Executive summary:

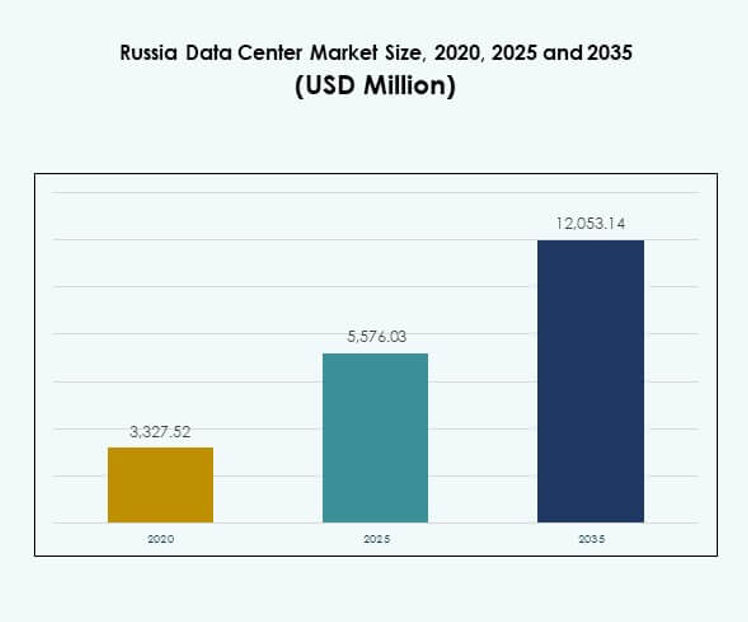

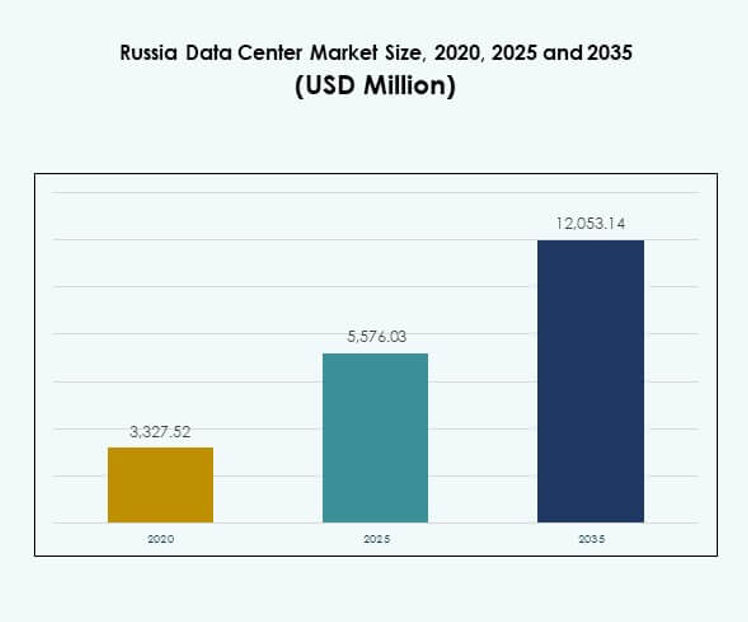

The Russia Data Center Market size was valued at USD 3,327.52 million in 2020 to USD 5,576.03 million in 2025 and is anticipated to reach USD 12,053.14 million by 2035, at a CAGR of 7.97% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Russia Data Center Market Size 2025 |

USD 5,576.03 Million |

| Russia Data Center Market, CAGR |

7.97% |

| Russia Data Center Market Size 2035 |

USD 12,053.14 Million |

The market is driven by rapid cloud adoption, rising demand for colocation services, and integration of AI-based technologies. Innovation in modular and energy-efficient data center designs enhances scalability and reduces operational costs. It supports business continuity, digital transformation, and strengthens investor confidence in infrastructure resilience. Strategic relevance lies in its ability to provide reliable digital infrastructure for enterprises, telecom operators, and government agencies.

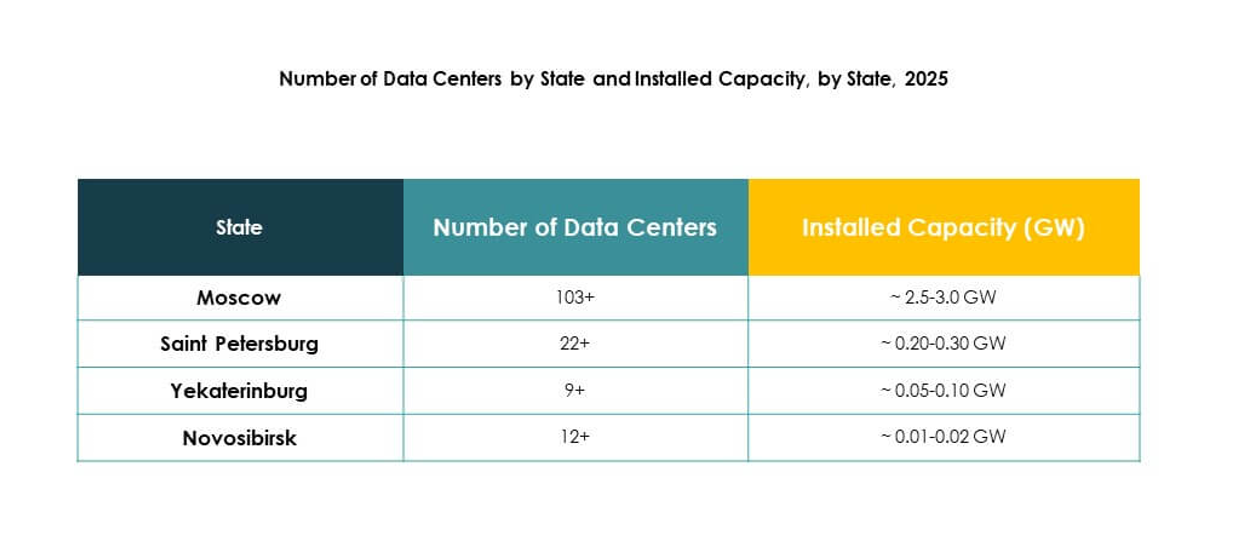

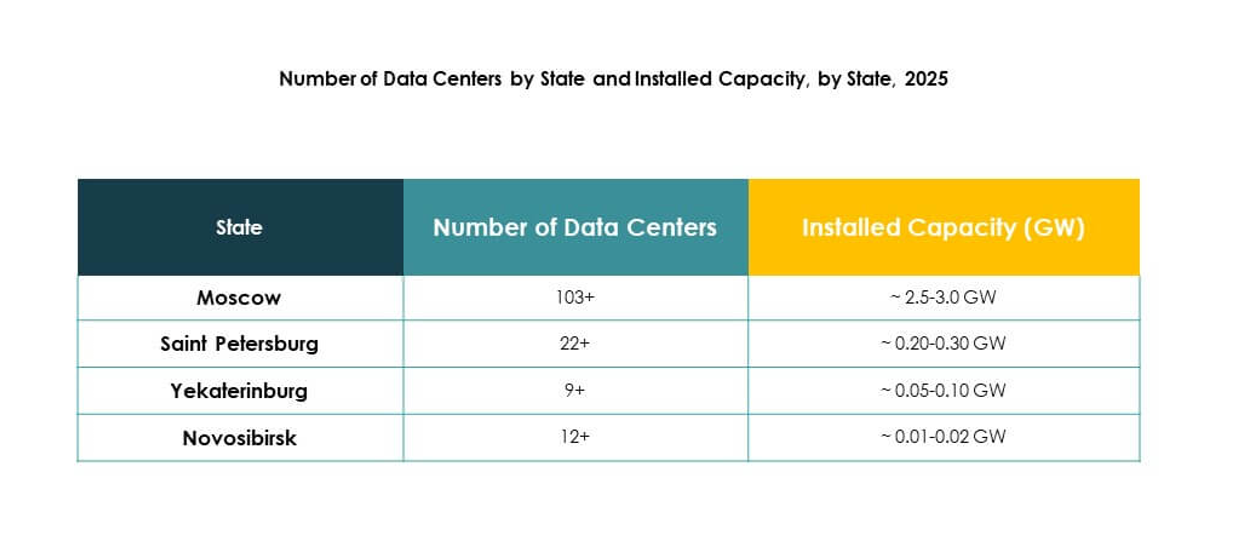

Moscow and St. Petersburg dominate due to their connectivity hubs, enterprise clusters, and strong international presence. Secondary regions like Yekaterinburg and Novosibirsk are emerging as demand for local infrastructure grows. It is further supported by government-led digitalization initiatives and telecom expansion, creating a balanced growth path across Western, Central, and Eastern Russia.

Market Drivers

Rising Demand for Digital Infrastructure and Advanced Technology Adoption

The Russia Data Center Market is expanding with strong demand for scalable infrastructure to support enterprise digitalization. Companies across industries seek facilities with advanced networking, cloud adoption, and AI integration. Enterprises prioritize low-latency operations to meet customer requirements in finance, telecom, and retail. It is essential for ensuring robust connectivity and business continuity. The market is also shaped by demand for advanced virtualization and orchestration technologies. Rising consumption of digital services drives investments in high-performance computing. Cloud-native enterprises continue to strengthen adoption strategies. This creates a long-term foundation for sustained growth.

- For instance, Selectel announced the construction of its new Yurlovsky data center in Moscow, planned with a total power capacity of 20MW and space for around 2,000 racks, strengthening the company’s ability to deliver large-scale colocation and cloud services.

Innovation in Data Center Design and Energy Efficiency

The market emphasizes sustainable construction, modular design, and power efficiency. Operators are implementing green building standards with advanced cooling technologies and renewable sourcing. It is vital to improve power usage effectiveness while ensuring cost savings. AI-based monitoring and automation help optimize facility performance. Hyperscale facilities are leading adoption of energy-efficient designs to reduce carbon emissions. The Russia Data Center Market benefits from technological transformation led by international and domestic firms. Enterprises consider green and modular setups as essential for future-ready growth. Sustainability ensures both investor confidence and operational resilience.

Shift Toward Cloud, Hybrid, and Edge Computing Models

Enterprises are adopting cloud-first approaches to reduce IT capital expenses and increase scalability. Cloud-based services, hybrid models, and edge deployments form the backbone of transformation. It strengthens data processing close to end-users, ensuring low latency. The Russia Data Center Market reflects this shift with growing demand from BFSI, healthcare, and government. It is strategically significant as enterprises accelerate digital transformation agendas. Edge facilities allow telecom operators to support 5G rollout and IoT adoption. The hybrid model balances data sovereignty and operational efficiency. This transformation secures new revenue streams for operators and providers.

- For instance, Rostelecom’s subsidiary RTK-TsOD launched a new data center in Nizhny Novgorod in June 2025, featuring four machine rooms, 401 racks, and a 5 MW IT capacity. The second stage was completed six months ahead of schedule, accelerating deployment and supporting regional digital infrastructure growth.

Strategic Importance for Businesses and Investor Confidence

The market plays a pivotal role in enabling secure storage, resilience, and faster digital workflows. Investors recognize its potential as enterprises demand scalable and compliant infrastructure. It is central to critical service delivery across finance, healthcare, and government. The Russia Data Center Market assures investors of long-term revenue stability. The strategic role includes providing uninterrupted services during cyber risks and geopolitical challenges. Local enterprises are adopting colocation and hyperscale solutions to meet rising workloads. Investor confidence is driven by energy efficiency and innovation metrics. This strengthens Russia’s positioning in global digital infrastructure growth.

Market Trends

Growing Role of Artificial Intelligence and Automation in Operations

The Russia Data Center Market is witnessing integration of AI to manage workloads and predict failures. Operators are deploying automation for power management, security monitoring, and predictive maintenance. It improves operational efficiency and reduces downtime for enterprises. AI-driven orchestration enhances scalability across colocation and hyperscale centers. It is increasingly vital to automate repetitive tasks and lower operational costs. Enterprises trust facilities offering automation to deliver service agility. Innovation in robotics for maintenance has also gained attention. Automation ensures reliability and aligns infrastructure with digital-first economies.

Expansion of Modular and Edge Data Centers Across Regions

Regional growth is supported by modular facilities designed for scalability and rapid deployment. Edge data centers bring processing closer to users, supporting 5G and IoT expansion. It enhances speed and reduces latency for industries such as telecom, retail, and manufacturing. The Russia Data Center Market reflects demand for modular setups due to flexibility. Enterprises are investing in smaller yet powerful data hubs in tier-2 cities. The trend strengthens national digital infrastructure across underserved areas. Edge deployments also help telecom providers scale regional networks efficiently. Modular solutions create opportunities for cost-efficient expansion.

Focus on Renewable Energy Integration and Sustainable Operations

Operators are prioritizing energy transition with renewable power procurement and advanced cooling systems. The Russia Data Center Market is advancing in energy-efficient technologies to reduce operational costs. It is driven by demand for environmentally sustainable operations across global enterprises. Facilities now include green power sourcing through solar and wind integration. Cooling innovations using liquid cooling and AI-based energy controls are expanding. Enterprises demand service providers who align with ESG standards. The adoption of renewable power contracts improves investor appeal. This trend positions the market toward a sustainable growth trajectory.

Evolving Interconnection Ecosystem and Digital Sovereignty

The Russia Data Center Market is shaping a secure and controlled digital ecosystem. Enterprises seek interconnection hubs offering cloud on-ramps, cross-connects, and carrier-neutral access. It ensures faster communication between service providers and customers. The market also focuses on compliance with digital sovereignty regulations. It is critical for ensuring data remains within the country’s jurisdiction. Government-driven initiatives support local cloud hosting and data localization. Interconnection ecosystems enhance collaboration between telecom, BFSI, and enterprise clients. This strengthens both compliance and service performance across sectors.

Market Challenges

Energy Constraints and High Operational Costs Impacting Scalability

The Russia Data Center Market faces challenges in meeting growing power requirements while managing operational expenses. Energy costs remain high due to dependence on traditional sources, impacting scalability. It is difficult for operators to maintain sustainable PUE levels without advanced systems. High capital investment for renewable integration slows down wider adoption. Cooling infrastructure requires modernization to prevent inefficiencies. Rising workloads demand consistent power backup systems, adding further costs. Providers are under pressure to balance efficiency with affordability. This creates a barrier for smaller enterprises entering the market.

Regulatory Uncertainty and Cybersecurity Concerns Restricting Growth

Operators face regulatory pressures linked to data localization and compliance frameworks. It is critical to align operations with evolving government requirements. The Russia Data Center Market is exposed to risks of shifting regulations and policy reforms. Cybersecurity threats also add complexity, with enterprises demanding higher protection standards. Increasing ransomware and cross-border attacks demand advanced security investments. SMEs struggle to afford high-cost cybersecurity systems, impacting adoption. Compliance gaps lower investor confidence in some regional projects. These challenges make stability and policy clarity vital for sustainable expansion.

Market Opportunities

Expansion Through Cloud, AI, and Edge-Driven Infrastructure Solutions

The Russia Data Center Market has strong potential for growth through AI integration, cloud adoption, and edge expansion. Enterprises in BFSI, healthcare, and telecom seek infrastructure capable of processing high-volume data with low latency. It is an opportunity for operators to deliver hybrid and scalable services. Local firms invest in AI-enabled monitoring tools, creating efficiency gains. Demand for edge infrastructure supports 5G-driven innovation. The integration of automation further enhances customer value. This positions providers to capture new enterprise segments and sustain growth.

Rising Investment in Green Data Centers and Renewable Integration

The Russia Data Center Market offers opportunities for green innovation and sustainable design. Enterprises demand facilities powered by renewable energy to align with ESG mandates. It is a chance for operators to differentiate services through eco-friendly models. Modular green facilities attract investor interest due to long-term efficiency. Operators are adopting liquid cooling and AI-based monitoring to reduce power use. Global partnerships enhance renewable sourcing potential in key hubs. These opportunities enable Russia to strengthen competitiveness in global digital infrastructure.

Market Segmentation

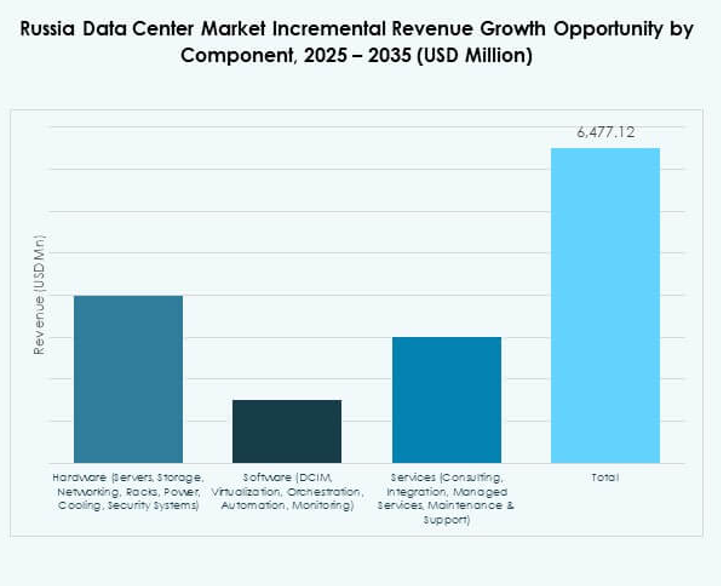

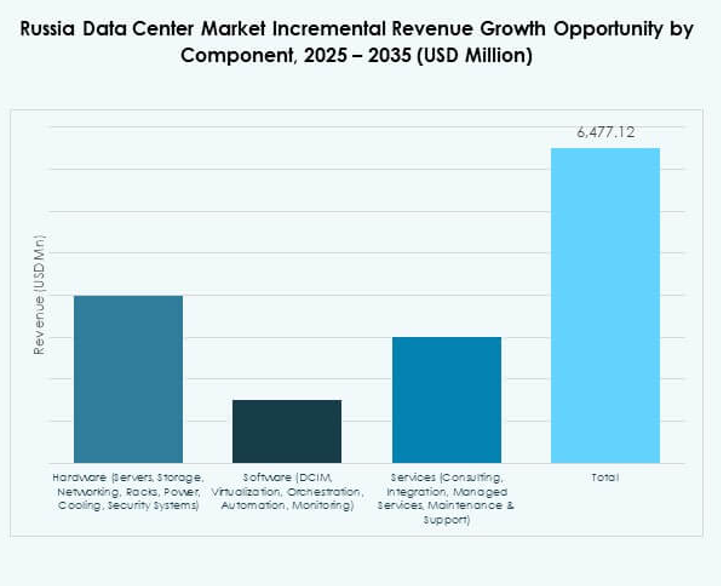

By Component

Hardware dominates the Russia Data Center Market, holding the largest share due to demand for servers, storage, and advanced networking equipment. Enterprises require robust infrastructure for workload management, disaster recovery, and business continuity. It is also driven by growth in racks, power systems, and security systems. Software solutions such as DCIM and virtualization are rising but remain secondary. Services like consulting and managed support gain traction, especially in hybrid models. Hardware ensures high performance, making it the backbone of data center facilities.

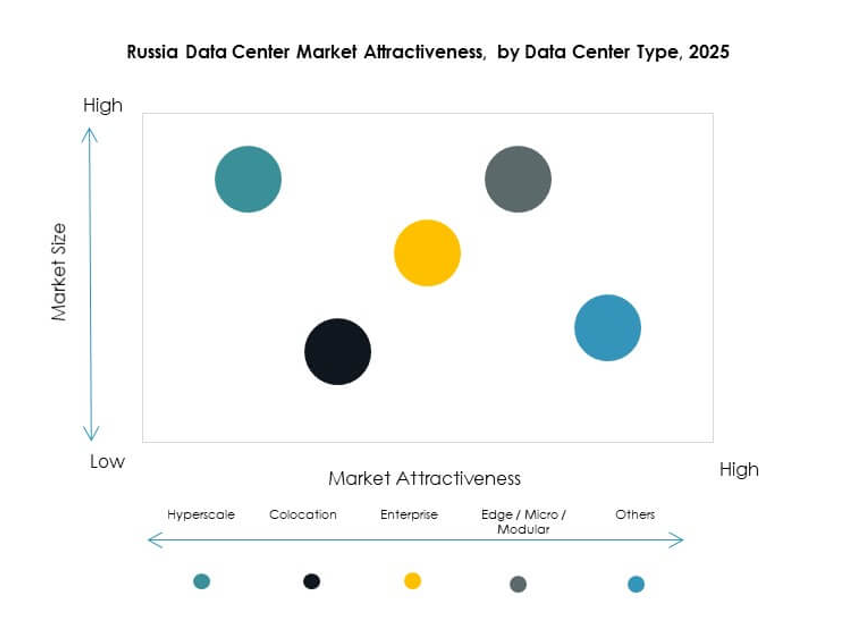

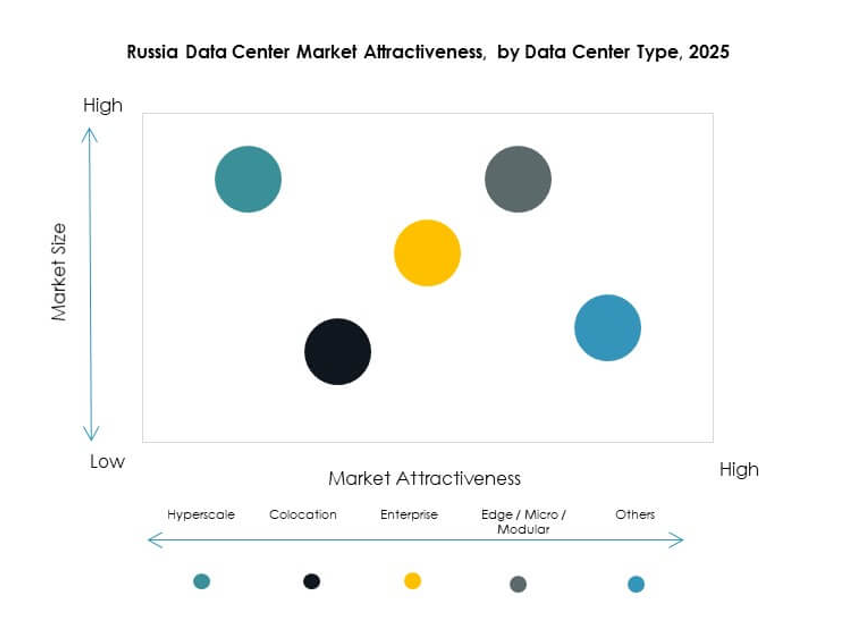

By Data Center Type

Colocation data centers lead the Russia Data Center Market, capturing the largest market share. Enterprises prefer colocation to reduce capital investment and access scalable infrastructure. It is a strategic choice for SMEs and large enterprises managing fluctuating workloads. Hyperscale centers are expanding due to cloud adoption, while modular and edge centers grow rapidly in underserved regions. Enterprise facilities remain relevant but contribute smaller shares. The emergence of mega data centers highlights future capacity demand. Cloud/IDC facilities strengthen connectivity, especially for BFSI and telecom.

By Deployment Model

Cloud-based deployment holds a dominant position in the Russia Data Center Market, driven by scalability and cost efficiency. Enterprises rely on cloud infrastructure for disaster recovery and agility. It is critical for digital-native firms focusing on SaaS and hybrid adoption. On-premises deployment continues in regulated sectors like government and defense. Hybrid deployment is rising as enterprises balance compliance with scalability. The market reflects a strong movement toward multi-cloud strategies. This segment highlights adaptability as a growth driver for enterprises.

By Enterprise Size

Large enterprises dominate the Russia Data Center Market due to their scale and resource availability. These enterprises demand advanced colocation and hyperscale facilities for large workloads. It is critical for sectors like BFSI, government, and telecom. SMEs are adopting hybrid models but face budget constraints. Their growth is supported by affordable colocation services. The shift toward digital transformation across all sizes fuels consistent demand. SMEs will gradually expand adoption as cloud-based services become more cost-effective. The segment balance reflects a widening adoption landscape.

By Application / Use Case

IT and telecom lead the Russia Data Center Market due to rising demand for connectivity and data processing. BFSI follows closely, driven by secure transactions and digital banking. It is vital for supporting fintech innovation. Healthcare demand grows with telemedicine and electronic health records. Government and defense invest in secure, compliant systems. Retail and e-commerce expand their digital presence through data-driven strategies. Media and entertainment leverage centers for streaming services. Manufacturing and energy sectors are emerging, supported by Industry 4.0 adoption.

By End User Industry

Cloud service providers dominate the Russia Data Center Market due to rising cloud adoption and SaaS deployment. Enterprises also contribute significantly with investments in colocation and hybrid models. It is essential for ensuring workload flexibility. Colocation providers support SMEs with affordable and scalable infrastructure. Government agencies invest in compliant, localized facilities to ensure data sovereignty. Other industries like utilities and education are gradually increasing reliance on data infrastructure. The dominance of cloud providers highlights the shift toward digital-first ecosystems.

Regional Insights

Western Russia: Moscow and St. Petersburg Leading with 58% Share

Western Russia leads the Russia Data Center Market with 58% share, supported by Moscow and St. Petersburg. Enterprises in finance, telecom, and government prefer these hubs due to strong connectivity and international gateways. It is the core of hyperscale and colocation developments. The presence of multinational providers strengthens infrastructure quality. Local enterprises benefit from well-developed networks and scalability. This subregion remains the backbone of the market’s expansion and investor interest.

- For instance, IXcellerate commissioned all five phases of its MOS5 data center in Moscow in 2024, providing a total capacity of 4,722 racks and 64 MW power, meeting Tier III standards and serving major clients in finance and retail.

Central and Volga Region: Emerging Hub with 27% Share

Central and Volga hold 27% share of the Russia Data Center Market, with cities like Yekaterinburg gaining traction. Regional enterprises drive demand for cloud, colocation, and hybrid deployments. It is supported by government-led digital transformation initiatives. Telecom operators expand connectivity infrastructure to meet growing workloads. Local businesses adopt modular centers to reduce cost barriers. This subregion is a rising growth engine for domestic data infrastructure.

- For instance, Megafon launched a new data center in Yekaterinburg in July 2025, offering 1 MW of baseline capacity that can be upgraded to 1.5 MW with high-load racks, supporting 110 racks in an energy-efficient 800 sqm facility.

Eastern Russia: Growth Potential with 15% Share

Eastern Russia accounts for 15% of the Russia Data Center Market, with focus on Novosibirsk and Vladivostok. Geographic positioning supports cross-border data flows between Asia and Russia. It is developing into a regional hub for cloud services and logistics enterprises. Emerging demand stems from manufacturing, energy, and retail sectors. Smaller colocation and modular setups expand accessibility in these cities. This subregion presents long-term growth opportunities for investors and operators.

Competitive Insights:

Competitive Insights:

- Rostelecom / RTK

- Selectel

- DataPro

- IXcellerate

- Equinix, Inc.

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc.

- Google LLC (Alphabet Inc.)

The Russia Data Center Market is highly competitive with domestic and global players building advanced infrastructure. Rostelecom, Selectel, and DataPro strengthen local dominance through colocation, cloud, and managed services. IXcellerate expands carrier-neutral hubs that attract multinational enterprises. Equinix and Digital Realty enhance global connectivity through interconnection ecosystems and hyperscale facilities. NTT, Microsoft, AWS, and Google extend cloud regions that support hybrid and edge deployments. It reflects a market shaped by partnerships, renewable energy adoption, and modular design strategies. Competition emphasizes efficiency, regulatory compliance, and scalability. Operators prioritize green solutions and high-density capacity to capture enterprise demand. This competitive landscape continues to evolve with rising investments and strategic alliances.

Recent Developments:

- In July 2025, Megafon, one of Russia’s leading telecom operators, launched new data centers in Yekaterinburg and Tver. Each newly opened facility delivers a capacity of 1MW, supporting the surging demand for cloud and colocation services in the region. This move underscores Megafon’s commitment to digital transformation and its strategy to accommodate the escalating requirement for reliable IT infrastructure across Russia.

- In June 2025, Rostelecom’s subsidiary RTK-TsOD launched a new data center in the Nizhny Novgorod region, featuring four machine rooms, 401 racks, and a 5MW IT capacity; this marks their 25th facility and accelerates regional digital infrastructure development by completing the second stage six months ahead of schedule.

- In April 2025, Yandex, the country’s top technology company, commenced the development of a major new data center in Mozhaisk. The project, reported by multiple local outlets, involves a hefty investment of 16 billion rubles (approximately $193 million). This facility is part of Yandex’s broader strategy to support the rapid expansion of its cloud and digital service offerings, reflecting the robust growth trajectory observed in the Russian data center market throughout 2025

Competitive Insights:

Competitive Insights: