Executive summary:

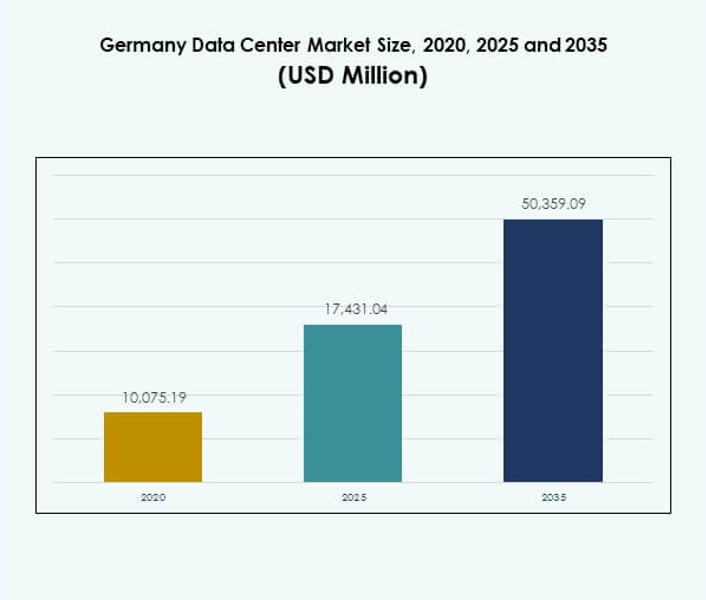

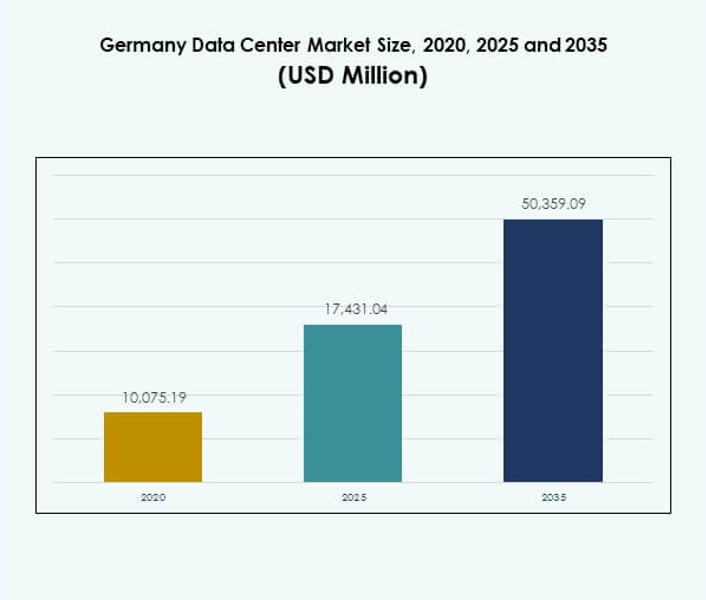

The Germany Data Center Market size was valued at USD 10,075.19 million in 2020 to USD 17,431.04 million in 2025 and is anticipated to reach USD 50,359.09 million by 2035, at a CAGR of 11.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Germany Data Center Market Size 2025 |

USD 17,431.04 Million |

| Germany Data Center Market, CAGR |

11.12% |

| Germany Data Center Market Size 2035 |

USD 50,359.09 Million |

The market is driven by rising adoption of cloud computing, artificial intelligence, and IoT technologies that demand advanced infrastructure. Enterprises focus on energy-efficient systems, modular solutions, and sustainability-led innovation to remain competitive. Strategic investments from global hyperscale operators and local providers strengthen Germany’s role as a secure, compliant, and innovation-focused hub. It creates opportunities for businesses and ensures investor confidence through predictable returns and long-term stability.

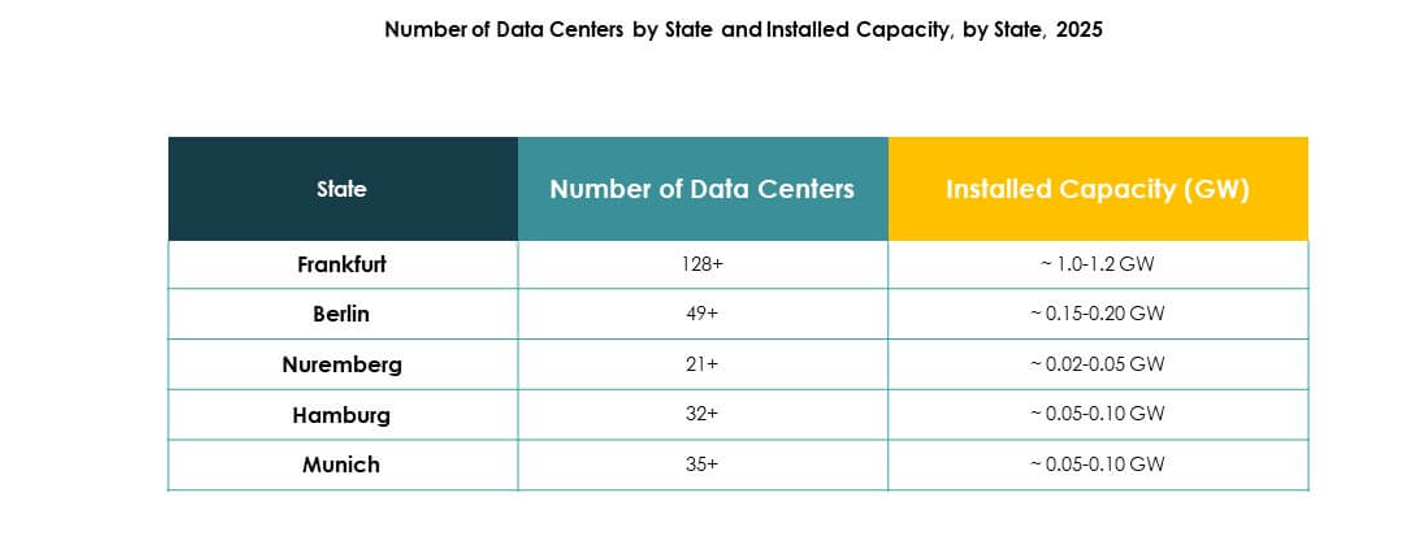

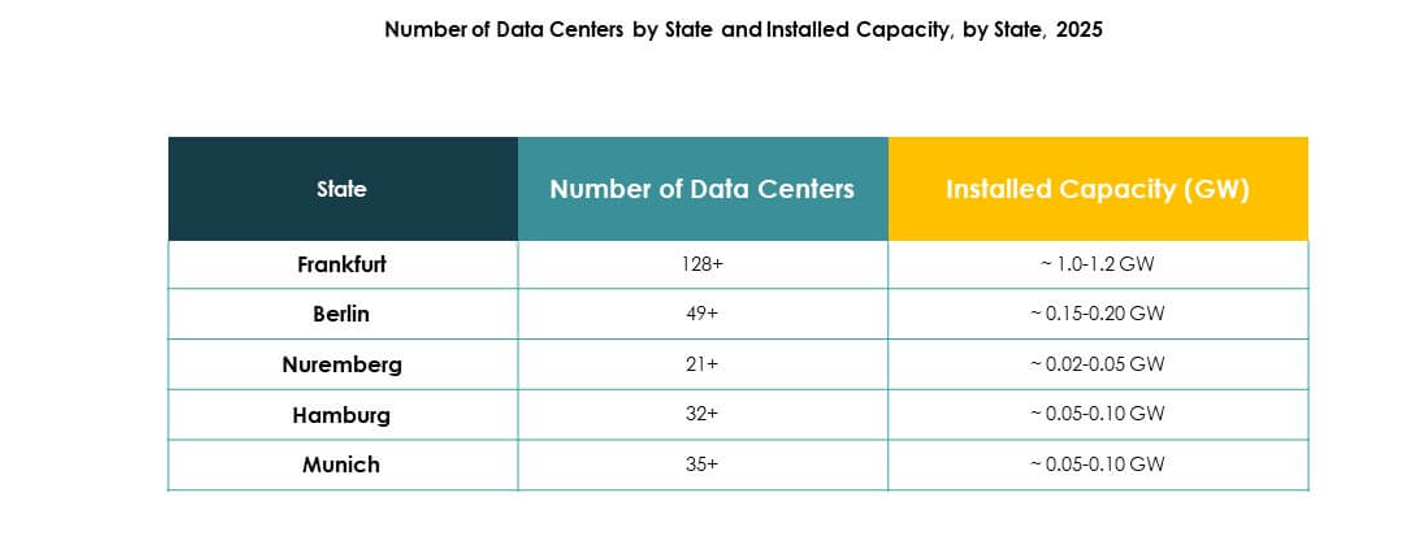

Western Germany leads the market due to Frankfurt’s prominence as a European connectivity hub supported by strong interconnection and hyperscale investments. Southern regions such as Munich drive demand from enterprise-heavy sectors like automotive and finance, while Berlin emerges as a growing digital and start-up hub. Northern Germany is developing through Hamburg’s connectivity and renewable integration, reflecting balanced growth across the country’s digital ecosystem.

Market Drivers

Growing Adoption Of Advanced Cloud And Digital Technologies In Business Ecosystems

The Germany Data Center Market benefits from a strong wave of cloud adoption that accelerates digital transformation across industries. Enterprises demand scalable cloud platforms that improve operational agility while meeting strict compliance standards. AI-driven automation, machine learning workloads, and IoT device expansion add pressure on infrastructure capacity. The market attracts investments from global cloud providers seeking to expand their European presence. Local enterprises adopt hybrid models that combine private and public resources for efficiency. This demand reshapes infrastructure planning and deployment strategies. It strengthens Germany’s role as a secure and reliable digital hub for Europe.

- For instance, in February 2024, Microsoft committed to investing €3.2 billion to double its AI infrastructure and cloud computing capacity in Germany, focusing on the rapid expansion of its cloud region in Frankfurt and new infrastructure across North Rhine-Westphalia to deliver advanced services for enterprise AI workloads.

Innovation In Sustainable Infrastructure And Energy-Efficient Cooling Solutions

Energy efficiency forms a critical driver as operators face rising demand for sustainable operations. Investors prioritize facilities integrating renewable energy, liquid cooling, and advanced airflow management. Hyperscale players commit to climate-neutral targets, aligning with Germany’s carbon reduction policies. The Germany Data Center Market gains momentum from innovation in heat reuse technologies that support local communities. Businesses adopt modular power designs and real-time monitoring tools to cut energy waste. Regulatory frameworks encourage operators to embed sustainability in expansion strategies. This trend ensures long-term viability for operators while strengthening Germany’s reputation for environmental leadership.

Strategic Importance Of Digital Hubs For Enterprise And Investor Confidence

Enterprises depend on Germany’s strong network backbone to ensure data security and low-latency connectivity. Its geographic location provides access to Central and Eastern Europe, making it vital for international expansion strategies. Data sovereignty laws increase trust among multinational firms seeking local compliance. The Germany Data Center Market gains further relevance through its role in supporting BFSI, healthcare, and government operations. Investors value the long-term stability, strong regulation, and predictable returns of the sector. Enterprises see it as an enabler of digital continuity in highly regulated industries. Germany remains a secure anchor point for European digital operations.

Transformation Driven By Industry Consolidation And Expansion Of Hyperscale Facilities

Consolidation across operators fosters economies of scale and improved infrastructure investments. International hyperscale players expand through acquisitions and new builds across Frankfurt, Berlin, and Munich. Strong capital inflows support the creation of advanced megawatt-scale campuses. The Germany Data Center Market reflects this shift, where enterprises and colocation providers share infrastructure to reduce cost burdens. Edge deployments also rise, meeting localized needs for industries like retail and manufacturing. This mix of hyperscale and edge growth reshapes the market structure. Investors align strategies with expanding ecosystems that deliver both global reach and regional resilience.

- For instance, in March 2025, Digital Realty opened the FRA18 data center at its Digital Park Fechenheim campus in Frankfurt, providing 8,200 square meters of space and launching with a 6.4MW initial capacity, with an additional 9.6MW to be added, to support high-performance computing and AI workloads as part of one of Europe’s largest data center campuses.

Market Trends

Shift Toward Edge Computing And Distributed Infrastructure For Localized Applications

Edge computing adoption grows as enterprises seek low-latency solutions for real-time applications. Industries including autonomous mobility, smart factories, and e-commerce demand distributed architectures. The Germany Data Center Market adapts through edge sites that complement hyperscale campuses. Operators expand modular micro data centers closer to users for efficiency. 5G rollouts accelerate this trend by enabling advanced IoT services. Enterprises see new potential for AI-driven applications supported at the edge. It creates new growth avenues for colocation providers. Edge expansion supports Germany’s position in Europe’s evolving digital economy.

Integration Of Artificial Intelligence And Automation In Data Center Operations

Operators integrate AI tools for monitoring workloads, optimizing cooling, and predicting failures. Automation ensures faster resource allocation while improving uptime metrics. The Germany Data Center Market increasingly reflects demand for intelligent, self-correcting infrastructure. Enterprises adopt software-defined systems to reduce operational risks. Colocation and cloud providers implement AI to reduce energy costs and improve sustainability. Predictive maintenance platforms minimize downtime and support continuous workloads. Automation strengthens competitive advantage by lowering long-term costs. It enhances trust among enterprise customers seeking high reliability.

Rise Of Hybrid Deployment Models Across Regulated Industries And SMEs

Hybrid adoption grows as enterprises balance control with flexibility. Highly regulated sectors like BFSI and healthcare use private setups integrated with cloud capacity for compliance. The Germany Data Center Market evolves to support these customized solutions for security-sensitive workloads. SMEs also adopt hybrid systems to manage costs without sacrificing scalability. Service providers design flexible packages combining colocation, cloud, and managed services. Hybrid models support global companies needing distributed infrastructure while maintaining local sovereignty. It creates opportunities for software and service providers. The trend ensures diverse adoption across industries.

Expansion Of Renewable Power And Circular Energy Integration In Data Center Design

Operators integrate renewable sources such as wind and solar to power campuses. Energy reuse systems channel waste heat into city grids and residential networks. The Germany Data Center Market aligns with national climate goals that prioritize carbon neutrality. Renewable contracts with utility providers lock in sustainable energy supplies for decades. Enterprises view sustainability as a key factor in vendor selection. Operators expand battery storage and grid integration to enhance resilience. These measures lower long-term costs while improving environmental impact. It builds strong differentiation in a competitive landscape.

Market Challenges

Rising Energy Demand And Sustainability Compliance Pressure On Operators

The sector faces mounting challenges from high electricity consumption and strict carbon-neutrality mandates. Meeting energy efficiency targets requires heavy investments in renewable integration, advanced cooling, and power optimization. The Germany Data Center Market must adapt while balancing capacity expansion with sustainability compliance. Operators face scrutiny from regulators and local communities concerned about resource use. Rising power costs further strain profitability for smaller enterprises and colocation providers. Achieving operational efficiency without compromising performance remains difficult. It forces players to explore innovative energy partnerships and technologies.

Regulatory Complexity, Data Sovereignty, And Land Availability Constraints

Compliance with strict EU and German data protection laws complicates expansion strategies for global firms. Operators must align with GDPR and national security standards, increasing compliance costs. The Germany Data Center Market encounters barriers from limited urban land availability, especially in Frankfurt and Berlin. Real estate shortages and community opposition delay large-scale projects. Skilled labor shortages also hinder timely facility development. Enterprises face longer timelines to secure reliable partners. It creates hurdles for investors seeking faster returns from infrastructure projects.

Market Opportunities

Growth Potential In Edge Deployments And Industry-Specific Cloud Solutions

Edge expansion creates opportunities for operators offering localized services. Industries including retail, manufacturing, and logistics need real-time data capabilities. The Germany Data Center Market supports this growth with modular and micro facilities across key urban hubs. Enterprises value these solutions for speed, compliance, and resilience. Service providers position themselves to capture niche workloads. Edge deployments open investment opportunities in new cities beyond Frankfurt. It diversifies the market landscape and enhances regional connectivity.

Strategic Role Of Germany As A Gateway For European Digital Transformation

Germany’s central location makes it a natural gateway for regional cloud and colocation expansion. Global providers choose the country to anchor European operations. The Germany Data Center Market gains long-term opportunities from rising cross-border data flows. Its regulatory environment ensures strong trust among international enterprises. Cloud-native innovation accelerates adoption in SMEs and large corporations. Investors recognize the stability of Germany’s infrastructure market. It strengthens confidence in sustained digital growth.

Market Segmentation

By Component

Hardware dominates the Germany Data Center Market, supported by strong demand for servers, storage, and power systems. Enterprises invest in advanced racks and cooling solutions to enhance operational efficiency. Hardware accounts for the largest revenue share due to constant upgrades. Software adoption also grows with DCIM and virtualization platforms improving automation. Services provide long-term support, but hardware remains the primary driver. It reflects Germany’s strong focus on reliable, high-performance infrastructure for enterprises.

By Data Center Type

Hyperscale facilities dominate due to rapid cloud expansion from global providers. The Germany Data Center Market also sees growth in colocation, as enterprises seek flexible outsourcing models. Edge and modular centers expand steadily with 5G deployment. Enterprise facilities remain relevant for regulated industries requiring in-house setups. Mega campuses emerge in Frankfurt, securing international attention. Cloud or IDC setups gain traction for scalability. The mix of large-scale hyperscale and growing edge ensures balanced industry development.

By Deployment Model

Hybrid deployment dominates as enterprises balance on-premises control with cloud flexibility. The Germany Data Center Market supports multi-cloud adoption that ensures resilience and compliance. On-premises models retain relevance for data-sensitive industries. Cloud-based adoption grows among SMEs for scalability and cost benefits. Hybrid remains the preferred approach due to flexibility. Enterprises leverage it to meet diverse regulatory and operational needs. Service providers tailor solutions to enterprise size and sector. The segment expands consistently across industries.

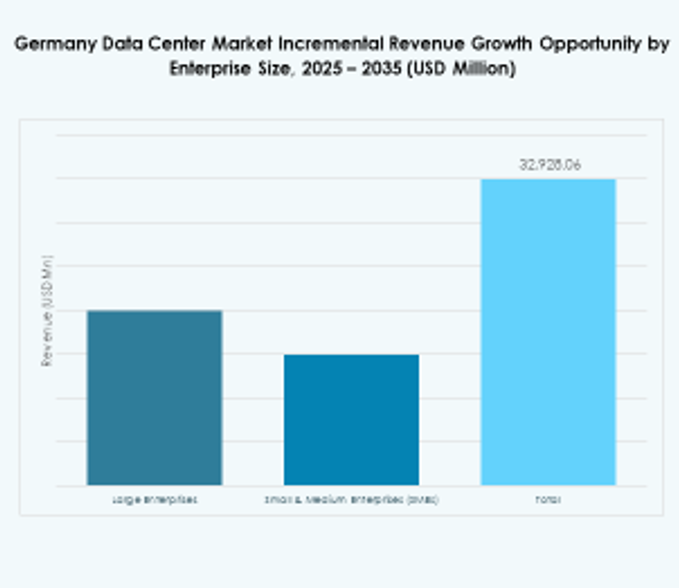

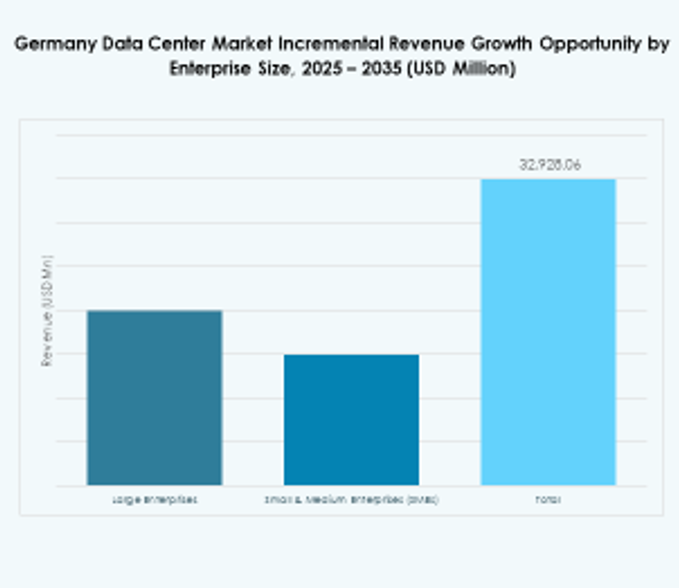

By Enterprise Size

Large enterprises dominate market demand, investing heavily in cloud and colocation solutions. The Germany Data Center Market benefits from their global operations that require robust, scalable infrastructure. SMEs also show rising demand, driven by digital adoption and cost-effective cloud services. Large corporations fuel hyperscale growth, while SMEs support hybrid and edge demand. Both groups influence service diversification. Service providers target SMEs with modular solutions. It ensures balanced adoption across the market.

By Application / Use Case

IT and telecom lead adoption, accounting for the largest share in the Germany Data Center Market. BFSI follows, relying on secure, compliant infrastructures. Healthcare adoption grows with digital records and telemedicine. Retail and e-commerce demand rises with digital platforms. Media and entertainment expand with streaming services. Manufacturing facilities integrate IoT-driven solutions requiring strong compute power. Government and defense remain consistent adopters. It reflects broad industry reliance on advanced data infrastructure.

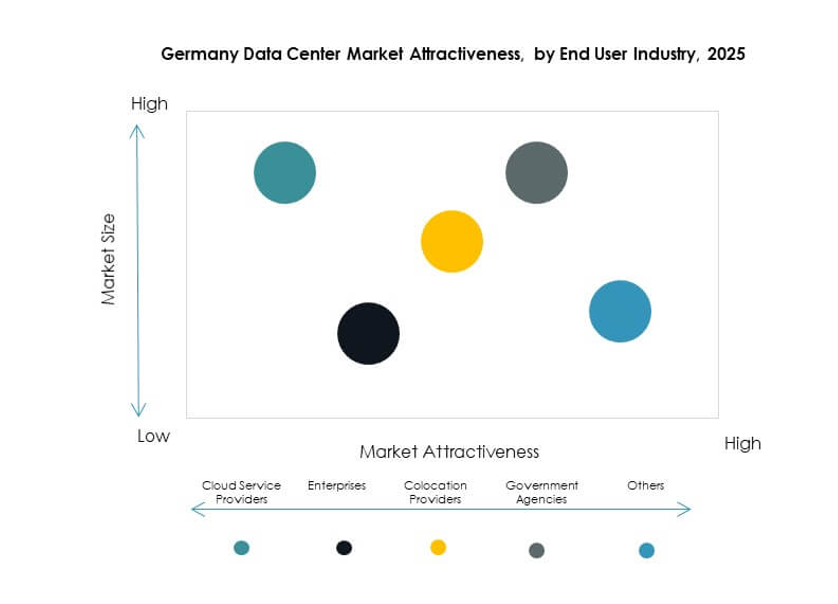

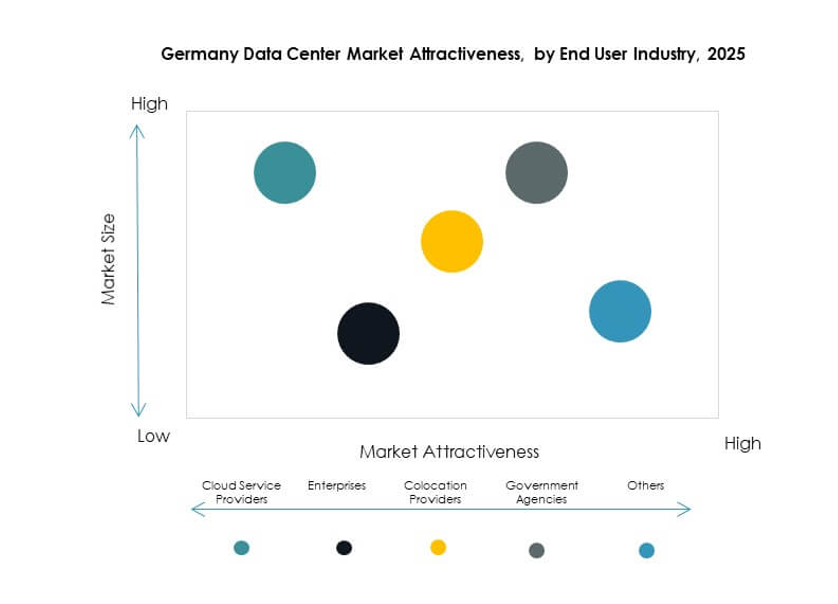

By End User Industry

Cloud service providers dominate the Germany Data Center Market with strong hyperscale investments. Colocation providers serve enterprises with flexible capacity options. Enterprises invest in hybrid systems to balance control and scalability. Government agencies maintain adoption for secure workloads. Smaller players add diversity through specialized managed services. Cloud providers remain the strongest driver of growth. It reflects the critical role of cloud-native solutions in Germany’s digital economy.

Regional Insights

Western Germany As The Core Digital Infrastructure Hub With Highest Share

Western Germany leads the Germany Data Center Market with 48% share, driven by Frankfurt’s dominance. Frankfurt acts as Europe’s key interconnection hub, attracting hyperscale, colocation, and cloud players. Its strong connectivity, real estate, and compliance readiness sustain growth. Dusseldorf and Cologne also expand capacity. The region’s ecosystem attracts global enterprises. It remains central to strategic deployments in Europe.

- For instance, in November 2023, Equinix opened its FR13 facility at the Frankfurt North-East campus, delivering 1,125 cabinets of capacity and enabling direct interconnection between more than 1,040 local companies and 10,000 global organizations, with energy-efficient operations designed to achieve up to 10% improved power usage effectiveness (PUE) versus previous standards.

Southern And Eastern Germany Emerging As Growth-Focused Subregions

Southern Germany holds 29% share, led by Munich’s enterprise-heavy digital landscape. Automotive, manufacturing, and financial firms drive demand for secure infrastructures. Eastern Germany expands at 15% share, with Berlin rising as a technology and start-up hub. The Germany Data Center Market adapts to urban demand patterns. Local ecosystems benefit from renewable integration. These subregions create new opportunities for edge and modular facilities.

Northern Germany As A Developing Region With Niche Opportunities

Northern Germany accounts for 8% share, supported by Hamburg’s growing connectivity role. Proximity to Nordic subsea cable routes boosts its appeal. The Germany Data Center Market reflects steady development in this subregion. Investments focus on regional hubs with maritime trade and logistics demand. Edge adoption supports localized digital transformation. It remains smaller compared to Western and Southern regions. However, its growth potential strengthens Germany’s nationwide digital ecosystem.

- For instance, in January 2025, Schwarz Group (owner of Lidl) announced plans to develop a 200 MW data center campus in Lübbenau, Germany on a 13-hectare site. The campus will house STACKIT’s infrastructure and repurpose waste heat to support local district heating.

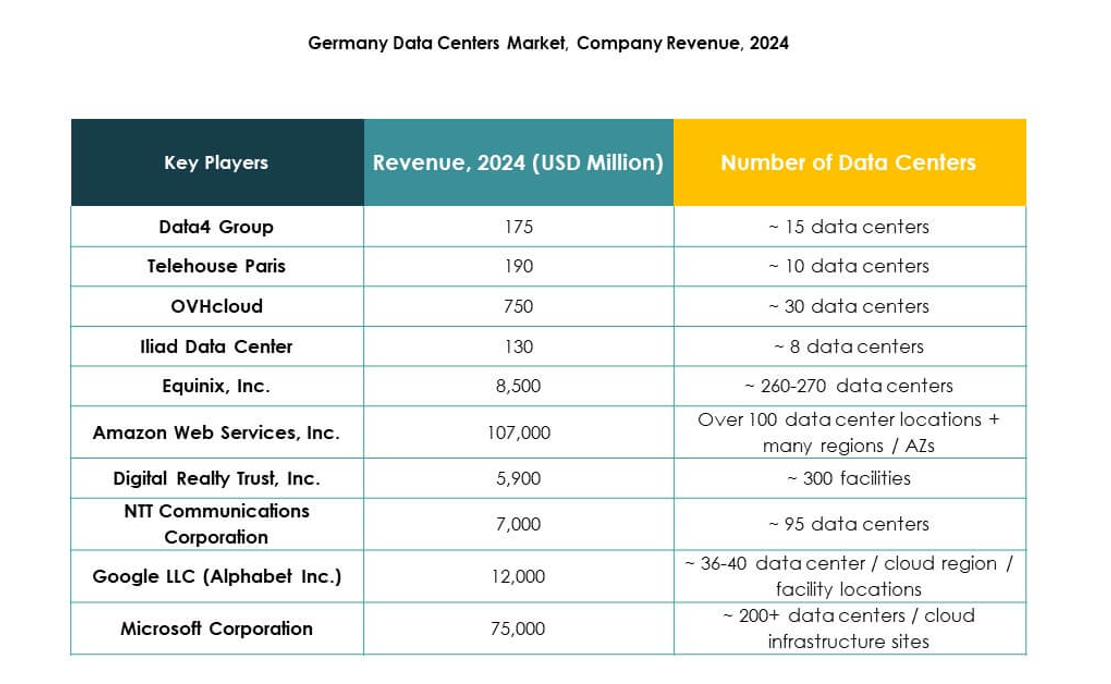

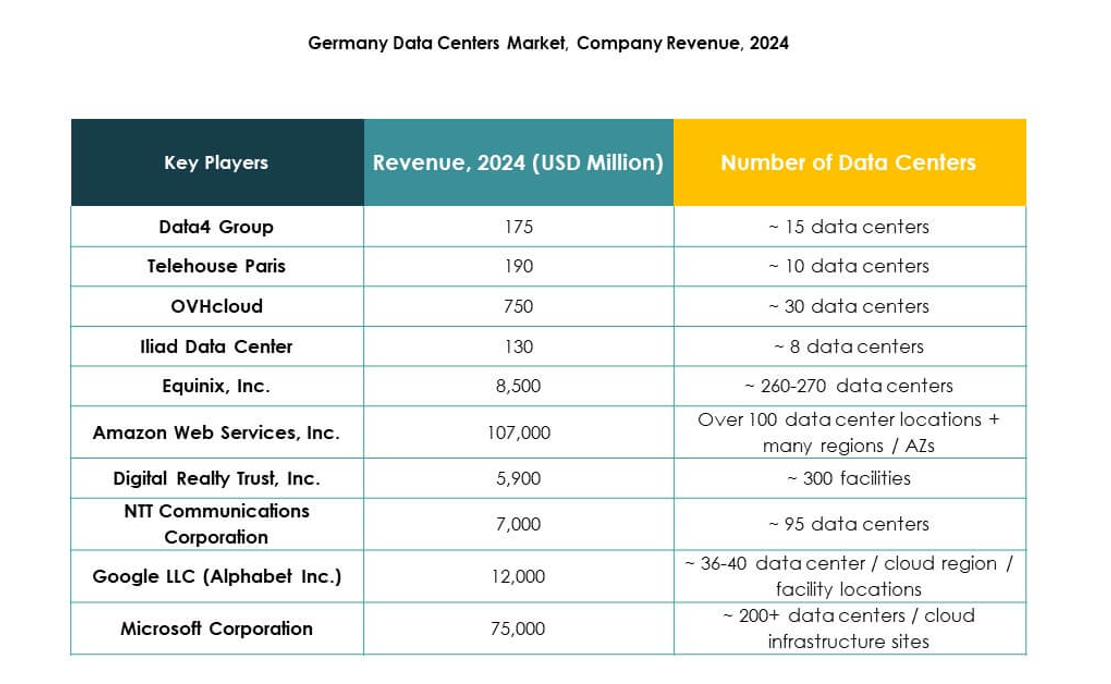

Competitive Insights:

- e-shelter (NTT)

- maincubes

- Telehouse Frankfurt

- Hetzner

- Equinix, Inc.

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Germany Data Center Market is characterized by strong competition among global hyperscale providers and local colocation specialists. It reflects a balance between international players such as Equinix, Digital Realty, AWS, Microsoft, and Google, and regional leaders like e-shelter, maincubes, and Hetzner. Operators compete through investments in new facilities, renewable energy integration, and advanced interconnection services. Demand for sustainable and low-latency infrastructure drives innovation in design and operations. It pushes companies to expand capacity in Frankfurt, Munich, and Berlin while exploring edge deployments in emerging cities. Strategic partnerships and acquisitions remain central to growth, with leading firms leveraging scale, compliance expertise, and technological innovation to maintain competitive positioning across industries.

Recent Developments:

- In September 2025, Penta Infra officially launched a new data center facility, HAM01, in Hamburg, Germany. The site provides 4.4 MW of power across 2,500 square meters of white space and integrates sustainability features, such as a photovoltaic facade, cooling systems utilizing natural refrigerants, and a green roof for improved heat regulation. The HAM01 launch marks a significant step in enhancing Penta Infra’s German footprint and advancing their commitments to energy efficiency and technological innovation.

- In September 2025, Portus broke ground on its second Munich data center site, planning to bring the facility’s capacity to 7 MW by early 2027. This development reflects ongoing efforts to meet Germany’s surging requirements for digital infrastructure and high-performance data processing solutions.

- In September 2025, Equinix unveiled a new global Distributed AI Infrastructure initiative, launching in Q1 2026 with AI-ready backbone capabilities, enhanced workload management, and dedicated AI Solutions Labs, leveraging its network across 270+ data centers, including Germany. This strategic expansion strengthens Equinix’s AI ecosystem and connects over 2,000 partners worldwide.

- In September 2025, NTT DATA entered a strategic partnership with Desay SV to co-develop software-defined vehicle platforms, leveraging NTT’s advanced data center and AI infrastructure in Germany to accelerate digital transformation within the automotive industry.