Executive summary:

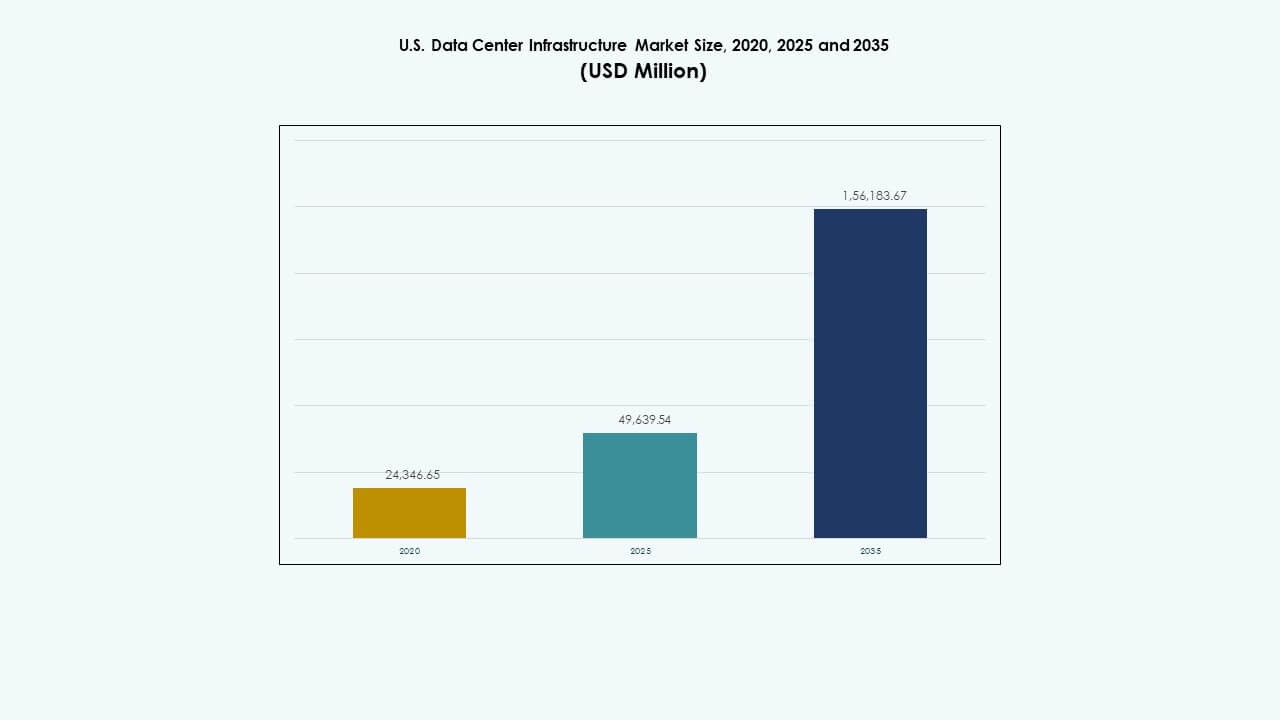

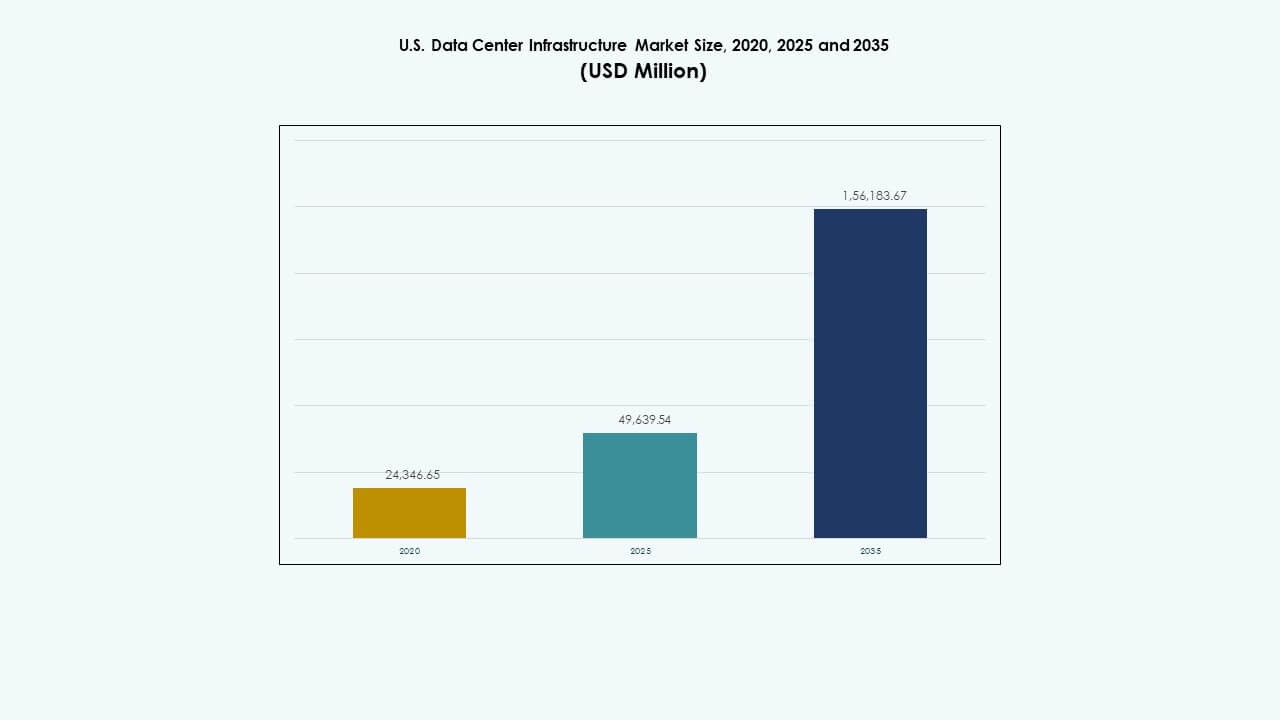

The U.S. Data Center Infrastructure Market size was valued at USD 24,346.65 million in 2020 to USD 49,639.54 million in 2025 and is anticipated to reach USD 156,183.67 million by 2035, at a CAGR of 12.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| U.S. Data Center Infrastructure Market Size 2025 |

USD 49,639.54 Million |

| U.S. Data Center Infrastructure Market, CAGR |

12.06% |

| U.S. Data Center Infrastructure Market Size 2035 |

USD 156,183.67 Million |

The market grows through strong adoption of energy-efficient power systems, liquid cooling solutions, and modular construction technologies. Innovation in automation, edge computing, and renewable integration shapes data center design and operations. It holds strategic importance for enterprises, investors, and cloud providers seeking scalable, low-latency, and sustainable infrastructure to support digital transformation and next-generation AI ecosystems.

Regionally, the Northeast leads due to established hyperscale hubs and dense network infrastructure. The Midwest and Sun Belt states emerge as competitive growth zones driven by lower costs, power availability, and renewable energy access. Expanding hyperscale and colocation projects strengthen the country’s overall data resilience. Emerging clusters in Texas, Arizona, and Ohio are transforming into major digital corridors supporting nationwide connectivity and edge expansion.

Market Drivers

Market Drivers

Rising Expansion of Hyperscale Facilities and Cloud Service Demand

The U.S. Data Center Infrastructure Market grows with the rapid expansion of hyperscale facilities supporting global cloud providers. Companies like Amazon, Google, and Microsoft build large-scale campuses to meet cloud and AI workloads. These developments require advanced power, cooling, and network systems. Rising data consumption and enterprise digitization strengthen the market’s relevance. Investments favor modular and scalable infrastructure. It becomes a foundation for data-intensive industries. Government incentives promote technology manufacturing within U.S. borders. Such growth attracts continuous capital inflow into infrastructure development.

- For example, Amazon, Google, and Microsoft together operate more than 400 hyperscale data centers, representing about 59% of global hyperscale capacity. Ongoing construction projects are expected to add nearly 2,000 MW of power capacity, highlighting the rapid global expansion of hyperscale campuses.

Shift Toward Energy-Efficient Power and Cooling Technologies

Data centers across the country adopt energy-efficient systems to reduce operational costs. Operators replace legacy UPS units with high-efficiency modular systems. Cooling innovations such as liquid-based systems and free-air cooling lower carbon footprints. The U.S. Data Center Infrastructure Market benefits from sustainability goals set by large enterprises. It strengthens compliance with state and federal energy mandates. Renewable energy partnerships rise, improving long-term viability. Advanced sensors enable predictive management of power use. Smart grid connectivity ensures reliability during high-demand cycles. These shifts make facilities more resilient and eco-aligned.

Growing Integration of Automation and AI in Infrastructure Management

Automation improves uptime and asset management across critical facilities. AI-driven software predicts potential faults and optimizes workload distribution. The U.S. Data Center Infrastructure Market witnesses growing integration of digital twins and smart monitoring. It increases operational transparency and reduces manual oversight. Robotics assists in physical maintenance, enhancing efficiency. Predictive analytics platforms ensure optimized cooling and server utilization. Automation supports remote supervision of distributed edge sites. This digital transformation enhances reliability across large-scale networks. Investors view this automation wave as a performance multiplier.

Increasing Edge Data Centers and Regional Connectivity Expansion

Edge facilities support faster content delivery and lower latency. Telecom operators and content providers expand local nodes near population clusters. The U.S. Data Center Infrastructure Market benefits from the roll-out of 5G and IoT ecosystems. It promotes compact, power-dense sites in suburban and rural zones. Localized infrastructure improves resilience during data surges. Compact modular systems simplify deployment and scaling. Regional operators gain competitiveness through efficient connectivity. Businesses depend on these edge expansions for continuity and speed. Edge growth complements core data center infrastructure growth nationwide.

- For instance, AWS has expanded its edge data center footprint to hundreds of locations throughout the U.S., enabling end-users to experience latency reductions commonly under 10 milliseconds. This extensive deployment supports 5G and IoT ecosystems by providing localized compute and storage capacity closer to population centers, enhancing content delivery speed and reliability.

Market Trends

Market Trends

Adoption of Modular and Prefabricated Construction for Faster Deployment

Modular construction becomes the preferred approach to reduce build timelines. Prefabricated units integrate electrical, mechanical, and networking components offsite. The U.S. Data Center Infrastructure Market reflects this shift toward flexibility and scalability. It supports phased development aligned with demand growth. Modular builds lower construction risks and costs. Data center operators use factory-assembled pods for consistency and quality control. Investors prioritize faster returns through reduced lead times. These modular systems also simplify future retrofits. Prefabrication evolves into a standard for high-growth zones.

Rising Focus on Liquid Cooling and Advanced Thermal Management

Operators adopt liquid cooling to handle increasing server densities. The U.S. Data Center Infrastructure Market observes growing adoption across AI and HPC clusters. Liquid-based systems improve thermal control in dense rack configurations. Immersion and direct-to-chip cooling enhance energy efficiency. These systems reduce power consumption compared with traditional CRAC units. Data center developers invest in hybrid solutions combining air and liquid cooling. Vendors innovate compact chillers and adaptive cooling software. Energy optimization remains a major focus of upcoming projects. This shift defines the future of sustainable facility design.

Growing Role of Renewable Energy and Carbon-Neutral Operations

Sustainability dominates infrastructure planning across U.S. regions. The U.S. Data Center Infrastructure Market moves toward renewable-powered campuses. Solar, wind, and hydro-based energy contracts strengthen operational sustainability. Power purchase agreements (PPAs) become a strategic investment tool. Large operators aim to achieve carbon neutrality by mid-decade. Energy storage integration enhances grid stability. Green certifications improve brand image and compliance credibility. Power density designs evolve for optimal efficiency. The trend reshapes how hyperscalers build and manage facilities.

Increased Demand for Interconnectivity and Fiber Expansion Projects

Growing internet traffic drives fiber network expansion across states. The U.S. Data Center Infrastructure Market aligns with demand for high-speed interconnectivity. Edge and regional centers depend on robust backbone connectivity. Fiber extensions support cloud exchange hubs and low-latency zones. Telecom partnerships enable redundancy and secure routing. Multi-tenant data centers integrate high-bandwidth optical networks. Government programs fund rural broadband development. These connectivity enhancements attract global service providers. Strong fiber infrastructure underpins the next generation of digital commerce.

Market Challenges

Rising Energy Costs and Sustainability Compliance Pressures

Energy cost volatility impacts profitability across facilities nationwide. The U.S. Data Center Infrastructure Market faces challenges from regional power shortages. Operators encounter stricter carbon compliance mandates from federal and state agencies. Retrofitting existing buildings for energy efficiency adds to expenditure. Renewable integration requires advanced grid coordination and capital investment. Cooling systems demand water conservation in drought-prone regions. Energy storage adoption remains limited by initial costs. Maintaining uptime amid power fluctuations challenges operational stability. Sustainability compliance continues to reshape investment priorities.

Growing Complexity in Supply Chain and Skilled Workforce Availability

Supply chain delays extend delivery of critical infrastructure components. The U.S. Data Center Infrastructure Market struggles with sourcing semiconductors, cables, and chillers on time. Labor shortages in construction and maintenance slow project completion. Specialized technical skills remain in short supply across U.S. states. Import dependence on specific parts elevates costs and risks. Project timelines face uncertainty due to material price inflation. Operators balance local sourcing with global procurement efficiency. Workforce training programs aim to fill critical engineering gaps. Infrastructure growth depends on resolving these constraints effectively.

Market Opportunities

Market Opportunities

Expansion of AI, Cloud, and Edge Workloads Creating Investment Openings

The U.S. Data Center Infrastructure Market benefits from rising AI and cloud workloads. Enterprises demand more compute density and low-latency environments. Edge expansions open opportunities for localized infrastructure providers. AI-focused facilities attract funding for liquid cooling and high-speed networking. Investment groups target scalable and power-efficient campuses. Businesses seek resilient and flexible builds to match demand cycles. New entrants focus on hybrid architectures integrating edge and hyperscale models. This broad ecosystem generates steady infrastructure spending opportunities.

Increased Government Support and Green Energy Integration Incentives

Federal and state initiatives favor domestic infrastructure manufacturing. The U.S. Data Center Infrastructure Market gains from incentives supporting clean power adoption. Tax credits for renewable integration encourage operators to decarbonize campuses. Public-private collaborations fund large connectivity and sustainability projects. Operators secure funding for energy-efficient retrofits. Grid modernization programs enhance reliability across urban corridors. These efforts attract foreign investment and accelerate long-term facility expansion. Green infrastructure policy alignment boosts nationwide growth potential.

Market Segmentation

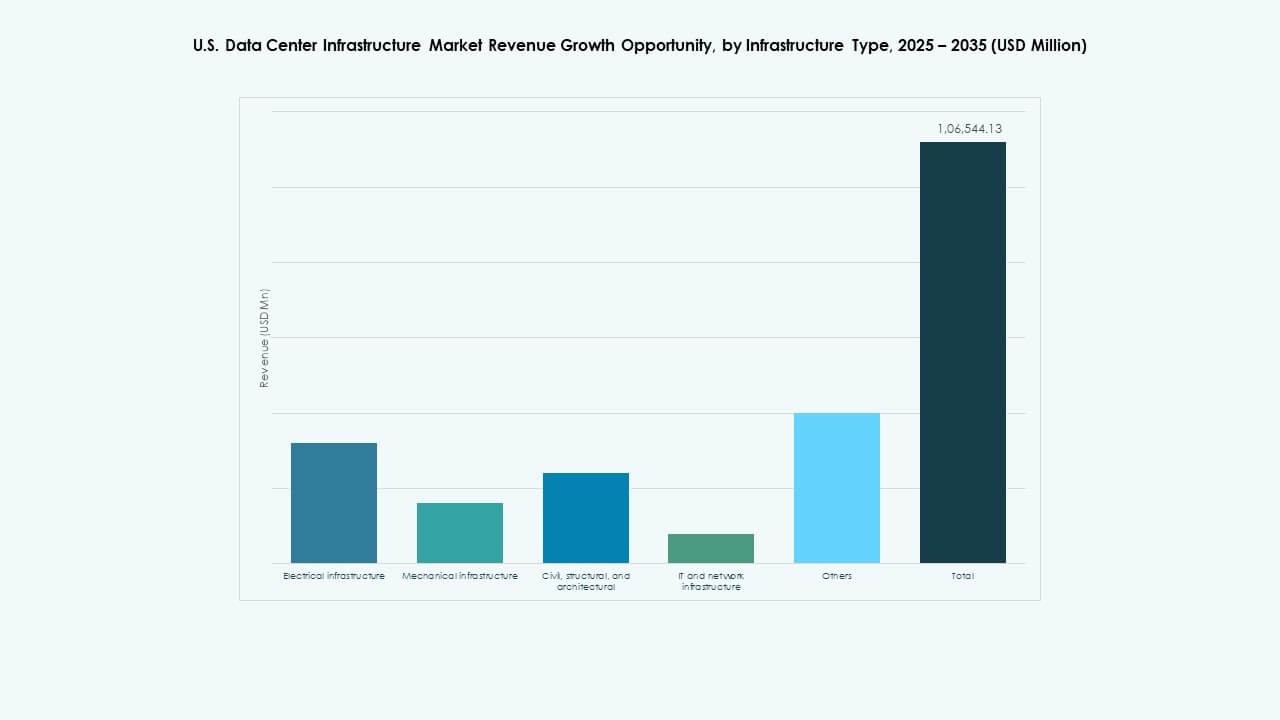

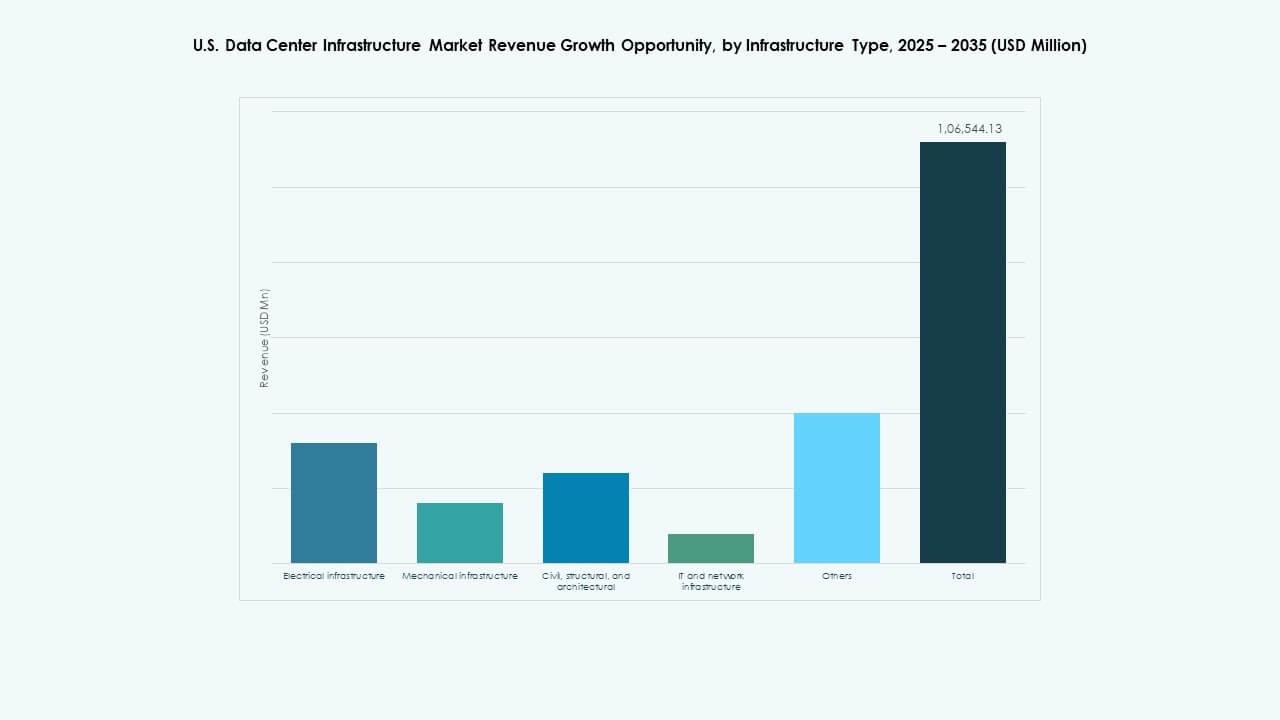

By Infrastructure Type

Electrical infrastructure dominates the U.S. Data Center Infrastructure Market due to its critical role in uptime reliability. Facilities depend on efficient power distribution and redundancy systems. Mechanical systems, including cooling units, follow closely to maintain operational stability. Civil and architectural designs evolve to meet modular construction needs. IT and networking infrastructure drive performance optimization for AI workloads. Each type contributes uniquely to building efficient, scalable, and resilient environments.

By Electrical Infrastructure

Uninterruptible Power Supply (UPS) systems hold a leading share in the market. The U.S. Data Center Infrastructure Market favors UPS solutions ensuring continuous operations during outages. Battery energy storage systems (BESS) grow rapidly due to renewable integration. PDUs and switchgears maintain balanced power flow across components. Utility grid connections improve through smart monitoring. Transfer switches ensure seamless transitions during power disruptions. Electrical systems anchor operational reliability and long-term sustainability.

By Mechanical Infrastructure

Cooling units such as CRAC and CRAH systems dominate mechanical infrastructure. The U.S. Data Center Infrastructure Market depends on efficient temperature management for optimal performance. Air and water-cooled chillers expand alongside containment designs. Pumps and piping support high-density cooling circuits. Operators deploy hybrid cooling for AI and HPC loads. Modular systems simplify maintenance. Mechanical designs now emphasize sustainability and resource efficiency.

By Civil / Structural & Architectural

Superstructure and building envelope systems lead in investment share. The U.S. Data Center Infrastructure Market emphasizes resilient construction for durability. Modular and prefabricated systems accelerate project delivery. Foundations and raised floors enable scalable layouts. Architectural envelopes enhance thermal insulation. Site preparation follows strict geotechnical and seismic compliance standards. Advanced designs enhance physical security and operational efficiency.

By IT & Network Infrastructure

Servers and networking equipment dominate spending within this segment. The U.S. Data Center Infrastructure Market relies on high-speed data handling and secure connectivity. Storage expansion supports AI, cloud, and analytics platforms. Cabling and optical fibers ensure reliable communication links. Racks and enclosures improve hardware organization and airflow. IT systems evolve toward hyper-converged and software-defined models.

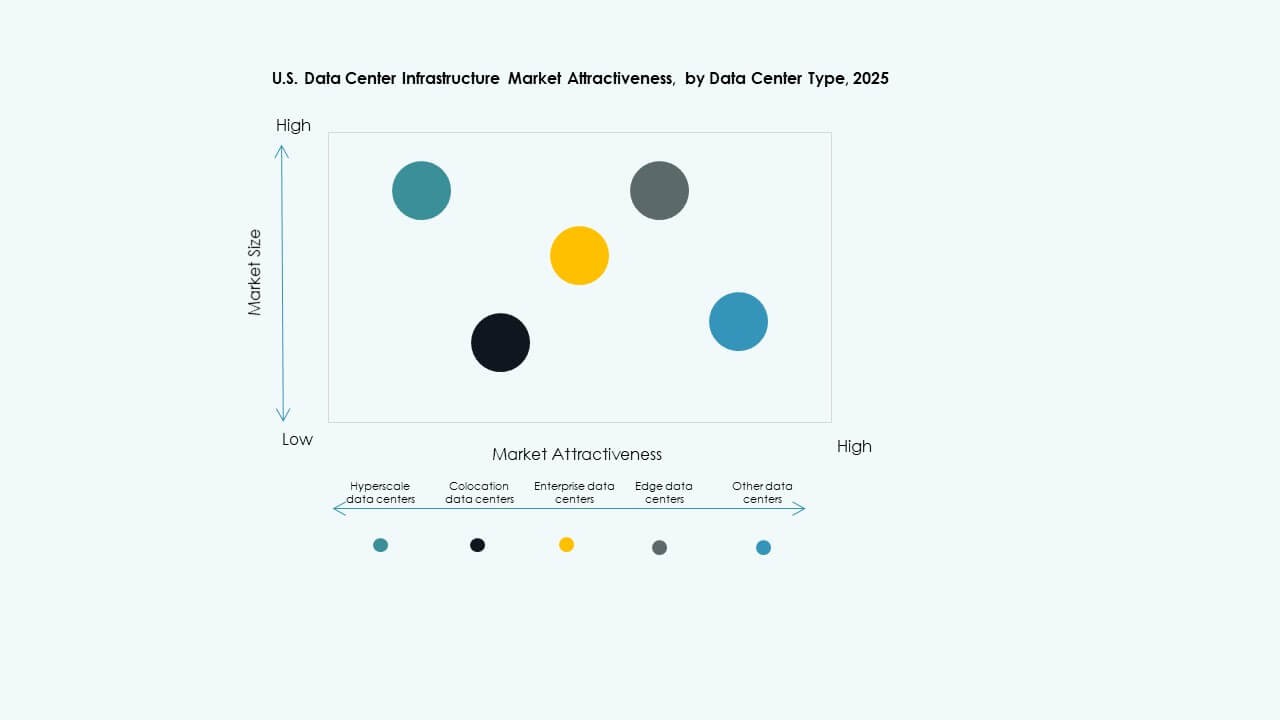

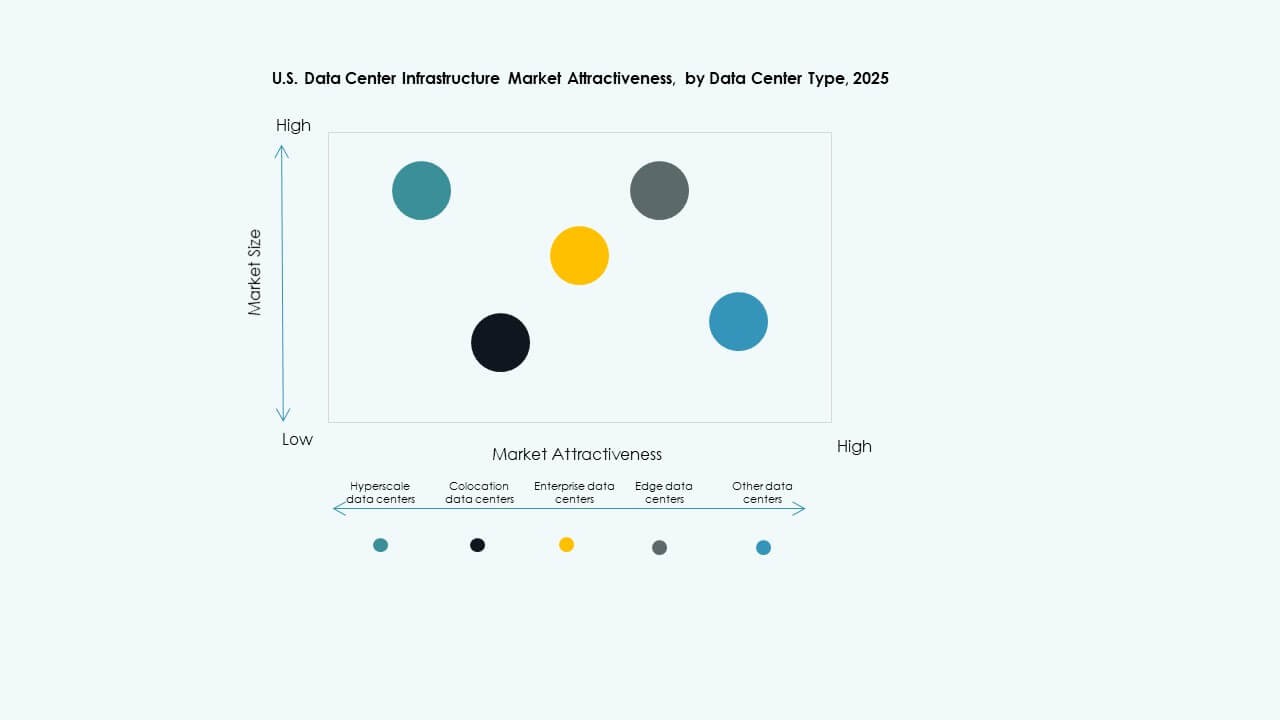

By Data Center Type

Hyperscale data centers lead market deployment due to cloud demand. The U.S. Data Center Infrastructure Market expands through enterprise and colocation models. Edge centers rise to meet regional traffic needs. Hybrid architectures gain traction for flexibility. Enterprise builds remain vital for regulated industries. Investments diversify across types to meet workload variety.

By Delivery Model

Design-build or EPC approaches dominate due to project complexity. The U.S. Data Center Infrastructure Market benefits from turnkey and modular factory-built models. Construction management supports multi-phase expansion. Retrofit projects modernize legacy centers. Modular solutions deliver faster deployments at lower costs.

By Tier Type

Tier 3 data centers hold the largest market share, offering a balance between cost and reliability. The U.S. Data Center Infrastructure Market shows rising Tier 4 investments for mission-critical use. Tier 1 and Tier 2 serve regional and smaller workloads. Higher-tier facilities ensure redundancy and maximum uptime. Operators favor scalable and certified tier architectures.

Regional Insights

Northeast Region – Established Hubs with 45% Market Share

The Northeast leads the U.S. Data Center Infrastructure Market with dense deployments in Virginia, New York, and New Jersey. Strong fiber connectivity and proximity to financial and government institutions drive dominance. Energy availability and advanced power infrastructure support continued investment. Northern Virginia remains the largest concentration of hyperscale facilities. The region benefits from robust real estate and cloud ecosystem maturity. Developers expand capacity to meet enterprise digital transformation goals.

- For example, Northern Virginia had about 1,100 MW of data center capacity under construction and nearly 5,500 MW in the development pipeline by mid-2025, with total operational capacity surpassing 4,900 MW, according to JLL.

Midwest Region – Emerging Growth Centers with 30% Market Share

The Midwest strengthens its role through investments in Ohio, Illinois, and Michigan. The U.S. Data Center Infrastructure Market in this area grows through land affordability and renewable access. Operators prefer these zones for scalable expansion. Proximity to central connectivity routes ensures efficient latency control. State incentives for sustainable builds attract hyperscalers. New construction in suburban hubs supports balanced national distribution. Infrastructure growth supports edge deployment and redundancy networks.

- For instance, Google launched a $1.2 billion data center expansion in the Midwest in late 2025, targeting scalable campuses in areas like Columbus, Ohio, to enhance interconnection capacity.

Western and Southern Regions – Expanding Corridors with 25% Market Share

The western and southern states experience significant expansion led by Texas, Arizona, and California. The U.S. Data Center Infrastructure Market in these zones benefits from favorable climates for free-air cooling. Solar availability supports renewable-based campuses. Texas and Arizona attract investors with lower utility costs and tax benefits. California remains key for innovation-focused enterprises. Expanding urban corridors strengthen long-term market presence. These regions emerge as new focal points for infrastructure diversification.

Competitive Insights:

Competitive Insights:

- ABB Ltd.

- Cisco Systems, Inc.

- Dell Inc.

- Equinix, Inc.

- Hewlett Packard Enterprise Development LP

- Schneider Electric SE

- Vertiv Group Corp.

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Oracle Corporation

The U.S. Data Center Infrastructure Market features strong competition among global technology leaders and specialized infrastructure providers. It emphasizes innovation across energy management, IT hardware, and modular construction. Companies strengthen portfolios through strategic acquisitions and sustainable product lines. Schneider Electric and Vertiv lead in power and cooling systems, while Cisco and Dell dominate network and compute infrastructure. Equinix and HPE expand through colocation and edge deployments. Vendors focus on automation, liquid cooling, and hybrid architectures to capture enterprise demand. Partnerships with hyperscalers and utilities enhance market reach. Competitors target higher efficiency, faster deployment, and lower total cost of ownership to secure long-term contracts.

Recent Developments:

- In November 2025, Kaufman Development and Daniel Kaufman Ventures announced a strategic expansion into data centers and AI infrastructure across the United States, underscoring continued growth and investment in the data center market driven by AI demands.

- In October 2025, BlackRock Inc.’s Global Infrastructure Partners led a $40 billion acquisition of Aligned Data Centers, marking the largest deal in the data center sector. The acquisition includes backing from partners such as Microsoft Corp. and Nvidia Corporation, signaling strong investment interest in AI-driven data center infrastructure.

- In May 2025, Seagate announced the sampling of its latest data storage platform, Mozaic 4, as part of innovations supporting data center infrastructure in the US and Ireland, reflecting ongoing product development aligned with evolving data demands.

- In March 2025, the US real estate company Related Companies launched a new data center development unit called Related Digital, with plans to develop gigawatts of capacity across the US and Canada, aiming to serve AI and cloud hyperscale companies with a near-term $45 billion development pipeline totaling 5GW.

- In January 2025, EDGNEX Data Centers by DAMAC announced a $20 billion US expansion project aiming to add 2,000MW of data center capacity, with the investment expected to potentially quadruple depending on demand. This expansion supports hyperscale data center infrastructure growth in the Sunbelt and Midwest regions amid rising AI adoption.

Market Drivers

Market Drivers Market Trends

Market Trends Market Opportunities

Market Opportunities Competitive Insights:

Competitive Insights: