Executive summary:

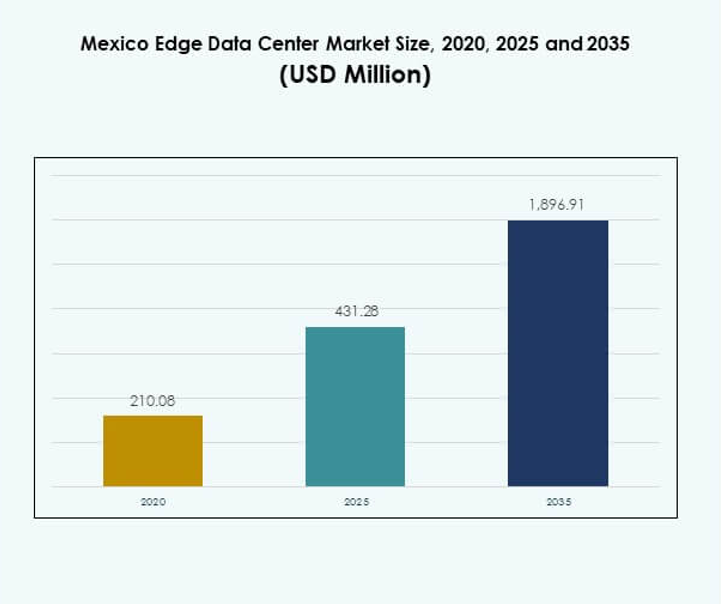

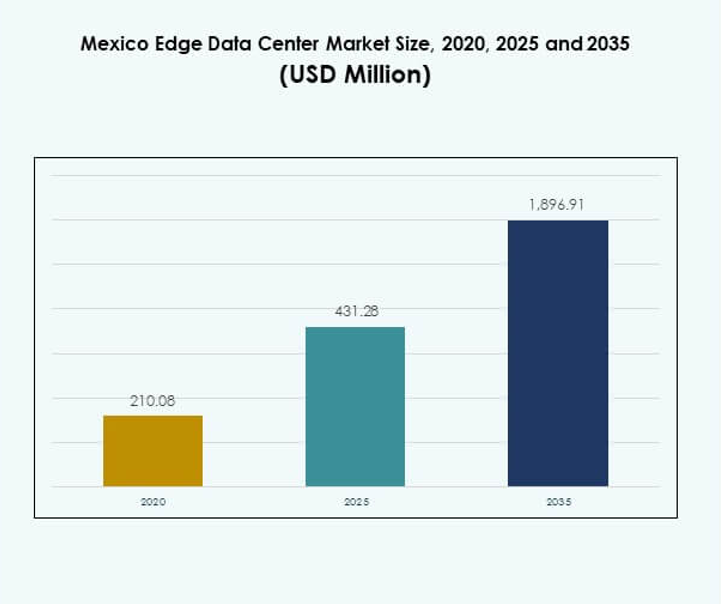

The Mexico Edge Data Center Market size was valued at USD 210.08 million in 2020, reached USD 431.28 million in 2025, and is anticipated to reach USD 1,896.91 million by 2035, at a CAGR of 15.83% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Mexico Edge Data Center Market Size 2025 |

USD 431.28 Million |

| Mexico Edge Data Center Market, CAGR |

15.83% |

| Mexico Edge Data Center Market Size 2035 |

USD 1,896.91 Million |

The market is driven by rapid 5G expansion, IoT adoption, and the increasing need for low-latency computing across industries. Companies are investing in modular and scalable edge infrastructure to improve data efficiency, security, and real-time analytics. It holds strategic importance for businesses and investors as it supports Mexico’s digital transformation, strengthens industrial automation, and improves nationwide data management for smart ecosystems.

Northern Mexico leads due to strong industrialization and proximity to the U.S., attracting cross-border digital investments. Central Mexico, including Mexico City and Querétaro, is emerging as a key digital hub supported by government initiatives and enterprise demand. Southern Mexico is developing steadily through renewable energy integration and regional connectivity expansion, creating balanced national growth in the edge data infrastructure landscape.

Market Drivers

Growing Demand for Low-Latency Data Processing and Network Efficiency

The Mexico Edge Data Center Market benefits from the rising need for low-latency computing across digital ecosystems. Businesses demand immediate data processing for industrial automation, autonomous logistics, and connected devices. Edge infrastructure supports latency below 10 milliseconds, ensuring smooth service delivery. Telecom operators deploy edge nodes near urban centers to reduce congestion on core networks. It supports real-time analytics, smart manufacturing, and next-generation retail operations. Cloud service providers invest in localized facilities to enhance response time for enterprise users. Governments encourage network densification through 5G spectrum allocation and fiber expansion. This creates an ecosystem favoring quick access and seamless digital transactions.

Expansion of 5G Networks and Internet of Things Integration Across Industries

Rapid 5G rollout accelerates demand for distributed computing sites. Telecom leaders and hyperscalers build regional edge facilities to manage IoT and sensor-driven workloads. Edge centers enable efficient backhaul and data storage within Mexico’s growing connected device ecosystem. It helps industries like automotive, logistics, and healthcare deploy intelligent applications at scale. Local operators collaborate with global technology vendors to strengthen capacity and uptime. 5G-linked smart city programs encourage modular and prefabricated data center deployment. Enterprises see cost optimization and improved service reliability through localized compute infrastructure. Such integration of IoT with edge architecture transforms data-intensive sectors into digital-first operations.

- For instance, in February 2024 AT&T Mexico and Ericsson implemented Mexico’s first private 5G network at Tecnológico de Monterrey’s CEDETEC, establishing a live testbed for robotics and low‑latency IoT use cases on campus to accelerate industrial and research applications with dedicated spectrum and on‑prem compute integration.

Technological Advancements Driving Modular, Scalable, and Energy-Efficient Edge Designs

Technology innovation defines the competitive strength of this market. Modular and containerized edge data centers allow flexible scalability in Mexico’s expanding telecom landscape. Advanced cooling systems and AI-driven monitoring enhance operational efficiency and uptime reliability. It leverages automation and predictive maintenance to reduce unplanned outages. Companies adopt renewable-powered solutions to align with energy transition goals. Intelligent software orchestrates workloads between central and edge nodes for optimal performance. The adoption of GPU-based processing units accelerates AI workloads across distributed environments. These improvements ensure sustainable growth in infrastructure and service quality.

- For instance, Scala Data Centers’ SMEXTP01 HyperEdge facility in Tepotzotlán launched with Phase 1 critical capacity of 5 MW and 142,133 square feet of built area, supplied with 100% renewable energy and designed for modular customization to serve hyperscale and content platforms requiring localized low‑latency delivery.

Strategic Importance of Edge Infrastructure for Businesses and Investors

Edge infrastructure strengthens national competitiveness by improving data sovereignty and digital readiness. Local enterprises gain control over critical applications and cybersecurity compliance. It reduces dependency on distant cloud regions, improving business continuity and resilience. Investors recognize strong ROI potential due to rising enterprise digitalization. Expansion of e-commerce, fintech, and OTT streaming boosts capital flow into data infrastructure. The market’s maturity supports hybrid deployment strategies for multinational corporations. Public-private partnerships accelerate infrastructure development across industrial corridors. This combination of policy support and enterprise adoption positions Mexico as a critical regional edge hub.

Market Trends

Shift Toward Distributed Edge Architectures and Decentralized Cloud Frameworks

Organizations in the Mexico Edge Data Center Market transition toward distributed infrastructure to balance performance and cost. Decentralized edge nodes enable faster processing for digital content, industrial automation, and retail analytics. Enterprises adopt hybrid models combining public cloud with regional edge platforms for better control. It facilitates compliance with emerging data protection standards. Decentralization supports multi-access edge computing for IoT and 5G environments. Regional carriers expand infrastructure closer to consumption points to improve latency and resilience. Software-defined networks optimize data routing between endpoints. This architectural shift marks a new phase in digital transformation strategies.

Increased Investment in AI-Enabled Monitoring and Autonomous Operations

AI integration defines the next stage of efficiency and reliability. Operators deploy machine learning tools for predictive maintenance and performance analytics. AI-based control systems reduce downtime and optimize energy use across distributed networks. It enhances fault detection, cooling management, and resource utilization in high-demand regions. Vendors offer advanced DCIM platforms integrating automation and analytics for visibility. These systems provide real-time insights that improve asset lifespan and operational safety. Data centers leverage robotic systems to streamline installation and maintenance. The trend toward AI-driven automation is redefining the future of infrastructure management.

Rising Focus on Renewable Energy Integration and Sustainability Standards

Sustainability dominates new data center construction plans across Mexico. Operators invest in renewable-powered facilities using solar and wind sources. The transition reduces carbon footprint and ensures long-term energy cost stability. It supports Mexico’s climate commitments while improving investor confidence in green infrastructure. Energy-efficient cooling and heat reuse systems gain rapid adoption in major hubs. Vendors collaborate with utility providers for renewable power purchase agreements. Data center designs emphasize LEED and ISO certifications to meet sustainability goals. The alignment with environmental standards attracts global enterprises prioritizing ESG compliance.

Growing Role of Edge in Supporting Emerging Technologies and Smart Ecosystems

Edge infrastructure becomes vital for emerging digital ecosystems. It supports AR/VR applications, real-time video streaming, and connected vehicle platforms. Businesses adopt edge-to-cloud orchestration for faster analytics and content delivery. The Mexico Edge Data Center Market enables smart grid and telemedicine initiatives through localized computing. Telecom companies and tech startups cooperate on low-latency service models. Edge networks provide backbone support for robotics, surveillance, and AI applications. It plays a key role in enabling immersive digital services for urban innovation. This evolution fosters technological self-sufficiency and scalable modernization.

Market Challenges

Infrastructure Limitations, Energy Constraints, and High Capital Requirements

The Mexico Edge Data Center Market faces several development constraints. Power reliability and grid stability pose major challenges for consistent operation. Limited renewable power access in remote zones affects project feasibility. It requires large capital expenditure for site acquisition, power supply, and cooling equipment. Many operators struggle to secure permits and funding for high-density edge builds. The shortage of skilled professionals in automation, cybersecurity, and operations adds further pressure. Infrastructure development outside major cities progresses slowly due to policy and utility delays. Such constraints delay deployment timelines and impact scalability of regional expansion.

Regulatory Barriers, Cybersecurity Concerns, and Supply Chain Volatility

Regulatory complexity around data privacy and cross-border transfer compliance affects investor confidence. The absence of unified policies complicates coordination between public and private entities. It exposes networks to risks related to data protection and incident response management. Rising cyber threats demand advanced security frameworks that smaller operators may lack. Global supply chain disruptions delay equipment procurement and increase installation costs. Import dependencies for IT hardware limit local manufacturing capabilities. The combination of these factors elevates risk and operational uncertainty within the sector.

Market Opportunities

Emergence of Smart Infrastructure and Regional Edge Expansion Potential

Significant opportunity arises from smart city programs and industrial digitalization projects. Edge computing improves data access for public utilities, logistics, and healthcare systems. It supports smart grid management, mobility platforms, and precision manufacturing ecosystems. Growth in northern industrial corridors strengthens regional edge expansion potential. Cloud providers and telecom firms pursue joint ventures for scalable deployments. Government-backed digital economy initiatives attract long-term infrastructure investment. Local enterprises benefit from faster analytics and reduced operational risk. This convergence drives steady ecosystem development across high-growth regions.

Integration of AI, 5G, and Cloud Services Creating Competitive Differentiation

Integration of advanced technologies unlocks strong competitive advantages for operators and investors. Edge facilities with AI and 5G support real-time analytics and automation for industries. It enhances the ability to process large datasets locally with minimal delay. Telecom companies explore multi-tenant edge frameworks to diversify service offerings. Global hyperscalers expand regional footprints to deliver customized cloud-edge solutions. Enterprises prioritize proximity computing for mission-critical applications. The synergy between AI and edge ensures rapid scalability for new digital services. This foundation strengthens Mexico’s position as a technology-driven regional hub.

Market Segmentation:

By Data Center Size

Micro data centers dominate the Mexico Edge Data Center Market due to rising demand for localized computing and low-latency applications. These compact, modular facilities serve industries implementing IoT, AI, and smart city solutions. They account for the largest share of installations because of their scalability and cost efficiency. Hyperscale and enterprise data centers follow, supported by cloud service expansion and increasing digital transformation projects. Continuous investment by telecom and IT operators in micro-edge infrastructure strengthens Mexico’s position in distributed data processing and regional connectivity advancement.

By Electrical Infrastructure

UPS systems lead the Mexico Edge Data Center Market, holding the largest share due to their vital role in ensuring uninterrupted power supply and operational stability. Advanced lithium-ion UPS solutions and modular designs improve efficiency and minimize downtime. Generators also register steady growth with growing backup requirements for off-grid and remote deployments. PDUs and switchgears support reliable energy distribution and monitoring across dense network environments. Continuous upgrades in electrical infrastructure enhance sustainability, reduce energy losses, and meet rising performance demands from data-intensive industries and 24/7 service operators.

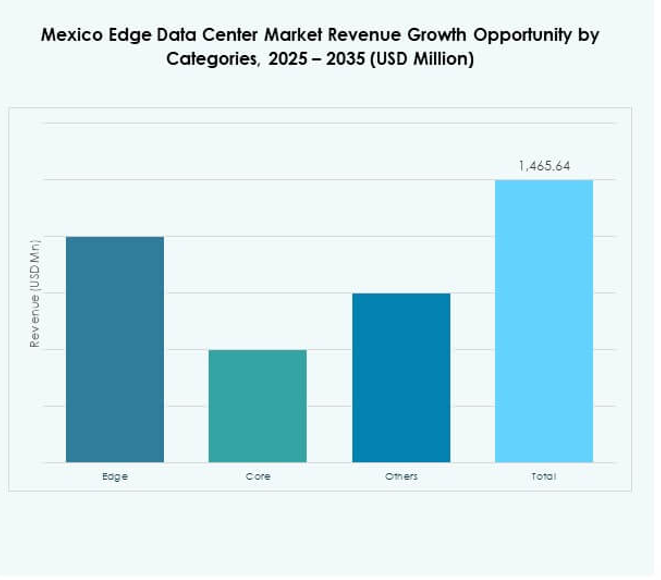

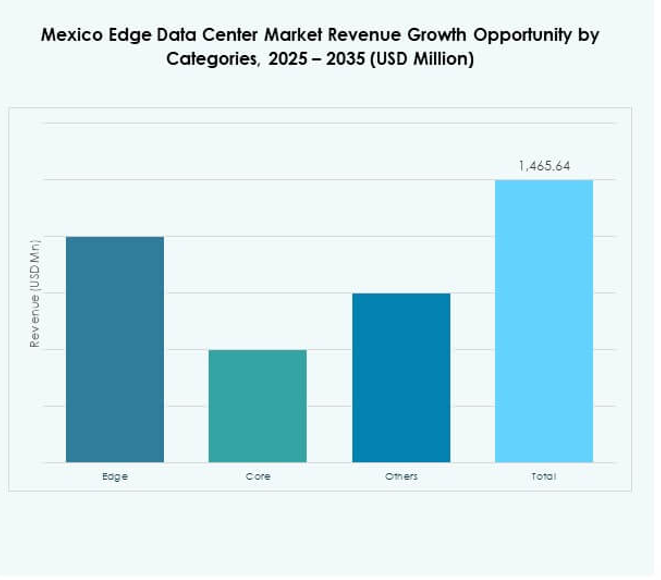

By Category

The edge category dominates the Mexico Edge Data Center Market, driven by the rapid expansion of 5G networks, IoT applications, and digital commerce. Edge deployments enhance data processing speed by minimizing transmission distance, crucial for latency-sensitive services. Core data centers continue to hold relevance for centralized storage and enterprise workloads. Hybrid deployment models integrating both categories are becoming prevalent. Companies investing in distributed edge facilities gain strategic advantages in real-time analytics and localized computing, creating a balanced and resilient digital infrastructure ecosystem across industrial and metropolitan regions.

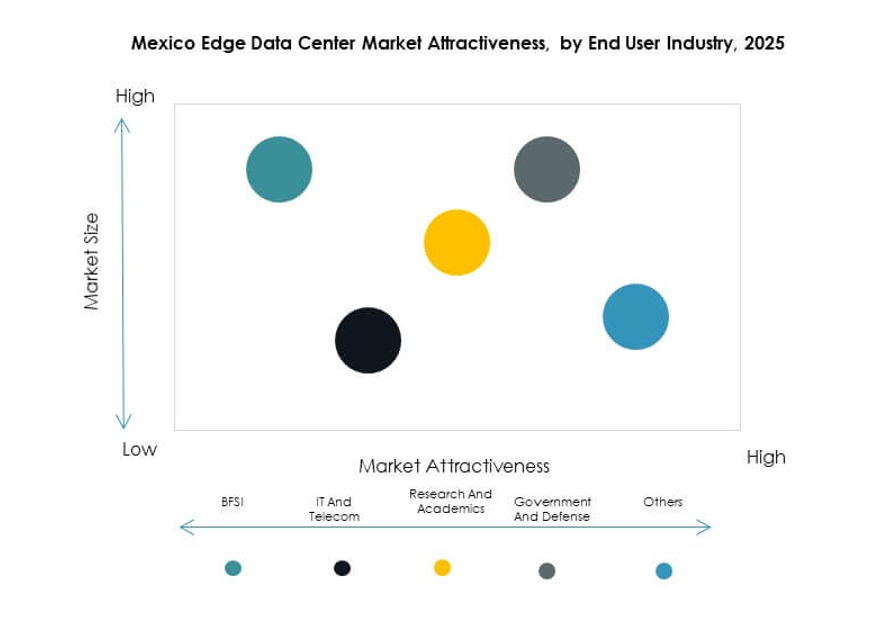

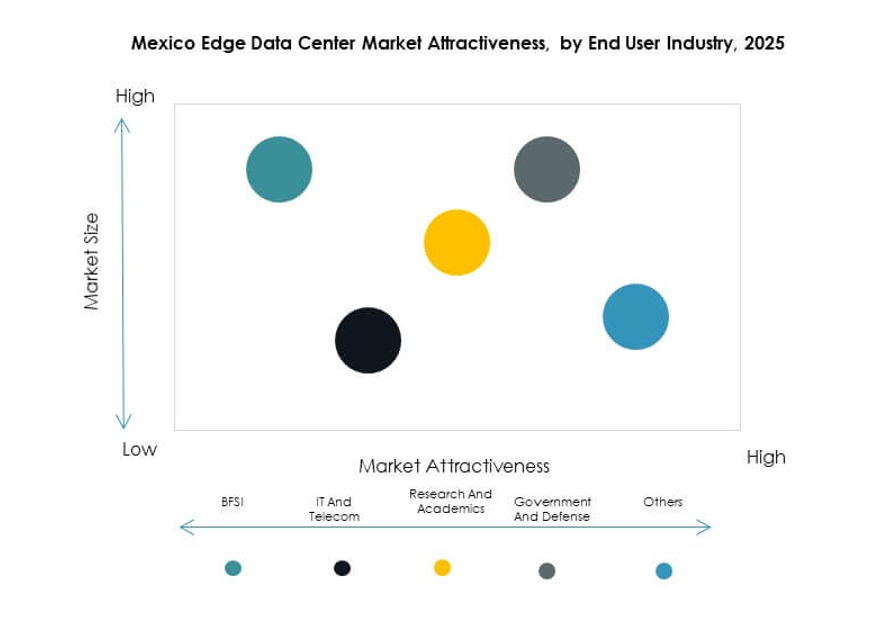

By End User Industry

The IT and telecom sector represents the largest share of the Mexico Edge Data Center Market, fueled by 5G rollout and data traffic growth from cloud services. BFSI follows with strong adoption of edge computing for real-time transaction processing and fraud detection. Manufacturing and healthcare sectors are emerging adopters, leveraging edge infrastructure for automation and remote diagnostics. Government and defense entities integrate edge computing to improve operational security and surveillance systems. The expanding digital ecosystem drives cross-industry adoption, reinforcing Mexico’s edge infrastructure as a foundation for national digital transformation.

Regional Insights:

Northern Mexico

Northern Mexico holds the largest share of 41% in the Mexico Edge Data Center Market, supported by strong industrialization and proximity to the United States. The region’s strategic location near key trade routes and cross-border logistics hubs attracts multinational data center investments. Cities such as Monterrey and Ciudad Juárez have evolved into high-demand zones for edge deployments, driven by manufacturing automation and logistics optimization. It benefits from established fiber connectivity and renewable power availability, strengthening operational reliability. Major telecom operators and hyperscalers prioritize this area for regional data traffic management and low-latency applications.

- For instance, in July 2025, Equinix confirmed the MO2 project in Monterrey is on schedule to be its next data center launch in Latin America; the facility is strategically located to enhance cross-border digital infrastructure and attract multinational deployments.

Central Mexico

Central Mexico accounts for 36% of the market share, primarily led by Mexico City and Querétaro. These metropolitan areas serve as the country’s digital backbone, hosting a concentration of enterprises, data networks, and government institutions. The region’s growing smart city initiatives and public sector digitalization accelerate data center capacity expansion. It benefits from advanced power infrastructure and consistent access to high-speed fiber networks. The presence of technology parks and established data service providers promotes continuous innovation. Cloud service adoption among financial and retail sectors drives significant edge infrastructure development in this subregion.

Southern Mexico

Southern Mexico captures a 23% share, showing steady growth supported by regional connectivity projects and renewable energy integration. The government’s focus on infrastructure modernization and regional equity encourages new data center investments in cities such as Mérida and Villahermosa. It remains a strategic frontier for expanding digital inclusion and enterprise access to edge computing. The region’s high solar potential supports the construction of sustainable edge facilities. Increasing demand from healthcare and education sectors enhances local data processing capabilities. Progressive initiatives to improve grid stability and connectivity position Southern Mexico as an emerging edge hub.

- For instance, in April 2024, Mexico Telecom Partners (MTP) entered the Fermaca Fiber Partners program and commenced the second phase of its Mérida edge data center, deploying combined dark fiber and micro-edge data center services that expanded high-speed connectivity and digital access for regional customers.

Competitive Insights:

- Axtel

- Megacable Holdings

- Totalplay Telecom

- EdgeConneX

- Eaton Corporation

- Dell Technologies Inc.

- Fujitsu

- American Tower

- Cisco

- SixSq

- Microsoft

- VMware

- Schneider Electric SE

- Rittal GmbH & Co. KG

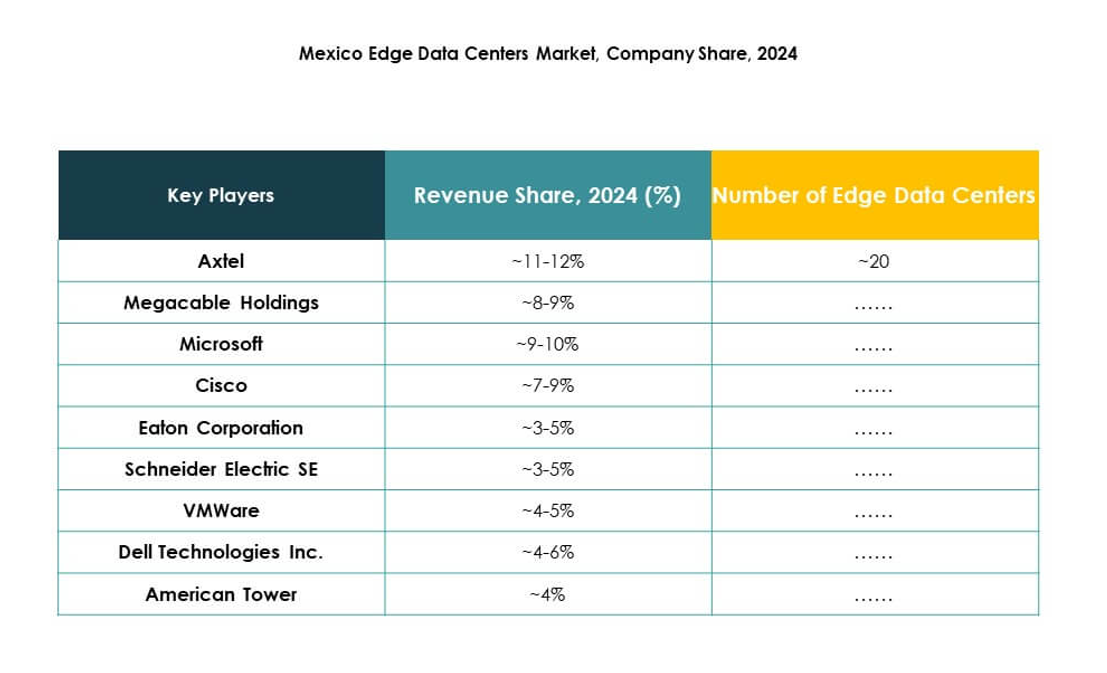

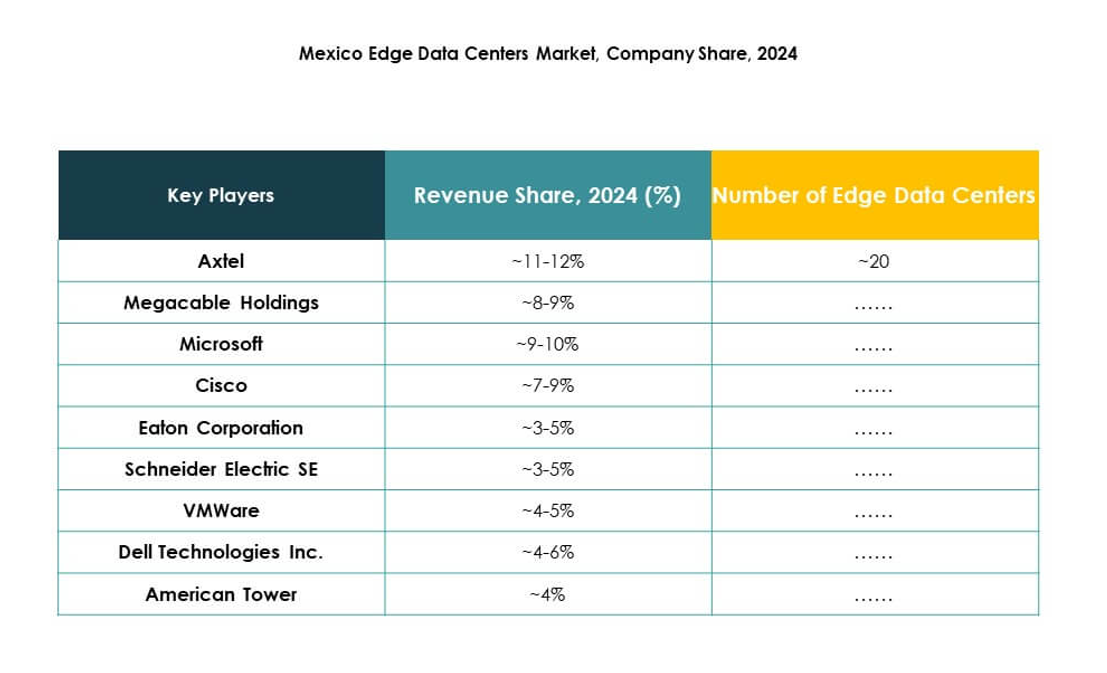

The Mexico Edge Data Center Market features a competitive environment driven by collaboration among telecom operators, technology providers, and infrastructure specialists. It shows strong participation from both domestic and global players focusing on edge scalability, modular designs, and energy efficiency. Companies such as EdgeConneX, Axtel, and American Tower lead in facility expansion and local network integration. Global technology firms including Dell Technologies, Microsoft, and Cisco enhance the ecosystem through cloud-edge convergence and automation. Vendors like Schneider Electric and Rittal strengthen competitiveness with advanced cooling and power management systems. Continuous partnerships, service innovation, and sustainability initiatives define the strategic growth direction of this market.

Recent Developments:

- In August 2025, Mexico Telecom Partners (MTP) commenced the second phase of its edge data center project in Merida, which expanded its operational presence to a total of 61 edge data centers across the country, strengthening distributed infrastructure capabilities for connectivity and data processing in emerging metropolitan and regional markets.

- In June 2025, Edgenet launched a national network of edge data centers in Mexico, beginning with the unveiling of Mayia, an artificial intelligence center recognized by the Ministry of Economy as the first AI center with the “Made in Mexico” designation; this rollout is part of a broader effort to deploy 30 AI-ready edge facilities across regions such as Baja California and Quintana Roo, following the acquisition of data center sites from Telefónica Movistar.

- In December 2024, Axtel deployed Telco Systems’ Edgility edge computing platform to deliver a managed Customer Experience solution over its network, positioning the operator to offer low-latency, edge-native services in Mexico’s enterprise market.