Executive summary:

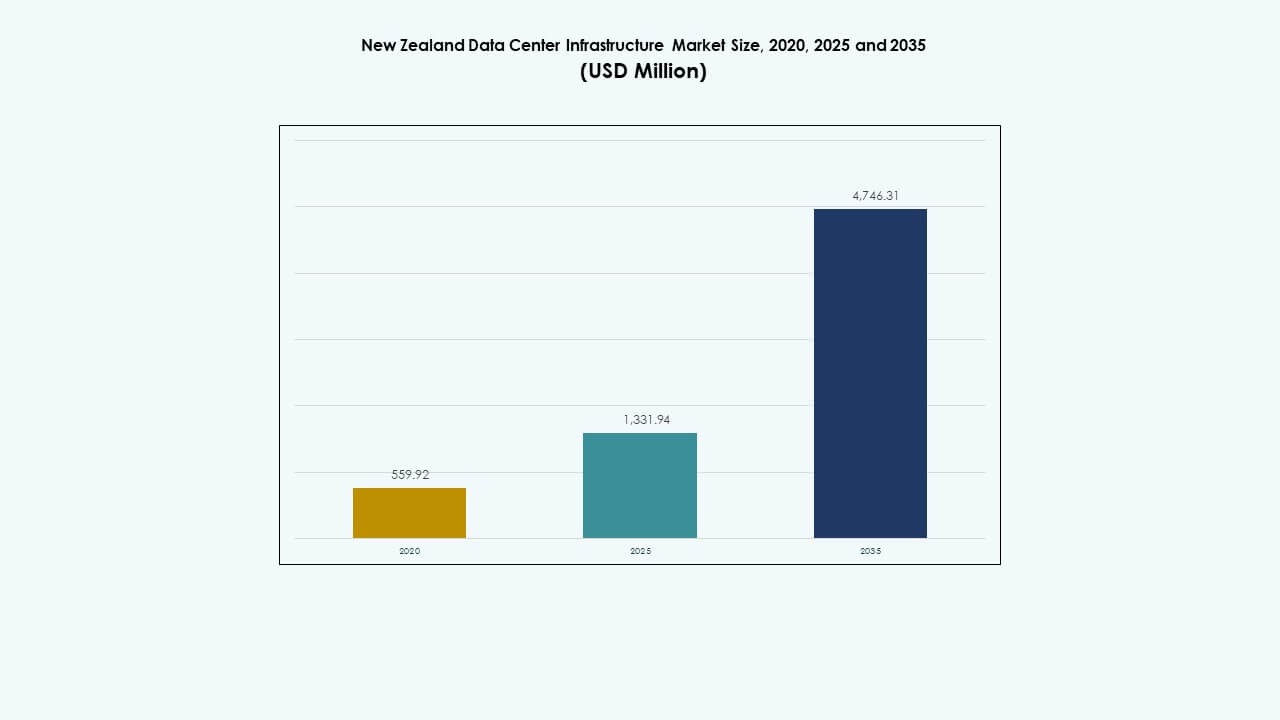

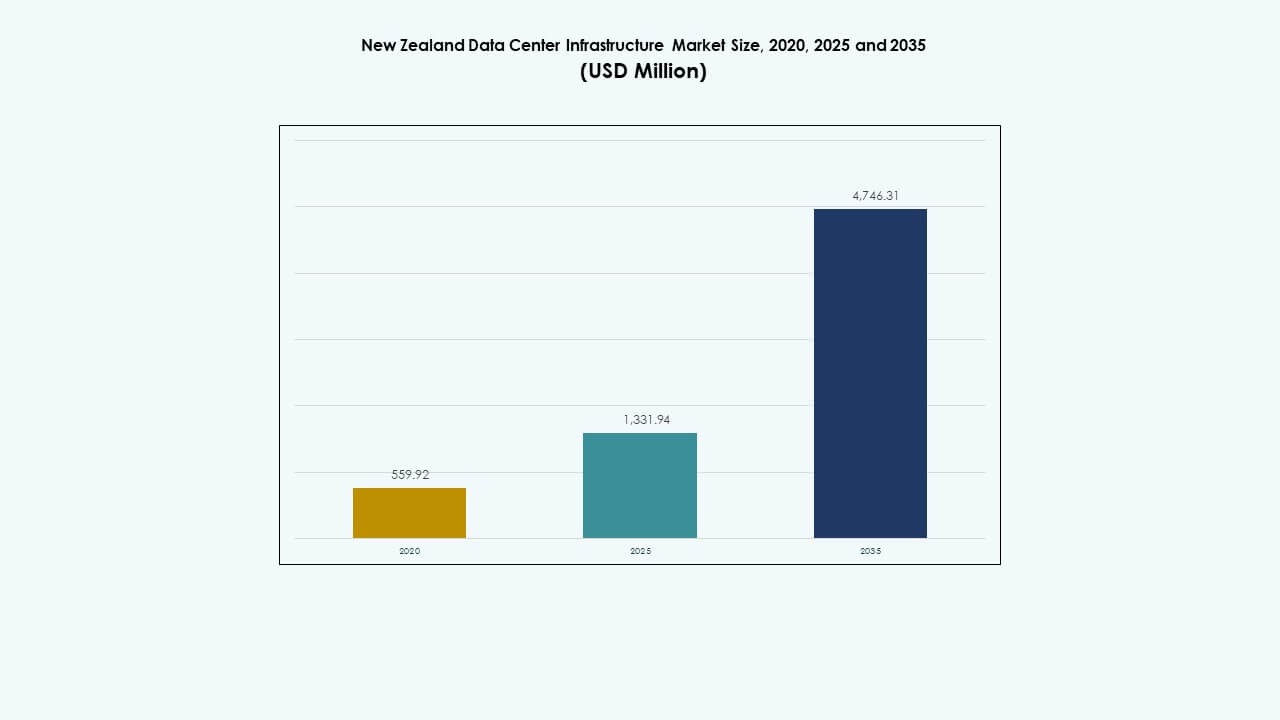

The New Zealand Data Center Infrastructure Market size was valued at USD 559.92 million in 2020, increased to USD 1,331.94 million in 2025, and is anticipated to reach USD 4,746.31 million by 2035, at a CAGR of 13.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| New Zealand Data Center Infrastructure Market Size 2025 |

USD 1,331.94 Million |

| New Zealand Data Center Infrastructure Market, CAGR |

13.44% |

| New Zealand Data Center Infrastructure Market Size 2035 |

USD 4,746.31 Million |

The market is driven by rising demand for cloud services, AI processing, and digital transformation across enterprise and public sectors. Businesses are modernizing IT infrastructure to support hybrid environments, low-latency applications, and data sovereignty needs. Operators are adopting modular designs, renewable energy integration, and automation to scale efficiently. Growing interest from global cloud and colocation providers strengthens infrastructure maturity. The market offers long-term strategic value through stable demand and high compliance standards.

Auckland leads the market due to its strong enterprise base, subsea cable connectivity, and fiber-rich environment. Wellington follows, supported by public sector digitization and government-hosted services. Christchurch is emerging as a secondary hub with lower seismic risk zones and reliable power access. Smaller cities like Hamilton and Tauranga show potential for edge data center deployment due to rising population and fiber expansion. The North Island dominates, while South Island is gaining relevance for sustainable hosting needs.

Market Drivers

Market Drivers

Strong Enterprise Digitalization and Rising Cloud Migration Among New Zealand Businesses

Businesses across financial services, retail, and logistics are driving digital adoption in New Zealand. This shift fuels demand for scalable, secure, and low-latency data center infrastructure. Companies are migrating to hybrid and multi-cloud architectures, accelerating the deployment of modular and virtualized infrastructure. The trend is expanding across both public and private sectors. Investment in high-availability systems is growing due to increased regulatory and uptime requirements. The New Zealand Data Center Infrastructure Market supports business continuity and disaster recovery capabilities. Cloud-native platforms are replacing legacy hardware systems. Demand for AI workloads is also growing across sectors. These shifts strengthen infrastructure upgrades across core and edge locations.

- For instance, ANZ Bank migrated 13 applications and 5 petabytes of data to the Cloudera Data Platform to power its enterprise-wide big data platform, consolidating the workload onto 70 servers to enhance data discovery and analytics efficiency.

Innovation in Edge Computing and Supportive Government Digital Strategies

Edge computing deployments are rising due to latency-sensitive applications in retail and manufacturing. Operators are installing compact edge data centers across urban and semi-rural zones. This supports faster access for IoT, AI, and AR/VR services. The New Zealand government’s digital inclusion and data sovereignty goals encourage regional data center builds. Public agencies are upgrading to cloud-based platforms, increasing local hosting demand. Edge infrastructure adoption is helping scale AI-enabled services for smart utilities and transport. The market is adopting prefabricated containerized units to deploy edge systems faster. This supports high-density zones and localized workloads. The New Zealand Data Center Infrastructure Market benefits from policies encouraging domestic data localization.

- For instance, Microsoft’s cloud migration initiatives with New Zealand councils enable AI-driven insights from Fabric platform, mapping resident journeys across services with modern edge-enabled offerings. This supports faster access for IoT, AI, and AR/VR services.

Surge in Renewable Integration and Green Data Center Design Standards

Green energy availability is shaping procurement and build decisions across the country. More operators are designing carbon-neutral facilities using hydro, wind, and solar power. Infrastructure providers are adopting energy-efficient UPS, modular chillers, and low-loss PDUs. Green building certifications, including NABERSNZ and Green Star, are influencing investor strategies. Operators are achieving lower PUE by combining free cooling, AI-based HVAC control, and airflow optimization. Sustainability compliance is now a core selection factor for hyperscale and colocation builds. The market is adopting lithium-ion battery storage systems to support grid resilience. Government energy efficiency programs support capex investments. The New Zealand Data Center Infrastructure Market is positioning as a leader in sustainable hosting across APAC.

Strategic Importance of Connectivity Infrastructure and Subsea Cable Integration

New international subsea cable projects such as Southern Cross NEXT and Hawaiki Nui strengthen New Zealand’s global internet transit. These enhance redundancy, reduce latency, and attract international hyperscalers. Telecom providers are expanding interconnection capacity across Auckland, Wellington, and Christchurch. IX points are evolving to support carrier-neutral colocation hubs. The rise in undersea cable landing stations is catalyzing new facility investments near coastal urban zones. Cross-island fiber routes are enabling inter-regional edge deployments. The New Zealand Data Center Infrastructure Market gains strategic value as a connectivity hub for trans-Pacific routes. Investors view cable-backed sites as future-ready assets. Colocation and cloud providers co-locate near cable landing zones for better throughput and resiliency.

Market Trends

Market Trends

Rising Adoption of Modular, Scalable, and Factory-Built Infrastructure Solutions

Operators are deploying modular systems to scale capacity faster and reduce site construction time. Factory-assembled components allow plug-and-play installation, speeding up project delivery. This trend is accelerating in Tier 2 cities with limited on-site engineering resources. New builds now feature modular chillers, prewired PDUs, and containerized UPS solutions. The approach supports better cost control and consistent performance. IT rooms are also shifting toward prefabricated units. The New Zealand Data Center Infrastructure Market is embracing factory-built systems to reduce design complexities. The trend benefits operators focused on quick deployment and phased expansion. Modular approaches also support sustainable construction and lower embodied carbon.

AI-Ready Design Architectures and Infrastructure Reconfiguration for High-Density Workloads

Rising AI training and inference workloads demand denser power delivery and thermal management. Operators are retrofitting rooms with liquid cooling systems and hot-aisle containment. High-performance computing applications drive rack power densities beyond 20 kW. Data centers are shifting toward customizable power paths and scalable cooling zones. AI GPU clusters require high-speed, low-latency networks with redundant paths. The New Zealand Data Center Infrastructure Market is evolving to support rack-level thermal optimization. Facilities are being designed with zone-based cooling and higher airflow per cabinet. AI-focused upgrades are increasing energy intensity, prompting efficiency innovations. These trends reshape infrastructure strategies for future data loads.

Growth in Hyperscale and Edge Buildouts Backed by Telecom and Cloud Partnerships

Major telecom providers and cloud hyperscalers are co-investing in hyperscale sites and edge clusters. These partnerships target localized zones with growing digital consumption. Hyperscale builds focus on 20–50 MW scalable campuses near cable landing and fiber convergence points. Edge builds in outer metro areas support latency-sensitive content delivery and real-time analytics. The New Zealand Data Center Infrastructure Market benefits from cloud-region expansion and local CDN caching demand. New hyperscale-ready zones are emerging in South Auckland, Upper Hutt, and Dunedin. Telecom-backed edge nodes support 5G rollout and IoT adoption. This dual structure improves nationwide compute and storage reach.

Hardware Lifecycle Management and Infrastructure-as-a-Service Model Adoption

Organizations are shifting from capex-heavy ownership to OPEX-based infrastructure procurement. Infrastructure-as-a-Service models are growing across private enterprises and SMBs. This includes leased servers, cooling systems, PDUs, and backup systems. Lifecycle management contracts reduce maintenance risk and extend asset usability. Remote monitoring, predictive failure analytics, and automated firmware updates support uptime. The New Zealand Data Center Infrastructure Market is adopting service-based models to simplify infrastructure refresh. Vendors offer modular leasing solutions bundled with software and analytics tools. Businesses prefer flexibility in hardware upgrades without disrupting critical workloads. This model aligns with cloud-first strategies and multi-cloud orchestration frameworks.

Market Challenges

Market Challenges

Geographic Constraints, Land Availability, and Construction Costs for Expansion Projects

New Zealand’s limited urban land supply and zoning restrictions challenge large-scale data center expansion. Land near cable landing stations or high-capacity substations is often scarce and expensive. Environmental regulations restrict greenfield development in many zones. Operators face high site preparation and permitting timelines. Seismic resilience requirements add structural design costs. The New Zealand Data Center Infrastructure Market encounters delays when expanding into new regions. Construction costs remain elevated due to labor shortages and logistics expenses. Builders must factor in site elevation, cooling access, and power grid proximity. These challenges affect hyperscale site planning and modular scalability.

Power Grid Limitations, Upgrade Timelines, and Renewable Integration Challenges

Power availability is a bottleneck for some zones, particularly outside core metro areas. Existing substations may not support multi-megawatt loads without costly upgrades. Grid reinforcement timelines often extend 24–36 months, slowing down deployment. Operators seek on-site generation or storage, which adds design complexity. While renewable energy is abundant, integrating intermittent sources needs advanced grid coordination. Battery storage system costs remain high for large-scale backup. The New Zealand Data Center Infrastructure Market faces uncertainty in aligning data center loads with evolving national grid policies. These power challenges increase deployment risk and extend ROI periods for investors.

Market Opportunities

Green Energy Abundance and Low-Carbon Infrastructure Demand from International Tenants

New Zealand’s strong hydropower base allows operators to market low-carbon hosting services. Global firms are seeking green data centers for ESG compliance and emissions reduction. Regions like Waikato and Otago offer grid-stable renewable energy. This supports long-term clean energy supply agreements. The New Zealand Data Center Infrastructure Market is positioned to attract sustainability-focused cloud and enterprise clients. It enables operators to build green campuses with minimal diesel backup.

Emergence of Secondary Data Center Clusters and Cross-Island Connectivity Expansion

Christchurch, Hamilton, and Tauranga are emerging as regional digital hubs. These locations attract edge deployments due to proximity to growing population centers. Cross-island fiber links support active-active replication and distributed hosting. The market is opening new investment zones outside Auckland and Wellington. The New Zealand Data Center Infrastructure Market gains diversification opportunities from balanced national infrastructure strategies.

Market Segmentation

Market Segmentation

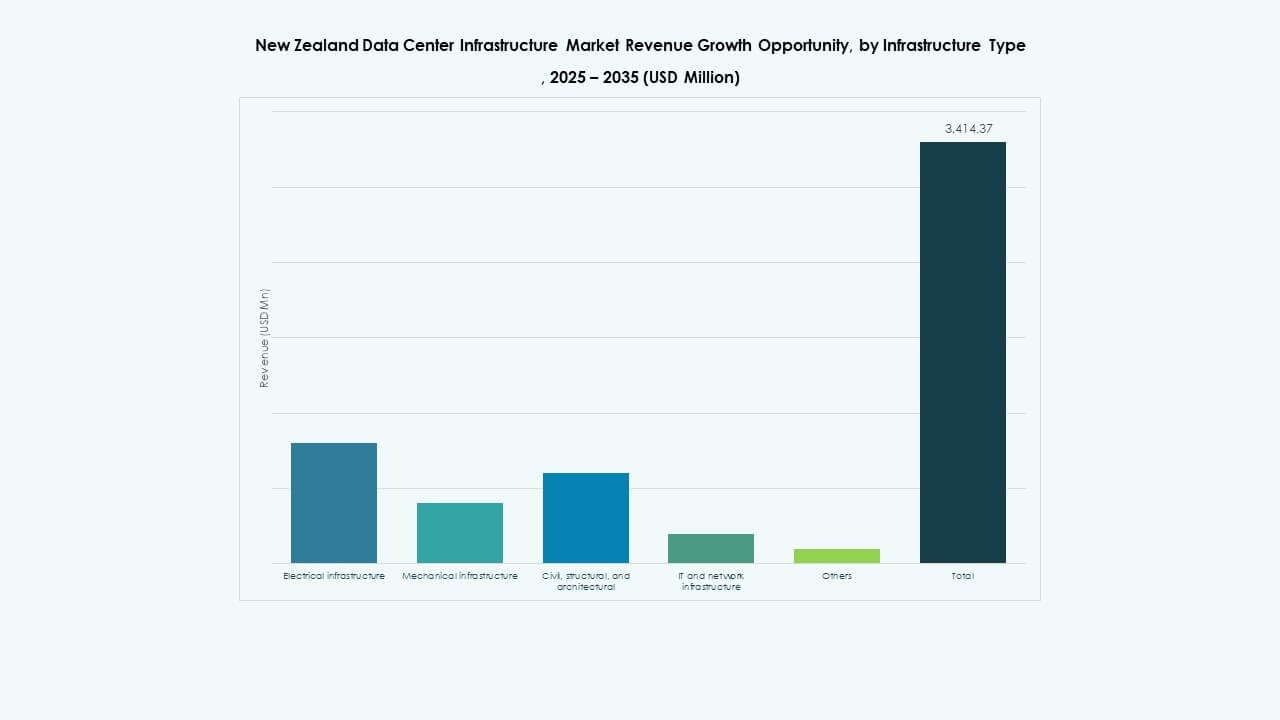

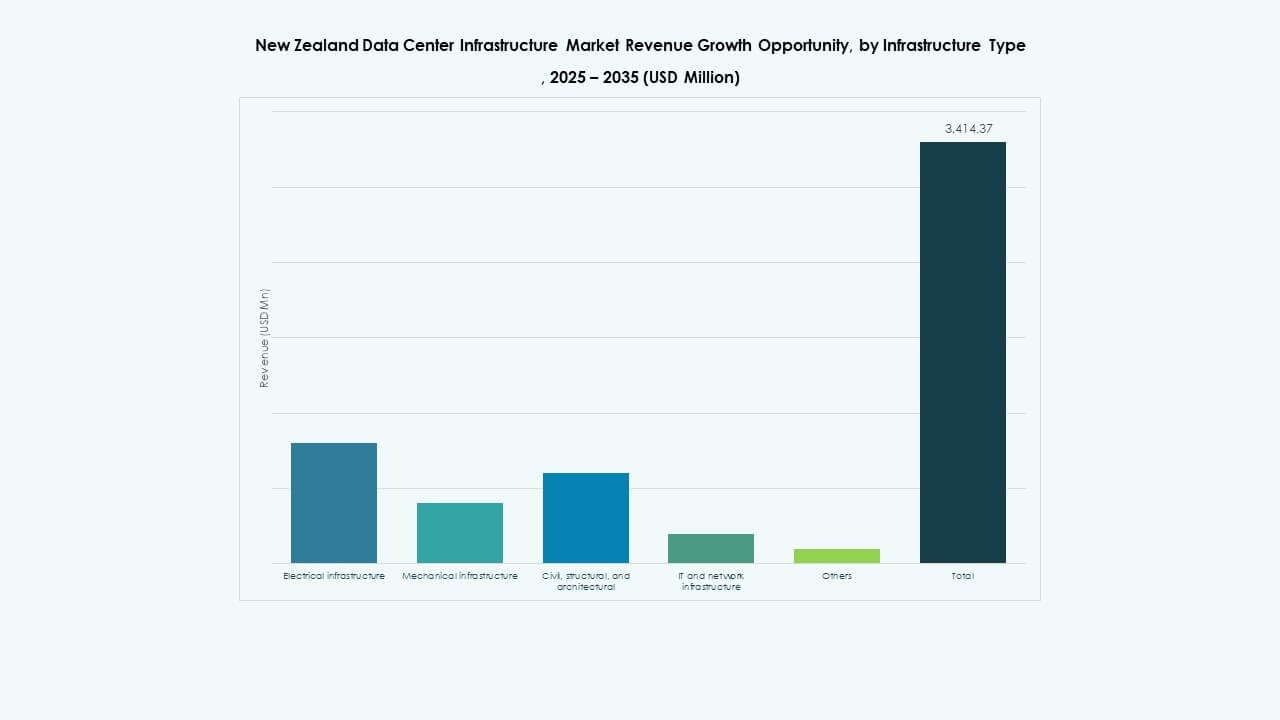

By Infrastructure Type

The New Zealand Data Center Infrastructure Market is dominated by electrical and IT infrastructure segments due to high-density compute requirements. Electrical systems drive uptime and redundancy, while IT and network infrastructure support evolving digital workloads. Mechanical and civil infrastructure segments follow closely with cooling and structural needs. Demand for modular construction and pre-integrated systems is rising in all categories.

By Electrical Infrastructure

Uninterruptible power supply (UPS) and power distribution units (PDUs) hold the largest market share due to critical uptime roles. Battery energy storage systems are gaining adoption with sustainability targets. Utility service upgrades and transfer switches are key for hyperscale expansion. Grid-resilient, lithium-ion–based backup systems are replacing traditional diesel generators.

By Mechanical Infrastructure

Cooling units and chillers lead the segment, especially in high-density AI and HPC deployments. Containment systems and pump setups are seeing growth in modular buildouts. Operators invest in efficient, scalable cooling to lower PUE. New deployments focus on integrated, adaptive mechanical systems that minimize operational power draw.

By Civil / Structural & Architectural

Site preparation and modular structures dominate this segment. Seismic design compliance, raised floors, and thermal-resistant envelopes are standard. Prefabricated modules and modular envelopes support edge and regional builds. Construction partners focus on fast-deployment models with optimized layouts.

By IT & Network Infrastructure

Networking equipment and servers drive this segment, supported by growing GPU and AI workloads. Storage systems, fiber cabling, and scalable rack setups follow. Operators are deploying high-throughput, low-latency infrastructure with greater rack densities. Optical fiber penetration supports future 800G/1.6T architecture transitions.

By Data Center Type

Colocation data centers dominate due to carrier-neutral access and growing interconnect needs. Hyperscale campuses are expanding near fiber routes and cable landings. Edge deployments grow across smaller cities. Enterprises still build private facilities but often outsource core workloads.

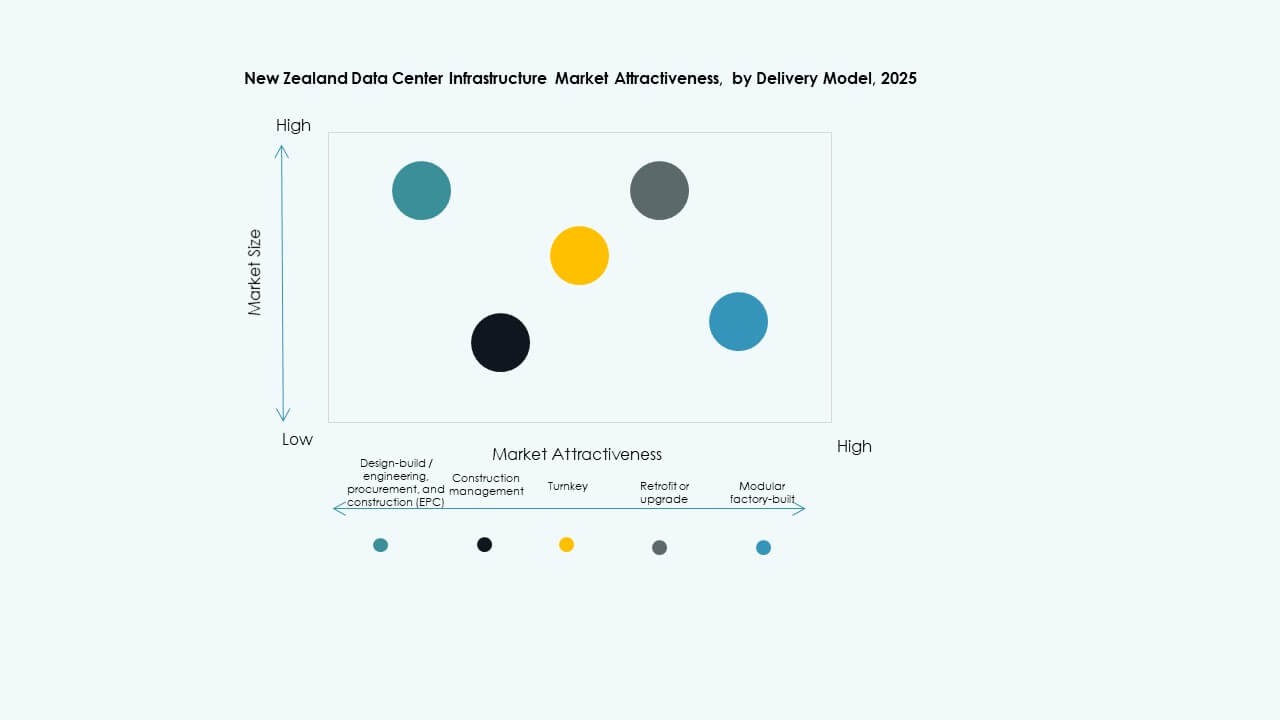

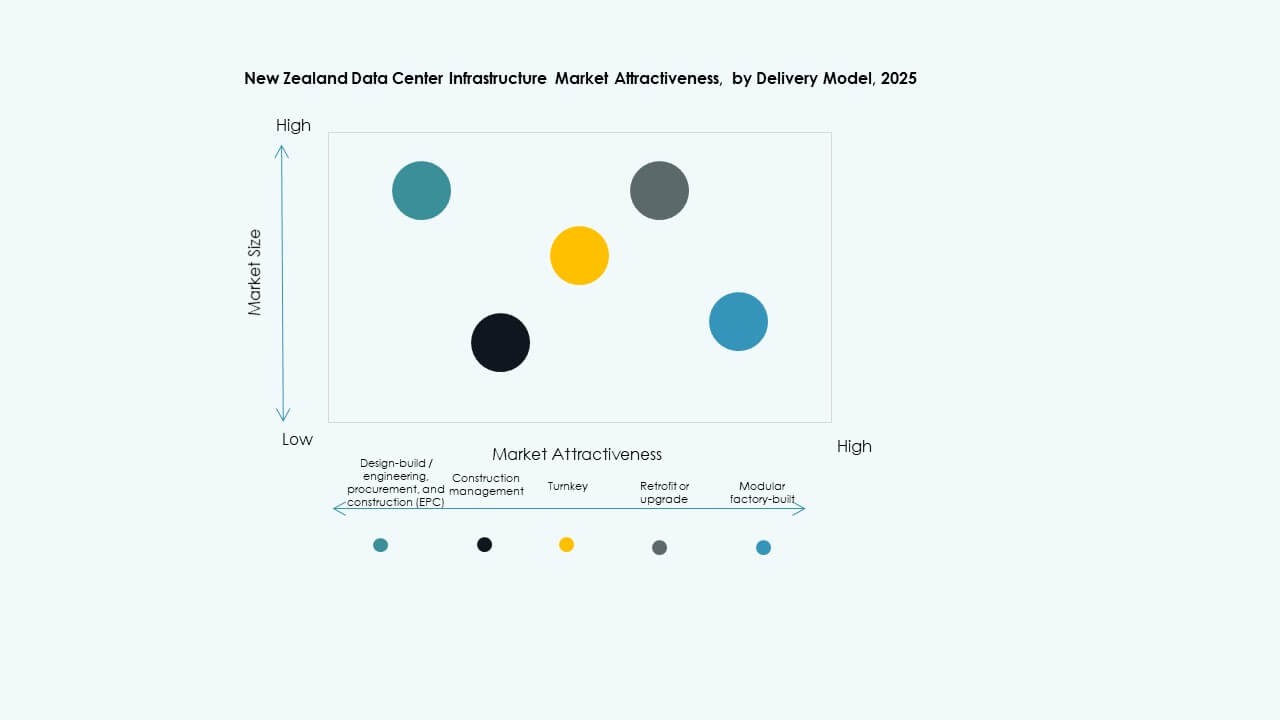

By Delivery Model

Turnkey and design-build models lead, offering speed and quality control. Retrofit activity is strong in enterprise campuses, while modular factory-built models scale edge deployments. Construction management is common for public-sector builds. EPC is preferred by telecom firms seeking integrated delivery.

By Tier Type

Tier 3 facilities dominate, offering balanced cost and reliability. Tier 2 is common among edge builds and regional deployments. Tier 4 is limited to hyperscale or banking-critical zones. Tier 1 is phasing out due to reliability concerns and SLA requirements.

Regional Insights

Auckland leads the New Zealand Data Center Infrastructure Market with over 55% share, driven by dense enterprise presence, subsea cable landings, and strong fiber backbone. Most hyperscale and colocation campuses are in South Auckland due to flat land, proximity to transmission lines, and access to clean energy. The city supports high cloud and telecom interconnect demand.

- For instance, Datavault expanded its Auckland facility by commissioning a fourth data hall built to Tier III standards, achieving a Power Usage Effectiveness (PUE) of 1.14 by implementing high-efficiency cooling and electrical infrastructure.

Wellington accounts for around 25% of the market, supported by government cloud migration and public-sector digital transformation. Data center investments here focus on resiliency and compliance. Facilities are often built with strict security and seismic resilience standards. It acts as a key backup zone for Auckland workloads.

Christchurch and other regional cities together hold nearly 20% market share. Christchurch sees growth due to its geographic spread, cooler climate, and rising tech economy. Hamilton and Tauranga are emerging edge hubs due to population growth and improved fiber links. These regions support active-active data replication and regional CDN caching. The South Island is gaining traction with green power supply and disaster redundancy planning.

- For instance, T4 Group New Zealand launched its Tihi facility in Auckland, designed with operational synergies for South Island coverage. The site offers dual power feeds, diverse fiber paths, and 100% availability guarantees, supported by ISO 9001, ISO 14001, and ISO 27001 certifications.

Competitive Insights:

- Datacom

- Spark

- Equinix

- DataVault

- Schneider Electric

- Vertiv Group Corp.

- ABB

- Cisco Systems, Inc.

- Dell Inc.

The New Zealand Data Center Infrastructure Market shows moderate concentration with strong global and regional players. Datacom and Spark hold strong domestic positions through enterprise and government relationships. Equinix strengthens competition through carrier‑neutral colocation and global interconnection platforms. DataVault focuses on secure and compliant facilities for regulated workloads. Global vendors such as Schneider Electric, Vertiv, and ABB compete through integrated power and cooling portfolios. Cisco and Dell drive competition in network and server infrastructure layers. Companies compete on reliability, energy efficiency, and deployment speed. Strategic partnerships between operators and technology vendors shape project wins. Sustainability credentials influence vendor selection and long‑term contracts. The market rewards firms that combine local execution strength with global technology expertise.

Recent Developments:

- In March 2024, Datacom announced the launch of its new data center module in Auckland, expanding its capacity to support growing demand for hybrid cloud and enterprise hosting solutions. The facility features modular cooling units and lithium-ion UPS systems designed for high-efficiency operations and AI-ready workloads.

Market Drivers

Market Drivers Market Trends

Market Trends Market Challenges

Market Challenges Market Segmentation

Market Segmentation