Executive summary:

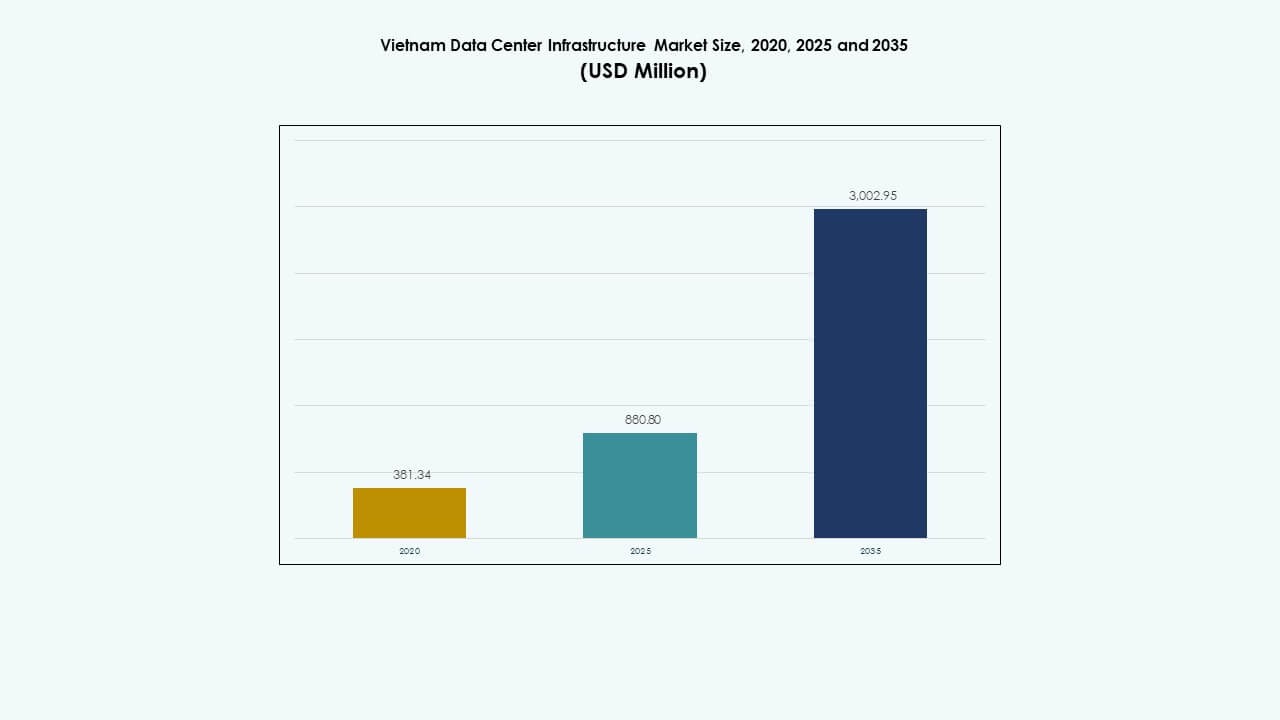

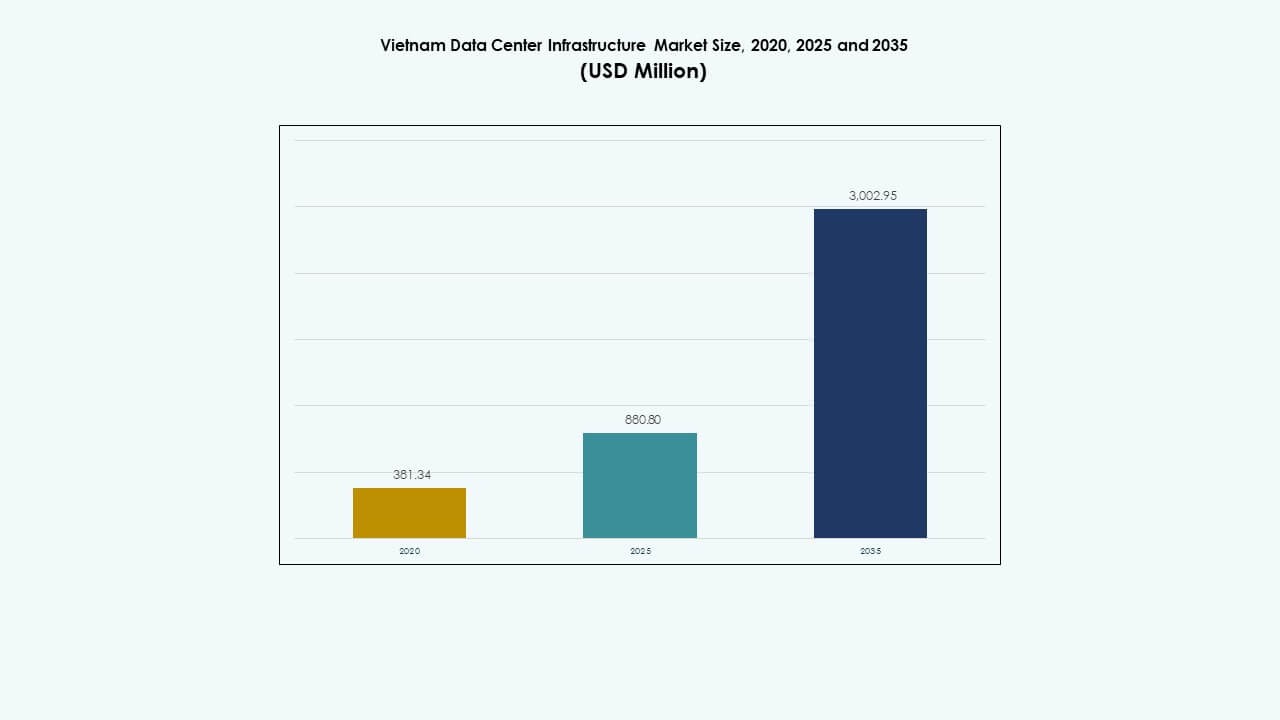

The Vietnam Data Center Infrastructure Market size was valued at USD 381.34 million in 2020 to USD 880.80 million in 2025 and is anticipated to reach USD 3,002.95 million by 2035, at a CAGR of 12.94% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Vietnam Data Center Infrastructure Market Size 2025 |

USD 880.80 Million |

| Vietnam Data Center Infrastructure Market, CAGR |

12.94% |

| Vietnam Data Center Infrastructure Market Size 2035 |

USD 3,002.95 Million |

Market growth is driven by cloud adoption and enterprise digitization. Businesses move workloads to colocation and hybrid environments. Telecom operators strengthen network and facility integration. Data localization rules increase domestic hosting demand. Innovation in cooling and power systems improves efficiency. The Vietnam Data Center Infrastructure Market holds strategic value for investors seeking stable digital assets. Enterprises view local data centers as critical infrastructure.

Southern Vietnam leads due to enterprise concentration and strong connectivity. Ho Chi Minh City hosts major colocation and carrier facilities. Northern Vietnam emerges with government and financial sector demand. Hanoi supports public cloud and sovereign data needs. Central Vietnam shows early growth through secondary hubs. These regions gain relevance due to latency, land availability, and resilience planning.

Market Dynamics:

Market Dynamics:

Rapid Cloud Adoption And Enterprise Digital Transformation Across Industries

Enterprises migrate workloads to cloud and colocation platforms. Digital banking, e-commerce, and SaaS expand nationwide. The Vietnam Data Center Infrastructure Market supports scalable IT environments for enterprises. Businesses demand low latency and local data hosting. Cloud service providers expand domestic footprints. Private cloud adoption supports data control needs. Hybrid models gain acceptance among regulated sectors. Infrastructure upgrades improve service reliability. Investors view this shift as long-term demand security.

- For instance, Viettel IDC developed a Tier III–certified data center at the Hoa Lac High-Tech Park near Hanoi. The facility supports enterprise and cloud workloads and strengthens domestic data hosting capacity in northern Vietnam.

Government Digital Programs And Data Localization Policy Enforcement

Public sector digitization drives infrastructure demand. E-government platforms require secure local hosting. Data residency rules encourage domestic data center use. Ministries deploy centralized and regional facilities. Telecom operators align networks with compliance needs. The Vietnam Data Center Infrastructure Market benefits from policy clarity. Stable regulation reduces investor risk. Long-term contracts support revenue visibility. Public workloads anchor baseline capacity demand.

- For instance, Hanoi supports sovereign cloud deployments for government and sensitive workloads under Vietnam’s data localization policies. National databases require domestic hosting, which strengthens data center demand in the capital region.

Telecom Network Expansion And High-Speed Connectivity Growth

5G rollout increases data traffic volumes. Fiber penetration improves nationwide connectivity. Telecom firms upgrade core and edge infrastructure. Content delivery needs push facility expansion. Enterprises rely on resilient carrier networks. Interconnection density becomes a key site factor. The Vietnam Data Center Infrastructure Market supports traffic localization. Network upgrades raise rack density requirements. Investors favor assets near carrier hubs.

Rising Foreign Direct Investment And Hyperscale Entry Interest

Global operators assess Vietnam as a growth hub. Manufacturing digitization raises enterprise IT demand. Regional cloud providers seek Southeast Asia scale. Colocation partnerships reduce market entry barriers. The Vietnam Data Center Infrastructure Market attracts capital inflows. Long leases improve asset stability. Infrastructure funds pursue yield-oriented assets. Scale economics improve operational margins. Strategic location enhances regional relevance.

Market Trends

Market Trends

Shift Toward Modular And Prefabricated Data Center Designs

Operators favor faster deployment cycles. Modular builds reduce construction risk. Standardized designs improve cost control. Scalability supports phased capacity expansion. Power and cooling modules integrate easily. The Vietnam Data Center Infrastructure Market adopts flexible layouts. Time-to-market gains improve competitiveness. Investors prefer predictable build schedules. Modular adoption supports future expansion planning.

Growing Focus On Energy Efficiency And Sustainable Operations

Operators prioritize efficient power usage. Advanced cooling systems reduce energy waste. Renewable energy sourcing gains attention. Sustainability reporting influences customer selection. Green certifications improve asset value. The Vietnam Data Center Infrastructure Market aligns with ESG goals. Energy-efficient designs reduce operating costs. Tenants favor lower carbon footprints. Long-term sustainability supports asset resilience.

Rising Demand For Edge And Distributed Data Center Locations

Latency-sensitive applications gain traction. Content streaming and gaming drive edge demand. Enterprises deploy regional processing nodes. Telecom operators integrate edge facilities. The Vietnam Data Center Infrastructure Market expands beyond core cities. Smaller facilities support regional users. Edge sites improve service quality. Distributed architecture reduces network strain. This trend reshapes site selection strategies.

Increased Automation And Smart Infrastructure Management Adoption

Operators deploy intelligent monitoring systems. Automation improves uptime and response speed. AI-driven tools optimize power usage. Predictive maintenance reduces service disruption. Smart controls lower staffing intensity. The Vietnam Data Center Infrastructure Market adopts digital operations. Operational efficiency improves profit margins. Clients value service consistency. Automation supports scalable growth models.

Market Challenges

Market Challenges

Power Availability Constraints And Grid Reliability Concerns

Data centers require stable power supply. Urban grids face rising demand pressure. Capacity expansion strains local infrastructure. Backup systems increase capital costs. Fuel logistics affect generator operations. The Vietnam Data Center Infrastructure Market faces planning complexity. Power delays impact project timelines. Operators invest heavily in redundancy. Energy risk affects site feasibility.

Land Acquisition Complexity And Skilled Workforce Gaps

Suitable land remains limited near hubs. Zoning approvals extend project timelines. Urban density raises land costs. Skilled technicians remain scarce. Training needs increase operating expenses. The Vietnam Data Center Infrastructure Market requires talent development. Competition for engineers intensifies. Workforce gaps affect service quality. These challenges influence investment pacing.

Market Opportunities

Expansion Of Regional Colocation And Enterprise Demand

SMEs seek outsourced IT infrastructure. Colocation lowers capital barriers. Enterprises prefer flexible capacity contracts. Secondary cities show rising demand. The Vietnam Data Center Infrastructure Market supports regional growth. New facilities target underserved areas. Local partnerships improve market access. Colocation improves ecosystem depth. Investors gain diversified tenant exposure.

Integration Of Renewable Energy And Advanced Cooling Solutions

Renewable sourcing reduces operating risk. Liquid and hybrid cooling gain traction. High-density racks require advanced systems. Energy innovation improves efficiency metrics. The Vietnam Data Center Infrastructure Market enables green investments. Sustainable assets attract global tenants. Cost savings improve long-term returns. Technology upgrades support premium pricing.

Market Segmentation

By Infrastructure Type

Electrical and mechanical infrastructure dominate capital spending due to power and cooling needs. IT and network infrastructure follows with strong demand from hyperscale and colocation operators. Civil and structural components support scalable facility design. The Vietnam Data Center Infrastructure Market shows higher share for electrical systems due to redundancy needs. Growth links to rising rack density and uptime standards. Integrated infrastructure delivery improves deployment speed. Investors favor balanced infrastructure portfolios for risk control.

By Electrical Infrastructure

UPS systems and power distribution units hold major share. Battery energy storage gains relevance for resilience. Grid connections remain critical for site selection. Transfer switches support uptime assurance. The Vietnam Data Center Infrastructure Market emphasizes electrical reliability. Growth aligns with higher availability tiers. Energy storage adoption supports grid stability. Electrical upgrades drive recurring investment cycles.

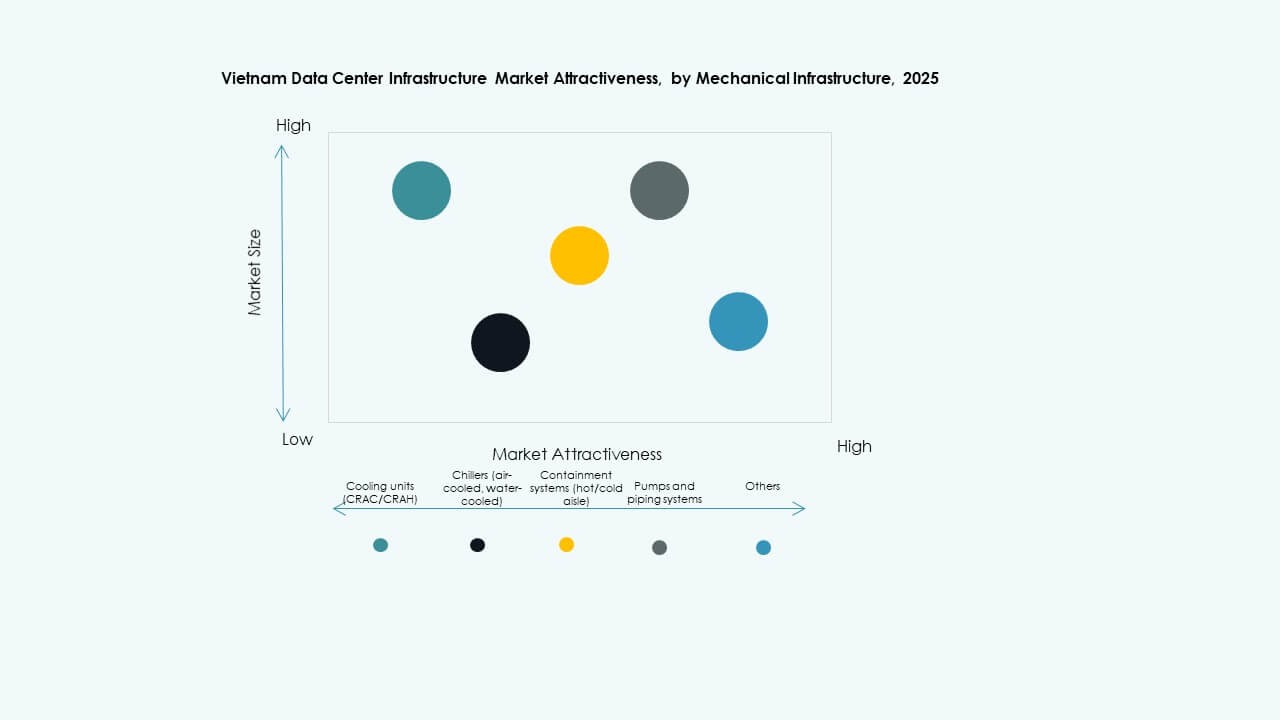

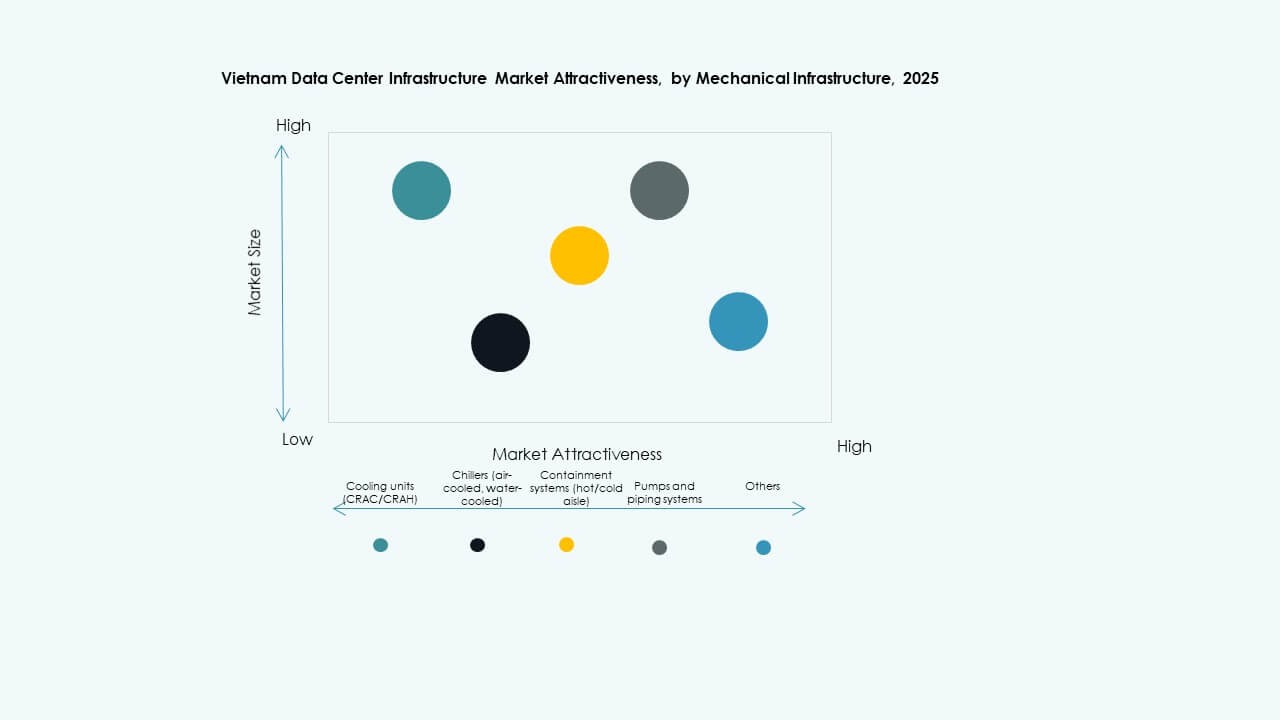

By Mechanical Infrastructure

Cooling units and chillers lead segment demand. Containment systems improve efficiency. Pumps and piping ensure thermal stability. The Vietnam Data Center Infrastructure Market adopts advanced cooling layouts. High-density loads drive innovation. Mechanical systems impact operating costs heavily. Efficient designs gain operator preference. Growth follows rack power escalation.

By Civil / Structural & Architectural

Superstructure and building envelopes dominate costs. Modular systems gain rapid adoption. Raised floors support cabling efficiency. Foundations address load requirements. The Vietnam Data Center Infrastructure Market favors flexible civil designs. Faster construction supports capacity scaling. Structural resilience improves asset lifespan. Design efficiency influences capital efficiency.

By IT & Network Infrastructure

Servers and networking equipment hold largest share. Storage demand rises with data growth. Cabling supports high-speed interconnects. Racks adapt to higher densities. The Vietnam Data Center Infrastructure Market reflects rapid IT refresh cycles. Hyperscale demand accelerates upgrades. Network performance shapes tenant satisfaction. This segment links closely to cloud growth.

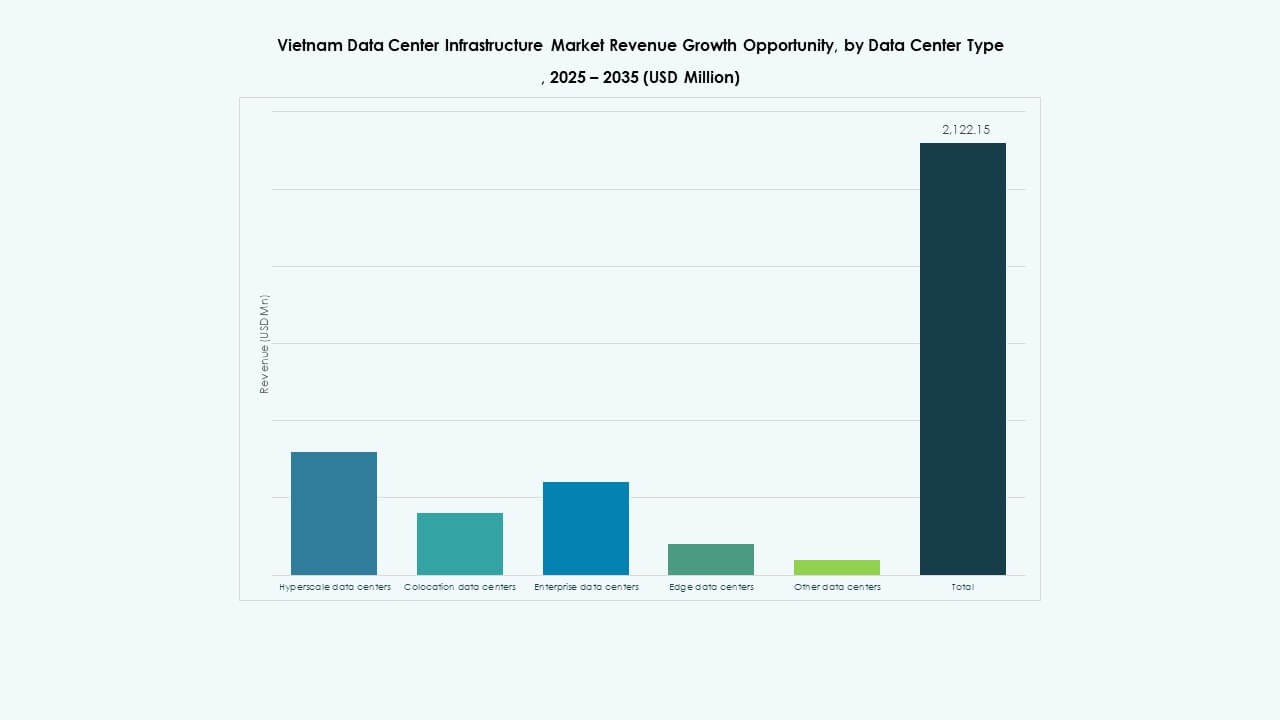

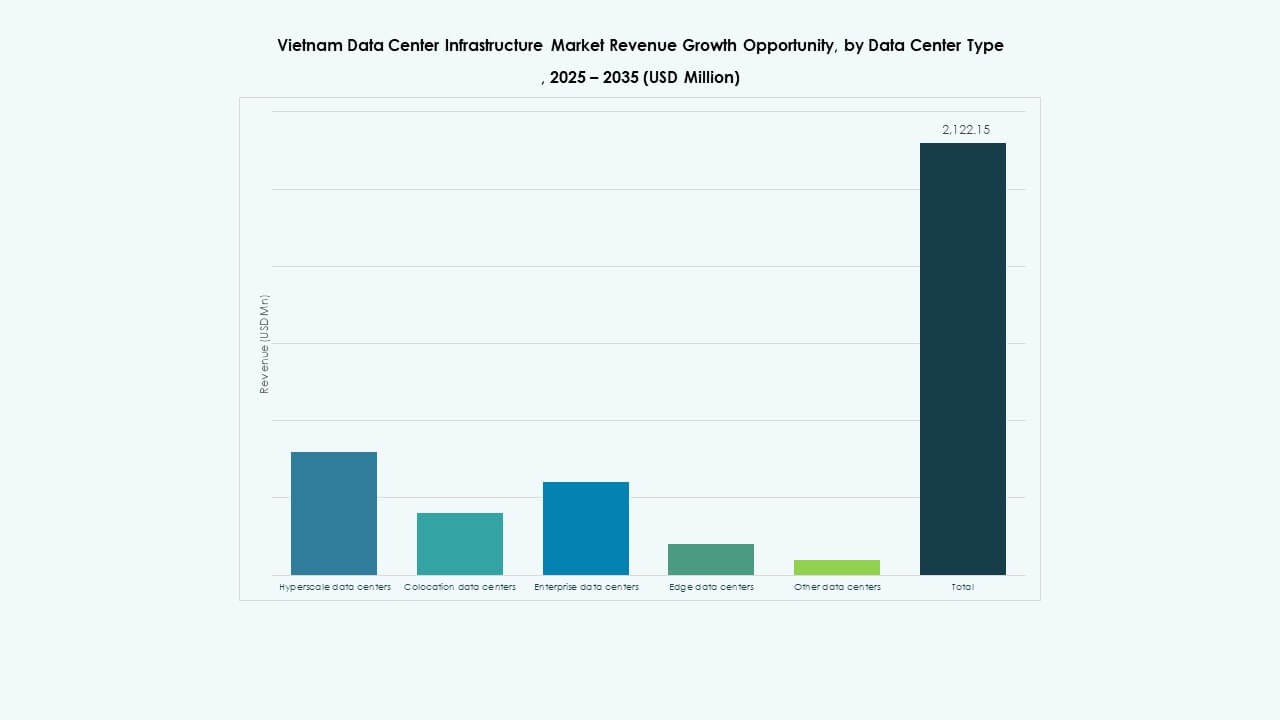

By Data Center Type

Colocation data centers lead market share. Hyperscale facilities show fastest growth. Enterprise centers maintain steady demand. Edge sites expand gradually. The Vietnam Data Center Infrastructure Market benefits from mixed facility types. Colocation attracts diverse tenants. Hyperscale drives scale investments. Edge supports latency-critical services.

By Delivery Model

Design-build and turnkey models dominate projects. Modular factory-built solutions gain traction. Retrofit projects rise in legacy facilities. Construction management suits complex builds. The Vietnam Data Center Infrastructure Market favors integrated delivery. Faster execution reduces risk. Turnkey models attract foreign investors. Delivery flexibility supports varied project scopes.

By Tier Type

Tier III facilities hold largest share. Tier IV adoption rises for mission-critical use. Tier II serves enterprise needs. Tier I remains limited. The Vietnam Data Center Infrastructure Market trends toward higher uptime. Financial and cloud clients demand resilience. Higher tiers increase capital intensity. Tier upgrades support premium pricing.

Regional Insights

Regional Insights

Southern Vietnam holds over half of national capacity. Ho Chi Minh City leads with strong enterprise and carrier density. It attracts colocation and hyperscale investments. The Vietnam Data Center Infrastructure Market benefits from regional connectivity. Industrial and digital services support demand. Market share remains dominant due to ecosystem maturity.

- For instance, FPT Telecom inaugurated the Fornix HCM02 data center with capacity for 3,600 racks, supporting large-scale enterprise and cloud workloads.

Northern Vietnam accounts for a significant portion of capacity. Hanoi supports government and financial workloads. Public sector digitization drives stable demand. The Vietnam Data Center Infrastructure Market sees steady growth here. Proximity to policy centers supports compliance needs. Northern facilities focus on secure hosting.

Central Vietnam holds a smaller but rising share. Da Nang and nearby cities emerge as secondary hubs. Disaster recovery and latency needs drive interest. The Vietnam Data Center Infrastructure Market expands gradually in this region. Lower land costs attract new entrants. Infrastructure upgrades support future capacity growth.

- For instance, data centers in Da Nang are designed to support high availability and resilience needs for disaster recovery workloads. Operators position these facilities to improve service continuity and regional redundancy.

Competitive Insights:

- Viettel IDC

- FPT Telecom

- VNPT

- Equinix, Inc.

- Schneider Electric

- Vertiv Group Corp.

- Huawei Technologies Co., Ltd.

- ABB

- Dell Inc.

The Vietnam Data Center Infrastructure Market shows a balanced mix of local operators and global technology providers. Domestic telecom-backed firms control core capacity and network reach. International players supply critical power, cooling, and IT systems. Colocation specialists focus on carrier density and uptime standards. Equipment vendors compete through efficiency, reliability, and service support. Partnerships between local operators and global suppliers shape project execution. It benefits from long-term contracts with enterprise and cloud clients. Competitive strength depends on scale, compliance readiness, and operational performance. Investors favor firms with proven delivery and expansion capability.

Recent Developments:

- In December 2025, HITC and Evolution launched a joint venture for large-scale data centers in Hanoi and Ho Chi Minh City to support cloud and AI workloads.

- In October 2025, Viettel IDC became a VMware Cloud Service Provider Pinnacle Tier Partner in the Broadcom Advantage Partner Program for Southeast Asia, offering managed VMware Cloud Foundation private cloud services including sovereign cloud options.

- In August 2025, LG CNS announced plans to develop a hyperscale AI data center in Vietnam in collaboration with VNPT and Korea Investment Real Asset Management.

- In August 2025, FPT Corporation inaugurated the Fornix HCM02 Data Center, a 10,000-square-meter facility accommodating 3,600 racks, marking one of Vietnam’s largest data centers.

Market Dynamics:

Market Dynamics: Market Trends

Market Trends Market Challenges

Market Challenges Regional Insights

Regional Insights