Executive summary:

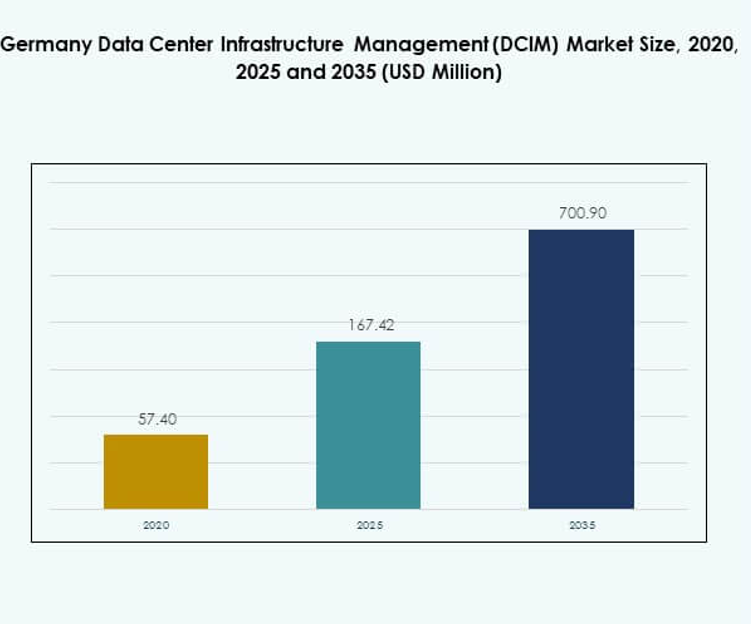

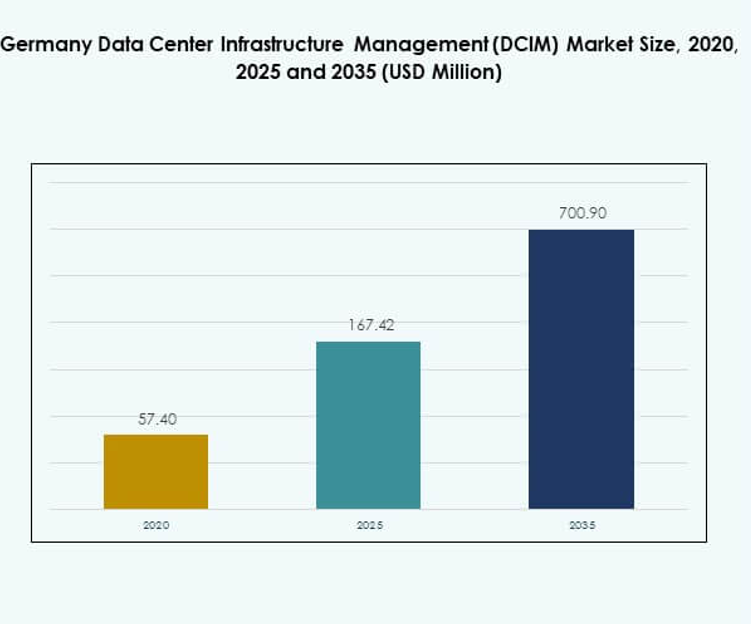

The Germany Data Center Infrastructure Management (DCIM) Market size was valued at USD 57.40 million in 2020 to USD 167.42 million in 2025 and is anticipated to reach USD 700.90 million by 2035, at a CAGR of 17.17% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Germany Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 167.42 Million |

| Germany Data Center Infrastructure Management (DCIM) Market, CAGR |

17.17% |

| Germany Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 700.90 Million |

Market growth is driven by rapid adoption of digital technologies, AI-powered monitoring, and cloud-native infrastructure solutions. Innovation in automation, predictive analytics, and sustainability-focused tools strengthens operational efficiency and reduces downtime. Enterprises adopt DCIM platforms to manage hybrid and multi-cloud environments while ensuring compliance with energy and security regulations. For businesses and investors, the market provides strategic value by supporting scalability, resilience, and data-driven decision-making across critical infrastructure.

Regionally, Western Germany leads adoption with its strong IT hubs, financial centers, and connectivity infrastructure. Southern Germany expands growth through advanced manufacturing and Industry 4.0 initiatives. Northern and Eastern regions are emerging with rising investments in colocation and edge facilities to improve latency and support digital trade. This geographic spread ensures balanced market development, with Germany positioned as a central hub for data-driven infrastructure in Europe.

Market Drivers

Rising Demand for Intelligent Infrastructure Management Through Technology Adoption

The Germany Data Center Infrastructure Management (DCIM) Market is witnessing strong growth from enterprises modernizing digital operations. Organizations deploy DCIM platforms to improve energy efficiency, streamline asset tracking, and reduce downtime. Increased adoption of AI-driven monitoring tools and IoT-enabled sensors enhances performance visibility. Businesses gain actionable insights for proactive decision-making through predictive analytics. The integration of automation supports sustainable operations and compliance with energy mandates. Industry demand reflects a shift toward resilient infrastructure and smarter resource use. Investors view this adoption cycle as a critical growth enabler. It strengthens competitiveness in a technology-driven economy.

- For instance, Equinix Germany’s Frankfurt FR6 site implemented Etalytics’ AI-based cooling optimization, achieving a 9% efficiency gain, cutting 900 MWh of cooling energy annually, and bringing PUE close to 1.2.

Innovation in Cloud and Hybrid Data Center Environments Creating Strategic Value

Innovation within hybrid and cloud environments drives investment in DCIM platforms. Enterprises combine on-premises assets with scalable cloud resources for optimized workloads. This model creates demand for unified monitoring and control solutions. It allows seamless integration of multiple data environments and helps achieve operational consistency. Companies deploy real-time analytics to support workload allocation and uptime requirements. The trend expands opportunities for providers focusing on hybrid optimization. Strategic adoption improves operational reliability while reducing operational overheads. It positions DCIM as a vital enabler of flexible, secure, and future-ready IT ecosystems.

Shift Toward Sustainability and Energy Optimization Transforming Data Center Operations

Sustainability drives new adoption strategies across the Germany Data Center Infrastructure Management (DCIM) Market. Rising energy costs and carbon reduction targets increase pressure on operators. DCIM platforms provide accurate data for power usage effectiveness and energy audits. Firms implement advanced cooling technologies to reduce environmental impact. Real-time monitoring ensures efficient power distribution and optimal resource use. These capabilities support corporate sustainability commitments and government regulations. Businesses gain both operational savings and stronger reputational value. It reflects a broader industry move toward greener and cost-efficient infrastructure management practices.

- For instance, Equinix Germany’s Frankfurt FR6 data center deployed Etalytics’ AI-based cooling optimization software, improving energy efficiency by 9% and cutting cooling energy use by 900 MWh annually, with PUE nearing 1.2. The solution later expanded across multiple Frankfurt sites after winning the DENA Energy Efficiency Award for digitalization and sustainability.

Strategic Importance of DCIM Platforms for Long-Term Competitiveness and Growth

DCIM solutions are increasingly viewed as strategic investments for enterprises and investors. They provide essential visibility into complex IT infrastructure environments. By enabling predictive maintenance, companies reduce disruptions and extend asset lifecycles. Investors recognize its role in protecting data center value and driving ROI. The ability to align IT and business operations enhances decision-making efficiency. Market growth is supported by integration with ERP and other enterprise systems. Organizations benefit from agility and rapid response to digital demands. It highlights DCIM’s strategic importance as a foundation for scalable digital transformation.

Market Trends

Expansion of Edge Computing Driving New Demand for Integrated DCIM Platforms

The Germany Data Center Infrastructure Management (DCIM) Market is shaped by rapid edge computing expansion. Enterprises build smaller, distributed facilities to reduce latency and support IoT applications. Edge sites require unified management tools for monitoring energy, security, and workload performance. DCIM vendors provide modular platforms tailored for edge deployments. Strong demand for real-time control creates opportunities for flexible and lightweight solutions. Operators focus on reducing response times through automated infrastructure visibility. The shift toward edge adoption strengthens regional connectivity ecosystems. It accelerates investments in localized digital infrastructure and operational resilience.

Adoption of Artificial Intelligence and Machine Learning for Predictive Operations

Artificial intelligence plays an expanding role in optimizing data center performance. AI-driven DCIM tools forecast power usage, detect anomalies, and automate responses. These capabilities improve asset utilization and reduce human error. Enterprises adopt ML-enabled analytics for predictive maintenance strategies. It enhances uptime and lowers operational risks across critical infrastructure. Intelligent software solutions drive greater efficiency in resource allocation. Growing demand for AI monitoring reflects the shift toward autonomous infrastructure management. The Germany Data Center Infrastructure Management (DCIM) Market benefits from this trend by embedding intelligence into routine operations.

Growing Importance of Security Integration with Infrastructure Management Platforms

Security concerns push operators to integrate DCIM platforms with cybersecurity frameworks. Enterprises prioritize unified visibility across physical and digital infrastructure. Monitoring unauthorized access, power anomalies, and environmental fluctuations becomes a priority. Solutions integrate with SIEM systems to strengthen overall security resilience. This creates opportunities for vendors delivering end-to-end monitoring with advanced security analytics. The trend highlights growing alignment between operational technology and IT security teams. Firms adopt these measures to meet compliance and reduce downtime risks. It ensures DCIM plays a central role in secure digital infrastructure strategies.

Focus on Modular and Scalable Platforms Supporting Business Continuity Goals

Modularity is emerging as a key trend in DCIM deployments. Enterprises demand scalable platforms capable of adapting to dynamic digital requirements. Vendors design flexible modules for power, cooling, and workload monitoring. It enables businesses to add capabilities without system overhauls. This trend supports both SMEs and large enterprises with different scale requirements. Operators deploy scalable platforms to support expansion into hybrid and edge environments. It strengthens continuity planning and reduces cost of ownership. The Germany Data Center Infrastructure Management (DCIM) Market benefits from modular solutions that align with future growth needs.

Market Challenges

High Implementation Costs and Integration Complexity Impacting Adoption Rates

The Germany Data Center Infrastructure Management (DCIM) Market faces challenges linked to high upfront investments. Enterprises encounter significant costs in deploying comprehensive platforms and training staff. Integration with legacy systems and multi-vendor environments creates complexity. Many businesses struggle to justify ROI within short-term cycles. Smaller firms find it difficult to allocate budgets for advanced solutions. The need for skilled personnel adds to operational expenses. It slows adoption among cost-sensitive enterprises despite long-term benefits. Addressing cost barriers remains critical to broadening market penetration.

Regulatory Pressure, Data Sovereignty, and Skills Shortages Creating Market Barriers

Regulations on energy use and data sovereignty increase compliance requirements. Enterprises must align DCIM solutions with regional data protection frameworks. This raises costs and extends deployment timelines. A shortage of skilled professionals complicates effective system operation. Organizations face difficulty recruiting specialists with expertise in hybrid IT and monitoring platforms. Cybersecurity requirements add another operational challenge. The Germany Data Center Infrastructure Management (DCIM) Market must adapt by improving ease of use and training support. It highlights the importance of balancing compliance, expertise, and scalability.

Market Opportunities

Emerging Role of Automation and AI-Driven Tools in Infrastructure Optimization

Automation presents major opportunities for the Germany Data Center Infrastructure Management (DCIM) Market. AI-enabled systems improve workload balancing, optimize cooling, and predict faults. Businesses can reduce costs while improving uptime. Cloud-native DCIM platforms expand opportunities for flexible deployments. These solutions support enterprises scaling into edge and hybrid ecosystems. Demand for intelligent automation creates room for innovation and partnerships. It allows providers to differentiate offerings with advanced capabilities. Businesses and investors see strong growth potential in automation-driven models.

Rising Demand for Cloud and Hybrid Platforms Strengthening Growth Prospects

The shift toward cloud and hybrid ecosystems fuels new opportunities for DCIM adoption. Enterprises require unified management to maintain visibility across complex infrastructures. Vendors offering cross-platform compatibility will gain significant traction. Cloud-based models support rapid scaling for SMEs and large enterprises. Hybrid deployments enhance flexibility for regulated industries. Growth prospects expand as firms prioritize continuity and security. The Germany Data Center Infrastructure Management (DCIM) Market benefits from cloud adoption to strengthen resilience. It creates long-term opportunities for providers delivering scalable and integrated solutions.

Market Segmentation

By Component

Solutions dominate the Germany Data Center Infrastructure Management (DCIM) Market, supported by demand for monitoring and automation tools. Companies prefer integrated software for asset, power, and environmental management. Services also gain momentum as enterprises seek consulting and managed offerings. Strong demand for predictive analytics strengthens the software-driven segment. Providers offering modular solutions achieve competitive advantage. Solutions hold the larger market share due to scalability. Service providers support enterprises with expertise and custom deployment. It ensures both segments maintain strong relevance in the market.

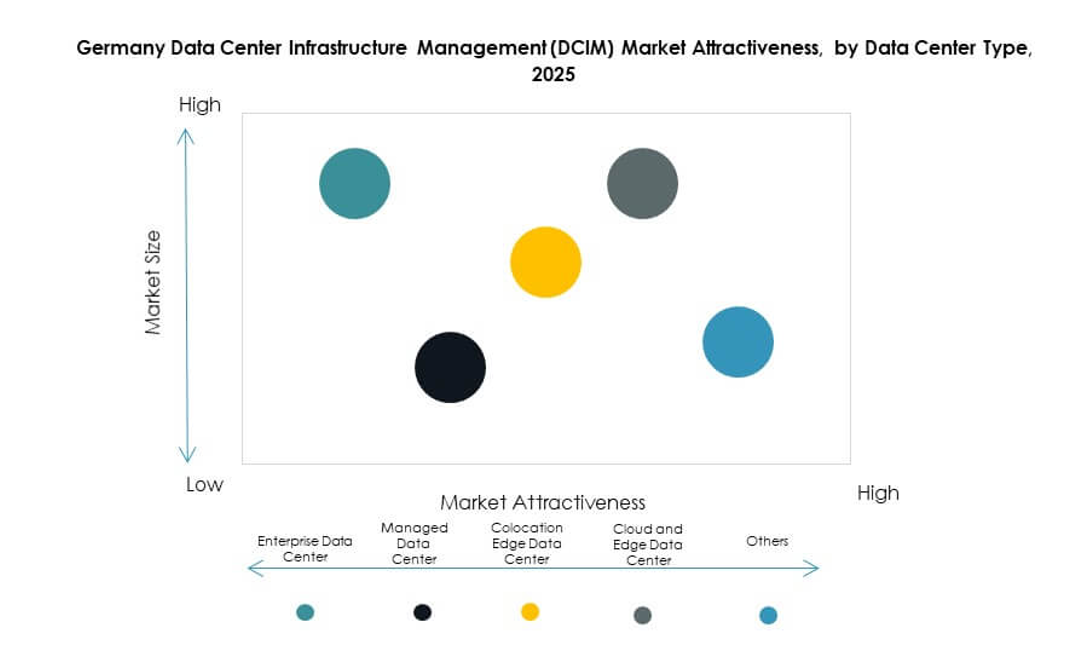

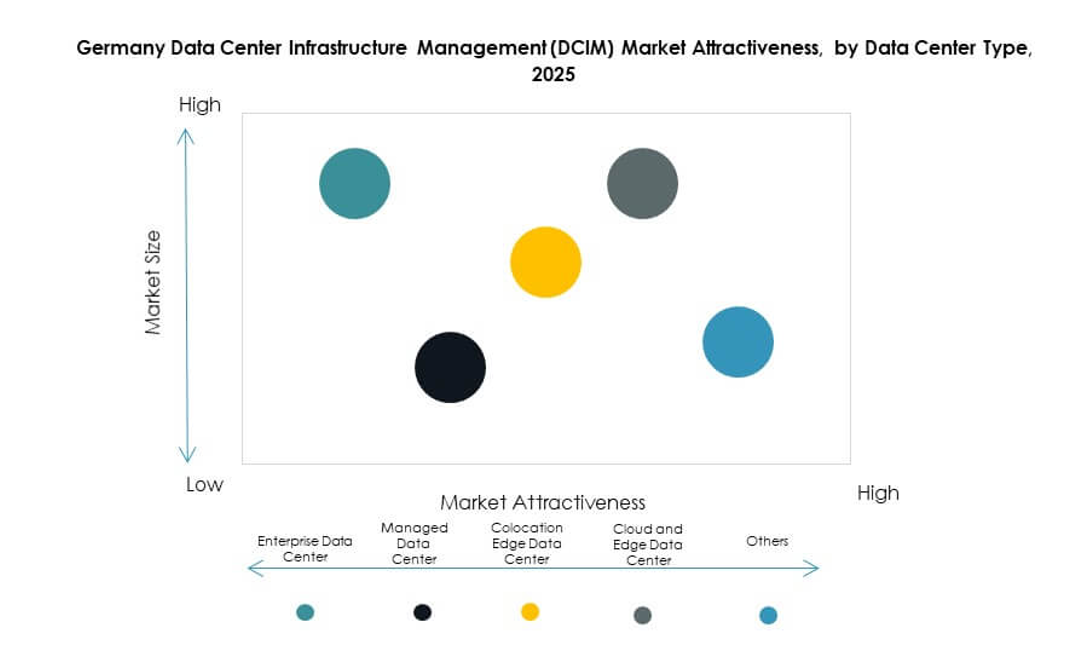

By Data Center Type

Enterprise data centers remain the leading segment due to established IT infrastructure and resource requirements. Managed data centers and cloud-based facilities show strong growth with rising outsourcing trends. Colocation and edge facilities gain traction as businesses adopt distributed architectures. Cloud and edge data centers enhance agility and scalability. The Germany Data Center Infrastructure Management (DCIM) Market highlights strong demand for colocation services supporting hybrid environments. Large enterprises prefer enterprise-owned infrastructure while SMEs drive colocation growth. Diverse facility models create balanced opportunities across all types.

By Deployment Model

Cloud-based DCIM platforms dominate adoption due to flexibility and rapid deployment. Enterprises favor cloud models for scalability and cost efficiency. On-premises solutions maintain relevance for highly regulated sectors requiring data control. Hybrid models show increasing adoption for combining control with flexibility. Vendors offering integration across deployment models achieve strong positioning. The Germany Data Center Infrastructure Management (DCIM) Market shows growing interest in cloud-native platforms. SMEs adopt cloud-first models while large enterprises balance hybrid strategies. Deployment flexibility strengthens overall adoption trends.

By Enterprise Size

Large enterprises account for the largest share of DCIM adoption due to complex infrastructure. These firms require advanced tools for predictive analytics and workload optimization. SMEs adopt DCIM platforms at a growing pace, leveraging cloud models. Cloud-based offerings make adoption accessible for smaller organizations. Vendors expand services to meet SME demands with cost-effective options. The Germany Data Center Infrastructure Management (DCIM) Market sees balanced growth across both enterprise categories. Large enterprises ensure stability while SMEs drive new adoption. It creates opportunities for providers serving diverse client scales.

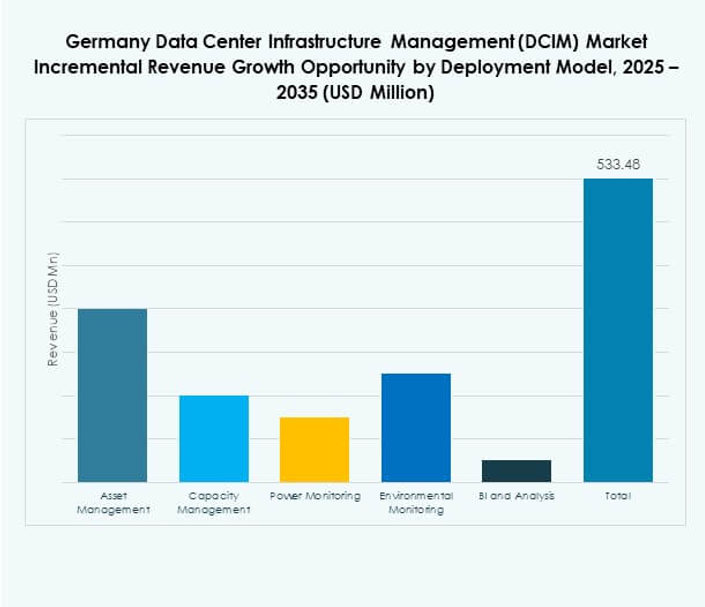

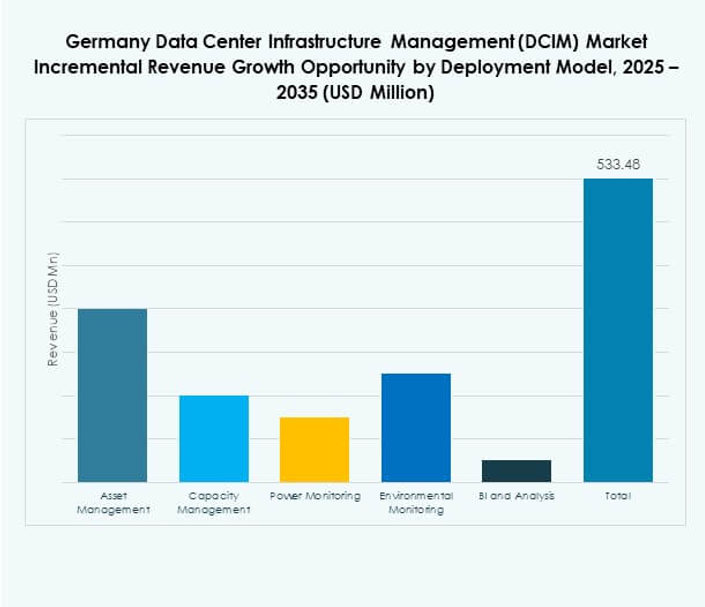

By Application / Use Case

Asset management and power monitoring dominate usage across enterprises. Capacity management and BI analytics gain traction with the need for predictive planning. Environmental monitoring supports sustainability goals and regulatory compliance. The Germany Data Center Infrastructure Management (DCIM) Market benefits from rising demand for advanced analytics. Use cases expand with integration into hybrid and multi-cloud strategies. Firms adopt capacity and asset management to optimize IT lifecycles. Broader adoption of BI enhances decision-making efficiency. Use case diversity ensures sustained market growth across all segments.

By End User Industry

IT and telecommunications dominate adoption, driven by high infrastructure demands. BFSI firms deploy DCIM platforms for compliance and security in mission-critical environments. Healthcare shows strong adoption trends with data-intensive operations. Retail and e-commerce expand demand for scalable and resilient infrastructure. Aerospace and defense prioritize high-security monitoring. Energy and utilities adopt DCIM to enhance efficiency and sustainability. The Germany Data Center Infrastructure Management (DCIM) Market shows diverse end-user growth. It reflects broad adoption across industries requiring reliable infrastructure control.

Regional Insights

Western Germany Leading Adoption with 42% Share of Market Revenues

Western Germany leads the Germany Data Center Infrastructure Management (DCIM) Market with a 42% share. Strong industrial base, financial hubs, and IT clusters strengthen adoption. Enterprises in cities like Frankfurt and Cologne prioritize advanced infrastructure monitoring. High colocation presence further drives demand for scalable solutions. Western Germany benefits from strategic connectivity with European data networks. It positions the region as the dominant hub for DCIM adoption.

- For instance, in November 2024, Equinix opened its FR13 data center at the Frankfurt North-East campus, designed to run on 100% renewable energy and built with energy-efficient cooling systems. The facility adopts optimized operating temperatures to improve power usage effectiveness (PUE) in line with Equinix’s climate neutrality goal for 2030.

Southern Germany Expanding Growth Through Manufacturing and Automotive Sectors with 33% Share

Southern Germany holds a 33% share, supported by leading manufacturing and automotive industries. Enterprises in Munich and Stuttgart adopt advanced monitoring platforms to support innovation. Strong digitalization projects in Industry 4.0 environments boost demand. Enterprises prioritize predictive analytics for uptime in production systems. Regional energy optimization initiatives further drive platform adoption. It makes Southern Germany a fast-growing area for DCIM investment.

Northern and Eastern Germany Emerging with 25% Market Share Through Cloud and Edge Growth

Northern and Eastern Germany collectively capture 25% of the market. Northern Germany strengthens adoption with port cities supporting logistics and digital trade. Eastern Germany invests in new colocation and edge facilities to reduce regional latency. Enterprises expand cloud infrastructure to meet growing digital workloads. Growth reflects increasing demand for localized and scalable infrastructure solutions. The Germany Data Center Infrastructure Management (DCIM) Market gains balanced growth across these regions. It ensures the market develops evenly with emerging hubs supporting national infrastructure resilience.

- For instance, in 2025, Deutsche Telekom and NVIDIA expanded edge cloud infrastructure projects in Hamburg and Leipzig to deliver low-latency cloud services. These initiatives apply next-generation AI and edge technologies to enhance enterprise application response times, supporting Deutsche Telekom’s goal of building Europe’s most advanced sovereign digital infrastructure.

Competitive Insights:

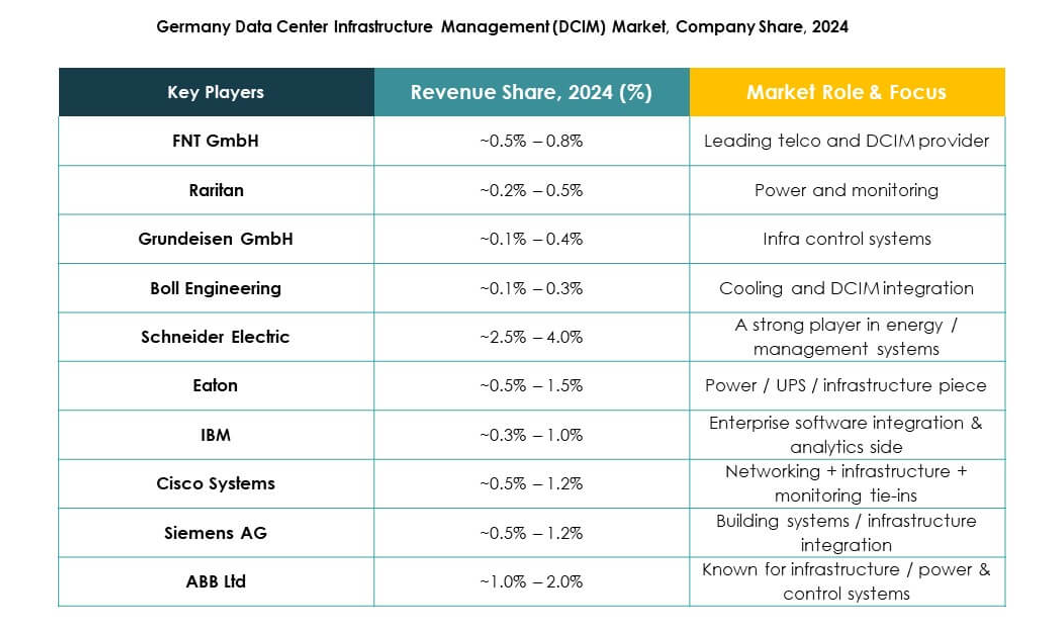

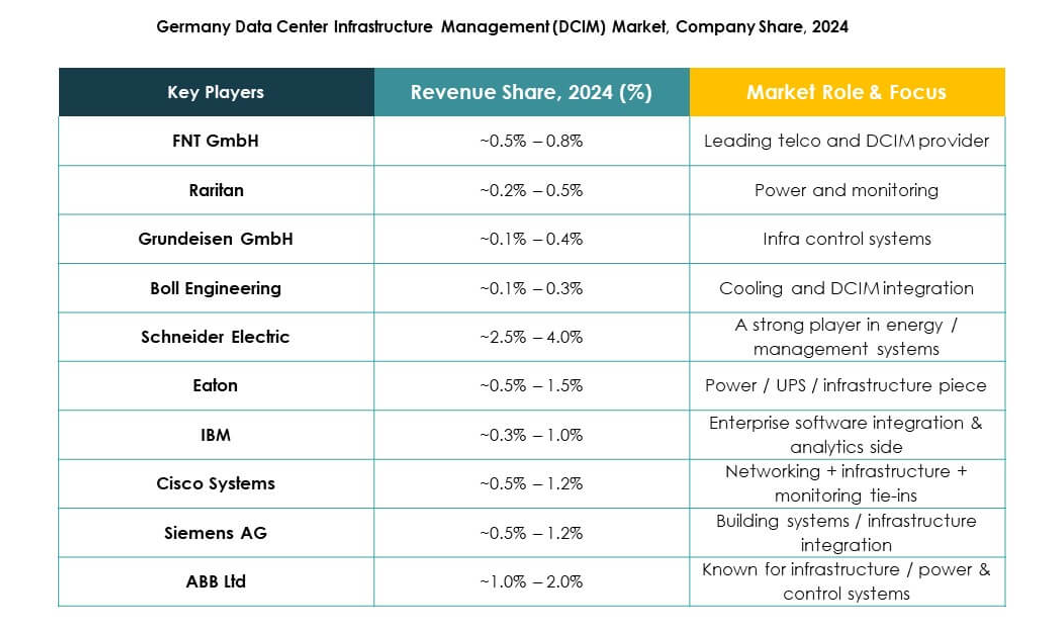

- FNT GmbH

- Raritan

- Grundeisen GmbH

- Boll Engineering

- Cancom AG

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd

- IBM

- Schneider Electric SE

- Siemens AG

- Hewlett Packard Enterprise (HPE)

- Delta Electronics

The competitive landscape of the Germany Data Center Infrastructure Management (DCIM) Market reflects strong participation from both global leaders and regional specialists. Companies like Schneider Electric, Siemens AG, ABB, and Cisco deliver integrated DCIM solutions with advanced monitoring, automation, and energy optimization features. FNT GmbH strengthens its presence with AI-powered platforms tailored for local enterprises, while Cancom AG and Boll Engineering provide managed services and consulting expertise. IBM, HPE, and Huawei focus on hybrid and cloud-compatible solutions to address complex workloads. Eaton Corporation and Delta Electronics emphasize power and cooling management innovations. It remains highly competitive, with firms differentiating through innovation, partnerships, and compliance-driven sustainability solutions, ensuring enterprises gain visibility, efficiency, and resilience in digital infrastructure management.

Recent Developments:

- In April 2025, FNT GmbH expanded its partnership with DC Smarter, fully integrating the AI-powered DC Vision software into the FNT platform to enable more efficient, transparent, and automated data center operations management in Germany through digital twins and real-time asset tracking.

- In Feb 2025, FNT GmbH also announced a partnership with Netcon Americas to broaden the reach of its DCIM solutions and deliver advanced management and automation capabilities to international data center infrastructure clients.