Executive summary:

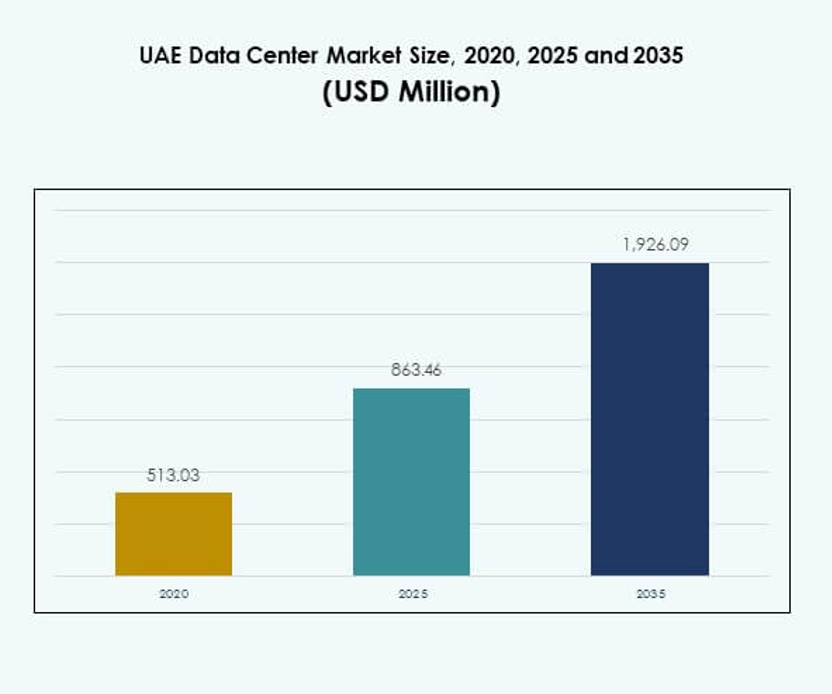

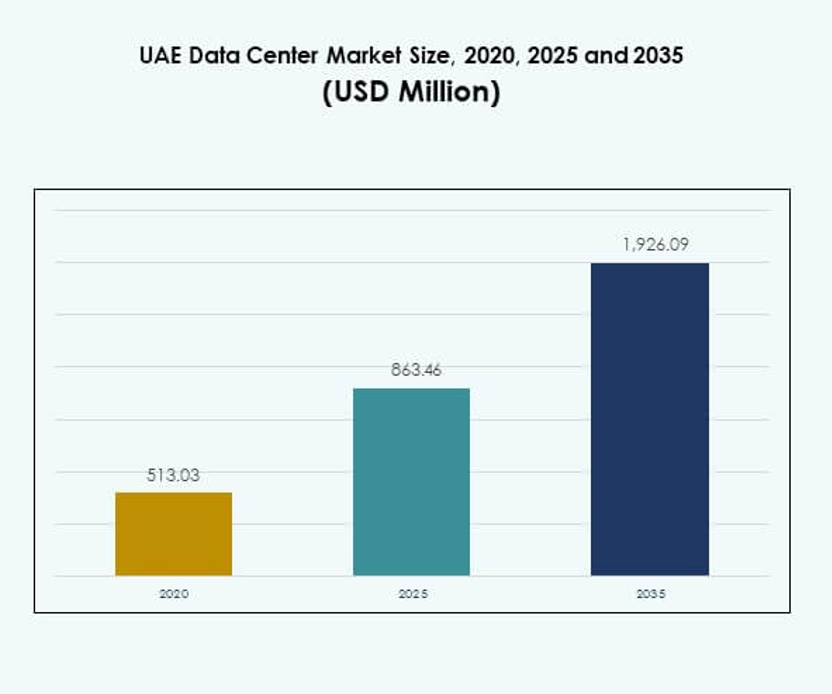

The UAE Data Center Market size was valued at USD 513.03 million in 2020 to USD 863.46 million in 2025 and is anticipated to reach USD 1,926.09 million by 2035, at a CAGR of 8.30% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| UAE Data Center Market Size 2025 |

USD 863.46 Million |

| UAE Data Center Market, CAGR |

8.30% |

| UAE Data Center Market Size 2035 |

USD 1,926.09 Million |

The market is fueled by rapid cloud adoption, AI integration, and strong demand for secure data storage across industries. Enterprises focus on automation, virtualization, and green cooling systems to improve efficiency and meet compliance. Government initiatives supporting digital transformation and smart city projects further strengthen the ecosystem. The UAE Data Center Market holds strategic importance for investors by offering long-term growth, innovation-driven infrastructure, and regional leadership in digital connectivity.

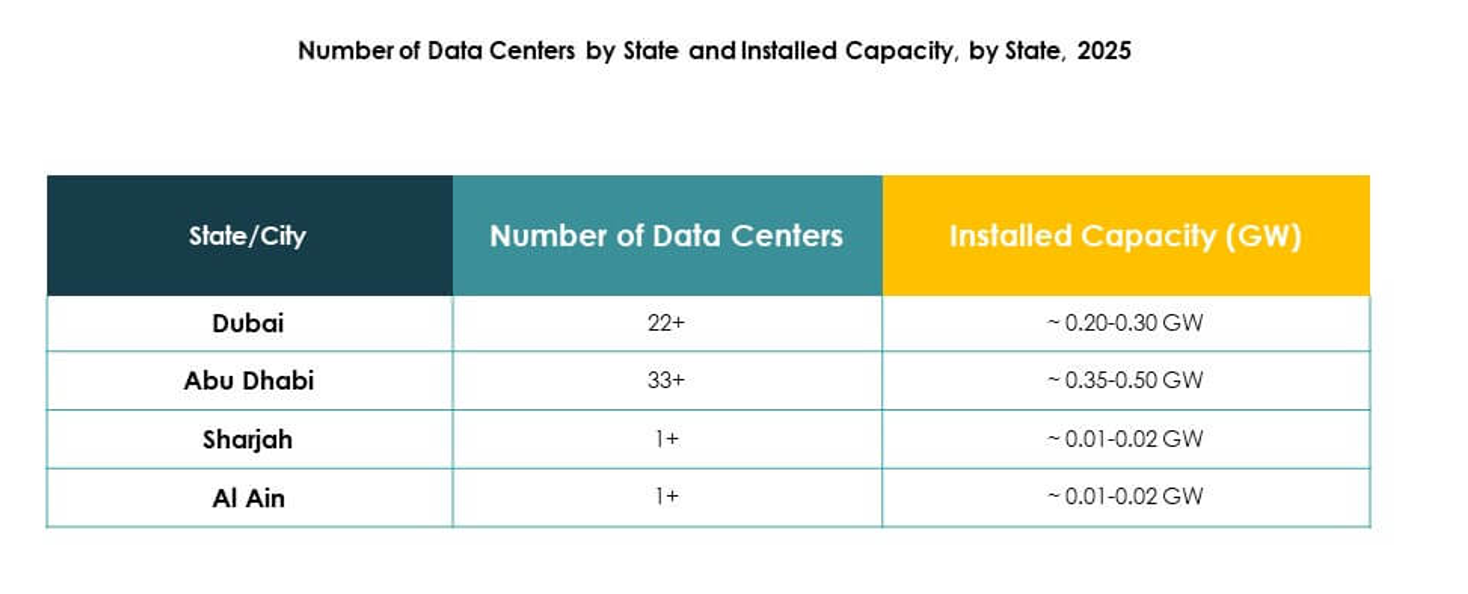

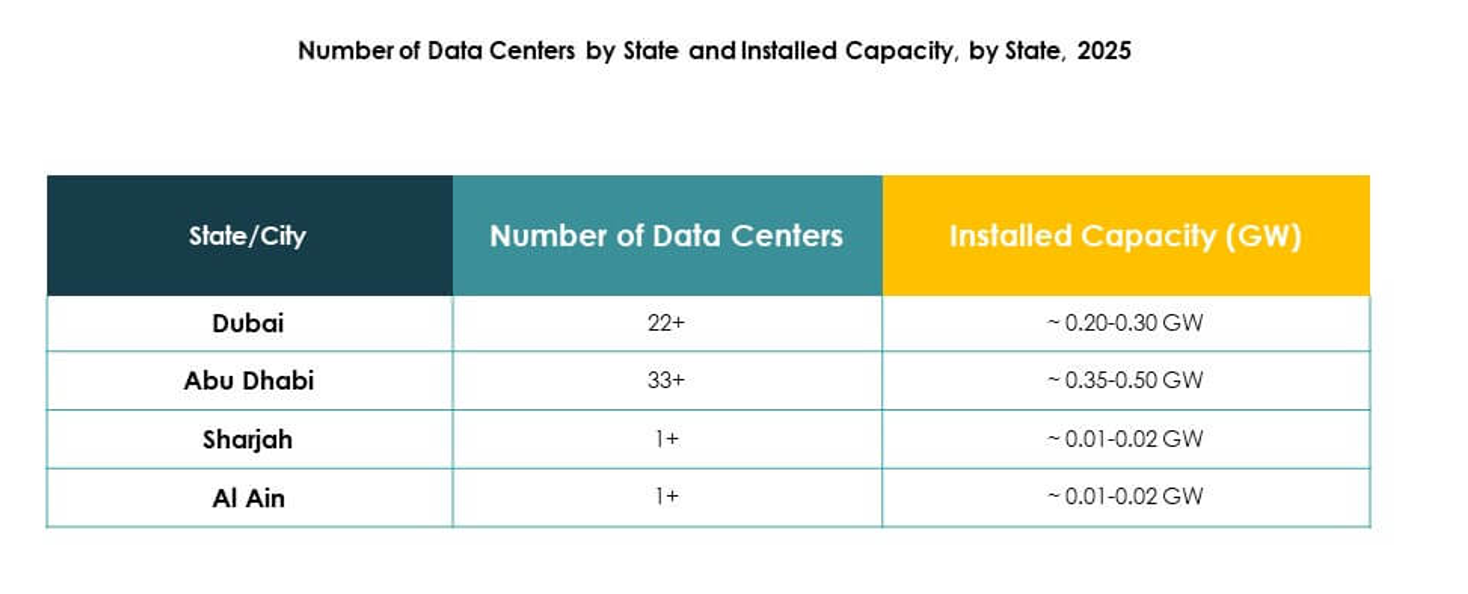

Dubai leads the market with advanced infrastructure, strong connectivity, and favorable free zone policies, making it a preferred hub for global operators. Abu Dhabi emerges as a major growth center supported by government investments in smart projects and sustainable power integration. The Northern Emirates are developing secondary hubs, attracting businesses seeking cost-effective expansion. Together, these regions create a balanced ecosystem that drives the UAE Data Center Market forward as a regional digital leader.

Market Drivers

Rapid Expansion of Digital Transformation and Cloud Infrastructure

The UAE Data Center Market benefits from the country’s accelerated digital transformation. Government initiatives supporting smart cities, e-governance, and fintech adoption push enterprises to expand cloud infrastructure. Companies deploy advanced servers and storage to meet data-intensive needs. Cloud adoption reduces operational costs while ensuring scalability and resilience. Enterprises across industries depend on hybrid and multi-cloud strategies to improve efficiency. Innovation in virtualization strengthens infrastructure reliability. The market gains strategic importance as global hyperscale players invest in local facilities. It enhances competitiveness and fosters investor confidence.

- For instance, in September 2025, Microsoft announced the general availability of DCasv6 and ECasv6 confidential VMs in its UAE North region, powered by 4th Gen AMD EPYC™ processors, offering up to 96 vCPUs, 672 GiB RAM, 25% higher performance, and SEV-SNP with AES-256 memory encryption.

Integration of Artificial Intelligence and Internet of Things in Data Ecosystems

The integration of AI and IoT technologies is driving demand for high-capacity, low-latency systems. AI workloads require scalable GPU clusters, while IoT generates vast streams of real-time data. Data centers deploy automation platforms to manage this complexity efficiently. Intelligent analytics improve predictive maintenance and resource optimization. AI adoption also enhances energy management, reducing power usage and cost. The UAE Data Center Market capitalizes on these shifts to attract enterprises across manufacturing, healthcare, and retail. It provides a reliable backbone for AI-enabled operations. Businesses gain critical advantages through reduced downtime and greater flexibility.

- For instance, Khazna Data Centers announced a collaboration with NVIDIA to certify next-generation data halls for the NVIDIA Blackwell architecture, with designs supporting individual AI clusters of up to 250 MW capacity to accelerate AI infrastructure across the region.

Strategic Investments in Renewable Energy and Sustainable Cooling Solutions

Growing focus on sustainability leads to investments in renewable-powered facilities and green cooling systems. Operators invest in solar energy integration and water-efficient cooling to meet ESG targets. Companies design modular data centers with energy-saving features. Regulations encourage environmentally conscious practices, improving compliance and reputation. Sustainability attracts global cloud providers seeking greener footprints. The UAE Data Center Market demonstrates its importance through long-term commitments to carbon reduction. It enables operators to secure partnerships with environmentally aware corporations. It positions the nation as a leader in sustainable digital infrastructure.

Increased Role of Government Regulations and Security Compliance

The government enforces data sovereignty rules to safeguard sensitive digital assets. Regulatory frameworks require enterprises to adopt secure storage and compliant data practices. Security concerns drive investment in advanced firewalls, encryption, and monitoring tools. Compliance enhances trust in critical industries like BFSI and government. The UAE Data Center Market strengthens its role by offering certified, secure ecosystems. It gains investor confidence by ensuring stability and resilience. Businesses value data centers that align with evolving regulatory landscapes. It reinforces strategic importance by mitigating cyber risks and building digital trust.

Market Trends

Adoption of Edge Computing and Modular Data Center Designs

Edge computing gains traction with the growth of 5G-enabled applications. Organizations deploy modular and micro data centers to improve latency-sensitive performance. Edge facilities support industries such as telecom, healthcare, and autonomous systems. Their rapid deployment capability reduces infrastructure delays. The UAE Data Center Market leverages modular solutions to support real-time analytics and decentralized data. It enables businesses to scale operations closer to users. Enterprises invest in smaller yet highly efficient systems. It diversifies infrastructure beyond traditional hyperscale centers.

Integration of Advanced Automation and Orchestration Platforms

Automation platforms streamline data center management and improve operational efficiency. Orchestration tools enable unified control of hybrid environments. Intelligent monitoring reduces downtime and supports predictive resource allocation. Companies adopt robotic process automation for IT tasks. The UAE Data Center Market incorporates orchestration frameworks to enhance workflow resilience. It enables operators to minimize human error and optimize workloads. Automated management supports faster disaster recovery and improved compliance. It ensures businesses maintain performance consistency while reducing operational cost.

Development of High-Density Data Centers to Support AI Workloads

Growing demand for AI and machine learning increases need for high-density computing. Facilities adopt liquid cooling and advanced power systems to manage heat and energy. Operators redesign rack layouts for GPU-heavy servers. The UAE Data Center Market supports AI-driven enterprises with optimized infrastructure. It provides high-performance computing for sectors including finance, logistics, and defense. Growth in big data further accelerates these investments. High-density designs ensure scalability without compromising sustainability. It helps enterprises meet expanding digital workloads effectively.

Strengthening of Interconnection Ecosystems and Peering Platforms

Regional interconnection platforms expand to improve cross-border data flow. Carrier-neutral hubs facilitate seamless cloud access for global businesses. Enterprises demand reliable peering to optimize latency and network efficiency. Operators partner with telecom providers to boost interconnection ecosystems. The UAE Data Center Market gains importance as a regional connectivity hub. It supports multinational companies by ensuring resilient cross-border operations. Businesses benefit from diversified network routes. It enhances UAE’s role as a digital bridge for global economies.

Market Challenges

Market Challenges

High Capital Expenditure and Rising Operational Costs for Operators

The construction and maintenance of advanced facilities require significant capital investment. Operators must deploy modern cooling, power backup, and cybersecurity systems. Rising energy costs add financial pressure to balance sustainability and profitability. Enterprises often face challenges in scaling infrastructure while ensuring affordability. The UAE Data Center Market faces hurdles in meeting increasing performance expectations within tight budgets. It must balance innovation with financial viability. Businesses expect cost-effective services without compromising reliability. It creates a barrier for new entrants and smaller players.

Shortage of Skilled Workforce and Rising Cybersecurity Threats

Demand for specialized talent in cloud engineering, cybersecurity, and AI integration exceeds supply. Organizations struggle to recruit experts capable of managing advanced infrastructures. Cybersecurity risks continue to rise, with targeted attacks on sensitive sectors. The UAE Data Center Market requires strong resilience to handle sophisticated threats. It depends on trained professionals to ensure compliance and system uptime. Businesses must invest in workforce development and robust protection frameworks. It highlights the challenge of balancing growth with security readiness.

Market Opportunities

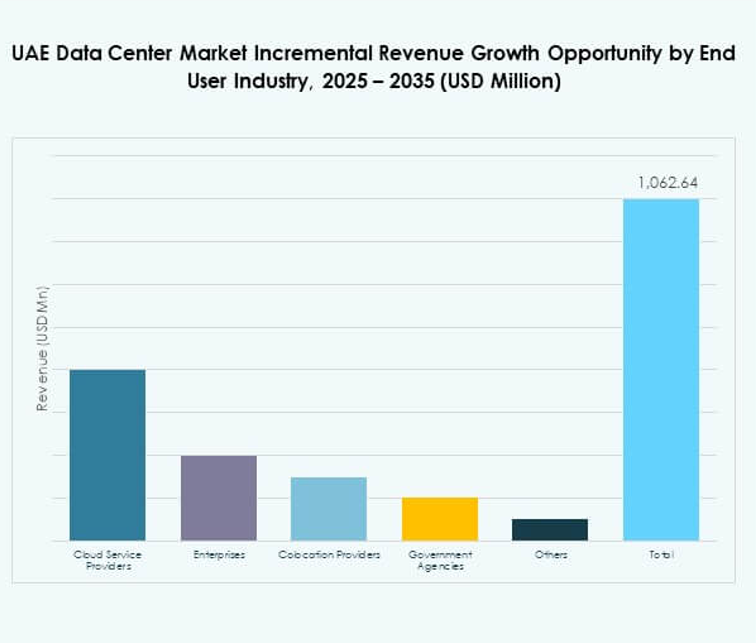

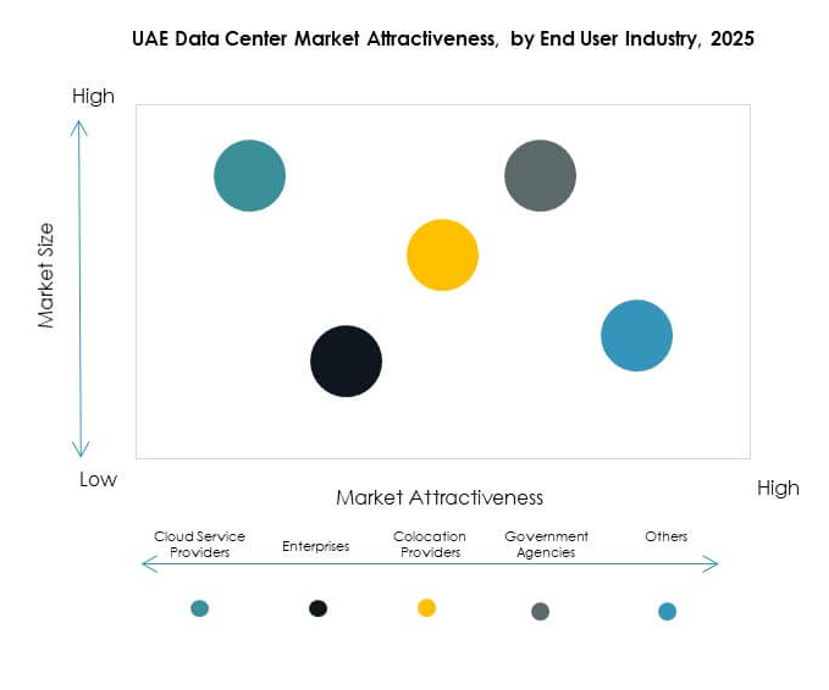

Expansion of Hyperscale and Colocation Facilities Across the Country

The rise of cloud adoption drives demand for hyperscale and colocation facilities. Global players seek entry through partnerships and local investments. Enterprises prefer colocation for scalability and reduced costs. The UAE Data Center Market benefits from increasing cross-industry demand for flexible hosting. It attracts new investors through regulatory support and business-friendly policies. Operators expand footprints in Dubai and Abu Dhabi to capture this growth. It strengthens regional competitiveness in hosting global digital workloads.

Rising Demand for Hybrid Cloud and Industry-Specific Infrastructure

Hybrid cloud adoption accelerates with growing enterprise digitalization. Organizations require customized solutions for industries like BFSI, healthcare, and retail. Data centers deploy vertical-specific infrastructure to meet compliance and performance needs. The UAE Data Center Market captures opportunities through tailored hybrid environments. It enables businesses to balance regulatory control with cloud scalability. Enterprises gain improved agility through industry-aligned designs. It positions UAE as a hub for specialized infrastructure innovation.

Market Segmentation

By Component

Hardware dominates the UAE Data Center Market, holding a major share due to demand for servers, networking equipment, and cooling systems. Investments in power and security infrastructure strengthen reliability. Software adoption grows with DCIM and virtualization tools ensuring efficient operations. Services gain traction as enterprises outsource management, integration, and support. Hardware leads growth as enterprises upgrade to high-performance systems. It remains essential for meeting data-intensive requirements across industries.

By Data Center Type

Hyperscale data centers hold the largest share, driven by cloud service providers and tech giants. Colocation facilities grow as enterprises demand scalable solutions. Edge and modular data centers see rising interest due to 5G adoption. Enterprise facilities remain important for controlled workloads. The UAE Data Center Market gains from mega and internet data centers expanding regionally. Hyperscale dominance ensures continued investment in large-scale digital hubs. It reflects increasing demand for high-capacity, low-latency systems.

By Deployment Model

Cloud-based deployment leads due to enterprises migrating workloads for flexibility and reduced capital expense. Hybrid models gain share as organizations balance security with scalability. On-premises remains relevant for sensitive industries requiring control. The UAE Data Center Market benefits from hybrid expansion in banking and healthcare. Cloud models dominate due to agility and cost savings. Hybrid strategies grow as compliance becomes critical. It ensures enterprises can operate within evolving digital frameworks.

By Enterprise Size

Large enterprises dominate due to higher capacity requirements and larger IT budgets. SMEs increasingly adopt cloud-based and colocation solutions for cost efficiency. The UAE Data Center Market supports SMEs with modular and scalable services. Large corporations lead in driving hyperscale adoption. SMEs create growth opportunities through digital transformation initiatives. The mix of enterprise sizes strengthens the overall ecosystem. It enhances inclusivity of infrastructure growth across industries.

By Application / Use Case

IT & Telecom leads, followed by BFSI and Government & Defense. Healthcare grows with demand for electronic health records and telemedicine. Retail and e-commerce expand digital reliance, driving infrastructure adoption. Media and entertainment benefit from content streaming. Manufacturing integrates IoT-based monitoring, fueling demand. The UAE Data Center Market covers diverse use cases across industries. It ensures broad application for digital transformation.

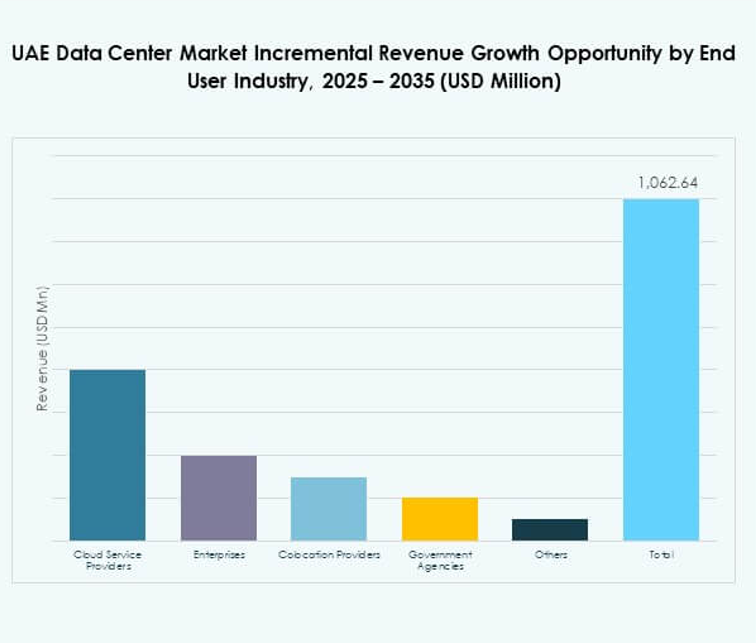

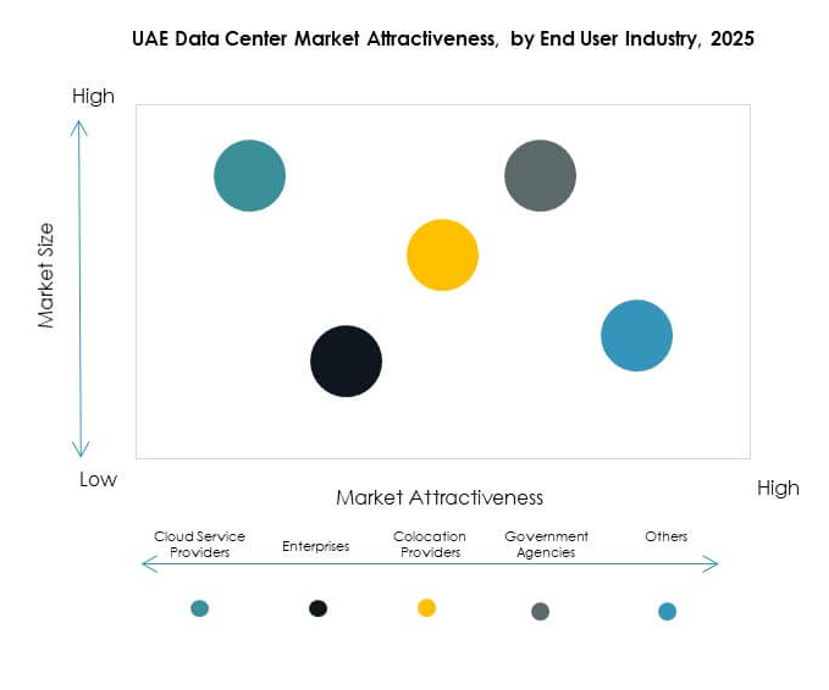

By End User Industry

Cloud service providers dominate, fueling hyperscale facility expansion. Enterprises adopt colocation and hybrid services to meet digital needs. Government agencies invest heavily in secure, compliant infrastructure. Colocation providers expand their market presence. The UAE Data Center Market benefits from a diverse mix of end users. Cloud providers lead with infrastructure modernization efforts. It drives overall ecosystem growth with balanced participation.Regional Insights

Dominance of Dubai as the Core Data Center Hub

Dubai accounts for 52% share, making it the leading subregion. Advanced infrastructure, strong connectivity, and free zone regulations support dominance. The city attracts global hyperscale operators and regional cloud leaders. Enterprises value Dubai’s role as a financial and digital hub. The UAE Data Center Market strengthens by positioning Dubai as a prime hosting destination. It consolidates its status with advanced investments. Businesses gain from reliable, globally connected infrastructure.

- For example, Equinix announced the launch of its third Dubai data center, DX3, in 2023 with a first-phase capacity of 900 racks, expandable to 1,800 cabinets, strengthening interconnection services across the region.

Growth of Abu Dhabi Through Government-Backed Digital Investments

Abu Dhabi holds 32% share, supported by heavy government investments in digital infrastructure. Smart city projects drive growth of enterprise and colocation facilities. Strong energy resources enable sustainable power integration. The UAE Data Center Market benefits from Abu Dhabi’s focus on innovation and regulation. It creates a secure environment for sensitive industries. Enterprises expand operations with confidence in long-term reliability. Abu Dhabi positions itself as a hub for public sector and defense workloads.

- For instance, Khazna Data Centers launched its AUH6 facility in Abu Dhabi in February 2024, providing 8 MW of IT load and employing a modular, repeatable design with integrated solar capacity to boost energy efficiency.

Emerging Potential of Northern Emirates in Regional Connectivity

The Northern Emirates contribute 16% share, emerging as secondary hubs. Investments in connectivity projects improve cross-border digital trade. Enterprises view these regions as cost-effective alternatives for expansion. The UAE Data Center Market benefits from diversification across multiple subregions. It enhances resilience by spreading infrastructure beyond major cities. Investors explore opportunities driven by lower costs and untapped demand. The Northern Emirates increase the market’s competitiveness across the Middle East.

Competitive Insights:

- Etisalat

- DU (Emirates Integrated Telecommunications Company)

- Equinix Middle East

- eHosting DataFort

- Khazna Data Centers

- IBM Cloud Middle East

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The UAE Data Center Market features intense competition driven by telecom operators, global hyperscale providers, and specialized colocation firms. Etisalat and DU leverage extensive network infrastructure to secure enterprise clients, while Khazna Data Centers expands local capacity through large-scale facilities. Equinix and Digital Realty strengthen their positions with global interconnection platforms. Cloud leaders such as Microsoft, AWS, and Google drive demand with scalable solutions for enterprises and government agencies. IBM and NTT Communications add value with managed services and hybrid offerings. It positions the UAE as a strategic digital hub where operators compete through infrastructure expansion, energy efficiency, and advanced security compliance.

Recent Developments:

- In September 2025, Khazna Data Centers secured a landmark $2.62 billion financing deal in partnership with Abu Dhabi Commercial Bank and First Abu Dhabi Bank, signifying one of the region’s largest ever digital infrastructure investments. This capital injection will accelerate Khazna’s expansion, supporting projects for two new facilities in Abu Dhabi, one in Dubai, and the UAE’s first AI-enabled data center in Ajman, which are designed to bolster the nation’s leadership in advanced colocation and AI data service solutions.

- In September 2025, Oracle Cloud entered a strategic partnership with e& enterprise to launch UAE OneCloud, aimed at delivering more than 200 Oracle Cloud Infrastructure (OCI) services in the country. This partnership is set to deepen sovereign cloud capabilities for UAE organizations operating in regulated sectors and support national digital transformation goals.

- In May 2025, G42 launched the “Stargate UAE” initiative, a massive AI-focused data center campus in Abu Dhabi, in collaboration with major tech companies like OpenAI, Oracle, NVIDIA, Cisco, and SoftBank Group. The project is expected to bring online its first 200 megawatts of AI computing capacity by 2026. This initiative aims to establish the UAE as a global leader in AI infrastructure and innovation.

- In April 2025, Emirates Integrated Telecommunications Company (du) and Microsoft announced a $544.5 million partnership to establish a hyperscale data center in the UAE, with du building and operating the facility and Microsoft serving as the primary tenant. This collaboration is set to advance the nation’s digital ecosystem and strengthen its position as a regional hub for cloud and AI solutions.

Market Challenges

Market Challenges