Executive summary:

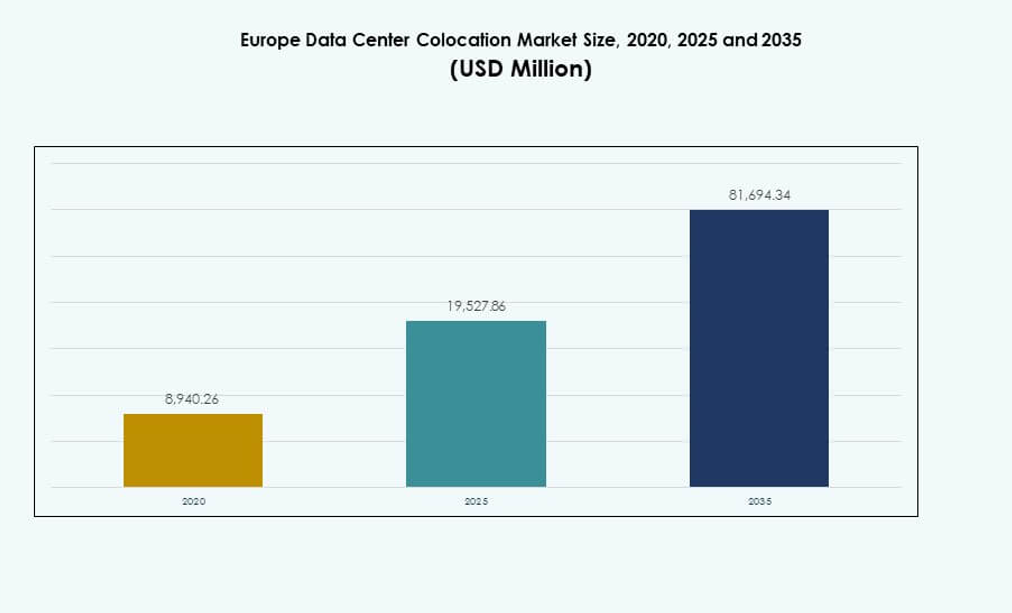

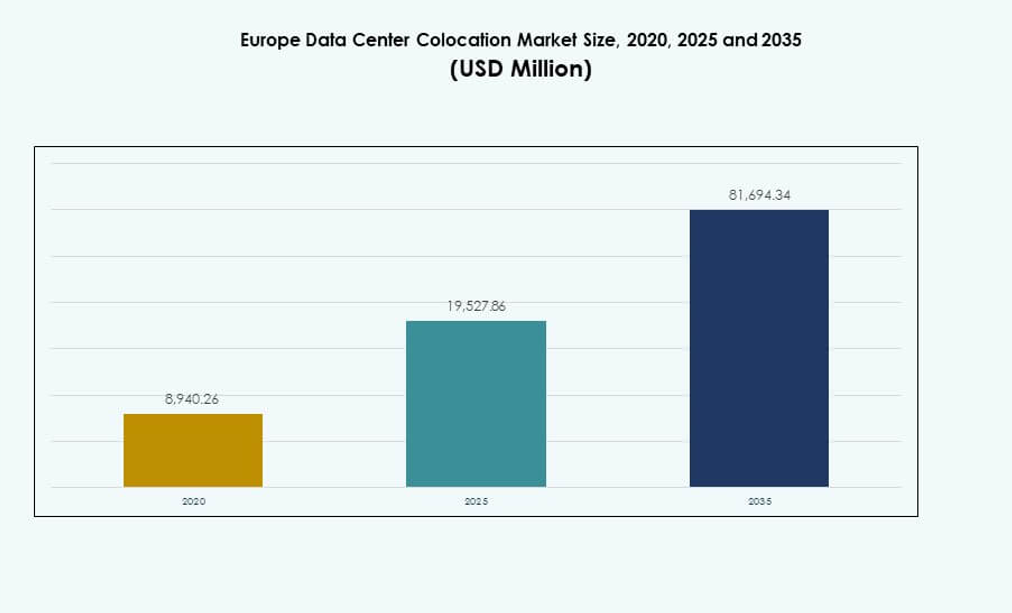

The Europe Data Center Colocation Market size was valued at USD 8,940.26 million in 2020 to USD 19,527.86 million in 2025 and is anticipated to reach USD 81,694.34 million by 2035, at a CAGR of 15.32% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Europe Data Center Colocation Market Size 2025 |

USD 19,527.86 Million |

| Europe Data Center Colocation Market, CAGR |

15.32% |

| Europe Data Center Colocation Market Size 2035 |

USD 81,694.34 Million |

The market is expanding rapidly due to strong technology adoption, growing cloud integration, and strategic investments in advanced digital infrastructure. Enterprises are shifting to scalable colocation facilities to enhance operational flexibility, security, and network performance. Innovation in energy-efficient systems and edge deployments is strengthening the ecosystem. It plays a strategic role for investors and businesses seeking stable, long-term opportunities tied to digital transformation.

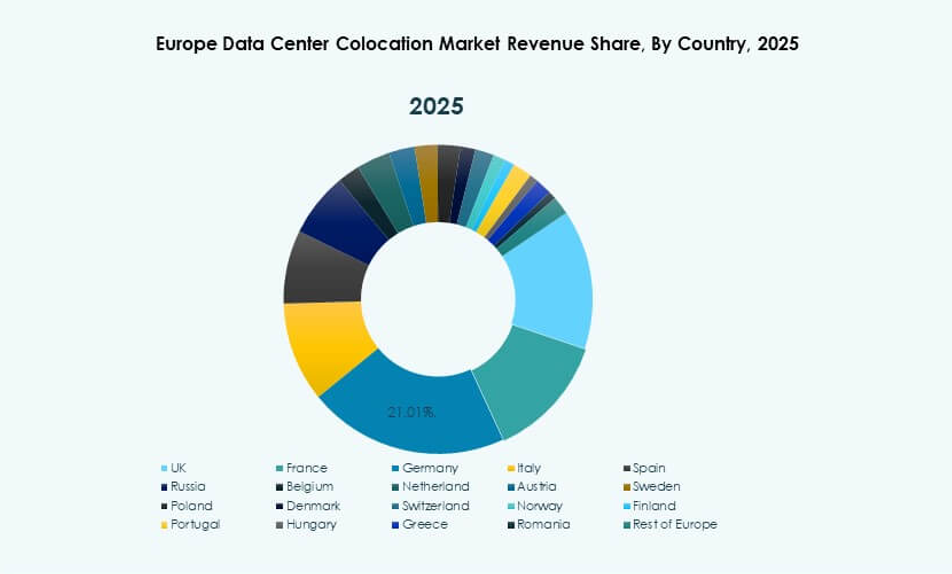

Western Europe leads this market, supported by advanced digital infrastructure and strong regulatory frameworks. Germany, the Netherlands, France, and the UK act as major hubs, driven by hyperscale activity. Central and Eastern Europe are emerging growth regions due to improving connectivity and cost advantages, attracting new investments in colocation capacity.

Market Drivers

Rising Adoption of Advanced Digital Infrastructure to Support Growing Enterprise IT Needs

The Europe Data Center Colocation Market is gaining momentum due to rapid digital transformation and increased IT outsourcing. Enterprises are focusing on cost efficiency, security, and high-speed connectivity. It supports data-intensive operations through scalable, reliable, and energy-efficient infrastructure. Demand for colocation facilities is expanding due to rising cloud adoption and hybrid IT strategies. Companies prefer colocation over traditional on-premise setups to reduce operational costs and enhance flexibility. Technological advances such as AI and edge computing improve data center efficiency and performance. Investors view this sector as a stable, high-return opportunity. The market plays a crucial role in enabling sustainable and resilient digital ecosystems.

- For instance, Equinix inaugurated its PA13x data center in Meudon, France, in February 2025 with an investment of €350 million. The facility incorporates a waste heat recovery system to supply nearby heating networks, supporting the company’s broader decarbonization strategy.

Accelerating Deployment of Cloud and Edge Computing to Drive Infrastructure Expansion

Cloud and edge computing are driving strong demand for advanced colocation facilities. Enterprises rely on hybrid environments to balance scalability, data security, and compliance. It enables companies to meet low-latency requirements and handle complex workloads efficiently. Edge deployments closer to end users enhance service delivery and user experience. Colocation providers are expanding capacity to accommodate hyperscalers and enterprise clients. Strategic partnerships with cloud service providers strengthen infrastructure capabilities. Businesses gain operational flexibility through shared facilities. This shift is reinforcing Europe’s position as a global digital infrastructure hub.

Growing Strategic Investments and Alliances to Strengthen Competitive Positioning

Strategic capital inflows are fueling rapid expansion of large-scale colocation facilities. Global hyperscalers and telecom operators are investing heavily in carrier-neutral infrastructure. It provides enterprises with better connectivity, resilience, and compliance with regulatory frameworks. Mergers, acquisitions, and joint ventures accelerate network coverage and service diversity. These investments also support green and energy-efficient solutions. Companies adopt innovative business models to expand across multiple regions. Strengthened infrastructure creates opportunities for long-term revenue growth. Investors benefit from predictable cash flows and asset appreciation in a growing market.

- For instance, Colt Data Centre Services announced the expansion of its Hayes campus in West London, with the first phase planned to deliver 60 MW of IT capacity by Q3 2025. The project is designed to support high-density and AI workloads, strengthening the company’s hyperscale colocation footprint in the UK.

Expanding Focus on Sustainability and Energy-Efficient Infrastructure Deployment

Environmental regulations and rising energy costs are pushing data center operators toward sustainable practices. Operators integrate renewable energy, liquid cooling, and energy management systems to reduce carbon footprints. It enhances operational efficiency and ensures compliance with evolving environmental standards. Demand for green colocation facilities is growing among global enterprises. Governments and regulators encourage clean energy adoption to align with carbon neutrality targets. This shift also strengthens corporate reputation and brand value. Businesses see sustainable infrastructure as a key factor in future competitiveness. Investors view eco-friendly data centers as valuable long-term assets.

Market Trends

Integration of Artificial Intelligence and Automation to Enhance Operational Efficiency

AI-driven solutions are transforming data center operations by optimizing cooling, power use, and workload management. The Europe Data Center Colocation Market is adopting predictive maintenance systems to reduce downtime and improve asset performance. AI-enabled monitoring platforms allow operators to make real-time decisions with greater accuracy. Automated resource allocation ensures high reliability and better cost control. This trend is driving efficiency at scale and reducing operational complexities. Companies focus on smarter infrastructure to maintain competitive advantage. AI also improves energy optimization strategies. Automation ensures faster deployment cycles and consistent service quality.

Shift Toward Modular and Scalable Data Center Designs for Faster Deployment

Modular designs are reshaping construction and operational strategies for colocation providers. Prefabricated units enable faster deployment, lower costs, and flexible capacity expansion. It supports businesses with dynamic workloads and seasonal demand peaks. Modular infrastructure improves uptime, adaptability, and energy performance. Operators can scale services to match growing data demands. This design trend aligns with rapid enterprise digital transformation strategies. Providers gain stronger competitive positioning through faster go-to-market capabilities. Modular approaches are becoming central to future-ready infrastructure planning.

Increasing Deployment of High-Density Racks to Maximize Space Utilization

Colocation providers are deploying high-density racks to support growing processing power and compact infrastructure needs. The Europe Data Center Colocation Market is evolving to accommodate AI and high-performance computing workloads. High-density solutions reduce footprint while improving power usage effectiveness. Operators integrate advanced cooling solutions to maintain performance standards. This trend supports large enterprises requiring robust computing environments. High-density deployments enhance operational scalability and sustainability. Providers are optimizing facility layouts for maximum efficiency. These upgrades enable better capacity utilization and performance consistency.

Expansion of Interconnection Ecosystems to Support Global Digital Connectivity

Interconnection services are becoming critical to enterprise digital strategies. Colocation operators are enhancing ecosystem connectivity with carriers, cloud providers, and content delivery networks. It allows businesses to reduce latency and improve user experience. Interconnection hubs drive traffic efficiency and strengthen digital supply chains. Cross-connect and peering services provide operational flexibility and resilience. This growing network ecosystem supports real-time applications and emerging technologies. The expansion of interconnected facilities positions Europe as a key global digital hub. This trend aligns with rising enterprise demand for integrated connectivity.

Market Challenges

Rising Energy Consumption and Environmental Pressures Increasing Operational Complexity

The Europe Data Center Colocation Market faces rising energy demands driven by expanding data volumes and high-density deployments. Energy-intensive operations strain power grids and increase operating costs for providers. It also intensifies environmental scrutiny and compliance obligations. Regulatory pressures are forcing operators to adopt renewable energy and efficient cooling systems. Transitioning to greener infrastructure requires significant upfront investments. Energy scarcity in certain regions creates operational risks and limits capacity expansion. Balancing sustainability goals with profitability remains a critical challenge. Operators must innovate to ensure reliable, cost-effective energy solutions.

Complex Regulatory Compliance and Data Sovereignty Concerns Affecting Expansion Strategies

Evolving data protection and localization laws create operational barriers for colocation providers. The Europe Data Center Colocation Market must align with strict GDPR requirements and national regulations. It complicates data sharing and storage strategies across borders. Different compliance standards across regions increase administrative burdens and costs. Enterprises face challenges in ensuring consistent legal adherence. This regulatory complexity slows expansion and impacts flexibility. Providers need robust governance frameworks to maintain trust and market positioning. Balancing operational agility with legal compliance remains a strategic concern.

Market Opportunities

Growing Demand for Hyperscale and Edge Deployments Creating Investment Opportunities

Hyperscale and edge deployments are accelerating colocation capacity expansion. The Europe Data Center Colocation Market benefits from rising enterprise cloud adoption and the need for low-latency infrastructure. Edge facilities closer to users improve speed and performance. Hyperscale demand from global tech firms creates stable revenue streams. These trends attract large infrastructure investors. Providers can leverage strategic locations to capture emerging demand. Expansion in underpenetrated regions provides significant growth potential.

Sustainability-Driven Innovations Creating a Competitive Advantage for Operators

Sustainable infrastructure solutions are unlocking new investment opportunities. The Europe Data Center Colocation Market is witnessing a strong shift toward renewable energy, efficient cooling, and circular design principles. Companies adopting green technologies gain better regulatory compliance and stronger brand value. Eco-friendly operations appeal to environmentally conscious enterprises. This shift enhances asset value and operational resilience. Green facilities also create competitive differentiation. Operators that prioritize sustainability secure long-term growth and investor confidence.

Market Segmentation

By Type

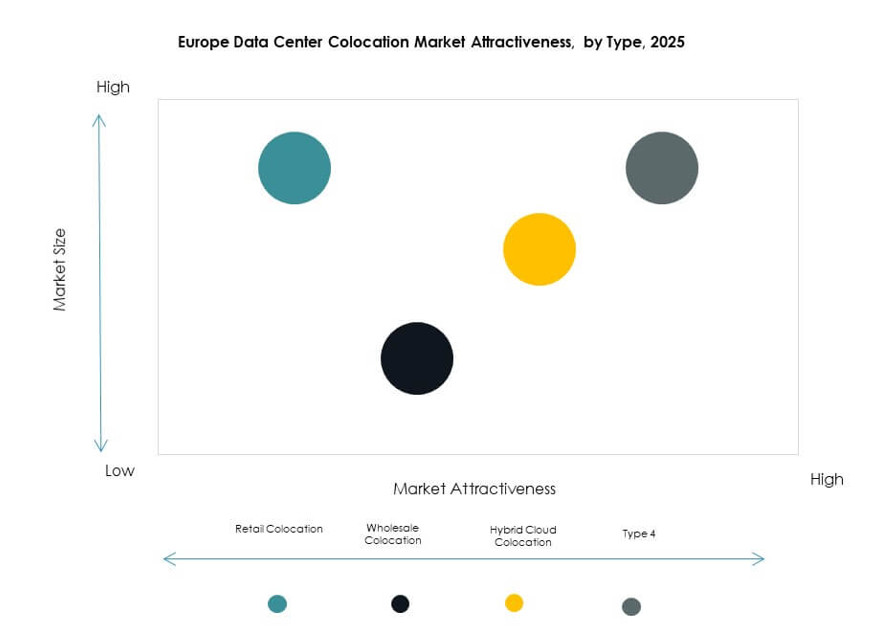

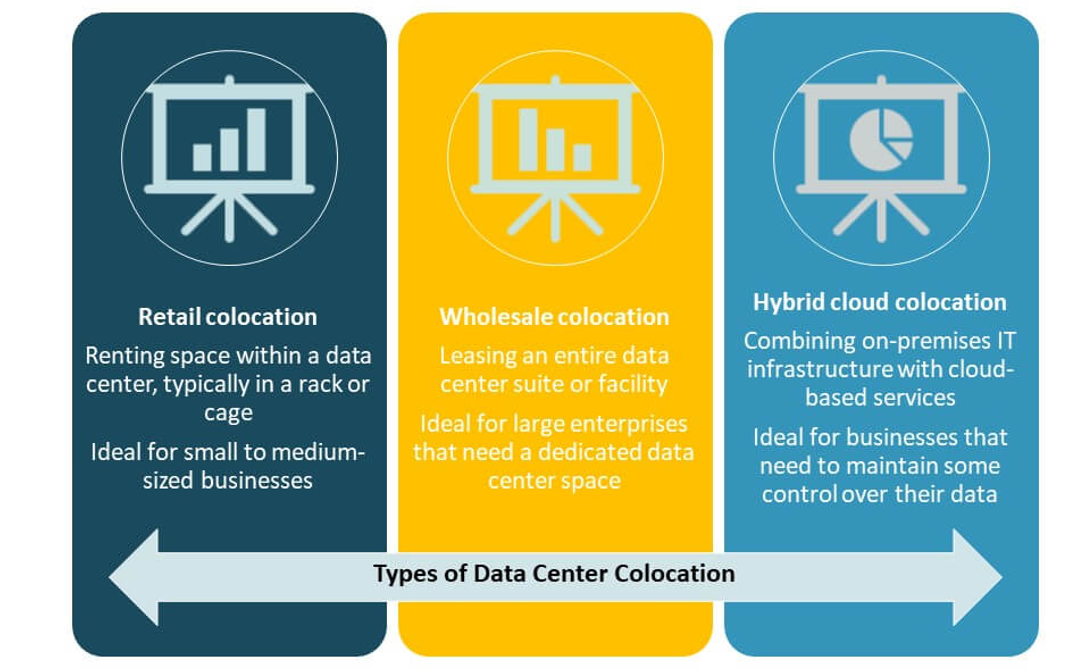

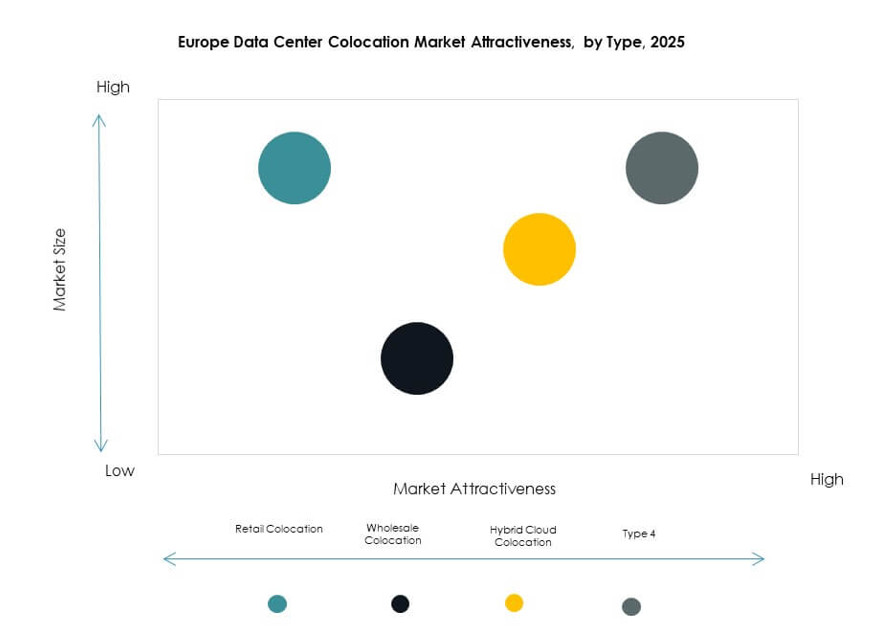

Retail colocation dominates the Europe Data Center Colocation Market with a significant share due to its flexibility and cost efficiency. Businesses prefer this model to manage smaller IT footprints without owning infrastructure. Wholesale colocation serves larger enterprises seeking dedicated space for high workloads. Hybrid cloud colocation is growing rapidly, supported by demand for seamless integration between on-premises and cloud environments. Retail remains the dominant model due to scalability and lower upfront investments.

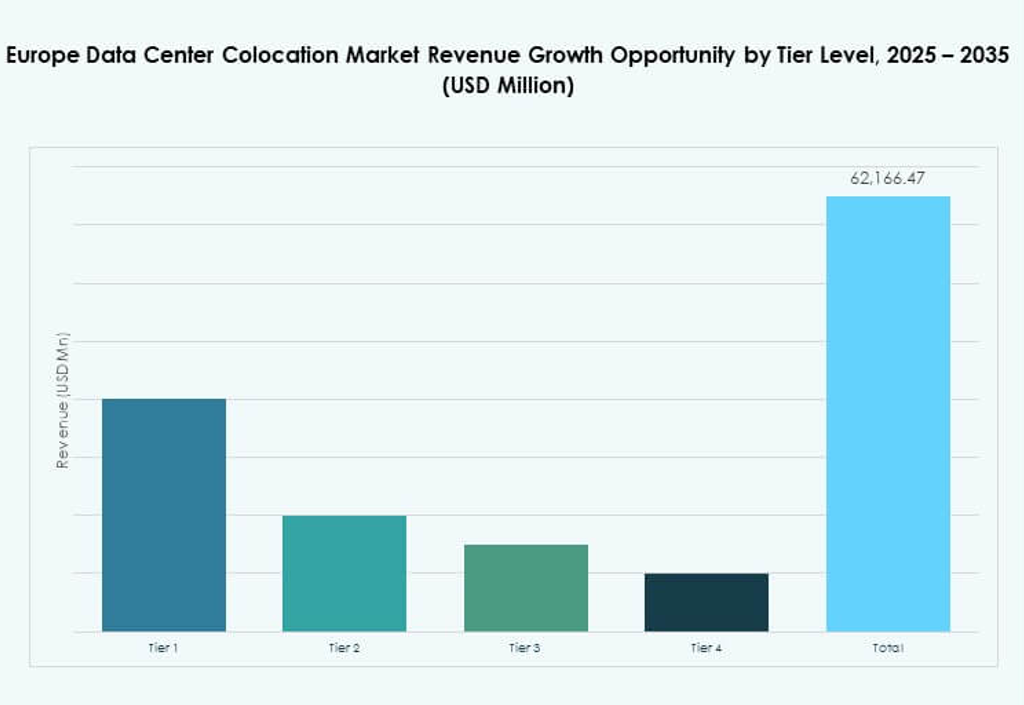

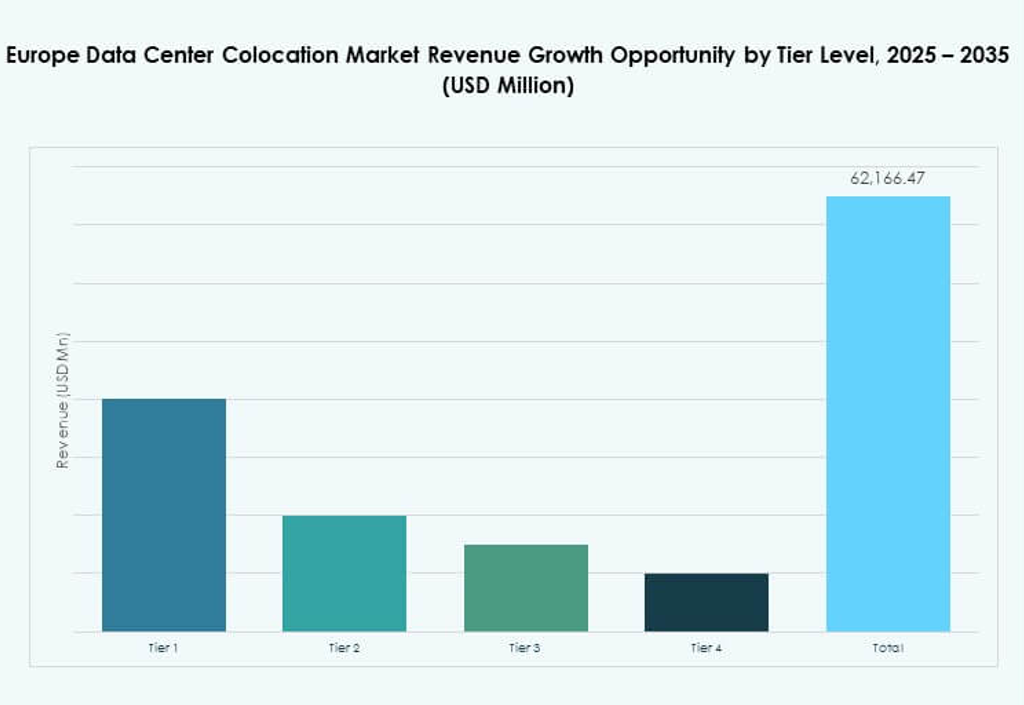

By Tier Level

Tier 3 holds the largest share in the Europe Data Center Colocation Market, offering high redundancy, security, and uptime guarantees. It supports mission-critical enterprise workloads with minimal downtime. Tier 4 is expanding steadily as companies demand maximum reliability and operational excellence. Tier 1 and Tier 2 cater to smaller organizations with lower criticality levels. Strong demand for high-performance infrastructure makes Tier 3 the preferred choice among enterprise customers.

By Enterprise Size

Large enterprises dominate the Europe Data Center Colocation Market due to their high data processing needs and complex IT requirements. These organizations rely on colocation to achieve better security, scalability, and global connectivity. SMEs are adopting colocation services to reduce infrastructure costs and improve efficiency. Large companies continue to lead, supported by strong digital transformation strategies and global expansion initiatives.

By End User Industry

The IT & Telecom sector holds the largest share of the Europe Data Center Colocation Market, driven by heavy data traffic and growing demand for high-speed connectivity. BFSI is another key segment, prioritizing secure and compliant infrastructure. Healthcare and media industries are expanding their usage to support telemedicine, streaming, and digital content delivery. Retail and other industries are adopting colocation to optimize operational costs. IT & Telecom remains the dominant industry due to its data intensity.

Regional Insights

Western Europe Leading the Market with Strong Digital Infrastructure and Investment

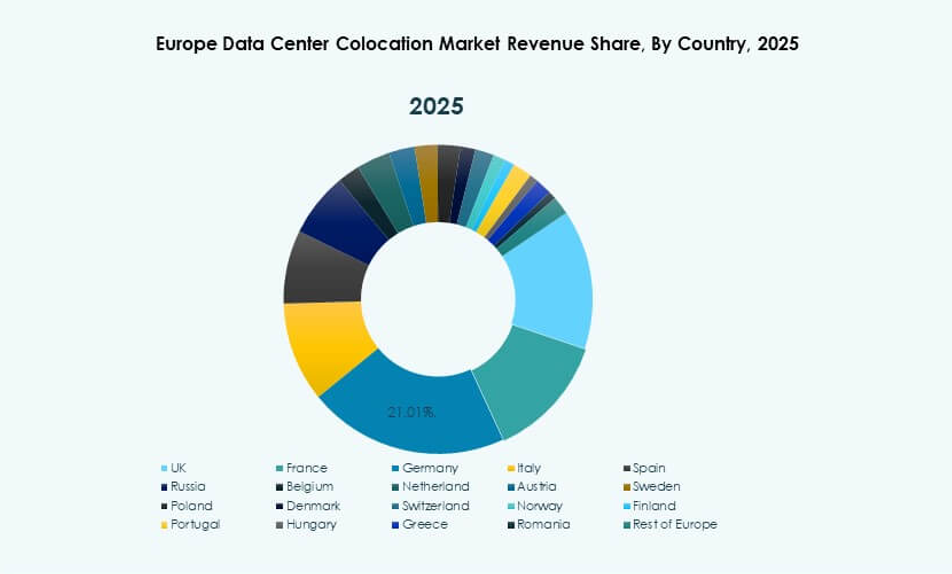

Western Europe leads the Europe Data Center Colocation Market with a 43% share, supported by advanced digital infrastructure, high connectivity, and strong regulatory frameworks. Germany, the Netherlands, France, and the UK act as key hubs for hyperscalers and enterprises. These countries offer stable energy supply, advanced interconnection ecosystems, and strategic locations. Strong investments in sustainability and technology adoption reinforce their leadership. Western Europe attracts both global operators and investors seeking reliable growth opportunities.

Northern and Southern Europe Emerging as Strategic Growth Regions

Northern and Southern Europe together account for a 34% market share, supported by growing enterprise demand and expanding network connectivity. Countries like Denmark, Sweden, Spain, and Italy are seeing increased data center development due to favorable climate conditions and renewable energy availability. The region benefits from government incentives for sustainable energy adoption. Strategic coastal locations enhance international connectivity. Emerging hubs in these regions attract hyperscale investments and new colocation providers.

- For instance, STACK Infrastructure announced a new data center campus in Høje-Taastrup, west of Copenhagen. The site is designed for up to 100 MW of capacity with renewable power secured and features water conservation and waste heat recovery systems to support district heating. The project reflects Denmark’s focus on sustainable digital infrastructure.

Central and Eastern Europe Showing Strong Potential for Capacity Expansion

Central and Eastern Europe hold a 23% share of the Europe Data Center Colocation Market. Poland, Czech Republic, and Hungary are emerging as competitive locations due to cost advantages and improving infrastructure. Lower operational costs and growing cloud adoption encourage investment in these markets. Governments support digital infrastructure expansion through favorable policies. Strategic positioning between Western Europe and Asia enhances regional importance. This region offers significant opportunities for investors targeting untapped colocation capacity.

- For instance, EdgeConneX’s Warsaw WAW02 facility offers 12.3 MW N+1 scalable to 31.5 MW, having launched as a hyperscale, carrier-neutral, Tier-3 designed data center serving cloud and content infrastructure needs in Poland since 2022.

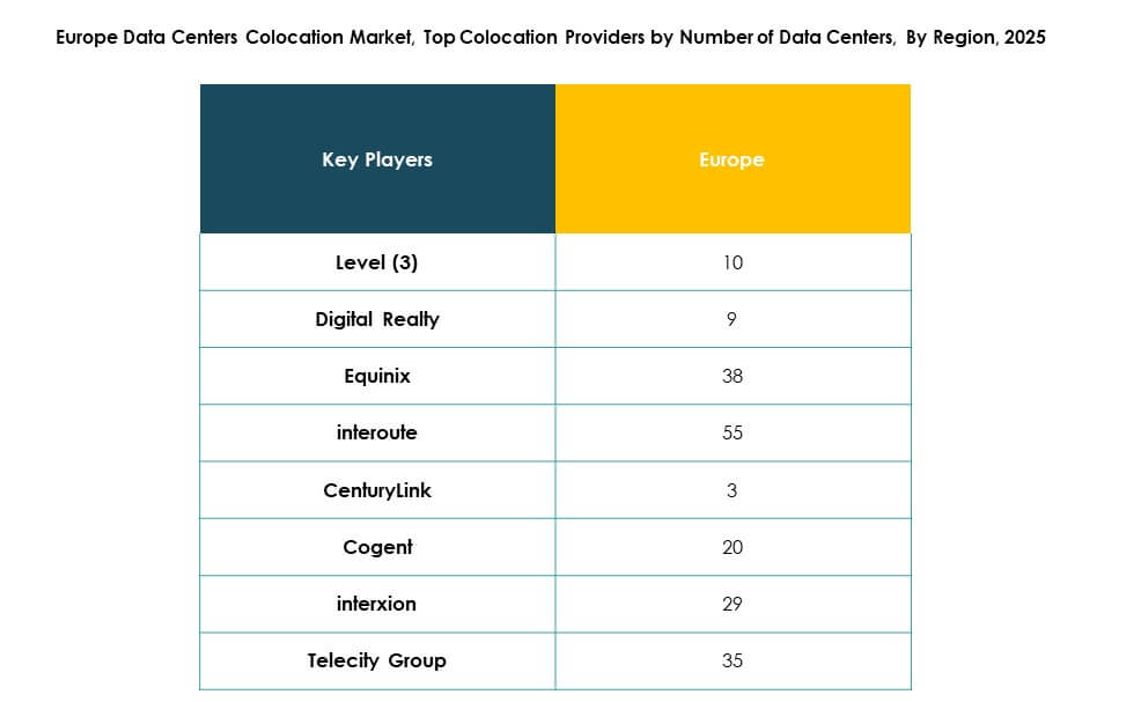

Competitive Insights:

- Virtus Data Centres

- Global Switch Holdings Limited

- Scaleway

- Cologix

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Centersquare

- Digital Realty Trust

- Equinix, Inc.

- NTT Ltd. (NTT DATA)

- QTS Realty Trust, LLC

- Rackspace Technology

- Telehouse (KDDI Corporation)

- Zayo Group, LLC

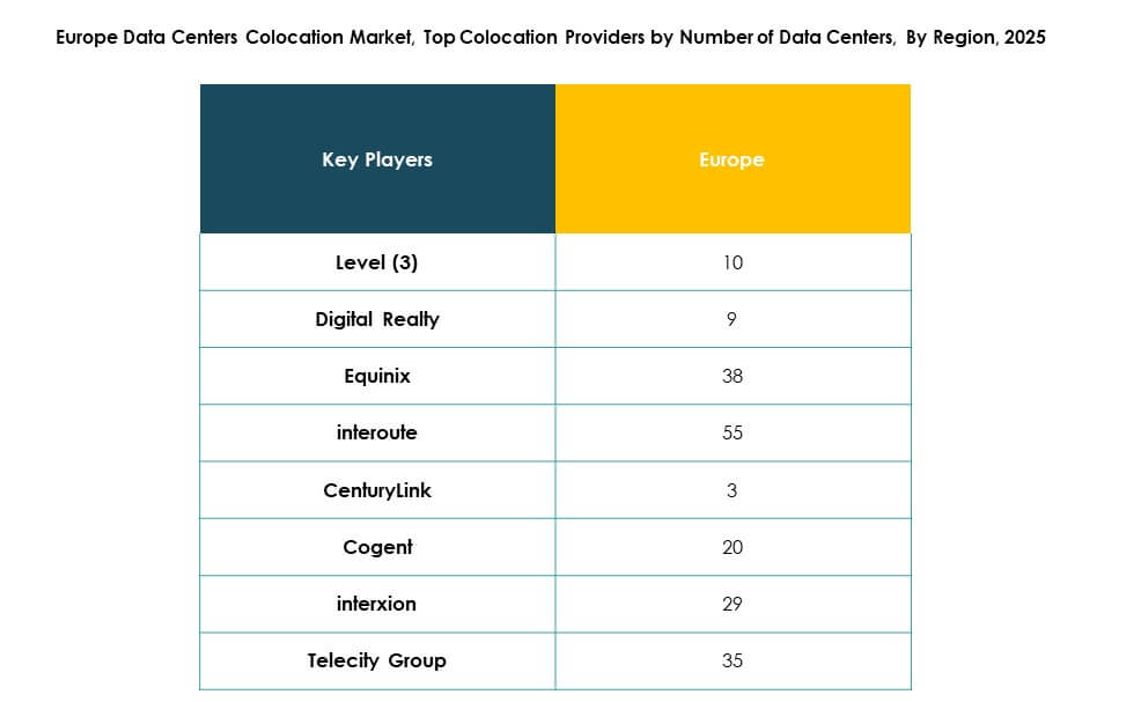

The Europe Data Center Colocation Market is defined by strong competition among global and regional players. It is characterized by continuous capacity expansion, strategic partnerships, and increased investment in sustainable infrastructure. Leading companies are building hyperscale facilities to meet rising enterprise and cloud demand. Operators focus on interconnection ecosystems and advanced cooling systems to enhance performance and reduce costs. Mergers and acquisitions strengthen market positioning and expand geographic reach. Sustainability commitments are shaping long-term differentiation strategies. High operational reliability, low latency, and strong regulatory compliance support competitive advantages. These dynamics create an environment where innovation and scalability drive leadership.

Recent Developments:

- In October 2025, QTS began site preparation for a new $13 billion data center in Northumberland, UK. The facility is projected to grow to 720MW on completion, positioning it among the largest colocation developments in Europe and targeting scalable service offerings for large enterprises and hyperscalers.

- In September 2025, EdgeMode and SUB1 announced a strategic partnership aimed at accelerating data center colocation projects across Europe. The collaboration seeks to leverage both companies’ expertise to deploy advanced facilities supporting AI and high-density workloads, with an initial focus on major urban markets in the UK and Germany.

- In August 2025, Goodman Group (Sydney-based) launched a European data center partnership to develop new colocation facilities in several capital cities. This initiative is designed to address surging demand from hyperscalers and cloud service providers, with construction planned for strategic locations in London, Frankfurt, and Amsterdam.

- In February 2025, Virtus Data Centres unveiled plans to launch its first facility in Milan, Italy, marking its expansion into a third European market beyond the UK and Germany. The development of this new site is set to begin in Q2 2025, addressing rising demand for digital infrastructure across continental Europe.