Executive summary:

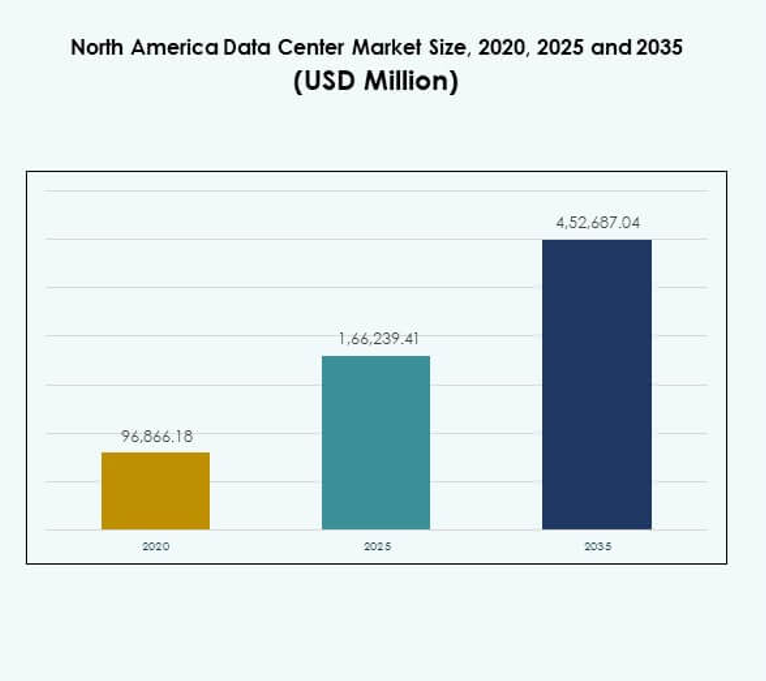

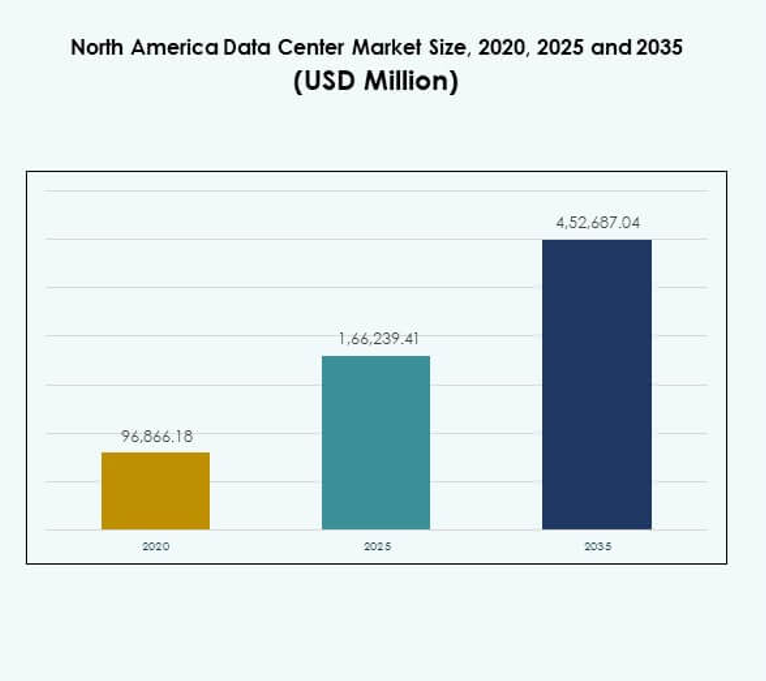

The North America Data Center Market size was valued at USD 96,866.18 million in 2020 to USD 1,66,239.41 million in 2025 and is anticipated to reach USD 4,52,687.04 million by 2035, at a CAGR of 10.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| North America Data Center Market Size 2025 |

USD 1,66,239.41 Million |

| North America Data Center Market, CAGR |

10.48% |

| North America Data Center Market Size 2035 |

USD 4,52,687.04 Million |

The market is driven by rapid adoption of cloud computing, digital transformation, and growing demand for data-intensive applications. Enterprises are investing in advanced IT infrastructure, including AI, edge computing, and automation, to optimize operations. The integration of energy-efficient cooling systems and modular designs highlights industry innovation. For businesses and investors, the market holds strategic importance due to its role in enabling secure, scalable, and resilient digital ecosystems across sectors.

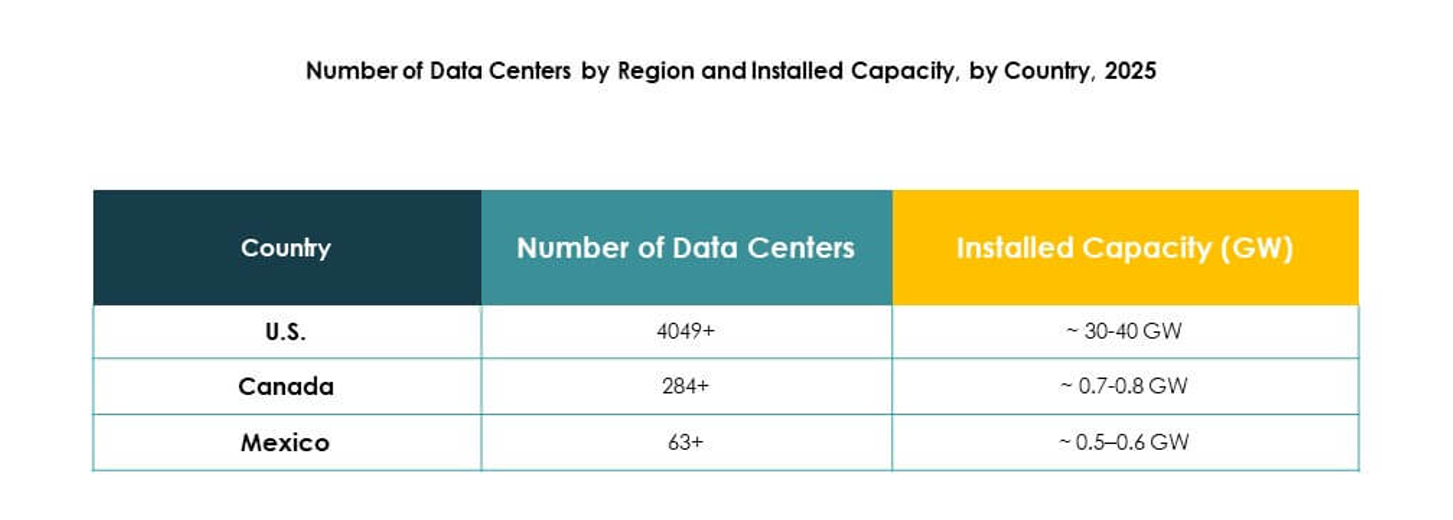

The U.S. dominates the regional landscape due to strong hyperscale and cloud service provider presence, followed by Canada with rising investments in colocation and edge facilities. Mexico is emerging as a high-growth market driven by digital infrastructure expansion and increasing enterprise adoption of cloud solutions. Together, these countries create a balanced ecosystem, with the U.S. leading in maturity while Canada and Mexico foster promising opportunities for future data center growth.

Market Drivers

Rapid Growth of Cloud Computing and Digital Transformation Driving Infrastructure Investments

The North America Data Center Market benefits from the strong momentum in cloud adoption and enterprise digitalization. Companies across industries shift workloads to cloud environments to achieve scalability and efficiency. Investments in hyperscale facilities support rising data traffic and complex applications. The demand for agile platforms enhances infrastructure spending by both enterprises and cloud service providers. It encourages partnerships between technology firms and data center operators. Organizations seek lower latency and higher computing performance. Enterprises prioritize hybrid models that integrate on-premises with cloud-based solutions.

- For instance, Microsoft announced a $1.1 billion data center project in West Des Moines, Iowa, in 2014, spanning about 154 acres with plans for over 1.2 million square feet of facility space to expand its cloud infrastructure.

Integration of Artificial Intelligence and High-Performance Computing Enhancing Operational Efficiency

Artificial intelligence, automation, and high-performance computing reshape operational frameworks in the North America Data Center Market. AI-enabled systems monitor power usage, cooling, and workload distribution. It improves efficiency and reduces downtime risks. High-performance computing supports data-heavy applications in research, healthcare, and financial services. Enterprises invest in smarter management platforms to increase resilience and service quality. Vendors focus on AI-driven predictive maintenance and workload balancing. Companies benefit from optimized resource allocation and reduced operational expenses. Growing reliance on advanced technologies attracts investor interest in the sector.

- For instance, in 2025, Google announced a $7 billion investment in Iowa to expand its cloud and AI infrastructure, including developments at its Council Bluffs facility and training more than 700 apprentices by 2030.

Sustainability and Energy Efficiency Emerging as Strategic Business Priorities

Sustainability initiatives and energy-efficient infrastructure transform the North America Data Center Market. Organizations adopt renewable energy sources and advanced cooling techniques to reduce emissions. It positions data centers as leaders in meeting corporate social responsibility goals. Power usage effectiveness metrics drive innovation in green design. Enterprises align operations with government climate policies and carbon-neutral targets. Vendors launch modular, eco-friendly facilities with scalable energy-saving solutions. Investors recognize sustainability as a factor influencing long-term profitability. Environmental certifications increase market credibility and brand value. Companies view energy efficiency as both a cost advantage and reputational driver.

Strategic Role of Data Centers in Enabling Enterprise Competitiveness and Investor Confidence

The North America Data Center Market establishes its importance as a backbone of digital economies. Enterprises rely on secure, scalable, and high-performance infrastructure to remain competitive. It supports e-commerce, digital banking, telemedicine, and media streaming growth. Businesses adopt colocation and cloud services to reduce capital expenditure burdens. Investors identify stable returns through long-term contracts with hyperscale and colocation providers. Market maturity encourages strategic mergers and expansions. Vendors innovate to deliver differentiated services and retain clients. The sector strengthens resilience in an increasingly digital business environment.

Market Trends

Expansion of Edge Data Centers to Support Low-Latency Applications Across Industries

Edge computing emerges as a critical trend in the North America Data Center Market. Companies deploy micro and modular facilities closer to end-users. It reduces latency for applications such as IoT, autonomous systems, and real-time analytics. Enterprises gain faster response times and improved customer experiences. Telecom operators integrate edge infrastructure with 5G networks. Colocation providers invest in regional expansion to meet edge demand. The shift broadens opportunities across tier-two and tier-three cities. The trend strengthens the role of data centers in enabling next-generation digital services.

Rising Adoption of Modular Designs Offering Scalability and Faster Deployment

Modular data centers gain traction in the North America Data Center Market due to flexible deployment needs. Enterprises prefer prefabricated and containerized solutions that reduce construction time. It enables scalability aligned with workload growth. Vendors design facilities with plug-and-play features for rapid integration. The approach improves energy efficiency and reduces upfront capital investment. Colocation providers use modular structures to expand regional footprints quickly. Industries adopt modular systems to handle fluctuating demand with minimal disruption. The trend appeals to organizations prioritizing cost efficiency and adaptability.

Growing Role of Quantum Computing and Advanced Architectures in Market Evolution

Quantum computing and advanced architectures begin shaping the North America Data Center Market. Research institutions and technology leaders experiment with quantum readiness infrastructure. It supports scientific simulations, cryptography, and complex analytics. Vendors adapt infrastructure designs to accommodate high-density workloads. Enterprises anticipate integration of quantum technology within existing hybrid ecosystems. Service providers explore partnerships with quantum-focused startups. Investors see long-term value in markets preparing for advanced computing. The trend positions the region as a leader in next-generation computational capabilities.

Automation and Orchestration Tools Increasing Operational Control and Resilience

Automation tools become integral in the North America Data Center Market for enhancing resilience. Enterprises adopt orchestration platforms for workload management and predictive insights. It improves operational control, reducing downtime and human error. AI-driven automation enhances resource utilization and energy performance. Managed service providers integrate AIOps for continuous optimization. Automation supports the scale of hyperscale facilities managing global traffic. Vendors emphasize intelligent platforms to deliver seamless client experiences. The trend elevates operational standards while ensuring reliable service delivery.

Market Challenges

High Energy Consumption and Rising Operational Costs Creating Pressure on Profitability

The North America Data Center Market faces significant challenges in managing energy consumption. Facilities require continuous power to support servers, cooling systems, and high-density workloads. It raises operational costs and strains profit margins. Energy efficiency improvements demand large-scale investments in renewable integration and innovative cooling systems. Small and medium enterprises struggle with high cost structures. Regulatory pressures for sustainability add complexity. Providers must balance performance demands with environmental commitments. The challenge intensifies competition between established players and emerging entrants.

Regulatory Complexity and Supply Chain Constraints Limiting Market Agility

The North America Data Center Market encounters hurdles in navigating regulatory landscapes. Compliance with data privacy, cross-border regulations, and cybersecurity requirements increases complexity. It slows expansion for multinational operators. Supply chain disruptions in equipment, semiconductors, and construction materials delay project timelines. Rising demand for specialized components creates procurement bottlenecks. Vendors must address risks linked to construction delays and cost overruns. Regulatory uncertainty complicates investment planning. The market requires coordinated approaches to manage compliance while ensuring timely facility delivery.

Market Opportunities

Expansion of Hyperscale and Cloud Facilities Offering Strategic Growth Avenues

Hyperscale and cloud expansions open new opportunities in the North America Data Center Market. Enterprises migrate workloads to scalable environments that support digital transformation. It fuels demand for new construction projects and upgrades of existing facilities. Vendors capture growth through long-term partnerships with hyperscale clients. Cloud adoption across sectors drives colocation and managed services demand. Investors benefit from predictable cash flows through multi-year contracts. The opportunity enhances resilience and growth in the sector.

Adoption of AI, IoT, and Industry-Specific Applications Driving Market Differentiation

The North America Data Center Market gains opportunities through adoption of AI, IoT, and specialized applications. Enterprises implement AI-driven insights and IoT-enabled operations to enhance efficiency. It strengthens demand for advanced infrastructure with low latency and high availability. Vendors differentiate by delivering tailored solutions for industries such as healthcare, BFSI, and manufacturing. The trend creates room for competitive advantage. Investors track companies innovating with industry-focused service portfolios. These opportunities reinforce long-term stability and profitability.

Market Segmentation

By Component

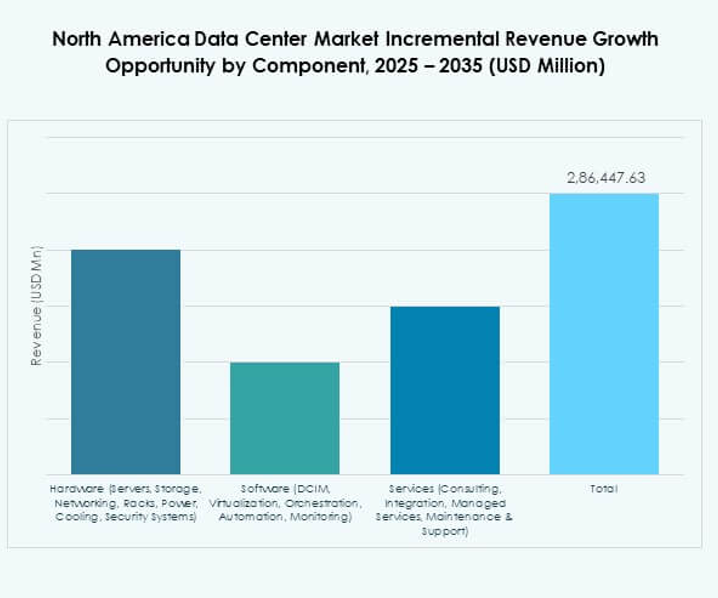

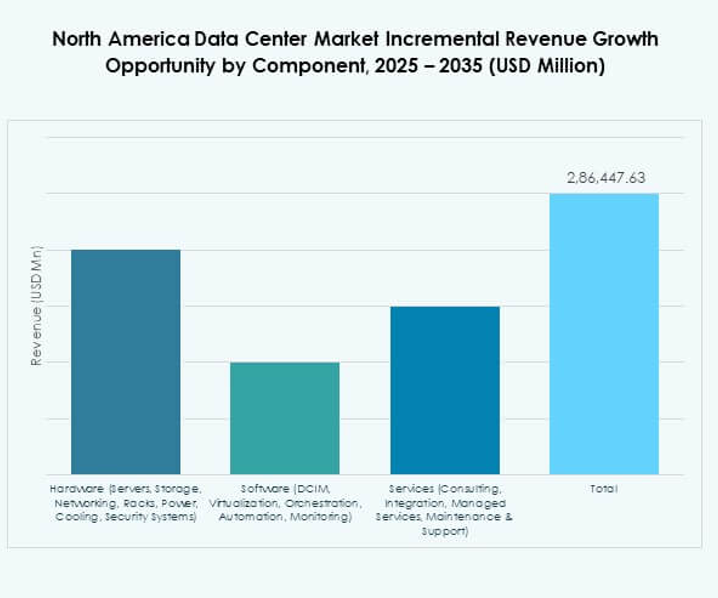

Hardware dominates the North America Data Center Market with 52% share in 2024. Servers, storage, and networking remain essential to handle rising volumes of AI, IoT, and big data applications. Cooling and power systems also attract investments as operators prioritize energy efficiency. Software segments such as DCIM, orchestration, and automation are growing steadily, enabling smarter monitoring and predictive management. Services including consulting and managed services contribute to long-term adoption. Hardware continues to lead due to its irreplaceable role in building resilient infrastructure.

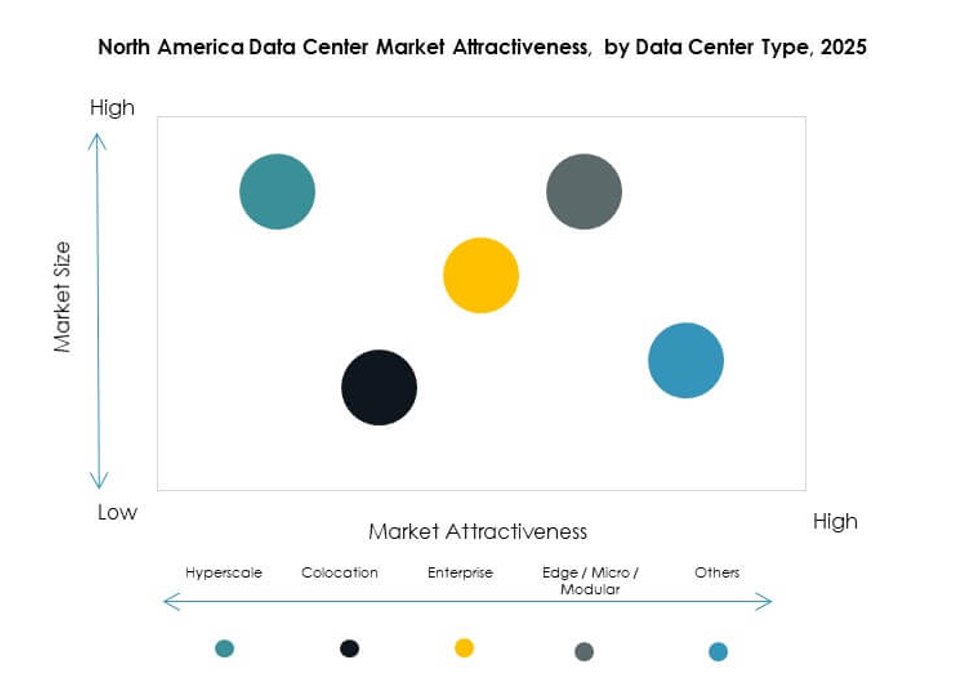

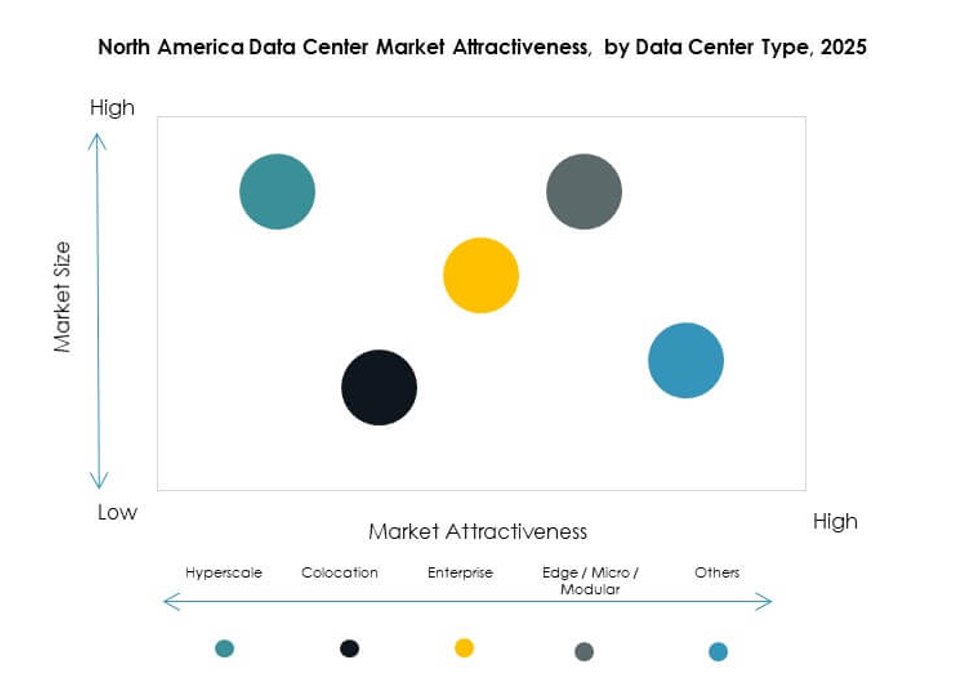

By Data Center Type

Hyperscale facilities lead the North America Data Center Market with more than 40% share in 2024. Cloud giants like AWS, Microsoft Azure, and Google Cloud drive demand for hyperscale infrastructure. Colocation centers follow closely, serving enterprises seeking cost savings and scalability. Edge and modular data centers record rapid growth, supporting low-latency applications in 5G and IoT. Mega data centers remain important for large-scale global connectivity, while enterprise centers cater to private workloads. Cloud and internet data centers align with the region’s hybrid IT adoption trend.

By Deployment Model

Cloud-based deployments account for 48% share of the North America Data Center Market in 2024. Enterprises accelerate workload migration to the cloud for flexibility and cost efficiency. Hybrid deployment models gain traction as businesses balance data security with scalability. On-premises deployments continue in industries with compliance-heavy requirements but show slower growth. Cloud adoption is propelled by AI, analytics, and SaaS expansion. Managed services within cloud frameworks improve resilience and performance. Cloud-based models remain the preferred choice for enterprises seeking digital transformation.

By Enterprise Size

Large enterprises dominate the North America Data Center Market with 67% share in 2024. They lead due to higher capital capacity, global operations, and continuous investment in advanced IT ecosystems. Their reliance on hyperscale and colocation infrastructure drives large-scale expansions. SMEs show steady growth by adopting cloud services and colocation models for cost efficiency. Increasing digital-first business models and cybersecurity needs push SMEs toward scalable infrastructures. Large enterprises remain at the forefront, but SMEs expand opportunities for providers targeting flexible deployments.

By Application / Use Case

IT & telecom holds 31% share of the North America Data Center Market in 2024, making it the largest segment. Telecom operators deploy infrastructure to enable 5G networks, IoT solutions, and AI platforms. BFSI ranks second, relying on secure and compliant facilities for financial data. Healthcare expands rapidly with telemedicine and electronic health records. Retail and e-commerce adopt scalable infrastructure to meet online demand surges. Media, entertainment, manufacturing, and government sectors also drive investments. Diverse application needs reinforce the sector’s resilience and growth potential.

By End User Industry

Cloud service providers dominate the North America Data Center Market with 38% share in 2024. Hyperscale players expand capacity to serve digital services across industries. Enterprises remain strong users of hybrid and colocation infrastructure. Colocation providers attract mid-sized firms looking to reduce CapEx burdens. Government agencies invest in secure data centers to strengthen national and state-level operations. Other sectors, including education and utilities, contribute to incremental demand. The growing dominance of cloud service providers reflects their pivotal role in shaping future market strategies.

Regional Insights

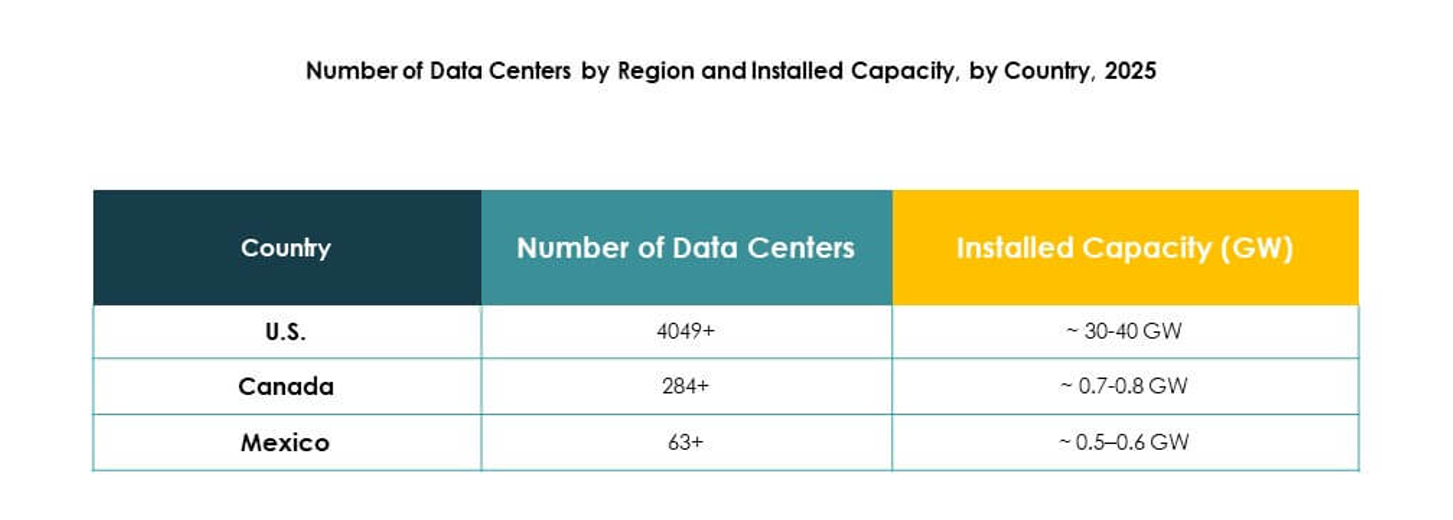

United States

The United States leads the North America Data Center Market with 72% share in 2024. It benefits from hyperscale dominance, cloud provider expansions, and a mature technological ecosystem. AWS, Microsoft, and Google anchor investments in high-density data centers. Growing AI, SaaS, and streaming services strengthen local demand. Renewable energy integration and sustainability regulations accelerate green facility development. It remains the central hub driving technological and operational maturity across the continent.

- For instance, in September 2025, Microsoft confirmed a $3.3 billion AI data center project in Mount Pleasant, Wisconsin, designed to house hundreds of thousands of NVIDIA GPUs and expected to deliver up to ten times the performance of today’s fastest supercomputers.

Canada

Canada holds 18% share of the North America Data Center Market in 2024. It gains traction from data sovereignty rules, cloud adoption, and renewable energy availability. Toronto, Montreal, and Vancouver serve as major hubs for hyperscale and colocation expansion. Colocation services rise in popularity as enterprises shift to flexible digital infrastructure. Investments in modular facilities improve regional accessibility. It positions Canada as a sustainable and strategically important extension of the U.S. market.

Mexico

Mexico accounts for 10% share of the North America Data Center Market in 2024. Growing telecom infrastructure, digital adoption, and cross-border investments strengthen its role. Querétaro and Monterrey attract major operators building new hyperscale and edge facilities. Enterprises in BFSI, retail, and manufacturing accelerate demand for colocation and cloud services. Proximity to the U.S. makes it attractive for cross-border data management. It continues to evolve as an emerging hub balancing growth in North America’s digital landscape.

- For example, in 2023, KIO Networks announced plans to invest US $400 million in its third data center campus in Querétaro, aiming to double its total Mexican capacity by 2025 by interconnecting it with two existing facilities.

Competitive Insights:

- Equinix, Inc.

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- CyrusOne Inc.

- Digital Realty

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

- Hewlett Packard Enterprise (HPE)

- Iron Mountain Data Centers

The North America Data Center Market is highly competitive with strong participation from hyperscale providers, colocation leaders, and technology vendors. It demonstrates significant consolidation through mergers, acquisitions, and partnerships aimed at expanding capacity and geographic presence. Equinix and Digital Realty maintain dominance in colocation and interconnection services. AWS, Microsoft, and Google lead hyperscale growth, driving cloud adoption across industries. HPE and NTT focus on hybrid infrastructure solutions, while Iron Mountain differentiates through secure and sustainable operations. The market emphasizes energy efficiency, edge integration, and AI-driven automation, creating an environment where innovation and operational scale determine competitive positioning.

Recent Developments:

- In September 2025, Equinix unveiled its new distributed AI infrastructure platform across 270 sites, introducing a dedicated AI-ready backbone and Fabric Intelligence to support advanced workloads, with launches planned for Q1 2026. This major initiative is designed to accelerate enterprise adoption of AI and enhance digital infrastructure capabilities across North America.

- In August 2025, Digital Realty partnered with Vultr to deliver global AI infrastructure for businesses, expanding the integration of AI compute and connectivity across its data centers. Furthermore, in July 2025, Digital Realty collaborated with Oracle, leveraging Oracle Solution Centers to help organizations accelerate hybrid IT and AI adoption directly within Digital Realty’s data center ecosystem.

- In May 2025, Novva Data Centers launched Project Borealis, a major new data center campus in Mesa, Arizona, consisting of five facilities totaling 300 MW of capacity, with the first 96 MW phase set to go live by the end of 2026.

- In January 2025, Blue Owl Capital completed the acquisition of IPI Partners’ investment management business for about $1 billion, thereby adding over $10 billion in digital infrastructure assets to its portfolio, strengthening its presence in the North America data center market