Executive summary:

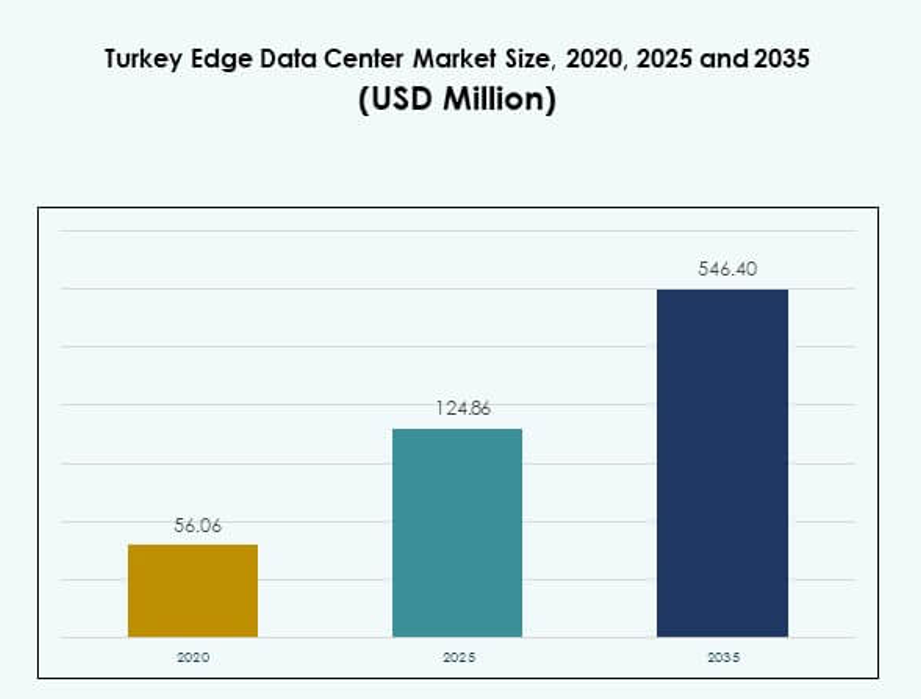

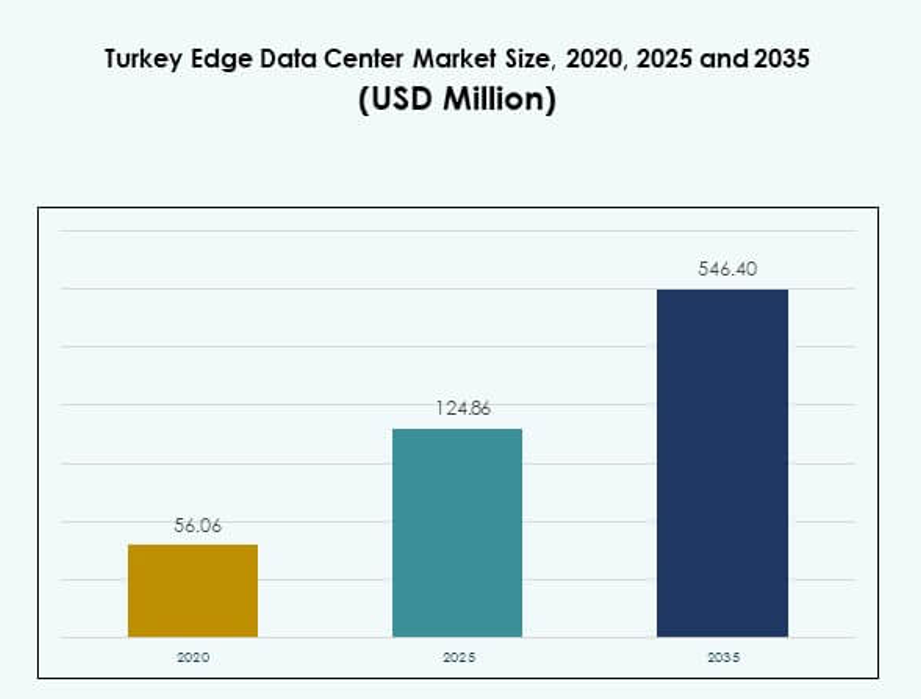

The Turkey Edge Data Center Market size was valued at USD 56.06 million in 2020 to USD 124.86 million in 2025 and is anticipated to reach USD 546.40 million by 2035, at a CAGR of 15.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Turkey Edge Data Center Market Size 2025 |

USD 124.86 Million |

| Turkey Edge Data Center Market, CAGR |

15.76% |

| Turkey Edge Data Center Market Size 2035 |

USD 546.40 Million |

Rising digital transformation, rapid 5G adoption, and modular infrastructure deployment are driving strong growth. Enterprises integrate edge solutions to support low-latency applications and real-time processing. Telecom operators, cloud providers, and hyperscalers invest in scalable edge networks to enhance performance and connectivity. These advancements position the Turkey Edge Data Center Market as a strategic enabler for AI innovation, smart cities, and critical industries, creating significant opportunities for investors and technology providers.

Urban hubs such as Istanbul and Ankara lead the market due to strong connectivity and high enterprise demand. Emerging regions like Izmir and Bursa are expanding their infrastructure capacity through strategic investments. Their geographic position between Europe and Asia makes them vital digital gateways. This balanced development strengthens national coverage, enhances network resilience, and creates new entry points for international collaborations and infrastructure projects.

Market Drivers

Accelerated Digital Transformation Fueling Demand for Edge Infrastructure

Turkey Edge Data Center Market is expanding rapidly with rising digital transformation across industries. Telecom operators, hyperscalers, and enterprises are deploying edge nodes to meet low-latency demands. It supports industrial automation, AI-driven processes, and connected devices. Enterprises rely on edge facilities to manage real-time applications and critical workloads. This strategic infrastructure improves operational resilience and network reliability. Government support and private investment further drive technology deployment. Digitalization across retail, healthcare, and manufacturing strengthens adoption. The strong connectivity ecosystem enhances business competitiveness and attracts foreign investors.

- For instance, Khazna Data Centers announced in April 2025 a planned AI-ready edge data center in Ankara with a potential capacity of 100 MW, designed to support hyperscale customers and next-generation AI applications, making it one of Turkey’s most ambitious digital infrastructure projects.

Expanding 5G Rollouts Strengthening Edge Network Capabilities

The rapid expansion of 5G networks accelerates edge infrastructure deployment. It creates stronger demand for localized processing power and bandwidth optimization. Telecom operators leverage distributed nodes to reduce network congestion and support real-time data processing. Edge centers enable enterprises to improve speed and reliability in connected services. This infrastructure is vital for autonomous systems, IoT devices, and immersive applications. Enterprises integrate edge computing to meet high-performance needs. It helps industries achieve faster innovation cycles and improved customer experience. Strong 5G integration supports regional leadership in advanced digital services.

- For instance, Vodafone Türkiye and Nokia Bell Labs conducted a live deployment of L4S (Low Latency, Low Loss, Scalable Throughput) technology over Vodafone’s fibre-to-the-home network in Istanbul, slashing latency from 220 ms to 4.7 ms—achieving a 94% reduction in delay for cloud gaming and video conferencing applications.

Enterprise Shift Toward Hybrid and Modular Data Center Architectures

Enterprises prefer modular edge solutions that deliver flexibility, scalability, and energy efficiency. It allows quick deployment and cost-effective expansion of digital capacity. Modular designs enable rapid response to changing data demands. Hybrid setups combine cloud and on-premises systems to optimize performance. These solutions help businesses control data while maintaining global connectivity. Hybrid architectures also reduce downtime risks and improve service delivery. Enterprises invest in modular designs to future-proof digital infrastructure. These shifts build strong foundations for sustained innovation and market expansion.

Government and Private Investment Driving Infrastructure Modernization

National initiatives and strategic foreign investments strengthen digital infrastructure development. Government programs encourage local and international players to deploy advanced data centers. Incentives and simplified regulations support high-capacity edge facilities. It creates a competitive environment that attracts hyperscalers and enterprises. Public-private partnerships boost energy-efficient and secure infrastructure deployment. These investments enhance connectivity and support economic diversification. Local developers collaborate with global technology providers to improve capabilities. Strong infrastructure spending accelerates modernization and supports business expansion strategies.

Market Trends

Rising Adoption of AI-Powered Edge Platforms for Real-Time Processing

AI-driven workloads push the demand for efficient edge processing. Enterprises deploy intelligent infrastructure to analyze data closer to users. It reduces latency and improves decision-making speed. AI integration also enables predictive maintenance and workload optimization. Edge platforms support advanced use cases such as computer vision and autonomous operations. This trend aligns with Industry 4.0 strategies across multiple sectors. Businesses see competitive advantages in lower costs and higher efficiency. Strong AI integration continues to shape market evolution and technology priorities.

Sustainable Infrastructure Development Becoming a Strategic Priority

Sustainability goals drive investments in green edge facilities. Operators deploy energy-efficient cooling systems and renewable power integration. It lowers operational costs and aligns with ESG compliance requirements. Green certifications and advanced designs increase the value of data center assets. Companies prioritize energy optimization to meet environmental regulations. These initiatives also enhance brand reputation and investor confidence. The shift toward sustainable infrastructure accelerates the transition to climate-resilient operations. Strong environmental strategies position the market for long-term stability and investment growth.

Deployment of Liquid Cooling Solutions Enhancing Performance Efficiency

The growing power density in data centers drives the need for advanced cooling solutions. Liquid cooling technologies provide efficient heat management in compact spaces. It supports higher processing loads without raising energy consumption. These systems enable stable operations and lower failure risks. Operators adopt direct-to-chip and immersion cooling methods to enhance performance. The technology ensures minimal downtime during peak workloads. Enterprises view liquid cooling as a critical enabler of future-ready facilities. The trend improves cost efficiency and operational reliability.

Integration of Edge Facilities with Smart City and IoT Initiatives

Smart city programs accelerate edge data center deployment across urban hubs. Cities integrate localized infrastructure to support traffic systems, surveillance, and public services. It enables real-time data collection and intelligent decision-making. Edge facilities provide low-latency support for autonomous mobility and IoT ecosystems. Municipal agencies and private developers collaborate on scalable deployments. These projects create new revenue streams and strengthen digital infrastructure. The integration of smart city initiatives drives consistent edge expansion. Urban infrastructure growth reinforces the strategic position of edge networks.

Market Challenges

High Capital Costs and Limited Skilled Workforce Hindering Expansion

Turkey Edge Data Center Market faces significant barriers due to high capital investments. Building and maintaining edge infrastructure requires large upfront costs. Many mid-sized enterprises struggle to allocate sufficient budgets. It creates dependency on foreign investors and delays local developments. The shortage of skilled professionals further slows project execution. Operational complexity increases when integrating advanced edge technologies. Training and retention challenges impact service quality. Limited technical capacity weakens regional competitiveness in high-tech deployments. These factors slow large-scale infrastructure rollout.

Energy Consumption, Infrastructure Resilience, and Regulatory Pressures

Power consumption remains a critical issue in scaling edge facilities. High energy usage raises operational costs and impacts sustainability goals. It forces operators to adopt advanced energy management solutions. Regulatory requirements on security, data privacy, and energy efficiency create additional pressure. It increases compliance costs and slows deployment timelines. Unstable power grids in some areas affect operational reliability. Cybersecurity threats also add complexity to infrastructure management. These combined challenges make market scaling more demanding and resource-intensive.

Market Opportunities

Strategic Investments Driving Regional Edge Network Expansion

Strong investment inflows create opportunities for infrastructure developers. Enterprises and governments focus on scaling edge nodes across multiple urban hubs. It strengthens cloud-native services and localized data processing. Hyperscalers partner with local providers to expand deployment capacity. Market players benefit from early positioning in strategic corridors. The investment ecosystem supports faster innovation cycles. This growth enables new service models for businesses and consumers.

Growing Digital Ecosystem Unlocking New Service Innovation

The expanding digital economy creates strong opportunities for ecosystem development. It boosts demand for AI, IoT, and edge-enabled services. Enterprises integrate automation to offer industry-specific solutions. Technology providers develop tailored architectures for different use cases. Growth in connected industries strengthens infrastructure needs. This creates room for new revenue streams and market entrants. Strong ecosystem collaborations drive sustained innovation and market expansion.

Market Segmentation

By Component

Solution dominates the Turkey Edge Data Center Market with a strong share driven by hardware and software integration. It includes power systems, racks, and management tools that improve efficiency. Service components grow steadily due to rising demand for managed and maintenance solutions. Enterprises rely on robust solutions to ensure low-latency performance. Integrated platforms enhance control, visibility, and uptime. Service providers offer advanced support models to maintain reliability. Solution providers continue to invest in scalable and modular technologies.

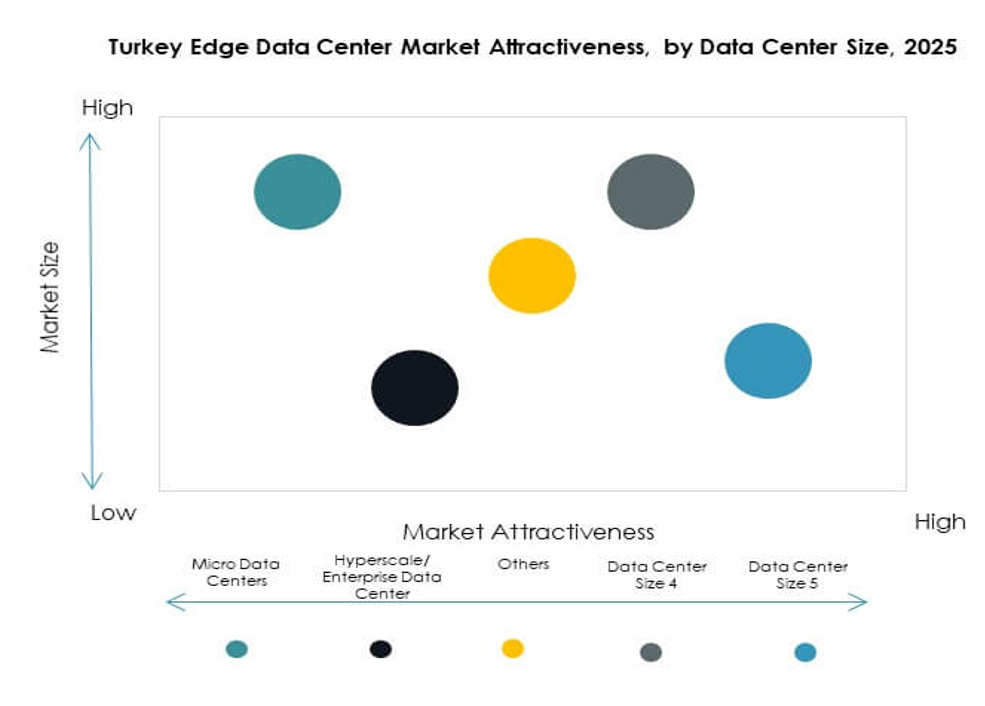

By Data Center Type

Colocation Edge Data Center leads the segment with a strong share, supported by enterprise and telecom adoption. It offers flexible capacity and faster deployment for critical workloads. Managed and cloud-edge centers follow closely due to growing cloud adoption. Enterprise data centers remain important for regulatory and security needs. It strengthens hybrid infrastructure strategies. Modular and distributed setups increase market competitiveness. Growth in colocation reflects rising demand for scalable and cost-efficient solutions.

By Deployment Model

Hybrid deployment dominates the market due to its flexibility and security advantages. It allows enterprises to balance on-premises control with cloud scalability. On-premises setups remain critical for sectors with strict data regulations. Cloud-based models gain momentum with hyperscaler partnerships. Hybrid systems provide optimized performance for latency-sensitive applications. It supports business continuity and cost optimization. Enterprises prefer hybrid setups to align with evolving IT strategies.

By Enterprise Size

Large enterprises hold a dominant share due to their higher IT budgets and infrastructure investments. These organizations deploy advanced edge nodes to support global operations. SMEs increase adoption due to affordable colocation and cloud services. It creates a balanced ecosystem across different business scales. Large enterprises lead in hybrid deployments, enabling stronger operational agility. SMEs contribute to distributed deployment growth in regional markets. This segmentation supports broad-based market expansion.

By Application / Use Case

Power Monitoring leads this segment due to its critical role in operational reliability. Enterprises use advanced monitoring systems to manage uptime and efficiency. Capacity and environmental monitoring also show steady adoption rates. It enables real-time visibility into infrastructure performance. BI and analysis drive value-added services for data-driven decisions. These applications improve resource utilization and cost control. Monitoring and analytics remain key growth drivers in edge infrastructure management.

By End User Industry

IT and Telecommunications hold the largest share due to continuous data traffic growth. BFSI and healthcare sectors adopt edge to secure and accelerate critical operations. Retail and e-commerce benefit from low-latency services for customer engagement. Aerospace & defense and energy & utilities adopt edge for mission-critical applications. It ensures reliable operations and compliance. Industry-wide adoption strengthens infrastructure resilience and market reach.

Regional Insights

Urban Industrial Hubs Driving Majority Market Share

Urban regions including Istanbul and Ankara dominate Turkey Edge Data Center Market with 54% share. These hubs host major telecom operators, hyperscalers, and enterprise customers. Strong fiber connectivity and cloud infrastructure make them ideal for edge deployments. High population density drives demand for real-time applications. Businesses invest heavily in these regions to strengthen competitive positions. Strategic investments support ongoing capacity expansion and innovation.

- For instance, Turkcell announced plans to expand its data center capacity by 8.4 MW by the end of 2025 through new infrastructure investments, strengthening support for low-latency digital services and strategic enterprise applications.

Emerging Secondary Cities Strengthening Regional Edge Ecosystem

Izmir, Bursa, and Antalya account for 28% of the market share. These cities benefit from rising digitalization in retail, logistics, and manufacturing. Regional governments promote smart city programs and connectivity upgrades. It encourages enterprises to build localized data processing facilities. Lower costs and strong talent pools support market expansion. These regions create balanced distribution of infrastructure development.

- For instance, Vodafone Turkey partnered with DAMAC’s Edgnex Data Centres in February 2024 to launch a Tier III edge data center in Izmir, designed to enhance digital services and support growing enterprise connectivity across the region.

Strategic Border Regions Enhancing Connectivity and International Reach

Border and special economic regions hold 18% of the market share. Their location supports international data exchange between Europe and Asia. These areas benefit from investment partnerships with global operators. Strategic corridors improve redundancy and latency management. These regions attract hyperscaler deployments focused on cross-border data flow. Their growth strengthens Turkey’s position as a digital gateway. This diversification supports nationwide infrastructure resilience.

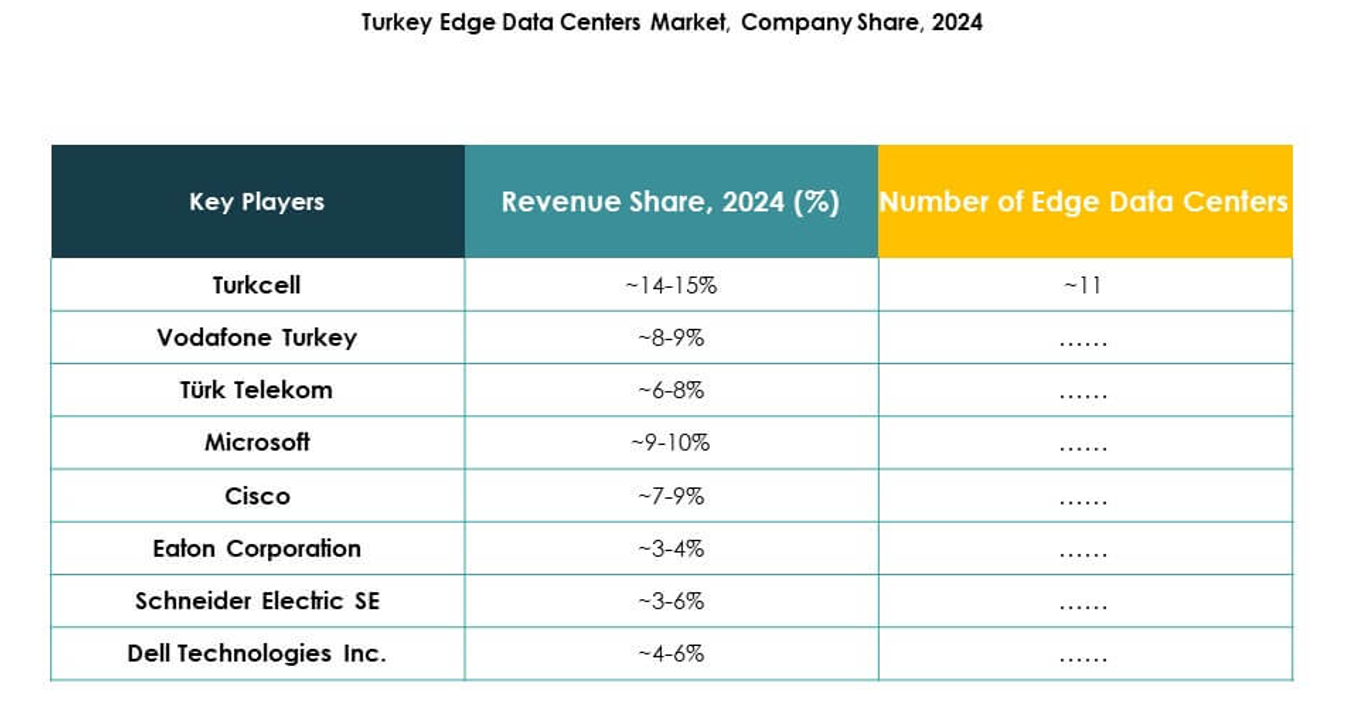

Competitive Insights:

- Turkcell

- Vodafone Turkey

- Türk Telekom

- MedNautilus

- EdgeConneX

- Eaton Corporation

- Dell Technologies Inc.

- Fujitsu

- Cisco

- SixSq

- Microsoft

- VMWare

- Schneider Electric SE

- Rittal GmbH & Co. KG

- Others

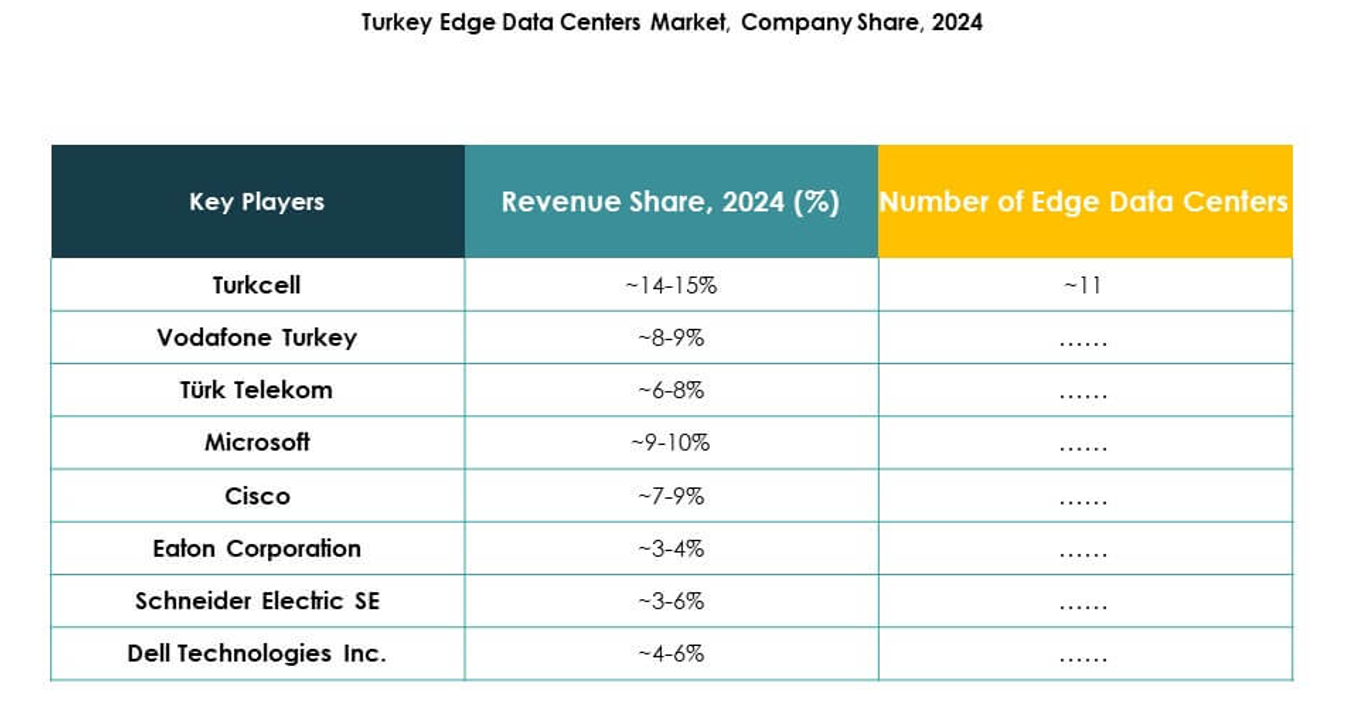

The Turkey Edge Data Center Market features strong competition between telecom operators, global technology providers, and infrastructure solution vendors. It benefits from a mix of local leaders like Turkcell, Vodafone Turkey, and Türk Telekom, which expand domestic infrastructure with low-latency networks. Global players such as Schneider Electric SE, Dell Technologies, Microsoft, and Cisco focus on energy efficiency, hybrid architectures, and AI integration. EdgeConneX and SixSq drive expansion through scalable colocation and edge services. Eaton and Rittal strengthen the ecosystem with advanced power and cooling solutions. Competitive strategies center on partnerships, modular deployments, and software-defined infrastructure. Strong investments and strategic collaborations shape market direction and innovation leadership.

Recent Developments:

- In May 2025, Turkcell secured €100 million ($112.5 million) in murabaha financing through a strategic agreement with Emirates NBD Bank, aiming to accelerate its data center investments and digital infrastructure initiatives via its TDC subsidiary. This move is expected to drive the expansion of Turkcell’s data center footprint by an additional 8.4MW by the end of 2025 and foster future strategic partnerships within the Turkey edge data center sector.

- In March 2025, Türk Telekom strengthened its data center strategy by partnering with Cisco to integrate the Cisco Mobility Services Platform into its edge facilities, supporting advanced cloud-based 5G applications. The partnership aligns with Türk Telekom’s focus on 5G innovation, smart cities, and domestic technology development for critical infrastructure and defense sectors.

- In February 2024, Vodafone Turkey initiated a partnership with Edgnex Data Centres by Damac, resulting in the formation of a joint venture to invest $100 million in a new edge data center in Izmir. This facility, built to Tier III standards and operational in Q1 2025, will initially offer 6MW of capacity, expandable to 12MW, positioning Vodafone to support both local and international digital transformation demands in western Turkey.