Executive summary:

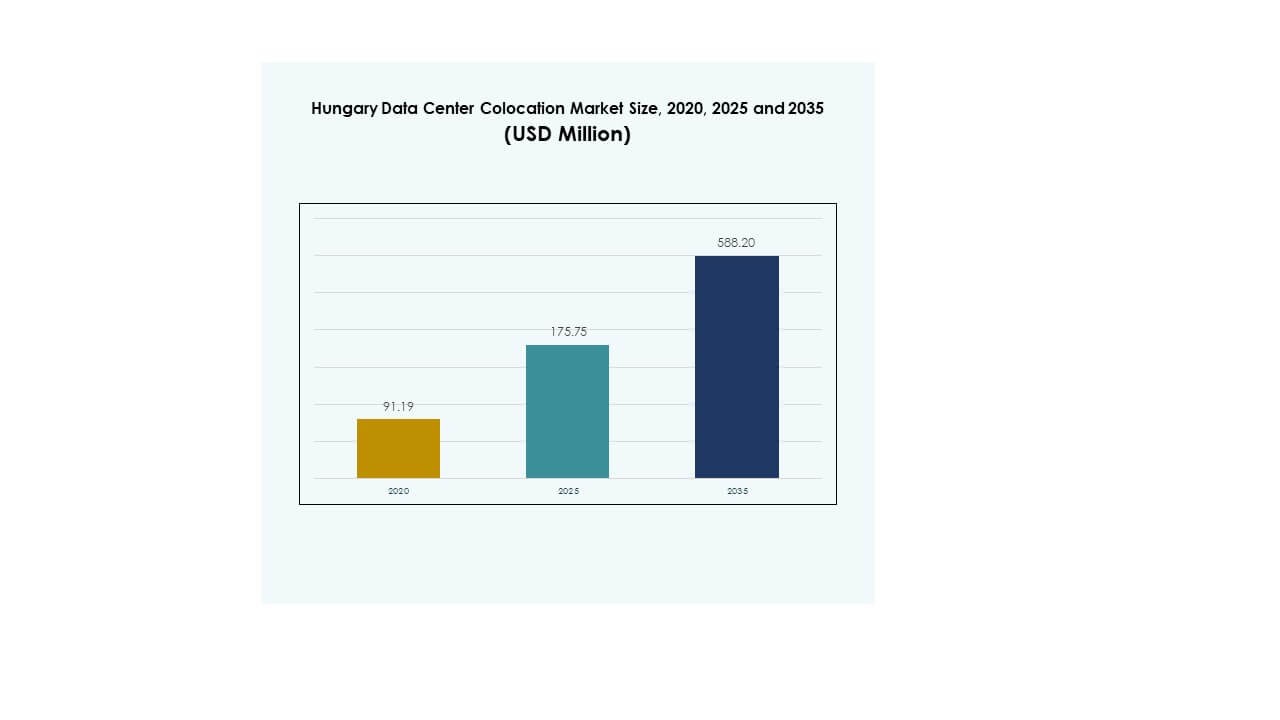

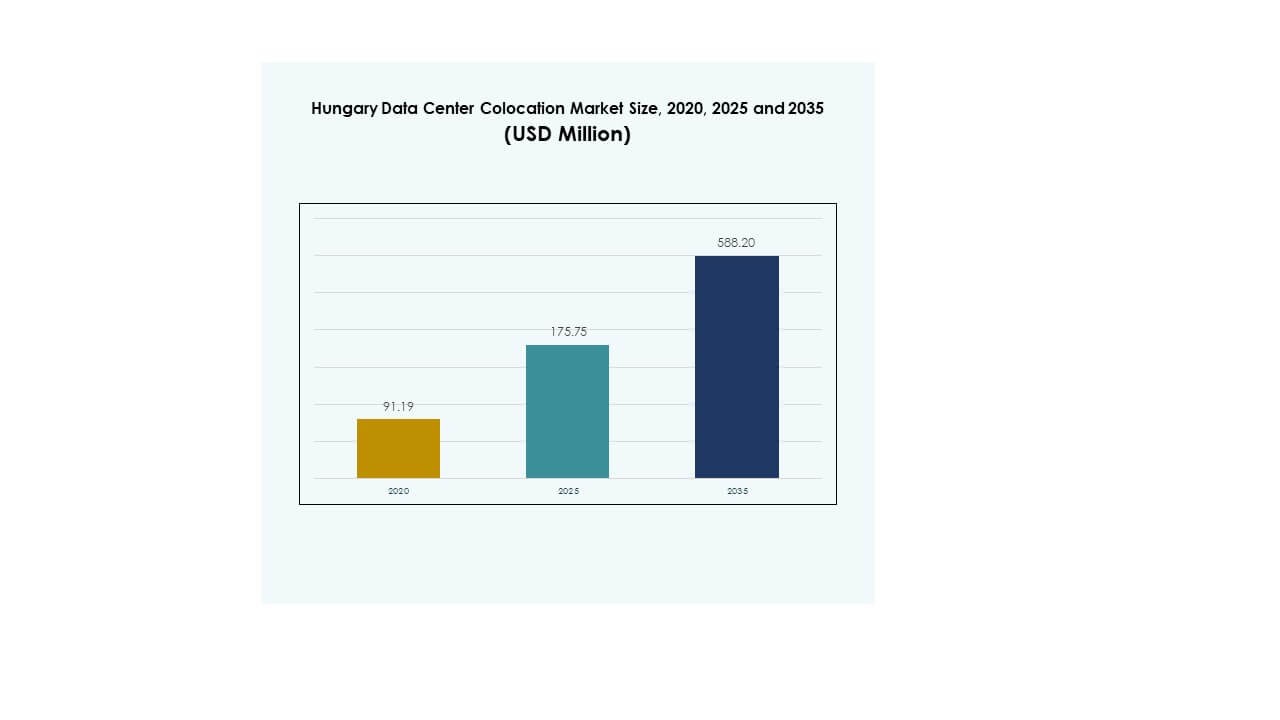

The Hungary Data Center Colocation Market size was valued at USD 91.19 million in 2020 to USD 175.75 million in 2025 and is anticipated to reach USD 588.20 million by 2035, at a CAGR of 12.78% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Hungary Data Center Colocation Market Size 2025 |

USD 175.75 Million |

| Hungary Data Center Colocation Market, CAGR |

12.78% |

| Hungary Data Center Colocation Market Size 2035 |

USD 588.20 Million |

The market is expanding through rapid cloud adoption, AI integration, and growing demand for edge infrastructure. Rising enterprise workloads and low-latency network requirements are pushing operators to build more scalable colocation facilities. Sustainability goals, automation, and hybrid cloud models are transforming operational strategies. It offers businesses secure, cost-effective, and high-performance hosting environments, making the market strategically important for investors and global providers.

Western Europe leads with advanced infrastructure and strong cloud ecosystems, creating favorable conditions for growth. Hungary is emerging as a regional hub due to its central location and expanding connectivity. Eastern European countries are gaining traction through rising foreign investments and digital transformation. This geographic shift is strengthening Hungary’s role within the broader European colocation landscape.

Market Drivers

Strong Growth Driven by Digital Transformation and Cloud Expansion

The Hungary Data Center Colocation Market is growing rapidly due to rising cloud adoption and enterprise digitalization. Businesses depend on scalable colocation facilities to reduce operational costs and achieve faster deployment. Strong demand for hybrid cloud solutions is transforming traditional IT infrastructure strategies. It enables companies to optimize workload management and enhance data security. Strategic investments in next-generation infrastructure create opportunities for both domestic and international players. High-speed fiber networks support growing data traffic and low-latency operations. Colocation facilities help enterprises avoid expensive infrastructure ownership. This shift strengthens the strategic value of colocation for critical workloads.

Integration of AI, Edge Computing, and Automation into Data Center Operations

Edge computing and AI integration drive the development of advanced colocation facilities. Companies are deploying intelligent automation tools to enhance resource allocation and operational efficiency. It improves performance, optimizes energy use, and supports evolving data-intensive applications. Businesses across retail, finance, and telecom rely on this infrastructure to remain competitive. Strategic innovation in automation tools enables operators to minimize downtime and increase reliability. This shift makes colocation an essential component of digital ecosystems. AI-powered monitoring ensures faster detection of anomalies and better network resilience. It enhances the overall competitiveness of service providers.

Rising Investor Interest and Strategic Infrastructure Development

Growing foreign investment is transforming Hungary into a key colocation destination in Europe. Investors target the country’s strategic location to serve Central and Eastern Europe. It allows multinational companies to expand their network coverage and meet data localization needs. Strong government support for digital infrastructure creates favorable investment conditions. Developers are constructing modular facilities to speed up capacity addition and improve energy efficiency. This strategic approach aligns with rising enterprise demand for secure and scalable hosting. Improved connectivity infrastructure enhances operational flexibility. This attracts both hyperscale and mid-size operators to the market.

- For example, in October 2025, 4iG Group signed a preliminary, non-binding agreement with Axiom Space outlining a USD 100 million investment commitment and a separate USD 100 million framework for an orbital data center program, signaling Hungary’s growing role in advanced digital infrastructure initiatives.

Energy Efficiency and Sustainability as Core Infrastructure Priorities

Sustainability is shaping design and construction decisions for colocation facilities. Operators focus on renewable energy integration and low PUE levels to meet strict efficiency goals. It ensures compliance with EU climate targets and lowers long-term operational costs. Green technologies like liquid cooling and AI-based energy management support these efforts. Businesses value sustainable facilities to meet their ESG goals and customer expectations. This alignment between corporate sustainability goals and infrastructure strategy accelerates market expansion. Continuous innovation in power and cooling solutions strengthens operator competitiveness. It positions Hungary as a sustainable data center hub in the region.

- For example, in 2025, Hungary launched a HUF 2 billion digital development program for SMEs, offering grants to support ICT investments and digital upgrades. The scheme aims to strengthen competitiveness and encourage technology adoption across the business ecosystem.

Market Trends

Rising Edge Deployment to Support Latency-Sensitive Applications

The Hungary Data Center Colocation Market is witnessing a sharp increase in edge facility deployments. Demand for low-latency processing in IoT, AI, and 5G services drives this expansion. Telecom operators and cloud providers are deploying edge infrastructure to deliver real-time services. It helps businesses support applications such as autonomous systems, AR/VR, and telemedicine. Edge nodes enhance service delivery while reducing network congestion. This trend aligns with enterprise demand for agile and cost-efficient infrastructure. Strong government initiatives around digital connectivity accelerate this development. It strengthens Hungary’s role as an emerging edge computing hub in Europe.

Expansion of Hyperscale and Carrier-Neutral Data Center Facilities

Hyperscale providers are expanding operations in Hungary to serve enterprise and cloud-native workloads. Carrier-neutral facilities allow businesses to interconnect multiple networks, improving flexibility and redundancy. It supports the growing number of multi-cloud deployments across industries. Service providers are focusing on strategic locations to offer lower latency and higher availability. This trend is strengthening partnerships between colocation operators and global tech firms. Increased deployment of hyperscale capacity enhances competitiveness and service reach. New market entrants are boosting competition, leading to better pricing models. It ensures enterprises gain access to cost-effective and scalable hosting solutions.

Focus on Advanced Security Infrastructure to Address Regulatory Demands

Growing concerns over cybersecurity are reshaping infrastructure planning for colocation facilities. Advanced security systems like zero-trust models and AI-based threat detection are gaining adoption. It supports strict compliance with EU data protection and privacy laws. Enterprises seek colocation environments with advanced encryption and real-time monitoring. The adoption of multi-layer security frameworks enhances trust between operators and clients. Service providers invest heavily in physical and network security to minimize vulnerabilities. This trend strengthens the overall resilience of data center ecosystems. It creates competitive differentiation for providers with advanced security capabilities.

Increasing Demand for Interconnectivity and High-Bandwidth Services

Enterprises are prioritizing colocation facilities with strong interconnectivity to support multi-cloud strategies. It improves data traffic handling and enables seamless application performance. Growing digital transformation across industries drives higher demand for carrier diversity and network reach. Cloud service providers and enterprises collaborate to deploy high-bandwidth interconnection solutions. These capabilities help businesses achieve faster service delivery and improved end-user experience. Interconnection hubs reduce dependency on single carriers and enhance flexibility. The rise of content-heavy industries like streaming and gaming fuels this demand further. It solidifies Hungary’s position as a regional interconnection hub.

Market Challenges

High Infrastructure and Energy Costs Impacting Expansion Strategies

The Hungary Data Center Colocation Market faces rising infrastructure costs that affect development timelines and pricing models. Power prices remain volatile, raising operational costs for colocation providers. It puts pressure on service pricing and slows capacity expansion plans. Small and mid-size operators face challenges competing with hyperscale providers. Energy efficiency initiatives require significant capital investment, creating barriers for new entrants. Strict regulatory compliance around sustainability further increases capital and operational costs. These cost factors create financial strain for operators seeking long-term profitability. Maintaining competitive pricing while meeting energy goals becomes increasingly difficult.

Skilled Workforce Shortage and Regulatory Complexities

A shortage of skilled professionals in data center operations poses operational challenges for service providers. It impacts the efficiency and reliability of mission-critical infrastructure management. Complex regulatory frameworks around data protection and energy use increase compliance burdens. Operators invest heavily in training and legal advisory to maintain operational alignment. This increases overall cost structures and affects speed of expansion. Global providers adapt quickly, but smaller players face hurdles scaling operations. Limited availability of experienced talent slows innovation cycles and strategic growth. These challenges require coordinated policy and industry action to overcome.

Market Opportunities

Rising Foreign Investment and Strategic Infrastructure Partnerships

The Hungary Data Center Colocation Market benefits from increasing foreign investments and joint ventures. Investors target the country’s central location to serve regional connectivity demands. It strengthens cross-border data traffic flows and improves digital infrastructure depth. Strategic partnerships between global hyperscalers and local operators expand capacity quickly. This cooperation allows faster market entry and broader service offerings. It enhances the country’s reputation as a reliable digital hub. The investment climate continues to attract both infrastructure funds and technology providers. This creates a favorable environment for sustained market growth.

Growing Demand for Green and Modular Data Center Solutions

Sustainability goals drive demand for energy-efficient, modular colocation facilities. It creates opportunities for operators to differentiate through green technologies and low PUE targets. Modular designs support faster deployment and scalability with lower upfront investment. This flexibility appeals to both SMEs and large enterprises seeking cost control. Renewable energy integration aligns with EU climate commitments. Operators leveraging sustainable infrastructure gain stronger market positioning. This shift supports long-term competitive advantage and investor confidence. It helps Hungary attract new market entrants focused on green technology innovation.

Market Segmentation

By Type

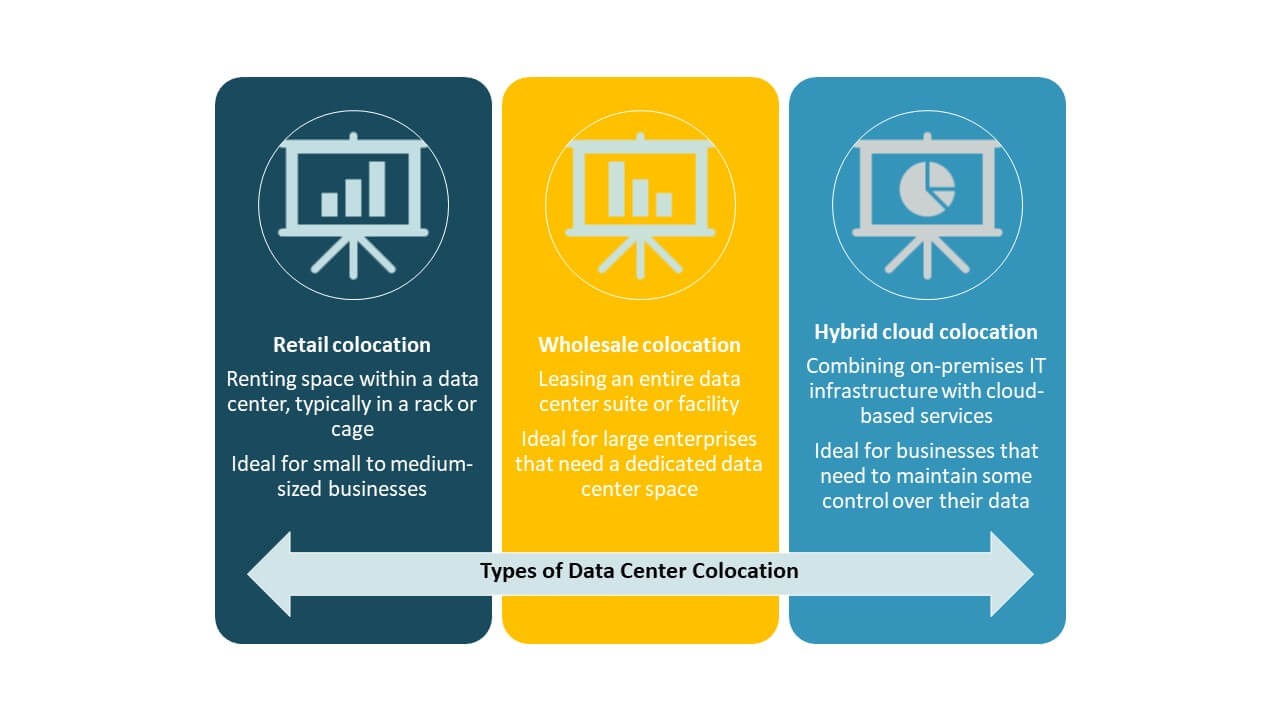

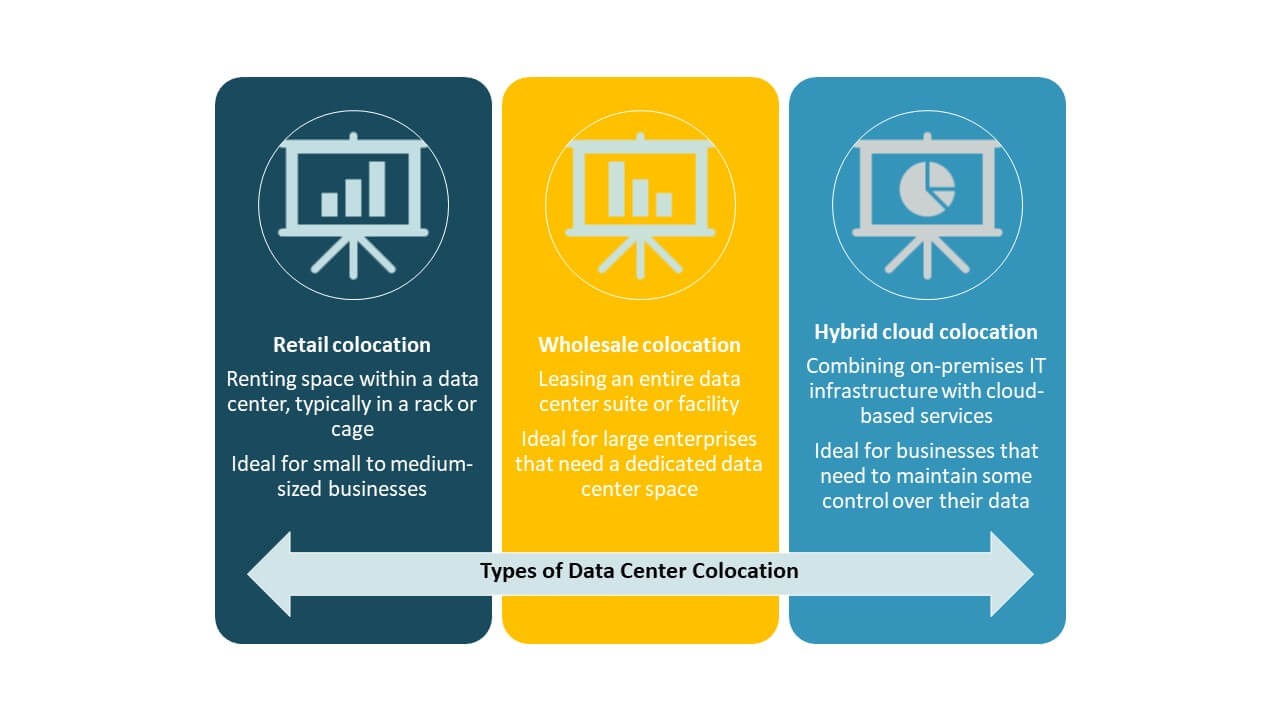

Retail colocation dominates the Hungary Data Center Colocation Market with strong demand from SMEs and mid-sized enterprises. It offers flexible capacity, lower capital costs, and quick deployment. Wholesale colocation follows, driven by hyperscale and cloud providers seeking large capacity blocks. Hybrid colocation is growing as enterprises adopt multi-cloud strategies. The flexibility of retail models makes it the preferred option for scalable deployments. Businesses prioritize cost efficiency and network control. Retail solutions enable secure, reliable hosting without high upfront infrastructure investment. This segment strengthens overall market growth and operator profitability.

By Tier Level

Tier 3 facilities dominate the Hungary Data Center Colocation Market, holding the largest market share. They offer high reliability, redundant systems, and cost-effective uptime solutions. Tier 4 is growing in demand among mission-critical industries requiring enhanced resilience. Tier 2 facilities remain relevant for non-critical applications seeking budget-friendly hosting. Tier 1 infrastructure shows limited expansion due to reliability limitations. Tier 3’s balance between cost and performance attracts enterprise customers. These facilities support compliance with global standards and customer SLAs. Strong preference for Tier 3 designs shapes ongoing infrastructure investments.

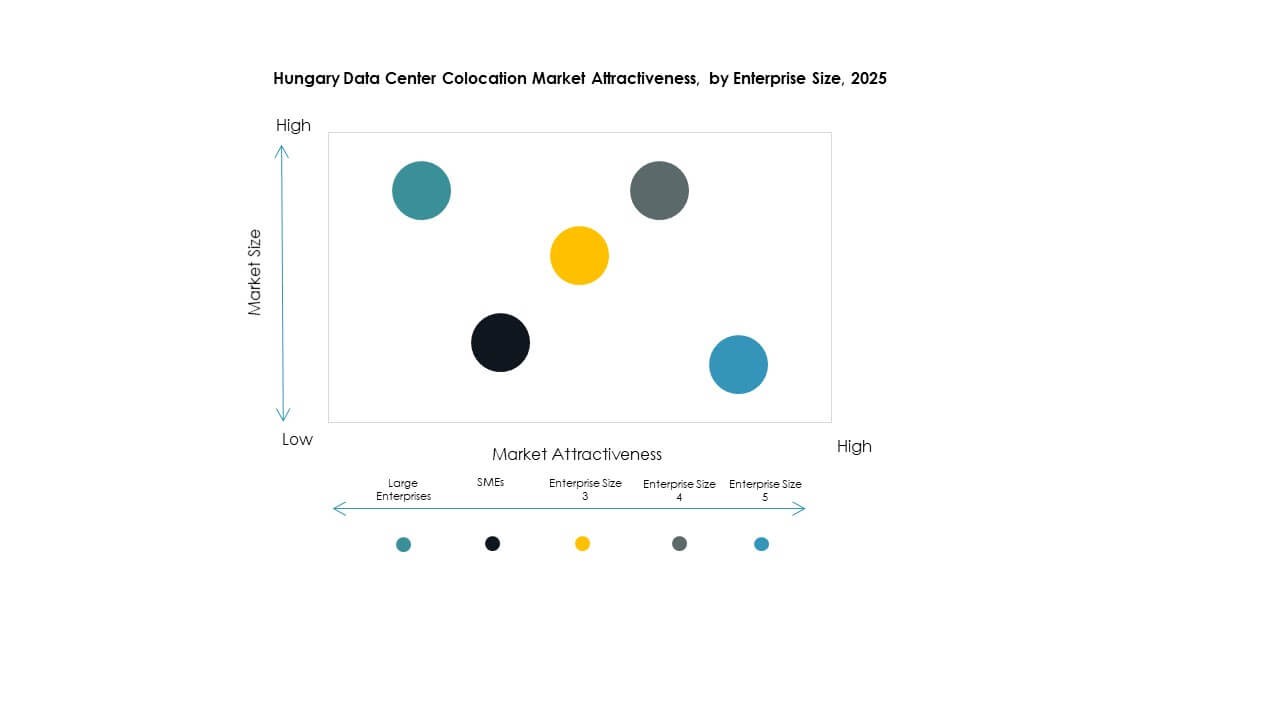

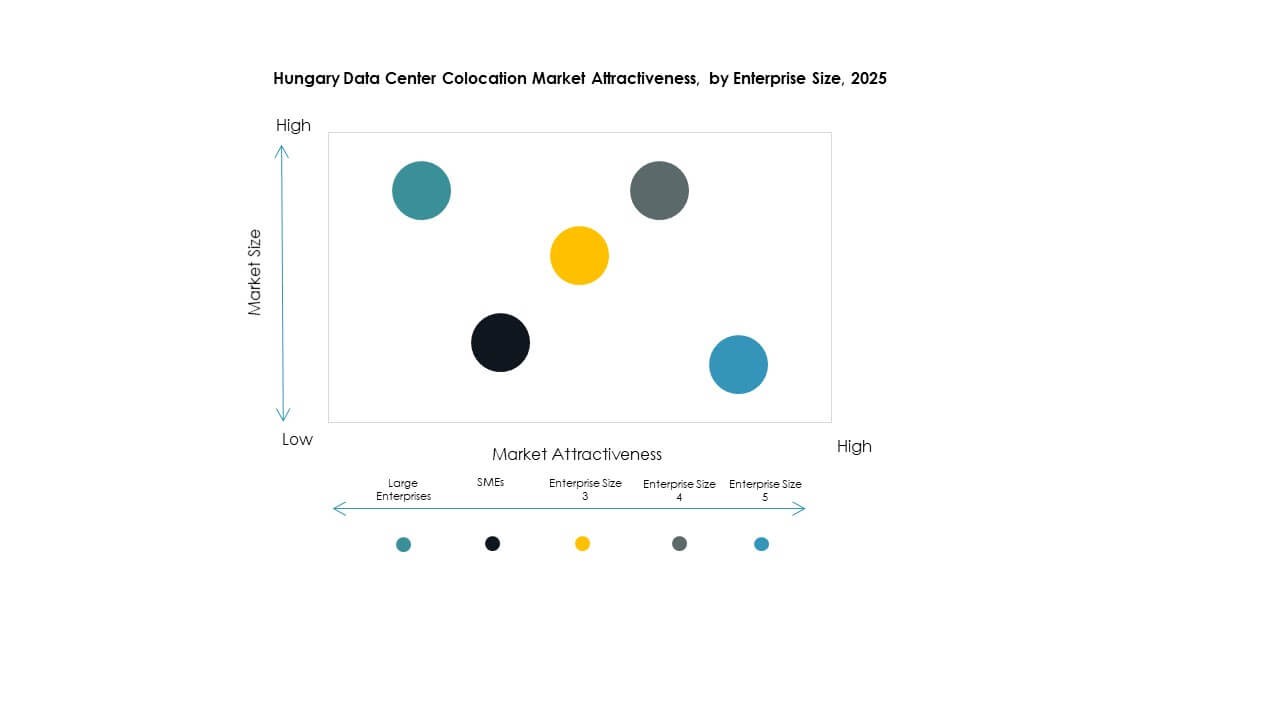

By Enterprise Size

Large enterprises lead the Hungary Data Center Colocation Market due to high data processing needs. They depend on scalable infrastructure to manage critical workloads securely. SMEs follow, leveraging retail colocation for cost-efficient IT operations. The flexibility of colocation allows smaller businesses to scale without heavy capital costs. Large corporations drive steady demand for advanced connectivity and compliance solutions. High data traffic from financial services, telecom, and media boosts capacity needs. SMEs benefit from shared infrastructure while maintaining data control. This dual demand structure supports balanced market expansion.

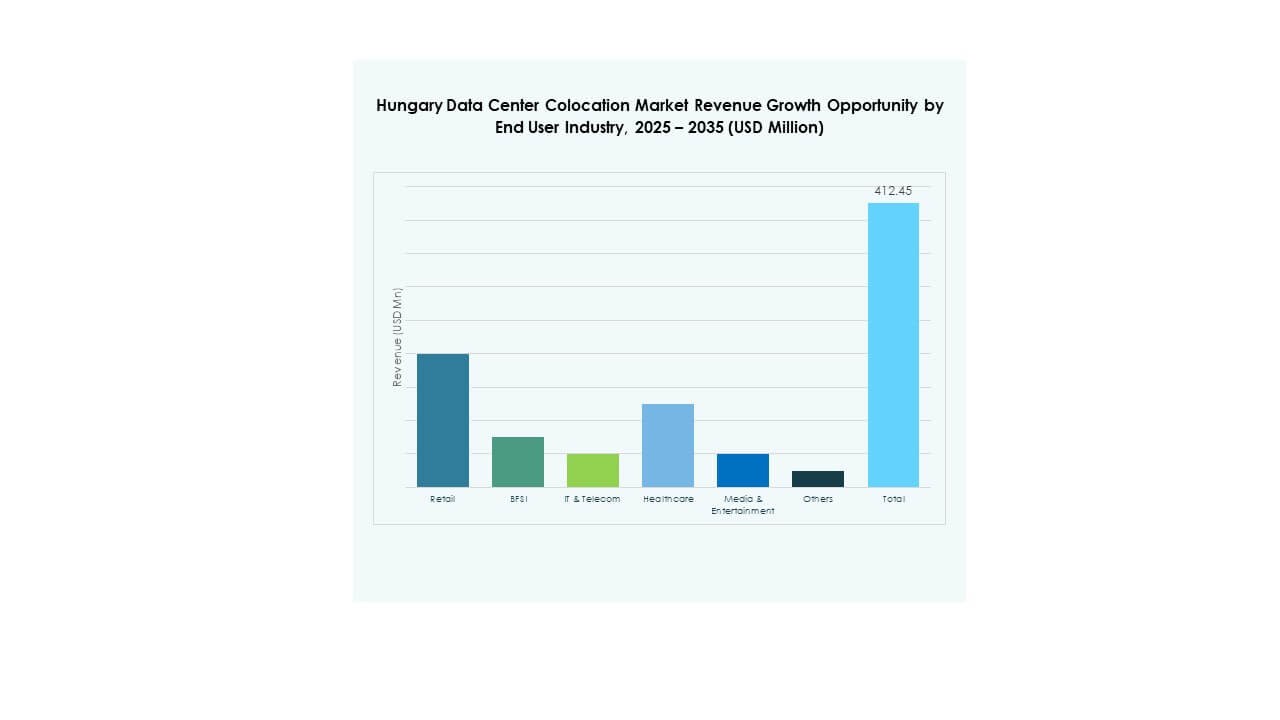

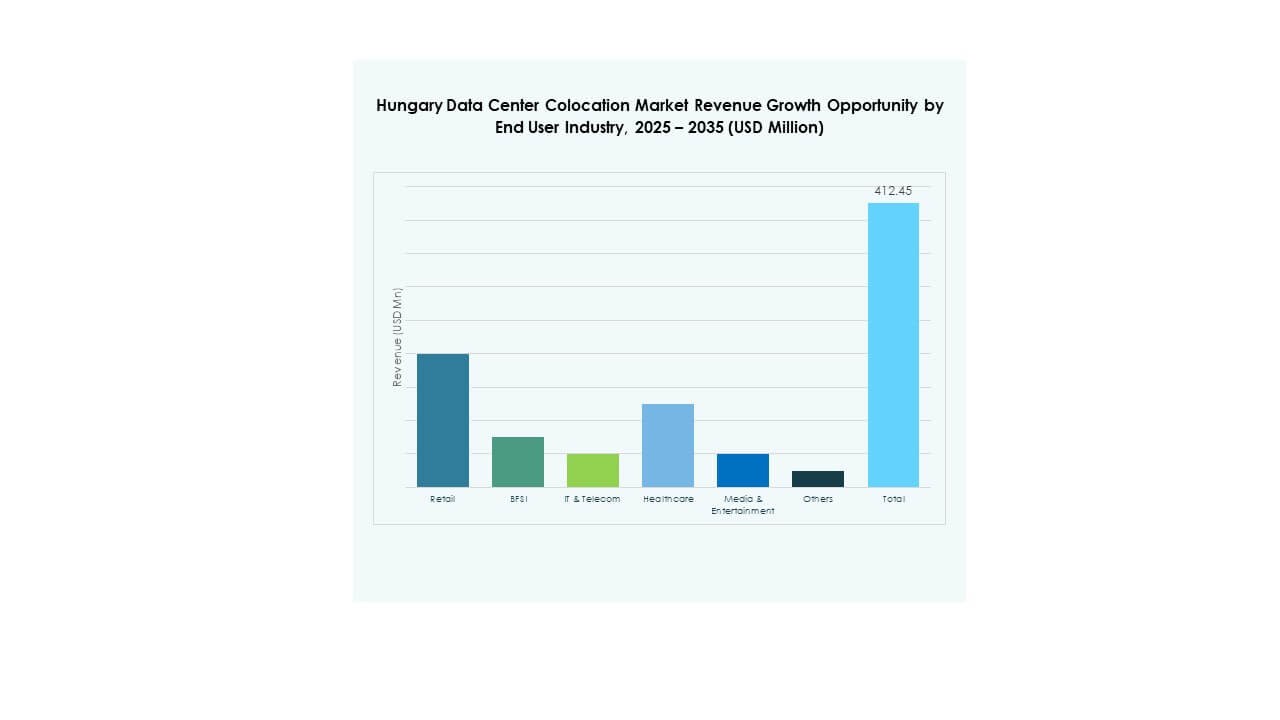

By End User Industry

IT & Telecom holds the largest share in the Hungary Data Center Colocation Market, supported by rapid cloud adoption and 5G rollout. BFSI follows, driven by data security and regulatory compliance requirements. Retail and healthcare industries are increasing their reliance on colocation for digital services. Media and entertainment show strong growth due to rising streaming and gaming traffic. Other sectors adopt colocation to reduce infrastructure ownership costs. High bandwidth demand and uptime reliability make IT & Telecom a dominant end-user. Strong digital ecosystem investments support further growth.

Regional Insights

Western Hungary Leading with Strong Infrastructure Backbone – 44% Share

Western Hungary holds 44% share of the Hungary Data Center Colocation Market, supported by well-developed fiber networks and stable energy supply. The presence of major industrial and technology hubs drives consistent demand. Enterprises prefer this subregion for its reliable connectivity and strategic proximity to EU markets. It attracts hyperscale operators and foreign investors seeking regional expansion. High population density and business activity boost infrastructure utilization rates. This leadership position strengthens Western Hungary’s role in the national digital economy. It remains a preferred location for both retail and wholesale colocation.

- For example, in June 2025, Magyar Telekom resolved to spin off its passive mobile infrastructure portfolio nearly 2,800 tower and rooftop sites into a wholly owned subsidiary, effective October 31, 2025.

Central Hungary Strengthening Role in National Connectivity – 36% Share

Central Hungary accounts for 36% share, emerging as a core connectivity hub in the national data center landscape. Budapest drives most demand through strong enterprise and government digital initiatives. Its central location offers logistical advantages for both domestic and cross-border operations. The region benefits from advanced network infrastructure and skilled workforce availability. Investment in edge facilities and interconnection hubs is rising rapidly. This strengthens Central Hungary’s position as a strategic deployment zone for data-intensive industries. It is becoming a prime destination for hybrid cloud expansion.

- For example, in 2024, 4iG Group partnered with Nokia to modernize and unify its IP access and DWDM backbone networks in Hungary. The company also launched 2Connect to expand its wholesale fiber and data center infrastructure across European routes.

Eastern Hungary Emerging with Growing Investment Momentum – 20% Share

Eastern Hungary holds 20% share of the Hungary Data Center Colocation Market and is gaining traction due to new infrastructure projects. Foreign investors and local developers target this region for future expansion. Lower land costs and untapped capacity create attractive investment opportunities. Government-led digitalization programs support the development of new colocation facilities. It is becoming a strategic alternative for companies seeking cost-efficient hosting solutions. Strong policy support helps bridge the infrastructure gap between eastern and western regions. This momentum is expected to strengthen its regional competitiveness over time.

Competitive Insights:

- Dataplex

- Invitel

- Rackforest

- Magyar Telekom

- Amazon Web Services (AWS)

- Google Cloud

- China Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- NTT Ltd. (NTT DATA)

The Hungary Data Center Colocation Market features a mix of domestic operators and global hyperscale players. It reflects strong competition focused on network capacity, uptime reliability, and service flexibility. Global leaders such as AWS, Google Cloud, Equinix, and Digital Realty strengthen their presence through scalable infrastructure and carrier-neutral facilities. Domestic providers like Dataplex, Invitel, Rackforest, and Magyar Telekom enhance competitiveness through localized solutions and strategic partnerships. Operators invest in low-latency networks, modular expansion, and advanced security to attract enterprises and cloud providers. This mix of global scale and local expertise creates a dynamic landscape where service innovation and connectivity strength define market leadership.

Recent Developments:

- In October 2025, Hungary’s 4iG Group announced a landmark partnership with U.S.-based Axiom Space, aiming to launch Europe’s first orbital data center (ODC). Signed on October 3, 2025, this preliminary agreement involves a potential joint investment of up to USD 200 million, highlighting Hungary’s ambition to strengthen its position in the global space and data center sectors.

- In October 2025, Digital Realty announced a collaboration with DXC Technology to accelerate enterprise AI adoption across its global data center network, including operations in Central Europe.