Executive summary:

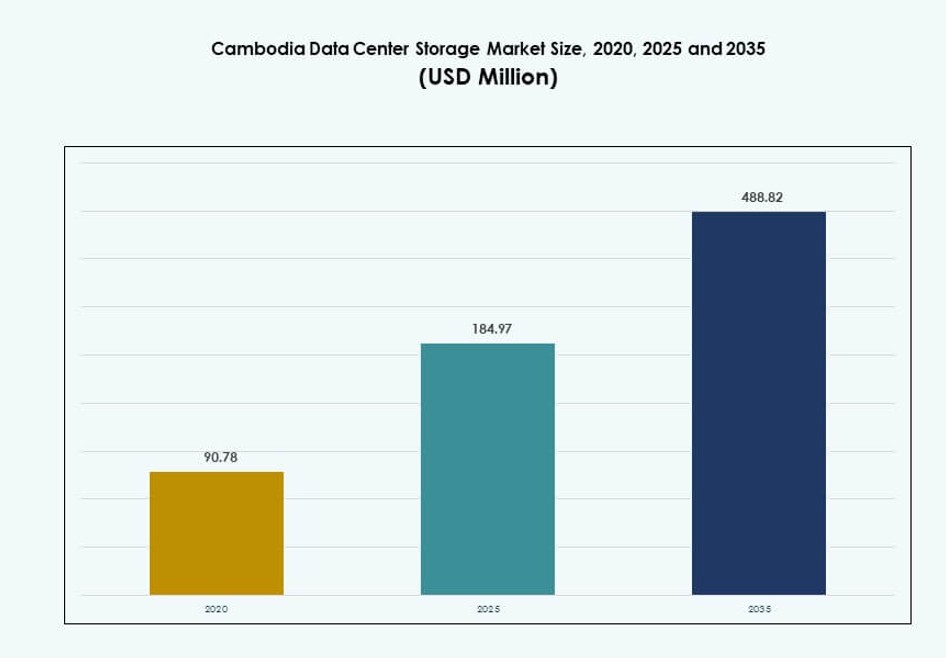

The Cambodia Data Center Storage Market size was valued at USD 90.78 million in 2020 to USD 184.97 million in 2025 and is anticipated to reach USD 488.82 million by 2035, at a CAGR of 10.09% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Cambodia Data Center Storage Market Size 2025 |

USD 184.97 Million |

| Cambodia Data Center Storage Market, CAGR |

10.09% |

| Cambodia Data Center Storage Market Size 2035 |

USD 488.82 Million |

Growing digital adoption across government, BFSI, and telecom sectors is driving demand for scalable and localized storage. Enterprises are shifting toward cloud-based and hybrid models to manage increasing data volumes efficiently. Innovation in software-defined storage, flash systems, and AI-powered data management is reshaping infrastructure. These changes support compliance, low-latency access, and long-term flexibility. The Cambodia Data Center Storage Market holds strategic importance for investors targeting early-stage infrastructure ecosystems. It presents opportunities to shape the digital backbone of a rising economy.

Phnom Penh leads the market due to dense enterprise activity, better fiber connectivity, and government-backed IT projects. The capital city is home to most carrier-neutral facilities and colocation hubs. Sihanoukville is emerging as a secondary zone driven by smart port and SEZ development. Siem Reap is gaining traction through tourism-led digital services and educational deployments. These zones are forming Cambodia’s foundational storage clusters, supporting growth beyond the capital.

Market Dynamics:

Market Drivers

Surging Demand for Localized Storage Infrastructure to Support Digitalization and Data Sovereignty

Enterprises in Cambodia are accelerating digital adoption, creating large volumes of sensitive data. With cross-border data restrictions tightening, demand for localized storage infrastructure is rising. Local businesses and government bodies need secure, compliant platforms to store information within national boundaries. Edge data centers are expanding near urban hubs to meet latency and redundancy needs. Storage architecture is shifting from legacy to modular systems that allow faster scaling. The Cambodia Data Center Storage Market is benefiting from these changes in public and private sectors. It supports new digital services, including e-governance and online finance. For investors, this shift presents long-term infrastructure opportunities. The market is gaining traction due to its early-stage potential.

Growth in Cloud-Based Workloads Across SMEs and Enterprise Segments

Cloud migration across Cambodia’s enterprises has opened new demand for flexible and scalable storage. Small and mid-sized businesses are moving from physical storage to subscription-based models. Service providers are offering bundled infrastructure-as-a-service (IaaS) and storage solutions. These trends reduce upfront capital costs and enable faster deployment. AI-ready storage, automated backup, and tiered access systems are becoming standard. National digital economy programs also push cloud-first adoption across verticals. The Cambodia Data Center Storage Market plays a critical role in supporting these hybrid and multi-cloud transitions. It allows local businesses to scale securely while staying compliant. The shift is creating consistent demand for SAN, NAS, and SSD-based systems.

- For exampale, in August 2025, Daun Penh Data Center (DPDC) partnered with ZStack to help enterprises deploy hybrid cloud‑ready infrastructure with high availability support. This collaboration strengthens local data storage capabilities by integrating virtual servers, cloud services, and supporting storage platforms for Cambodian businesses.

Strategic Importance of Low-Latency Storage to Support E-Commerce and Fintech Platforms

Cambodia’s e-commerce and fintech sectors require real-time data access and processing capabilities. Storage infrastructure must deliver low-latency performance to support mobile payments and digital banking. Flash storage and caching systems help platforms meet performance expectations. Rapid adoption of QR payments and mobile wallets adds to transaction volumes. The need for high-speed, secure storage platforms is growing rapidly. Digital-native startups demand APIs for quick integration with back-end systems. It makes the Cambodia Data Center Storage Market a critical foundation for the country’s tech-driven sectors. The infrastructure also helps build resilience against cyber threats. This demand is fueling investments in advanced storage configurations.

- For instance, the National Bank of Cambodia reported that the Bakong payment system processed over 200 million transactions by the end of 2023, highlighting strong digital payment adoption and the subsequent need for low‑latency data infrastructure to support fintech and e‑commerce services.

Digital Government Programs and Smart City Projects Driving Storage Infrastructure Growth

Government initiatives are encouraging data localization and digital service delivery across provinces. Smart city programs are being deployed with video surveillance, traffic sensors, and e-services. These systems generate structured and unstructured data that need scalable storage. Public cloud services are integrating with national IT infrastructure for redundancy. Data analytics, public sector digitization, and open data initiatives also depend on robust storage. The Cambodia Data Center Storage Market benefits from these use cases. It enables cities to deploy connected infrastructure and maintain digital continuity. Private partnerships are being encouraged to build edge and core storage systems. These shifts are opening long-term public-private collaboration models.

Market Trends

Rise of Modular and Containerized Storage Systems for Faster Deployment and Scalability

Storage providers in Cambodia are introducing containerized data centers with pre-integrated storage racks. These modular designs reduce deployment time and simplify expansion. It suits remote industrial zones and developing cities lacking large facilities. Businesses are opting for rack-scale flash units to cut power use and floor space. Modular systems also support hybrid deployment models in cloud-native setups. Vendors offer plug-and-play SAN and NAS bundles optimized for scaling. Cambodia Data Center Storage Market benefits from modular adoption due to limited legacy burden. It allows fast adoption of new formats and flexibility in small-scale environments. These trends align with infrastructure-light growth strategies.

Shift Toward Software-Defined Storage (SDS) for Cost Optimization and Policy-Based Management

Cambodian enterprises are adopting SDS to manage storage across mixed environments. SDS separates software from hardware, allowing use of commodity servers. Organizations benefit from centralized control, automation, and better cost efficiency. SDS enables policy-driven management, such as replication or tiering based on workload. These systems support both structured and unstructured data. Startups and SMEs use open-source SDS platforms to reduce licensing costs. The Cambodia Data Center Storage Market is seeing early-stage uptake of SDS across telecom, IT, and BFSI. It helps reduce reliance on proprietary hardware vendors. The trend is expected to scale with broader digitization.

Deployment of AI-Ready Storage for Edge Analytics and Image-Based Workloads

AI-driven applications are gaining traction in retail analytics, surveillance, and smart infrastructure. These workloads require high-speed input/output and low-latency access. Edge storage systems are being enhanced with GPU acceleration for real-time analysis. AI-ready storage platforms now support image classification, facial recognition, and anomaly detection. Retailers and logistics companies are adopting such platforms to improve operations. Cambodia Data Center Storage Market is witnessing interest in high-throughput storage tailored to AI use cases. Such deployments enable localized decision-making and lower cloud reliance. Vendors are designing compact AI+storage appliances for edge integration.

Use of Green Storage Technologies Aligned with Sustainable Infrastructure Investments

Sustainability in data infrastructure is gaining policy-level attention in Cambodia. Green storage includes low-power SSDs, intelligent cooling, and tiered storage to reduce active load. Service providers promote energy-efficient storage to appeal to ESG-conscious clients. Vendors offer sustainability dashboards to monitor carbon impact per terabyte stored. Hyperscalers planning entry into the region include green infrastructure as a core element. The Cambodia Data Center Storage Market is gradually aligning with sustainable practices. It enables power savings and long-term opex reduction. This trend will shape procurement and facility design standards.

Market Challenges

Limited Legacy Infrastructure and Low Data Localization Awareness Restricting Storage Uptake

Cambodia’s data infrastructure ecosystem is still in its early phase of development. Many SMEs lack internal IT systems or rely on paper-based records. Low awareness around data protection and localization laws affects digital maturity. Without strong compliance frameworks, businesses hesitate to invest in long-term storage platforms. Legacy systems are not easily integrable with cloud or modular storage. This creates migration challenges for mid-size enterprises. Cambodia Data Center Storage Market needs more ecosystem development and regulatory clarity. Local storage vendors also face trust barriers against international competitors. Addressing policy and digital education gaps is vital for sustainable growth.

Skill Shortages and Supply Chain Constraints Affect Advanced Storage Deployment

There is a shortage of local talent skilled in managing enterprise-class storage systems. Most professionals are trained in basic networking or general IT operations. This limits adoption of SDS, flash arrays, and AI-ready platforms. Hardware supply chains face delays due to regional import dependencies. Import taxes and infrastructure logistics raise TCO for high-end systems. Cambodia Data Center Storage Market needs greater investment in tech training and vendor partnerships. Joint ventures with experienced integrators can bridge gaps. Without localized support services, advanced storage solutions remain underutilized.

Market Opportunities

Rising Cloud-Native Startup Ecosystem to Drive Demand for Flexible Storage Platforms

Cambodia is seeing rapid growth in cloud-native startups across fintech, e-commerce, and mobility. These businesses need flexible, cost-effective, and API-driven storage. Local data centers can offer tailored solutions with pay-as-you-grow models. The Cambodia Data Center Storage Market is well-positioned to serve these new digital-first enterprises. It creates space for managed storage services and platform-as-a-service offerings. Partnerships with incubators and tech parks can capture demand early.

Emergence of Cross-Border Data Hosting Potential with Indochina Connectivity Projects

Cambodia is part of several regional connectivity and fiber backbone initiatives. This opens possibilities for cross-border data hosting targeting neighboring Laos and Vietnam. Storage providers can position the country as a latency-friendly regional storage node. The Cambodia Data Center Storage Market can gain export-oriented value through regulatory harmonization. It strengthens the role of local infrastructure in ASEAN digital trade flows.

Market Segmentation

By Storage Type

Traditional storage continues to dominate due to its lower upfront costs and simpler integration. However, all-flash storage is gaining popularity in BFSI and telecom sectors requiring high-speed access. Hybrid storage remains attractive for mixed workloads across enterprises. In the Cambodia Data Center Storage Market, hybrid setups are preferred where budget and performance must balance. All-flash systems are growing fastest due to falling SSD costs and increasing real-time data needs.

By Storage Deployment

Storage Area Network (SAN) systems lead the market due to performance, scalability, and fault tolerance. NAS systems are preferred by content-heavy industries and SMEs requiring shared access. Direct-attached Storage (DAS) remains common in legacy setups and edge locations. Cambodia Data Center Storage Market sees SAN dominance in cloud and telecom infrastructure. Emerging deployments integrate SAN and NAS for hybrid workload efficiency.

By Component

Hardware components contribute the largest revenue share due to physical infrastructure requirements. Software layers are expanding with the rise of SDS and analytics-driven storage. Cambodia Data Center Storage Market relies heavily on hardware for capacity expansion. Software adoption is rising with enterprises seeking centralized control and performance optimization. Future growth will hinge on intelligent storage orchestration tools.

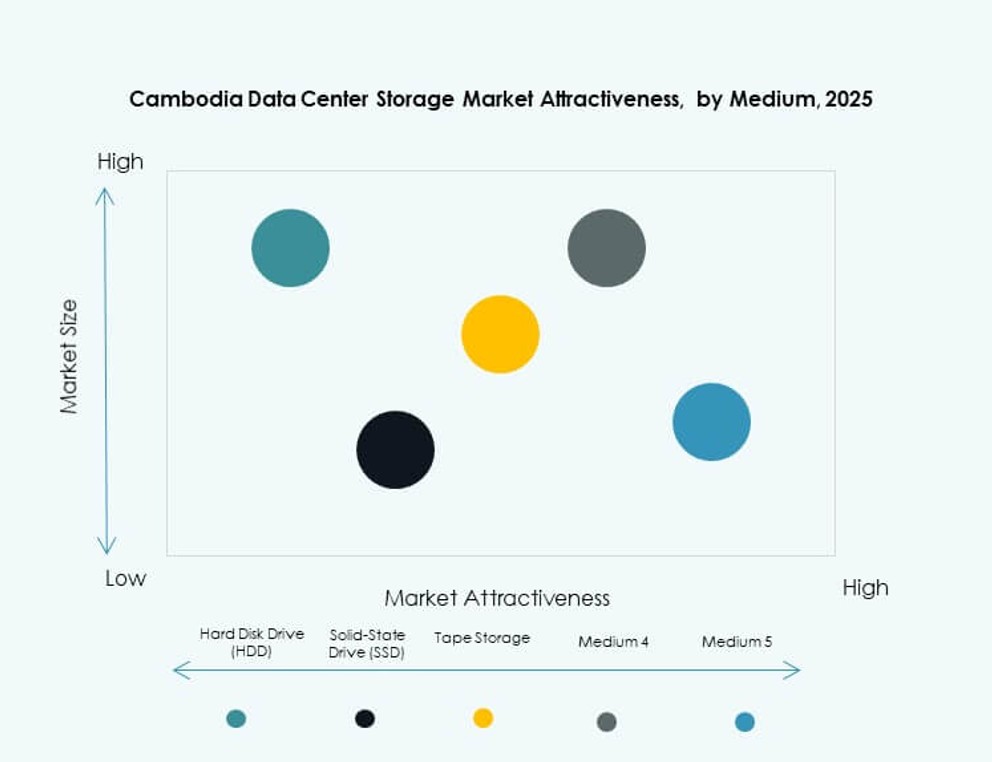

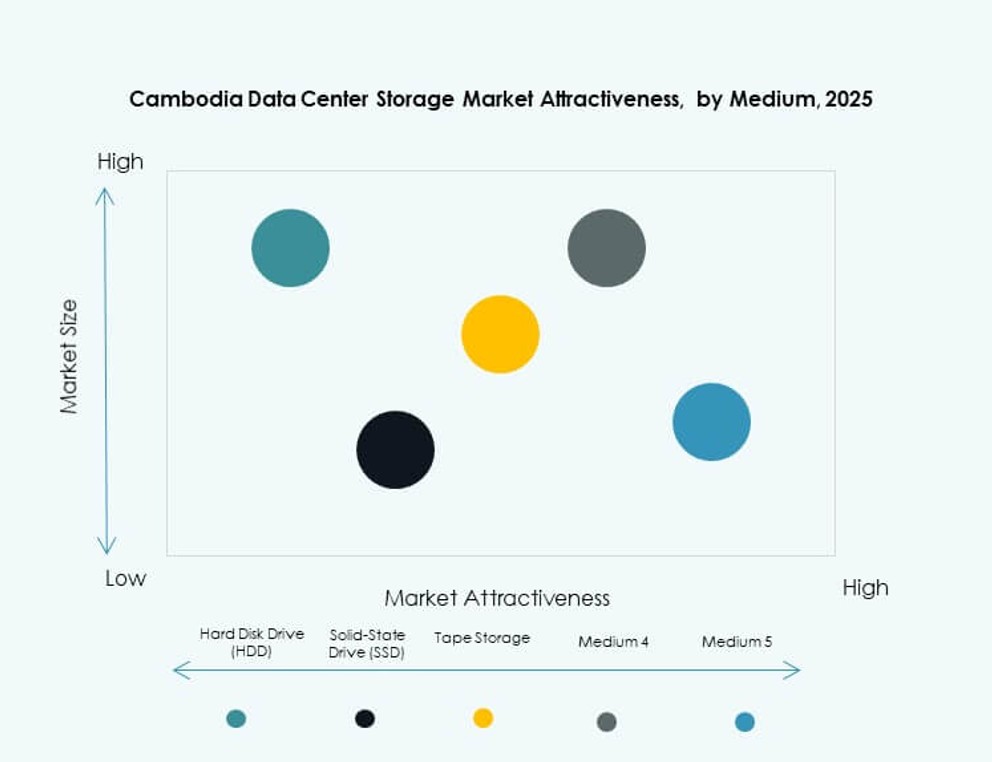

By Medium

Hard Disk Drives (HDDs) continue to lead due to affordability and availability. Solid-State Drives (SSDs) are growing rapidly in high-performance applications like AI and cloud. Tape storage remains marginal, mostly in archival and compliance setups. The Cambodia Data Center Storage Market is shifting toward SSDs for speed and lower latency. However, HDDs remain preferred for bulk and long-term storage.

By Deployment Model

On-premises storage holds a strong share among government and BFSI due to security concerns. Cloud-based storage is expanding with SMEs adopting flexible solutions. Hybrid models are emerging in multi-location enterprises managing real-time and archival needs. Cambodia Data Center Storage Market is witnessing rapid interest in cloud-backed hybrid setups. Cost savings and remote access make this model appealing.

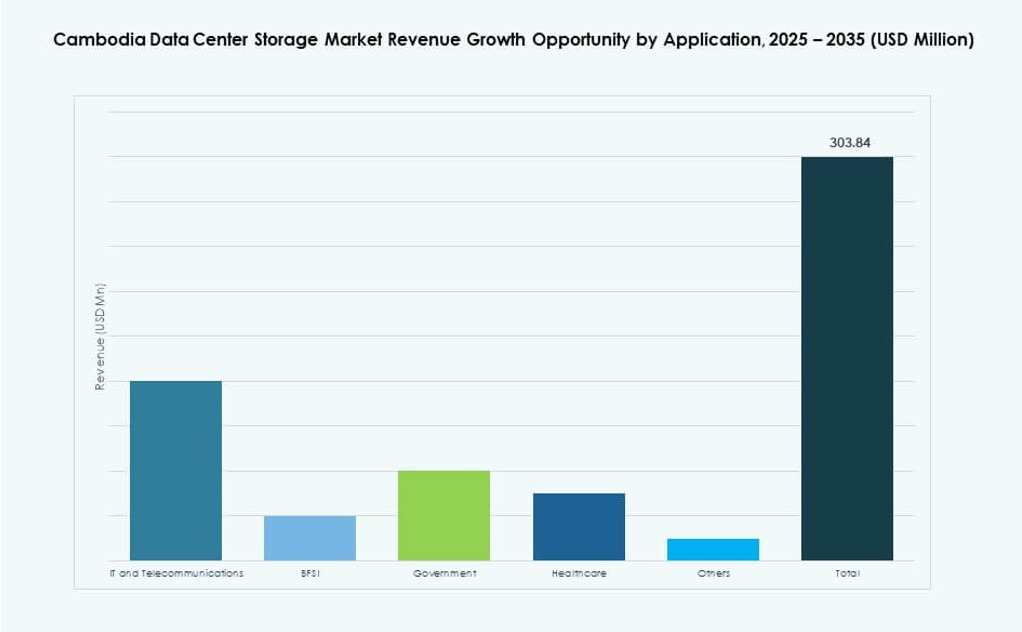

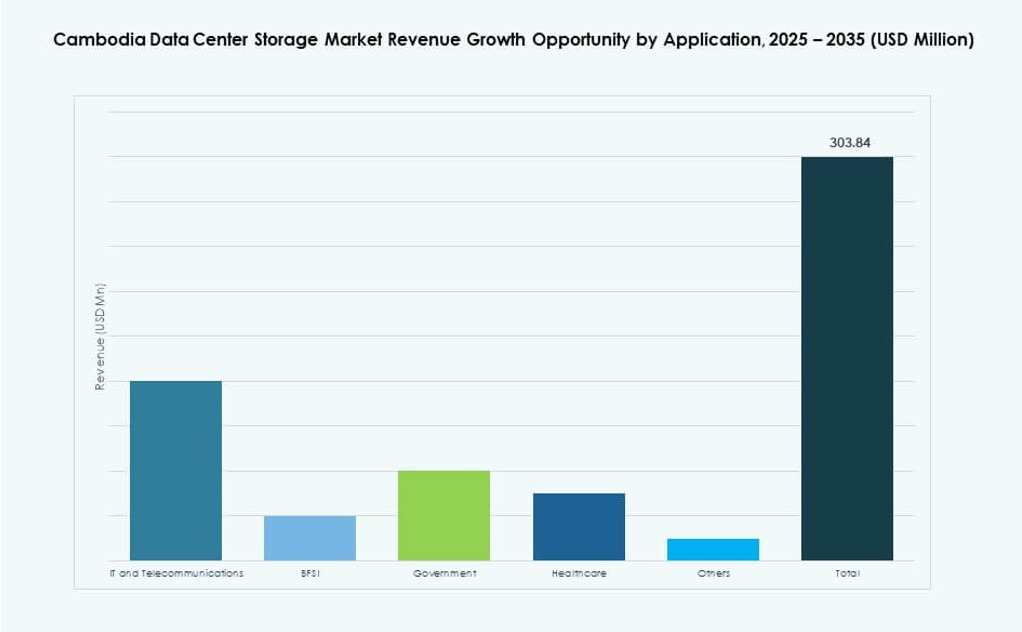

By Application

IT and Telecommunications lead storage demand, driven by network data and cloud services. BFSI follows with needs for secure, compliant, and high-speed storage. Government projects contribute significantly through digitization and surveillance. Healthcare and others represent growing verticals due to telehealth and record digitization. Cambodia Data Center Storage Market is heavily shaped by IT and BFSI sectors with strong secondary growth in healthcare.

Regional Insights

Phnom Penh accounts for over 65% of the Cambodia Data Center Storage Market share. The capital houses key telecom hubs, government data centers, and enterprise headquarters. It benefits from dense connectivity, urban demand, and active government infrastructure programs. Most major colocation and cloud players operate out of this region. Phnom Penh’s role as the digital core ensures it leads in capacity and innovation.

- For instance, ByteDC launched Cambodia’s first Uptime-certified Tier III data center in Phnom Penh in May 2023. The facility supports enterprise workloads with up to 3 MW of IT load and is designed for high energy efficiency with a PUE below 1.8.

Sihanoukville contributes around 20% of the market, driven by SEZ and smart port initiatives. Proximity to undersea cable landings and regional fiber rollouts supports data growth. New logistics and manufacturing zones demand localized storage and analytics. The area attracts infrastructure developers targeting industrial automation. The market here is gaining momentum through coastal infrastructure projects and smart logistics investments.

Siem Reap and other emerging urban areas contribute 15% market share. Growth is led by tourism digital platforms, regional enterprise activity, and education digitization. The region is seeing early-stage storage adoption for DRaaS and media backup. Fiber backbone upgrades improve reliability and access. Cambodia Data Center Storage Market sees Siem Reap as a frontier for edge deployment and secondary hub development.

- For instance, Siem Reap’s Smart City Roadmap, developed with support from JICA, outlines digital transformation goals including open data systems, tourism digitization, and smart governance platforms, forming the foundation for future ICT and data infrastructure in the region.

Competitive Insights:

- Metfone Data Center

- Opennet

- NEC Corporation

- NetApp

- IBM Corporation

- Dell Technologies

- Cohesity, Inc.

- Quantum Corporation

- Cisco Systems, Inc.

- Hitachi Vantara

The Cambodia Data Center Storage Market features a blend of local and global players offering traditional, hybrid, and software-defined storage solutions. Local firms like Metfone and Opennet dominate initial infrastructure layers and colocation services, leveraging telecom networks and domestic reach. Global leaders such as Dell Technologies, NetApp, and IBM focus on enterprise storage, cloud integration, and AI-ready solutions. These companies provide scalable hardware and virtualization platforms suited to Cambodia’s emerging digital economy. The competitive landscape is shaped by infrastructure modernization, regulatory alignment, and demand for energy-efficient systems. Firms differentiate through flash architecture, hybrid deployment models, and partnerships with telecom operators and government-backed programs. Market share varies by segment, with multinationals capturing enterprise contracts while local firms hold strength in public sector and SME deployments.

Recent Developments:

- In April 2025, Dell Technologies launched updated all‑flash and hybrid storage systems for Southeast Asian markets, including Cambodia. The new portfolio targets mid-sized enterprises seeking scalable, energy-efficient storage.

- In October 2024, Cohesity, Inc. expanded its presence in emerging ASEAN markets by onboarding a Cambodia-based distributor. The move aims to support backup, recovery, and ransomware-resilient storage platforms for SMEs and cloud-native firms.