Executive summary:

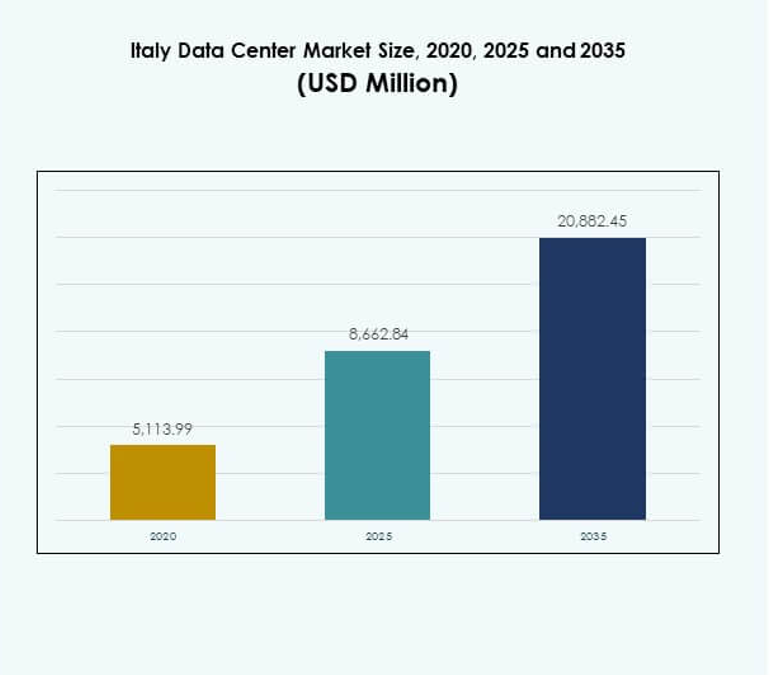

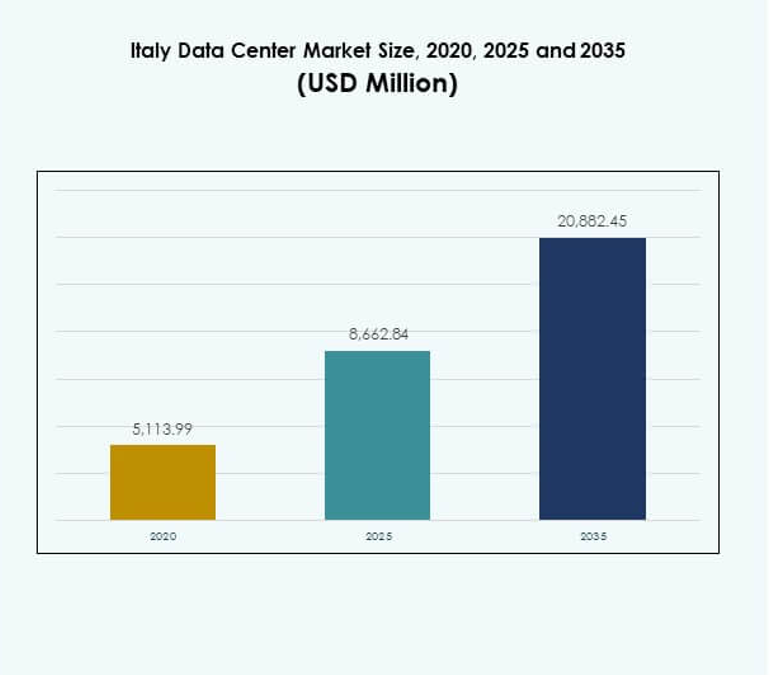

The Italy Data Center Market size was valued at USD 5,113.99 million in 2020 to USD 8,662.84 million in 2025 and is anticipated to reach USD 20,882.45 million by 2035, at a CAGR of 9.16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Italy Data Center Market Size 2025 |

USD 8,662.84 Million |

| Italy Data Center Market, CAGR |

9.16% |

| Italy Data Center Market Size 2035 |

USD 20,882.45 Million |

The market is advancing due to increasing adoption of cloud computing, edge infrastructure, and AI-enabled services. Enterprises are prioritizing scalable, modular, and energy-efficient data center solutions to meet growing digital demands. Innovation in automation, hybrid models, and renewable-powered infrastructure highlights the sector’s evolution. It plays a strategic role in supporting digital transformation, securing data sovereignty, and attracting sustained investments from both local and global players.

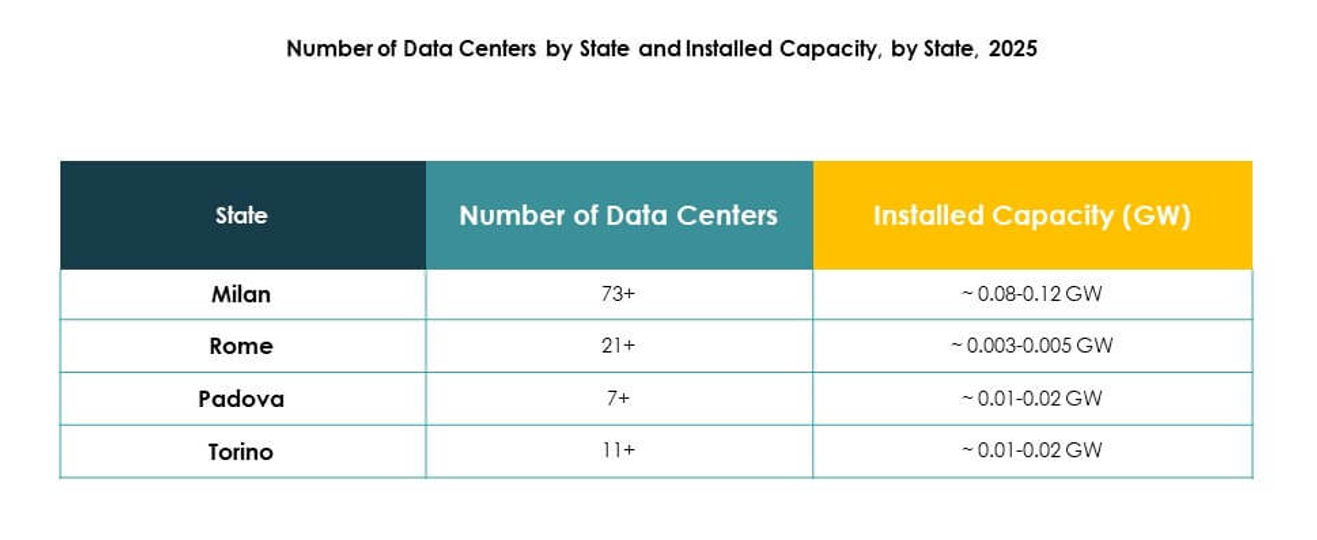

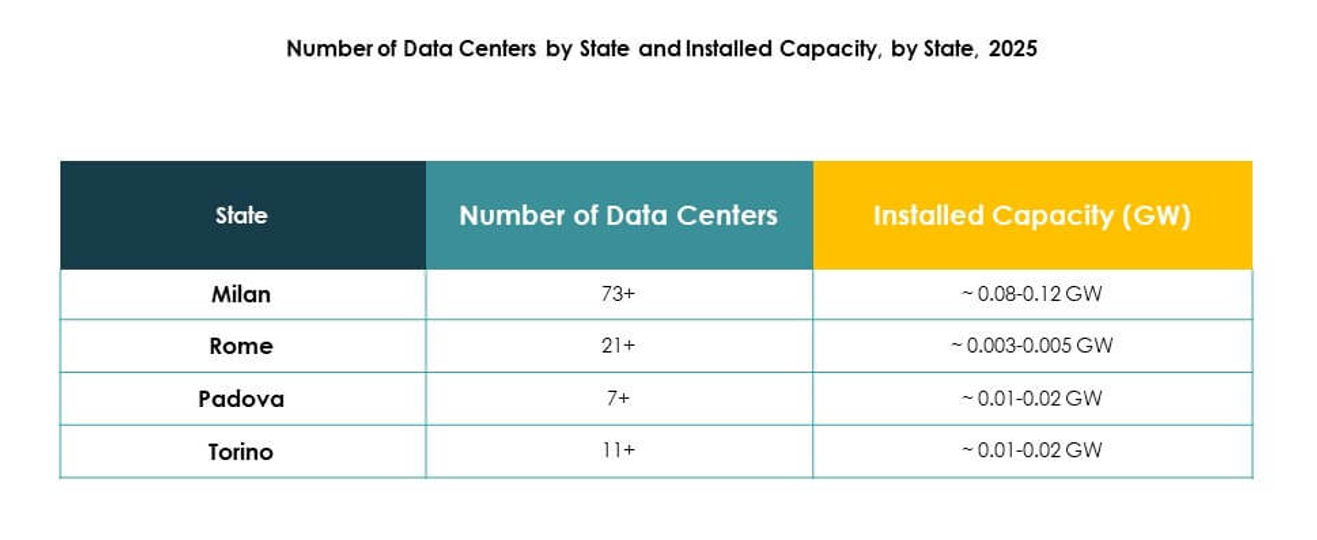

Northern Italy leads the market with strong connectivity and established hubs in Milan, making it the primary growth region. Central Italy, with Rome as a focal point, is emerging as a secondary center driven by government and enterprise adoption. Southern Italy and islands are gradually building relevance through infrastructure upgrades, renewable integration, and EU-backed projects. This regional balance strengthens Italy’s role in Europe’s digital ecosystem.

Market Drivers

Adoption Of Cloud, AI, And Edge Computing Accelerates Market Expansion

The Italy Data Center Market is being transformed by rapid adoption of cloud, AI, and edge solutions. Enterprises seek greater scalability and performance to handle demanding workloads. Investment in automation, machine learning, and hybrid models is rising steadily. It is creating opportunities for hyperscale and colocation operators to scale infrastructure. Businesses are adopting advanced cooling and power management to reduce costs. Investors are focusing on Italy due to its expanding digital backbone. Strong policy support and EU funding accelerate modernization across regions. These factors firmly position Italy as a leading European hub.

Innovation In Energy Efficiency And Sustainable Infrastructure Development

Sustainability is driving major innovations within the Italy Data Center Market. Operators are prioritizing renewable power sourcing and advanced energy recovery systems. Modern facilities adopt liquid cooling, modular power setups, and green building certifications. Enterprises demand eco-friendly solutions to meet ESG compliance and regulatory targets. It is encouraging vendors to design low-carbon architectures and flexible data halls. Investors view energy-efficient infrastructure as critical for long-term ROI. The market is strategically positioned to support Italy’s decarbonization goals. Sustainability innovations are becoming essential differentiators for attracting global hyperscale clients.

- For instance, in June 2024, Data4 signed a 10-year PPA with Edison Energia for a 148 MW solar park near Viterbo, expected to supply over 500 GWh across the contract period, meeting 10% of its Italian energy needs. In 2024, Equinix also signed a 10-year PPA with Neoen to source 53 MW of solar power for its Italian data centers.

Shift Towards Hybrid, Modular, And Scalable Infrastructure Solutions

A strong shift toward hybrid, modular, and scalable systems defines the Italy Data Center Market. Enterprises prefer models combining on-premises and cloud deployment to ensure flexibility. Modular data halls allow faster construction and efficient scaling for high-demand workloads. Edge computing expands in telecom and industrial sectors to support 5G adoption. It is enhancing latency-sensitive services such as IoT, AR, and autonomous mobility. Managed services and consulting gain traction among SMEs entering digital transformation. Investors recognize modular expansion as a cost-efficient growth strategy. Scalable infrastructure ensures resilience in evolving enterprise ecosystems.

Strategic Importance For Business Continuity And Investor Confidence

The Italy Data Center Market holds high strategic importance for global businesses. Enterprises view advanced facilities as critical for data sovereignty and operational resilience. Localized infrastructure reduces dependency on cross-border connectivity. It is enabling industries like BFSI and healthcare to secure sensitive workloads. Multinational firms expand in Italy to benefit from strong regulatory frameworks. Investors are attracted by consistent digital adoption and rising enterprise spending. The country’s central location within Europe strengthens connectivity to Mediterranean and global markets. These advantages position Italy as a prime investment destination.

- For example, in August 2024, Retelit announced that its Avalon 3 data center will recover waste heat to warm about 1,250 homes in Milan’s district heating system, preventing 3,300 tons of CO₂ emissions annually.

Market Trends

Expansion Of Interconnection And Carrier-Neutral Data Ecosystems

The Italy Data Center Market is seeing growth in interconnection ecosystems. Carrier-neutral facilities are attracting enterprises seeking flexible peering. Strong fiber connectivity supports cross-border digital commerce. Interconnection hubs in Milan strengthen Italy’s role in European telecom networks. It is boosting demand for colocation facilities that integrate multiple carriers. Cloud adoption drives requirements for direct on-ramps to hyperscale providers. Enterprises prioritize carrier neutrality to enhance redundancy. The trend positions Italy as a key node in global digital traffic exchange.

Rising Deployment Of Automation, AI-Driven Monitoring, And Smart Infrastructure

Automation and AI-driven monitoring tools are reshaping operations in the Italy Data Center Market. Smart sensors optimize cooling, power, and workload distribution. Enterprises are adopting predictive maintenance to cut downtime risks. AI-enabled monitoring enhances cybersecurity in multi-tenant facilities. It is improving efficiency for colocation and hyperscale providers managing large workloads. Vendors are focusing on orchestration platforms that enable faster deployment. Automation strengthens service quality for end-users across critical industries. This trend enhances competitiveness of Italian facilities within Europe.

Growth Of Data Localization And Compliance-Centric Infrastructure Demand

Regulations are fueling new investments in data localization within the Italy Data Center Market. Enterprises in BFSI, government, and healthcare prioritize local hosting of sensitive workloads. GDPR enforcement drives demand for secure regional facilities. It is compelling providers to expand data halls in compliance-focused hubs. Compliance-ready infrastructure is emerging as a key differentiator for colocation vendors. Industries handling critical data adopt dedicated servers for regulatory assurance. Investor focus aligns with facilities that maintain certified standards. This trend creates sustained demand for secure infrastructure across sectors.

Integration Of Renewable Energy And Circular Economy Practices

Operators are integrating renewable energy and circular economy practices across the Italy Data Center Market. Facilities adopt green energy power purchase agreements to lower emissions. Waste heat reuse systems supply nearby districts with thermal energy. It is enabling cities to benefit from sustainable power-sharing models. Vendors incorporate recyclable materials and eco-friendly designs in data halls. Enterprises demand transparency in carbon accounting for hosted workloads. Renewable integration strengthens Italy’s green positioning in the European market. This trend reflects long-term sustainability commitment from both vendors and regulators.

Market Challenges

High Energy Consumption And Infrastructure Cost Barriers For Operators

The Italy Data Center Market faces rising challenges linked to energy consumption and infrastructure costs. Power demand in hyperscale facilities increases operational expenditure. Operators are pressured to secure renewable sourcing amid limited supply. It is creating difficulties for small providers competing with global players. Building advanced cooling and resilient networks requires significant capital. Investors remain cautious about high upfront costs in regions with slow returns. Balancing efficiency and affordability is becoming complex. These barriers delay expansion of smaller enterprises across Italy.

Regulatory Complexity And Skills Gap In Advanced Data Center Management

The Italy Data Center Market also faces obstacles tied to regulatory complexity and workforce limitations. Strict compliance with GDPR, energy efficiency laws, and sustainability targets adds operational burdens. Providers must constantly adapt infrastructure to evolving regulations. It is challenging enterprises without established compliance strategies. A shortage of skilled technicians limits growth in advanced data center management. Training and recruitment require long-term investment. Enterprises demand specialized expertise in AI-driven monitoring and hybrid integration. The skills gap threatens operational stability and investor confidence in future projects.

Market Opportunities

Expansion Of Edge Facilities And 5G Infrastructure Integration

The Italy Data Center Market is opening opportunities through edge facility deployment. Telecom operators invest in distributed infrastructure supporting ultra-low latency applications. Enterprises in automotive, healthcare, and manufacturing require real-time processing. It is boosting demand for modular and micro data centers across urban regions. 5G adoption creates synergies with edge computing platforms. Colocation providers leverage this opportunity to expand into regional hubs. Strong growth prospects exist for vendors offering scalable edge solutions. These developments increase attractiveness for both local and international investors.

Development Of AI, Cloud, And Industry-Specific Hosting Services

The Italy Data Center Market is creating opportunities in industry-specific hosting. AI-driven platforms require advanced computing infrastructure. Healthcare and BFSI sectors demand secure localized hosting for mission-critical workloads. It is encouraging vendors to design vertical-focused services with tailored compliance. Cloud adoption by SMEs further supports hybrid integration opportunities. Enterprises are seeking managed services to reduce operational complexity. Providers offering industry-grade resilience attract high-value contracts. This opportunity strengthens Italy’s position as a digital infrastructure leader in Southern Europe.

Market Segmentation

By Component

The hardware segment dominates the Italy Data Center Market with a significant share. High demand for servers, racks, and cooling systems drives investment. Energy-efficient and modular power solutions further boost adoption. Software solutions like DCIM and orchestration gain traction for automation. It is expanding opportunities for monitoring and virtualization tools. Services segment grows steadily with rising demand for managed and integration services. Maintenance and consulting ensure continuous optimization. This balance strengthens the overall component ecosystem in the market.

By Data Center Type

Hyperscale data centers lead the Italy Data Center Market due to rising cloud adoption. Strong investments by global operators increase capacity and scalability. Colocation remains a key growth driver for enterprises seeking cost efficiency. It is expanding with demand for carrier-neutral ecosystems in Milan. Edge facilities show rapid momentum with 5G and IoT adoption. Enterprise data centers remain critical for regulated industries. Cloud or IDC facilities attract SMEs shifting workloads. Mega data centers create long-term growth in strategic hubs.

By Deployment Model

Hybrid models dominate the Italy Data Center Market due to their flexibility and resilience. Enterprises use hybrid setups to balance control and scalability. On-premises models retain importance for industries needing data sovereignty. It is particularly relevant for BFSI, healthcare, and government workloads. Cloud-based deployment accelerates with SMEs embracing digital-first strategies. Vendors support integration across hybrid systems through orchestration tools. The mix of deployment models enhances competitive diversity. This segmentation ensures long-term sustainability across enterprise ecosystems.

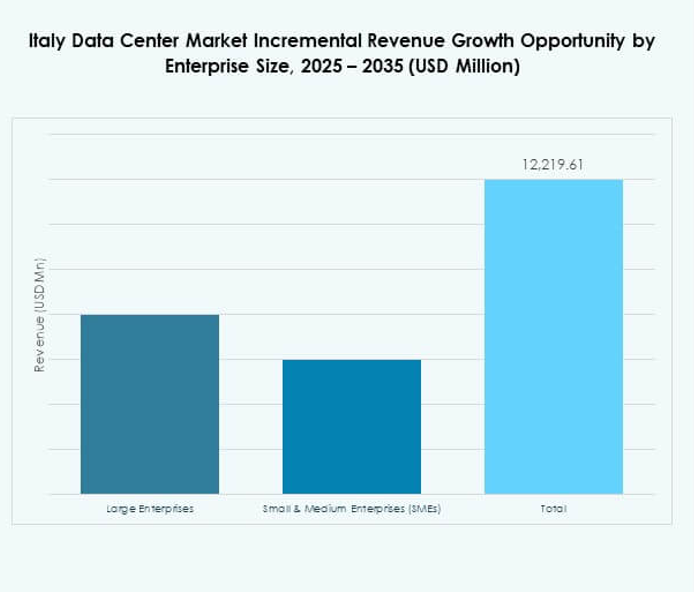

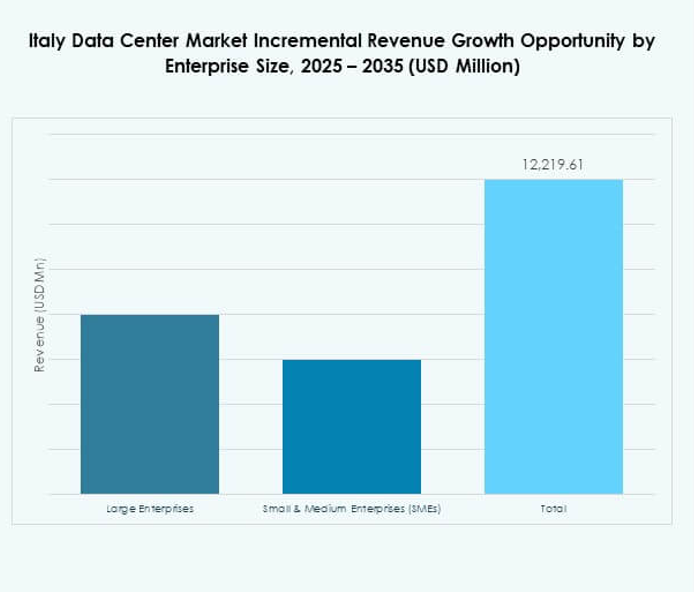

By Enterprise Size

Large enterprises hold the dominant share in the Italy Data Center Market. Their focus on resilience, compliance, and scalability drives demand for hyperscale and colocation. SMEs are adopting managed services and hybrid solutions for cost efficiency. It is helping expand cloud-based and modular infrastructure adoption. Investments in flexible data models align with SME requirements. Large enterprises drive advanced service adoption like AI-based monitoring. SMEs continue to expand through partnerships with colocation providers. This mix ensures a balanced enterprise size segmentation.

By Application / Use Case

IT and telecom dominate the Italy Data Center Market in application scope. Demand is driven by 5G rollout, IoT adoption, and cloud services. BFSI remains a strong segment due to compliance-driven workloads. It is followed by government, healthcare, and retail industries expanding digital infrastructure. Media and entertainment adopt advanced hosting for streaming and content platforms. Manufacturing increasingly uses data centers for Industry 4.0 applications. Education and utilities emerge as niche contributors. This segmentation highlights wide cross-industry adoption.

By End User Industry

Cloud service providers lead the Italy Data Center Market as key end-users. Hyperscale operators expand capacity to meet enterprise hosting demands. Enterprises continue investing in hybrid and on-premises models for critical workloads. It is driving long-term contracts with colocation providers. Government agencies expand infrastructure to support digital transformation. Other users like energy firms adopt specialized hosting. Colocation providers play a pivotal role in supporting SMEs. This segmentation ensures balanced growth across diverse end-user categories.

Regional Insights

Northern Italy Leading With Strong Infrastructure And High Market Share

Northern Italy dominates the Italy Data Center Market with a 47% share. Milan stands as the primary hub due to its financial and telecom clusters. Strong connectivity attracts hyperscale and colocation providers. It is also home to carrier-neutral interconnection hubs. Industrial presence supports enterprise data adoption. Local infrastructure investments strengthen the region’s leadership. Northern Italy will remain the key epicenter for data center activity.

- For instance, in July 2020, Equinix inaugurated its ML5 data center in Milan, with an initial capacity of 500 cabinet equivalents and direct cloud on-ramps to Microsoft Azure and AWS, establishing one of Italy’s largest carrier-neutral hubs.

Central Italy Emerging As A Secondary Growth Destination

Central Italy holds a 33% share of the Italy Data Center Market. Rome anchors growth due to strong government and defense demand. Digital adoption is accelerating in urban centers. It is attracting investments in cloud and hybrid deployments. Regional universities and research institutions fuel demand for HPC hosting. Enterprises in retail and healthcare adopt localized facilities. Central Italy positions itself as a growing secondary hub.

Southern Italy And Islands Building Capacity For Regional Expansion

Southern Italy and islands account for a 20% share of the Italy Data Center Market. Infrastructure projects improve connectivity in Naples, Bari, and Sicily. Telecom expansion and renewable integration drive new investment. It is gaining relevance for disaster recovery and edge deployments. Local demand from SMEs supports gradual adoption. EU-backed initiatives fund digital infrastructure development. Southern Italy is evolving as a support base for nationwide growth.

- For instance, in June 2025, Open Fiber reported the completion of ultra-broadband rollouts connecting all “white area” municipalities in the Marche region, and expanded FTTH coverage supporting up to 10 Gbps speeds for residential and business users.

Competitive Insights:

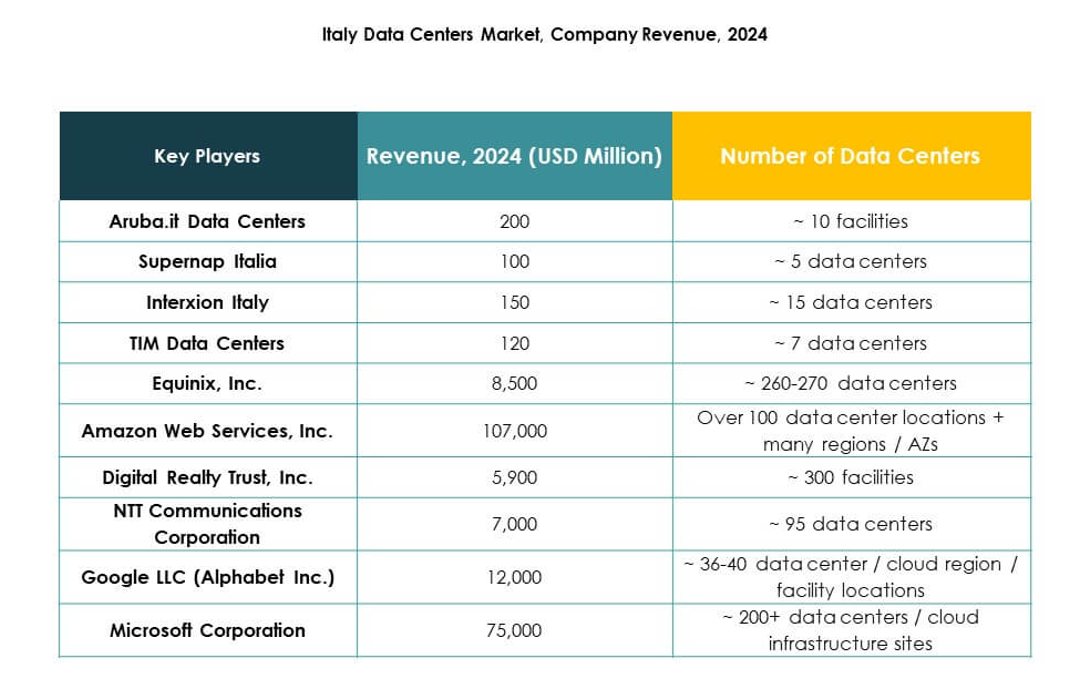

- it Data Centers

- Supernap Italia

- Interxion Italy (Digital Realty subsidiary)

- TIM Data Centers

- Equinix, Inc.

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

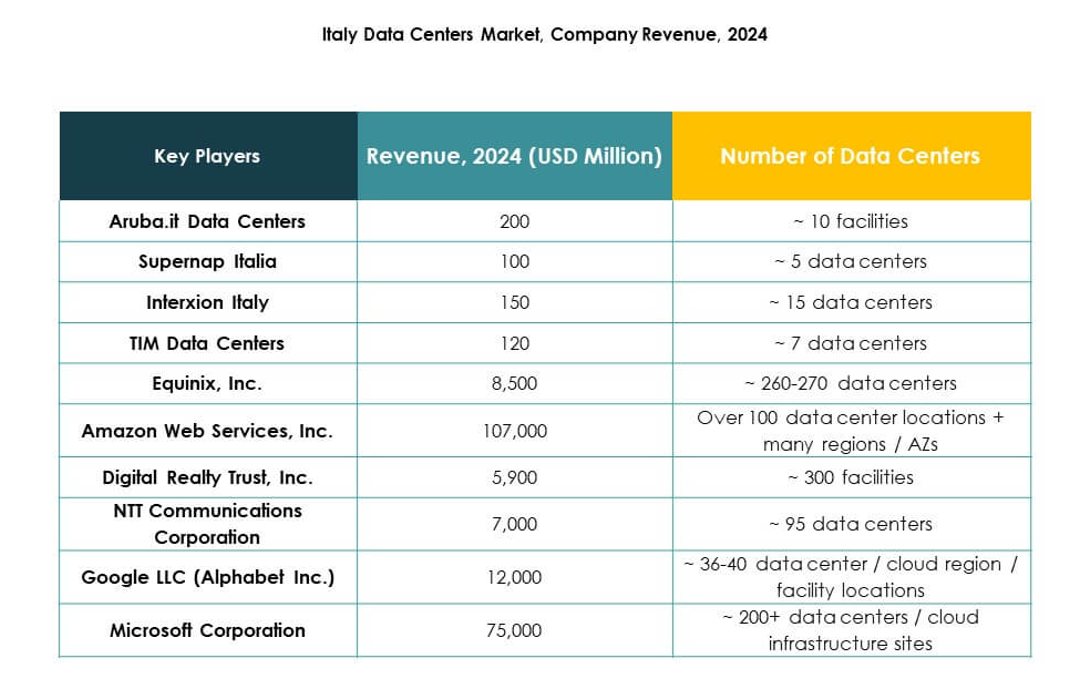

The Italy Data Center Market is shaped by strong competition among global hyperscale operators, regional providers, and telecom-backed enterprises. Aruba.it and Supernap Italia anchor local dominance with large-scale facilities and tailored colocation services. Global leaders such as Equinix, Digital Realty, and NTT strengthen Italy’s connectivity through carrier-neutral hubs and scalable infrastructure. Cloud majors including AWS, Microsoft, and Google drive hyperscale investments by enabling enterprise cloud migration. It is supported by TIM Data Centers and Interxion Italy, which bridge enterprise demand with secure colocation. Vendors emphasize renewable sourcing, modular expansions, and compliance-driven architectures to attract high-value contracts. Strategic mergers, alliances, and green initiatives further define competition, positioning Italy as a hub where regional specialization meets global infrastructure leadership.

Recent Developments:

- In September 2025, Open Fiber launched a new Edge data center outside Pescara, marking its third Edge facility in Italy and announcing plans to establish at least a dozen more across the country to support local digital expansion and services.

- In July 2025, Italian energy group Eni and Dubai-based Khazna signed a preliminary agreement to jointly develop a 500-megawatt data center campus in northern Italy, near Milan, as part of a broader UAE–Italy partnership aiming to deploy up to 1 gigawatt of digital infrastructure nationwide.

- In October 2024, Aruba SpA officially inaugurated its Hyper Cloud Data Center campus in Rome, representing an investment of over €300 million. This campus spans 74,000 sqm and is designed to host five independent data centers, delivering 30MW of IT power at full capacity. The first data center is already active, and the second is set to open in the first half of 2025.