Executive summary:

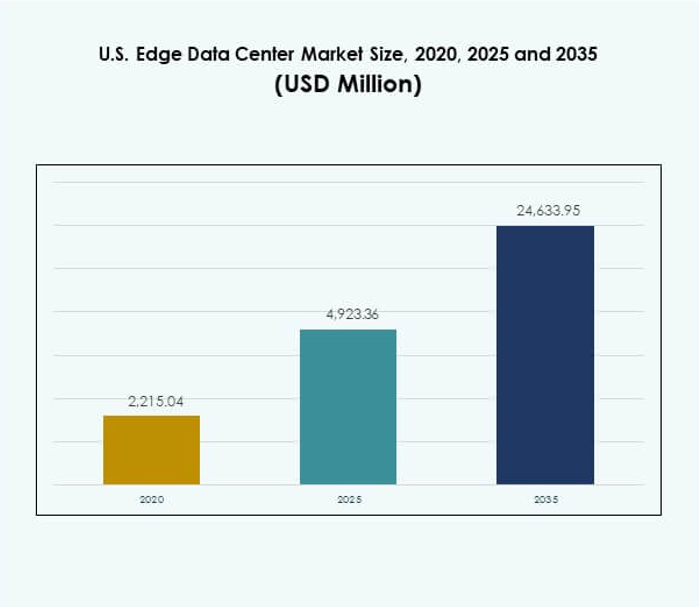

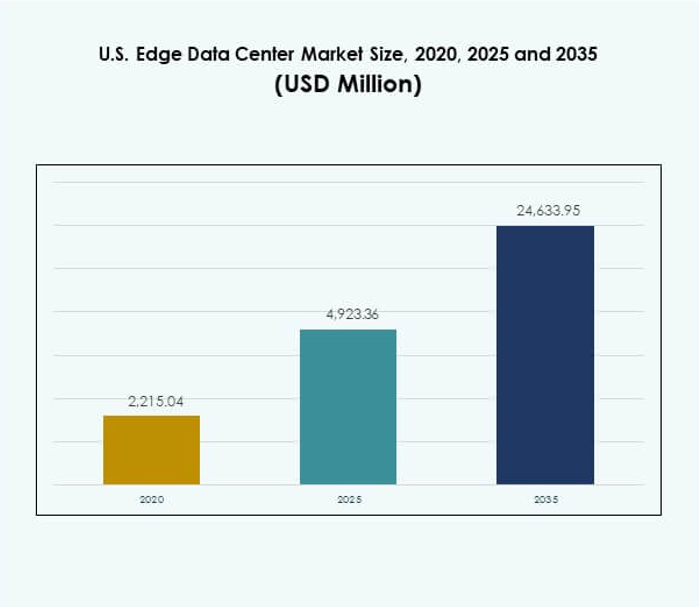

The U.S. Edge Data Center Market size was valued at USD 2,215.04 million in 2020, increased to USD 4,923.36 million in 2025, and is anticipated to reach USD 24,633.95 million by 2035, at a CAGR of 17.32% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| U.S. Edge Data Center Market Size 2025 |

USD 4,923.36 Million |

| U.S. Edge Data Center Market, CAGR |

17.32% |

| U.S. Edge Data Center Market Size 2035 |

USD 24,633.95 Million |

Growth in the market is driven by rapid adoption of 5G, IoT, and AI technologies. Enterprises deploy edge facilities to reduce latency and enhance real-time data processing. Rising investments in modular, energy-efficient, and AI-integrated designs support the market’s evolution. It holds strategic importance for businesses optimizing digital infrastructure and for investors seeking growth in decentralized computing networks.

Regionally, dominance is seen in the North-East and Mid-Atlantic regions, supported by strong connectivity and cloud ecosystems. The South and Midwest regions are emerging growth hubs due to lower operational costs and expanding digital infrastructure. The West region continues advancing with high innovation and renewable integration.

Market Drivers

Rising Demand for Low-Latency Data Processing and Network Optimization

The U.S. Edge Data Center Market is driven by enterprises seeking ultra-low latency for mission-critical operations. The demand for real-time analytics and instant data processing pushes companies to deploy localized edge facilities. It helps reduce dependency on centralized cloud networks, ensuring higher performance and reliability. Telecommunications and industrial automation sectors benefit from edge nodes closer to end-users. Rapid expansion of 5G networks strengthens adoption across urban and rural areas. Data-intensive industries such as autonomous vehicles and video streaming rely on latency-sensitive architecture. The market’s growth highlights its importance in supporting decentralized data ecosystems.

Accelerating 5G Rollout and the Integration of Advanced Network Technologies

The ongoing 5G expansion across the U.S. encourages large-scale edge data center deployment. Network operators invest in regional infrastructure to manage surging mobile data traffic. It supports applications such as AR/VR, IoT, and connected devices requiring seamless connectivity. The growing number of IoT sensors and endpoints drives massive data flow, making proximity computing vital. This trend improves bandwidth efficiency and reduces network congestion. Cloud service providers expand edge nodes to support AI-driven workloads. The integration of network slicing and software-defined architectures enhances operational agility. The sector’s progress strengthens the digital economy’s backbone.

- For instance, Verizon and AWS expanded 5G Mobile Edge with AWS Wavelength to 19 U.S. metro areas including Nashville and Tampa, positioning 75% of the U.S. population within 150 miles of a Wavelength Zone for ultra‑low‑latency services, per 2022 coverage and updates referenced in later summaries.

Increasing Enterprise Digital Transformation and Data Sovereignty Focus

Businesses across sectors accelerate digital transformation to remain competitive. The U.S. Edge Data Center Market benefits from enterprises preferring on-premise and regional data hosting. Data sovereignty regulations drive the need for localized infrastructure to secure sensitive information. It supports industries such as BFSI, healthcare, and defense with strict compliance needs. The market’s growth also aligns with corporate sustainability objectives through energy-efficient infrastructure. Companies emphasize high uptime, automation, and smart monitoring tools. This approach enhances operational efficiency and service reliability. Localized edge environments ensure seamless business continuity and reduced downtime.

Growing Investments from Hyperscalers and Colocation Providers to Expand Edge Networks

Major technology companies and colocation providers continue investing heavily in edge expansions. It reflects the growing need for distributed compute infrastructure across metropolitan and secondary cities. Hyperscalers like Amazon Web Services, Microsoft, and Google build micro-data centers closer to customer sites. This expansion supports dynamic workloads and regional computing needs. Startups and telecom providers partner to extend access to rural and underserved areas. The rise in modular and prefabricated edge data centers boosts deployment speed. These facilities also integrate AI-driven cooling and automation solutions. The sector’s investment wave marks a major inflection point for edge computing maturity.

- For instance, Equinix reports an average annual PUE of 1.42, 96% renewable energy coverage in 2023 toward a 100% target by 2030, and active adoption of advanced liquid cooling and ASHRAE A1 Allowable temperature ranges to boost deployment efficiency for distributed footprints supporting AI and latency‑sensitive workloads.

Market Trends

Widespread Deployment of Modular and Prefabricated Edge Facilities for Scalability

Edge data centers increasingly adopt modular and prefabricated designs to reduce setup time. These facilities enhance scalability, flexibility, and maintenance efficiency. The modular architecture supports phased capacity expansion aligned with enterprise growth. It ensures faster deployment in remote and urban locations without heavy construction. Prefabricated units also reduce operational risk and cost per deployment. It allows firms to maintain standardized infrastructure models across geographies. The U.S. Edge Data Center Market sees growing traction from logistics and retail sectors. Prefabrication improves deployment agility and aligns with sustainability objectives.

Rising Integration of Artificial Intelligence and Automation in Edge Management

Artificial intelligence plays a vital role in optimizing edge infrastructure performance. Automation enhances workload distribution, energy use, and predictive maintenance accuracy. AI-driven orchestration tools simplify managing large edge networks in real time. It helps companies balance compute demand and optimize energy efficiency. The adoption of robotic monitoring and digital twins improves uptime and resource utilization. Intelligent analytics platforms support anomaly detection and operational safety. The U.S. Edge Data Center Market witnesses AI integration across colocation and cloud operators. These innovations elevate performance reliability and operational transparency.

Expanding Use of Renewable Energy Sources to Power Edge Facilities

Sustainability initiatives drive edge operators toward renewable and low-carbon energy solutions. Many facilities now integrate solar, wind, or battery storage systems. It helps reduce power dependency on traditional grids and minimizes carbon emissions. Companies adopt liquid and immersion cooling systems to cut energy consumption. The focus on green building certifications and energy reuse becomes stronger. It also supports corporate ESG goals and government carbon-reduction mandates. The U.S. Edge Data Center Market reflects this shift across hyperscale and mid-sized operators. Energy optimization now stands as a strategic advantage in data infrastructure design.

Growing Focus on Edge-to-Cloud Integration to Enhance Enterprise Agility

Edge-to-cloud convergence transforms data management and workload optimization. Companies build hybrid ecosystems combining real-time processing at the edge with centralized analytics. This integration improves response times and supports flexible data governance models. It simplifies multi-cloud operations and cross-platform data orchestration. Businesses use this model to achieve seamless scalability across diverse applications. Edge-to-cloud strategies improve efficiency for AI, ML, and IoT-based operations. The U.S. Edge Data Center Market benefits from this convergence trend across key industries. It redefines digital infrastructure by blending flexibility, control, and operational speed.

Market Challenges

High Capital Expenditure and Complex Infrastructure Integration Constraints

The expansion of the U.S. Edge Data Center Market faces financial and technical barriers. High capital costs limit small enterprises from establishing large-scale facilities. Infrastructure integration with existing networks requires advanced design expertise and reliable connectivity. It demands collaboration between telecom, IT, and construction sectors for success. Equipment procurement delays and regulatory approvals often slow deployment schedules. The lack of standardized architecture raises compatibility issues among vendors. It also impacts interoperability across multiple edge and cloud systems. These challenges make large-scale adoption slower in cost-sensitive regions and sectors.

Persistent Cybersecurity Risks and Data Governance Complications Across Distributed Networks

Edge data centers handle highly sensitive and distributed data streams, raising cybersecurity concerns. The decentralized nature increases exposure to unauthorized access and malware threats. It requires robust encryption, intrusion detection, and continuous monitoring solutions. Maintaining compliance with evolving data governance frameworks is also complex. Industries like BFSI and healthcare face stricter regional data retention laws. Edge networks must coordinate consistent policies across multiple zones and devices. The U.S. Edge Data Center Market continues to invest in advanced cybersecurity infrastructure. Achieving full resilience demands unified standards and secure cross-network visibility.

Market Opportunities

Rising Adoption of IoT, AI, and 5G Applications Across Industry Verticals

The surge in IoT and AI-powered applications drives large-scale edge infrastructure deployment. It supports sectors like manufacturing, transport, and smart cities with real-time insights. The combination of 5G and edge processing delivers faster response and operational control. Enterprises utilize these advancements to enhance productivity and service quality. The U.S. Edge Data Center Market benefits from public-private partnerships focused on connectivity. It positions the U.S. as a global leader in intelligent digital ecosystems. These advancements create new growth avenues for technology providers and investors.

Emerging Rural Connectivity Programs and Expansion of Localized Edge Infrastructure

Government and private initiatives aim to bridge digital divides across rural America. Edge facilities support low-latency applications for agriculture, education, and healthcare. Telecom providers deploy smaller edge nodes in underserved regions to improve access. It enables faster content delivery and enhanced communication reliability. The U.S. Edge Data Center Market gains traction through flexible design solutions. Modular architecture and scalable investments promote cost-efficient rural deployment. This approach supports balanced national digital growth while unlocking new business opportunities.

Market Segmentation

By Component

The solution segment dominates the U.S. Edge Data Center Market with significant share, driven by strong demand for hardware, cooling, and network equipment. Enterprises prioritize scalable solutions supporting high-density workloads. Service offerings, including maintenance and integration, expand rapidly as firms adopt edge models. Growing reliance on AI and analytics tools enhances operational efficiency. It promotes advanced solution architectures supporting flexible configurations and modularity.

By Data Center Type

Colocation edge data centers lead the segment with growing preference among mid-sized enterprises. Businesses leverage shared facilities to reduce operational costs while maintaining high connectivity. Managed and cloud-based edge centers gain traction due to remote operation capabilities. The U.S. Edge Data Center Market benefits from rising demand for hybrid deployment models. Colocation growth reflects trust in established operators and their service reliability.

By Deployment Model

Hybrid deployment models hold a dominant position in the market, combining flexibility and control. Enterprises integrate both on-premise and cloud-based setups to balance data governance. Hybrid frameworks allow localized computing and centralized analytics simultaneously. It provides scalability and security required by diverse industry applications. The trend aligns with organizations modernizing legacy infrastructure through edge-cloud integration.

By Enterprise Size

Large enterprises represent the dominant segment due to extensive IT infrastructure requirements. These organizations deploy localized computing centers to enhance business continuity. Small and medium enterprises increasingly adopt modular and managed edge solutions. The U.S. Edge Data Center Market supports SMEs with cost-efficient hosting and data management services. Adoption among startups grows through cloud-based subscription models offering scalability.

By Application / Use Case

Power monitoring and environmental management segments dominate due to operational reliability needs. Asset management and capacity optimization gain traction across manufacturing and energy sectors. The integration of analytics enhances data-driven performance and predictive maintenance. It reflects the market’s focus on intelligent infrastructure and automation tools. Edge facilities now support BI, control systems, and sustainability tracking functions.

By End User Industry

The IT and telecommunications sector leads with widespread deployment across network nodes. BFSI and healthcare follow due to compliance-driven infrastructure needs. Retail and e-commerce adopt edge systems to deliver real-time customer experiences. Aerospace, defense, and utilities rely on it for security and process optimization. The U.S. Edge Data Center Market benefits from multi-industry digital transformation initiatives.

Regional Insights

North-East and Mid-Atlantic Region Dominating with 38% Share

The North-East and Mid-Atlantic regions lead the U.S. Edge Data Center Market with a 38% share. Strong cloud and telecom presence in New York, Virginia, and New Jersey fuels growth. These areas host key interconnection hubs supporting national and international networks. Enterprises prefer proximity to major population centers and financial institutions. The availability of power and fiber infrastructure attracts large-scale investments. It strengthens their dominance in connectivity and cloud services within the region.

- For instance, Nasdaq operates its U.S. equities markets from the Equinix NY11 data center in Carteret, New Jersey, which serves as a primary hub for low-latency trading and interconnection. In 2024, Equinix enhanced its financial ecosystem infrastructure at the New Jersey campus to improve cloud connectivity and trading performance for financial institutions.

South and Midwest Region Emerging as High-Growth Zones with 33% Share

The South and Midwest regions hold a 33% share, driven by expanding digital ecosystems. Cities such as Dallas, Chicago, and Atlanta act as central connectivity hubs. The region benefits from lower energy costs and abundant land availability. Enterprises adopt edge infrastructure to support industrial IoT and manufacturing applications. Strategic location advantage ensures reduced latency across multiple states. It continues attracting data infrastructure projects from leading technology firms and telecom operators.

- For instance, Digital Realty launched the Digital Realty Innovation Lab (DRIL) at its Northern Virginia campus in September 2025, allowing AI and hybrid cloud deployments to be validated in a live high-density edge environment, with customers able to test workloads using real-world data center infrastructure.

West Region Expanding Rapidly with 29% Share Due to Tech Innovation

The West region captures 29% market share, supported by Silicon Valley and Los Angeles clusters. High concentration of hyperscale operators and technology startups drives edge deployment. States like California, Oregon, and Washington promote renewable energy adoption. Edge facilities integrate green technologies and advanced automation solutions. It benefits from the proximity to cloud availability zones and research centers. The region maintains its position as the innovation core of the digital infrastructure ecosystem.

Competitive Insights:

- 365 Operating Company LLC

- EdgeConneX

- Eaton Corporation

- Dell Technologies Inc.

- Compass Datacenters

- Fujitsu

- American Tower

- Cisco Systems, Inc.

- SixSq

- Microsoft Corporation

- VMware, Inc.

- Schneider Electric SE

- Rittal GmbH & Co. KG

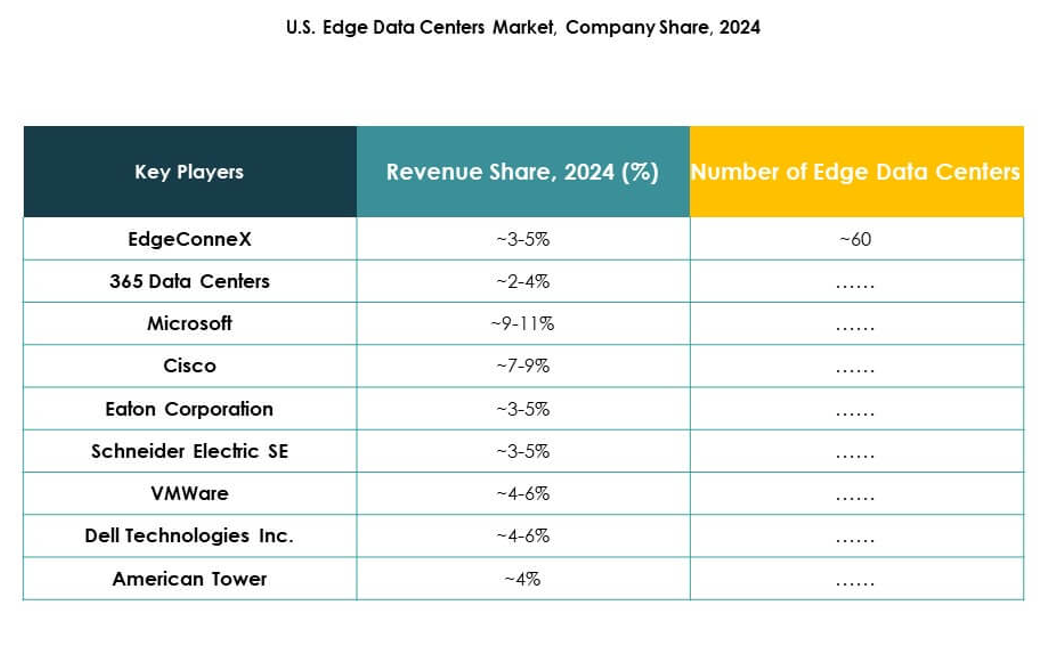

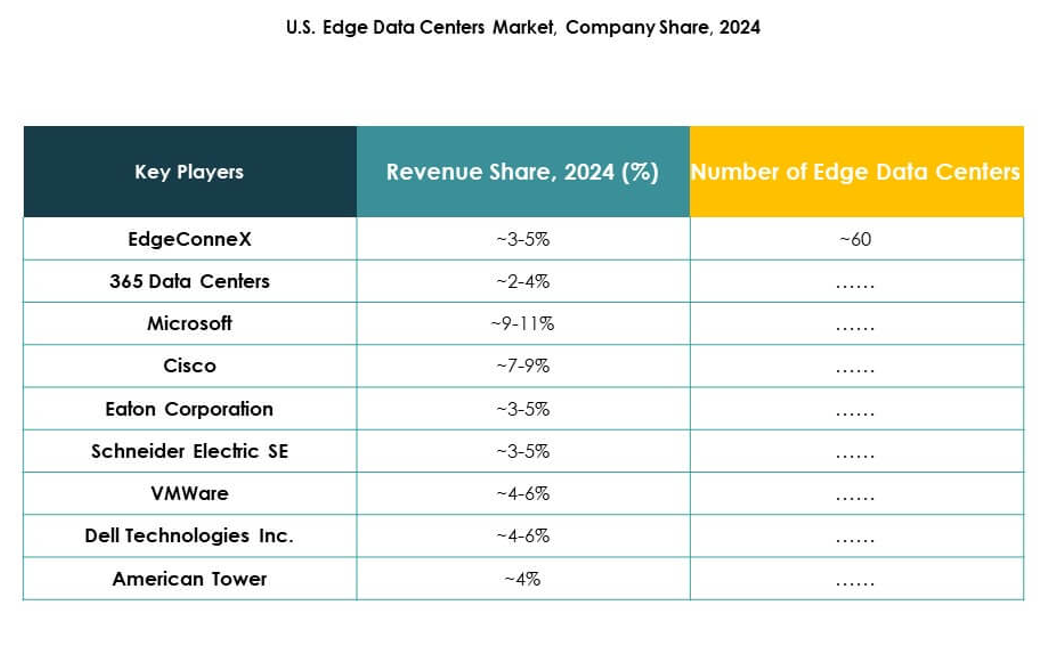

The U.S. Edge Data Center Market features strong competition among technology leaders, infrastructure providers, and cloud innovators. It is defined by continuous investment in localized facilities, automation, and energy-efficient design. EdgeConneX and Compass Datacenters focus on rapid regional deployment, while Microsoft and Dell strengthen edge-to-cloud integration. Schneider Electric and Eaton emphasize advanced power management and sustainability. Cisco, VMware, and Fujitsu enhance network and virtualization efficiency through software-driven solutions. American Tower expands its edge node footprint across telecom sites, supporting nationwide coverage. Collaboration and acquisitions remain central to competitive growth strategies across this evolving market.

Recent Developments:

- In September 2025, Airedale by Modine unveiled new EdgeDX and EdgeAire precision cooling product lines tailored for North American edge data facilities, positioning the portfolio for compact, high‑density deployments at the network edge.

- In August 2025, EdgeConneX and Lambda publicly disclosed plans to co-develop advanced AI data centers in Chicago and Atlanta. The Chicago facility will be a single-tenant, 23 MW site purpose-built for high-density AI and HPC workloads, scheduled to be ready for service in 2026. This initiative leverages EdgeConneX’s Ingenuity platform and hybrid cooling technologies to support large-scale AI infrastructure expansion.

- In August 2025, Nixxy Inc. announced the acquisition of edge data center and telecom assets to accelerate its AI infrastructure rollout and market expansion in the United States, strengthening its footprint in edge‑adjacent infrastructure.

- In July 2025, 365 Data Centers announced an expanded partnership with Megaport to enhance cloud connectivity in the U.S. edge data center market. This partnership resulted in Megaport introducing new Points-of-Presence at several 365 Data Centers’ facilities, giving customers improved access to cloud services and direct connectivity options to major public cloud providers such as AWS, Microsoft Azure, Google Cloud, Oracle Cloud, and IBM Cloud.

- In July 2025, Eaton Corporation accelerated its data center infrastructure transformation efforts through its collaboration with NVIDIA. Eaton is developing next-generation power management systems to support the expanding needs of U.S. edge and AI-driven data centers. Their comprehensive power platform is designed to optimize both reliability and energy efficiency to meet rapid demand growth triggered by AI applications.