Executive summary:

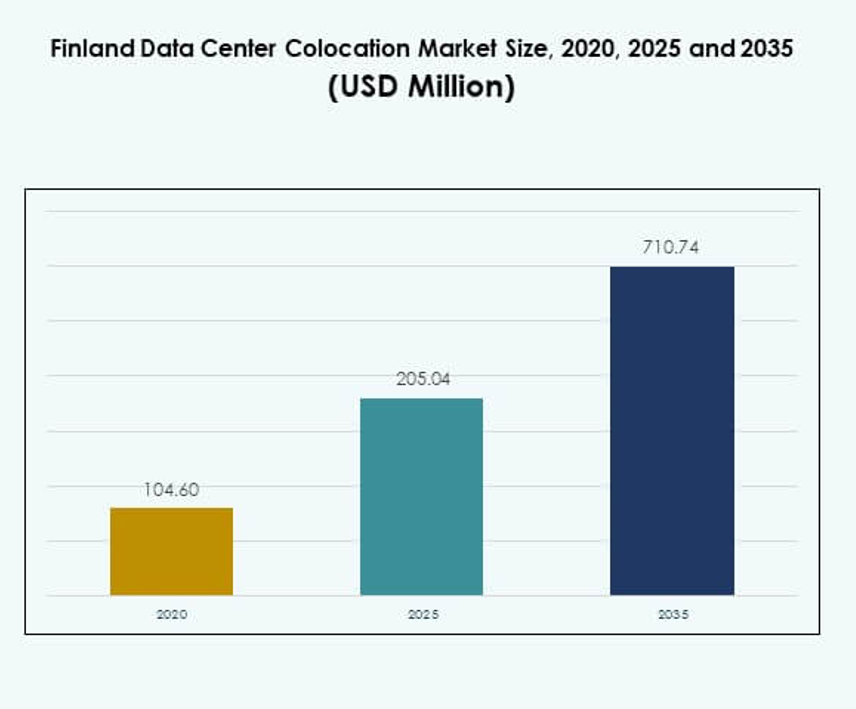

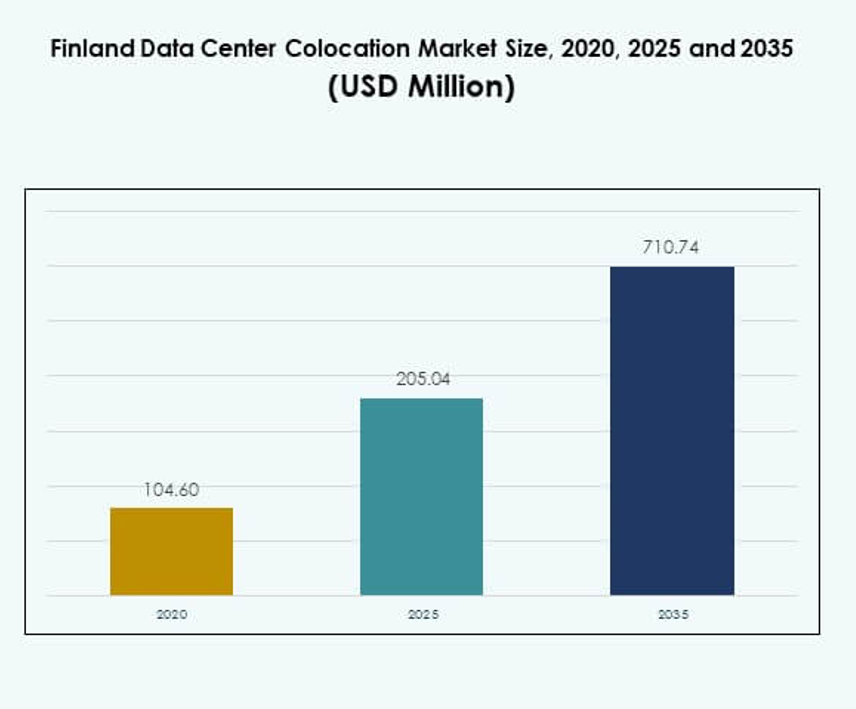

The Finland Data Center Colocation Market size was valued at USD 104.60 million in 2020 to USD 205.04 million in 2025 and is anticipated to reach USD 710.74 million by 2035, at a CAGR of 13.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Denmark Data Center Colocation Market Size 2025 |

USD 205.04 Million |

| Denmark Data Center Colocation Market, CAGR |

13.18% |

| Denmark Data Center Colocation Market Size 2035 |

USD 710.74 Million |

The market is expanding due to rising cloud adoption, digital transformation, and increasing demand for sustainable infrastructure. Enterprises are investing in colocation facilities to strengthen connectivity, security, and operational resilience. Advanced fiber networks and renewable power availability support scalable deployments. Strategic investments in green technology and automation make Finland a preferred location for hyperscalers and enterprises, enhancing its global importance for investors and operators.

Southern Finland leads the market due to its mature data center ecosystem, strong fiber connectivity, and strategic position in Northern Europe. Central Finland is emerging with growing modular deployments and energy efficiency advantages. Northern Finland shows strong potential with renewable energy availability and land resources, supporting long-term expansion and green data center strategies.

Market Drivers

Rising Digitalization and Strong Demand for Cloud Infrastructure

Widespread digital transformation across industries is accelerating demand for advanced colocation services in the Finland Data Center Colocation Market. Enterprises are shifting critical workloads to colocation facilities to achieve better reliability and operational efficiency. Cloud adoption is driving investment in high-density rack solutions, advanced cooling technologies, and scalable interconnection platforms. Local businesses are strengthening their hybrid IT strategies to enhance agility. International hyperscalers view Finland as a gateway to Northern Europe due to its strategic location and robust connectivity infrastructure. Favorable climate conditions lower energy costs for cooling operations. Data center operators are leveraging renewable energy sources to meet ESG commitments. These factors strengthen the market’s strategic role for global and regional investors.

Growing Focus on Green Energy Integration and Power Efficiency

The country’s extensive renewable energy availability is pushing operators to invest in sustainable colocation facilities. Companies are deploying energy-efficient designs, direct free cooling, and power usage effectiveness optimization. It is aligning with decarbonization goals while maintaining operational resilience. Investors see this trend as a competitive advantage for long-term growth. Large cloud and content providers are selecting Finland for low-carbon deployments to meet climate targets. Renewable power access reduces cost volatility, improving margins for operators. This shift reinforces the country’s role as a preferred data center hub in Europe. Sustainable investments ensure compliance with evolving EU energy standards. These developments drive market growth and attract capital inflows.

Rapid Expansion of Fiber Connectivity and Strategic Geographical Position

Finland offers extensive fiber backbone infrastructure that connects Northern and Central Europe. Its location supports low-latency traffic between Europe, Asia, and North America. The undersea cable networks strengthen its appeal for hyperscalers, OTT platforms, and financial institutions. The government promotes high-speed network initiatives, improving overall digital infrastructure. It is enhancing colocation operators’ ability to deliver fast and reliable services to global customers. This robust connectivity ecosystem supports deployment of latency-sensitive workloads such as AI and IoT. Businesses view Finland as a secure, neutral, and stable location for critical data operations. Strong network resilience ensures long-term strategic benefits for investors.

- For instance, Cinia Oy initiated route studies for the Far North Fiber submarine cable in April 2024. The 15,000 km system is planned to be operational by late 2026, aiming to strengthen Finland’s role as a key hub for transcontinental data traffic.

Rising Edge Deployment and Hybrid IT Adoption by Enterprises

Edge computing is gaining traction among manufacturing, telecom, and enterprise users. Colocation operators are deploying edge nodes closer to end users to reduce latency and improve service quality. It is supporting emerging technologies like IoT, AI-driven analytics, and real-time applications. Hybrid cloud models are integrating colocation with public and private cloud infrastructures. Businesses are diversifying their IT footprints to achieve higher flexibility and resilience. This shift is creating new service models and revenue streams for operators. Growing enterprise IT modernization efforts align with Finland’s strong connectivity and power efficiency. Investors are capitalizing on these shifts to secure long-term returns. This momentum is reinforcing Finland’s strategic role in Europe’s digital landscape.

- For instance, Equinix partnered with Groq to deploy low-latency AI inference infrastructure at its Helsinki data center. Groq leased space to support real-time AI inference workloads, strengthening Finland’s position as a key edge AI hub in Europe.

Market Trends

Surging Adoption of AI Workloads and High-Density Deployments

AI-driven workloads are reshaping design and capacity planning in the Finland Data Center Colocation Market. Operators are integrating high-density racks that can support GPU-based systems. It is pushing facilities to upgrade power distribution and precision cooling systems. AI training and inference workloads require ultra-low latency and stable power availability. Operators are integrating liquid cooling and modular power distribution to meet these demands. AI adoption is also driving investment in edge computing and cloud integration strategies. These infrastructure enhancements make Finland a hotspot for AI infrastructure hosting. AI-focused upgrades are improving efficiency and expanding colocation capacity.

Rising Interest in Modular and Prefabricated Data Center Designs

Prefabricated and modular designs are gaining momentum among colocation providers. Modular infrastructure allows operators to scale capacity faster and reduce construction time. It is enabling flexible deployment strategies aligned with demand growth. These facilities lower upfront capital costs and improve energy performance. Operators use these designs to expand in secondary cities and remote locations. Investors view modular expansion as a cost-effective way to meet capacity growth. It supports rapid deployment for enterprise and hyperscale customers. Modular design adoption is positioning Finland as a leader in agile colocation infrastructure development.

Growing Strategic Partnerships and Joint Ventures with Global Operators

Collaborations between domestic and international players are increasing market maturity. Global operators are forming joint ventures with local data center providers to expand capacity. It is supporting the transfer of advanced technologies, operational expertise, and investment capital. These alliances help in building hyperscale-ready infrastructure faster. Strategic partnerships ensure service standardization and strengthen global connectivity. Local players gain access to new customer bases and financing channels. This trend is driving rapid ecosystem growth and competitive positioning. Global partnerships are reinforcing Finland’s role as a high-value digital infrastructure hub.

Advanced Automation and Data Center Management Innovation

Operators are investing in AI-enabled monitoring, predictive maintenance, and digital twin solutions. Automation reduces downtime risk and enhances service reliability. It is improving resource optimization and operational performance. Smart management platforms are integrating power, cooling, and capacity analytics. This creates better visibility and control over infrastructure. Automated operations help scale facilities to meet growing workload demands. Investors prefer facilities with intelligent management systems for cost optimization. Advanced automation ensures long-term competitiveness and resilience for colocation providers. This innovation cycle supports stronger market growth and differentiation.

Market Challenges

Energy Supply Constraints and Grid Capacity Limitations for Large-Scale Expansions

The Finland Data Center Colocation Market faces increasing pressure from growing energy demand. The fast rise in high-density deployments requires stable and scalable grid capacity. It is creating challenges in grid balancing and energy distribution for large operators. Regulatory frameworks emphasize renewable integration, but transmission expansion remains slow. Regional grid limitations create delays in project development timelines. Energy price fluctuations affect operational cost stability for colocation operators. Competition for renewable sources intensifies between industrial sectors. This constraint makes energy availability a critical factor in market scaling. Strategic grid reinforcement is essential to meet future colocation demand.

Talent Shortage and High Operational Complexity in Modern Facilities

Modern data centers rely on advanced technologies, increasing the need for skilled technical staff. The local workforce faces shortages in power engineering, cooling design, and cybersecurity expertise. It is raising operational costs and slowing down service expansion. Recruitment of specialized talent remains challenging for both domestic and international operators. Complex infrastructure design requires continuous training and knowledge transfer. Market competition for skilled labor is intensifying, particularly in edge and AI-focused deployments. Operators need structured workforce development programs to sustain growth. Without strong talent pipelines, scaling and operational excellence become harder to achieve.

Market Opportunities

Expanding Hyperscale Presence and Green Data Center Investments

Hyperscale operators are targeting Finland for sustainable and scalable expansions. Its renewable power mix, low energy cost, and advanced network connectivity create attractive conditions for large deployments. It is positioning the country as a preferred location for green hyperscale infrastructure. Investors see opportunities in joint development projects and energy-efficient colocation solutions. These investments accelerate market expansion and strengthen Finland’s digital competitiveness. Strong ESG commitments from global players align well with the country’s energy landscape.

Strategic Role as a Gateway to Northern and Central Europe

Finland’s strategic location offers low-latency connectivity to multiple regions. Its fiber network and subsea cable systems enhance cross-border traffic flows. It is positioning the country as a regional interconnection hub for cloud and OTT providers. Investors can tap into strong growth in traffic aggregation and enterprise hybrid IT demand. This gateway advantage supports expansion in adjacent Nordic and European markets. Geostrategic relevance gives Finland long-term opportunities to attract capital and advanced workloads.

Market Segmentation

By Type

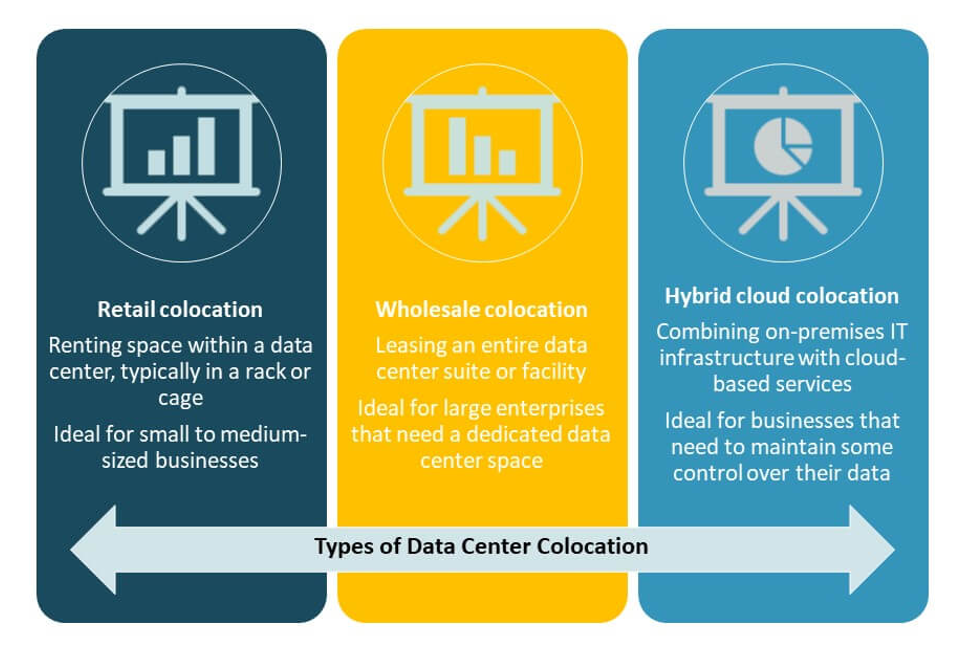

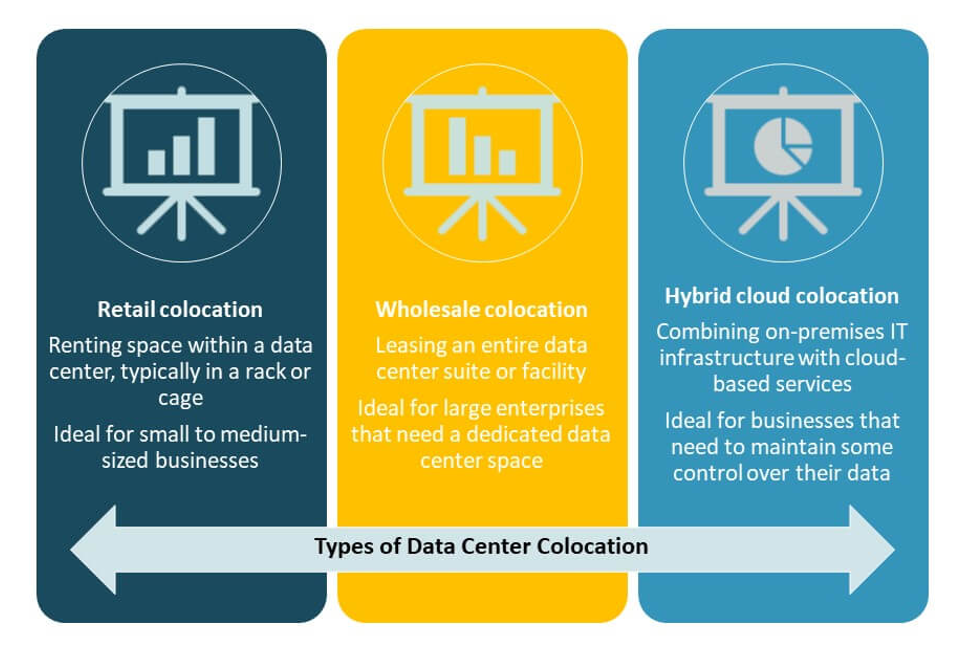

Retail colocation dominates the Finland Data Center Colocation Market, supported by strong demand from SMEs and enterprise clients seeking scalable solutions. Retail facilities offer flexible rack space and predictable cost structures. Wholesale colocation is expanding due to hyperscaler and large enterprise deployment strategies. Hybrid cloud colocation is gaining momentum as businesses integrate colocation with public and private cloud infrastructures. Retail colocation holds the largest share, driven by growing digitalization and rising data volumes.

By Tier Level

Tier 3 facilities lead the market with their balanced reliability, efficiency, and cost structure. These facilities offer strong uptime guarantees and attract both enterprise and hyperscale customers. Tier 4 data centers are expanding due to increasing AI and mission-critical workload requirements. Tier 1 and Tier 2 facilities hold smaller shares, serving edge and regional deployments. Tier 3 infrastructure dominates because it aligns with the operational demands of most enterprises and service providers in Finland.

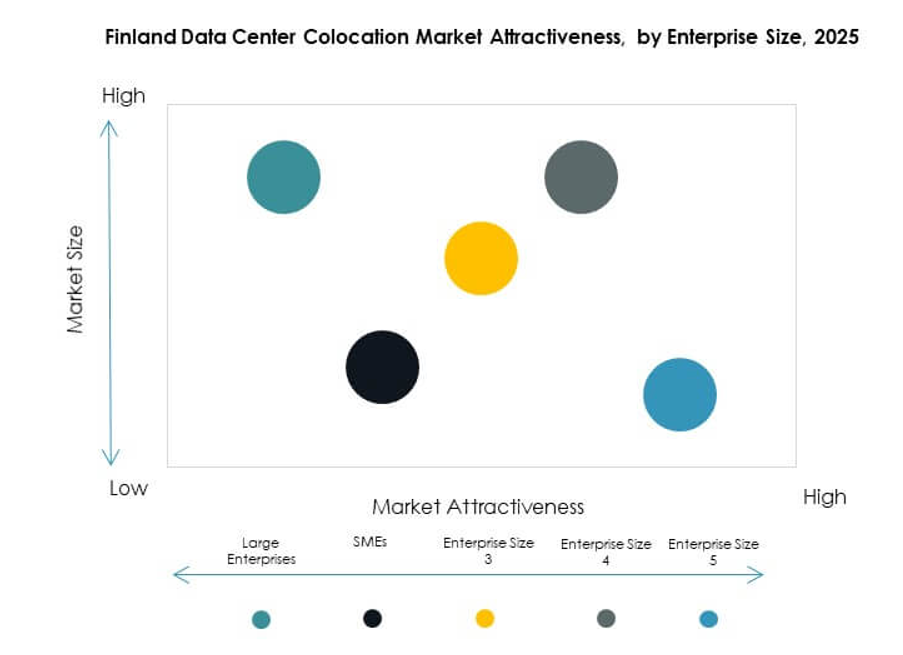

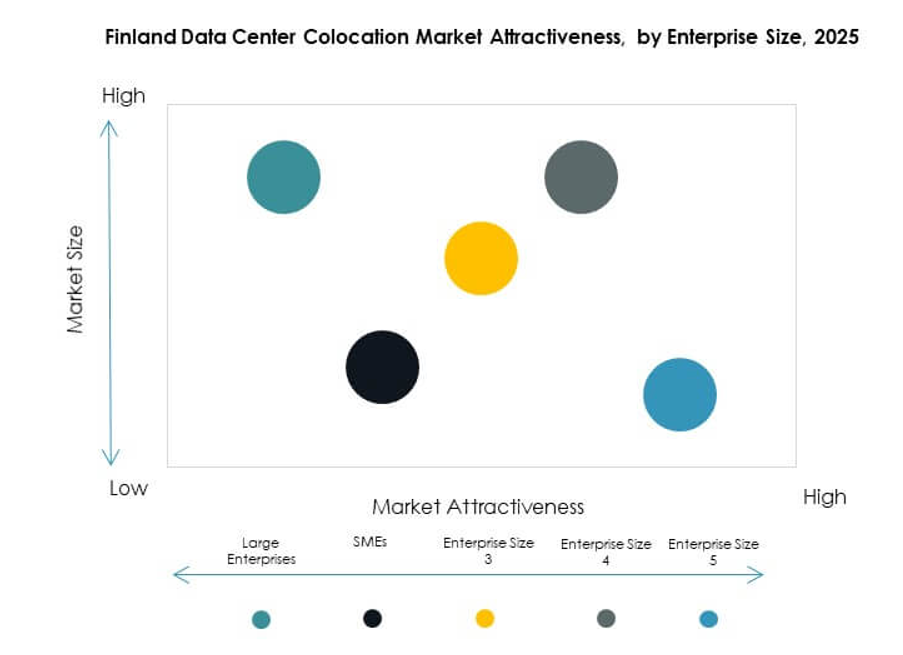

By Enterprise Size

Large enterprises drive a significant share of demand in the Finland Data Center Colocation Market. Their focus on IT modernization and hybrid infrastructure strategies increases colocation adoption. SMEs are adopting retail colocation for cost-effective scaling without heavy capital investment. Large enterprises continue to dominate due to their high capacity needs, compliance requirements, and focus on business continuity. SME growth is accelerating, adding diversity to the customer base.

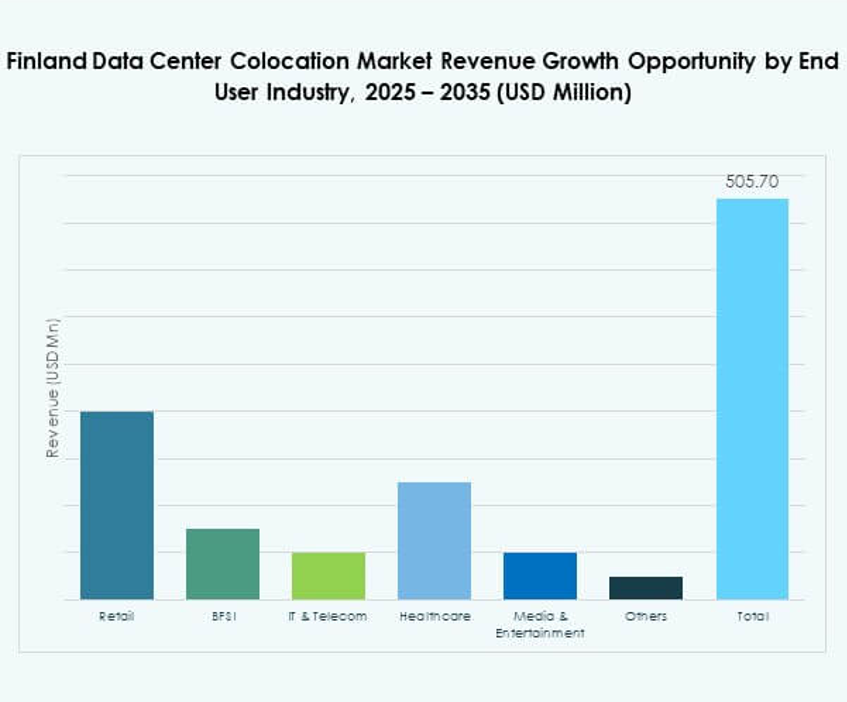

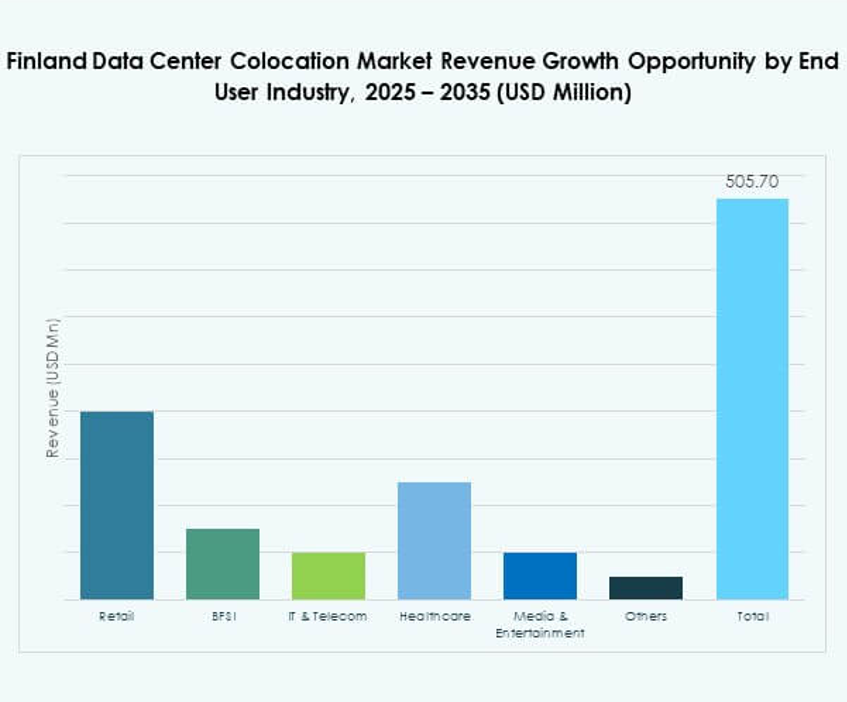

By End User Industry

IT & Telecom holds the dominant share of the Finland Data Center Colocation Market due to heavy data traffic and strong cloud adoption. BFSI follows, driven by regulatory compliance and data sovereignty needs. Media & entertainment is growing fast, fueled by content streaming and gaming demand. Retail and healthcare industries are steadily increasing investments in digital infrastructure. IT & Telecom remains the largest segment due to the sector’s critical connectivity and processing needs.

Regional Insights

Southern Finland – Core Market Hub with 62% Share

Southern Finland holds the largest share in the Finland Data Center Colocation Market due to its advanced infrastructure, fiber connectivity, and strategic location. Helsinki serves as the primary hub for hyperscalers, OTT players, and enterprise colocation customers. The region benefits from stable energy supply, robust connectivity, and low-latency access to European networks. High-density deployments and edge computing investments strengthen its leadership. Colocation operators favor this region for its ecosystem maturity and customer concentration.

- For instance, Telia’s Helsinki Data Center integrates liquid cooling solutions for AI and GPU workloads and is connected to the district heating network. The facility is expanding its waste heat recovery capacity to 90% by spring 2025, supporting large-scale energy reuse and sustainable operations.

Central Finland – Emerging Growth Region with 23% Share

Central Finland is witnessing steady investment in modular and mid-scale facilities. Its competitive energy prices and land availability attract regional operators and expanding enterprises. It is becoming an attractive location for edge node deployment to reduce network congestion in major hubs. Infrastructure modernization and renewable energy integration support regional expansion. The area’s strategic development position makes it a key growth zone for future capacity.

Northern Finland – High-Potential Region with 15% Share

Northern Finland is emerging as a favorable location for sustainable and green data center projects. Abundant renewable energy sources and cold climate offer significant operational advantages. It is gaining attention for hyperscale-ready land availability and low-cost power. The region’s connectivity improvements are accelerating its attractiveness for long-term investment. Its position complements national capacity distribution and supports energy-efficient expansion strategies. These factors position Northern Finland as a rising star in the colocation landscape.

- For instance, the CSC Data Center in Kajaani operates entirely on renewable hydroelectric power and uses year-round air and water cooling. The facility achieved a PUE of 1.03 and channels waste heat into Kajaani’s district heating network, supplying energy to hundreds of households.

Competitive Insights:

- Elisa

- Telia Finland

- Hetzner Finland

- Ficolo

- Amazon Web Services (AWS)

- Google Cloud

- China Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- NTT Ltd. (NTT DATA)

The Finland Data Center Colocation Market features a mix of domestic telecom operators, hyperscale cloud providers, and global colocation leaders. Elisa, Telia Finland, and Hetzner Finland maintain strong local presence with established connectivity and energy-efficient operations. Global hyperscalers like AWS and Google Cloud expand their capacity to support AI workloads and enterprise cloud migration. Equinix, Digital Realty, and NTT strengthen market depth through large-scale interconnection platforms. Ficolo drives sustainability-focused operations, leveraging renewable energy. China Telecom and Colt Technology target enterprise segments through global network reach. The competitive landscape is defined by strategic capacity expansion, green data center development, and rising demand from hybrid IT deployments. It is positioning Finland as a critical colocation hub for Northern Europe.

Recent Developments:

- In October 2025, Glesys made an important acquisition in the Finland data center colocation market, agreeing to acquire Verne’s managed private cloud operations along with two major data center facilities in Pori and Tampere. This strategic move is set to strengthen Glesys’s position in the Nordics by expanding its footprint, allowing it to deliver broader cloud and colocation services with more scalable infrastructure.

- In June 2025, Elisa Oyj, a leading telecommunications operator in Finland, expanded its collaboration with Google Cloud to accelerate the deployment of AI-driven autonomous network solutions, aiming to enhance their data center operations and service quality for Finnish customers.

- In April 2025, Amazon signed a power purchase agreement with OX2 Suomi to support two new wind power projects in Finland, representing the largest single investment in Finnish wind power and consolidating AWS’s commitment to clean energy for its data center operations across Europe.