Executive summary:

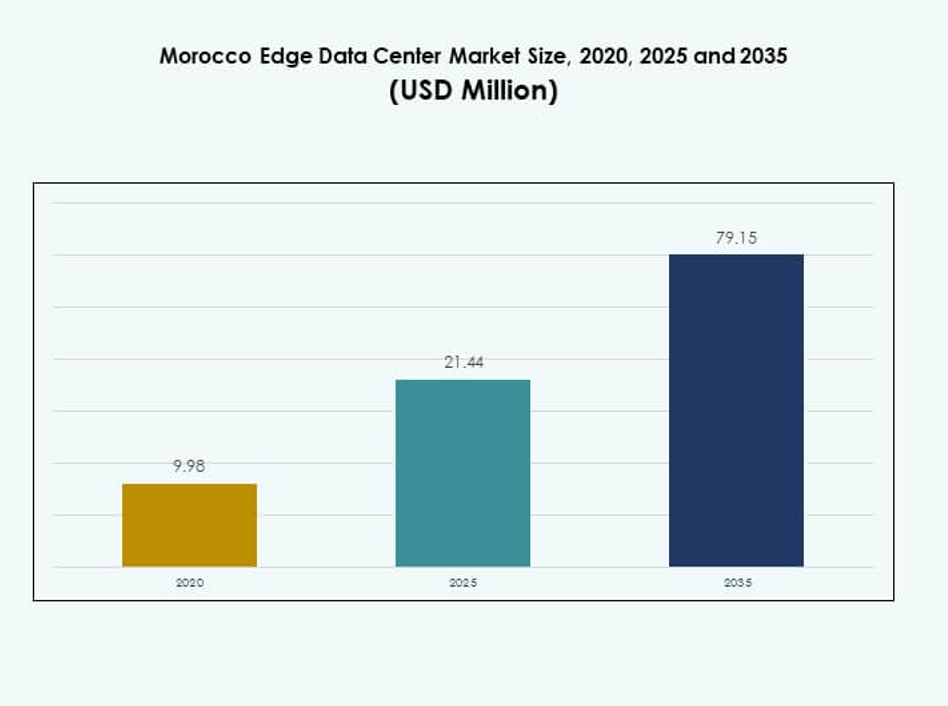

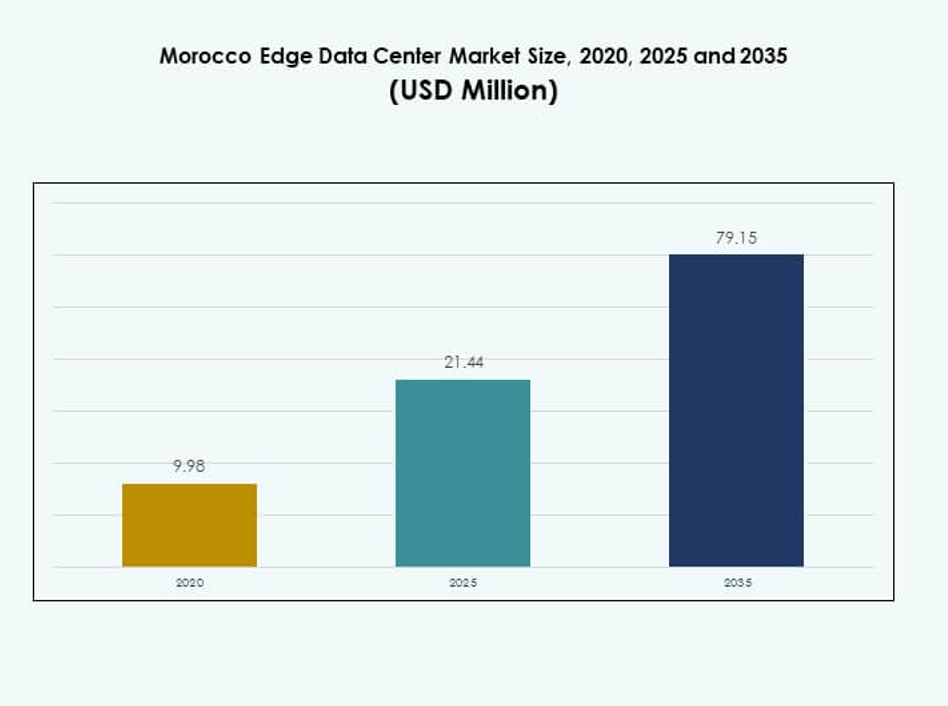

The Morocco Edge Data Center Market size was valued at USD 9.98 million in 2020, increased to USD 21.44 million in 2025, and is anticipated to reach USD 79.15 million by 2035, at a CAGR of 13.77% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Morocco Edge Data Center Market Size 2025 |

USD 21.44 Million |

| Morocco Edge Data Center Market, CAGR |

13.77% |

| Morocco Edge Data Center Market Size 2035 |

USD 79.15 Million |

Rapid digital transformation, 5G deployment, and increased cloud adoption are driving strong demand for edge infrastructure. Telecom operators and global tech firms are investing in modular, low-latency facilities to support critical applications. It plays a strategic role in enabling real-time processing, improving network efficiency, and creating scalable solutions that attract both domestic and international investors.

North Africa is leading with strong connectivity infrastructure, growing digital trade, and supportive regulations. Europe is an emerging partner region, fueling international collaborations and investments. Sub-Saharan Africa is showing growing potential, driven by digital inclusion initiatives and expanding enterprise demand for edge services.

Market Drivers

Growing Demand for Low-Latency Infrastructure Across Critical Industries

The Morocco Edge Data Center Market benefits from increasing demand for low-latency processing across telecommunications, manufacturing, and finance. Businesses rely on fast data delivery to support real-time operations and connected ecosystems. It enables secure local data storage and improves application response time. The deployment of advanced fiber-optic networks strengthens this growth. Telecom operators are prioritizing edge infrastructure to support IoT integration and enterprise connectivity. Private sector investments in cloud-native applications create strong momentum. Edge facilities enable mission-critical workloads without dependence on distant cloud nodes. This ecosystem enhances business agility and scalability.

Rising Digital Transformation and Cloud Ecosystem Expansion

The country is witnessing accelerated adoption of cloud solutions by enterprises seeking operational efficiency. Public and private organizations are embracing hybrid IT environments to reduce network congestion and improve data security. It supports AI-driven decision-making and real-time analytics for diverse industries. Strategic collaborations between telecom operators and hyperscale providers strengthen infrastructure capabilities. Government policies encourage digital transformation and incentivize infrastructure deployment. New edge facilities allow enterprises to serve customers with improved uptime and resilience. Investment confidence grows as infrastructure matures. This digital shift fuels strong economic and technological gains.

Widespread Adoption of Emerging Technologies Across Multiple Sectors

The market benefits from the growing integration of IoT, AI, 5G, and automation in industrial operations. Smart manufacturing plants and logistics hubs require efficient computing power closer to end-users. It helps enterprises minimize latency and optimize bandwidth consumption. 5G networks accelerate the use of connected devices across cities and industries. Companies invest in scalable edge deployments to improve service delivery and operational visibility. Industry convergence drives demand for multi-tenant edge facilities. Automation technologies push more data processing to the network edge. This transformation attracts strategic investments from global infrastructure players.

- For instance, in 2025, Morocco’s ANRT awarded 5G licenses to Maroc Telecom, Inwi, and Orange to support national next-generation network deployment. This milestone marked the official start of the country’s 5G rollout, strengthening its digital infrastructure.

Strategic Importance for Economic Competitiveness and Investment Growth

The country positions edge data centers as critical enablers of economic modernization. It strengthens digital trade, supports e-commerce expansion, and improves public service delivery. Strategic investments align with government initiatives to build a knowledge-based economy. International operators see Morocco as a bridge for data connectivity between Europe and Africa. High-speed terrestrial and submarine cable networks enhance connectivity. This positioning attracts global investors seeking to expand their digital footprint. Enterprises leverage local infrastructure to secure sensitive data. Competitive infrastructure boosts regional digital leadership and investor trust.

- For instance, in June 2025, Morocco surpassed South Africa to become the leading host of data centers in Africa, operating 23 facilities in Casablanca-Settat and Rabat-Salé-Kénitra This growth has drawn international infrastructure investors and operators targeting Europe-Africa connectivity.

Market Trends

Integration of AI and Automation to Enhance Edge Network Efficiency

Automation and AI are redefining how data centers operate at the network edge. Intelligent control systems optimize energy use, detect anomalies, and improve uptime. It allows operators to manage larger workloads with minimal manual intervention. AI-based workload distribution enhances performance during peak demand. Predictive analytics tools improve system reliability and cut operational costs. Vendors are deploying smart software-defined infrastructure for flexible resource allocation. This trend supports future-ready, scalable network design. Edge AI adoption strengthens Morocco’s digital competitiveness in global markets.

Development of Modular and Scalable Edge Infrastructure Designs

Modular construction techniques enable faster deployment and flexible capacity scaling for operators. Compact, containerized units reduce build time and operational complexity. It improves agility for telecom and cloud providers entering new regions. Scalable designs support different industry needs, from BFSI to e-commerce. Enterprises can add capacity without major infrastructure changes. This modular approach supports decentralized computing expansion across remote locations. Vendors are prioritizing efficient thermal management systems. Market participants adopt this model to balance cost and flexibility in infrastructure investments.

Increasing Focus on Sustainable and Energy-Efficient Edge Facilities

Sustainability is shaping investment and operational strategies across the market. Operators adopt energy-efficient cooling and renewable power integration to meet environmental targets. It lowers operational expenses and enhances regulatory compliance. Enterprises prioritize green infrastructure for achieving ESG goals. Innovative designs enable reduced water use and optimized airflow management. Certification standards push operators toward higher energy performance. This sustainable shift attracts eco-conscious investors and global partners. Morocco leverages its renewable energy capacity to strengthen this transition.

Strengthening Regional Connectivity and Digital Infrastructure Integration

Improved terrestrial and submarine cable systems enhance Morocco’s strategic value as a connectivity hub. It creates strong links between Africa, Europe, and the Middle East. Investment in high-capacity backbone networks boosts edge deployment viability. Telecom operators expand capacity to support global content delivery and enterprise networks. Strategic partnerships drive co-location services and hybrid cloud adoption. Enhanced connectivity supports cross-border trade and logistics applications. This trend cements Morocco’s position in the global digital value chain.

Market Challenges

Limited Specialized Skill Base and Operational Capability Constraints

The Morocco Edge Data Center Market faces workforce shortages in advanced networking, AI integration, and energy-efficient operations. Technical expertise in edge deployment and management remains limited. It creates higher dependency on foreign service providers for implementation. Limited skilled resources slow down deployment speed and quality assurance. Training programs are expanding but require more industry alignment. Operational reliability may be affected by slow response to incidents. Scaling advanced facilities requires consistent workforce development. Bridging this talent gap remains a major strategic priority.

High Infrastructure Costs and Energy Supply Reliability Concerns

Building modern edge facilities requires large upfront capital and long payback periods. Securing uninterrupted power remains a challenge in specific regions. It increases operational costs and limits the pace of new project development. Energy reliability concerns push operators to invest in redundant systems. High import costs for critical equipment create additional pressure. Local financing for digital infrastructure remains underdeveloped. Investment risk perception can slow project execution. Achieving cost-efficiency while maintaining service quality requires structured incentives.

Market Opportunities

Strategic Positioning as a Regional Digital Gateway

The Morocco Edge Data Center Market holds significant potential to become a digital bridge between Europe and Africa. It can attract hyperscale operators seeking a strong connectivity node. Government policies support infrastructure investments that align with regional trade goals. Local enterprises can expand digital operations with low-latency services. Proximity to major submarine cables enhances international network traffic flow. Infrastructure providers gain first-mover advantage in regional cloud services. Strategic partnerships strengthen the country’s role in cross-border connectivity.

Rising Demand for Industry-Specific Edge Solutions

Industry verticals such as BFSI, healthcare, and logistics are shifting toward localized data infrastructure. It creates new demand for sector-focused edge computing services. Vendors can provide specialized solutions for real-time analytics and regulatory compliance. Enterprises require resilient and secure infrastructure to support digital operations. Scalable deployment models offer flexibility for SMEs and large corporations. Innovation-focused operators gain market differentiation. This growing demand opens profitable opportunities for investors and service providers.

Market Segmentation

By Component

Solution dominates the segment with a significant market share driven by strong enterprise adoption. It offers critical infrastructure for data processing, storage, and network functions at the edge. Service demand grows with managed support for deployment and maintenance. Businesses rely on integrated solutions to reduce latency and improve efficiency. The strong presence of network modernization programs accelerates growth. Vendors focus on delivering modular and interoperable solutions. Enterprises prefer reliable, scalable platforms for operational continuity.

By Data Center Type

Colocation edge data centers lead the segment with high adoption from telecom operators and enterprises. It offers shared infrastructure with strong connectivity, operational flexibility, and cost efficiency. Cloud and edge data centers also record strong growth supported by hybrid IT strategies. Enterprise facilities focus on security and control. Managed centers enable resource optimization without heavy capital spending. Strategic partnerships between carriers and cloud providers enhance deployment speed. Strong demand from content delivery networks boosts colocation momentum.

By Deployment Model

Cloud-based deployment dominates due to lower capital costs and faster scalability. It enables enterprises to expand services across different regions with minimal infrastructure ownership. On-premises models retain relevance for sensitive workloads and regulatory compliance. Hybrid models gain traction for their flexibility and control. Enterprises choose cloud-first strategies for agility and innovation. Vendor ecosystems expand to support seamless migration between models. Strong telecom connectivity supports faster rollout of cloud-based solutions.

By Enterprise Size

Large enterprises hold a significant market share driven by strong investment capacity and advanced IT needs. It enables deployment of high-capacity edge nodes for complex workloads. SMEs show increasing interest in adopting cost-effective cloud-based edge solutions. Digital transformation initiatives across industries drive SME engagement. Vendors offer flexible pricing and scalable services. Market participation widens as digital infrastructure becomes more accessible. Growth in SME adoption expands the overall customer base.

By Application / Use Case

Power monitoring leads the application segment, supported by growing energy efficiency goals. It enables better visibility and control over critical systems. Asset and capacity management solutions follow, supporting operational optimization. Environmental monitoring gains traction for sustainable operations. BI and analysis tools enhance data-driven decisions at the edge. Enterprises prioritize applications that improve uptime and reduce energy waste. Modular platforms support multiple use cases for flexible deployment.

By End User Industry

IT and telecommunications dominate the segment due to heavy network traffic and service demands. BFSI follows with strong regulatory and security requirements. Retail and e-commerce sectors drive demand for faster customer engagement. Healthcare expands edge use to support telemedicine and patient data applications. Energy and utilities leverage edge capabilities for grid stability. Aerospace and defense adopt secure nodes for critical missions. Broad industry participation supports market maturity and growth.

Regional Insights

Strong Presence of North Africa with Morocco as a Core Digital Hub

North Africa holds a 41.3% share of the Morocco Edge Data Center Market, driven by strong connectivity and government-led digital initiatives. It serves as a strategic hub for international data routes linking Europe and Africa. Telecom operators and global investors invest in network infrastructure to enhance edge capabilities. It benefits from regulatory clarity and high-capacity backbone networks. Strong enterprise demand and favorable policies support continued infrastructure expansion.

- For instance, in June 2025, Naver Cloud, Nvidia, Nexus Core Systems, and Lloyds Capital announced plans to build a 500 MW AI data center campus in Morocco, powered by renewable energy and designed to support advanced AI workloads. This project reflects growing global investment in Morocco’s edge and AI infrastructure.

Rising Opportunities Across Sub-Saharan Africa and West Africa

Sub-Saharan Africa accounts for 34.6% of the market share, supported by rapid urbanization and digital inclusion programs. Emerging economies in this subregion focus on expanding network capacity to reduce latency and enhance service delivery. It attracts regional cloud providers aiming to expand their footprint. Infrastructure development improves cross-border connectivity for industries. The growing demand for content delivery services boosts edge adoption.

- For instance, in April 2022, Google and WIOCC completed the landing of the Equiano subsea cable into the OADC Lagos Tier III facility. The site supports a 20 MW power load and offers capacity for over 3,200 racks across 7,200 m², serving as a major connectivity hub in West Africa.

Increasing Strategic Investments from European Operators

Europe contributes 24.1% to the market share, positioning itself as a strategic investor and partner. European firms see Morocco as a key point for transcontinental connectivity. It strengthens integration with submarine cable systems and fiber networks. Strategic alliances support hybrid cloud and content delivery expansions. Investment in sustainable infrastructure reinforces its role in global data exchange. The collaboration between Moroccan and European operators drives strong market maturity.

Competitive Insights:

- Maroc Telecom

- Orange Maroc

- Inwi

- Africa Data Centres

- Groupe Télécom Algérie

- EdgeConneX

- Eaton Corporation

- Dell Technologies Inc.

- Fujitsu

- Cisco

- SixSq

- Microsoft

- VMWare

- Schneider Electric SE

- Rittal GmbH & Co. Kg

- Others

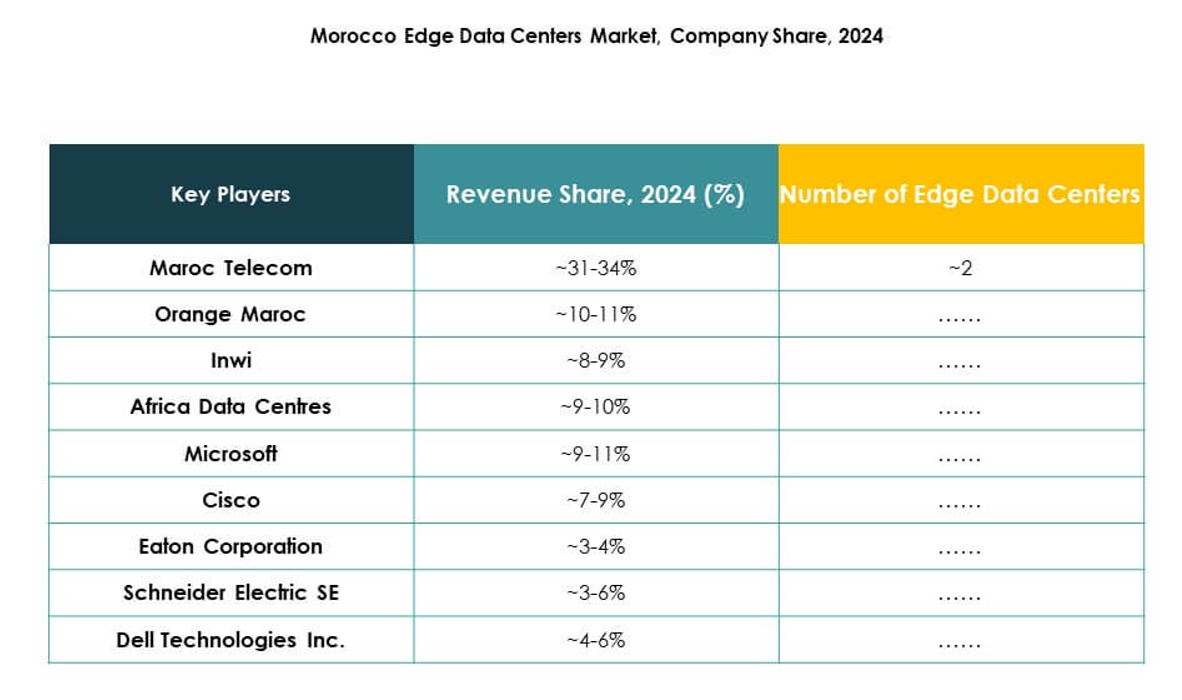

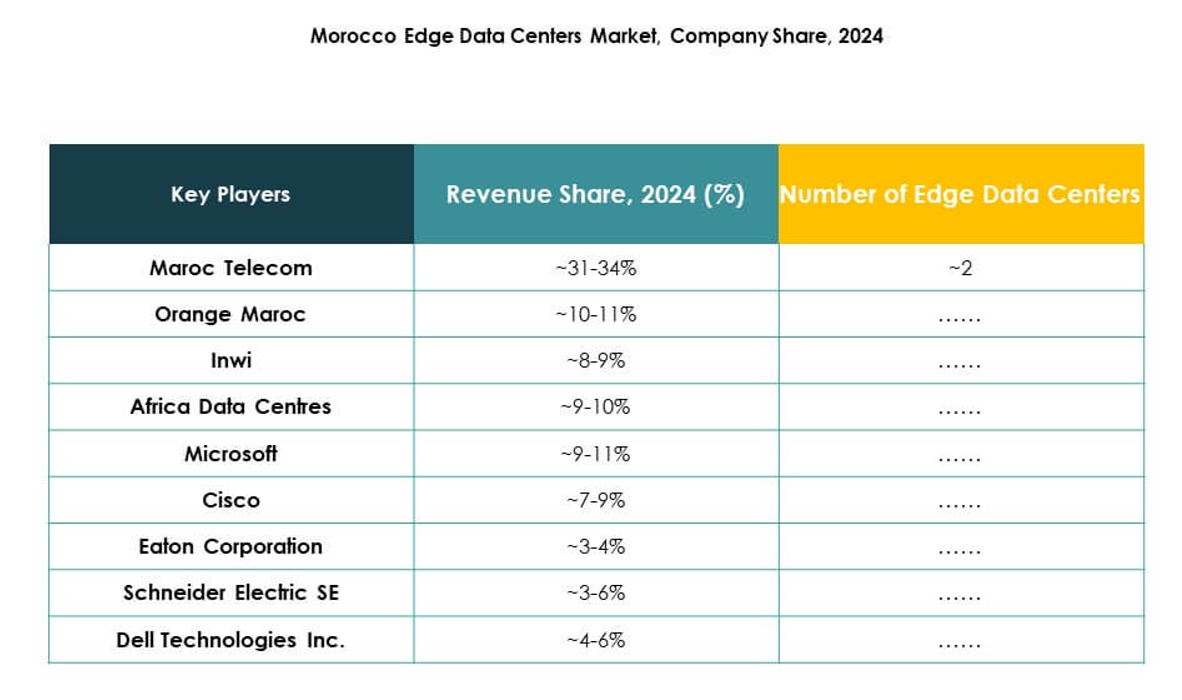

The Morocco Edge Data Center Market features strong competition between regional telecom operators and global technology providers. Telecom leaders invest in expanding edge infrastructure to strengthen network performance and support low-latency applications. Global vendors offer advanced power, cooling, and virtualization solutions to enhance facility efficiency and reliability. It fosters strategic alliances between local operators and global firms to accelerate deployment and achieve scale. Companies focus on modular designs, AI integration, and energy optimization to gain competitive advantages. International players leverage their expertise to build hybrid and scalable architectures. Market leadership depends on technology capabilities, service quality, and long-term infrastructure strategies. The competitive landscape continues to intensify with growing investments from both domestic and international stakeholders.

Recent Developments:

- In February 2025, Amazon Web Services in partnership with Orange launched the AWS Wavelength Zone Edge location in Morocco. This deployment was designed to support ultra-low latency applications by bringing AWS compute and storage services closer to end-users, marking a significant step in strengthening Morocco’s edge data center infrastructure.

- In June 2025, Oracle launched a new research and development center in Casablanca to drive innovation in cloud and AI solutions across Morocco’s rapidly expanding edge data center market. This move signifies the rising interest from global tech leaders in building advanced infrastructure within the region.

- In June 2025, a major consortium led by South Korea’s Naver and US-based Nvidia, alongside Nexus Core Systems and Lloyd Capital, announced the commencement of work on a 500MW artificial intelligence data center in Morocco. The first phase, involving the construction of a 40MW AI supercomputing facility with Nvidia’s latest Blackwell GPUs, is set to begin in the fourth quarter of 2025.