Executive summary:

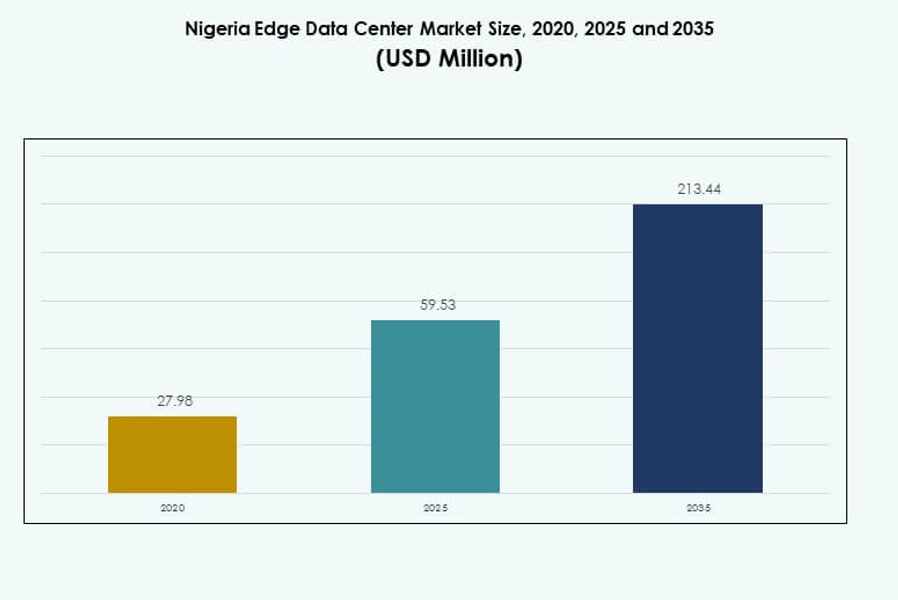

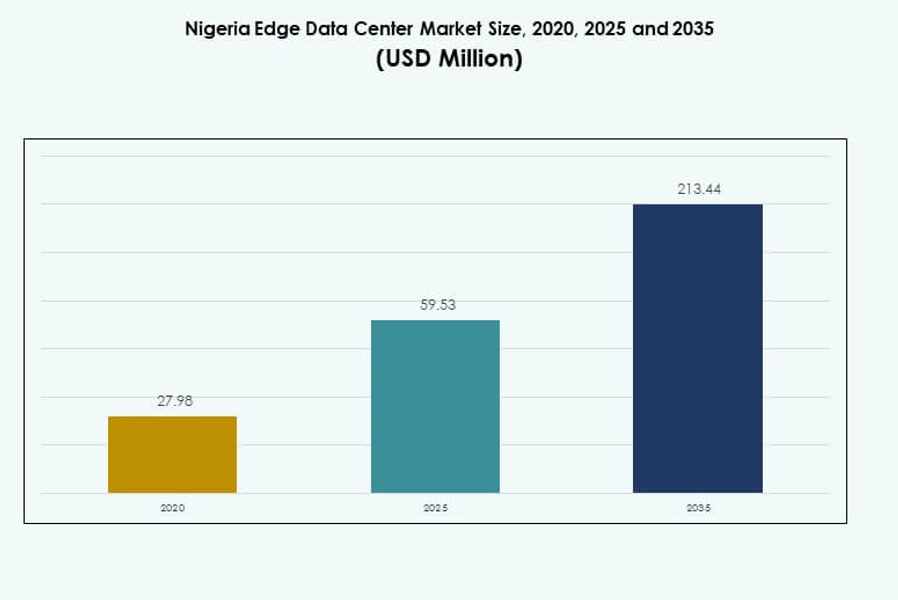

The Nigeria Edge Data Center Market size was valued at USD 27.98 million in 2020 to USD 59.53 million in 2025 and is anticipated to reach USD 213.44 million by 2035, at a CAGR of 13.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Nigeria Edge Data Center Market Size 2025 |

USD 59.53 Million |

| Nigeria Edge Data Center Market, CAGR |

13.48% |

| Nigeria Edge Data Center Market Size 2035 |

USD 213.44 Million |

The market is driven by rapid digital transformation, 5G expansion, and strong enterprise demand for low-latency infrastructure. Rising cloud adoption, modular edge deployments, and AI integration are reshaping connectivity and data processing strategies. These shifts enhance operational agility for enterprises while creating strong investment opportunities for technology providers and infrastructure developers in the region.

Southwestern Nigeria leads the market due to its advanced connectivity, concentration of businesses, and robust infrastructure. Southeastern Nigeria is emerging as a key growth hub, supported by industrial expansion and growing telecom networks. Northern Nigeria is gaining traction through targeted infrastructure projects, creating new opportunities for distributed edge deployments.

Market Drivers

Rising 5G Rollouts and Fiber Infrastructure Expansion Strengthening Edge Deployments

The Nigeria Edge Data Center Market is gaining momentum through rapid 5G expansion and fiber backbone upgrades. Telecom operators are deploying fiber across urban corridors to enable low-latency connectivity for real-time applications. Edge locations are being established near population hubs to support network densification and reduce backhaul loads. Enterprises across logistics, manufacturing, and BFSI are integrating edge infrastructure into their digital strategies to enhance operational efficiency. The market benefits from public and private sector collaborations driving telecom modernization. Smart city programs are accelerating distributed computing needs. The deployment of new submarine cables is improving international bandwidth access. This shift is positioning Nigeria as a critical digital hub in West Africa.

- For instance, MTN Nigeria, in partnership with Ericsson, is modernizing its core networks under a five‑year program worth over $120 million, enabling standalone 5G coverage and deploying over 700 5G sites across 13 cities as of 2025.

Accelerating Enterprise Digital Transformation Driving Edge Adoption in Strategic Sectors

The strong uptake of digital platforms in banking, telecom, and manufacturing sectors is driving the need for edge computing infrastructure. Enterprises are shifting critical workloads closer to end-users to reduce response time and support advanced applications. Data-intensive services such as real-time payment processing and video streaming depend on low-latency architecture. It supports AI-driven analytics, IoT integration, and immersive technologies that require distributed computing power. Edge infrastructure is enabling hybrid IT environments that improve agility and operational control. This expansion is strengthening enterprise resilience against network disruptions. The government’s push for digital economy growth creates favorable conditions for private investment. This transition marks a fundamental industry shift toward distributed data ecosystems.

- For instance, Airtel Nigeria is constructing a $120 million, 38 MW hyperscale AI data center in Eko Atlantic City, Lagos, designed to power domestic artificial intelligence workloads and local cloud services, positioning it as one of West Africa’s largest upcoming private data facilities, expected to go live by early 2026.

Integration of AI, IoT, and Automation Boosting Edge Infrastructure Utilization

Emerging technologies like AI, IoT, and automation are transforming enterprise operations and data processing strategies. These technologies require scalable infrastructure near the point of use to process massive data volumes efficiently. It enables real-time decision-making across industries like healthcare, retail, and energy. Companies are investing in modular and prefabricated edge facilities to accelerate deployment cycles. Integration with smart grids and connected devices supports greater operational efficiency. AI-driven monitoring tools enhance uptime, performance, and energy optimization. These advancements make edge sites more resilient and cost-effective. The convergence of these technologies is establishing a strong foundation for sustained market growth.

Strategic Investments and Regulatory Reforms Supporting Market Growth

Strategic investment from hyperscalers, telecom operators, and infrastructure developers is reshaping the competitive landscape. Investors view Nigeria as a strategic digital infrastructure hub for West Africa. Regulatory agencies are introducing policies to support data localization, privacy, and security compliance. It builds investor confidence and improves ease of doing business. Tax incentives and simplified licensing processes encourage rapid infrastructure buildouts. Data center operators are expanding Tier III and Tier IV facilities to meet international standards. International partnerships are introducing global expertise and best practices. This investment wave supports large-scale network transformation and drives market acceleration.

Market Trends

Growing Preference for Modular and Prefabricated Edge Data Centers

Modular and prefabricated designs are becoming a preferred solution for operators to deploy edge facilities faster. It enables rapid scaling, reduced construction time, and improved energy efficiency. Prefabrication supports deployment in remote locations with minimal infrastructure. Operators are adopting standardized modules to achieve operational flexibility and cost optimization. Modular architecture simplifies future upgrades, reducing downtime and complexity. It enhances disaster recovery capabilities and ensures business continuity. The Nigeria Edge Data Center Market is experiencing strong demand from industries seeking agile infrastructure solutions. This trend is reshaping investment priorities across the value chain.

Rising Demand for Green Data Centers and Energy-Efficient Designs

Sustainability is becoming a core design principle for new edge deployments. Operators are incorporating renewable energy, efficient cooling systems, and intelligent energy management to reduce carbon footprint. It aligns with global ESG mandates and improves operational cost efficiency. Energy-efficient edge designs support better power usage effectiveness and grid stability. Renewable-powered facilities reduce dependency on unreliable grid supply. Businesses are prioritizing sustainable infrastructure to meet corporate environmental goals. Vendors are offering innovative solutions integrating solar and hybrid power systems. This shift is driving a new wave of energy-conscious data center development.

Growing Role of AI and Automation in Edge Data Center Operations

Operators are integrating AI-based monitoring and automation tools to enhance data center management. Intelligent systems predict equipment failures, optimize power usage, and ensure high uptime. It improves reliability, reduces manual intervention, and supports scalable operations. Automation enables predictive maintenance, improving resource allocation and cost control. AI also enhances cybersecurity and intrusion detection capabilities. Integration with IoT systems ensures seamless monitoring of environmental and network parameters. The Nigeria Edge Data Center Market is witnessing a surge in smart operational models. This evolution enhances performance and investor confidence in infrastructure stability.

Expanding Ecosystem of Cloud and Edge Integration Models

Cloud providers are partnering with edge infrastructure developers to deliver hybrid solutions that balance performance and scalability. Enterprises are adopting multi-cloud and edge computing strategies to meet dynamic workload requirements. It provides improved data sovereignty, speed, and application reliability. Integration supports mission-critical applications in healthcare, fintech, and energy sectors. Cloud-edge convergence enables new service models and strengthens the digital economy. Telecom operators are expanding local interconnection hubs to improve network efficiency. This expanding ecosystem is driving new business models and partnerships across industries. It accelerates enterprise modernization strategies.

Market Challenges

Power Supply Instability and High Operational Costs Limiting Edge Infrastructure Expansion

Unstable power supply remains a critical obstacle to scaling distributed infrastructure. Frequent outages increase reliance on costly diesel generators, raising operational costs. It impacts energy efficiency targets and environmental goals for data center operators. High energy costs discourage small and medium businesses from adopting edge solutions. Limited availability of stable renewable power further complicates deployment plans. Infrastructure operators must invest heavily in backup systems to maintain uptime. This increases capital expenditure and delays project timelines. The Nigeria Edge Data Center Market faces sustained pressure to balance reliability and cost efficiency. Addressing these gaps is key to long-term competitiveness.

Regulatory Complexity and Limited Local Skill Base Slowing Growth

Complex licensing processes and inconsistent regulatory enforcement create entry barriers for operators. Lack of clear frameworks for data localization and security compliance causes project delays. Limited skilled workforce in critical areas like power management and network engineering affects deployment quality. It pushes companies to rely on foreign expertise, raising project costs. Regulatory uncertainty discourages some international investors from scaling operations. Security concerns around data protection create compliance challenges. Infrastructure expansion requires closer alignment between private investors and public institutions. This regulatory and skills gap remains a major hurdle to market maturity.

Market Opportunities

Strong Digital Transformation Momentum Creating Investment Opportunities Across Industries

Enterprises in BFSI, telecom, and manufacturing sectors are accelerating digital transformation initiatives. They require robust and distributed infrastructure to meet rising demand for real-time services. It opens opportunities for investors and operators to deliver localized edge solutions. Expansion of fintech, e-commerce, and streaming platforms increases infrastructure needs. Edge facilities can support advanced analytics and AI workloads at lower latency. Strategic investments can target underserved secondary cities with rising data demand. This momentum creates new revenue models and business alliances. The Nigeria Edge Data Center Market is positioned for large-scale investment activity.

Regional Connectivity Expansion and Technology Innovation Boosting Growth Potential

New submarine cables and terrestrial fiber expansions are improving national and regional connectivity. It creates opportunities to build edge hubs that serve local and cross-border traffic. Advanced cooling technologies, modular systems, and renewable integration support scalable infrastructure. International vendors can partner with local operators to expand footprints efficiently. Edge networks can anchor future smart city and IoT ecosystems. Policy support and strategic alliances encourage capital inflow into this sector. The shift toward intelligent, sustainable edge sites enhances investor confidence. This expanding connectivity network supports a competitive and future-ready market environment.

Market Segmentation

By Component

The solution segment dominates the Nigeria Edge Data Center Market, driven by rising adoption of modular edge infrastructure and advanced power management systems. Organizations prioritize integrated solutions to reduce complexity and improve efficiency. The service segment is gaining traction through managed hosting, maintenance, and support services. Demand for value-added services is increasing as enterprises focus on operational continuity. Vendors are expanding service portfolios to capture recurring revenue streams. This segment’s growth is supported by enterprises seeking end-to-end infrastructure solutions.

By Data Center Type

Colocation edge data centers hold the largest share of the Nigeria Edge Data Center Market, supported by strong enterprise demand for flexible and cost-efficient capacity. These facilities allow businesses to scale without heavy capital expenditure. Managed and enterprise data centers are expanding rapidly in urban areas to support digital services. Cloud and edge data centers are attracting new entrants targeting hybrid workloads. Tier III and Tier IV upgrades strengthen infrastructure reliability and uptime guarantees. This segmentation reflects a clear shift toward shared and scalable infrastructure models.

By Deployment Model

The cloud-based segment leads the Nigeria Edge Data Center Market as enterprises shift workloads to distributed cloud environments for agility and cost savings. Hybrid models are expanding due to demand for flexible and secure infrastructure that combines on-premises control with cloud efficiency. On-premises deployments remain relevant for industries requiring strict regulatory compliance. The cloud ecosystem enables rapid scaling for digital services, fintech platforms, and streaming applications. This segment reflects the growing maturity of Nigeria’s digital infrastructure landscape.

By Enterprise Size

Large enterprises dominate the Nigeria Edge Data Center Market due to higher IT spending capacity and advanced digital transformation strategies. These organizations are investing in edge infrastructure to support mission-critical workloads and improve user experience. SMEs are increasingly adopting scalable edge solutions that offer lower entry costs. Managed service providers and modular edge platforms make adoption more accessible for smaller players. This segmentation indicates a broadening customer base across industries of different scales.

By Application / Use Case

Power monitoring and environmental monitoring represent the leading application segments of the Nigeria Edge Data Center Market. Enterprises prioritize these functions to maintain uptime, reduce energy costs, and ensure operational stability. Asset management and capacity management are gaining importance for dynamic infrastructure planning. BI and analysis functions support real-time decision-making and service optimization. This segment reflects the growing focus on energy-efficient and intelligent infrastructure operations.

By End User Industry

The IT and telecommunications segment holds the largest share of the Nigeria Edge Data Center Market due to network expansion and increasing data traffic. BFSI follows with strong demand for low-latency financial transactions and secure hosting environments. Healthcare and retail sectors are growing rapidly with the rise of telemedicine and e-commerce platforms. Energy and utilities are adopting edge infrastructure for smart grid and monitoring solutions. This diverse industry base highlights the expanding scope of edge computing in Nigeria.

Regional Insights

Southwestern Nigeria Leading the Edge Infrastructure Landscape with 58% Share

Southwestern Nigeria leads the Nigeria Edge Data Center Market, holding 58% share, driven by the dominance of Lagos as the country’s digital and financial hub. The region benefits from high fiber penetration, strong enterprise presence, and proximity to international submarine cables. Lagos hosts major colocation and hyperscale edge investments, making it the primary connectivity gateway. Infrastructure upgrades in transport and energy networks further support this leadership. This concentration of investment creates a robust ecosystem for cloud and edge services.

- For instance, Digital Realty officially launched its third data center in Lagos (LKK2) in August 2025, located in Lekki, adding nearly 2 MW of IT capacity and 13,000 ft² of data hall space. The facility connects directly to the 2Africa subsea cable through its LKK1 site, giving access to over 46 landing points across 33 countries. This expansion enhances cloud reliability, accelerates enterprise adoption, and strengthens Lagos’ status as a global interconnection hub.

Southeastern Nigeria Emerging as a Fast-Growing Edge Deployment Zone with 27% Share

Southeastern Nigeria holds a 27% share, supported by the growth of industrial hubs and expanding telecom networks. The region is witnessing rapid investments in regional data hubs to reduce latency and improve service reliability. Port Harcourt and Enugu are becoming strategic nodes for enterprise connectivity. This expansion is driven by demand from energy, retail, and logistics sectors. Strong infrastructure corridors support integration with national and international networks. This region is positioning itself as a secondary investment hotspot.

- For instance, Equinix announced in April 2025 an investment of $140 million to expand its Nigerian operations, which includes construction of PR1 — its first Port Harcourt data center. The PR1 facility will host Meta’s 2Africa submarine cable landing and significantly boost regional bandwidth, aiming to balance Nigeria’s coastal and inland connectivity disparity. The company will also scale its LG3 Lagos site to meet growing enterprise cloud demand.

Northern Nigeria Gaining Traction with Strategic Expansion and 15% Market Share

Northern Nigeria holds 15% share, supported by growing interest in expanding infrastructure to underserved markets. Urban centers like Abuja are attracting new deployments to support government digitalization initiatives. Limited existing infrastructure creates opportunities for first movers and investors. The focus is on modular and renewable-powered edge facilities to overcome grid limitations. Strategic initiatives aim to strengthen regional connectivity and close digital gaps. The region shows strong growth potential for long-term infrastructure development.

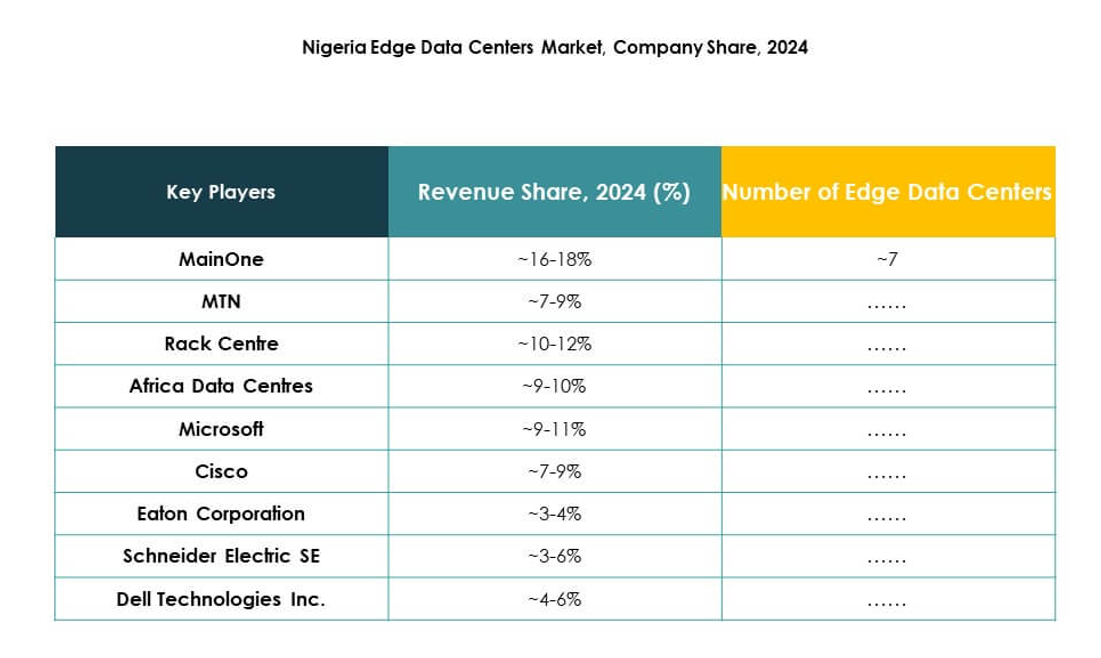

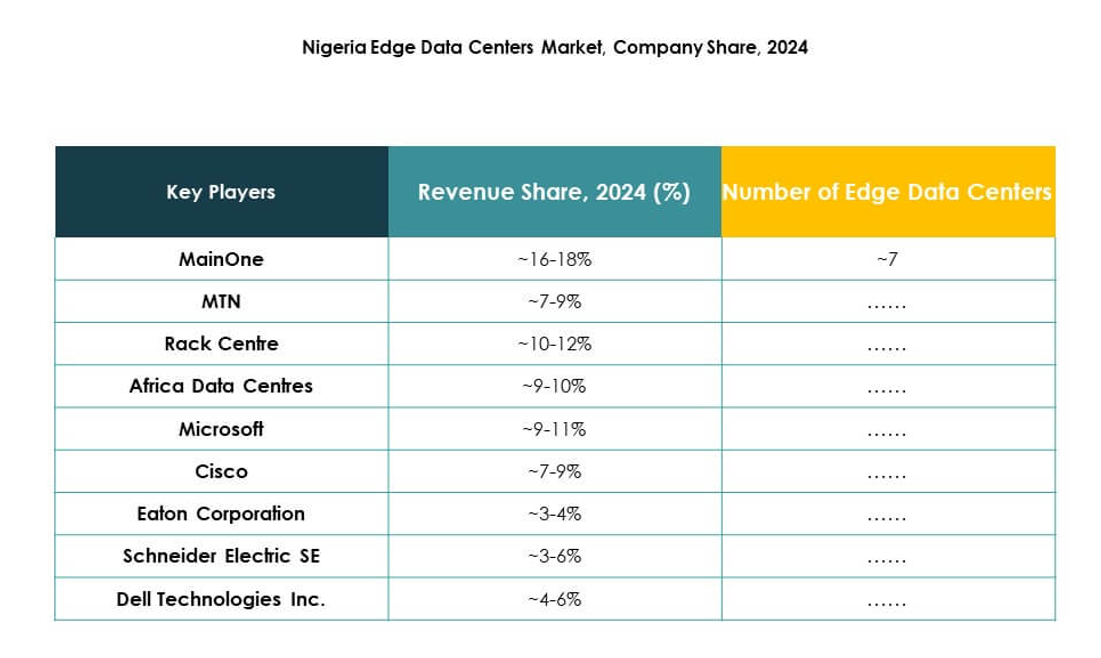

Competitive Insights:

- MainOne

- MTN

- Rack Centre

- Africa Data Centres

- EdgeConneX

- Eaton Corporation

- Dell Technologies Inc.

- Fujitsu

- Cisco

- SixSq

- Microsoft

- VMware

- Schneider Electric SE

- Rittal GmbH & Co. Kg

The Nigeria Edge Data Center Market features a competitive landscape shaped by regional operators and global technology providers. Local players such as MainOne, MTN, and Rack Centre focus on expanding edge capacity, enhancing network resilience, and improving colocation services. Global firms like Microsoft, Dell, and Cisco strengthen the market through advanced computing, power management, and cloud-edge integration solutions. It reflects a balanced structure where local firms provide geographic reach and global firms bring technology leadership. Strategic alliances, hybrid infrastructure deployments, and renewable energy integration are key competitive themes. Companies emphasize modular design, energy efficiency, and scalability to secure market share and meet growing enterprise demand. This blend of regional strength and international innovation defines the industry’s competitive edge.

Recent Developments:

- In August 2025, Digital Realty expanded its footprint in Nigeria by launching a new 2 MW data centre in Lagos. This move strengthens the company’s presence in West Africa, advancing its mission to deliver scalable colocation and interconnection services. The Lagos facility is part of Digital Realty’s strategy to address growing demand for localized data hosting driven by Nigeria’s accelerating digital transformation.

- In July 2025, MTN Nigeria made headlines by launching the first phase of its 9 MW Sifiso Dabengwa Data Centre in Lagos. This new facility, inaugurated on July 1, 2025, represents West Africa’s largest Tier III data centre. The first phase of the project provides 4.5 MW of IT load capacity across 780 racks, and MTN plans to expand up to 20 MW in subsequent phases. Valued at approximately $235 million, the centre is equipped with advanced modular cooling and power systems and integrates local cloud infrastructure worth $20 million.

- In May 2025, Rack Centre, backed by Jagal and Actis, commenced expansion of its Lagos facility to add an additional 12MW IT load, transforming it into sub-Saharan Africa’s largest data center. This expansion aims to meet Nigeria’s growing demand for cloud services and enterprise data hosting across sectors like finance, oil and gas, and public services.