Executive summary:

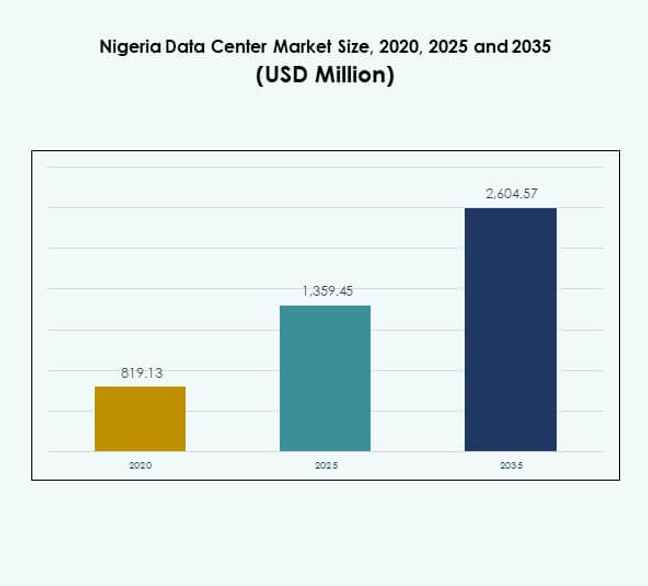

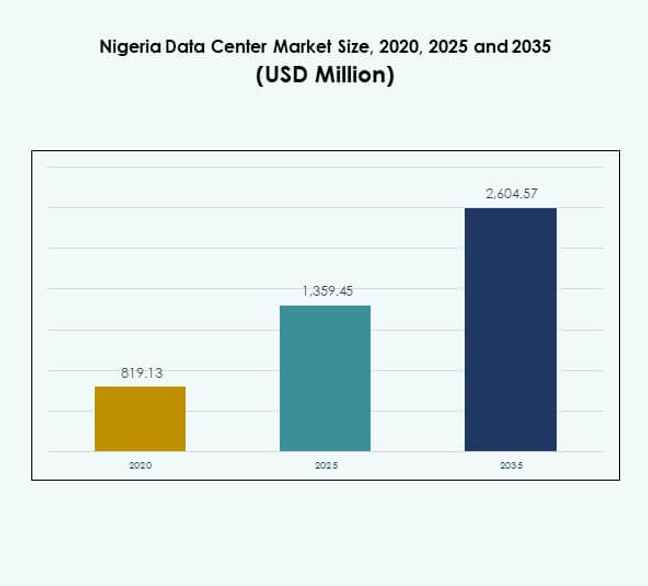

The Nigeria Data Center Market size was valued at USD 819.13 million in 2020 to USD 1,359.45 million in 2025 and is anticipated to reach USD 2,604.57 million by 2035, at a CAGR of 6.66% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Nigeria Data Center Market Size 2025 |

USD 1,359.45 Million |

| Nigeria Data Center Market, CAGR |

6.66% |

| Nigeria Data Center Market Size 2035 |

USD 2,604.57 Million |

Growth in the Nigeria Data Center Market is driven by strong enterprise digitalization, cloud adoption, and the rise of fintech and e-commerce ecosystems. Companies invest in scalable infrastructure, AI applications, and modular data centers to improve operational efficiency. Innovation in automation and energy-efficient cooling supports business continuity, while hybrid models enhance security and flexibility. For investors, it represents a strategic gateway into West Africa, offering resilient infrastructure and long-term opportunities.

The Nigeria Data Center Market is concentrated in Lagos and the southern region, benefiting from subsea cable landings and enterprise hubs. Lagos serves as the country’s digital core, supported by fintech and telecom networks. Northern Nigeria is emerging with government projects in Abuja, while western and eastern regions expand through edge and modular deployments. This distribution reflects balanced geographic growth, with the south maintaining dominance and other regions strengthening their roles.

Market Drivers

Rapid Digital Transformation and Expanding Adoption of Cloud Services

The Nigeria Data Center Market is gaining momentum with businesses embracing digitalization across multiple industries. Enterprises adopt cloud computing to improve scalability and efficiency, fueling demand for secure and reliable hosting facilities. Financial institutions, telecoms, and startups see data centers as critical to operational resilience. Government support for digital economy projects strengthens adoption of cloud-first strategies. Investors identify the sector as a pathway to high returns in West Africa. It becomes an enabler of fintech and e-commerce ecosystems. The digital shift continues to position Nigeria as a regional hub.

Technology Innovation and Integration of Advanced Computing Infrastructure

The Nigeria Data Center Market benefits from strong adoption of AI-driven platforms and high-performance computing. Enterprises deploy advanced servers and automation tools to reduce downtime and streamline operations. Modular and scalable architectures help companies manage unpredictable workloads. Energy-efficient cooling technologies and DCIM software improve reliability and monitoring. Technology innovation enhances competitiveness for both local and global players. It creates opportunities for hyperscale facilities to serve multinational clients. Investments in advanced infrastructure encourage partnerships between telecom operators and technology vendors. This cycle of innovation shapes Nigeria’s data-driven future.

- For instance, in April 2025, Equinix expanded its Lagos footprint by opening the LG2.3 hyperscale data center, enhancing interconnection and colocation capacity to support Nigeria’s growing digital infrastructure needs.

Strategic Role of Data Centers in Business Continuity and Risk Management

The Nigeria Data Center Market plays a vital role in supporting business continuity strategies. Companies recognize data centers as essential for disaster recovery and cybersecurity compliance. Multinational firms establish colocation footprints to mitigate risks from power outages and connectivity disruptions. Growing adoption of hybrid models allows enterprises to balance performance with cost efficiency. It provides secure and compliant environments for regulated sectors such as BFSI and healthcare. Organizations view reliable infrastructure as a competitive advantage. Business resilience strategies drive continuous investments. The sector anchors Nigeria’s digital transformation roadmap.

- For example, MTN Nigeria launched the first phase of its Dabengwa Sifiso Data Centre in Lagos in July 2025. The facility is Uptime Institute Tier III certified for Constructed Facility (TCCF), features 780 racks and a 4.5 MW IT load. It is equipped with advanced cloud infrastructure to meet enterprise needs, including disaster recovery standards.

Investor Confidence and Expanding Enterprise ICT Adoption in Key Industries

The Nigeria Data Center Market attracts foreign and local investors seeking scalable returns in emerging markets. ICT adoption expands across healthcare, government, and retail industries, increasing demand for capacity. Fintech firms rely on colocation and cloud facilities to ensure customer trust. Growing consumption of digital services boosts enterprise IT investments. Investors see Nigeria as a gateway into West African digital ecosystems. It underscores the importance of long-term infrastructure funding. The push toward digital inclusion enhances investor confidence. Strong enterprise demand secures steady growth for the market.

Market Trends

Growth of Renewable Energy Integration in Data Center Operations

The Nigeria Data Center Market is witnessing an increased focus on renewable energy use. Operators invest in solar and hybrid power solutions to overcome grid instability. Partnerships with energy firms support sustainable development goals. Green energy adoption reduces operating costs and improves environmental compliance. It aligns with global commitments to lower carbon emissions. Renewable-powered facilities also enhance brand reputation with eco-conscious clients. The trend accelerates as hyperscale players demand efficient, sustainable energy. Nigeria becomes a testbed for large-scale renewable integration in West Africa.

Expansion of Subsea Cable Connectivity and Its Impact on Data Center Growth

The Nigeria Data Center Market benefits from new subsea cable projects landing along the coast. Increased bandwidth enhances international connectivity and lowers latency. Global hyperscale providers prioritize Nigeria for regional hubs due to strong connectivity. Cable landings strengthen Lagos as a digital gateway to West Africa. It improves user experience for cloud and streaming services. Enterprises leverage reliable connectivity to expand operations. The trend supports new investment in coastal cities. Nigeria positions itself as a strategic point for global data exchange.

Adoption of Edge and Modular Data Centers for Localized Processing Needs

The Nigeria Data Center Market is experiencing higher demand for edge and modular facilities. Enterprises deploy smaller, agile sites closer to end users. Edge processing enables real-time analytics for industries like telecom, retail, and healthcare. Modular data centers deliver rapid deployment and lower capital costs. It provides scalability for enterprises with limited resources. Businesses see modular solutions as essential for underserved regions. The trend opens opportunities for domestic operators and SMEs. Edge and modular facilities bridge the gap between rural and urban connectivity.

Increased Demand for Managed Services and Data Center Outsourcing

The Nigeria Data Center Market reflects a growing shift toward managed services. Enterprises outsource infrastructure management to reduce costs and focus on core operations. Managed service providers deliver expertise in security, compliance, and scalability. Outsourcing creates opportunities for partnerships across multiple industries. It reduces pressure on in-house IT teams facing talent shortages. Adoption of managed services grows across SMEs seeking reliable hosting. Data center operators expand service portfolios to capture new clients. The trend enhances long-term revenue generation in the market.

Market Challenges

Infrastructure Constraints and High Energy Dependence on National Grid

The Nigeria Data Center Market faces critical challenges from unreliable power supply and grid limitations. Operators rely heavily on diesel generators, raising costs and affecting sustainability goals. Limited energy infrastructure creates risks for uptime commitments and service reliability. Enterprises face higher expenses that can deter expansion plans. It increases operational risks for hyperscale projects targeting regional markets. Persistent grid instability reduces efficiency across facilities. Businesses must plan for redundant systems, raising capital expenditure. These issues remain a barrier to sustainable growth in Nigeria.

Cybersecurity Gaps and Talent Shortages in the Emerging Ecosystem

The Nigeria Data Center Market also struggles with rising cybersecurity threats and a shortage of skilled professionals. Data breaches and ransomware attacks place additional pressure on operators to enhance protection systems. Compliance with global security standards requires significant investment. It is difficult to retain talent due to international competition for skilled experts. SMEs lack adequate cybersecurity budgets, exposing vulnerabilities in operations. Growing reliance on hybrid and cloud deployments creates more complex risks. Limited availability of advanced training programs restricts workforce development. Security and talent gaps slow the pace of digital expansion.

Market Opportunities

Expansion of Hyperscale Facilities and Regional Digital Ecosystem Development

The Nigeria Data Center Market presents strong opportunities with rising demand for hyperscale facilities. Global cloud providers target Nigeria to establish regional clusters. Telecom operators expand data services to meet enterprise and consumer needs. It strengthens Nigeria’s role in digital inclusion across West Africa. Hyperscale expansions attract local partnerships, creating new jobs and skills. Enterprises benefit from cost-efficient storage and processing solutions. The opportunity drives sustainable investments in large-capacity sites. Nigeria emerges as a regional powerhouse in the digital economy.

Growth of Digital Services Adoption Among SMEs and Public Sector Agencies

The Nigeria Data Center Market opens opportunities with SMEs and government agencies adopting cloud and colocation services. SMEs seek affordable, scalable solutions to support innovation and growth. Public sector agencies leverage data centers for e-governance and smart city projects. It reduces reliance on foreign infrastructure and improves data sovereignty. Cloud-based services provide cost flexibility for growing enterprises. The adoption of digital services builds resilience across multiple industries. New partnerships between local operators and enterprises expand opportunities. Nigeria strengthens its domestic digital infrastructure landscape.

Market Segmentation

By Component

The Nigeria Data Center Market is led by the hardware segment, holding the largest share due to high demand for servers, racks, power, and cooling systems. Software solutions such as DCIM and automation platforms grow steadily as enterprises seek efficiency. Services including consulting, integration, and managed support gain importance, especially among SMEs. Hardware remains the core backbone of facility investments, while services ensure long-term operational excellence.

By Data Center Type

The Nigeria Data Center Market is dominated by colocation facilities, driven by demand from telecom and fintech industries. Hyperscale data centers are expanding quickly, fueled by investments from global players. Edge and modular facilities show potential in regional cities outside Lagos. Cloud and internet data centers also witness rising adoption with increased cloud-first strategies. Enterprise data centers remain relevant but less dominant compared to shared models.

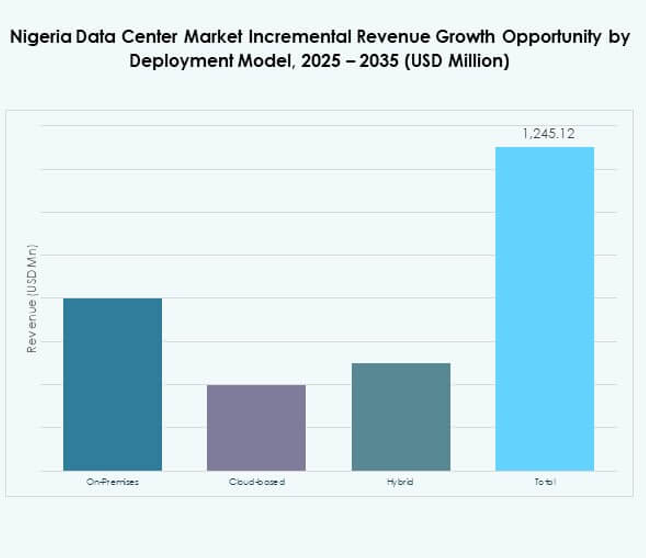

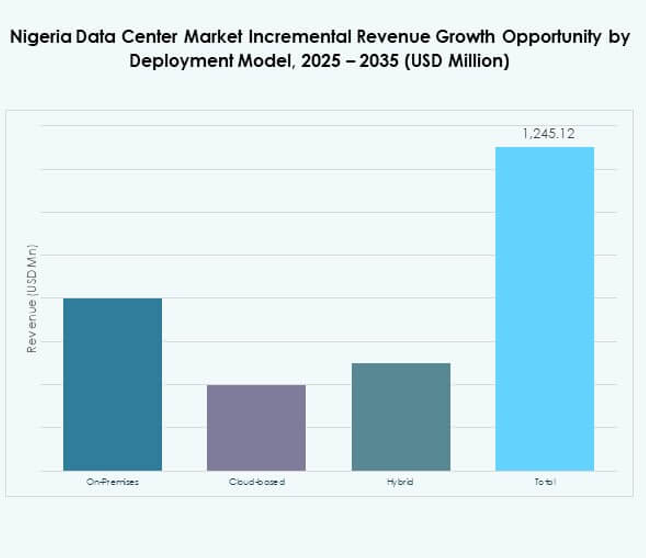

By Deployment Model

The Nigeria Data Center Market is increasingly shaped by hybrid deployments, offering flexibility for enterprises managing sensitive workloads. On-premises facilities remain vital for regulated industries like BFSI and healthcare. Cloud-based models show the fastest growth as digital transformation deepens. Enterprises prefer hybrid for cost optimization and data control. Cloud providers and colocation operators collaborate to support adoption. This blend of models reflects the maturing ecosystem.

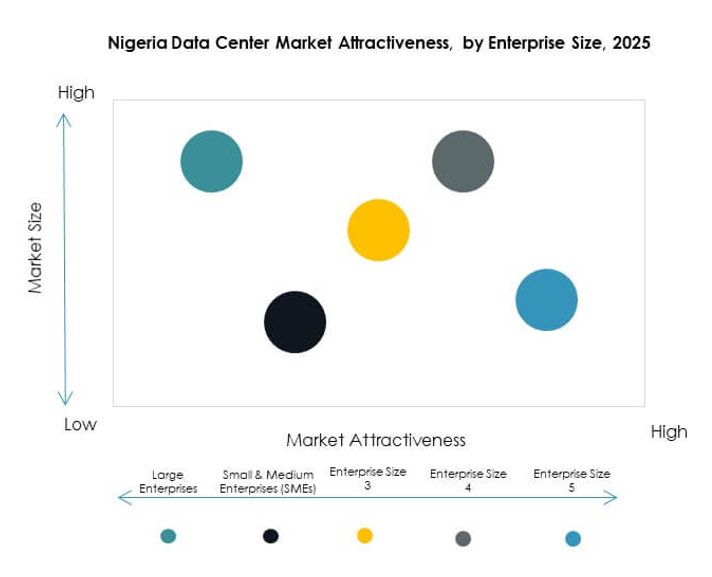

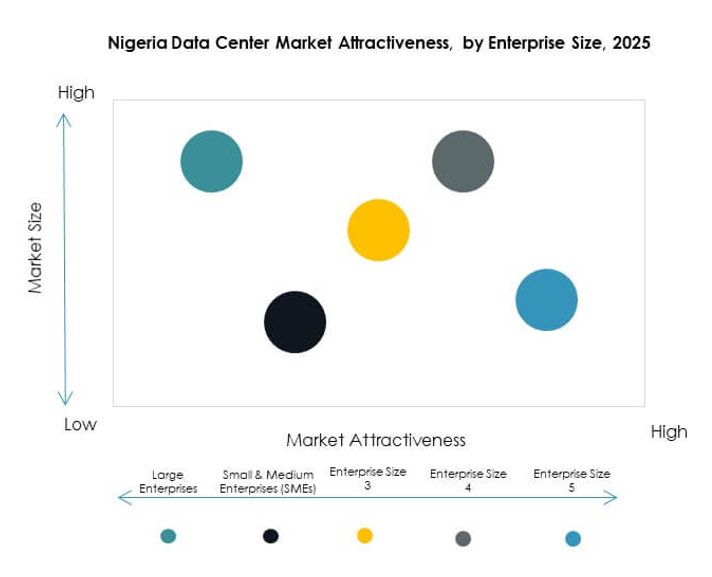

By Enterprise Size

The Nigeria Data Center Market sees large enterprises leading in adoption, driven by fintechs, telecoms, and multinationals. SMEs rapidly expand usage through affordable colocation and cloud services. SMEs focus on cost-efficient scalability to compete with larger players. Large enterprises emphasize compliance and disaster recovery. It highlights the varied needs across business sizes. SMEs show the highest potential for long-term adoption growth.

By Application / Use Case

The Nigeria Data Center Market is dominated by BFSI and IT & Telecom applications due to strict compliance needs and high data volume. Healthcare and retail emerge as strong growth areas with digital services expansion. Media and entertainment see adoption through streaming platforms and content delivery. Manufacturing and e-commerce invest in real-time analytics. Other sectors like education and energy also explore digital infrastructure. BFSI continues as the anchor application segment.

By End User Industry

The Nigeria Data Center Market shows cloud service providers as the leading end user group. Enterprises remain critical adopters seeking security and cost benefits. Colocation providers gain traction with SMEs and multinational firms. Government agencies expand their digital infrastructure needs through local hosting. Other industries, including energy, contribute to diversified demand. Cloud service providers remain the key driver of market growth.

Regional Insights

Dominance of Lagos and Southern Region With 52% Market Share

The Nigeria Data Center Market sees Lagos and the southern region maintaining a 52% share due to subsea cable landings and proximity to enterprise hubs. Lagos acts as the central hub for international connectivity and cloud adoption. Strong fintech and telecom industries fuel demand in this region. It positions the south as the most advanced subregion for digital infrastructure.

- For instance, the MainOne MDXi data center in Lekki is Tier III certified and directly connected to the MainOne submarine cable system, providing carrier-neutral colocation services that anchor Nigeria’s digital ecosystem.

Rising Opportunities in Northern Nigeria With 28% Market Share

The Nigeria Data Center Market records 28% share in the northern region, supported by growing enterprise and government digital initiatives. Abuja serves as a key hub for federal data projects and public sector adoption. Infrastructure projects strengthen resilience against power issues. It highlights the growing importance of northern states in supporting secure and distributed facilities.

Emerging Growth in Western and Eastern Regions With 20% Market Share

The Nigeria Data Center Market secures 20% share across western and eastern regions, with growing SME and retail adoption. Regional cities experience rising interest in modular and edge data centers. These regions support localized connectivity, expanding access to digital services. It underlines the importance of balanced geographic distribution for nationwide digital expansion.

- For example, Equinix announced a $140 million investment to expand digital infrastructure across southern Nigeria, including a new data center in Port Harcourt and expansion of its Lagos facility.

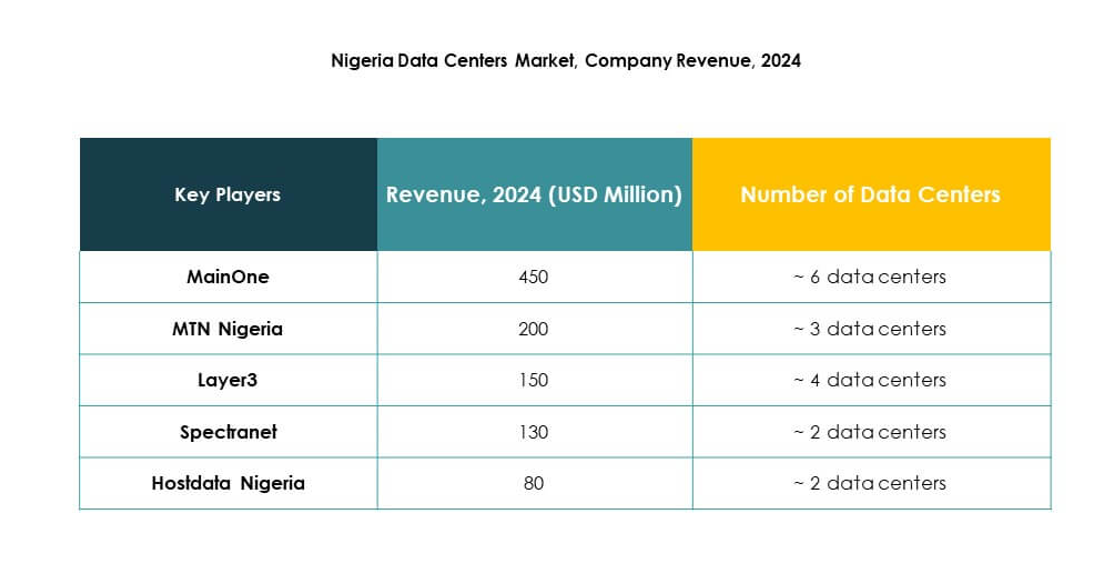

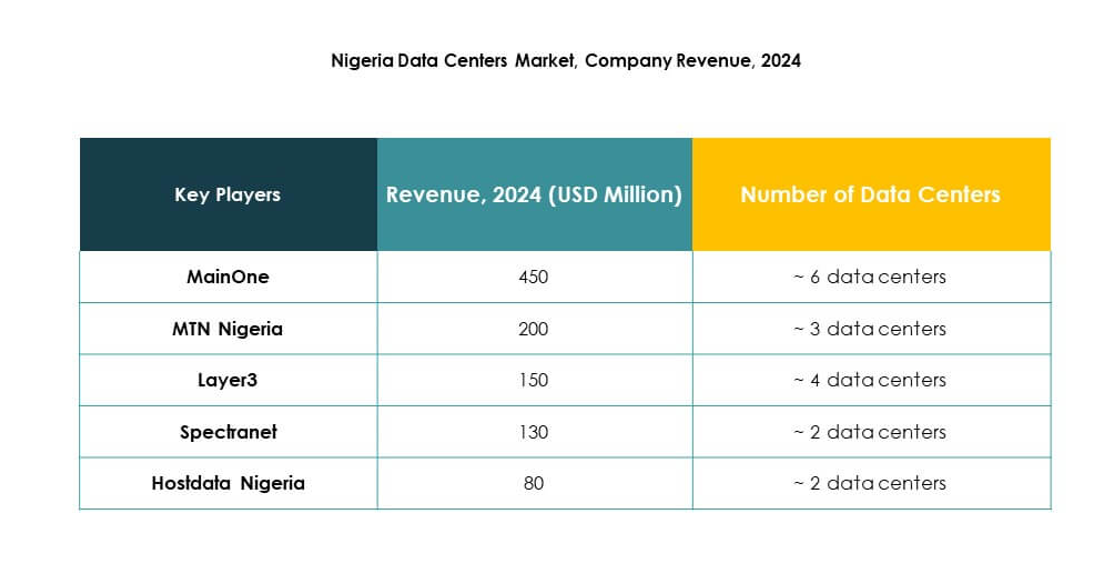

Competitive Insights:

- Rack Centre

- MainOne (Equinix)

- MTN Nigeria

- Layer3

- Spectranet

- Microsoft Corporation

- Amazon Web Services (AWS)

- Google LLC (Alphabet Inc.)

The Nigeria Data Center Market is defined by a mix of domestic operators and global hyperscale providers. Rack Centre and MainOne lead local infrastructure with colocation and enterprise-focused services. MTN Nigeria strengthens the market through telecom-driven data services, while Layer3 and Spectranet target connectivity and managed solutions. Microsoft, AWS, and Google expand regional presence through cloud zones, driving enterprise adoption of hybrid and cloud-native workloads. It reflects growing consolidation and international partnerships, with global firms collaborating with local players to enhance resilience, sustainability, and capacity. Competition focuses on energy efficiency, regulatory compliance, and service diversification, ensuring enterprises gain secure and scalable hosting options across the country.

Recent Developments:

- In July 2025, MTN Nigeria officially launched the first phase of its Sifiso Dabengwa Tier III Data Centre in Lagos, with an initial $100 million investment and a 4.5MW IT load capacity. This facility is designed to support AI workloads and commercial cloud services and marks MTN’s major entry into Nigeria’s competitive data center and cloud infrastructure market. The second phase is expected to further scale up capacity, making this the largest data centre in West Africa to date

- In April 2025, Rack Centre commissioned its new LGS2 12MW IT Load Data Centre in Lagos. This hyperscale, AI-ready facility marks a transformative milestone for Nigeria’s digital infrastructure, increasing the company’s data center capacity eightfold. The center is designed for energy efficiency and scalable cloud services, underlining Rack Centre’s leadership as a digital infrastructure hub in sub-Saharan Africa.