Executive summary:

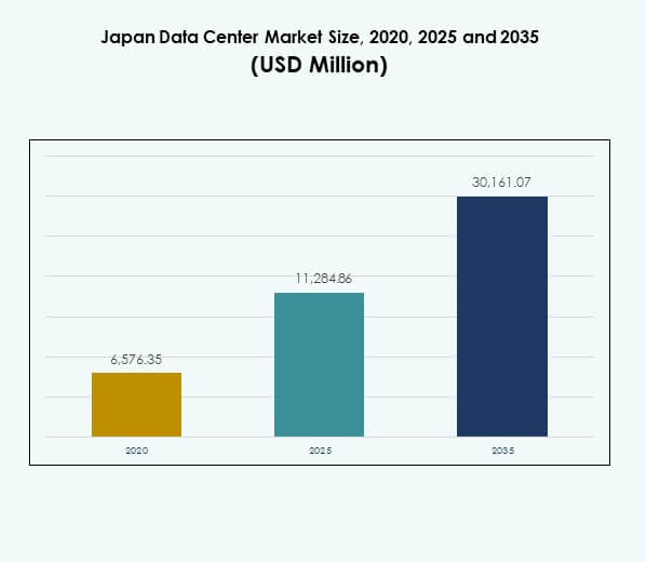

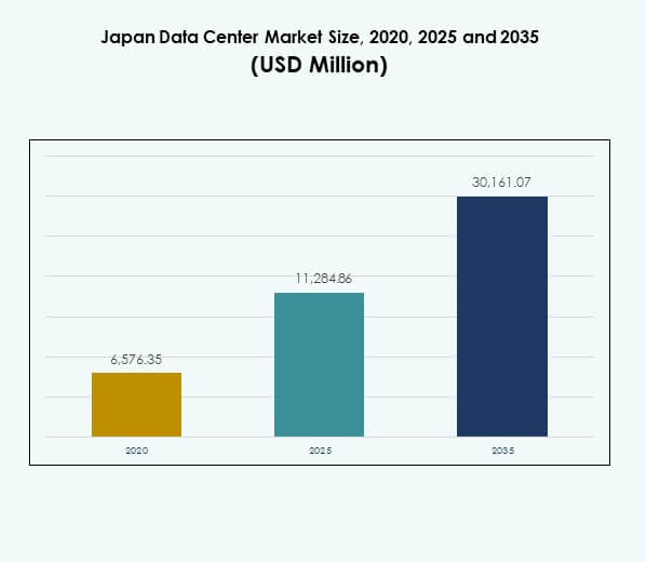

The Japan Data Center Market size was valued at USD 6,576.35 million in 2020 to USD 11,284.86 million in 2025 and is anticipated to reach USD 30,161.07 million by 2035, at a CAGR of 10.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Japan Data Center Market Size 2025 |

USD 11,284.86 Million |

| Japan Data Center Market, CAGR |

10.26% |

| Japan Data Center Market Size 2035 |

USD 30,161.07 Million |

Growth in the Japan Data Center Market is driven by increasing adoption of cloud services, artificial intelligence, and IoT solutions. Enterprises are shifting toward hybrid and multi-cloud models to improve scalability, resilience, and operational efficiency. Innovation in automation, virtualization, and energy-efficient infrastructure is strengthening digital competitiveness. The market holds strategic importance for global providers and domestic enterprises as it supports business continuity, compliance, and long-term digital transformation strategies.

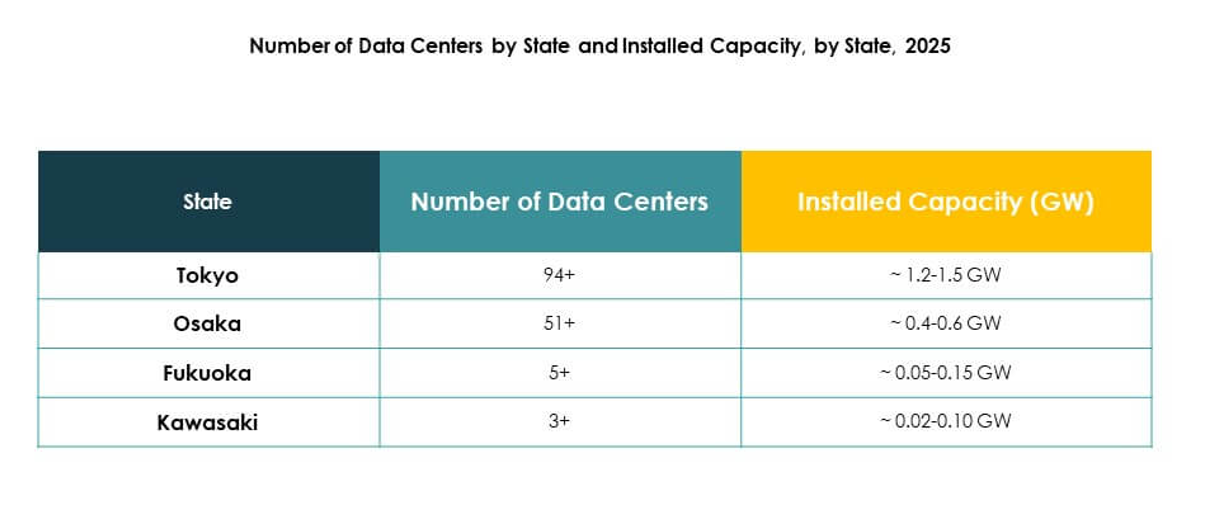

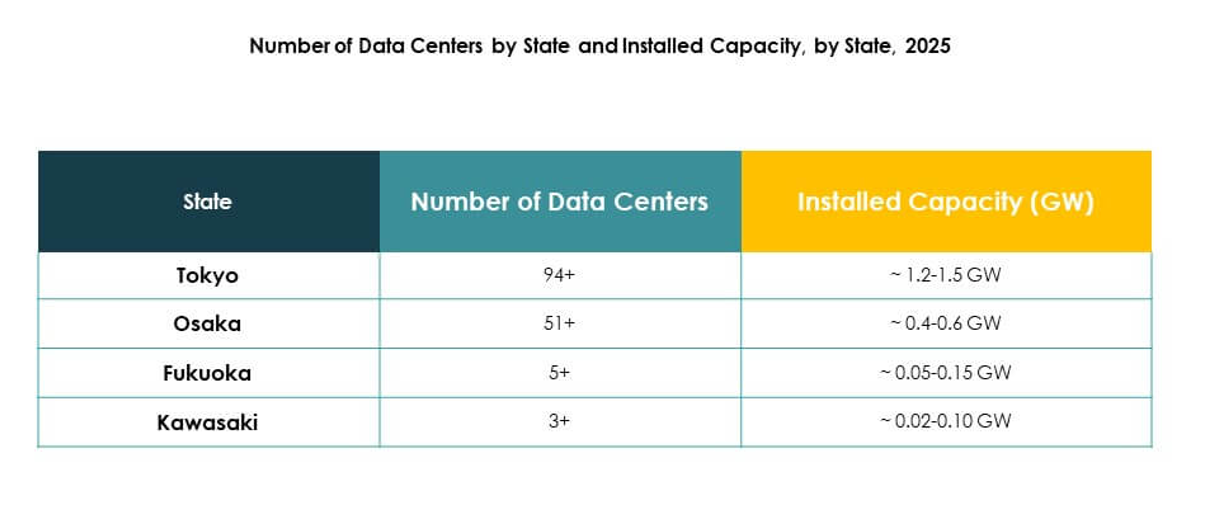

Tokyo leads the Japan Data Center Market due to its concentration of enterprises, financial institutions, and connectivity hubs. Osaka follows as an important secondary hub, supporting disaster recovery and expanding hyperscale investments. Emerging regions like Fukuoka and Sapporo are attracting attention for edge deployments that meet localized demand. These regional dynamics ensure balanced growth, resilience, and broader national coverage for future digital infrastructure.

Market Drivers

Rapid Digital Transformation and Expansion of Cloud Ecosystems

The Japan Data Center Market is driven by accelerating digital transformation and rising cloud adoption. Enterprises across banking, telecom, and manufacturing sectors are migrating workloads to hybrid and multi-cloud models. It strengthens resilience, scalability, and operational efficiency for enterprises and service providers. Businesses benefit from cost-effective IT management and faster innovation cycles. The shift reflects a growing need to manage big data, AI, and IoT-driven applications. Data-intensive workloads demand robust and scalable infrastructure. Strategic partnerships with global cloud leaders boost Japan’s ecosystem. This creates steady demand for hyperscale and enterprise data center expansion.

- For instance, Equinix opened its fifteenth Tokyo data center, TY15, in Q4 2024, providing 1,200 new cabinets with direct fiber connectivity to the existing TY2 campus, addressing growing cloud and network service demand and strengthening Tokyo’s leadership in Asia-Pacific interconnection growth projected at 1,758 Tbps by 2025.

Adoption of Emerging Technologies and AI Integration Across Industries

Artificial intelligence, automation, and IoT adoption fuel strong infrastructure requirements. Industries deploy AI-enabled analytics for healthcare, finance, and telecom. It raises computing intensity and requires low-latency environments for mission-critical operations. Japan’s enterprises adopt 5G-enabled applications and machine learning solutions that expand bandwidth needs. This boosts investments in high-performance computing, advanced storage, and smart monitoring systems. Technology shifts highlight the importance of scalable, energy-efficient facilities. Strong innovation policies encourage private sector investments. The expansion of AI-driven workloads creates long-term strategic opportunities for both investors and enterprises.

Government Policies and Regulations Driving Data Sovereignty

Japan enforces strict compliance and data sovereignty rules, supporting domestic data hosting demand. Enterprises prefer local data centers for security, transparency, and legal compliance. It strengthens trust in local providers and reduces risks from cross-border regulations. Government-led digital transformation initiatives in healthcare, defense, and administration create long-term infrastructure demand. Policies encourage colocation and sovereign cloud investments. Enterprises view local compliance as a competitive advantage for sensitive industries. These frameworks improve investor confidence and attract global providers to build localized hubs. Public-private collaboration reinforces infrastructure expansion across strategic locations.

Sustainability Mandates and Energy-Efficient Infrastructure Development

Environmental regulations and corporate sustainability goals shape Japan’s infrastructure. Operators invest in renewable-powered facilities to reduce carbon footprints. It aligns with national energy policies and sustainability frameworks. Data centers deploy green cooling technologies, smart power systems, and waste heat reuse projects. Hyperscale providers highlight sustainability credentials to attract eco-conscious enterprises. Japan’s focus on carbon neutrality drives innovation in low-emission operations. Efficiency metrics like PUE improvement enhance cost savings. Sustainability commitments create competitive differentiation and strengthen investor interest in eco-aligned infrastructure.

- For instance, in 2024, Digital Realty matched 185 global data centers including its facilities in Japan to 100% renewable energy, reached 1.5 GW of renewable energy capacity under contract, achieved 75% renewable electricity globally, and introduced hydrotreated vegetable oil (HVO 100) for backup diesel at 30 sites, demonstrating industry-leading benchmarks in sustainable operations.

Market Trends

Edge Deployments and Distributed Infrastructure to Support 5G Ecosystem

Edge computing is rising as 5G networks expand nationwide. The Japan Data Center Market benefits from low-latency demand in gaming, automotive, and IoT. Enterprises need edge hubs near urban and industrial zones. It enhances application responsiveness and reduces data transfer costs. Telecom operators lead investments in distributed infrastructure aligned with 5G rollouts. Edge facilities improve efficiency in connected devices and AR/VR applications. Distributed networks support autonomous systems, healthcare telemedicine, and smart city platforms. This creates long-term opportunities for modular and micro data centers.

Rising Investment in Hyperscale Expansion by Global Providers

Hyperscale providers continue to invest heavily in the Japanese market. Cloud leaders expand Tokyo and Osaka hubs with scalable, energy-efficient facilities. It reflects demand for AI-driven workloads and multinational enterprise adoption. Hyperscale data centers provide global connectivity and high-density computing. Large-scale investments improve competitiveness and attract multinational corporations. The rise of hybrid and cloud-native applications strengthens demand for hyperscale ecosystems. Investors view hyperscale expansions as reliable long-term revenue streams. The segment remains central to global digital strategies.

Integration of Smart Monitoring and Automation for Operational Efficiency

Automation is reshaping operational strategies in data centers. The Japan Data Center Market adopts DCIM, AI-driven orchestration, and predictive monitoring tools. It improves uptime, enhances cost control, and optimizes resource use. AI-enabled management systems predict failures and reduce downtime. Automation supports sustainability by optimizing cooling and energy flows. Enterprises use orchestration tools for workload balancing across hybrid environments. It strengthens infrastructure resilience and agility. Smart operations deliver scalability and align with evolving digital priorities.

Expansion of Colocation and Interconnection Services for Enterprises

Colocation services gain momentum across mid-sized enterprises. Businesses prioritize secure and flexible data management through shared facilities. It lowers capital expenditure and enhances connectivity. Colocation hubs provide interconnection opportunities with telecom and cloud networks. Providers enhance their service portfolios with managed services and direct cloud on-ramps. Growing enterprise reliance on multi-cloud strategies fuels colocation adoption. Interconnection ecosystems support faster collaboration and low-latency business applications. This trend reinforces Japan’s position as a critical enterprise hub.

Market Challenges

Rising Energy Costs and Infrastructure Sustainability Constraints

High energy costs challenge operators in the Japan Data Center Market. Power-intensive infrastructure increases operational expenses and impacts profitability. It pressures providers to adopt renewable sources and advanced cooling. Urban centers face limited space for new large-scale facilities. Balancing power supply with sustainability requirements creates ongoing challenges. Operators face regulatory scrutiny on carbon emissions. It limits flexibility and raises compliance costs. Rising demand for energy-efficient technologies is critical to maintain long-term competitiveness and attract eco-conscious clients.

Talent Shortages and Increasing Cybersecurity Demands

Skilled workforce shortages affect infrastructure deployment and operations. Advanced systems require expertise in AI, automation, and cybersecurity. It limits scalability and delays expansion projects. Rising cyber threats add complexity, requiring stronger defenses and monitoring. Enterprises face increasing pressure to safeguard sensitive information. The Japan Data Center Market faces higher investment needs in cybersecurity frameworks. It drives costs and requires strong partnerships with security vendors. Talent gaps and cyber risks remain significant hurdles for long-term sustainability.

Market Opportunities

Expansion of AI, IoT, and High-Performance Workloads Creating Growth Potential

The Japan Data Center Market presents growth opportunities in AI, IoT, and HPC-driven workloads. It benefits enterprises seeking low-latency infrastructure for mission-critical operations. AI adoption in healthcare, manufacturing, and financial services drives demand for scalable facilities. IoT devices create exponential data traffic across connected ecosystems. Investments in HPC and edge enhance national competitiveness. Global players expand partnerships with Japanese firms to capture these opportunities. Enterprises and investors gain long-term strategic returns by aligning with this growth trajectory.

Colocation and Green Infrastructure Adoption Strengthening Market Attractiveness

Colocation providers expand services with hybrid connectivity and security features. Enterprises value cost savings and direct cloud on-ramps. It supports SMEs aiming for scalable IT management. Green data centers powered by renewable energy enhance investor appeal. Operators align infrastructure with sustainability goals. This creates differentiation in a competitive landscape. Enterprises prefer eco-aligned facilities for compliance and brand reputation. These opportunities reinforce Japan’s role in global data infrastructure.

Market Segmentation

Market Segmentation

By Component

Hardware dominates the Japan Data Center Market due to strong demand for servers, networking, and power systems. Enterprises invest in cooling and security solutions to maintain uptime and efficiency. Software adoption grows with DCIM, virtualization, and monitoring tools supporting automation. Services expand rapidly with consulting, managed services, and integration playing vital roles. Growth in hardware remains steady, but services represent recurring revenue streams. Software innovation enhances real-time insights and operational optimization. Together, these segments define a balanced growth landscape.

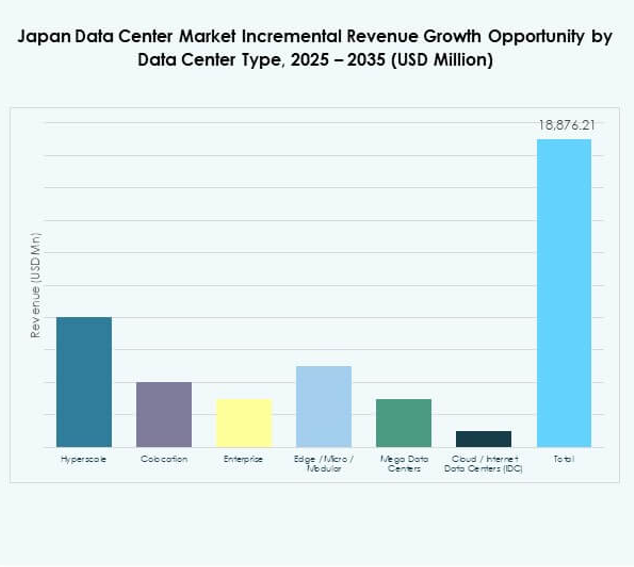

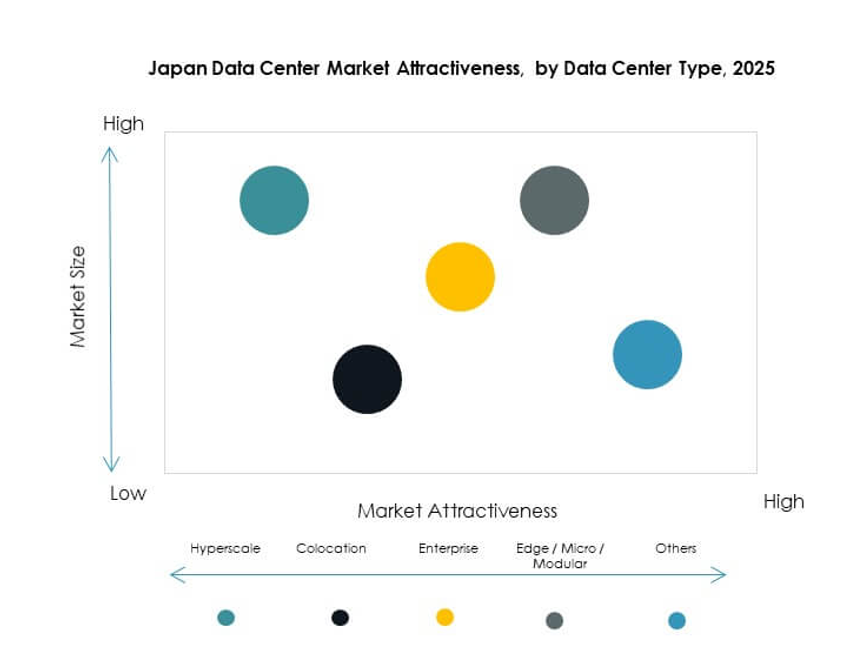

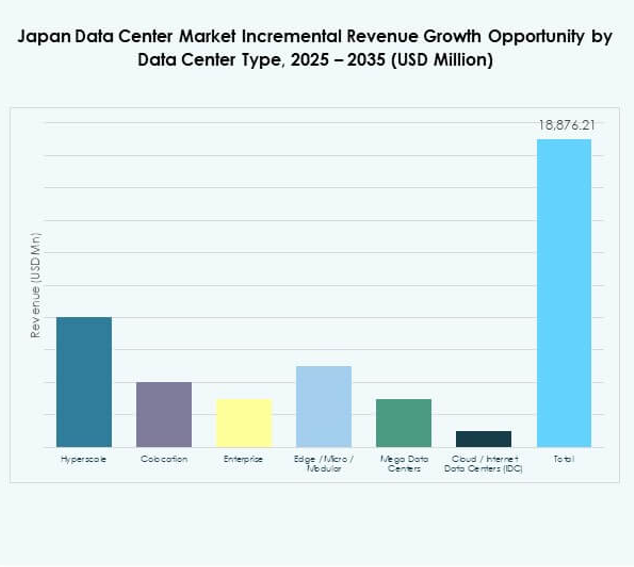

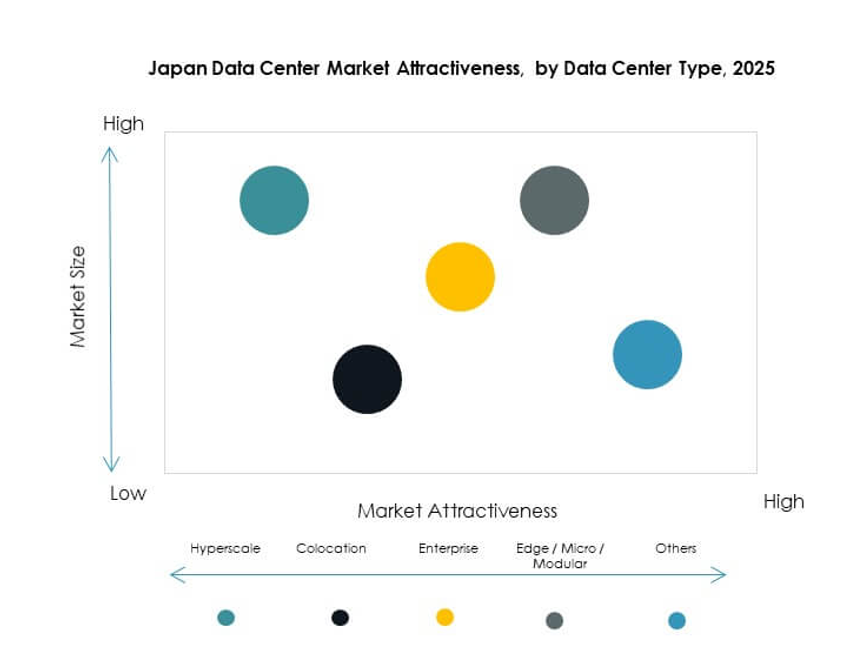

By Data Center Type

Hyperscale facilities hold a leading position due to global cloud provider investments. Colocation data centers serve mid-sized enterprises with flexibility and cost savings. Enterprise data centers support critical workloads requiring in-house control. Edge and modular solutions gain traction for 5G and IoT applications. Mega data centers expand capacity in Tokyo and Osaka. Cloud and Internet Data Centers support multinational cloud adoption. The Japan Data Center Market sees hyperscale growth as dominant, while edge and modular deployments emerge as future accelerators.

By Deployment Model

Hybrid models dominate due to flexibility and balance between security and scalability. Cloud-based deployment gains momentum with SMEs and startups. On-premises models remain relevant in industries requiring data sovereignty. Enterprises increasingly integrate hybrid setups for seamless workload management. Cloud platforms provide elasticity, while hybrid ensures control and compliance. On-premises systems support critical workloads in government and defense. The Japan Data Center Market highlights hybrid adoption as the most strategic model. It aligns with evolving enterprise IT transformation.

By Enterprise Size

Large enterprises dominate demand due to complex IT needs and global operations. They drive adoption of colocation, hybrid, and hyperscale facilities. SMEs expand rapidly by leveraging cloud-based and colocation services. It enables cost savings and operational agility. SMEs contribute significantly to edge computing adoption. Large enterprises shape demand in AI and big data workloads. SMEs fuel growth in cloud-native applications. Both segments complement each other, strengthening long-term industry stability.

By Application / Use Case

IT and telecom lead applications due to strong digital infrastructure reliance. BFSI follows with high security and compliance needs. Government and defense prioritize sovereignty and resilience in operations. Healthcare leverages data centers for digital records and AI-driven diagnostics. Retail and e-commerce demand scalable systems for online platforms. Media and entertainment drive traffic from streaming and gaming. Manufacturing integrates IoT and automation. The Japan Data Center Market sees IT and telecom as dominant, with healthcare and e-commerce gaining momentum.

By End User Industry

Cloud service providers dominate infrastructure adoption. Enterprises rely on hybrid and colocation for flexibility. Colocation providers grow as SMEs prioritize shared solutions. Government agencies expand demand for localized data storage. Other industries like education and energy diversify market growth. The Japan Data Center Market benefits from global cloud provider dominance while national agencies reinforce demand. End user segments shape demand patterns with balanced contributions from multiple sectors.

Regional Insights

Tokyo Region Leading with 58% Market Share

Tokyo dominates the Japan Data Center Market with 58% share, driven by enterprise density and global connectivity. It serves as a financial hub and primary gateway for hyperscale providers. Urban demand supports large-scale facilities with direct cloud on-ramps. It benefits from superior telecom infrastructure and regulatory support. Investors prioritize Tokyo for long-term strategic projects. The city strengthens its role as the country’s digital epicenter. It remains the central hub for innovation and international data services.

- For instance, in mid-2023, Equinix launched the TY13x data center in Tokyo, offering 8 MW of IT power in its initial phase and incorporating advanced energy efficiency measures to support hyperscale cloud deployments.

Osaka Region Emerging with 27% Market Share

Osaka holds 27% share, supported by regional enterprises and disaster recovery demand. It balances national infrastructure by complementing Tokyo’s concentration. Strong manufacturing and industrial bases fuel regional data adoption. Osaka attracts hyperscale investments for capacity expansion. It also supports enterprises with low-latency needs across western Japan. The Japan Data Center Market relies on Osaka as a backup and secondary hub. The city expands its role in colocation and cloud adoption.

- For instance, Digital Realty’s KIX11 data center in Osaka provides 28 MW of IT power capacity and spans approximately 86,000 square feet, serving major enterprise and cloud customers across the Kansai region.

Other Regions Expanding with 15% Market Share

Other regions including Fukuoka, Sapporo, and Nagoya represent 15% share. These regions attract interest for edge deployments and localized infrastructure. Enterprises target distributed facilities for smart city, IoT, and connected ecosystems. It supports national resilience and spreads infrastructure beyond urban hubs. Regional growth reduces risks from urban over-dependence. Investors explore modular facilities for scalable opportunities. These regions strengthen national coverage while diversifying infrastructure growth.

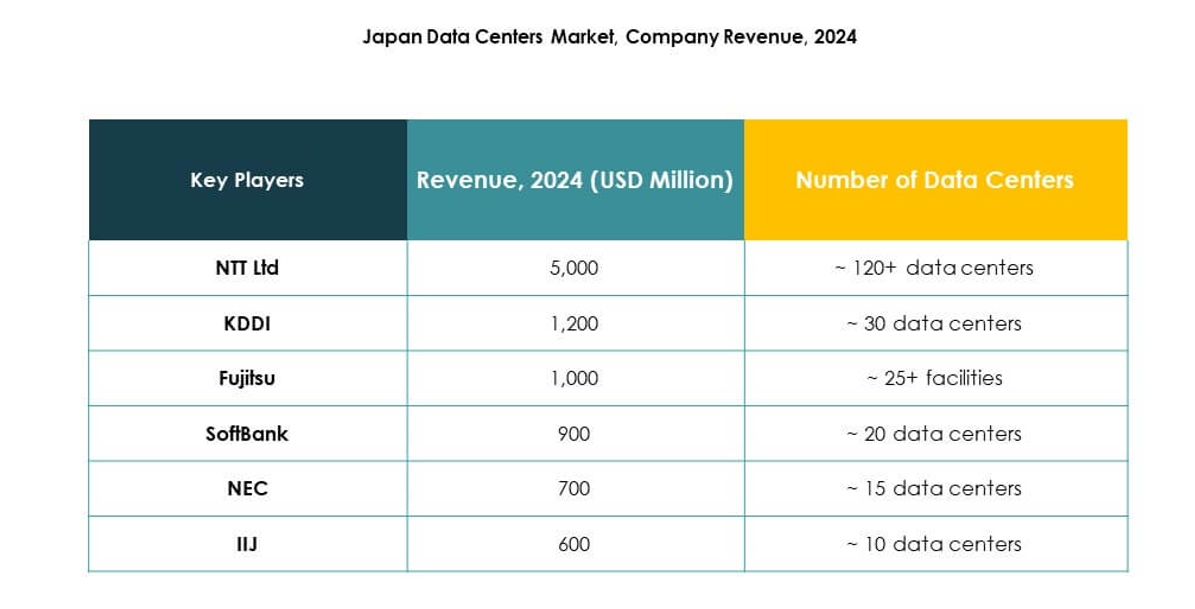

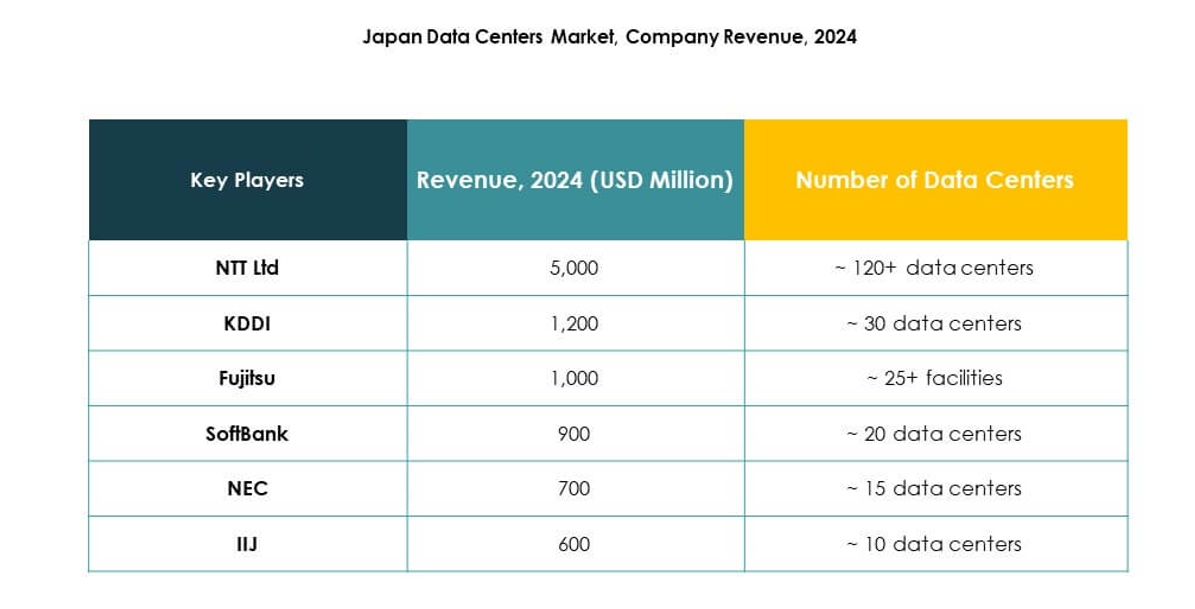

Competitive Insights:

- KDDI Corporation

- Fujitsu Limited

- SoftBank Group Corp.

- NEC Corporation

- Internet Initiative Japan (IIJ)

- GMO GlobalSign

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Japan Data Center Market features a competitive mix of domestic leaders and global hyperscalers. It is shaped by NTT Communications and KDDI, which dominate with extensive colocation and enterprise solutions. Global providers such as AWS, Microsoft, and Google strengthen their presence through hyperscale cloud facilities in Tokyo and Osaka. Fujitsu, SoftBank, and NEC leverage enterprise networks and ICT capabilities to drive growth. Digital Realty expands interconnection and wholesale colocation capacity, while IIJ and GMO GlobalSign specialize in secure hosting and managed services. Competition centers on hybrid deployments, sustainability, and energy-efficient infrastructure. It pushes companies to differentiate through localized compliance, advanced connectivity, and innovative service portfolios that align with Japan’s demand for digital transformation and long-term resilience.Recent Developments:

- In September 2025, Keppel DC REIT announced the acquisition of Tokyo Data Centre 3 in Inzai City, Greater Tokyo, for S$707 million. The facility is fully leased to a major global hyperscaler for a 15-year period and is expected to boost Keppel DC REIT’s portfolio resilience and scale, marking its second major acquisition in the Japanese market this year.

- In August 2025, EdgeConneX completed the acquisition of its second data center site in Japan, located in the Greater Osaka and Yawata areas. This new site will offer an additional 150MW of utility power upon completion, bringing the company’s total data center platform capacity in Japan to 350MW. The facility is purpose-built to support advanced workloads, including AI and GPU deployments, highlighting EdgeConneX’s commitment to high-performance infrastructure in a rapidly growing data center market.

- In June 2025, KDDI Corporation expanded its data center footprint in Japan by announcing partnerships with major cloud service providers to enhance connectivity options within its TELEHOUSE Tokyo data centers, aiming to support rising demand for hybrid and multi-cloud solutions in the region.

- In April 2024, Fujitsu Limited launched its new “Fujitsu Sovereign Cloud” service in Japan, enabling enterprises to host critical data in-country to comply with tightening data residency regulations and bolster security standards.

Market Segmentation

Market Segmentation