Executive summary:

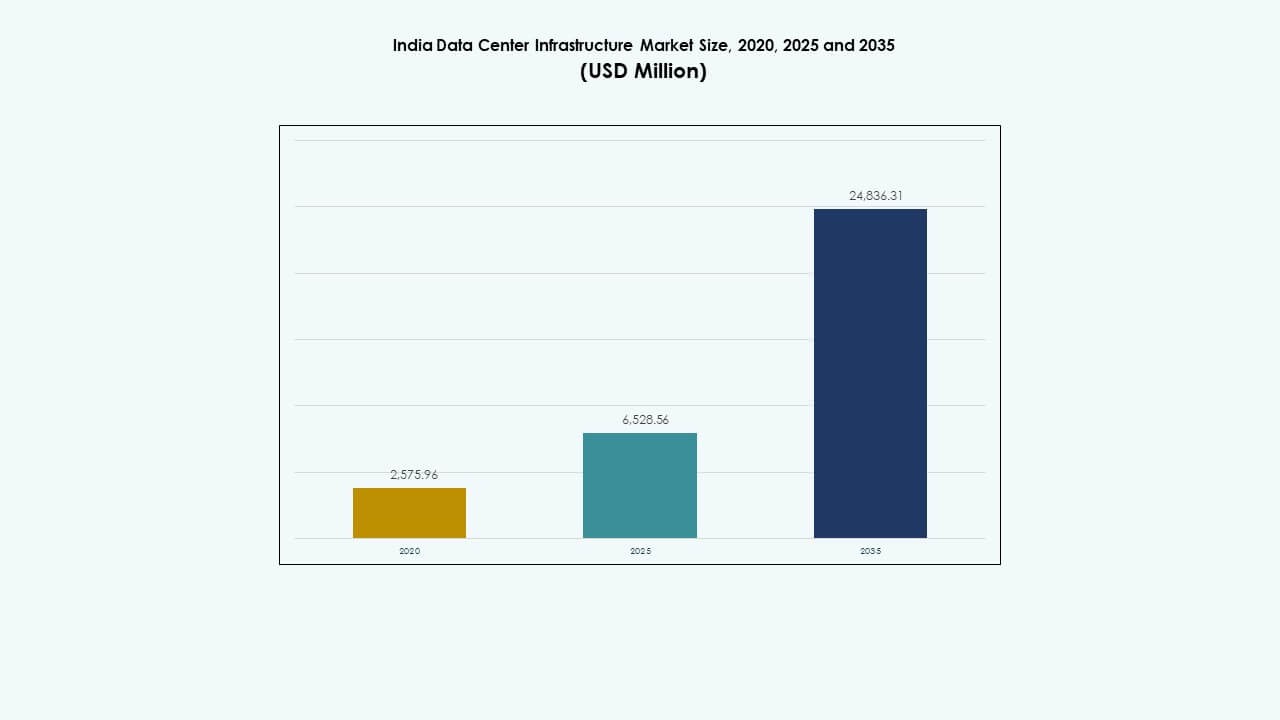

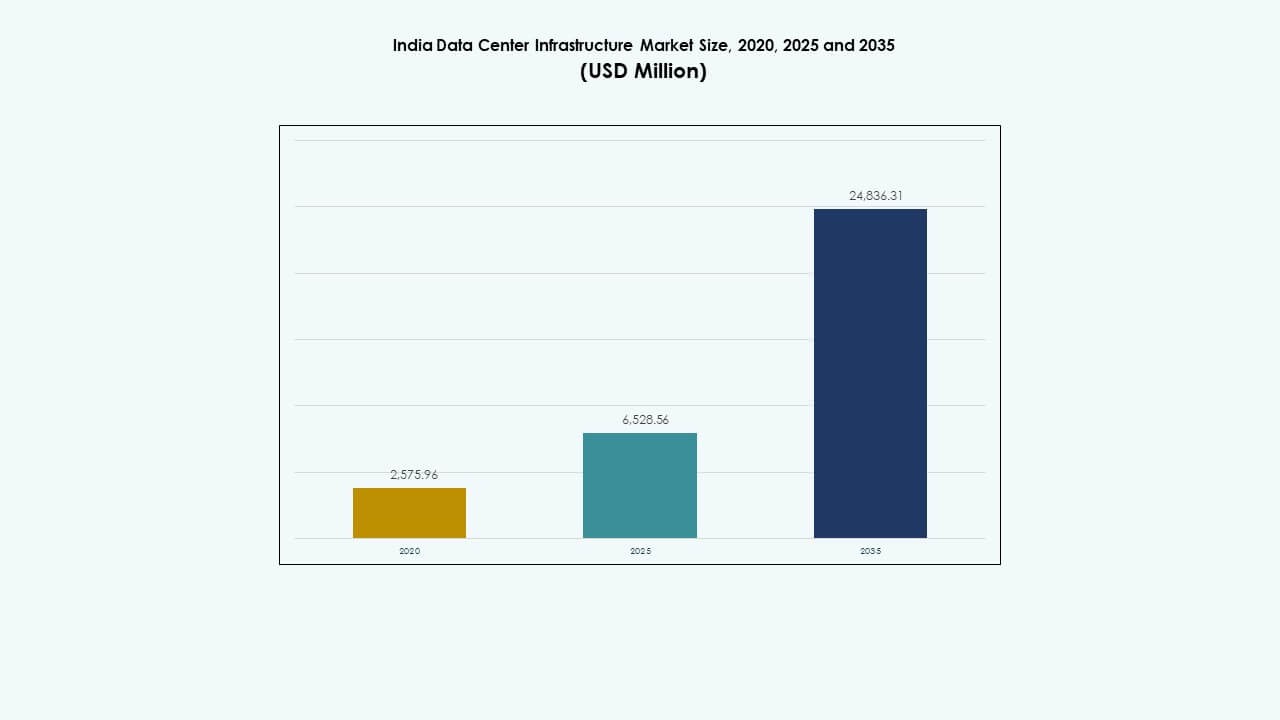

The India Data Center Infrastructure Market size was valued at USD 2,575.96 million in 2020, increased to USD 6,528.56 million in 2025, and is anticipated to reach USD 24,836.31 million by 2035, at a CAGR of 14.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| India Data Center Infrastructure Market Size 2025 |

USD 6,528.56 Million |

| India Data Center Infrastructure Market, CAGR |

14.23% |

| India Data Center Infrastructure Market Size 2035 |

USD 24,836.31 Million |

The market is fueled by a surge in cloud services, AI workloads, 5G rollouts, and demand for low-latency computing. Enterprises are modernizing their IT systems with scalable, hybrid infrastructure to handle growing digital traffic. Data localization rules and government-led digital initiatives drive long-term investments. Sustainability goals push operators toward energy-efficient designs and renewable integration. These shifts make the India Data Center Infrastructure Market strategically critical for hyperscalers, investors, and infrastructure providers.

Western India, led by Mumbai and Pune, dominates the market due to strong connectivity, subsea cable landings, and access to power. Southern cities like Chennai, Hyderabad, and Bengaluru are fast-growing hubs backed by hyperscale investments and supportive state policies. Northern and eastern regions, including Delhi NCR and Kolkata, are gaining traction with public sector demand and edge deployments. Tier 2 cities are emerging as edge zones due to improved fiber networks and lower land costs.

Market Dynamics:

Market Dynamics:

Growing Cloud Adoption and AI Integration Are Pushing Scalable Infrastructure Investment Across Enterprises

The India Data Center Infrastructure Market is experiencing growth due to increasing cloud workloads, AI training, and digital services. Public and private cloud adoption drives demand for hyperscale facilities with scalable, high-performance infrastructure. Organizations are modernizing core systems to support virtualized environments and advanced analytics. AI workloads and generative models require dense GPU clusters and low-latency architectures. IT spending shifts from legacy hardware to software-defined and cloud-native solutions. Rising demand for edge processing accelerates investment in regional nodes. Government digital programs increase traffic volumes and compute needs. Enterprises and hyperscalers focus on hybrid models that blend public, private, and edge deployments. It remains a strategic investment for efficiency and business resilience.

- For instance, Reliance Jio operationalized 10 MW Jio-Azure cloud data centers in Jamnagar and Nagpur in 2022. Public and private cloud adoption drives demand for hyperscale facilities with scalable, high-performance infrastructure.

Government Policies, Incentives, and Localization Norms Are Accelerating Infrastructure Growth Across States

The government is providing favorable policy frameworks, including data center park schemes and infrastructure status recognition. States such as Uttar Pradesh, Maharashtra, and Tamil Nadu offer land subsidies, stamp duty waivers, and power tariff discounts. These incentives attract both domestic and global data center operators. Data localization regulations are pushing firms to host and process data within national borders. The India Data Center Infrastructure Market benefits from stable demand across banking, telecom, healthcare, and e-commerce sectors. Public-sector digitization, Aadhaar-linked services, and digital banking amplify infrastructure needs. SEZ-like incentives and 100% FDI allowance in IT infrastructure improve capital inflow. Local partnerships with energy providers support power provisioning in emerging zones. Policy alignment enhances long-term market attractiveness.

- For instance, in January 2024, the Maharashtra government signed an MoU with Adani Group to develop 1 GW of hyperscale data center infrastructure across Navi Mumbai and Pune, supporting the state’s digital economy goals.

Digital Transformation Across Industries Strengthens Multi-Sector Infrastructure Demand

Retail, manufacturing, BFSI, media, and government sectors are transitioning to digital-first business models. Digital payment systems, real-time logistics platforms, and OTT content delivery require robust back-end compute. The India Data Center Infrastructure Market supports this shift with scalable compute, storage, and network capacity. Enterprises prioritize latency reduction and uptime assurance across operational footprints. Smart city projects and e-governance solutions need localized processing and secure storage. Companies are shifting toward containerized application environments, increasing rack densities and power demand. Growth in digital startups and unicorns boosts colocation and modular facility adoption. Sector-specific regulatory compliance needs drive demand for secure and compliant hosting. Cross-sector demand diversity improves market stability and expansion runway.

Edge Computing, 5G Rollouts, and Urban Data Needs Drive Decentralized Infrastructure Deployment

The 5G rollout triggers new low-latency use cases across IoT, smart grids, and telemedicine. Edge data centers reduce backhaul traffic and support instant processing near users. The India Data Center Infrastructure Market expands into Tier 2 cities for last-mile performance gains. Applications such as connected mobility, remote surgeries, and industrial IoT benefit from near-user infrastructure. Telecom firms deploy mini data hubs to serve real-time workloads. Urban digital infrastructure planning includes edge nodes for smart surveillance and traffic systems. Modular and container-based setups allow faster deployment near demand zones. Local cloud services improve access for MSMEs and regional enterprises. Edge investments align with national connectivity and digital equity goals.

Market Trends

Market Trends

Surge in Hyperscale Facility Construction Across Urban and Suburban Zones

Hyperscale operators are driving a construction boom across India’s top metro and emerging regions. Mumbai, Chennai, and Hyderabad see consistent launches of facilities with 25+ MW capacity. Developers prefer large land parcels close to power grids and subsea cable landing stations. Long-term leases and anchor tenant commitments de-risk project financing. It continues to attract global REITs, sovereign wealth funds, and infrastructure investors. The India Data Center Infrastructure Market supports integrated campuses with shared electrical and mechanical infrastructure. Pre-fabricated modular designs reduce time-to-market. Sustainability certification becomes a standard requirement across hyperscale assets. Operators emphasize energy use efficiency and space utilization metrics in design planning.

Sustainability, Energy Efficiency, and Renewable Integration Shape Facility Investment Plans

Operators are aligning infrastructure planning with carbon-neutral and net-zero goals. Green power procurement through open access and captive solar/wind projects is increasing. The India Data Center Infrastructure Market responds to rising ESG pressures by prioritizing low-PUE architecture. Use of liquid cooling, indirect evaporative systems, and chilled water loops is increasing. Battery energy storage systems are integrated with UPS for grid balancing. Developers adopt energy-efficient power distribution designs and smart PDUs. LEED, IGBC, and EDGE certification become standard metrics. Infrastructure planning incorporates lifecycle carbon analysis and circular design principles. Renewable procurement helps reduce scope 2 emissions and ensures long-term tariff stability.

Rack Density Upgrades and High-Power Equipment Drive Electrical Modernization

Rack power consumption has increased with AI and HPC workloads demanding 15–40 kW per rack. Operators upgrade UPS, PDUs, and switchgear systems to handle higher loads efficiently. The India Data Center Infrastructure Market incorporates scalable electrical designs to support phased expansion. Adoption of modular UPS, lithium-ion battery banks, and busway systems is rising. Facilities deploy intelligent monitoring systems for load balancing and predictive maintenance. Power usage patterns influence layout planning and containment strategies. Grid tie-ins are reinforced with dual feeds and substation proximity. Smart power backup systems offer energy visibility and lower operational risk. Electrical efficiency becomes a key differentiator for competitive colocation pricing.

Rise of Software-Defined Infrastructure and DCIM for Automation and Optimization

Software-defined networking, storage, and compute are reshaping traditional facility management. Operators use DCIM (Data Center Infrastructure Management) platforms for real-time visibility and control. The India Data Center Infrastructure Market integrates AI/ML-powered tools to optimize energy use and predict failures. Digital twins model airflow, power flow, and capacity utilization before deployment. APIs enable automated provisioning, resource allocation, and ticketing workflows. Facilities adopt AI-based security surveillance and biometric access control. Smart infrastructure enables remote management and workload shifting during outages. Virtualization extends to cooling and power provisioning decisions. This trend enhances uptime, lowers OPEX, and improves environmental performance across sites.

Market Challenges

Market Challenges

Power Availability, Grid Reliability, and Land Acquisition Hurdles in High-Demand Zones

Power provisioning remains a key challenge in Tier 1 cities where demand exceeds grid availability. Urban zones face delays in substation approvals and power draw permissions. The India Data Center Infrastructure Market contends with long lead times for transformer and panel delivery. Diesel-based backup power attracts emissions scrutiny and regulatory delays. Land acquisition in proximity to subsea cable landing stations is cost-intensive and fragmented. Disputes on zoning, environmental clearances, and lease tenures complicate site development. Delays in single-window clearance systems impact project timelines. Utility coordination, transformer capacity, and power corridor planning lag in new metro zones. Power-intensive workloads push operators to explore greenfield locations despite connectivity trade-offs.

Skilled Workforce, Import Dependence, and Component Supply Chain Constraints

India depends on global vendors for advanced cooling units, UPS systems, and specialized server racks. Import delays, currency fluctuations, and logistics issues affect procurement cycles. The India Data Center Infrastructure Market faces limited local manufacturing for Tier 3 and Tier 4-certified systems. Talent shortage in specialized fields such as HVAC, electrical design, and BMS integration slows project execution. Operators require trained teams for remote infrastructure management, especially at edge sites. Custom regulatory frameworks for data center components are still evolving. Hardware compatibility and integration challenges delay hybrid system deployment. Standardization across vendor ecosystems remains low, affecting modular build efficiency. These supply and skill gaps increase operating risk and cost overheads.

Market Opportunities

Surge in AI Workloads and National Cloud Programs Drive High-Density Facility Demand

AI, ML, and large-scale training models require denser compute clusters and advanced thermal management. The India Data Center Infrastructure Market supports these demands with GPU-ready racks and liquid cooling adoption. National cloud initiatives create new opportunities across government, defense, and education sectors. Operators can build long-term anchor contracts with public-sector clients. Edge-to-core infrastructure platforms improve accessibility in semi-urban zones.

Rise in Financial Investments, Real Estate Collaboration, and RE Integration Boosts Long-Term Growth

Private equity and infrastructure funds are investing in data center REITs, platform firms, and construction ventures. Local RE developers are partnering with global hyperscalers for powered land aggregation. The India Data Center Infrastructure Market attracts interest through renewable procurement frameworks. Green power bundling and solar parks near campuses improve energy sustainability. These investment partnerships accelerate delivery timelines and improve risk sharing.

Market Segmentation

By Infrastructure Type

The India Data Center Infrastructure Market includes electrical, mechanical, civil, and IT infrastructure, with electrical infrastructure holding the dominant share. Electrical systems such as UPS, switchgear, and backup units account for the largest spend due to high energy intensity. IT and network infrastructure follows, driven by growing AI and cloud processing needs. Mechanical and civil systems gain relevance for cooling, structural integrity, and modularity. Growth is strong across all types, supported by hyperscale and enterprise adoption.

By Electrical Infrastructure

UPS systems dominate the electrical infrastructure segment due to their critical role in ensuring continuous uptime. Power distribution units and switchgear are also significant, as higher rack density increases load complexity. Battery energy storage systems gain traction for sustainability and backup flexibility. The India Data Center Infrastructure Market is adopting lithium-ion and modular UPS systems. Grid connections and transformer sourcing remain a priority during site planning. Growth depends on power-intensive workloads and regulatory push for clean energy integration.

By Mechanical Infrastructure

Cooling units lead the mechanical infrastructure segment due to rising server heat output. Chillers, containment systems, and efficient airflow design are key for thermal management. Pumps and piping systems are critical for chilled water and liquid cooling. The India Data Center Infrastructure Market incorporates indirect evaporative cooling and liquid immersion systems in newer builds. High-density AI training racks drive demand for advanced cooling. Containment systems improve energy use and airflow management. Mechanical efficiency supports ESG and uptime goals.

By Civil / Structural & Architectural

Site preparation, foundations, and building envelopes form the core of this segment. Modular buildings, raised floors, and superstructures support scalable, phased expansions. The India Data Center Infrastructure Market prefers pre-engineered buildings in urban zones. Civil works align with seismic, wind, and fire safety norms. Raised floors enable efficient cable and air routing. Modular systems reduce construction time and improve cost control. Structural strength and site grading influence design choices, especially in multi-story builds.

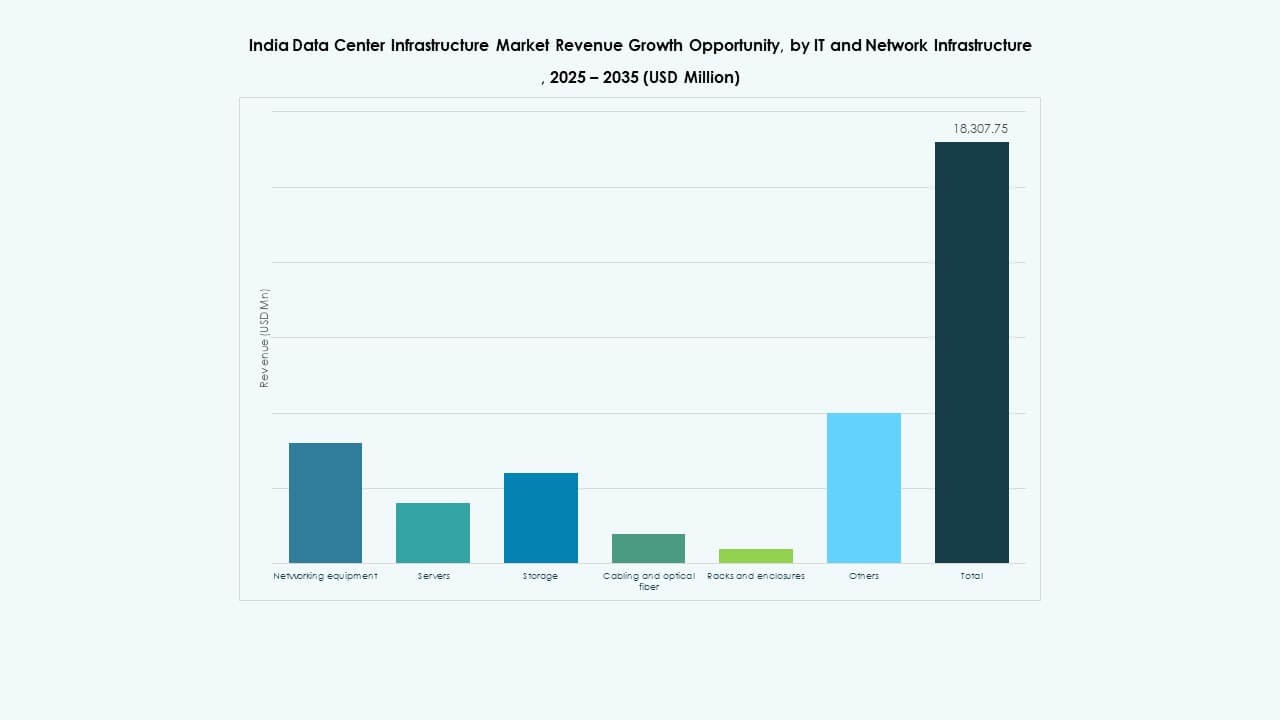

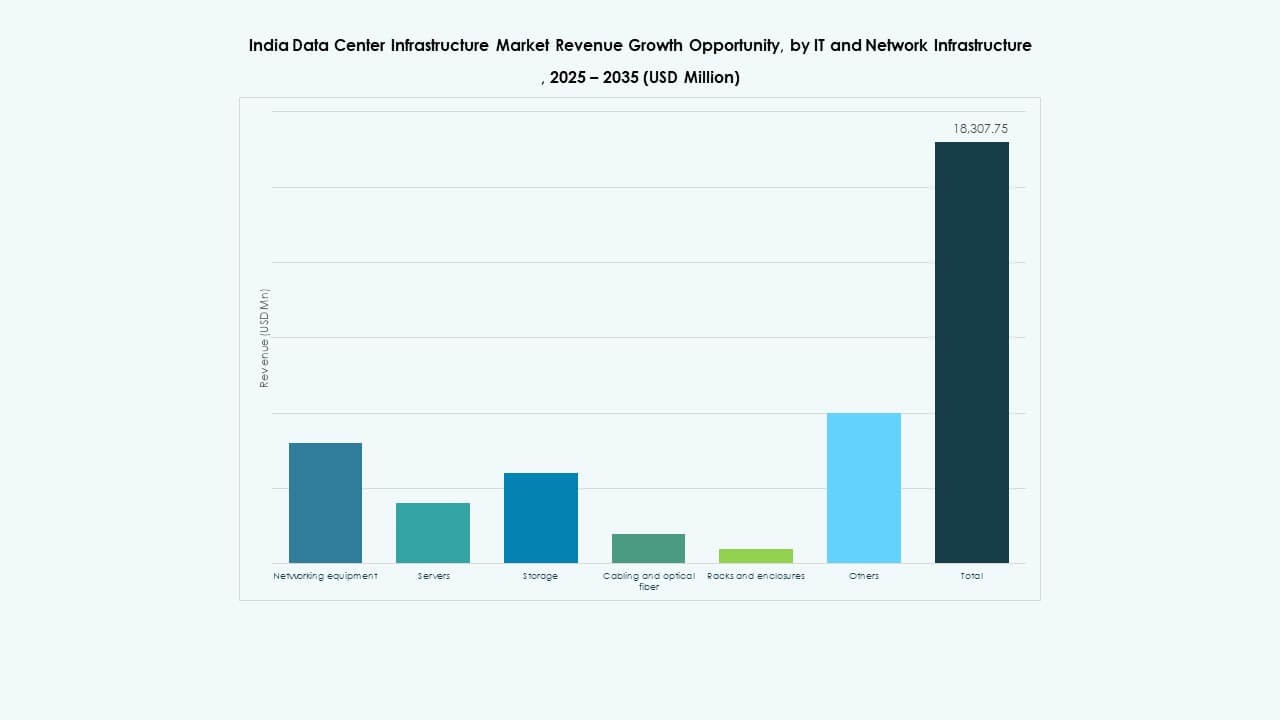

By IT & Network Infrastructure

Servers and storage lead this segment, driven by AI, analytics, and high-throughput workloads. Networking equipment and cabling follow as data center interconnects expand. The India Data Center Infrastructure Market requires scalable, energy-efficient compute. High-speed fiber and redundant cabling designs support traffic routing. Racks and enclosures are evolving for higher density. Smart PDU integration enhances power monitoring. Growth stems from public cloud, private workloads, and localized service delivery.

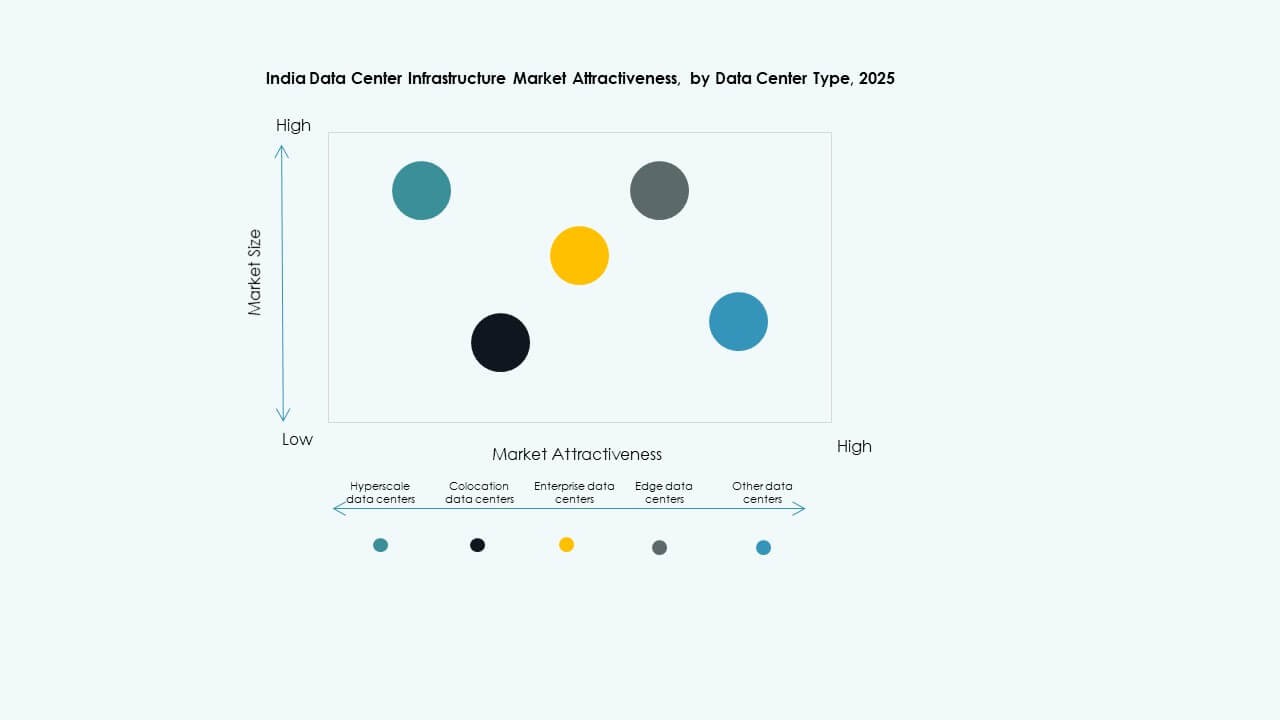

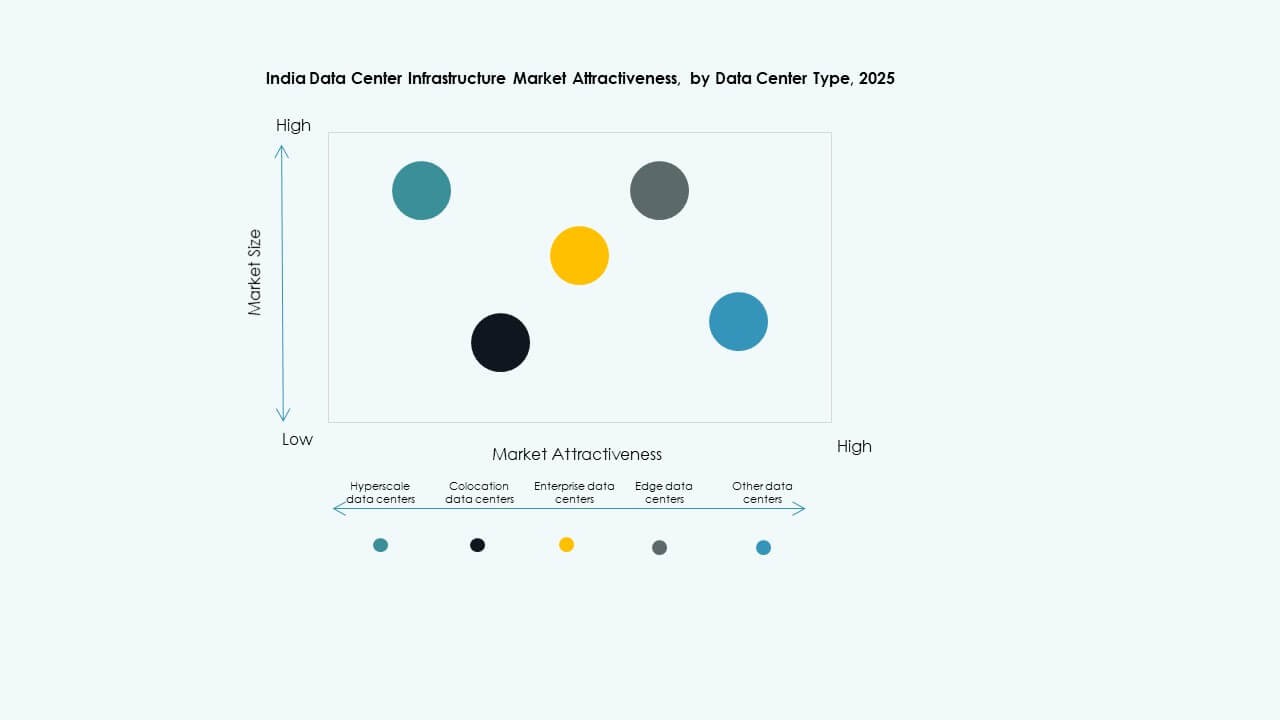

By Data Center Type

Hyperscale data centers dominate the market due to strong demand from cloud and content providers. Colocation facilities see stable growth as enterprise clients seek scalable, outsourced infrastructure. The India Data Center Infrastructure Market is witnessing edge facility development in Tier 2 cities. Enterprise and modular builds continue for specific industry verticals. Tier-based classification drives design differentiation. Edge nodes support 5G and real-time applications. Hyperscale and edge form the twin pillars of future expansion.

By Delivery Model

Turnkey and design-build (EPC) models dominate the delivery segment due to speed and cost certainty. Modular factory-built solutions are gaining traction for edge and smaller sites. The India Data Center Infrastructure Market uses retrofit and upgrade models to modernize legacy facilities. Construction management suits operators with in-house design capacity. Modular EPC models enable multi-phase expansion with prefabricated systems. Delivery choice depends on timeline, scale, and tenant requirements.

By Tier Type

Tier 3 facilities dominate due to balanced uptime and cost efficiency. Tier 4 sites grow in critical sectors like banking, defense, and health. Tier 2 and Tier 1 models are used for edge and regional processing. The India Data Center Infrastructure Market aligns tier type with SLAs and client compliance. Redundancy design influences power and cooling needs. Tier 3-to-4 transitions increase in hyperscale sites. Tier classification ensures consistency across design and operations.

Regional Insights

Regional Insights

Western India Leads the Market with Strong Metro Connectivity and Subsea Landing Proximity

Western India holds the largest share in the India Data Center Infrastructure Market, accounting for nearly 38% of total capacity. Mumbai is the key hub due to its subsea cable landings, financial district proximity, and power access. Pune supports hyperscale expansions with available land and better cost control. Gujarat offers SEZs and renewable energy integration for energy-heavy users. Western India continues to attract investments from REITs and global platform firms. It plays a vital role in international data traffic and latency-sensitive applications.

- For instance, Amazon Web Services (AWS) signed an agreement with the Telangana government in December 2025 to invest USD 7 billion over 14 years to expand cloud and data center infrastructure in Hyderabad, strengthening the AWS Asia Pacific (Hyderabad) Region and supporting digital services across India

Southern India Emerges as a High-Growth Zone with Hyperscaler and Cloud Expansion Projects

Southern India contributes about 30% of the market, driven by Chennai, Bengaluru, and Hyderabad. Chennai benefits from subsea connectivity and port proximity. Bengaluru leads in enterprise data consumption and cloud adoption. Hyderabad sees hyperscale activity due to state incentives and IT park presence. The India Data Center Infrastructure Market sees increasing southern investment from AWS, Microsoft, and CtrlS. Government support and local talent availability improve execution speed. Southern states plan multiple data center parks with dedicated power corridors.

- For instance, CtrlS Bangalore DC1 features 1,848 racks in a B1+G+7+Terrace structure with 12 MW power capacity and nine-zone security.

Northern and Eastern India Expand for Edge, Enterprise, and Public Sector Applications

Northern India accounts for 20%, with Delhi NCR as the primary hub. Public sector demand, cloud services, and content consumption support the region. Eastern India, with a 12% share, remains underpenetrated but gains traction for edge and government applications. Kolkata sees growth in financial services and education cloud projects. The India Data Center Infrastructure Market expands in Lucknow, Bhubaneswar, and Patna for regional coverage. National fiber initiatives improve interconnect capacity in these zones. Localized infrastructure ensures balanced geographic distribution of capacity.

Competitive Insights:

- CtrlS Datacenters

- NTT

- STT GDC India

- AdaniConneX

- Equinix, Inc.

- Schneider Electric

- Vertiv Group Corp.

- Delta Electronics

- Huawei Technologies Co., Ltd.

- IBM

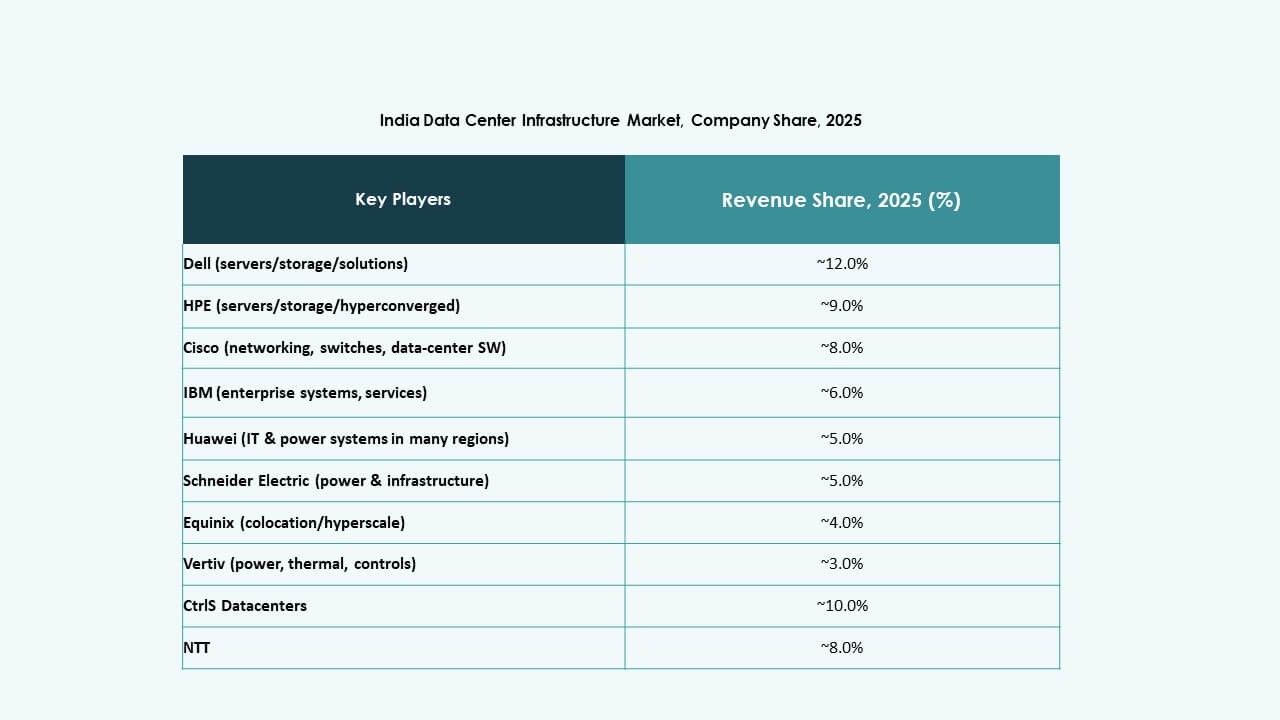

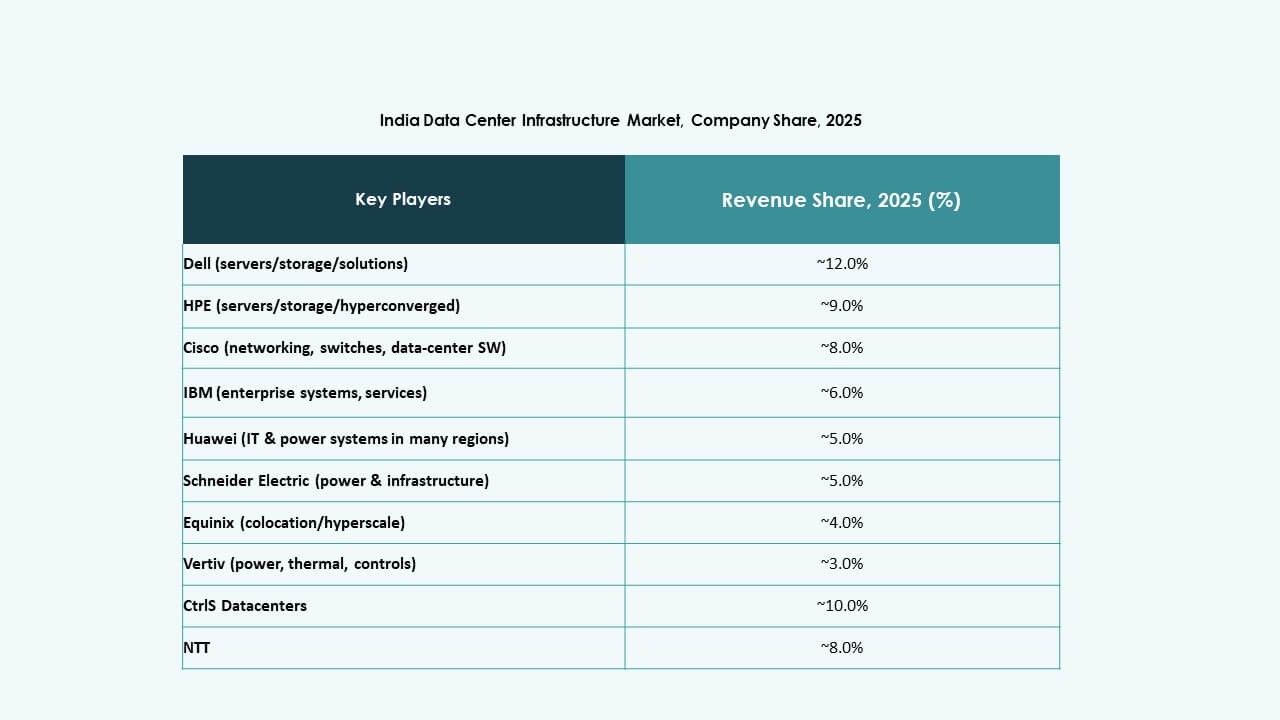

The India Data Center Infrastructure Market is marked by strong competition among global OEMs, regional operators, and diversified service providers. CtrlS, NTT, STT GDC, and AdaniConneX lead the facility ownership and expansion landscape, targeting both hyperscale and colocation clients. Global players like Equinix and IBM extend their presence through strategic partnerships and campus builds. Schneider Electric and Vertiv dominate power and cooling infrastructure, offering modular and energy-efficient systems. Huawei and Delta focus on integrated electrical systems and prefabricated units for large deployments. Companies compete on energy efficiency, uptime assurance, and scale flexibility. It offers scope for cross-sector collaboration between tech vendors, construction firms, and RE developers. Vendor differentiation increasingly depends on turnkey delivery, renewable integration, and automation tools supporting long-term operational efficiency.

Recent Developments:

- In December 2025, AdaniConneX incorporated a new wholly owned subsidiary, AdaniConneX Hyderabad Three Limited dedicated to constructing, developing, and operating data centers as part of its expansion in India’s digital infrastructure sector.

- In November 2025, CtrlS Datacenters and NTPC Green Energy signed a strategic MoU to jointly establish grid-connected renewable energy projects with up to 2 GW capacity through greenfield development or acquisitions, aimed at supplying green power to CtrlS facilities in New Delhi and Hyderabad.

- In October 2025, CtrlS Datacenters received Frost & Sullivan’s 2025 India Competitive Strategy Leadership Recognition for its expansions including new launches in Patna, Hyderabad, Chennai, and Kolkata, alongside partnerships with Oracle, Google Cloud, ConnectiviTree, and Genie Networks.

- In October 2025, Airtel partnered with Google to establish India’s first mega AI hub and data center in Vizag, including a gigawatt facility for AI workloads, a subsea cable landing station, and high-speed fiber networks

Market Dynamics:

Market Dynamics: Market Trends

Market Trends Market Challenges

Market Challenges Regional Insights

Regional Insights