Executive summary:

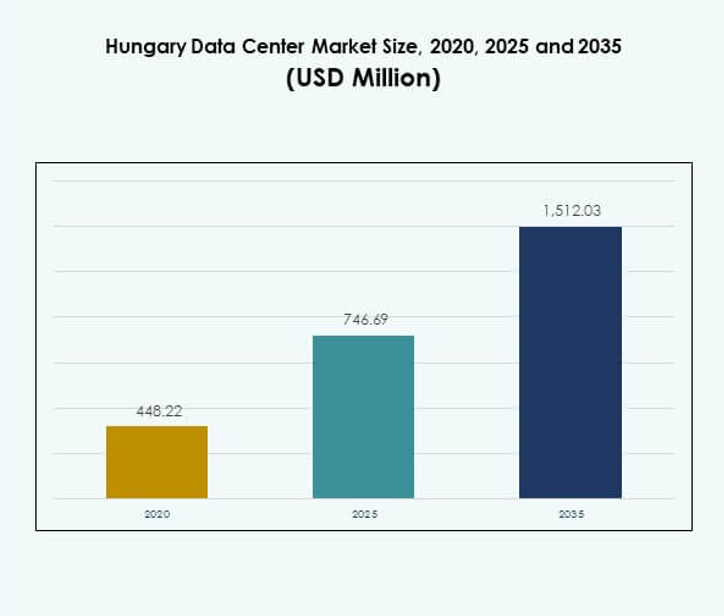

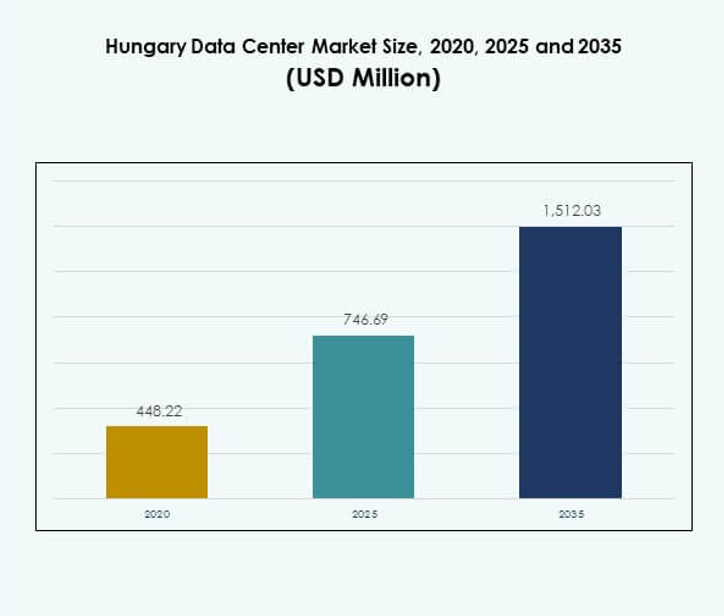

The Hungary Data Center Market size was valued at USD 448.22 million in 2020 to USD 746.69 million in 2025 and is anticipated to reach USD 1,512.03 million by 2035, at a CAGR of 7.27% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Hungary Data Center Market Size 2025 |

USD 746.69 Million |

| Hungary Data Center Market, CAGR |

7.27% |

| Hungary Data Center Market Size 2035 |

USD 1,512.03 Million |

Growth is fueled by cloud adoption, rising digital services, and strong demand for colocation infrastructure. Businesses invest in automation, virtualization, and energy-efficient technologies to improve performance and reduce costs. The Hungary Data Center Market is strategically important as it supports enterprise digital transformation, high-performance computing, and compliance with evolving regulations, attracting both regional and global investors seeking stable returns.

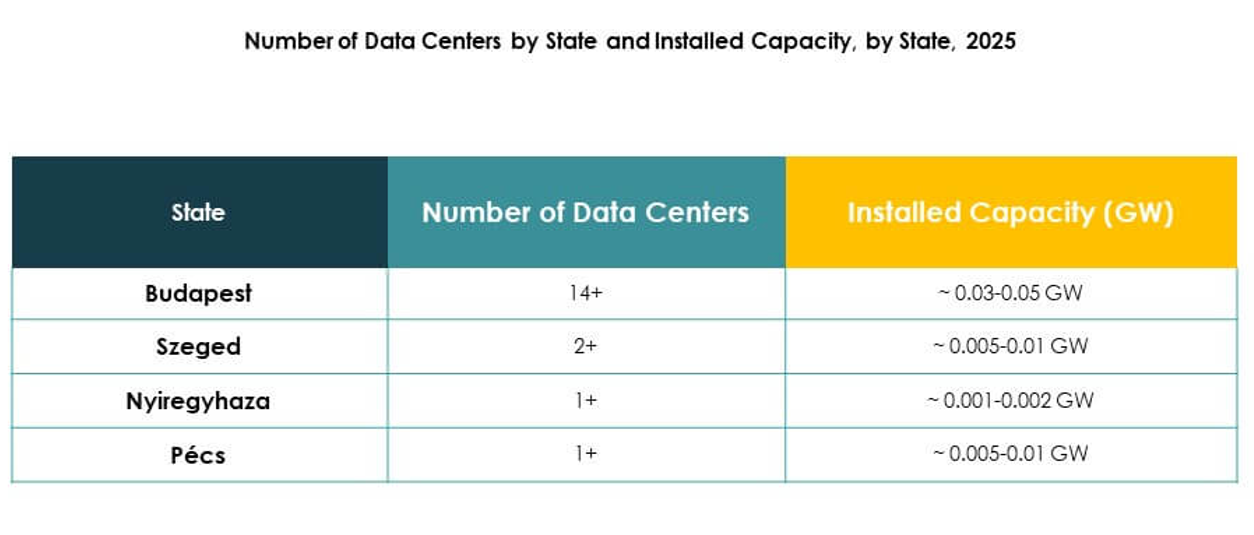

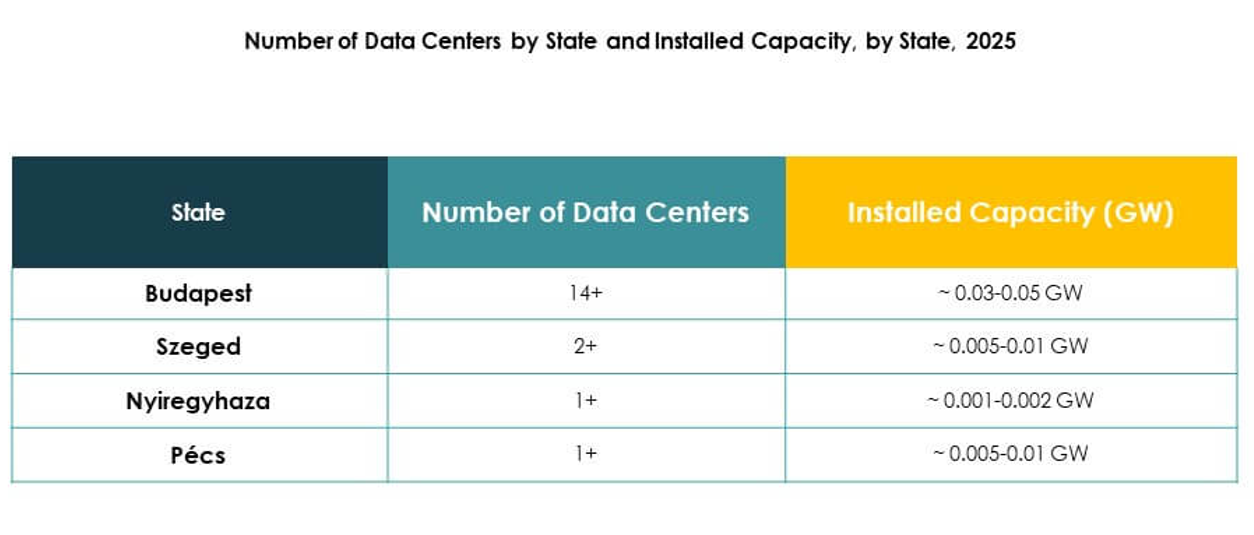

Western and Central Hungary dominate due to advanced connectivity and concentration of enterprises, with Budapest serving as the key hub. Eastern Hungary is emerging with industrial expansion and supportive government initiatives, while Southern Hungary shows potential through SME-driven demand and modular deployments. These dynamics highlight diverse growth opportunities across subregions.

Market Drivers

Rising Demand For Advanced Digital Infrastructure And Cloud Integration

The Hungary Data Center Market is driven by rapid digital transformation and strong demand for scalable infrastructure. Enterprises prioritize cloud integration to ensure flexibility, efficiency, and faster deployment of services. Government initiatives toward digitalization also create supportive policies and attract private investments. Telecom providers strengthen connectivity with high-speed networks, improving reliability for large-scale operations. The growth of e-commerce and digital payments accelerates the need for advanced processing capacity. Strong interest from multinational firms boosts investor confidence and sustains capital inflow. It positions Hungary as a regional hub for technology services. Businesses view the market as a strategic platform for innovation and competitiveness.

- For instance, Microsoft opened its first cloud region in Hungary in 2022, delivering Azure services with local data residency and expanding enterprise access to low-latency cloud infrastructure.

Adoption Of Artificial Intelligence, Internet Of Things, And Data-Centric Applications

Businesses integrate artificial intelligence and Internet of Things solutions across industries, increasing the load on computing and storage. It enhances efficiency in financial services, healthcare, and retail, demanding stronger data handling capacities. The Hungary Data Center Market grows with rising demand for edge computing to process data closer to end-users. Automation tools improve performance monitoring and ensure seamless uptime in complex infrastructures. Predictive analytics also gains traction, reducing downtime and improving operational planning. Enterprises seek real-time insights to maintain competitiveness and agility. Expanding smart city projects highlight the critical role of connected infrastructure. Investors see it as a pathway to sustained returns in a dynamic landscape.

Increasing Focus On Energy Efficiency And Green Data Center Solutions

Sustainability becomes central to operational strategy, with emphasis on renewable energy adoption and reduced emissions. The Hungary Data Center Market benefits from Europe’s strong environmental regulations that mandate efficient infrastructure. Operators deploy liquid cooling systems, advanced air management, and energy optimization tools. It reduces costs and strengthens compliance with regional directives. Companies view sustainable operations as essential for attracting environmentally conscious clients. The use of power purchase agreements further expands the appeal of renewable-based centers. Growth of green financing supports energy-efficient investments. Strategic positioning in this area helps Hungary align with global decarbonization goals.

Strategic Location And Growing Importance Of Regional Connectivity

Hungary’s central position in Europe enhances its connectivity to both Western and Eastern markets. The Hungary Data Center Market strengthens with high cross-border data traffic, making the country a digital transit hub. Reliable infrastructure and fiber-optic expansion increase its regional competitiveness. Businesses see Hungary as a gateway to emerging Eastern European economies. It enables seamless distribution of services across diverse markets. Strong collaboration with international telecom operators ensures better resilience. The growing demand for disaster recovery services highlights the need for cross-regional presence. Investors recognize long-term value in Hungary’s strategic geographic role within the digital economy.

- For instance, in 2025 GNM expanded its European network by launching a Point of Presence in Budapest’s Dataplex data center, improving low-latency regional connectivity.

Market Trends

Growing Expansion Of Hyperscale And Colocation Facilities In Central Europe

The Hungary Data Center Market observes a steady increase in hyperscale and colocation developments. Global providers deploy large-scale infrastructure to serve multinational corporations and local enterprises. It offers scalability and cost efficiency, reducing the need for in-house facilities. Businesses prefer colocation for shared resources and managed services. Demand for hyperscale centers grows as cloud adoption rises among financial, healthcare, and e-commerce sectors. Regional connectivity enhances Hungary’s value for cross-border workloads. Operators expand capacity through modular expansions to meet client requirements. Growth in these facilities reflects global patterns of data consolidation and regional distribution.

Shift Toward Hybrid And Multi-Cloud Deployment Models Across Enterprises

Organizations in Hungary adopt hybrid strategies, balancing on-premises control with cloud flexibility. The Hungary Data Center Market experiences strong interest in multi-cloud frameworks for resilience and vendor diversity. It supports disaster recovery, scalability, and compliance in regulated industries. Enterprises seek to integrate private and public cloud resources seamlessly. Strong focus on secure migration services fuels service provider growth. Demand for hybrid frameworks reflects the need for agility and operational continuity. Local service providers invest in consulting and integration to strengthen enterprise adoption. Hybrid and multi-cloud solutions gain momentum as businesses avoid dependence on single vendors.

Integration Of Advanced Automation And Monitoring Tools For Operational Efficiency

Data center operators focus on intelligent automation to enhance performance, efficiency, and service quality. The Hungary Data Center Market adapts to automated monitoring platforms that reduce downtime. It provides predictive insights for energy usage, hardware health, and workload distribution. Robotics and AI-based systems optimize maintenance and reduce manual intervention. Enterprises view automation as critical for scaling operations with limited workforce expansion. Monitoring tools also enhance compliance reporting, meeting strict regulatory demands. Predictive maintenance minimizes disruptions, protecting business continuity. The adoption of advanced automation sets a strong base for future infrastructure innovation.

Emergence Of Modular And Edge Data Centers To Support Low-Latency Applications

Edge and modular facilities grow in importance with the expansion of IoT, 5G, and AI applications. The Hungary Data Center Market embraces modular systems that ensure quick deployment and flexibility. It provides localized processing capacity for industries like healthcare, logistics, and manufacturing. Edge solutions support real-time decision-making by minimizing latency. Enterprises gain improved performance for applications requiring instant responses. Modular builds allow scalability without major upfront costs. Strong demand for mobile edge networks highlights Hungary’s evolving digital ecosystem. Industry adoption reflects a strategic shift toward localized, agile infrastructure models.

Market Challenges

High Energy Costs, Infrastructure Constraints, And Regulatory Compliance Pressures

The Hungary Data Center Market faces significant challenges due to high operational energy costs. Energy-intensive infrastructure requires sustainable alternatives to meet client demands. It struggles with the rising costs of electricity, impacting profitability for operators. Companies must comply with strict EU energy efficiency regulations, adding complexity to planning. Legacy infrastructure limits modernization speed in certain regions. Securing long-term power purchase agreements remains a challenge. Infrastructure gaps in rural areas also restrict equal distribution of services. Businesses view these constraints as barriers to rapid expansion and global competitiveness.

Growing Security Threats And Limited Skilled Workforce Availability

Cybersecurity threats increase with higher dependence on digital infrastructure across industries. The Hungary Data Center Market must handle sophisticated attacks targeting sensitive government and enterprise data. It invests heavily in firewalls, encryption, and real-time monitoring to mitigate risks. The shortage of skilled IT professionals creates difficulties in maintaining security standards. It reduces the capacity to manage complex systems at scale. Operators find recruitment and training costly and time-consuming. Growing pressure for advanced compliance frameworks further complicates operations. Businesses highlight these challenges as crucial to address for sustainable market growth.

Market Opportunities

Expansion Of Cloud Adoption And Growing Role Of Managed Services Providers

Enterprises accelerate cloud adoption to ensure flexibility, cost efficiency, and secure data access. The Hungary Data Center Market benefits from growing reliance on managed services providers for integration and optimization. It creates opportunities for players offering migration, consulting, and disaster recovery. SMEs view cloud-based solutions as vital for competitiveness. Government-backed digital programs also encourage enterprises to adopt cloud-first strategies. Providers leverage this demand to expand portfolios and attract foreign investments.

Emerging Potential In Green Data Centers And Renewable Energy Integration

Sustainability creates opportunities for operators to adopt renewable-based infrastructure. The Hungary Data Center Market attracts investments through solar, wind, and hydropower integration. It offers clients sustainable solutions with reduced carbon footprints. Green financing supports expansion and encourages eco-friendly innovation. Enterprises partner with renewable suppliers to lower operational risks. It creates a strong market for energy-efficient products and services. Sustainability-focused operations enhance brand image and attract global clients.

Market Segmentation

By Component

The Hungary Data Center Market shows hardware as the leading segment with servers, storage, networking, and power systems dominating investments. It holds a large share due to the critical need for performance and efficiency. Cooling and security solutions gain importance as facilities expand. Software such as DCIM and virtualization also grows, supporting automation and monitoring. Services like consulting and managed solutions rise with enterprise reliance on outsourcing. The balance among components highlights increasing integration of advanced technologies.

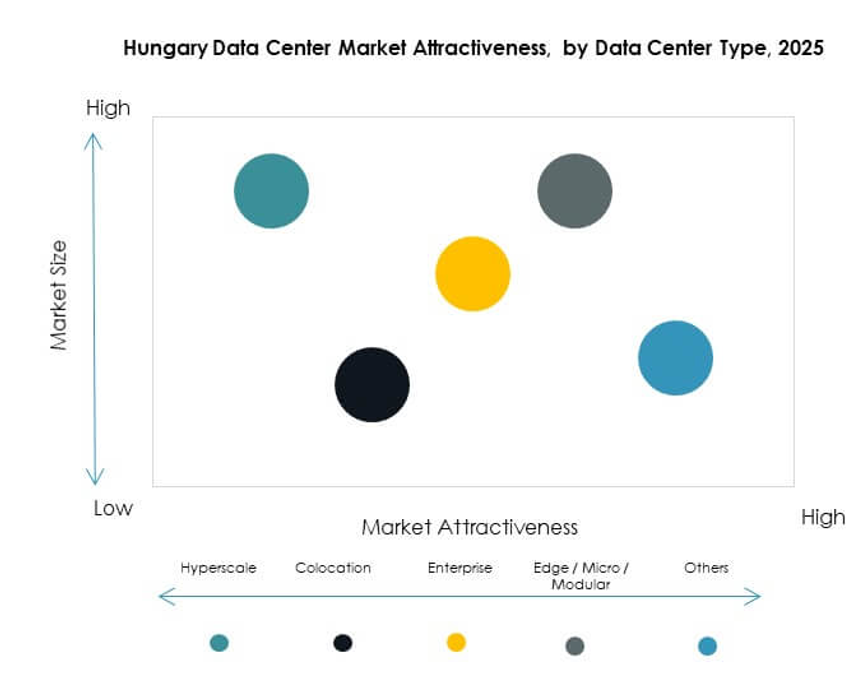

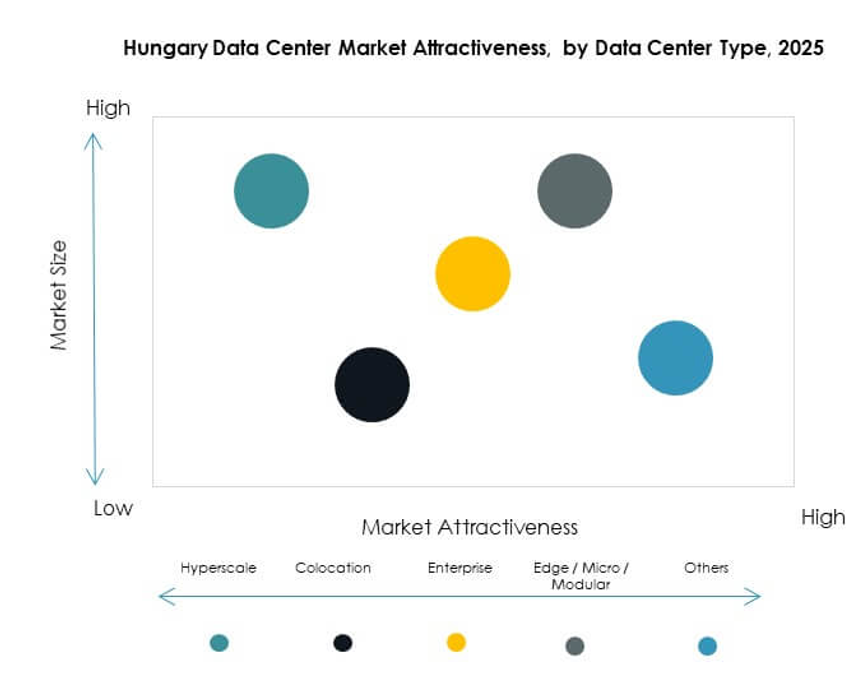

By Data Center Type

Colocation facilities dominate the Hungary Data Center Market, driven by enterprise demand for shared, cost-efficient infrastructure. Hyperscale centers gain traction with global providers targeting cloud-first clients. Enterprise data centers remain relevant for organizations with security-sensitive workloads. Edge and modular types expand to support real-time and localized processing. Mega centers emerge slowly due to high capital requirements. Cloud and internet data centers strengthen with SaaS adoption. The diversity of types reflects market flexibility and adaptability.

By Deployment Model

Cloud-based models lead the Hungary Data Center Market as enterprises shift to scalable and agile platforms. Hybrid deployment also records growth due to demand for flexible integration of public and private solutions. On-premises facilities retain value for government and sensitive data applications. Enterprises prefer hybrid for regulatory compliance and performance optimization. Cloud providers strengthen dominance with affordable and secure solutions. The deployment mix underscores evolving enterprise strategies for digital resilience.

By Enterprise Size

Large enterprises dominate the Hungary Data Center Market due to their extensive IT infrastructure needs. They drive demand for hyperscale, colocation, and hybrid deployments. SMEs also adopt cost-efficient cloud and managed services to remain competitive. Growth in e-commerce and digital-native firms supports SME contributions. It ensures diversity of demand across enterprise scales. The dual demand strengthens provider strategies for both global firms and local innovators.

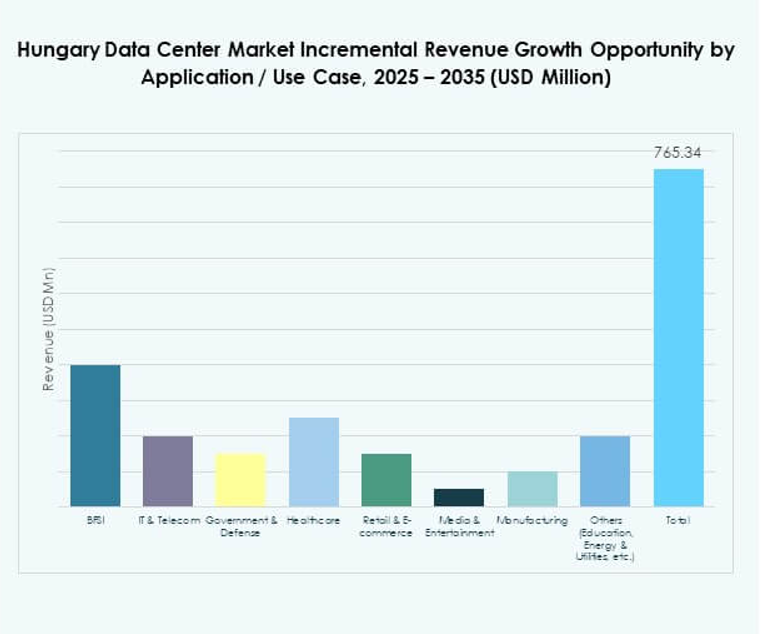

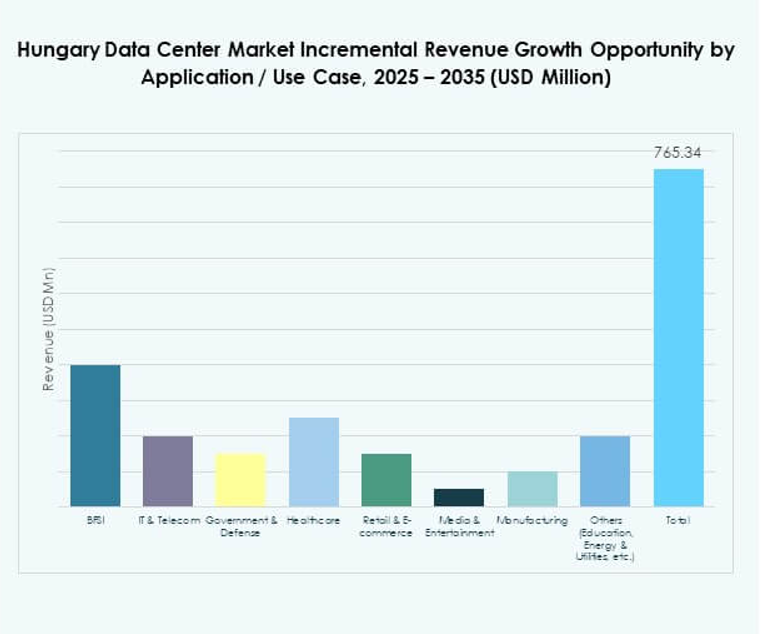

By Application / Use Case

IT and telecom lead the Hungary Data Center Market as connectivity, mobile growth, and 5G adoption increase data loads. BFSI follows with heavy reliance on secure processing and compliance. Government and defense sectors expand investments for sovereign data security. Healthcare emerges as a growing segment with electronic health records and telemedicine. Retail and e-commerce also fuel expansion through digital platforms. Manufacturing leverages Industry 4.0 solutions requiring robust computing. Media, entertainment, and education further diversify market demand.

By End User Industry

Cloud service providers dominate the Hungary Data Center Market by enabling scalable, cost-effective operations. Enterprises hold strong demand for private, hybrid, and multi-cloud frameworks. Colocation providers expand to attract SMEs and mid-tier enterprises. Government agencies increase participation to strengthen national digital resilience. Other industries including utilities and education contribute steadily. This diversity ensures resilience and long-term growth opportunities for service providers.

Regional Insights

Western And Central Hungary Leading With Largest Share In Market Revenue

Western and Central Hungary account for 48% of the Hungary Data Center Market. Budapest serves as the core hub, driven by connectivity, enterprise density, and foreign investments. It attracts hyperscale and colocation providers seeking direct access to regional clients. Enterprises leverage the strong urban infrastructure for digital transformation. It highlights Budapest’s centrality in innovation and growth. Strategic projects in the capital enhance its role in attracting regional partners.

- For instance, in early 2025 GNM launched a Point of Presence inside Magyar Telekom’s Dataplex data center in Budapest, expanding European backbone connectivity and strengthening low-latency access.

Eastern Hungary Expanding Rapidly With Focus On Infrastructure And Industrial Growth

Eastern Hungary holds 32% share, supported by industrial expansion and regional government initiatives. The Hungary Data Center Market in this region benefits from affordable land and energy resources. Enterprises view it as cost-effective for large-scale facilities. It gains importance with manufacturing and logistics growth that requires digital infrastructure. Infrastructure expansion projects also increase competitiveness against Central Europe. The region’s emerging role ensures long-term value for investors.

- For example, in 2021, OTP Bank partnered with SambaNova Systems to install a multi-rack AI supercomputer in a Budapest data center. This deployment highlights how advanced financial workloads are driving demand within the Hungary Data Center Market and strengthening the country’s role in regional digital infrastructure.

Southern Hungary Showing Rising Potential With Emerging Data And Cloud Adoption

Southern Hungary contributes 20% share, supported by growing enterprise adoption of cloud and digital services. The Hungary Data Center Market in this subregion benefits from energy-efficient projects and industrial clusters. It shows strong interest from SMEs that seek cost-effective solutions. Regional players expand presence through modular facilities and managed services. It also strengthens through collaborations with telecom providers for better connectivity. Southern Hungary demonstrates promising potential as enterprises expand digital operations.

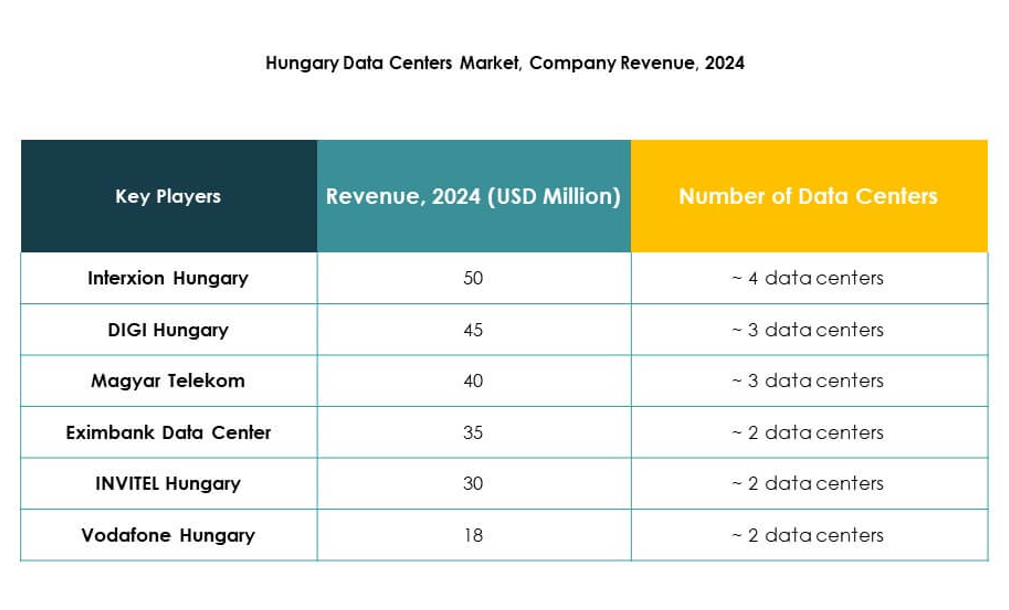

Competitive Insights:

- Interxion Hungary

- DIGI Hungary

- Magyar Telekom

- Eximbank Data Center

- INVITEL Hungary

- Vodafone Hungary

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

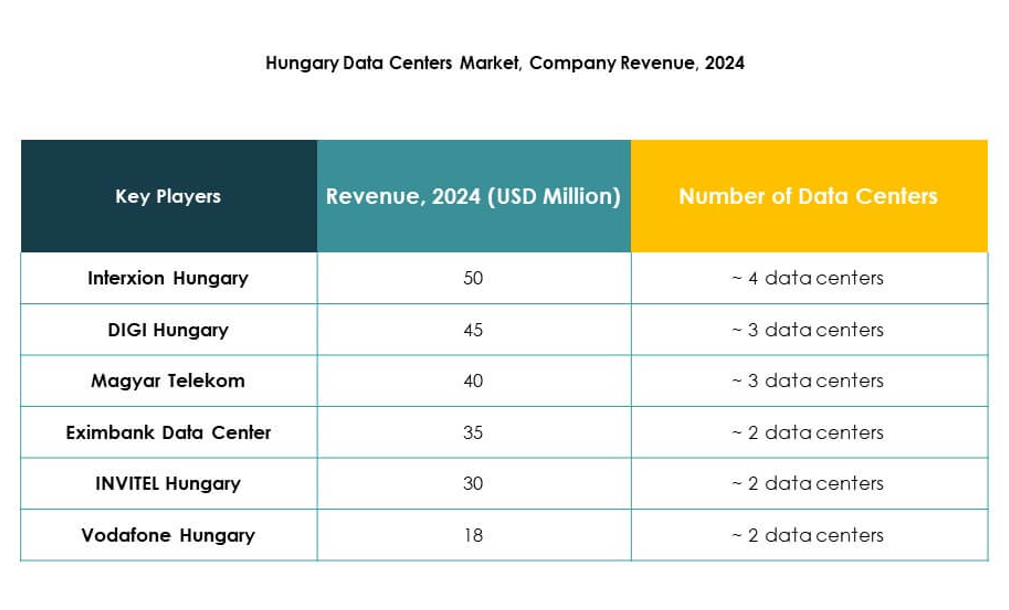

The Hungary Data Center Market features strong competition among global hyperscale providers and domestic telecom operators. Interxion Hungary, Magyar Telekom, and Vodafone Hungary dominate local infrastructure with robust connectivity and colocation services. International giants including Microsoft, AWS, and Google expand cloud platforms to capture enterprise demand. Digital Realty and NTT strengthen presence through scalable colocation and managed services. DIGI Hungary and INVITEL focus on regional coverage and service diversity. Eximbank Data Center supports specialized enterprise and government workloads. It remains highly attractive for investors due to sustained demand for hybrid, cloud, and colocation models, creating a balanced competitive environment between local operators and multinational leaders.

Recent Developments:

- In July 2025, EuroHPC signed an agreement to deploy the LEVENTE mid-range supercomputer in Budapest to enhance national compute capacity. This investment adds high-performance computing infrastructure and benefits the Hungary Data Center Market by elevating computational needs locally.

- In July 2025, ParTec AG announced plans for a €3 billion investment to build a large data centre in Hungary. This planned facility would expand capacity significantly, further underpinning growth potential in the Hungary Data Center Market.