Executive summary:

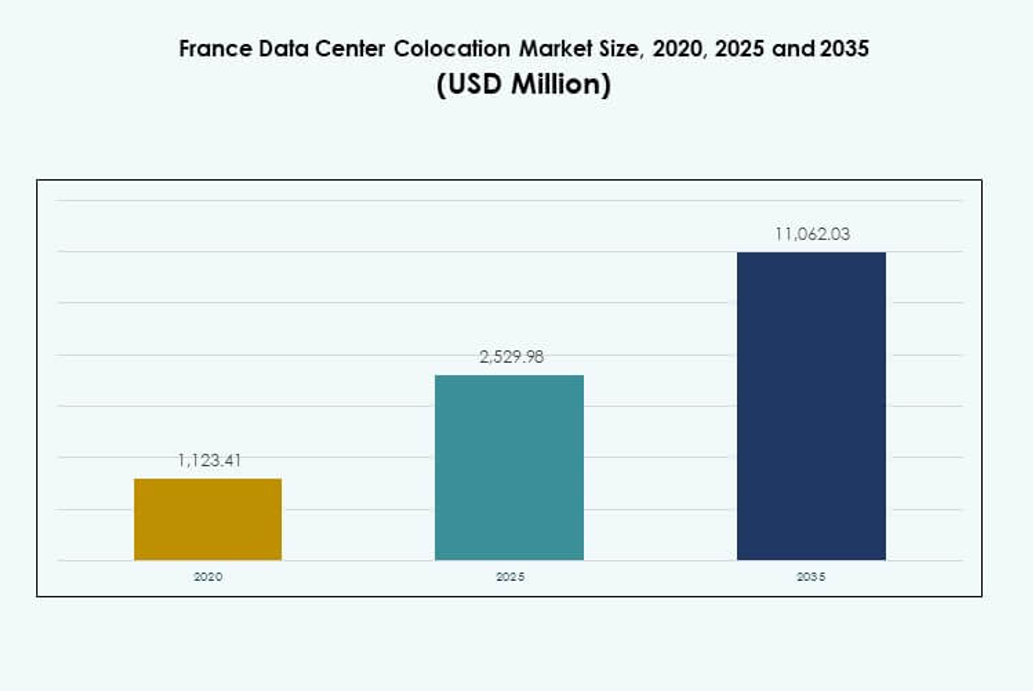

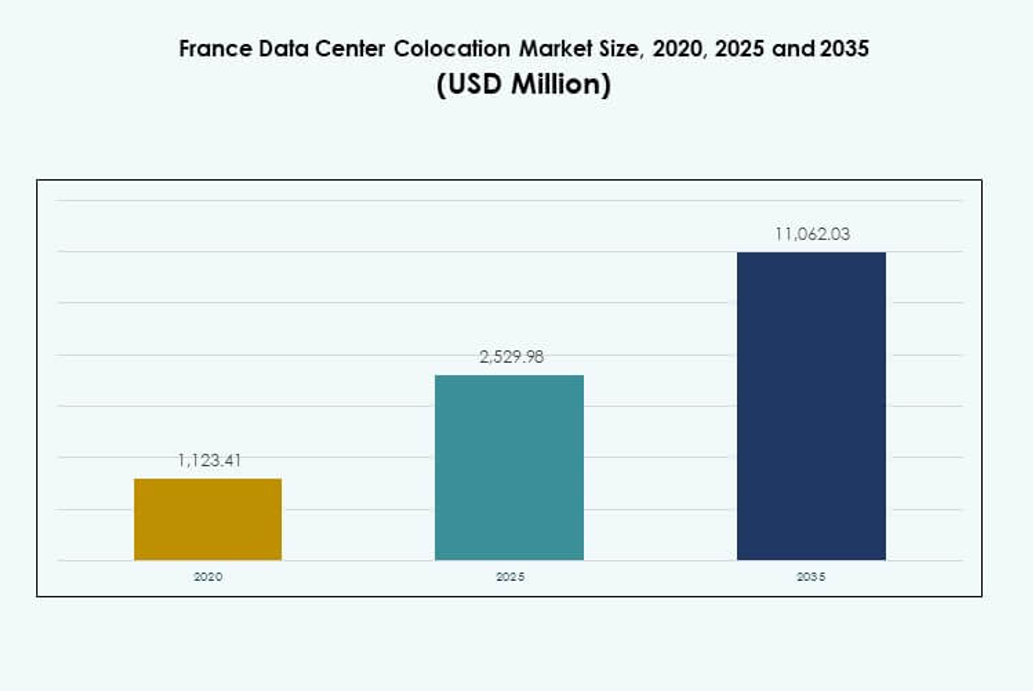

The France Data Center Colocation Market size was valued at USD 1,123.41 million in 2020 to USD 2,529.98 million in 2025 and is anticipated to reach USD 11,062.03 million by 2035, at a CAGR of 15.82% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| France Data Center Colocation Market Size 2025 |

USD 2,529.98 Million |

| France Data Center Colocation Market, CAGR |

15.82% |

| France Data Center Colocation Market Size 2035 |

USD 11,062.03 Million |

Strong technology adoption, AI integration, and hybrid cloud deployment are driving market growth. Hyperscale investments are accelerating capacity expansion, while sustainability initiatives are reshaping facility design. The market plays a critical role for businesses seeking cost-efficient, high-performance infrastructure. Investors view this sector as strategically important due to stable returns, strong regulatory support, and increasing enterprise outsourcing. Its position as a European interconnection hub further enhances its appeal.

Île-de-France leads the market due to its dense connectivity, carrier presence, and hyperscale campuses. Provence-Alpes-Côte d’Azur is emerging as a strategic international gateway, supported by submarine cable networks. Secondary cities such as Lyon and Lille are growing fast, driven by edge deployments and enterprise adoption. This regional diversity strengthens the country’s position in Europe’s digital infrastructure network.

Market Drivers

Rising Digital Transformation and Hyperscale Expansion Across Strategic Industries

Enterprises across France are accelerating digital transformation initiatives to support high data volumes, cloud migration, and application modernization. Hyperscale operators are expanding their regional presence to meet growing enterprise and government workload demands. High-speed connectivity, stable power supply, and reliable infrastructure make the region an attractive hub for colocation investments. The France Data Center Colocation Market is strategically positioned to support these developments. Businesses view colocation as a cost-efficient alternative to building private data centers. It enables faster deployment of applications and resilient operations. Major technology firms are deploying large-scale facilities near Paris and Marseille to strengthen interconnection capabilities. Investors see stable returns in this ecosystem due to long-term contracts and rising enterprise IT outsourcing.

Growing Cloud Adoption and AI Integration Driving Infrastructure Optimization

Cloud-first strategies are reshaping IT infrastructure planning among enterprises and SMEs. Organizations are migrating core applications to hybrid and multi-cloud architectures to enhance scalability and performance. It offers flexibility to manage AI workloads and advanced analytics closer to the user edge. The France Data Center Colocation Market benefits from hyperscale cloud operators building availability zones in key cities. AI integration into data center operations increases energy efficiency and improves uptime through predictive maintenance. Power management solutions and real-time analytics enhance data center sustainability. Enterprises prefer colocation facilities with certified green credentials and AI-powered resource optimization. This transition strengthens investor confidence in long-term operational stability.

- For instance, OVHcloud deploys industry-leading water-cooling systems across its French data centers, allowing server rooms to operate entirely without air conditioning, thereby reducing energy consumption. In 2023, OVHcloud introduced a carbon calculator tool that enables clients to transparently track their infrastructure’s carbon footprint, supporting responsible AI and IT operations.

Strengthening Connectivity Infrastructure and Low-Latency Edge Network Demand

The development of submarine cables and regional fiber backbones enhances network resilience and latency performance. International operators view France as a gateway between Europe, Africa, and the Middle East. Low-latency edge networks support data-intensive applications in fintech, media, and healthcare. The France Data Center Colocation Market gains strong traction due to this cross-border connectivity advantage. Telecom providers and hyperscalers are deploying edge nodes in strategic hubs to support 5G rollouts. Enterprises are shifting critical workloads to colocation facilities closer to end users to reduce delays and improve service quality. This trend reinforces France’s role as a core interconnection zone in Europe. Investors are prioritizing assets with dense carrier ecosystems and route diversity.

- For instance, Orange completed the landing of the new “Medusa” submarine cable in Marseille in October 2025. The 1,050 km Marseille–Bizerte segment offers direct fiber links to interconnected data centers in the city and connects major European hubs such as Paris, London, and Frankfurt, strengthening Marseille’s status as a gateway for Europe–Africa digital infrastructure.

Government Incentives and Strong Regulatory Environment Supporting Market Confidence

France’s favorable regulatory environment supports stable and long-term colocation investments. Data protection laws, GDPR compliance, and tax incentives promote market confidence among domestic and foreign investors. It creates a reliable environment for operators to expand capacity and enhance redundancy. The France Data Center Colocation Market benefits from national digital strategies encouraging infrastructure modernization. Government programs support renewable energy integration, power grid resilience, and sustainable development of colocation facilities. Investors are aligning with ESG goals to secure financial backing and customer trust. Enterprises see compliance with strict standards as a competitive advantage. This combination of strong policy backing and technological maturity strengthens overall market attractiveness.

Market Trends

Surging Demand for Sustainable Data Center Infrastructure and Green Certifications

Sustainability initiatives are reshaping infrastructure design and operational strategies. Operators are focusing on renewable power sourcing, advanced cooling systems, and waste heat reuse to reduce carbon emissions. Many facilities are adopting green building certifications to appeal to environmentally conscious customers. The France Data Center Colocation Market reflects strong momentum toward net-zero targets by major operators. Energy-efficient equipment and innovative designs help meet ESG commitments. Clients favor colocation partners with proven energy performance and transparent reporting. Government policies further push the industry to achieve measurable decarbonization targets. This shift makes sustainability a key factor in market competition.

Expanding Interconnection Ecosystems Through Carrier-Neutral and Hyperscale Hubs

Interconnection demand is increasing due to the growth of cloud-native applications, streaming services, and enterprise edge deployments. Carrier-neutral facilities enable flexible network routing and faster access to global traffic exchange points. The France Data Center Colocation Market is gaining significance as operators build high-capacity interconnection hubs. These hubs support diverse peering arrangements, IXPs, and cloud on-ramps. Telecom providers and OTT platforms leverage these ecosystems to reduce costs and improve service delivery. Dense connectivity zones near Paris attract multinational enterprises seeking reliable low-latency links. This trend enhances the region’s competitiveness in the European data economy. Investors value assets with strong interconnection density and carrier diversity.

Integration of Automation and AI-Driven Operational Management Systems

Operators are increasingly deploying AI-driven monitoring platforms to optimize performance, predict failures, and lower energy use. Automated control systems allow real-time adjustments in power distribution, temperature, and airflow. The France Data Center Colocation Market is witnessing strong adoption of such technologies to improve uptime and operational resilience. AI integration reduces manual intervention, enhances service level agreements, and strengthens business continuity. Predictive analytics provides operators with insights to maximize capacity utilization. Automation also lowers operational costs, attracting price-sensitive enterprises. Technology-driven operations create a competitive edge in service quality and reliability. This accelerates the transition toward fully intelligent colocation environments.

Growing Investment in Edge Infrastructure and Regional Data Clusters

Demand for localized processing is increasing due to high-performance applications in IoT, gaming, and autonomous systems. Edge facilities offer proximity to end users and support real-time computing. The France Data Center Colocation Market is evolving as operators build micro data centers in regional cities beyond Paris. Enterprises use these clusters to enhance digital experiences and reduce latency. This trend supports a distributed architecture that complements large hyperscale campuses. Telecom and cloud providers are partnering to develop standardized edge deployments. These investments strengthen regional digital infrastructure and attract new market entrants.

Market Challenges

Rising Energy Constraints and Infrastructure Pressure Creating Operational Complexity

The rapid expansion of data center capacity has intensified energy demand. Power grid limitations in certain regions make capacity planning more complex for operators. The France Data Center Colocation Market faces growing pressure to secure reliable and sustainable energy sources. Operators must balance expansion with compliance to strict environmental standards. Delays in grid upgrades impact the ability to scale efficiently. The growing need for renewable integration also increases operational costs. Energy price volatility influences colocation pricing strategies. Investors closely monitor long-term power purchase agreements to reduce financial risks. Meeting performance goals while maintaining efficiency remains a significant operational challenge.

Regulatory Compliance, Land Availability, and Supply Chain Constraints Slowing Growth

Strict data protection laws, construction permits, and zoning regulations require extensive planning and increase project timelines. Suitable land availability near fiber and power infrastructure is becoming scarce in key metropolitan areas. The France Data Center Colocation Market faces additional challenges from global supply chain disruptions affecting equipment delivery schedules. Regulatory hurdles can slow capacity expansion and limit new market entries. Delays in permitting and construction approvals create uncertainty in project timelines. Operators must invest in legal and technical expertise to maintain compliance. These factors make strategic site selection and long-term infrastructure planning critical to remain competitive.

Market Opportunities

Rising Adoption of Hybrid Cloud and AI Workloads Unlocking Capacity Expansion

The growing preference for hybrid IT models is fueling demand for colocation space across key cities. Enterprises are deploying AI workloads and advanced analytics at scale to improve decision-making and service delivery. The France Data Center Colocation Market benefits from this shift toward flexible and scalable infrastructure. Hybrid models allow companies to balance cost, control, and performance. Colocation providers offering direct connectivity to hyperscale clouds gain a clear competitive advantage. This opportunity attracts new investments in high-density facilities.

Expanding Role of France as a Strategic Interconnection Gateway for Europe

France’s geographic position creates strong potential for cross-border data traffic exchange. Submarine cable landing stations and advanced terrestrial networks strengthen its position as a major digital gateway. The France Data Center Colocation Market can leverage this strategic role to attract international operators and hyperscale tenants. Enhanced connectivity draws financial services, OTT platforms, and global enterprises. This opportunity supports long-term market growth and global network integration.

Market Segmentation

By Type

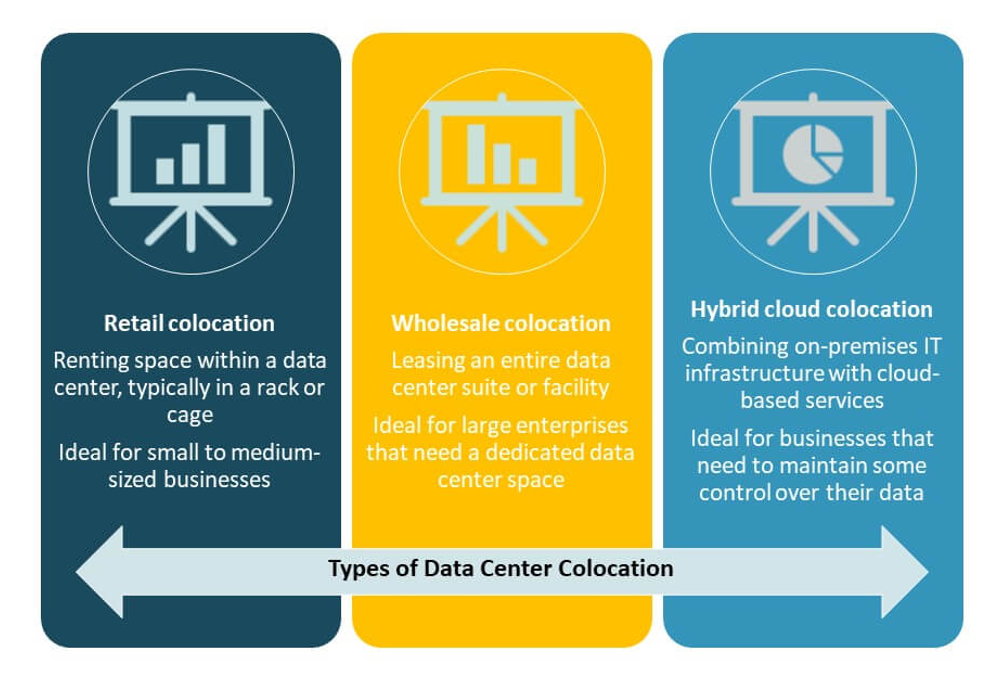

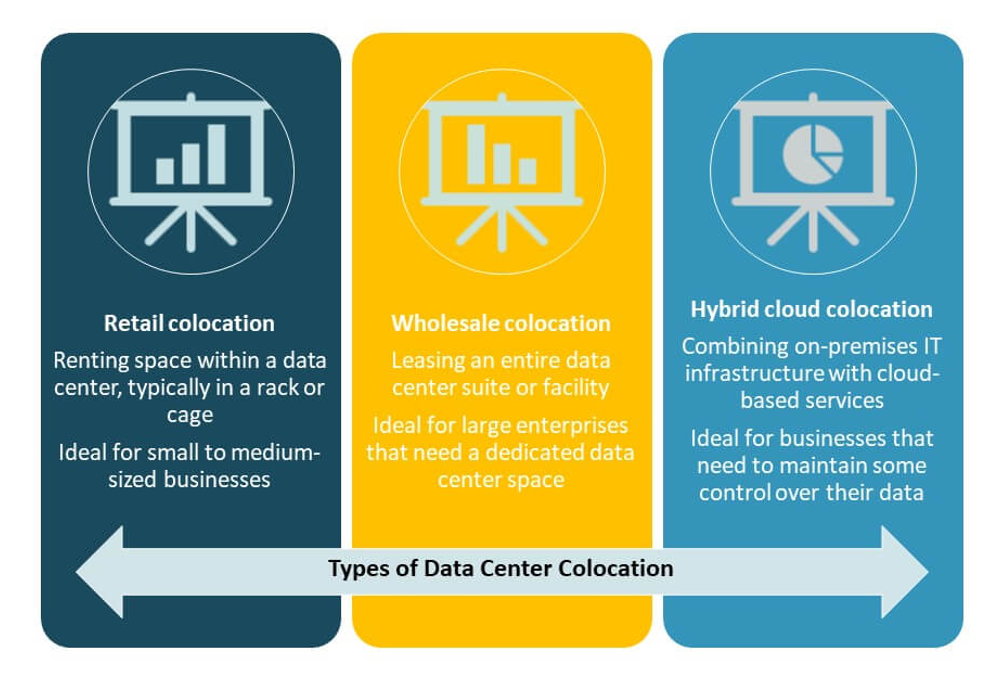

Retail colocation dominates the France Data Center Colocation Market with a large share, driven by demand from SMEs and enterprises seeking flexible and cost-efficient solutions. It supports shorter contract terms and scalable rack space for rapid deployment. Wholesale colocation is expanding due to hyperscale investments, while hybrid cloud colocation gains traction for integration flexibility. Retail remains preferred for its ease of management, lower upfront costs, and quick setup.

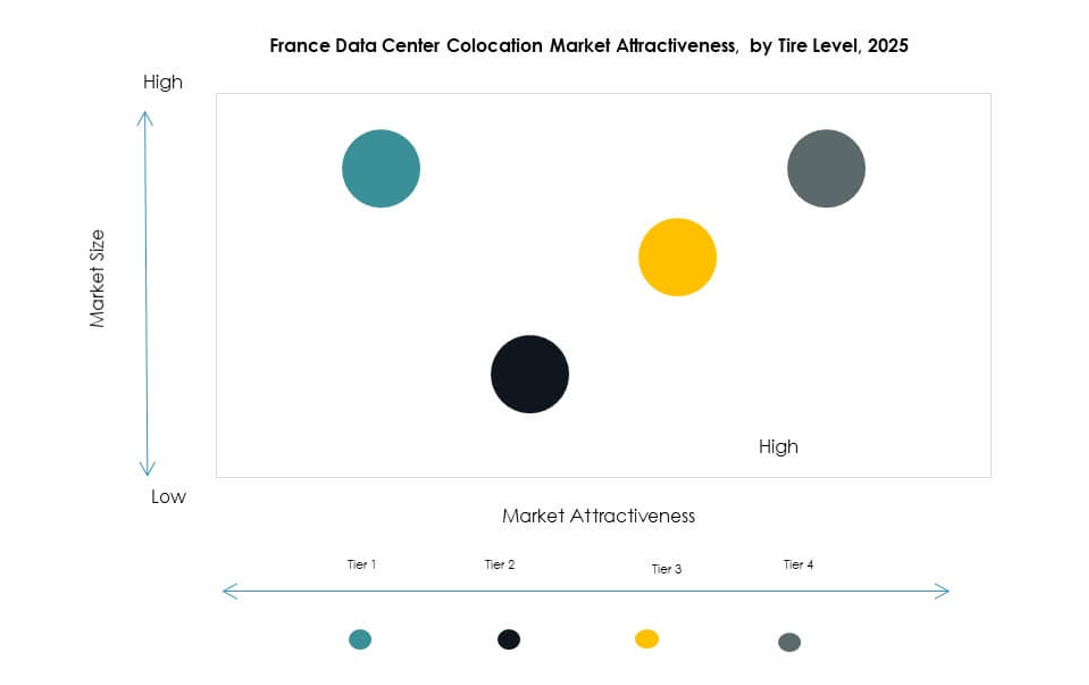

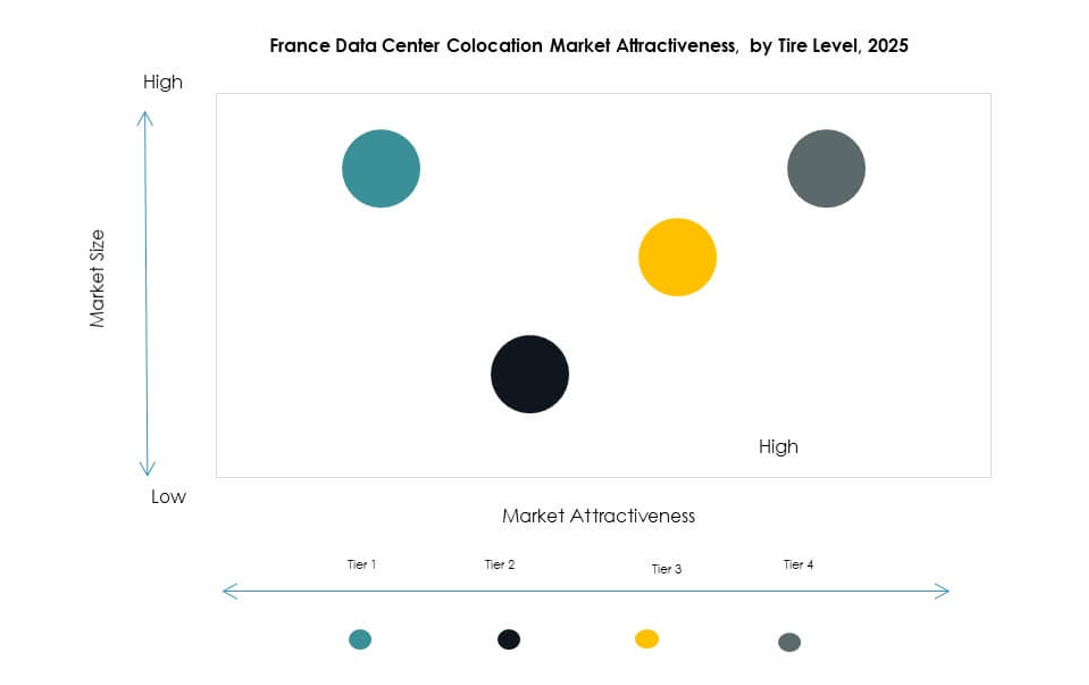

By Tier Level

Tier 3 data centers hold the largest share of the France Data Center Colocation Market due to their balance between cost and reliability. These facilities offer N+1 redundancy, ensuring high availability for critical workloads. Tier 4 is growing in adoption among financial and hyperscale clients seeking maximum uptime. Tier 1 and Tier 2 facilities serve smaller enterprises and less critical applications. Investments in Tier 3 and Tier 4 strengthen service reliability.

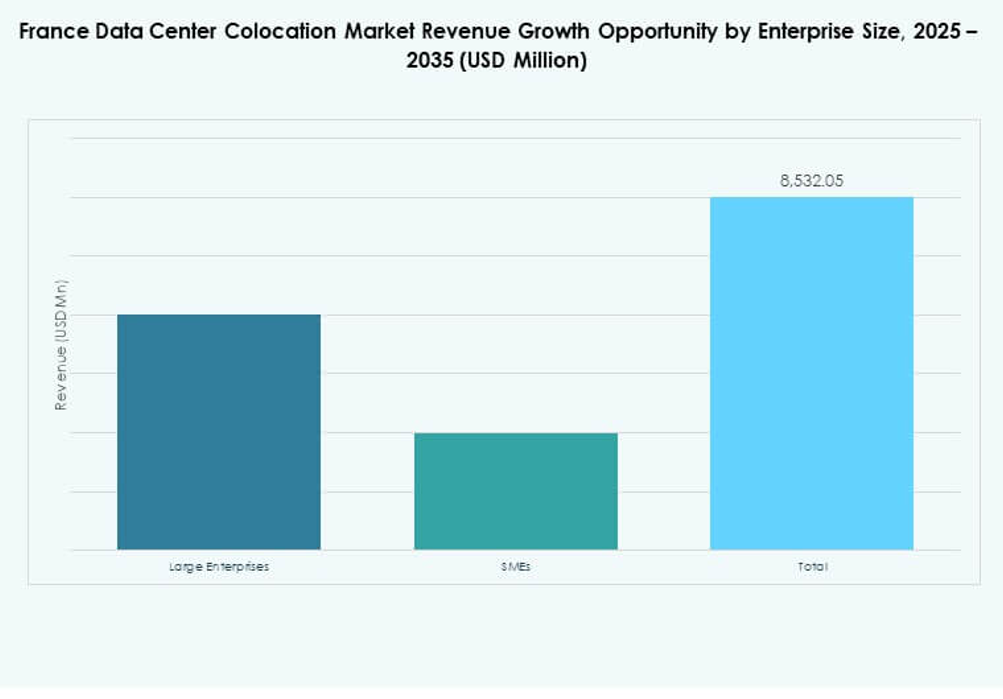

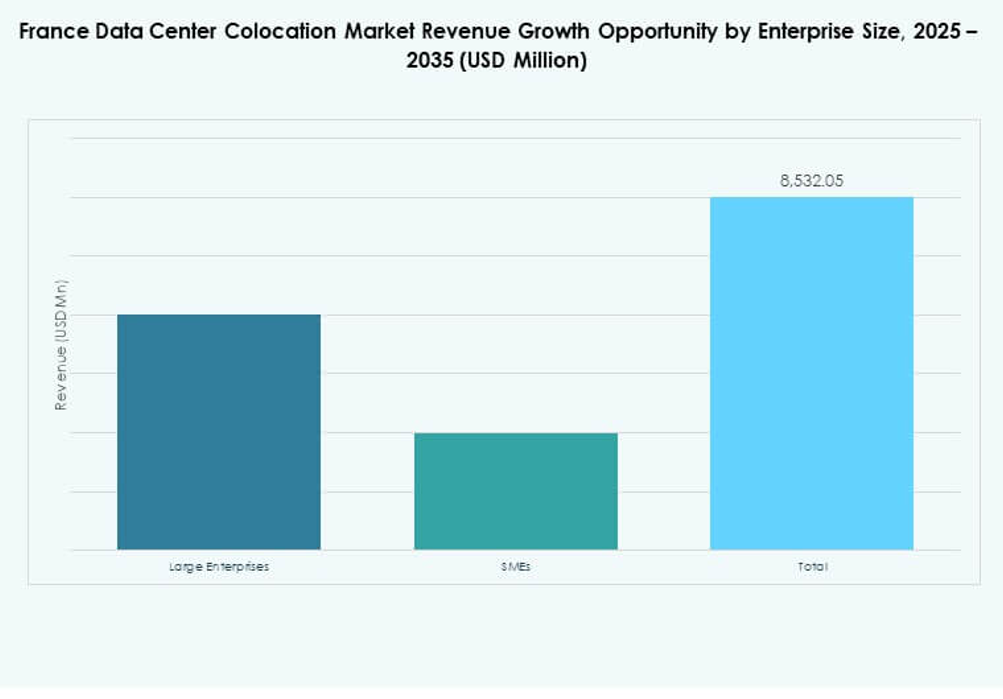

By Enterprise Size

Large enterprises lead the France Data Center Colocation Market due to their high computing needs and regulatory compliance requirements. These organizations prioritize security, uptime, and advanced connectivity. SMEs are increasing adoption of colocation to avoid high capital expenditure for building private data centers. Flexible pricing and modular solutions make colocation attractive for growing businesses.

By End User Industry

The IT & Telecom sector dominates the France Data Center Colocation Market, driven by strong demand for cloud services, content delivery, and 5G rollout. BFSI follows closely with high security and uptime needs. Healthcare and media industries are also increasing their presence due to rising data volumes and regulatory compliance. Retail and other sectors use colocation to support digital transformation strategies.

Regional Insights

Île-de-France: Core Digital Hub Driving the Largest Market Share

Île-de-France holds 46.7% of the France Data Center Colocation Market due to its dense fiber infrastructure, hyperscale presence, and proximity to major enterprises. Paris acts as the primary connectivity hub, hosting most carrier-neutral facilities and international interconnection points. Energy availability, regulatory support, and skilled workforce attract global operators. The region benefits from strong government backing and major technology investments.

- For example, Equinix’s PA10 data center in Paris, opened in 2023 at the Saint-Denis campus, provides approximately 2,250 cabinets and 5,775 square meters of colocation space at full build-out. The site runs on 100% renewable energy and recovers heat to warm public facilities, such as the Olympic Aquatic Centre for Paris 2024, supplying surplus heat free of charge for 15 years.

Provence-Alpes-Côte d’Azur: Strategic Gateway for International Data Traffic

Provence-Alpes-Côte d’Azur accounts for 29.3% of the France Data Center Colocation Market share. Marseille serves as a landing point for major submarine cables connecting Europe, Africa, and Asia. Its strategic coastal location makes it critical for intercontinental data routing. Telecom and cloud providers continue to invest in expanding local capacity to support international traffic.

- For example, Interxion (a Digital Realty company) began the construction of its MRS4 data center in Marseille, designed to add up to 13.6 megawatts (MW) of customer capacity and 6,700 square meters of space upon completion. This expansion reinforces Marseille’s role as a landing point for major international submarine cables, supporting hundreds of global and regional providers through advanced connectivity infrastructure.

Other Regions: Growing Edge Infrastructure and Regional Connectivity

Other regions together hold 24% of the France Data Center Colocation Market share. Emerging edge deployments in cities such as Lyon, Lille, and Toulouse support local enterprise growth and latency-sensitive applications. These regions attract investments focused on distributed IT models. Strong regional digital strategies and infrastructure programs are accelerating their role in national connectivity.

Competitive Insights:

- DATA4 Group

- Scaleway

- OVHcloud

- Ikoula

- Amazon Web Services (AWS)

- Google Cloud

- China Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The competitive landscape of the France Data Center Colocation Market features a mix of domestic operators and global hyperscale leaders. It is shaped by strategic investments in power capacity, network interconnection, and sustainable infrastructure. Large players like Equinix, Digital Realty Trust, and OVHcloud focus on expanding high-density facilities and edge locations to support cloud and AI workloads. Domestic providers such as DATA4 Group and Scaleway strengthen their presence through energy-efficient operations and flexible service models. Hyperscale firms including AWS and Google Cloud drive demand for scalable colocation ecosystems. Partnerships, mergers, and capacity expansions remain core strategies. Competitive intensity is increasing, with operators prioritizing network-rich campuses, green energy integration, and low-latency connectivity to capture enterprise and hyperscale demand.

Recent Developments:

- In September 2025, DATA4 Group became the first data center operator in France to sign a twelve-year Nuclear Production Allocation Contract (CAPN) with EDF, France’s electric utility provider. This groundbreaking agreement, set to commence in 2026, guarantees DATA4 access to 40 MW of nuclear power—approximately 230 GWh per year—to fuel its French data center infrastructure with reliable, low-carbon electricity.

- In August 2025, Data4, a major European data center operator, underwent a strategic acquisition as Arjun Infrastructure Partners acquired a stake in Data4’s stabilized data center portfolio. This investment signals heightened interest from institutional investors in the French colocation market and supports Data4’s continued development and expansion activities within France.

- In June 2025, Scaleway, a key French cloud service provider, entered a strategic partnership with France Télévisions, the nation’s leading audiovisual group, to facilitate the hosting and processing of broadcast data and streaming services on Scaleway’s sovereign cloud platform. This collaboration is designed to promote tech sovereignty and develop innovative cloud-native, open-source tools for France’s media sector, ensuring all data remains within French borders.