Executive summary:

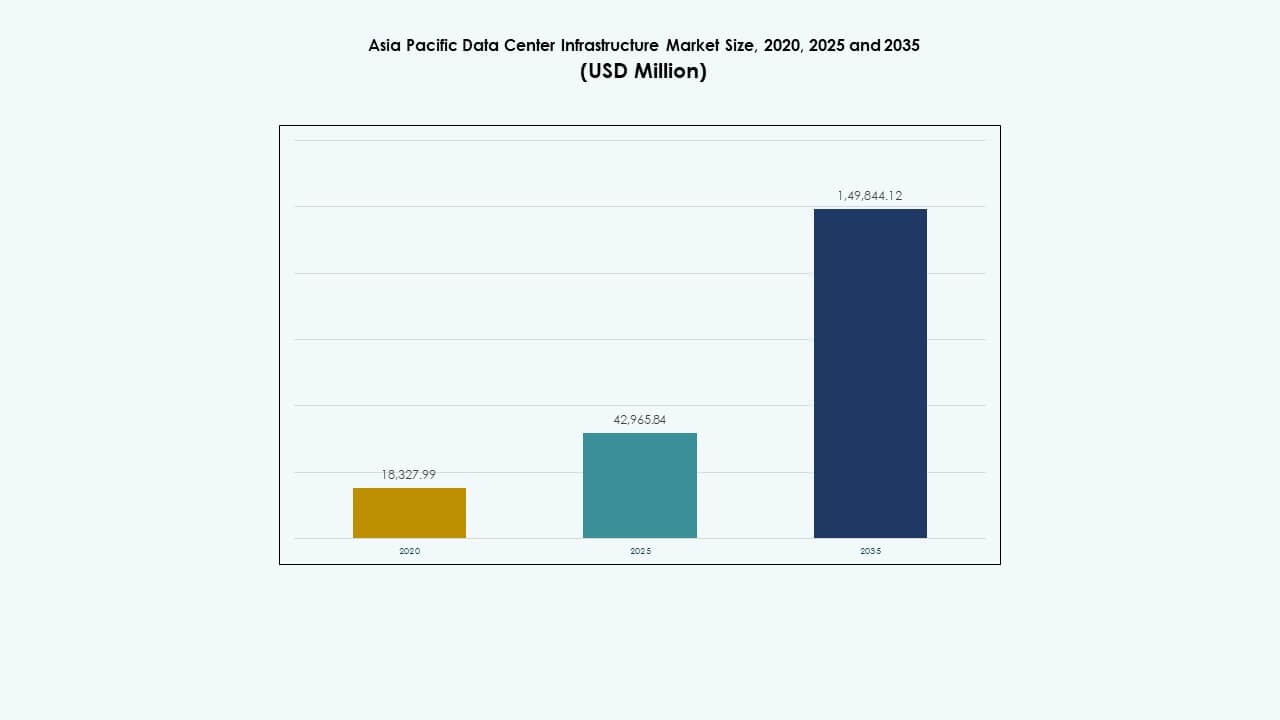

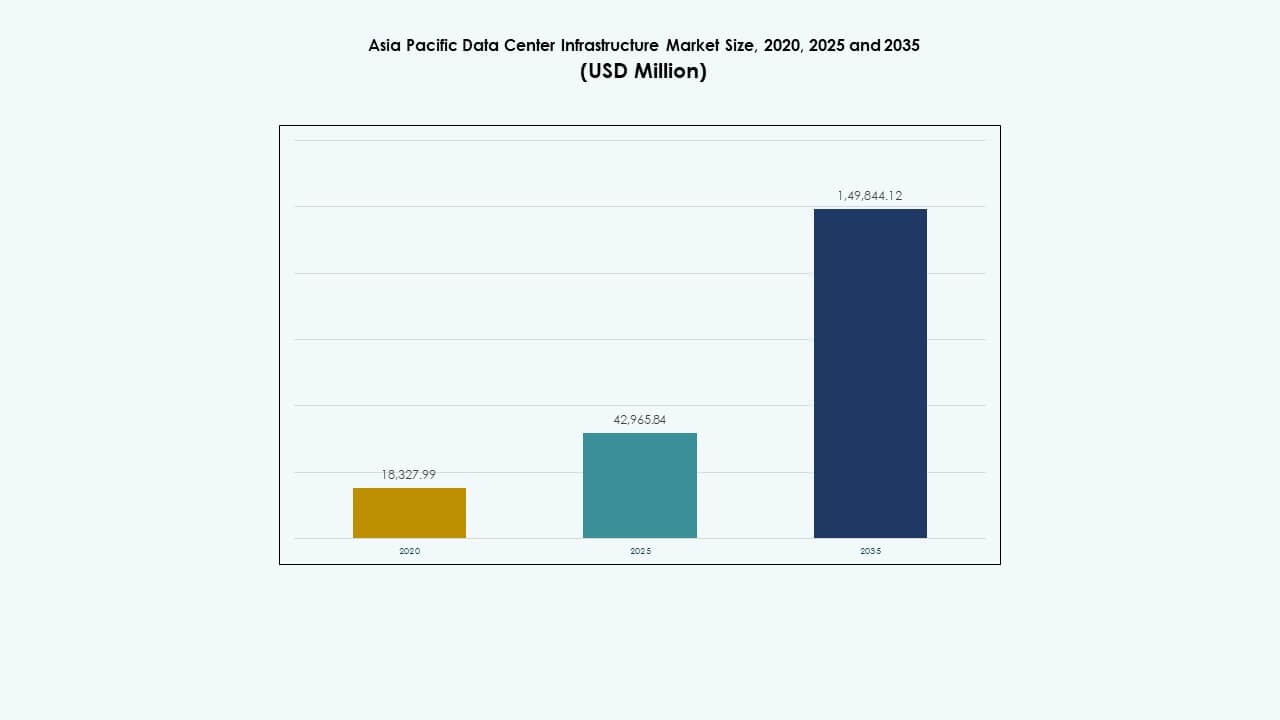

The Asia Pacific Data Center Infrastructure Market size was valued at USD 18,327.99 million in 2020 to USD 42,965.84 million in 2025 and is anticipated to reach USD 1,49,844.12 million by 2035, at a CAGR of 13.20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Asia Pacific Data Center Infrastructure Market Size 2025 |

USD 42,965.84 Million |

| Asia Pacific Data Center Infrastructure Market, CAGR |

13.20% |

| Asia Pacific Data Center Infrastructure Market Size 2035 |

USD 1,49,844.12 Million |

Strong cloud adoption drives sustained infrastructure demand across the region. Hyperscale expansion raises needs for power, cooling, and modular builds. AI workloads increase rack density and reliability needs. Operators invest in smart power systems and advanced cooling. Enterprises pursue data localization and secure hosting. The Asia Pacific Data Center Infrastructure Market holds strategic value for investors. Long asset lives support stable returns. Vendors gain repeat business from phased expansions.

East Asia leads due to mature digital ecosystems and large hyperscale campuses. China, Japan, and South Korea anchor regional capacity. Southeast Asia emerges with rapid cloud growth and supportive policies. India advances through enterprise digitalization and new builds. Australia attracts projects through stability and renewable access. The Asia Pacific Data Center Infrastructure Market benefits from regional diversity. Urban hubs drive demand first. Secondary cities follow with edge deployments.

Market Dynamics:

Market Dynamics:

Expansion of Cloud Platforms and Hyperscale Data Center Investments Across Asia Pacific

Cloud service providers expand capacity across Asia Pacific to meet enterprise demand. Hyperscale operators build large campuses near major metros. These facilities require advanced electrical and mechanical systems. Power reliability remains a core priority for operators. Investors view this build cycle as long term. The Asia Pacific Data Center Infrastructure Market gains strategic value from scale-driven efficiency. It supports stable returns for infrastructure-focused funds. Technology vendors secure repeat contracts from phased expansions. Regional governments support projects through policy clarity.

- For instance, AWS announced a USD 6.2 billion investment to establish a new cloud region in Malaysia with three availability zones. This hyperscale development requires advanced electrical and mechanical infrastructure to support high availability and large-scale operations.

Rapid Adoption of High-Density Computing and Advanced Power Architectures

AI workloads push racks toward higher power density. Operators redesign power distribution for safety and efficiency. Smart switchgear improves fault isolation and uptime. Modular UPS systems support phased capacity growth. Energy storage improves load balancing. The Asia Pacific Data Center Infrastructure Market benefits from these upgrades. It attracts suppliers with digital power expertise. Businesses gain predictable performance under peak loads. Capital flows favor firms with proven power technologies.

Growing Focus on Energy Efficiency and Sustainable Infrastructure Design

Operators prioritize energy efficiency to manage operating costs. Cooling designs shift toward containment and liquid-ready systems. Efficient chillers reduce electricity demand. Sustainability goals influence equipment selection. Green certifications shape procurement decisions. The Asia Pacific Data Center Infrastructure Market aligns with ESG priorities. It draws interest from sustainability-focused investors. Vendors invest in low-loss components. Long-term savings strengthen project viability.

- For instance, Google committed RM9.3 billion (about USD 2 billion) to develop its first data center campus in Malaysia’s Klang Valley. The project adopts advanced cooling designs, including containment and liquid-ready systems, to reduce electricity demand through efficient chiller technologies.

Rising Enterprise Digitalization and Regional Data Localization Policies

Enterprises migrate workloads to regional data centers. Data sovereignty laws encourage local infrastructure builds. Governments support domestic hosting capacity. Enterprises demand secure and compliant facilities. This shift increases demand for IT and network systems. The Asia Pacific Data Center Infrastructure Market benefits from regulatory alignment. It offers steady demand across industries. Investors value policy-backed infrastructure growth. Local players gain partnership opportunities.

Market Trends

Market Trends

Shift Toward Modular and Prefabricated Data Center Construction Models

Operators prefer faster deployment timelines. Modular designs reduce construction risk. Factory-built systems improve quality control. Standardized modules ease future expansion. Capital planning becomes more predictable. The Asia Pacific Data Center Infrastructure Market reflects this shift. Suppliers adapt product portfolios to modular formats. Contractors strengthen offsite manufacturing capabilities. Speed to market becomes a competitive edge.

Integration of Intelligent Monitoring and Digital Infrastructure Management Tools

Data centers deploy real-time monitoring platforms. Sensors track power, temperature, and asset health. Predictive alerts reduce downtime risk. Digital dashboards support remote operations. Automation lowers manual intervention needs. The Asia Pacific Data Center Infrastructure Market adopts these tools widely. Vendors embed intelligence into hardware. Operators improve operational visibility. This trend supports long-term efficiency gains.

Growing Demand for Edge Data Centers Supporting Latency-Sensitive Applications

Content delivery and 5G drive edge deployments. Smaller facilities locate near users. These sites need compact infrastructure systems. Standardized designs simplify replication. Reliability remains critical despite smaller scale. The Asia Pacific Data Center Infrastructure Market adapts to this model. Equipment suppliers offer space-efficient solutions. Edge builds diversify regional demand. Network performance becomes a key value driver.

Increased Preference for Vendor-Integrated Infrastructure Ecosystems

Operators seek simplified procurement processes. Integrated vendors reduce interface risks. Single-source accountability improves project execution. Lifecycle support becomes more important. Vendors offer bundled electrical and cooling solutions. The Asia Pacific Data Center Infrastructure Market supports ecosystem strategies. Large suppliers gain competitive advantage. Buyers value reduced coordination complexity. Long-term service contracts gain traction.

Market Challenges

Market Challenges

High Capital Intensity and Complex Project Execution Requirements

Data center infrastructure requires large upfront investment. Cost control remains a constant challenge. Equipment lead times affect schedules. Skilled labor shortages delay execution. Supply chain volatility raises procurement risk. The Asia Pacific Data Center Infrastructure Market faces margin pressure. Smaller players struggle to scale operations. Financing costs influence project feasibility. Risk management remains critical for stakeholders.

Power Availability Constraints and Grid Integration Complexity

Urban power grids face capacity limits. Data centers compete with industrial demand. Grid upgrades take long timelines. Backup systems raise capital requirements. Regulatory approvals slow new connections. The Asia Pacific Data Center Infrastructure Market must navigate these barriers. Operators invest in on-site energy solutions. Planning complexity increases development cycles. Location selection becomes more strategic.

Market Opportunities

Growth Potential from Emerging Economies and Secondary Data Center Cities

Emerging markets expand digital services rapidly. Secondary cities attract new data center projects. Land and power costs remain favorable. Governments promote regional digital hubs. Infrastructure demand rises across segments. The Asia Pacific Data Center Infrastructure Market benefits from geographic diversification. Suppliers enter new territories early. Investors gain exposure to high-growth zones. Local partnerships strengthen market access.

Opportunities Linked to Retrofit, Upgrade, and Lifecycle Modernization Projects

Older facilities require infrastructure upgrades. Operators improve efficiency and capacity. Retrofit projects offer steady revenue streams. Modular upgrades reduce operational disruption. Lifecycle services gain importance. The Asia Pacific Data Center Infrastructure Market supports recurring business models. Vendors provide upgrade-focused solutions. Service contracts enhance long-term value. Modernization spending remains resilient.

Market Segmentation

Market Segmentation

By Infrastructure Type

Electrical infrastructure holds a dominant share due to its role in uptime assurance. Mechanical systems follow closely, driven by cooling needs. IT and network infrastructure shows steady demand from digital workloads. Civil and structural segments support large-scale builds. The Asia Pacific Data Center Infrastructure Market benefits from balanced segment growth. Electrical systems gain priority in high-density environments. Mechanical solutions evolve with efficiency targets. Civil works support modular construction trends. This mix supports stable market expansion.

By Electrical Infrastructure

UPS systems and PDUs account for significant market share. Grid connection equipment remains critical for new builds. Energy storage systems gain traction for resilience. Switchgear supports safe power distribution. The Asia Pacific Data Center Infrastructure Market favors reliable electrical components. Growth links to rising power density. Smart electrical solutions gain preference. Vendors focus on scalability and safety. Electrical upgrades remain a core investment area.

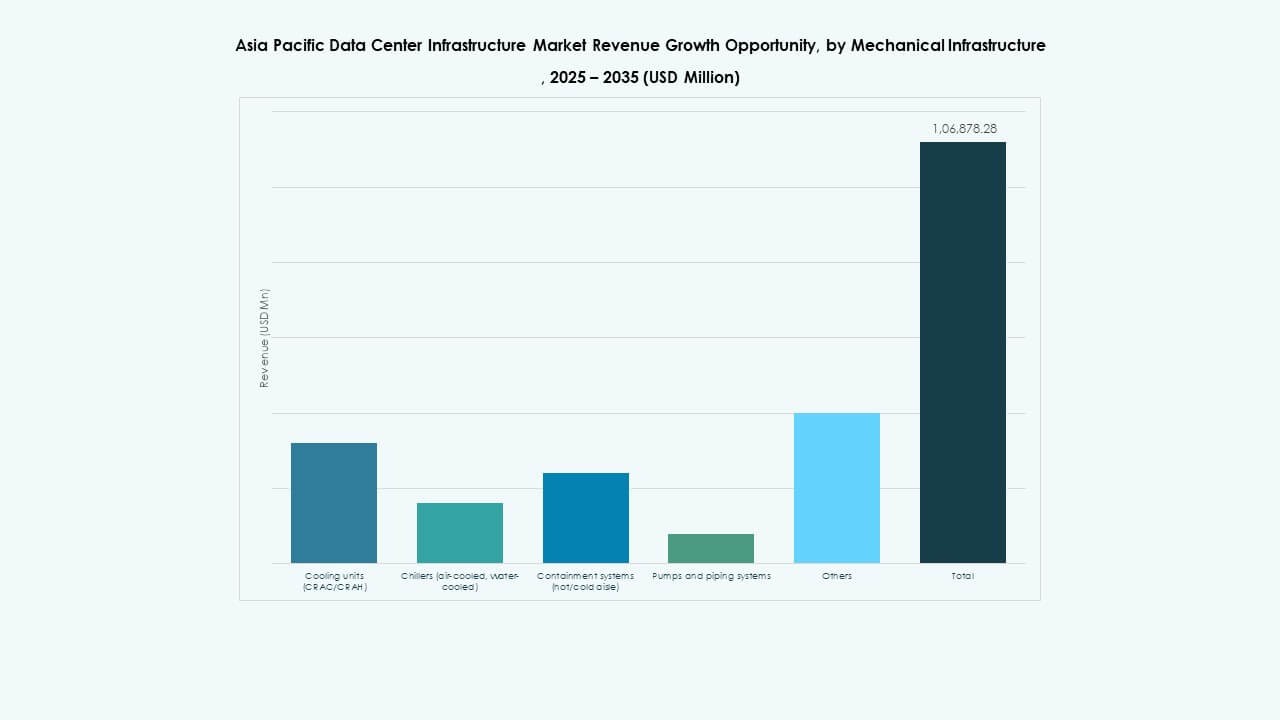

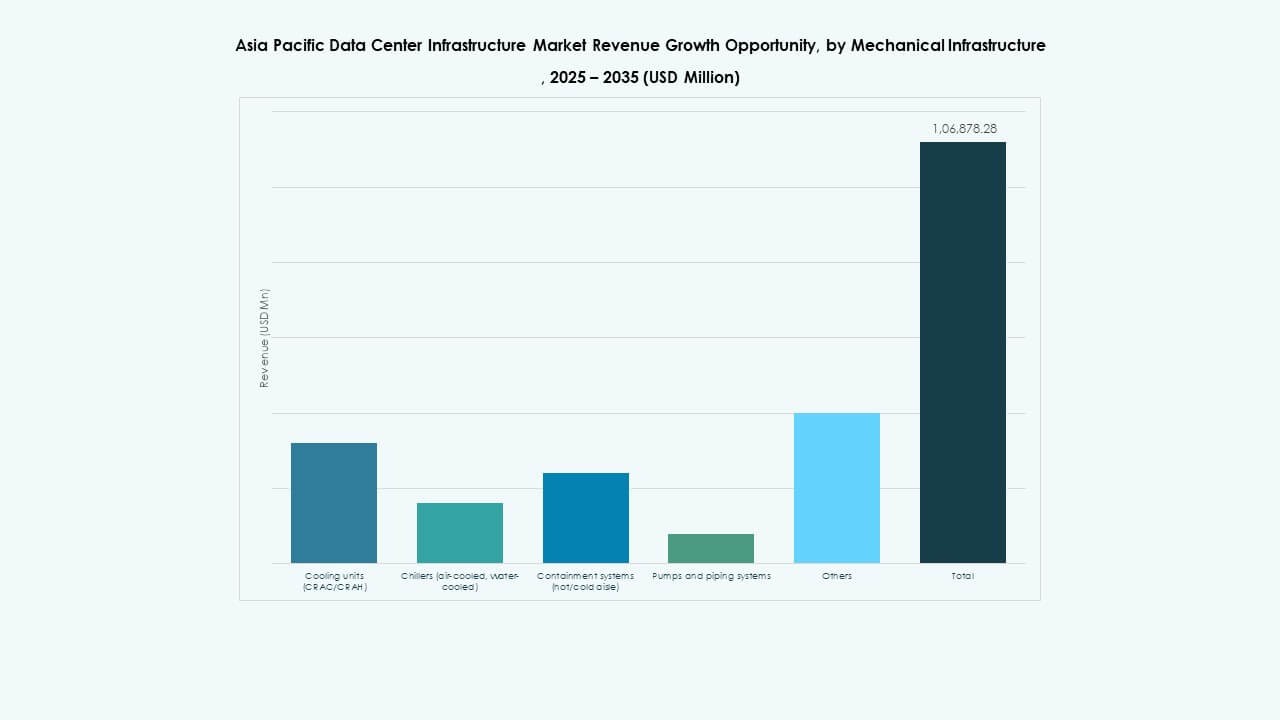

By Mechanical Infrastructure

Cooling units represent the largest mechanical segment. Chillers support large hyperscale facilities. Containment systems improve airflow efficiency. Pumps and piping ensure thermal stability. The Asia Pacific Data Center Infrastructure Market reflects strong cooling demand. Heat density drives mechanical innovation. Energy efficiency shapes purchasing decisions. Modular cooling gains popularity. Mechanical reliability remains essential.

By Civil / Structural & Architectural

Site preparation and superstructure dominate this segment. Building envelopes support energy control. Raised floors remain relevant in traditional designs. Modular buildings gain share in fast deployments. The Asia Pacific Data Center Infrastructure Market values construction quality. Structural strength supports heavy equipment loads. Prefabrication reduces timelines. Architectural design supports airflow management. Civil works anchor long-term facility performance.

By IT & Network Infrastructure

Servers and networking equipment lead this segment. Storage demand grows with data volumes. Cabling supports high-speed connectivity. Racks and enclosures adapt to dense layouts. The Asia Pacific Data Center Infrastructure Market sees strong IT investment. Cloud adoption drives hardware demand. Network reliability remains critical. Vendors focus on scalability. Integration supports operational efficiency.

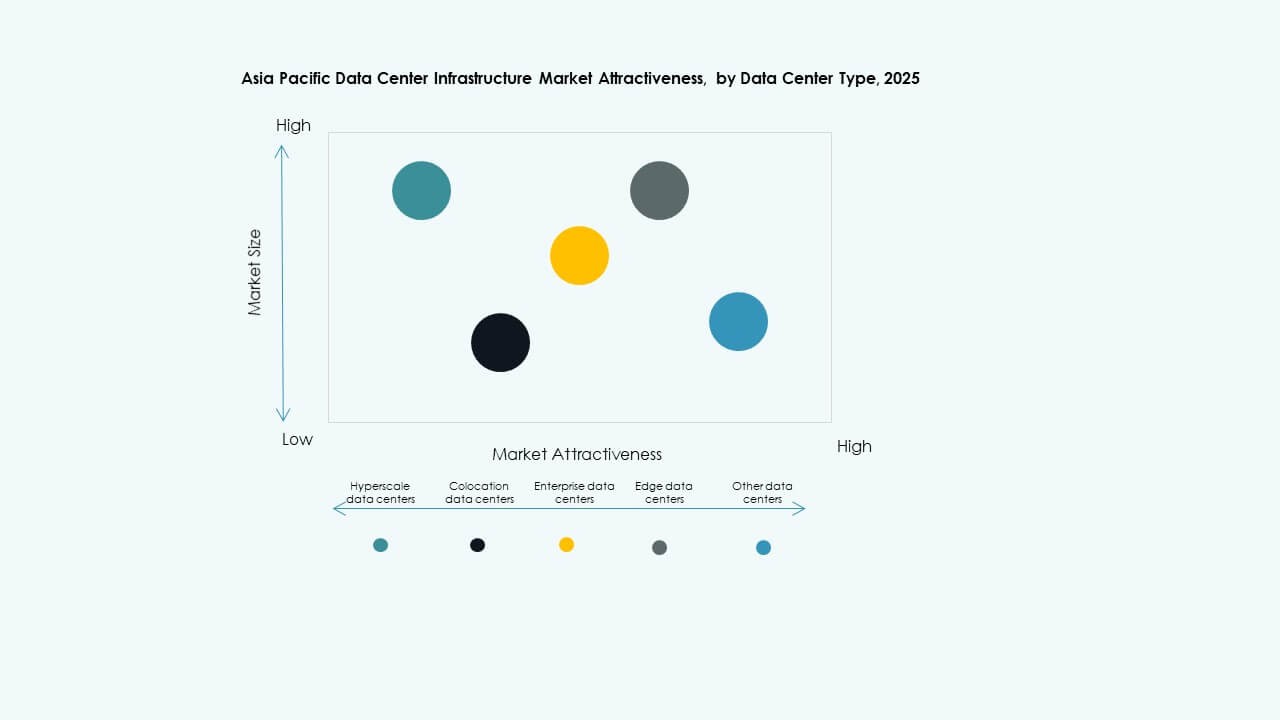

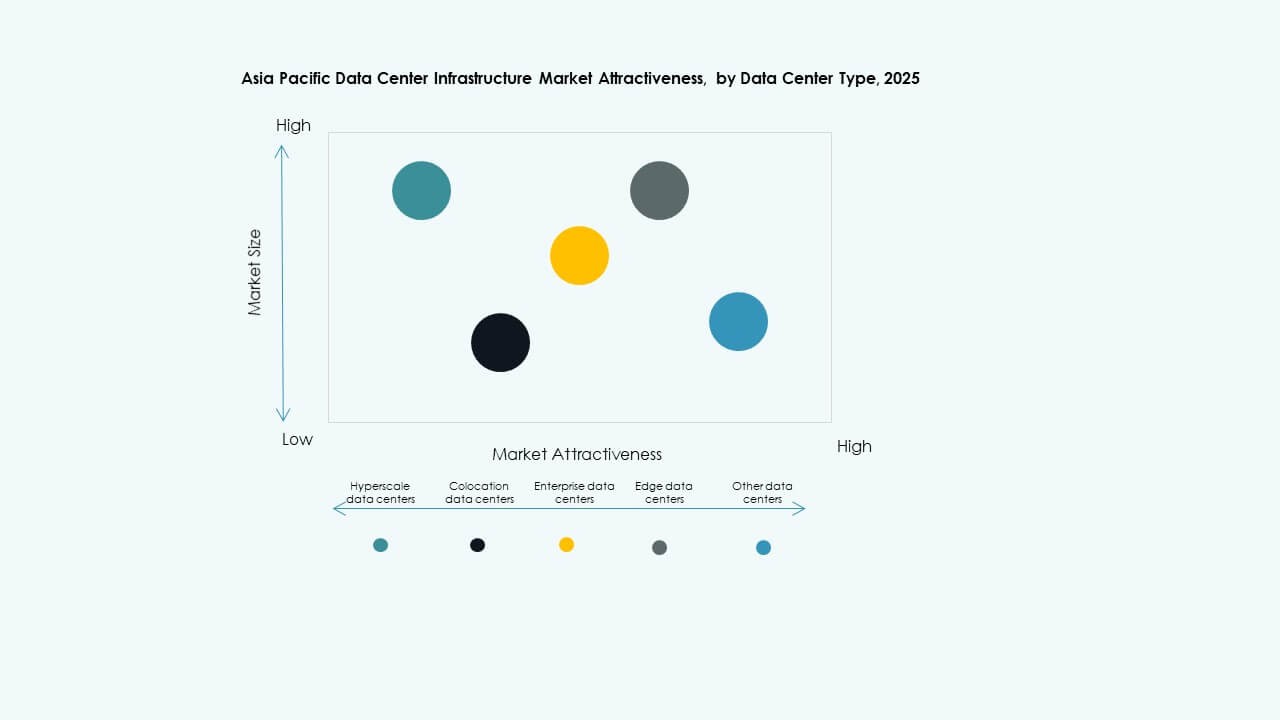

By Data Center Type

Hyperscale data centers hold the largest share. Colocation facilities show strong growth. Enterprise centers modernize existing assets. Edge data centers expand across cities. The Asia Pacific Data Center Infrastructure Market supports all types. Hyperscale drives volume demand. Colocation attracts diversified clients. Edge supports latency needs. Each type fuels segment demand.

By Delivery Model

Turnkey and design-build models dominate. EPC offers execution certainty. Retrofit projects gain importance. Modular delivery supports speed. The Asia Pacific Data Center Infrastructure Market favors integrated delivery. Clients reduce coordination risks. Vendors expand service scope. Speed influences model choice. Delivery flexibility supports growth.

By Tier Type

Tier 3 facilities lead market share. Tier 4 grows in mission-critical uses. Tier 2 supports cost-sensitive projects. Tier 1 serves small deployments. The Asia Pacific Data Center Infrastructure Market aligns with uptime needs. Tier 3 balances cost and reliability. Tier 4 attracts financial and cloud clients. Tier segmentation guides investment decisions. Reliability standards shape demand.

Regional Insights

Regional Insights

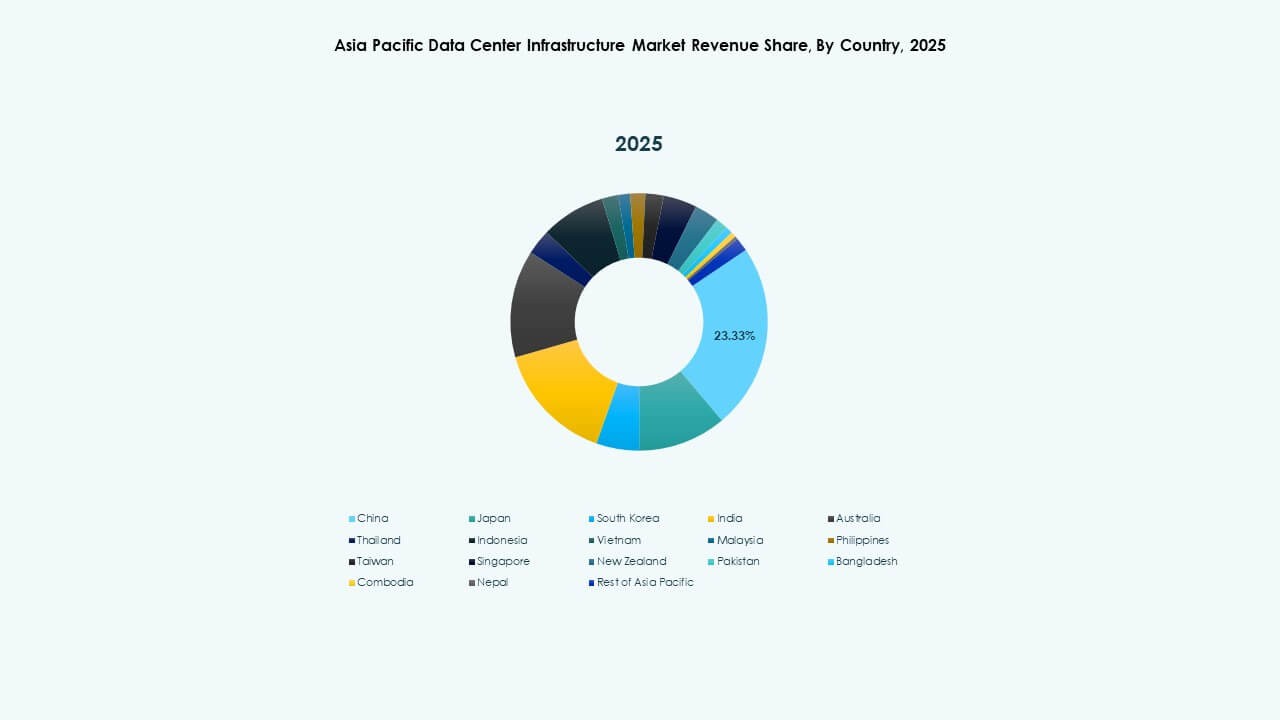

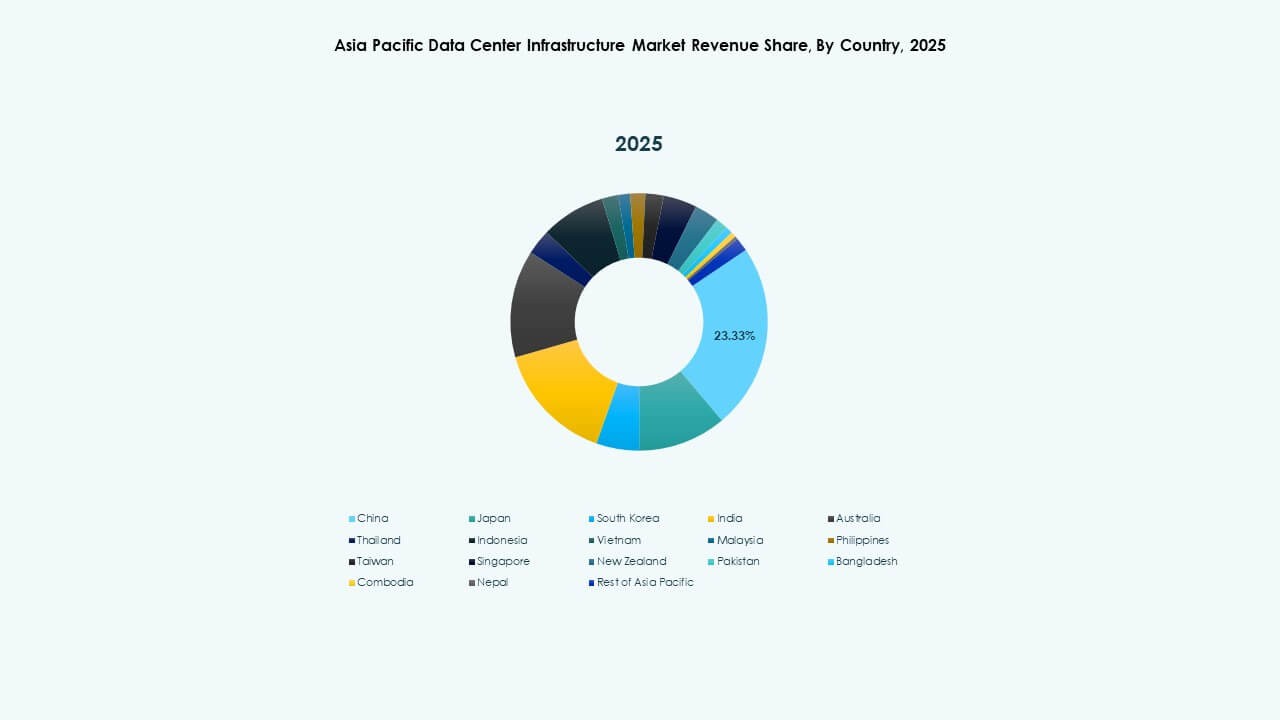

East Asia Including China, Japan, and South Korea

East Asia accounts for nearly 40% market share. China leads through hyperscale expansion. Japan focuses on resilient and efficient facilities. South Korea supports AI-driven demand. The Asia Pacific Data Center Infrastructure Market benefits from mature ecosystems. Strong manufacturing bases support supply chains. Power reliability remains a priority. Regulatory clarity supports investor confidence.

- For example, Alibaba Cloud expanded its global infrastructure to support cloud and AI workloads, operating more than 80 availability zones worldwide. The company continues to add regional data centers to strengthen capacity and service coverage across Asia Pacific.

South Asia and Southeast Asia Including India and ASEAN Countries

This subregion holds about 35% market share. India drives growth through cloud adoption. Singapore remains a regional hub. Indonesia and Vietnam emerge rapidly. The Asia Pacific Data Center Infrastructure Market gains momentum here. Digital economy expansion fuels demand. Government incentives attract investments. Infrastructure buildouts accelerate across cities.

Australia and Emerging Pacific Markets

Australia contributes close to 25% market share. Stable regulations attract hyperscale players. Renewable energy access supports sustainability goals. Smaller Pacific markets show early-stage growth. The Asia Pacific Data Center Infrastructure Market sees steady demand here. Reliability standards remain high. Investors favor long-term stability. Regional connectivity improves future prospects.

- For example, CtrlS Datacenters has publicly announced the Chandanvelly hyperscale data center campus near Hyderabad with a planned capacity of up to 612 MW. The project includes liquid-cooling readiness to support high-density and AI-focused workloads, which aligns with disclosed design intent.

Competitive Insights:

- ABB

- Cisco Systems, Inc.

- Cummins

- Dell Inc.

- Equinix, Inc.

- Delta Electronics

- Hewlett Packard Enterprise

- Huawei Technologies Co., Ltd.

- Schneider Electric

- Vertiv Group Corp.

The competitive landscape of the Asia Pacific Data Center Infrastructure Market shows strong presence of global technology and power solution providers. Large firms focus on integrated electrical, cooling, and digital management portfolios. Power and thermal specialists compete on reliability, efficiency, and lifecycle support. IT vendors strengthen positions through servers, networking, and system integration. Colocation leaders influence infrastructure standards through large campus projects. Strategic partnerships support regional expansion and local compliance. Product differentiation centers on modular design, smart monitoring, and energy efficiency. Capital strength enables scale and long-term contracts. Competitive intensity remains high, with innovation and execution speed shaping market leadership.

Recent Developments:

- In March 2024, Schneider Electric announced a partnership with NVIDIA to deliver reference designs for AI-ready data center power and cooling systems in Asia Pacific. The collaboration focuses on integrated electrical infrastructure, liquid cooling compatibility, and digital power management.

- In April 2024, Vertiv Group Corp. launched upgraded prefabricated modular data center power and cooling solutions for high-density deployments across Asia Pacific. The new systems support faster deployment, higher rack power levels, and improved energy efficiency. This launch supports hyperscale and colocation operators seeking rapid capacity expansion within the Asia Pacific Data Center Infrastructure Market.

- In September 2024, Huawei Technologies Co., Ltd. introduced an enhanced smart data center facility solution in select Asia Pacific markets. The offering integrates power supply, cooling, and intelligent management platforms under a unified architecture. This product update supports energy-efficient operations and strengthens Huawei’s competitive position in the Asia Pacific Data Center Infrastructure Market.

Market Dynamics:

Market Dynamics: Market Trends

Market Trends Market Challenges

Market Challenges Market Segmentation

Market Segmentation Regional Insights

Regional Insights