Executive summary:

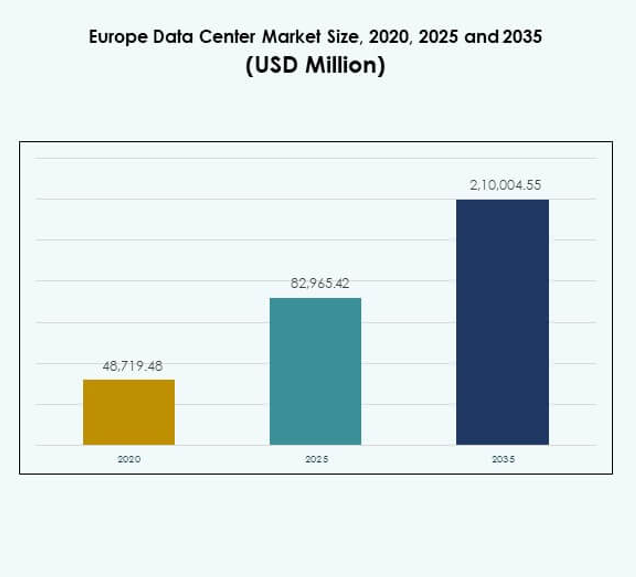

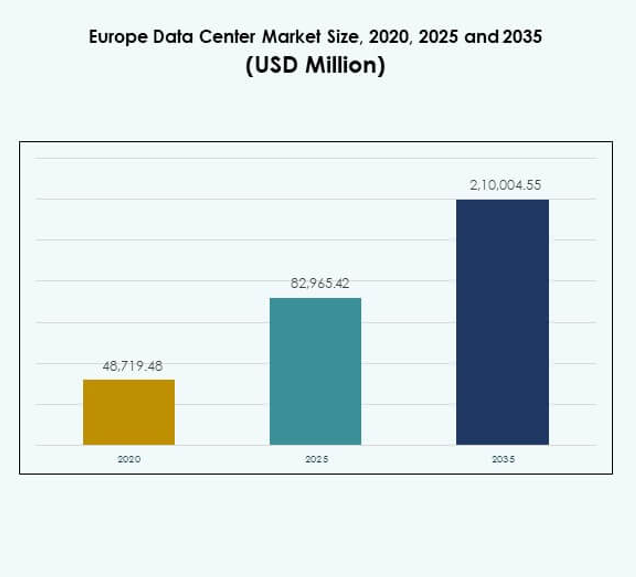

The Europe Data Center Market size was valued at USD 48,719.48 million in 2020 to USD 82,965.42 million in 2025 and is anticipated to reach USD 2,10,004.55 million by 2035, at a CAGR of 9.68% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2025 |

| Forecast Period |

2025-2035 |

| Europe Data Center Market Size 2025 |

USD 82,965.42 Million |

| Europe Data Center Market, CAGR |

9.68% |

| Europe Data Center Market Size 2035 |

USD 2,10,004.55 Million |

The market is driven by rapid technology adoption, expanding cloud deployments, and increasing demand for AI-ready infrastructure. Enterprises across sectors are modernizing IT systems, embracing edge computing, and investing in sustainable operations. Innovation in automation, liquid cooling, and virtualization strengthens efficiency while enabling low-latency services. The Europe Data Center Market holds strategic significance for businesses and investors by supporting digital economies, securing data sovereignty, and unlocking new opportunities in advanced connectivity.

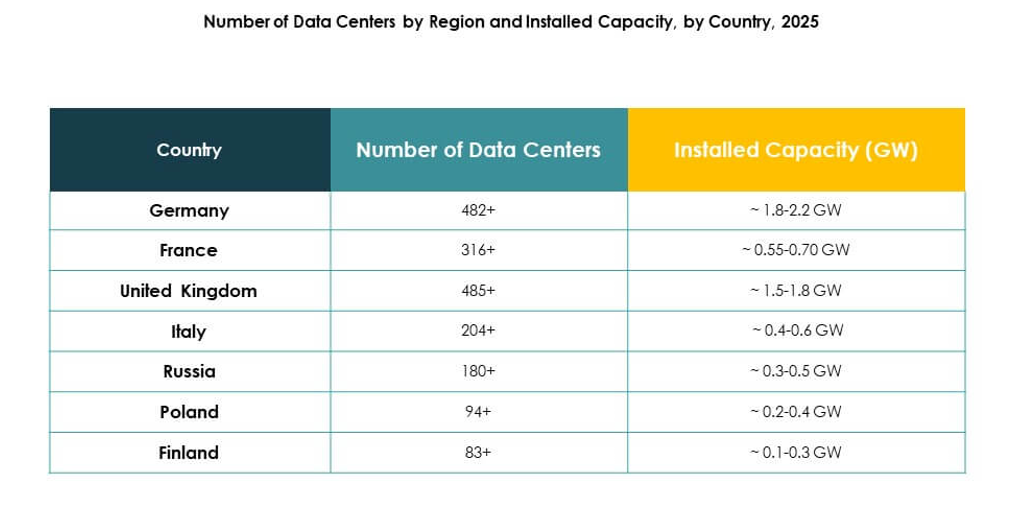

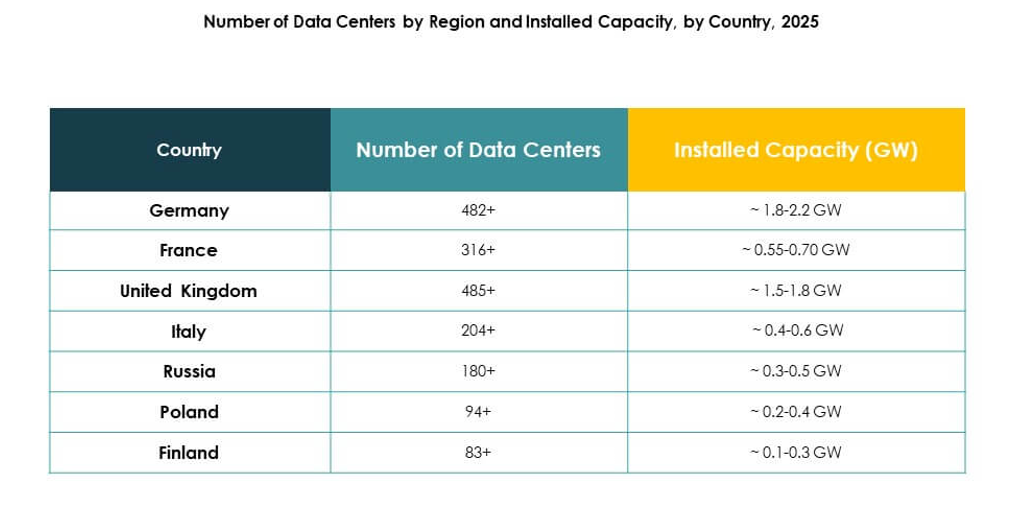

Geographically, Western Europe leads with strong infrastructure and concentration of hyperscale hubs in Germany, the UK, and France. Nordic countries are emerging as sustainability leaders, leveraging renewable energy and favorable climates for green data centers. Southern and Eastern Europe are gaining momentum with growing enterprise digitization, urban infrastructure expansion, and supportive government policies. The Europe Data Center Market benefits from diverse regional strengths, driving balanced growth across mature and emerging hubs.

Market Drivers

Rising Digital Transformation Across Core Industries

The Europe Data Center Market is propelled by the rapid digital shift in banking, telecom, retail, and manufacturing. Enterprises need secure, high-capacity facilities to support their evolving digital strategies. It benefits from rising adoption of AI, IoT, and advanced analytics requiring vast storage and computing power. Cloud migration remains a strong enabler, expanding the demand for scalable architectures. Investors view the market as a key gateway to long-term infrastructure growth. Businesses prioritize reliable centers to enhance resilience and data availability. Strategic alliances between technology firms and enterprises accelerate innovation. Government support for digital infrastructure strengthens growth momentum across the continent.

- For instance, on July 1, 2025, Deutsche Telekom consolidated its cloud offerings under the “T Cloud” brand, unifying Telekom Deutschland and T-Systems infrastructure to offer sovereign, Europe-focused cloud solutions.

Strong Adoption Of Hyperscale And Edge Computing Platforms

Hyperscale operators dominate new deployments by offering scale, efficiency, and global connectivity. The Europe Data Center Market is shaped by growing investment in modular and edge sites enabling low-latency applications. It supports the rise of 5G-driven services, immersive media, and real-time analytics. Enterprise reliance on colocation centers boosts demand for flexible and cost-efficient operations. Operators deploy energy-efficient designs to reduce operational costs and ensure compliance. Edge facilities in urban hubs strengthen regional connectivity and business continuity. Cross-border digital trade creates further investment opportunities. Cloud adoption combined with edge expansion redefines strategic positioning for operators and stakeholders.

- For instance, Equinix opened its FR13 IBX data center in Frankfurt as part of its Frankfurt North-East campus, offering 1,125 cabinets and 7.75 MW of IT power capacity with advanced energy-efficiency features.

Focus On Sustainable Energy Efficiency And Carbon Neutrality Goals

The market is highly influenced by sustainability targets driving green data center construction. The Europe Data Center Market adopts renewable power solutions to meet strict emission norms. It integrates liquid cooling, AI-driven optimization, and advanced power management systems. Enterprises choose eco-certified facilities to align with environmental responsibility. Green investments attract global operators seeking reliable yet sustainable growth avenues. Renewable energy availability in Nordic regions positions them as preferred sites. It accelerates Europe’s commitment to carbon neutrality by promoting efficient designs. Regulatory frameworks encourage adoption of circular economy principles in infrastructure development.

Increasing Strategic Importance For Businesses And Investors

Data centers are no longer just back-end support systems but core enablers of digital economies. The Europe Data Center Market holds strategic relevance for technology firms, telecom players, and financial institutions. It drives cross-border collaboration and business continuity through interconnected ecosystems. Investors see the sector as a resilient asset class with stable returns. It creates opportunities for mergers, acquisitions, and partnerships across geographies. Enterprises benefit from flexible leasing models, fostering scalability. Strong demand from SMEs broadens the revenue base. Strategic positioning across digital corridors strengthens the continent’s competitive edge.

Market Trends

Growing Integration Of Artificial Intelligence In Data Center Operations

AI-based automation is transforming facility management, enabling predictive maintenance and energy optimization. The Europe Data Center Market integrates AI for workload distribution, fault detection, and resource allocation. It enhances operational efficiency while reducing downtime risks. Smart monitoring systems elevate customer trust and service quality. Operators invest in machine learning to ensure better capacity planning. The trend creates smarter and leaner operations aligning with sustainability goals. It also supports enhanced cybersecurity measures through anomaly detection. AI continues to shape both design and day-to-day management of modern facilities.

Rapid Expansion Of Colocation And Cloud Connectivity Services

Businesses increasingly prefer colocation centers to lower capital costs and gain flexible options. The Europe Data Center Market shows rising demand for multi-cloud interconnection supporting enterprise workloads. Colocation hubs serve as gateways for hybrid architectures combining on-premises and cloud resources. It allows firms to expand internationally without building their own infrastructure. Operators are expanding cross-connect options for direct access to hyperscale cloud providers. Enterprises in regulated sectors adopt secure colocation facilities to ensure compliance. Demand for scalable hosting capacity grows with digital trade expansion. The trend fosters more partnerships between colocation providers and telecom firms.

Deployment Of Advanced Cooling And Power Management Systems

Operators are focusing on innovative liquid cooling, immersion techniques, and high-density power racks. The Europe Data Center Market experiences strong demand for efficient thermal solutions due to rising energy costs. It integrates advanced airflow systems and modular cooling units for reliability. Operators adopt AI-based power optimization to minimize wastage. Green hydrogen and renewable integration also gain traction. Urban locations emphasize compact but efficient cooling solutions. High-performance computing applications necessitate customized designs. Sustainability-focused investors push for cutting-edge upgrades across the continent.

Rising Influence Of 5G Networks On Edge And Micro Data Centers

The rollout of 5G boosts real-time applications in autonomous vehicles, gaming, and smart cities. The Europe Data Center Market benefits from expansion of edge and micro data centers. It ensures ultra-low latency and improved regional connectivity. Telecom operators collaborate with data center firms to host 5G workloads. Urban clusters demand compact modular solutions for dense population hubs. Enterprises leverage edge sites to enhance customer experience. Governments promote network upgrades supporting smart infrastructure. The synergy between telecom and digital infrastructure accelerates market development.

Market Challenges

High Operational Costs And Energy Consumption Issues

The Europe Data Center Market faces significant challenges due to high energy costs and resource intensity. It requires constant investment in power optimization and cooling infrastructure. Operators balance capacity expansion with rising electricity expenses. Environmental regulations increase compliance costs across regions. Renewable energy integration requires upfront capital and long-term planning. Data center operators must ensure reliability while reducing environmental impact. The cost burden is particularly high in Western Europe. Limited land availability in urban hubs further amplifies operational hurdles.

Intensifying Competition And Regulatory Complexity Across Subregions

The competitive landscape is crowded with hyperscale, colocation, and local enterprise operators. The Europe Data Center Market is affected by stringent regulations on data sovereignty and environmental norms. Operators must adapt to country-specific policies that differ across subregions. Rising competition lowers margins and forces continuous innovation. Market entry barriers remain high for smaller firms. Governments demand stricter compliance on data privacy and carbon footprint. The mix of diverse legal environments complicates cross-border operations. Businesses must adapt strategies quickly to sustain profitability in this environment.

Market Opportunities

Expanding Cloud Adoption And Digital Infrastructure Investments

The Europe Data Center Market holds strong opportunities from rising cloud migration and digital service expansion. It benefits from surging demand across finance, healthcare, and government. Multinational corporations expand presence through regional hosting partnerships. It enables SMEs to scale operations without heavy capital investment. Governments promote digital-first policies creating favorable environments. Cloud adoption accelerates new colocation and hyperscale projects. Renewable-powered facilities add investment attractiveness. Edge data centers in urban clusters open further avenues for future growth.

Adoption Of Emerging Technologies And Industry-Specific Solutions

Sectors such as media, healthcare, and manufacturing demand AI-enabled, industry-tailored data centers. The Europe Data Center Market benefits from IoT, AR/VR, and blockchain integration. It supports workloads requiring secure, low-latency solutions. Modular designs address needs of fast-growing enterprises. AI and automation attract investors seeking efficient models. Partnerships with telecom providers enhance 5G service delivery. Customized offerings improve customer acquisition and retention. Growth opportunities multiply as industries digitize their operations at scale.

Market Segmentation

By Component

Hardware dominates the Europe Data Center Market, holding the largest share due to growing server and storage demand. Cooling and power systems also account for significant investments driven by efficiency needs. Software solutions such as DCIM and orchestration platforms expand steadily to enhance management. Services including consulting and managed operations gain traction as enterprises outsource non-core functions. The segment thrives on hybrid adoption and multi-cloud growth.

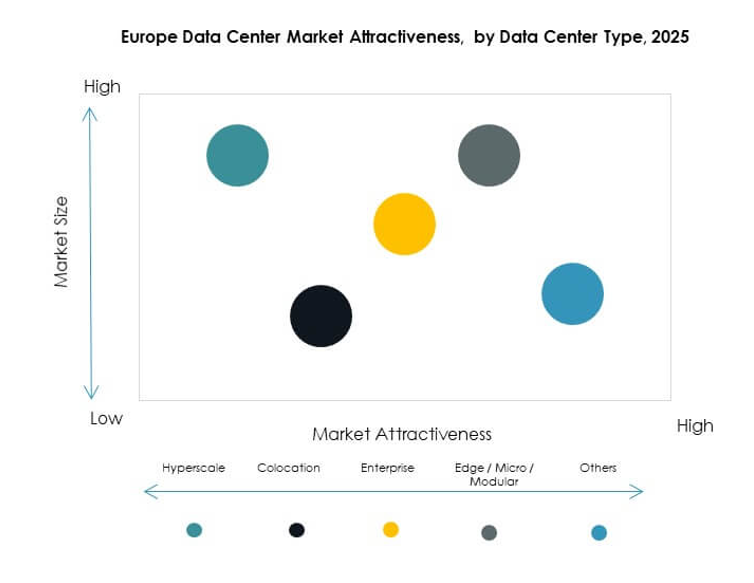

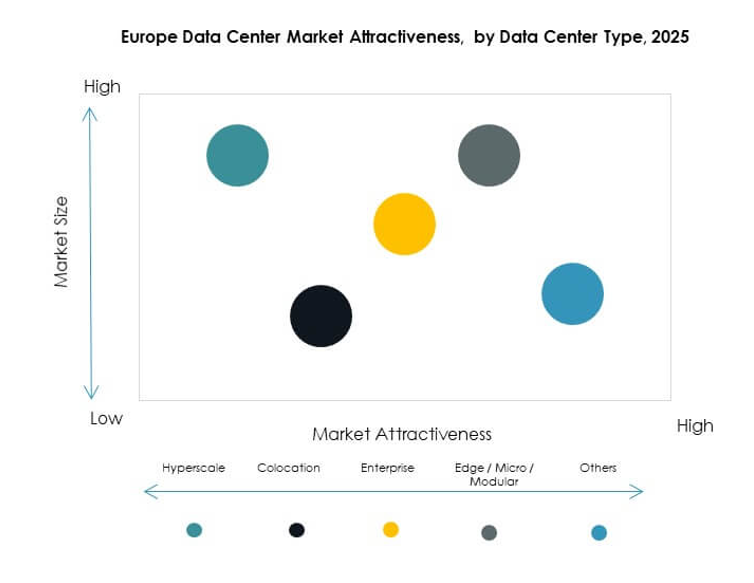

By Data Center Type

Hyperscale facilities lead the Europe Data Center Market, driven by global cloud providers and tech giants. Colocation centers follow closely with strong adoption across enterprises seeking scalable solutions. Enterprise data centers hold a smaller but stable share, serving legacy infrastructure. Edge and modular data centers are emerging segments gaining traction with 5G rollout. Mega facilities continue expanding in Western Europe. Cloud and internet data centers also grow rapidly to support evolving workloads.

By Deployment Model

Cloud-based models lead the Europe Data Center Market, supported by multi-cloud and SaaS adoption. Hybrid models gain strong traction as enterprises combine flexibility with control. On-premises deployments maintain relevance in regulated sectors requiring data sovereignty. Enterprises invest in private cloud options within colocation setups. It supports business continuity through distributed deployment. Demand is influenced by vertical-specific needs. Hybrid remains the fastest-growing model due to its balanced approach.

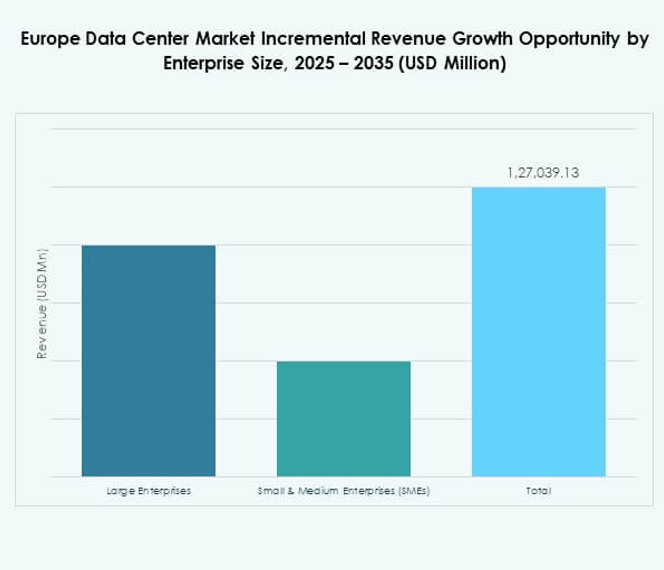

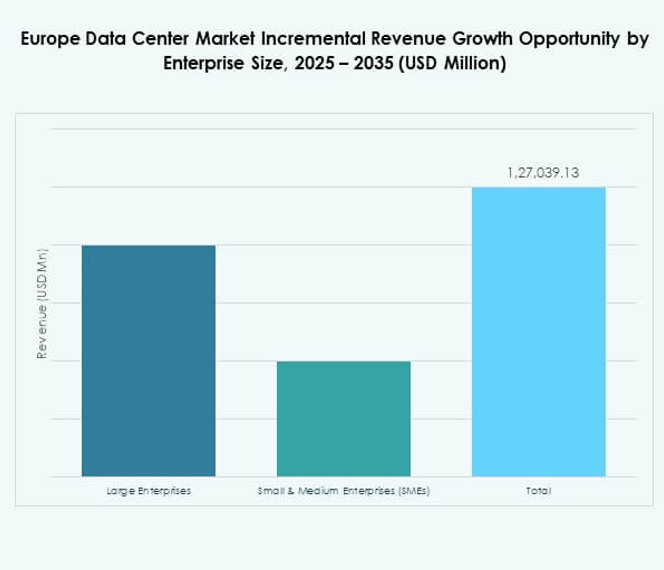

By Enterprise Size

Large enterprises dominate the Europe Data Center Market with greater investment capacity and digital needs. SMEs show rising adoption through cost-efficient colocation and managed services. It enables smaller firms to access enterprise-grade infrastructure. SMEs benefit from flexible pricing and scalable cloud options. Enterprises across industries adopt hybrid infrastructure strategies. Growth in SME participation diversifies the revenue base.

By Application / Use Case

IT and telecom dominate the Europe Data Center Market, driven by connectivity expansion and digital platforms. BFSI follows with strong demand for secure and resilient facilities. Healthcare grows quickly as digital health records and telemedicine rise. Government and defense invest heavily in sovereign infrastructure. Retail and e-commerce fuel growth with digital commerce platforms. Media and entertainment expand due to streaming services. Manufacturing and education add further demand diversity.

By End User Industry

Cloud service providers lead the Europe Data Center Market, shaping demand across hyperscale and colocation sites. Enterprises follow by driving hybrid adoption strategies. Colocation providers capture revenue through flexible hosting solutions. Government agencies emphasize sovereign data facilities. Other end users such as energy utilities adopt modular centers for efficiency. Partnerships between end users and providers support long-term growth.

Regional Insights

Western Europe Leading With Strong Digital Ecosystem

Western Europe commands 42% share of the Europe Data Center Market, led by Germany, UK, and France. It benefits from advanced telecom infrastructure, digital economies, and strong enterprise demand. Investors prioritize Western Europe due to established markets and regulatory stability. Hyperscale providers cluster in metro hubs across London, Frankfurt, and Paris. It attracts both domestic and foreign investment. Western Europe continues to lead digital innovation and interconnection opportunities.

Northern Europe Emerging As Sustainable Growth Hub

Northern Europe holds 28% share of the Europe Data Center Market, driven by Nordic countries. Abundant renewable energy and favorable climate conditions position the subregion as a sustainability leader. Operators in Sweden, Finland, and Denmark attract hyperscale investments with low-cost energy. It supports Europe’s carbon neutrality goals through green-powered facilities. Governments incentivize renewable integration and digital infrastructure. Northern Europe gains relevance as a hub for long-term green development.

- For instance, OpenAI is launching its first Stargate data centre in Norway in partnership with Nscale and Aker, installing 100,000 Nvidia processors and powering it entirely by renewable hydropower.

Eastern And Southern Europe Gaining Momentum

Eastern and Southern Europe together account for 30% share of the Europe Data Center Market. Countries like Spain, Italy, and Poland are rising as emerging hubs. It benefits from expanding urban infrastructure and growing enterprise digitization. Local operators collaborate with global players to attract new investments. Governments in Eastern Europe promote digital corridors through supportive policies. Rising cloud adoption across both subregions strengthens regional market expansion.

- For instance, Aruba S.p.A. expanded its IT3 data center campus in Bergamo, Italy, with the opening of two new facilities in November 2022, totaling more than 31,000 square meters and a combined 17 MW of IT power, as officially reported in company news releases and industry reports.

Competitive Insights:

- Equinix, Inc.

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Interxion (Digital Realty)

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

- Data4 Group

- Global Switch

- Others

The Europe Data Center Market is defined by strong competition among global hyperscale providers, regional colocation firms, and enterprise-driven operators. It features Equinix and Digital Realty leading with extensive interconnection hubs and multi-market expansions, while NTT and Interxion strengthen capacity through strategic partnerships and new facility rollouts. Cloud giants including Microsoft, AWS, and Google expand regional availability zones to serve enterprise and public sector workloads. Data4 Group and Global Switch enhance competitiveness by focusing on sustainability, modular capacity, and strategic locations in major European hubs. The market emphasizes energy efficiency, compliance with data sovereignty laws, and cross-border connectivity, creating high entry barriers and pushing incumbents to innovate in service delivery.

Recent Developments:

- In September 2025, Digital Realty earmarked more than €500 million to expand its data center infrastructure in Madrid and Barcelona, marking a significant new investment aimed at serving the growing demands of cloud, AI, and enterprise customers in Spain.

- In August 2025, Maincubes received approval to begin development of a new data center campus near Berlin, Germany, signing a 200 MW grid connection agreement to support the project, with plans for the campus to eventually supply up to 400 MW of power capacity strengthening its presence in the European data center ecosystem.

- In August 2025, Goodman Group announced the launch of a strategic partnership to develop European data center facilities, aiming to capitalize on surging regional demand by targeting major European capital cities for new developments within the next months.

- In August 2025, Vesper Infrastructure became the majority stakeholder in Norwegian operator Terekraft, securing ownership and refurbishment of next-generation infrastructure. The flagship facility in Norway will offer 10 MW of power capacity, reinforcing Vesper’s commitment to AI-optimized, renewable-powered data centers in Scandinavia

- In August 2025, Equinix entered a collaboration with alternative energy providers, including a pre-order power agreement for 500 MWe to expand its data centers across Europe, as part of its initiative to deliver sustainable, AI-ready infrastructure.