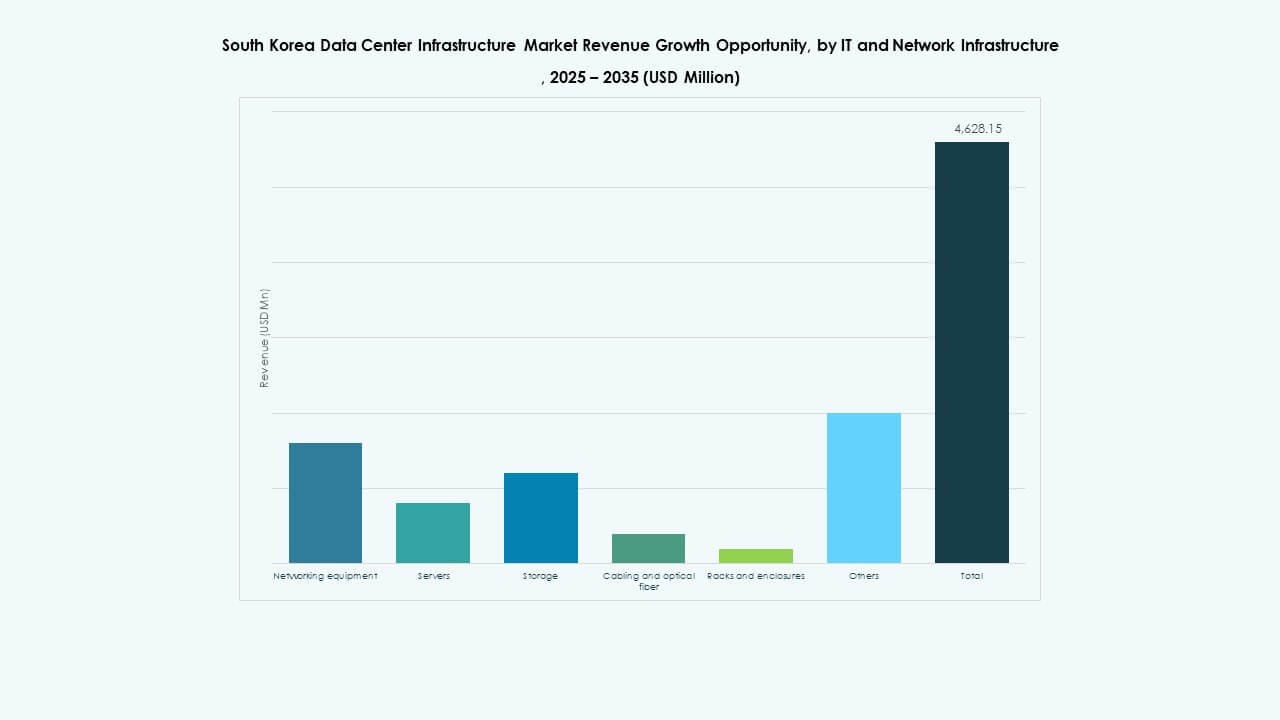

By IT & Network Infrastructure

Servers and networking equipment dominate IT infrastructure segments. AI clusters and cloud-native workloads push demand for scalable storage and high-speed cabling. Rack density increases support growth in advanced cooling and power delivery systems.

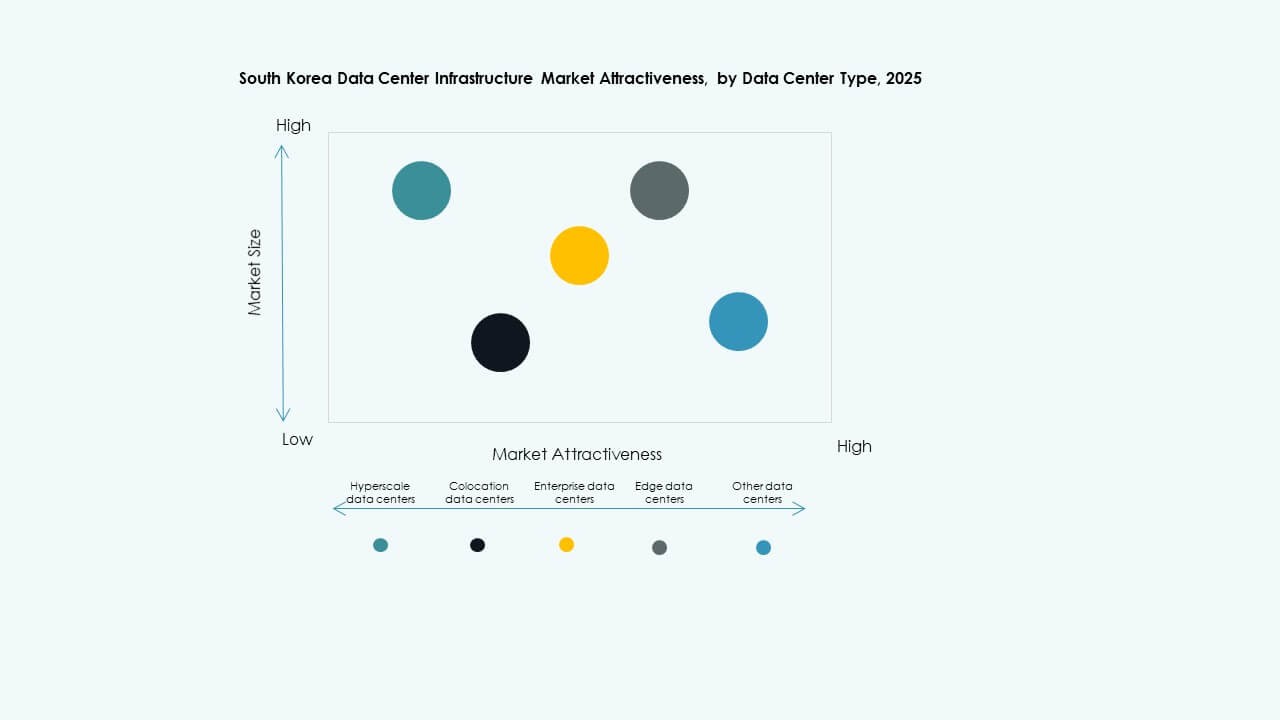

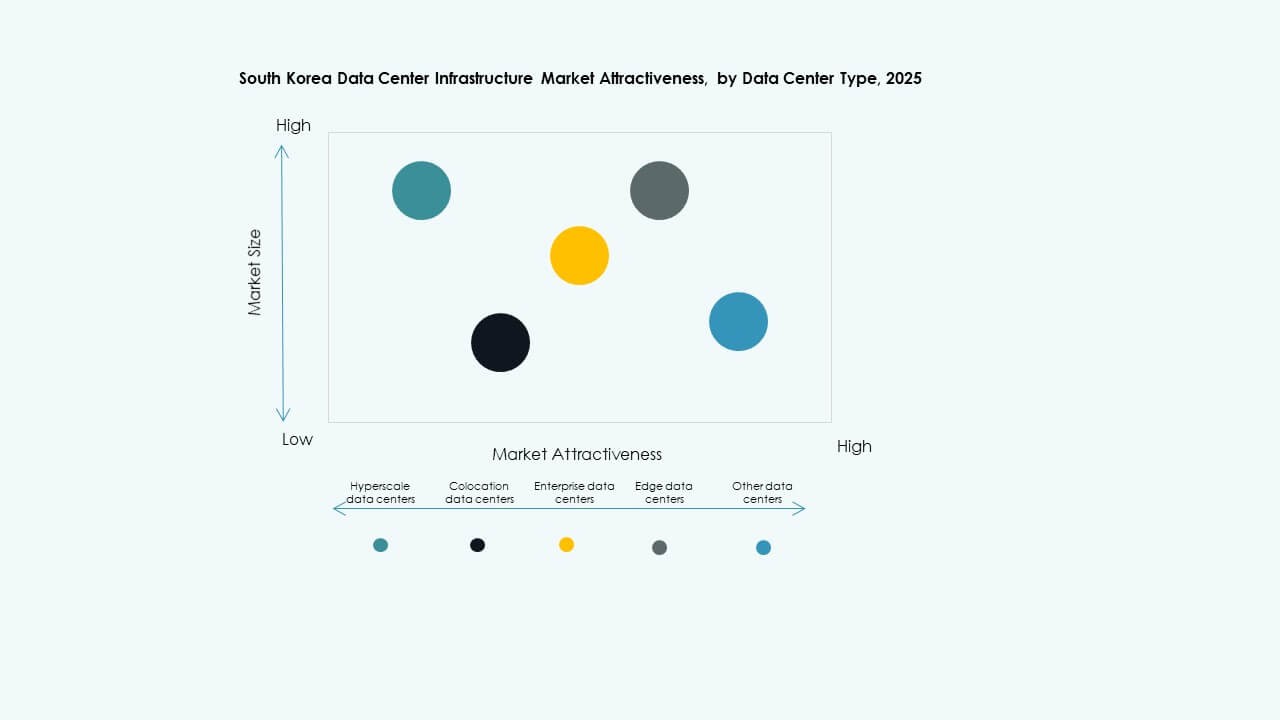

By Data Center Type

Hyperscale data centers lead the market with the highest share, driven by cloud service expansion. Colocation data centers follow closely, favored by enterprises seeking flexibility and managed infrastructure. Edge data centers gain traction near 5G and industrial zones.

By Delivery Model

Turnkey and design-build models dominate the market due to time-sensitive deployments. Modular factory-built systems gain preference for repeatable, scalable builds. Retrofit and upgrade models grow with digital transformation in legacy enterprise sites.

By Tier Type

Tier 3 facilities dominate with robust uptime and redundancy features. Tier 4 gains adoption among financial and public-sector workloads requiring maximum fault tolerance. Tier 2 and Tier 1 remain in use for edge and regional deployments.

Regional Insights

Regional Insights

Seoul Capital Area Holds the Largest Market Share with Dense Demand Clusters

The Seoul Capital Area accounts for over 60% of the South Korea Data Center Infrastructure Market. Its dense population and concentration of enterprises drive strong demand for hyperscale and colocation facilities. It remains the core hub for cloud providers, telecom firms, and financial institutions. High land and power costs constrain new builds but encourage vertical retrofits. The market here evolves through smart upgrades, high-density deployments, and hybrid cloud enablement.

- For instance, Equinix launched its SL4 International Business Exchange (IBX) data center within the SL2x xScale site in Goyang‑si, Gyeonggi‑do, providing capacity for 475 cabinets to support cloud, network, and AI‑oriented infrastructure. This facility strengthens digital infrastructure in South Korea and enhances connectivity for local and global cloud providers, telecoms, and enterprise networks.

Incheon and Gyeonggi Province Support Expansion with Land Availability and Grid Access

Incheon and Gyeonggi regions collectively account for 25% of the market share. These areas offer space for greenfield developments and better access to power grids. Major hyperscalers choose these locations for campus-scale data centers. Regional governments support digital infrastructure with industrial cluster incentives. Proximity to Seoul ensures connectivity while reducing urban pressure.

Emerging Regional Hubs Drive Growth Beyond Core Metropolitan Zones

Busan, Daejeon, and Daegu represent emerging hubs, holding around 15% of the market. They support edge computing, public-sector digitization, and secondary enterprise zones. Competitive land rates, lower latency needs, and modular construction fuel market entry. These subregions are key for balancing national digital infrastructure expansion. The South Korea Data Center Infrastructure Market finds decentralization momentum across these urban-rural edges.

- For instance, in 2025, Gyeonggi Province allocated ₩1 trillion to develop AI data center clusters and digital infrastructure hubs, supporting large-scale compute and regional innovation. This investment strengthens South Korea’s national AI ecosystem through hyperscale infrastructure expansion.

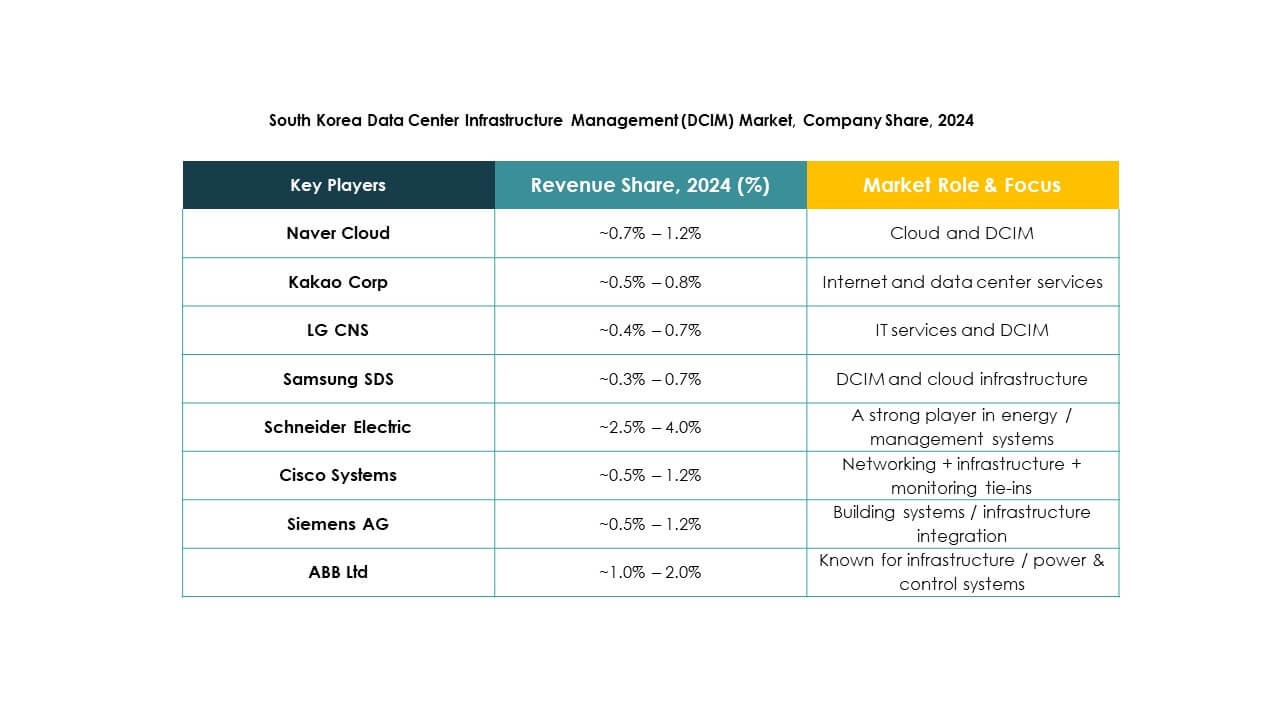

Competitive Insights:

- Delta Electronics

- Hitachi, Ltd.

- Huawei Technologies Co., Ltd.

- IBM

- Cummins

- ABB

- Cisco Systems, Inc.

- Equinix, Inc.

- Schneider Electric

- Vertiv Group Corp.

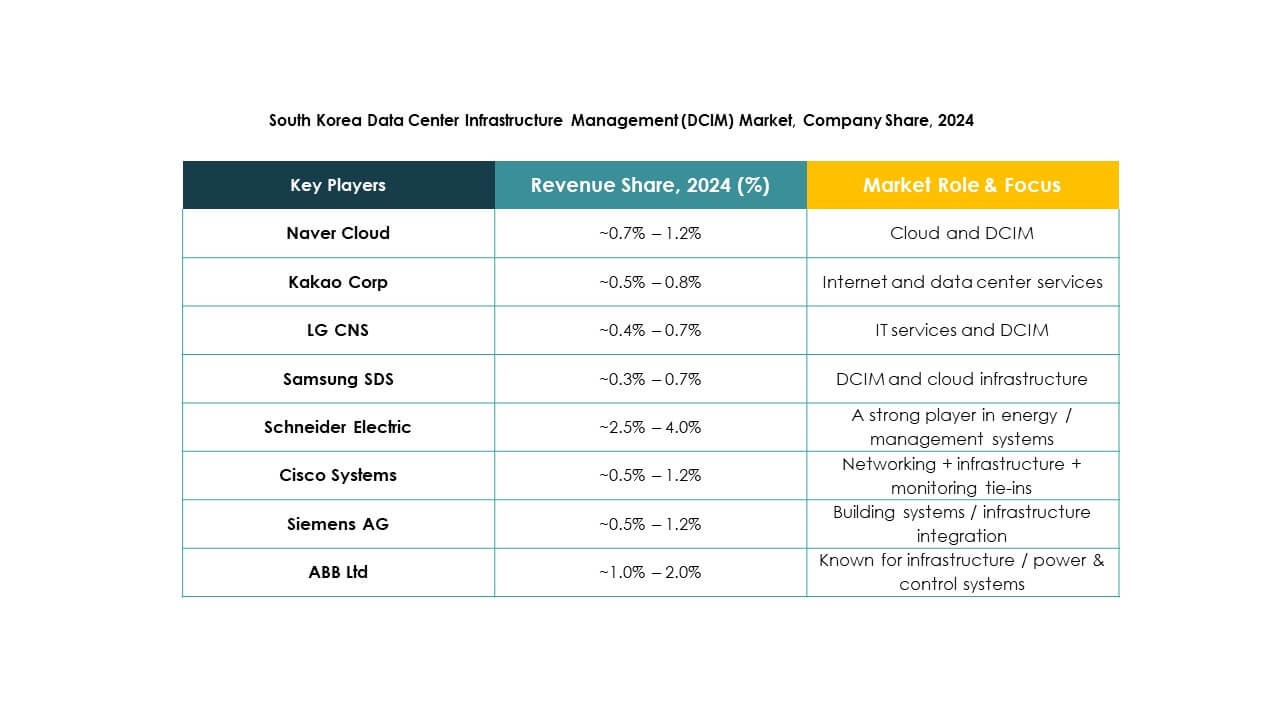

The South Korea Data Center Infrastructure Market is highly competitive, with global and regional leaders competing across infrastructure layers. Vertiv, Schneider Electric, and ABB dominate in electrical and cooling systems, offering advanced UPS, PDUs, and thermal solutions. Cisco, Dell, and Huawei lead in IT and network infrastructure with servers, racks, and switches tailored for AI and edge applications. Equinix and IBM operate large-scale colocation facilities, serving cloud-native and enterprise clients. Delta and Hitachi expand through energy-efficient systems and modular builds. Strategic focus areas include high-density design, ESG compliance, and local manufacturing partnerships. It sees increasing investments from telecom and hyperscale cloud players, prompting constant innovation among vendors. Competitive advantage depends on integration capability, speed of deployment, and support for evolving workloads.

Recent Developments:

- In November 2025, KT signed a business agreement with DigitalBridge to jointly develop AI‑focused data centers in South Korea. The collaboration targets domestic AI facility builds and overseas projects, while sharing ESG technologies and operational expertise.

- In November 2025, ESR announced construction of its first South Korean data center, the 80 MW KR1 facility in Incheon, with Wide Creek Asset Management. The center is slated to be operational by 2028 and will be leased to Princeton Digital Group.

- In November 2025, Princeton Digital Group revealed a US$700 million plan to build a 48 MW data campus in Incheon and pursue a 500 MW expansion roadmap across the country. This initiative highlights its AI and cloud strategy in the region.

- In September 2025, Warburg Pincus partnered with DC Connects and Wide Creek AMC to acquire land in Yongin City for an 80 MW hyperscale data center. Construction has started with planned readiness by 2027.

Market Drivers

Market Drivers Market Trends

Market Trends Market Challenges

Market Challenges Market Segmentation

Market Segmentation Regional Insights

Regional Insights