Executive summary:

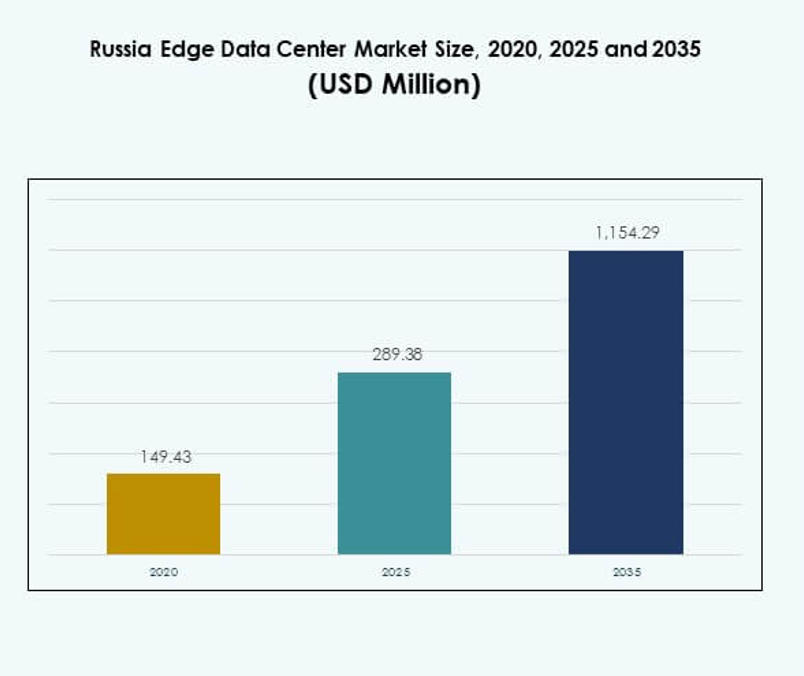

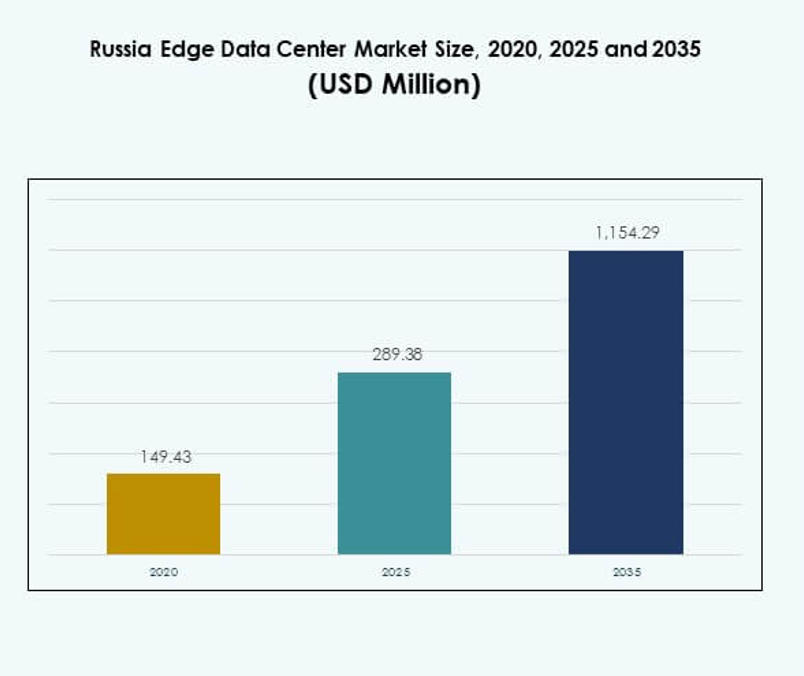

The Russia Edge Data Center Market size was valued at USD 149.43 million in 2020, reached USD 289.38 million in 2025, and is anticipated to reach USD 1,154.29 million by 2035, growing at a CAGR of 14.71% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Russia Edge Data Center Market Size 2025 |

USD 289.38 Million |

| Russia Edge Data Center Market, CAGR |

14.71% |

| Russia Edge Data Center Market Size 2035 |

USD 1,154.29 Million |

The Russia Edge Data Center Market is expanding due to rapid digitalization, 5G rollout, and adoption of IoT-enabled infrastructure. Enterprises are deploying edge systems to reduce latency, enhance data processing, and improve connectivity for cloud and AI applications. Investments in modular and energy-efficient designs also strengthen network resilience. The market holds strategic importance for investors aiming to capture opportunities in localized computing, smart cities, and industrial automation.

Western Russia, led by Moscow and St. Petersburg, dominates with strong infrastructure, high enterprise density, and government-backed digital projects. Central Russia is emerging as an industrial hub, driven by expanding logistics and manufacturing bases. Eastern regions are developing steadily, benefiting from telecom expansion and cross-border technology partnerships that support long-term regional connectivity growth.

Market Drivers

Growing Need for Low-Latency Data Processing and Digital Transformation

The Russia Edge Data Center Market is expanding due to rising demand for real-time data processing and digital connectivity. Enterprises in logistics, banking, and retail sectors rely on edge infrastructure to improve responsiveness. It supports faster data exchange between devices and central systems. Increasing adoption of Industry 4.0 technologies, such as automation and IoT, accelerates market growth. The rising use of smart sensors in industrial applications also boosts demand for localized computing. Cloud service providers are investing in regional data nodes to enhance coverage. Businesses seek to reduce downtime through efficient data transfer. This digital shift strengthens Russia’s competitive position in edge computing.

Rising Integration of 5G Networks and Cloud Services

Integration of 5G networks drives major technological advancement in the market. Telecom operators deploy edge facilities to enable faster data delivery and seamless connectivity. It improves efficiency in streaming, gaming, and smart city applications. Growing reliance on cloud-based workloads encourages hybrid infrastructure adoption. The synergy between 5G and edge computing enhances real-time analytics and automation. Companies optimize network bandwidth through localized storage and processing. Government programs supporting 5G coverage expansion further accelerate implementation. These factors collectively elevate network speed and reliability, improving digital service delivery across industries.

- For instance, in 2021 MTS and Huawei activated 5G networks at 14 sites in Moscow using Super Blade Site technology, demonstrating over 1 Gbps connection speeds, rapid 2 GB downloads in 10 seconds, and low-latency streaming and gaming capabilities for pilot users in Russia’s largest city

Increased Focus on Energy-Efficient Infrastructure and Green Data Initiatives

Sustainability is becoming a core consideration for Russian data infrastructure investors. Companies integrate advanced cooling systems, renewable energy sources, and efficient rack designs. It helps reduce operational costs while meeting environmental standards. Vendors invest in modular edge systems that optimize energy use and lower emissions. Demand for carbon-neutral facilities from global enterprises is also increasing. Partnerships between utility providers and technology firms improve grid integration for data centers. The focus on environmental efficiency attracts foreign investment and enhances corporate ESG compliance. These initiatives make edge facilities more cost-effective and sustainable in the long term.

Strategic Investments and Expansion by Global and Domestic Players

Large-scale investments by multinational and local firms are transforming the market landscape. International vendors collaborate with Russian IT companies to establish secure, high-performance edge networks. It ensures regional compliance and data sovereignty. Domestic players focus on expanding capacity across major urban centers. These investments support new business models such as distributed cloud and AI-based monitoring. Strategic partnerships strengthen Russia’s role in the Eurasian digital corridor. Increasing venture funding and mergers improve infrastructure capability. The sector’s strategic value attracts continuous investor interest, making Russia a critical market for regional data growth.

- For example, in November 2021, Rostelecom acquired a 57,291 sqm facility in South Moscow to develop a 55 MW hyperscale campus with 4 buildings and design capacity for 6,710 racks, targeting public sector and enterprise infrastructure needs.

Market Trends

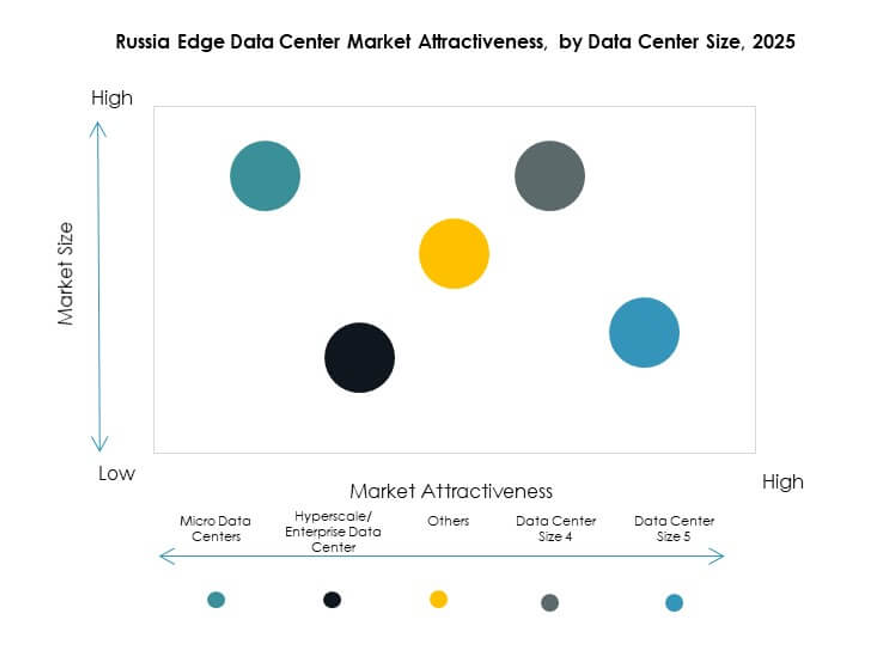

Expansion of Micro Data Centers and Modular Edge Infrastructure

A growing trend involves the adoption of modular and micro data centers. These compact units enable quick deployment near data sources, improving performance and scalability. It supports flexible operations in remote industrial zones and urban business hubs. The modular design reduces construction time and capital costs. Enterprises favor scalable edge setups to support unpredictable workloads. Manufacturers develop pre-integrated modules that ensure high power density and redundancy. The adoption of such systems aligns with the need for agile IT environments. This trend strengthens operational continuity across diverse industries.

Adoption of Artificial Intelligence for Data Optimization and Automation

AI-driven automation is reshaping how edge facilities manage power, cooling, and performance. Operators employ predictive maintenance to prevent system failures and optimize uptime. It enhances decision-making accuracy and operational resilience. Intelligent resource management reduces energy waste while improving processing efficiency. AI also enables adaptive load distribution to balance high-demand scenarios. Integration with machine learning tools enhances real-time analytics. These capabilities allow data centers to operate autonomously with minimal manual intervention. The growing sophistication of AI technologies supports sustainable and efficient facility operations.

Rising Demand for Data Localization and Regulatory Compliance

Increasing focus on data sovereignty influences market expansion. The Russian government enforces local data storage requirements to ensure national security. It drives enterprises to establish edge data centers within the country’s borders. Compliance with local laws becomes a competitive advantage for service providers. The trend encourages collaboration between international cloud operators and Russian partners. Businesses prioritize secure, compliant infrastructures that meet privacy regulations. Data localization enhances customer trust and transparency in digital ecosystems. The emphasis on compliance creates a structured framework for long-term growth.

Shift Toward Hybrid and Distributed Cloud Architectures

The adoption of hybrid models gains traction among enterprises balancing on-premises and cloud computing. Hybrid deployment provides flexibility and control over data management. It allows firms to leverage both private infrastructure and public cloud services. The approach enhances reliability during high-traffic periods and disaster recovery scenarios. Service providers offer distributed cloud solutions with edge nodes for better proximity. It helps enterprises reduce latency while maintaining data governance. Integration between global platforms and local facilities improves service quality. The trend signals a shift toward resilient, multi-location IT ecosystem.

Market Challenges

Regulatory Barriers and Infrastructure Modernization Limitations

The Russia Edge Data Center Market faces challenges related to complex regulations and modernization constraints. Strict data localization laws increase compliance costs for global companies. It limits the entry of foreign service providers without local partnerships. Aging power grids and regional disparities in connectivity slow infrastructure expansion. Some regions face difficulty in ensuring consistent power supply and cooling resources. Limited availability of skilled technicians delays facility upgrades. High import costs for advanced hardware increase operational expenditure. These factors create uneven market development across Russian territories.

Cybersecurity Threats and Dependence on Imported Technology

Growing reliance on digital systems increases exposure to cyber risks. The market experiences rising threats targeting sensitive enterprise data and national systems. It requires stronger encryption, intrusion detection, and backup frameworks. Limited domestic production of hardware components raises dependence on imported equipment. Sanctions and supply chain disruptions affect hardware availability. Operators struggle to source critical networking gear under trade restrictions. It pressures companies to seek alternative suppliers or develop local manufacturing. The balance between cybersecurity and supply resilience remains a key strategic concern.

Market Opportunities

Rising Adoption of AI, IoT, and Industrial Digitalization

The Russia Edge Data Center Market holds vast potential through AI and IoT expansion. Industries like manufacturing and energy integrate connected sensors for real-time monitoring. It enables faster decision-making and predictive maintenance. Government-backed digital programs stimulate smart city and infrastructure investments. Increasing automation in logistics and utilities drives local computing demand. Data-driven industries benefit from faster and more secure analytics processing. These applications attract global technology partners seeking new regional markets. Such adoption boosts national competitiveness and industrial innovation.

Expansion into Secondary Cities and Emerging Industrial Zones

Edge data centers are moving beyond Moscow and St. Petersburg into mid-sized cities. Demand in regions like Yekaterinburg and Novosibirsk grows due to enterprise decentralization. It helps balance national network load and reduce service latency. Telecom and IT companies target regional customers seeking localized storage. New industrial clusters support growth of regional data connectivity. Expanding into these markets improves nationwide digital access and resilience. This regional diversification opens new investment avenues for technology providers and infrastructure developers.

Market Segmentation

By Component

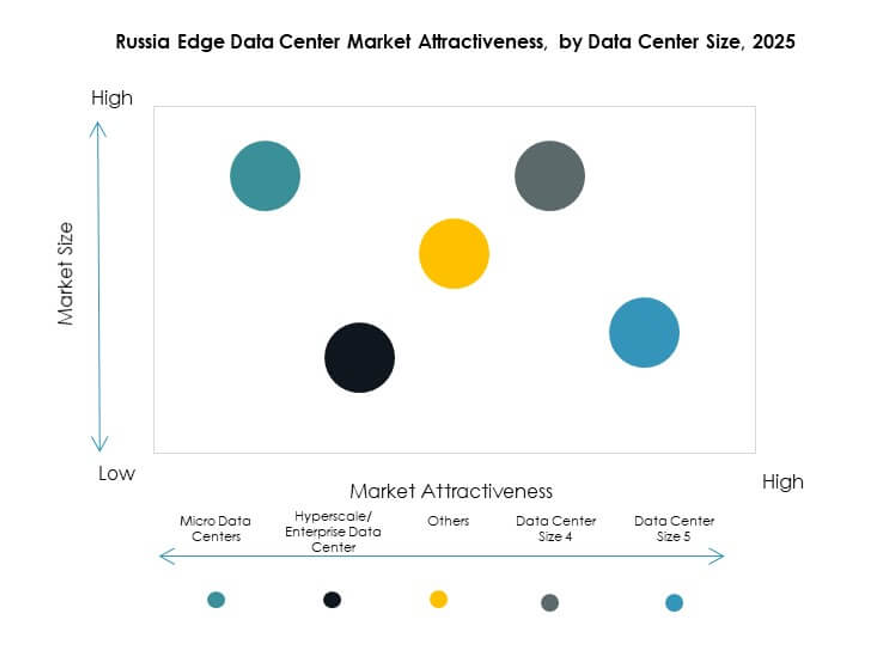

Solutions dominate the Russia Edge Data Center Market with a significant share due to rising demand for integrated infrastructure systems. Enterprises prioritize efficient power, cooling, and server solutions for low-latency operations. It ensures stability in remote and high-density environments. Service segments grow steadily, driven by demand for monitoring and maintenance contracts. Increasing vendor partnerships support end-to-end service delivery. Companies seek flexible deployment and scalability. Solutions segment remains vital for optimizing performance and cost efficiency.

By Data Center Type

Colocation Edge Data Centers lead the market, offering enterprises shared infrastructure at lower operational costs. It enables scalable capacity without heavy capital investments. Managed and cloud-edge data centers also gain traction through hybrid deployment models. Enterprises use them to balance security and flexibility in data handling. It supports digital expansion across industries like finance and e-commerce. Colocation hubs in Moscow and St. Petersburg attract strong investor interest. This dominance reflects the growing need for reliable, connected facilities in strategic urban regions.

By Deployment Model

Hybrid deployment holds the largest market share, driven by enterprises combining on-premises and cloud resources. It offers better data control, security, and integration with legacy systems. On-premises models remain relevant for regulated sectors such as BFSI and defense. Cloud-based models grow with the rise of SaaS adoption. It enables cost-efficient scaling and faster application delivery. Hybrid systems deliver optimal balance between flexibility and compliance. Growing enterprise awareness of hybrid benefits strengthens its market position across Russia.

By Enterprise Size

Large enterprises dominate due to higher IT budgets and digital transformation initiatives. They invest heavily in scalable, secure edge solutions for high-volume data processing. It helps enhance business continuity and operational resilience. SMEs show rapid adoption, seeking affordable and compact solutions. Government programs and regional incentives support SME digitization. Growing start-up activity in cloud and AI sectors accelerates this trend. The large enterprise segment, however, maintains leadership through advanced infrastructure deployment and innovation investment.

By Application / Use Case

Power Monitoring holds the leading share in the market, driven by focus on operational efficiency and cost control. It enables real-time tracking of energy use across multiple sites. It supports sustainability goals and system reliability. Capacity management and BI analytics follow closely with data-driven business optimization. Asset and environmental monitoring enhance facility safety and uptime. Edge centers use analytics tools to prevent overload and improve performance. Demand for integrated monitoring drives continuous software innovation and adoption.

By End User Industry

IT and Telecommunications sector dominates the Russia Edge Data Center Market due to high data traffic and 5G rollout. Enterprises in BFSI and retail sectors also show strong deployment rates. It supports secure transactions and digital commerce expansion. Healthcare and energy industries use edge computing for analytics and remote monitoring. Aerospace and defense require high-speed secure data transmission. This broad application base ensures long-term market stability and cross-sector adoption.

Regional Insights

Western Russia: The Core of Edge Infrastructure and Innovation (Share: 56%)

Western Russia leads the market, driven by major data center clusters in Moscow and St. Petersburg. It benefits from superior connectivity, enterprise concentration, and government-backed digital projects. It serves as the hub for international and domestic investments. Telecom operators expand edge nodes to support 5G networks and cloud services. The presence of advanced IT ecosystems ensures high service reliability. Growing enterprise digitalization strengthens its dominance and market growth potential.

- For instance, Rostelecom opened a new Tier III data center in St. Petersburg’s Kalininsky district in 2021, providing a facility capacity of 800 racks and 7.4 MW. The facility supports hosting, cloud services, and redundancy functions for the region, working in tandem with major Moscow data centers. This expansion is aligned with government-backed digital projects and growing demand for secure, large-capacity data storage.

Central Russia: Expanding Industrial and Technological Ecosystem (Share: 27%)

Central Russia emerges as a strong contributor due to manufacturing and logistics growth. It attracts investment in smart industrial applications and localized data management. It connects western hubs with eastern economic zones. The region experiences rising installation of modular data centers for real-time analytics. Increased collaboration between technology firms and industrial parks fuels capacity expansion. Government incentives for digital transformation drive strong mid-term growth.

Eastern Russia: Rising Potential and Network Expansion (Share: 17%)

Eastern Russia remains an emerging subregion supported by expanding telecom infrastructure and digital inclusion projects. It gains importance for connecting Asian trade and data exchange routes. It serves industries in mining, energy, and transport requiring reliable computing. Gradual improvement in connectivity and power stability boosts market interest. It attracts investment from cross-border technology collaborations with Asia-Pacific. Its evolving infrastructure positions the subregion as a key frontier for future edge growth.

- For instance, TransTeleCom (TTK) operates more than 76,000 km of fiber network connecting Russia to China and Mongolia, enabling high-capacity cross-border data exchange and supporting seamless data transit for Asian trade routes and logistics customers.

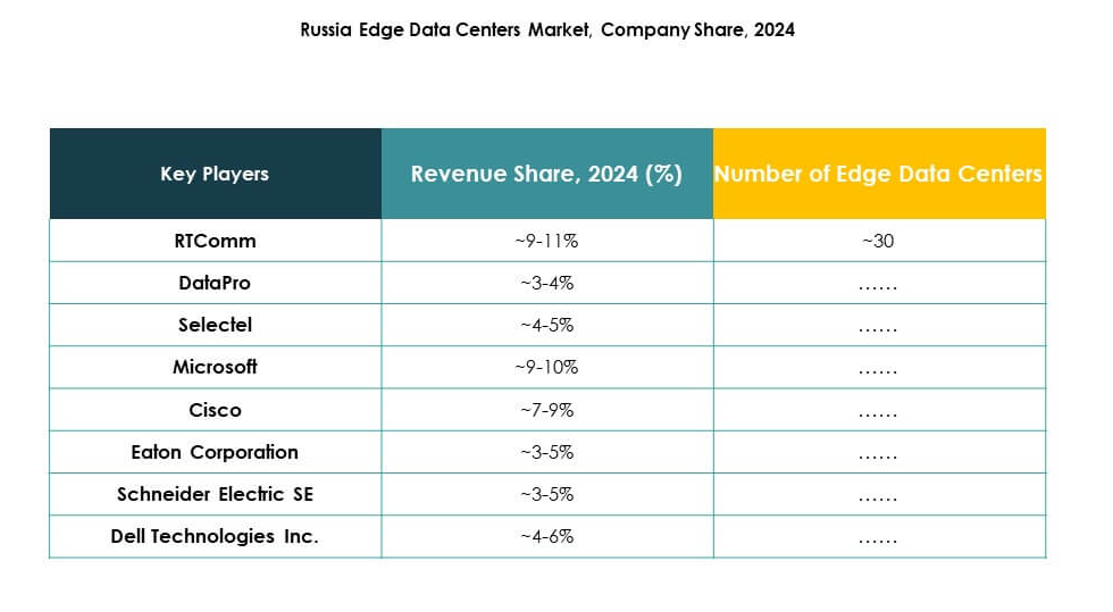

Competitive Insights:

- RTComm

- DataPro

- Selectel

- EdgeConneX

- Eaton Corporation

- Dell Technologies Inc.

- Fujitsu

- Cisco

- SixSq

- Microsoft

- VMware

- Schneider Electric SE

- Rittal GmbH & Co. Kg

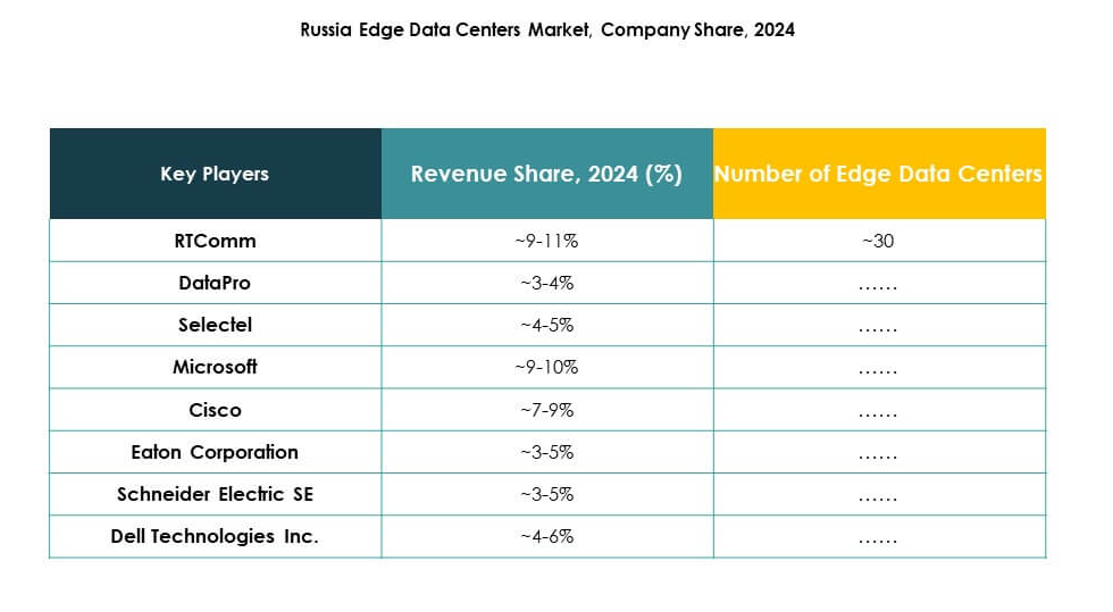

The Russia Edge Data Center Market features a mix of domestic and international players competing on infrastructure reliability, innovation, and energy efficiency. RTComm, DataPro, and Selectel strengthen their presence through localized operations and regulatory compliance. Global leaders such as Microsoft, Cisco, and Dell Technologies expand cloud and edge integration across enterprise networks. It benefits from strategic collaborations between hardware manufacturers and service providers focusing on modular, low-latency architectures. Schneider Electric and Rittal enhance power management and cooling technologies, supporting green data initiatives. Competitive intensity grows with partnerships, acquisitions, and new deployments across industrial and telecom sectors, driving continuous technological advancement.

Recent Developments:

- In July 2025, Megafon launched new data centers in Yekaterinburg and Tver, each offering a capacity of 1MW. These facilities boost Megafon’s infrastructure footprint in regional Russian cities, addressing increasing data demand at the edge.

- In June 2025, RTComm’s parent company RTK-TsOD launched a major new data center in the Nizhny Novgorod region in Russia, marking its first site in this area and accelerating regional digital infrastructure development. The facility boasts four machine rooms and a total IT capacity of 5MW, with both its first and second construction phases completed well ahead of schedule, furthering Rostelecom’s systematic expansion of its edge data center network across Russia.