Executive summary:

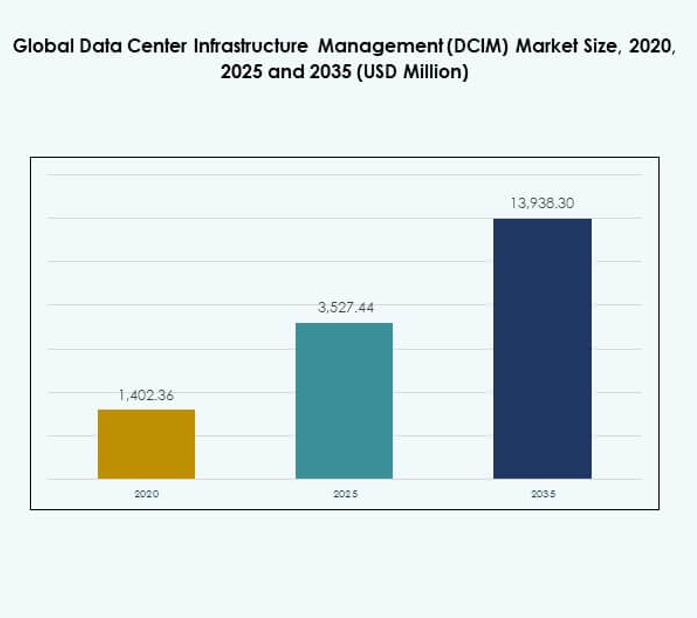

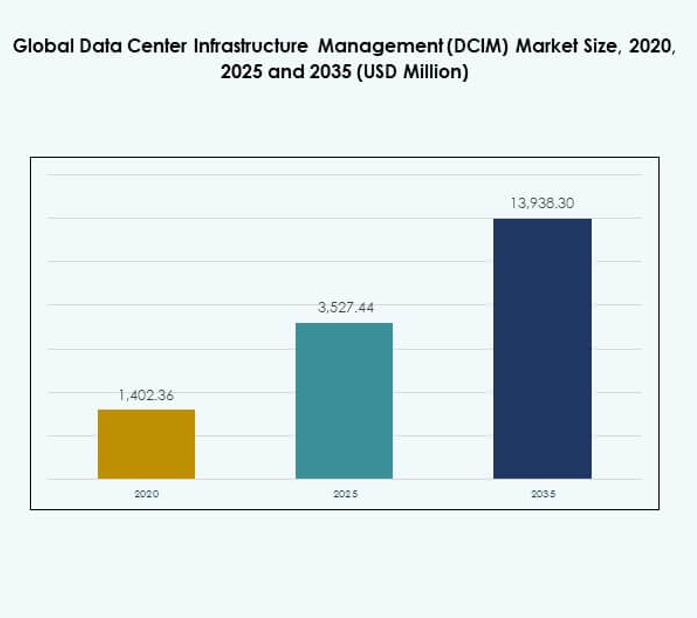

The Global Data Center Infrastructure Management (DCIM) Market size was valued at USD 1,402.36 million in 2020 to USD 3,527.44 million in 2025 and is anticipated to reach USD 13,938.30 million by 2035, at a CAGR of 16.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 3,527.44 Million |

| Data Center Infrastructure Management (DCIM) Market, CAGR |

16.52% |

| Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 13,938.30 Million |

The market is driven by the rising adoption of AI-driven automation, cloud integration, and hybrid IT models. Organizations are focusing on sustainability, predictive analytics, and real-time monitoring to optimize performance and reduce costs. Innovation in software-defined infrastructure and intelligent energy management highlights the strategic importance of DCIM. For businesses and investors, it enables cost efficiency, compliance, and resilience, making DCIM a critical enabler of scalable digital transformation strategies across industries.

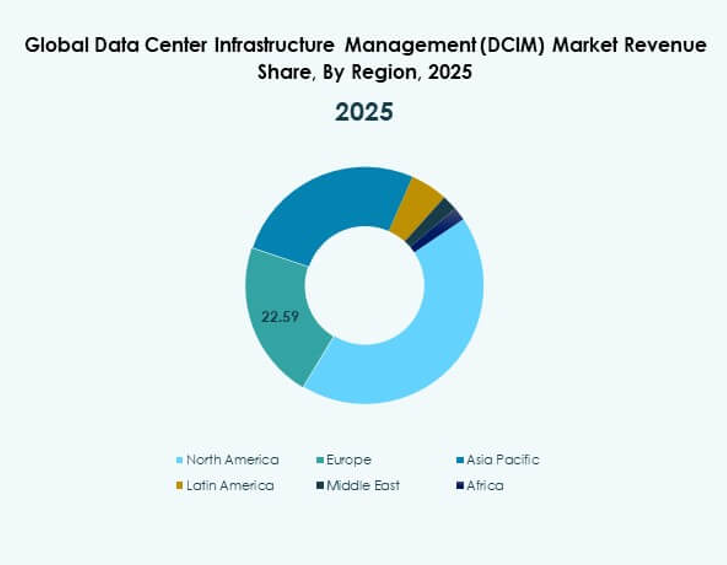

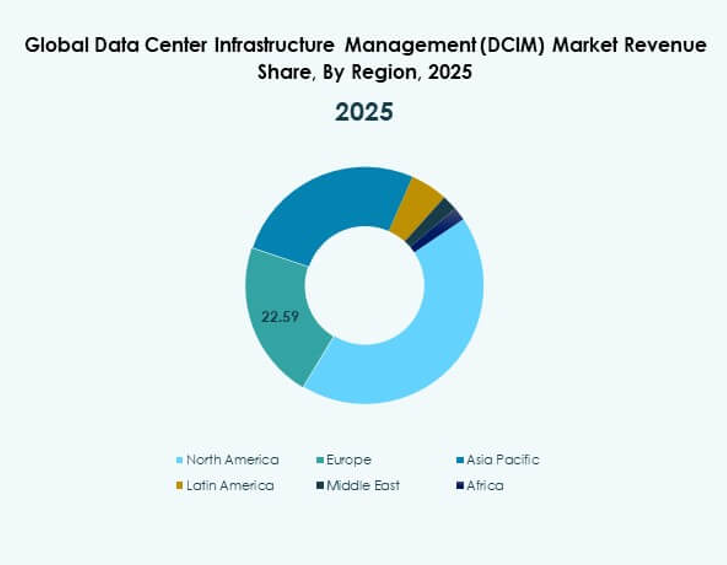

Regionally, North America dominates due to hyperscale data centers and early hybrid IT adoption, while Europe strengthens its position through sustainability initiatives and regulatory compliance. Asia Pacific emerges as the fastest-growing region, supported by 5G rollouts, smart city projects, and large-scale cloud investments. Latin America, the Middle East, and Africa demonstrate steady potential, driven by expanding colocation facilities, digitalization initiatives, and growing enterprise IT demand. This regional spread highlights DCIM’s global relevance and growth momentum.

Market Drivers

Rising Demand for Advanced Infrastructure Efficiency and Energy Optimization

The Global Data Center Infrastructure Management (DCIM) Market is driven by the growing need for operational efficiency and reduced energy consumption in large-scale data centers. Enterprises are under pressure to optimize their infrastructure performance while lowering costs, and DCIM solutions offer precise tools for achieving this balance. The adoption of advanced monitoring systems allows organizations to analyze real-time data across critical assets, improving decision-making and minimizing downtime. Energy management is gaining strategic importance with data centers consuming vast power resources, pushing investments in intelligent DCIM platforms. Sustainability initiatives are also fueling growth, as organizations aim to cut carbon footprints through efficient energy management practices. Investors are recognizing the long-term potential of solutions that can meet these evolving requirements. It is becoming clear that DCIM technologies are essential for aligning cost efficiency with environmental responsibility. Businesses view this alignment as a key differentiator in competitive global markets.

- For example, Schneider Electric deployed its StruxureWare Data Center Operation platform at a 70-rack government data center in Thailand, achieving a 38% reduction in cooling power consumption immediately after implementation along with 342,430 lbs of greenhouse gas reductions per year through intelligent DCIM-driven cooling optimization.

Growing Integration of Artificial Intelligence and Automation for Predictive Operations

The integration of AI and automation technologies is accelerating within the Global Data Center Infrastructure Management (DCIM) Market. Predictive analytics powered by AI is enabling facilities to identify risks before failures occur, driving operational reliability. Automation tools streamline complex workflows, reduce manual intervention, and support proactive decision-making. Organizations can optimize cooling systems, power usage, and maintenance schedules with enhanced accuracy. It is helping data centers to scale efficiently without compromising resilience or security. Businesses and investors value this transformation as it ensures stability in an environment of rapid digital growth. The demand for intelligent automation is not limited to hyperscale providers but extends to mid-sized enterprises adopting hybrid IT strategies. Vendors are also innovating AI-based DCIM platforms that continuously adapt to evolving workloads. The synergy of automation and predictive capabilities strengthens the resilience of digital infrastructure globally.

- For example, NTT Global Data Centers implemented smart sensor upgrades in its U.K. data centers, which resulted in fan energy use being cut by 50% and an annual energy savings of 2.6 GWh. This was achieved by optimizing temperature and pressure settings via automated and AI-driven systems, underscoring real operational reliability improvements with measurable energy reduction.

Increasing Cloud Expansion and Hybrid Infrastructure Adoption Across Enterprises

Cloud expansion and hybrid IT adoption are significantly shaping the Global Data Center Infrastructure Management (DCIM) Market. Organizations are balancing on-premises infrastructure with public and private cloud resources, creating more complex environments that demand efficient management. DCIM solutions provide unified visibility, supporting better capacity planning and workload distribution. It is ensuring that enterprises can maintain security, compliance, and resource optimization across hybrid systems. The strategic value lies in empowering businesses to scale rapidly while controlling infrastructure costs. Investors see hybrid adoption as a growth catalyst that expands the role of DCIM solutions in enterprise IT ecosystems. The increasing reliance on digital transformation initiatives further drives demand for robust monitoring and optimization platforms. Cloud service providers are also leveraging DCIM to enhance operational efficiency in multi-tenant environments. This hybrid model will continue to fuel innovation and competitive investment in DCIM technologies.

Regulatory Compliance, Security Needs, and Strategic Business Continuity Planning

Data centers face strict regulations for energy efficiency, data protection, and operational safety, creating strong demand in the Global Data Center Infrastructure Management (DCIM) Market. DCIM solutions help organizations align with compliance frameworks while maintaining high operational standards. Security requirements are intensifying with growing risks of cyber threats and physical disruptions, and DCIM platforms support integrated risk management strategies. It ensures resilience by enabling business continuity planning and disaster recovery preparedness. Enterprises are prioritizing compliance-driven investments to avoid penalties and reputation damage. Investors are increasingly focused on platforms that integrate compliance and risk management features into infrastructure monitoring. This focus highlights the strategic importance of DCIM in safeguarding critical digital assets. The role of compliance and security is expanding as industries undergo digital modernization. Businesses view these solutions as essential for sustainable and secure growth across global operations.

Market Trends

Growing Adoption of Edge Data Centers and Localized Infrastructure Management Needs

The Global Data Center Infrastructure Management (DCIM) Market is experiencing rapid adoption of edge data centers, driven by rising demand for low-latency services. These localized facilities support applications such as IoT, AI, and 5G, which require immediate data processing closer to users. DCIM platforms are evolving to handle the complexity of distributed infrastructures spread across multiple geographies. It is enabling operators to monitor performance, optimize resources, and ensure security at the edge. Businesses recognize edge adoption as a critical trend that enhances service delivery efficiency. Investors see the opportunity in DCIM providers developing agile solutions tailored for smaller, distributed centers. The growing diversity of applications will continue to push localized management requirements. Edge-driven growth highlights the adaptability and scalability of next-generation DCIM solutions worldwide.

Emergence of Software-Defined Data Centers and Virtualized Infrastructure Integration

The trend toward software-defined data centers (SDDCs) is transforming the Global Data Center Infrastructure Management (DCIM) Market. Virtualization of resources such as storage, networking, and computing is creating flexible, dynamic infrastructure models. DCIM platforms are being integrated with virtualized environments to provide comprehensive oversight and real-time adaptability. It ensures that organizations can scale workloads seamlessly while maintaining control of physical and virtual assets. Businesses are prioritizing such solutions to maximize agility in competitive markets. Investors are focusing on vendors building software-defined integrations that support digital-first strategies. Virtualization is also enabling improved cost structures and rapid deployment capabilities. This trend reinforces the role of DCIM as a strategic enabler of hybrid and software-defined ecosystems.

Rising Focus on Sustainability, Green Data Centers, and Carbon Neutral Operations

Sustainability is becoming a defining trend within the Global Data Center Infrastructure Management (DCIM) Market. Enterprises and operators are committing to carbon-neutral targets, driving demand for green data centers supported by advanced DCIM platforms. Energy-efficient designs, renewable integration, and intelligent cooling systems are central to this shift. It allows operators to optimize power usage while reducing emissions without compromising performance. Businesses see sustainable operations as critical for brand reputation and regulatory compliance. Investors are prioritizing DCIM solutions that enable measurable sustainability outcomes. Vendors are integrating features such as carbon footprint tracking and renewable adoption into DCIM platforms. This trend reinforces the market’s long-term alignment with global sustainability goals.

Enhanced Demand for Real-Time Analytics, Visualization, and Performance Intelligence Tools

The Global Data Center Infrastructure Management (DCIM) Market is witnessing increasing adoption of real-time analytics and visualization technologies. Operators are leveraging advanced dashboards, AI-driven insights, and predictive intelligence tools to maintain high-performance levels. It supports proactive decision-making by identifying risks, inefficiencies, and optimization opportunities instantly. Businesses value the ability to make fast, data-backed decisions in competitive environments. Investors see strong potential in analytics-driven platforms that can deliver measurable ROI. Vendors are developing tools that provide comprehensive visualization of power, cooling, and network performance. The focus on performance intelligence is reshaping operational standards across hyperscale and enterprise facilities. This trend highlights the centrality of real-time analytics in modern infrastructure management.

Market Challenges

Complexity of Integration and Rising Costs in Infrastructure Modernization

The Global Data Center Infrastructure Management (DCIM) Market faces challenges related to integration complexity and escalating costs. Organizations often struggle to integrate DCIM solutions with existing legacy systems, leading to operational inefficiencies. It demands skilled expertise, extended implementation timelines, and significant capital outlay. Businesses face difficulty balancing modernization needs with budget limitations, creating barriers to adoption. Vendors must address interoperability issues to ensure seamless deployments. Investors are cautious about the high upfront costs, which can delay market penetration. Enterprises also deal with disruption risks during migration from traditional systems. This challenge slows adoption despite the clear benefits of advanced infrastructure management.

Growing Concerns Around Cybersecurity and Compliance Management Across Data Centers

Cybersecurity and regulatory compliance are critical challenges in the Global Data Center Infrastructure Management (DCIM) Market. Data centers face constant risks from cyber threats, creating pressure on operators to safeguard critical systems. DCIM solutions must integrate strong security and compliance tools to mitigate vulnerabilities. It requires continuous monitoring, real-time threat detection, and automated compliance reporting. Businesses view these demands as resource-intensive, often stretching IT teams. Investors recognize compliance risks as potential barriers for large-scale adoption. Vendors are expected to deliver robust, integrated security frameworks within DCIM platforms. The rising complexity of regulations globally compounds these concerns for operators and enterprises.

Market Opportunities

Expanding Role of DCIM in Supporting AI, IoT, and 5G-Driven Infrastructure Growth

The Global Data Center Infrastructure Management (DCIM) Market offers opportunities driven by the growth of AI, IoT, and 5G technologies. These advancements require agile and intelligent infrastructure management tools, and DCIM platforms are positioned to fill this role. It supports automation, predictive operations, and performance optimization in environments with heavy workloads. Businesses can achieve scalability and reliability while embracing next-generation technologies. Investors view this intersection as a strong growth catalyst for innovative vendors. Edge deployments and AI-driven applications further expand the opportunity landscape. DCIM will become a cornerstone of digital infrastructure evolution.

Rising Investments in Emerging Markets and Expansion of Colocation Facilities

Emerging economies present significant opportunities for the Global Data Center Infrastructure Management (DCIM) Market. Rising digitalization, expanding cloud adoption, and enterprise growth are fueling investments in data center infrastructure. It creates demand for advanced DCIM platforms capable of meeting large-scale and complex operational requirements. Businesses in these regions seek efficient energy management and compliance support, strengthening DCIM adoption. Investors are actively funding colocation providers expanding in Asia, Latin America, and the Middle East. Vendors with localized strategies can capitalize on these rapidly growing markets. The expansion of colocation capacity aligns with the increasing role of DCIM solutions globally.

Market Segmentation:

By Component

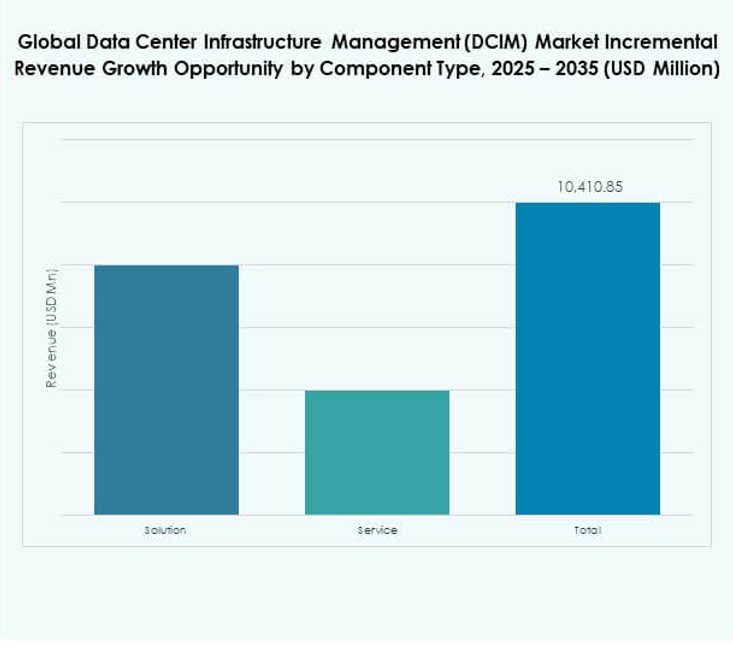

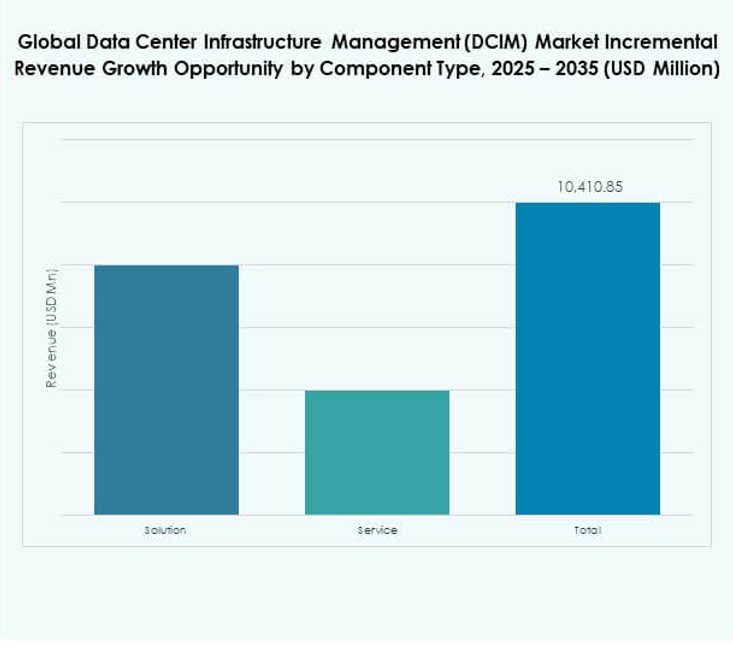

In the Global Data Center Infrastructure Management (DCIM) Market, solutions dominate with a significant share due to their role in asset tracking, power optimization, and capacity planning. Advanced monitoring tools and analytics platforms are driving adoption among enterprises that seek operational efficiency and sustainability. Services, including consulting, integration, and maintenance, are gaining momentum as organizations require tailored deployment strategies and ongoing support. The combination of robust software platforms with professional services strengthens overall market value. Growth is fueled by demand for integrated, automated systems that enhance both scalability and resilience.

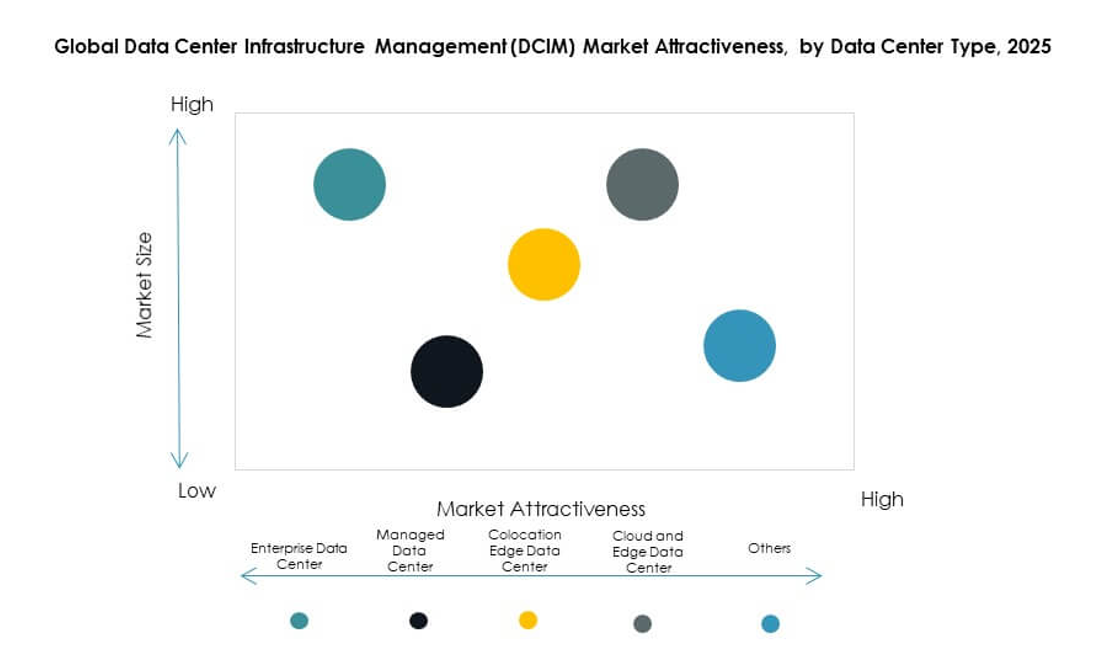

By Data Center Type

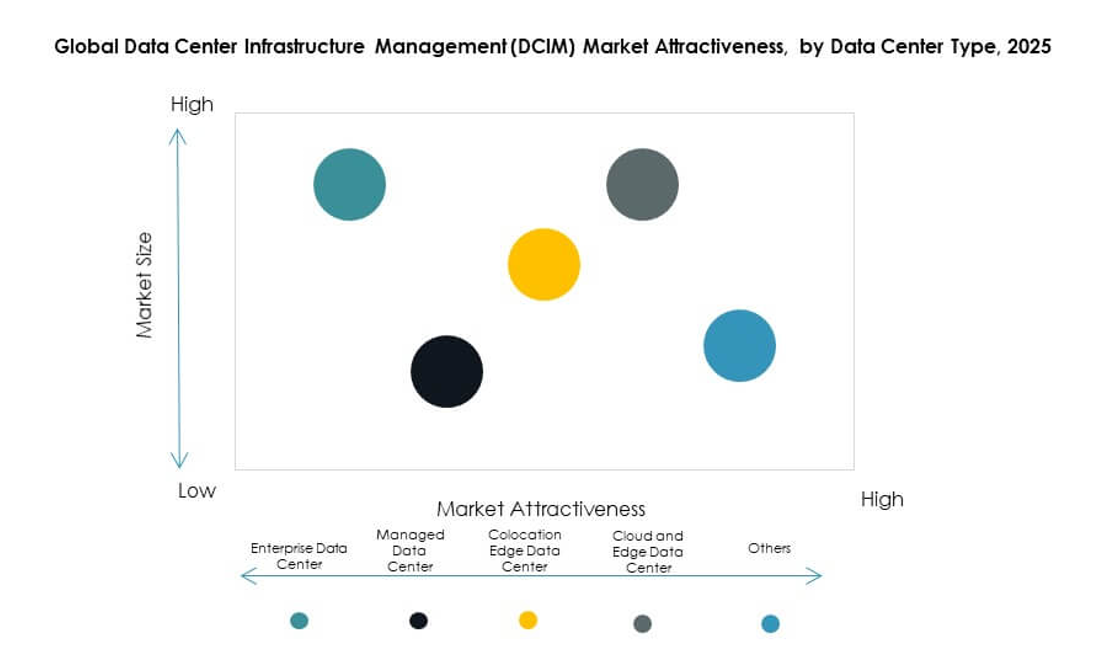

Enterprise data centers lead the Global Data Center Infrastructure Management (DCIM) Market, driven by large-scale digital transformation initiatives and the need for advanced control over in-house infrastructure. Managed data centers and colocation facilities are expanding rapidly as enterprises shift toward outsourcing to reduce costs and enhance agility. Cloud and edge data centers are emerging as high-growth segments, supported by 5G rollouts, IoT adoption, and low-latency applications. Hybrid models with distributed architectures further strengthen demand. These developments highlight how organizations balance efficiency, flexibility, and security through diversified infrastructure.

By Deployment Model

On-premises deployment holds the largest share in the Global Data Center Infrastructure Management (DCIM) Market due to strict compliance requirements, security concerns, and full control over infrastructure. Cloud-based deployment is growing quickly as businesses embrace scalable, cost-effective solutions with remote accessibility. Hybrid models are emerging as the preferred approach for enterprises balancing legacy systems with cloud adoption. It enables flexibility, improved resource utilization, and resilience. Growing investments in cloud-native DCIM solutions highlight a shift toward real-time analytics, automation, and AI integration across distributed data environments.

By Enterprise Size

Large enterprises dominate the Global Data Center Infrastructure Management (DCIM) Market, supported by high IT budgets, complex infrastructure, and compliance-driven investments. Their need for advanced monitoring, predictive maintenance, and automation drives significant adoption of DCIM solutions. Small and medium enterprises (SMEs) represent a rising growth segment as cloud-based DCIM offerings reduce entry barriers with lower costs and simplified deployment. The SME segment is leveraging DCIM to optimize operations, ensure data security, and enhance scalability. This dual demand emphasizes the versatility of DCIM solutions across organization sizes.

By Application / Use Case

Asset management leads the Global Data Center Infrastructure Management (DCIM) Market, holding the largest share due to the critical importance of tracking IT assets and improving utilization. Capacity management follows closely, driven by enterprises optimizing space, power, and cooling resources. Power and environmental monitoring segments are expanding with sustainability targets and regulatory requirements. BI and analysis are gaining prominence as businesses seek actionable insights from infrastructure data. Growing complexity of multi-site and hybrid IT environments ensures consistent demand for comprehensive DCIM applications.

By End User Industry

The IT and telecommunications sector dominates the Global Data Center Infrastructure Management (DCIM) Market, supported by rising cloud adoption, 5G expansion, and massive data traffic. BFSI remains a major contributor, requiring secure, compliant, and high-performance infrastructure management. Healthcare and retail sectors are rapidly expanding, with growing digitalization of patient records, telehealth, and e-commerce operations. Energy and utilities are adopting DCIM to optimize critical infrastructure, while aerospace and defense focus on secure and mission-critical operations. This broad industry adoption highlights DCIM’s role as a strategic enabler of digital ecosystems.

Regional Insights:

North America

The North America Global Data Center Infrastructure Management (DCIM) Market size was valued at USD 576.37 million in 2020 to USD 1,455.07 million in 2025 and is anticipated to reach USD 5,718.19 million by 2035, at a CAGR of 16.45% during the forecast period. North America holds the largest share of the market, contributing 41% of the global total. Strong presence of hyperscale data centers, rapid adoption of cloud services, and high investments in AI-driven monitoring tools drive growth. The U.S. leads the region with massive infrastructure upgrades and early adoption of hybrid IT models. Canada is emerging with increased colocation and green data center projects. It is further supported by strong regulatory frameworks and sustainability targets. Enterprises focus on automation, cybersecurity, and predictive analytics, reinforcing North America’s dominant market position.

- For instance, in April 2024, U.S. data centers saw average rack densities rise to 12 kW per rack, up from 8.5 kW in 2022, driven by advanced DCIM deployments and liquid cooling. Around 58% of U.S. operators rolled out AR/VR solutions in their DCIM by 2024, enabling improved asset management and operational efficiency, as tracked by the 2024 State of the Data Center Report.

Europe

The Europe Global Data Center Infrastructure Management (DCIM) Market size was valued at USD 301.65 million in 2020 to USD 796.85 million in 2025 and is anticipated to reach USD 2,922.86 million by 2035, at a CAGR of 15.66% during the forecast period. Europe contributes 21% of the global market share. The region’s growth is driven by strict regulatory frameworks on energy efficiency and sustainability, pushing enterprises toward advanced DCIM adoption. The UK, Germany, and France remain key hubs with strong data center ecosystems. Expansion of colocation facilities and investment in edge deployments strengthen the regional market. It benefits from growing demand in e-commerce, fintech, and cloud services. Northern Europe emphasizes renewable-powered data centers, creating opportunities for sustainable DCIM solutions. Southern and Eastern Europe show rising adoption from SMEs, driven by digitalization policies and government-backed initiatives.

Asia Pacific

The Asia Pacific Global Data Center Infrastructure Management (DCIM) Market size was valued at USD 370.08 million in 2020 to USD 855.76 million in 2025 and is anticipated to reach USD 3,826.76 million by 2035, at a CAGR of 17.94% during the forecast period. Asia Pacific accounts for 27% of the global share, positioning it as the fastest-growing regional market. China, India, and Japan lead adoption due to large-scale digital transformation, 5G rollouts, and strong cloud expansion. Rapid urbanization, government-backed smart city initiatives, and rising e-commerce activity accelerate demand. It is further supported by massive hyperscale and colocation investments across Southeast Asia. Enterprises focus on hybrid infrastructure and automation, driving adoption of advanced DCIM platforms. Growing sustainability requirements also push adoption of green solutions. This regional momentum highlights Asia Pacific’s role in reshaping global infrastructure management.

Latin America

The Latin America Global Data Center Infrastructure Management (DCIM) Market size was valued at USD 71.52 million in 2020 to USD 190.48 million in 2025 and is anticipated to reach USD 689.95 million by 2035, at a CAGR of 15.51% during the forecast period. Latin America holds a 5% global share, with Brazil leading adoption followed by Mexico and Chile. Expanding cloud adoption and growing digital ecosystems drive demand for DCIM platforms. Enterprises invest in colocation facilities to address rising IT workloads and improve scalability. It is further supported by increasing demand in fintech, healthcare, and telecom sectors. Governments are focusing on data sovereignty and compliance regulations, which enhance DCIM relevance. Local providers are collaborating with global vendors to strengthen service offerings. The region demonstrates significant potential, despite infrastructure and connectivity challenges.

Middle East

The Middle East Global Data Center Infrastructure Management (DCIM) Market size was valued at USD 43.19 million in 2020 to USD 118.17 million in 2025 and is anticipated to reach USD 410.48 million by 2035, at a CAGR of 15.03% during the forecast period. The region accounts for 3% of the global market share. Rapid digital transformation initiatives, smart city projects, and expanding hyperscale deployments fuel demand. UAE and Saudi Arabia are leading markets, supported by strong government strategies for AI and cloud adoption. It benefits from regional expansion of international cloud providers and colocation players. Enterprises in banking, telecom, and energy are driving demand for advanced DCIM platforms. Investments in sustainable and modular data centers are also increasing. The Middle East demonstrates steady growth, aligning with digital economy diversification goals.

Africa

The Africa Global Data Center Infrastructure Management (DCIM) Market size was valued at USD 39.55 million in 2020 to USD 111.11 million in 2025 and is anticipated to reach USD 370.06 million by 2035, at a CAGR of 14.55% during the forecast period. Africa contributes 3% of the global share, with South Africa leading adoption followed by Nigeria, Egypt, and Kenya. Growth is fueled by digitalization efforts, rising cloud penetration, and expanding fintech ecosystems. Investments in colocation facilities are increasing as enterprises seek reliable, scalable IT infrastructure. It is further supported by regional initiatives promoting data sovereignty and digital inclusion. Challenges related to power supply and connectivity remain, but innovative modular solutions are gaining traction. Global players are partnering with local providers to expand regional reach. Africa shows steady potential as digital infrastructure demand continues to accelerate.

- For instance, in August 2025, Teraco completed its JB4 Bredell Campus expansion in South Africa, now supporting 50 MW of critical IT load and deploying a closed-loop chilled water cooling system with AI-enabled real-time cooling optimization, achieving a Power Usage Effectiveness (PUE) of 1.3 and zero water usage during ongoing cooling.

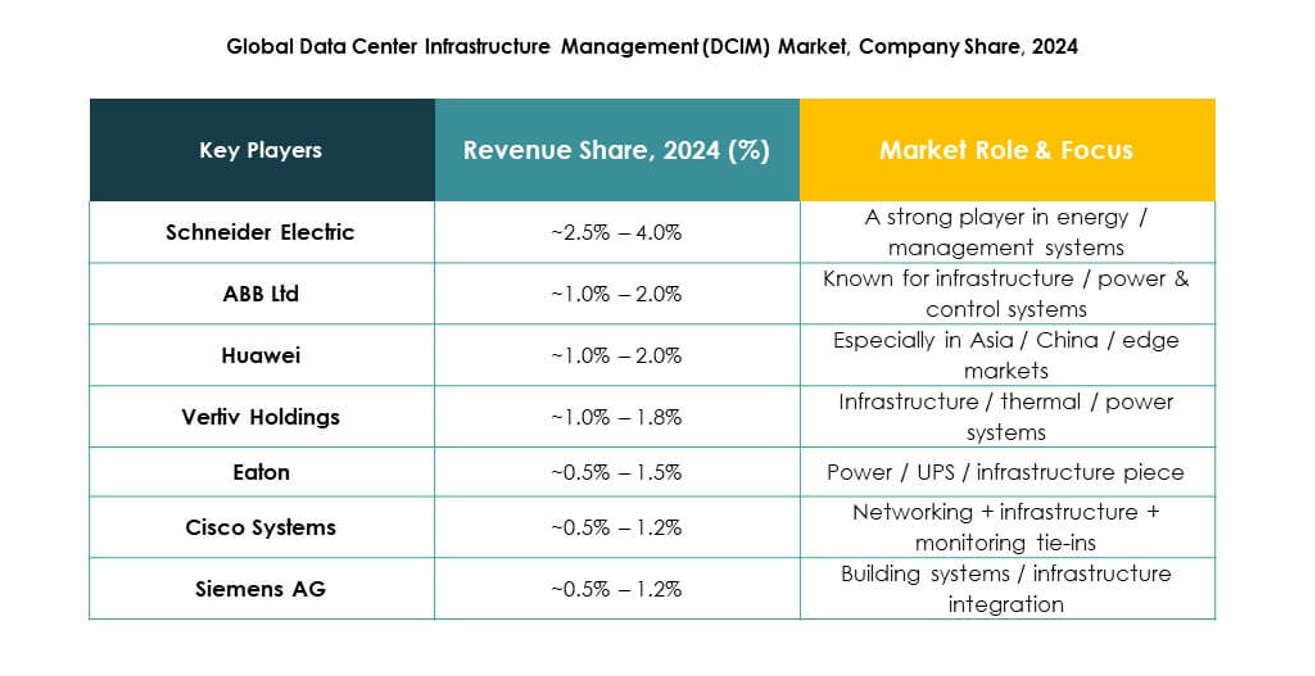

Competitive Insights:

- ABB Ltd.

- Cisco Systems, Inc.

- Device42, Inc.

- Eaton Corporation

- FNT GmbH

- Huawei Technologies Co., Ltd

- IBM Corporation

- Schneider Electric SE

- Siemens AG

- HPE (Hewlett Packard Enterprise)

- Sunbird Inc.

- Vertiv Holdings

- Delta Electronics

- Nlyte Software

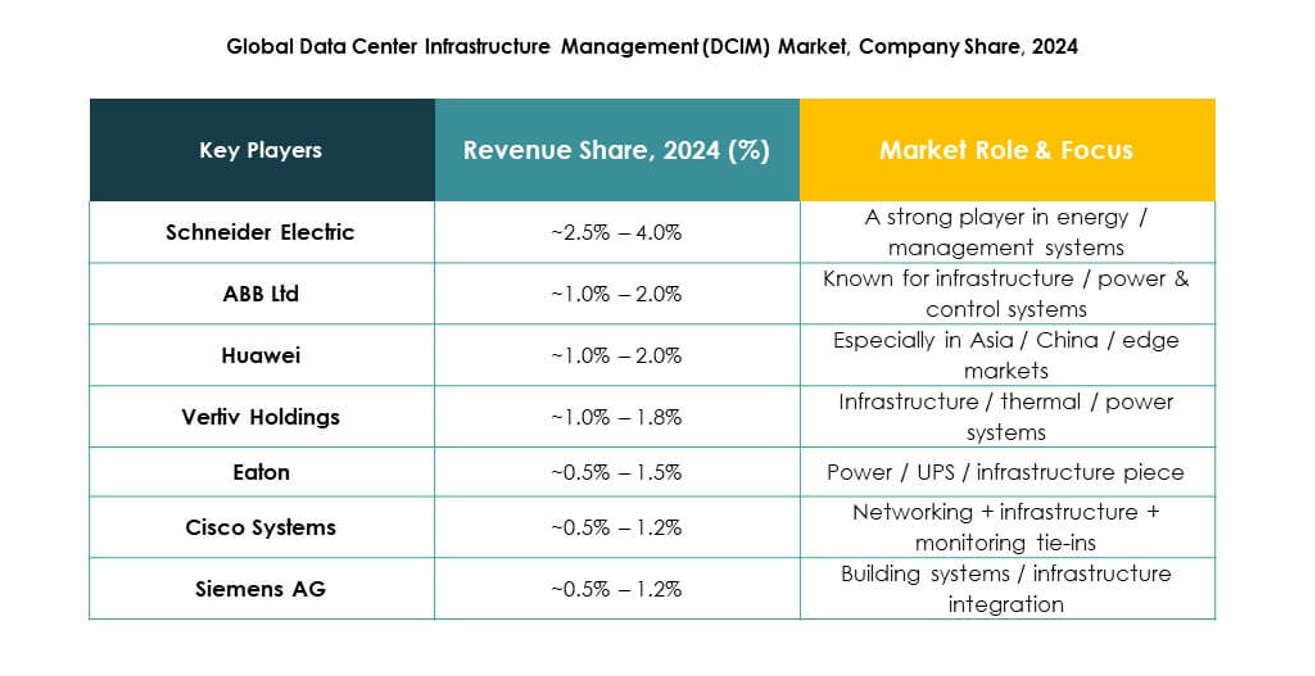

The Global Data Center Infrastructure Management (DCIM) Market is highly competitive, with global leaders and niche players actively shaping innovation. Established companies such as Schneider Electric, Vertiv, and ABB dominate with strong portfolios in energy efficiency and automation. Cisco, Huawei, and IBM are leveraging expertise in networking, AI, and hybrid IT environments to expand market presence. Emerging vendors like Device42 and Sunbird focus on specialized solutions with faster deployment and flexible integration. It is driving partnerships, mergers, and continuous product advancements, creating a dynamic environment where both scale and specialization determine success. Vendors differentiate through sustainability initiatives, real-time analytics, and cloud-based capabilities, aligning their strategies with rising enterprise demand for intelligent and resilient infrastructure management.

Recent Developments:

- In July 2025, Amazon made a significant investment announcement of USD 20 billion to develop two new data-center complexes in Pennsylvania, with one being co-located with the Susquehanna nuclear power plant, underlining strategic infrastructure expansion in the sector.

- In June 2025, Cisco Systems, Inc. launched the new Cisco Data Center Networking Suite, which incorporates AI-driven automation features for improved DCIM performance, enabling clients to optimize infrastructure management and operational costs.

- In July 2024, Vertiv introduced its new liquid-cooled modular data center solution called MegaMod CoolChip, specifically designed for AI computing workloads in the Canada Data Center Infrastructure Management market. This product aims to help Canadian data centers manage increasing energy consumption and support efficient, high-density operations needed for AI applications, signaling a shift toward greater innovation and sustainability in infrastructure management.