Executive summary:

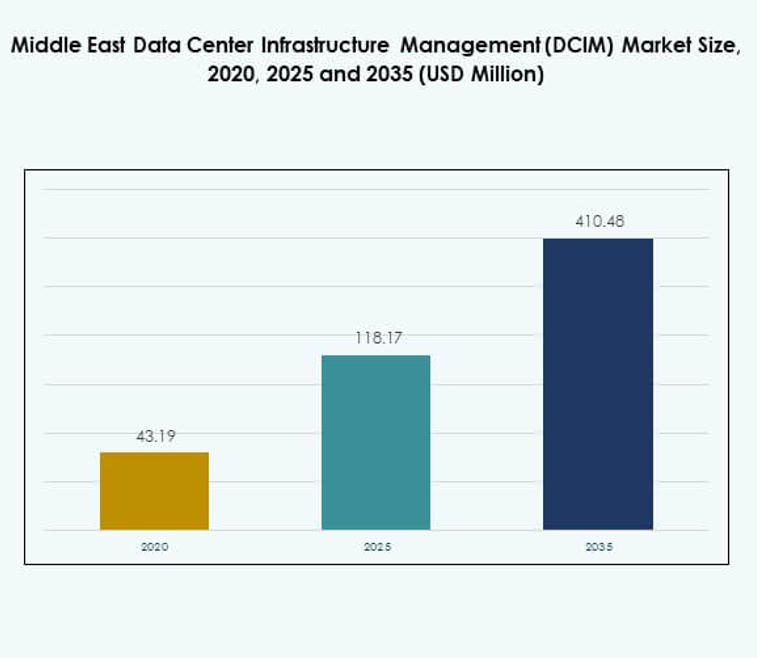

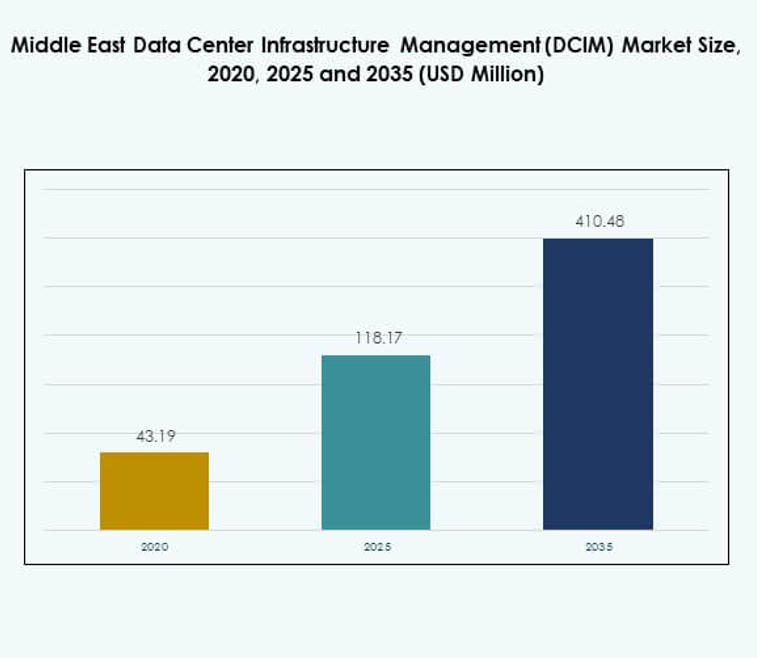

The Middle East Data Center Infrastructure Management (DCIM) Market size was valued at USD 43.19 million in 2020, reaching USD 118.17 million in 2025, and is anticipated to reach USD 410.48 million by 2035, growing at a CAGR of 15.03% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Middle East Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 118.17 Million |

| Middle East Data Center Infrastructure Management (DCIM) Market, CAGR |

15.03% |

| Middle East Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 410.48 Million |

The market growth is driven by digital transformation across industries, rapid adoption of cloud computing, and the integration of AI and IoT in data center operations. Rising investments in automation, energy optimization, and predictive analytics are redefining infrastructure efficiency. Businesses and investors consider the market strategically vital for ensuring scalability, operational resilience, and energy-efficient management of modern data centers.

The UAE and Saudi Arabia lead the market due to advanced digital infrastructure, supportive government policies, and strong hyperscale development. Emerging regions such as Qatar, Bahrain, and Oman are expanding rapidly through colocation and cloud partnerships. Their growing digital ecosystems and renewable-powered facilities position them as the next wave of regional data center growth hubs.

Market Drivers

Rapid Digital Transformation and Expansion of Data Center Ecosystem

The Middle East Data Center Infrastructure Management (DCIM) Market is driven by accelerated digital transformation initiatives across government and enterprise sectors. Investments in AI, IoT, and 5G infrastructure fuel large-scale data center construction. Organizations demand integrated DCIM tools to manage complex workloads, monitor performance, and ensure energy efficiency. It supports automation and real-time decision-making through intelligent analytics. The shift toward digital-first economies in Saudi Arabia and the UAE intensifies competition and infrastructure upgrades. Businesses rely on advanced DCIM platforms to reduce downtime and operational costs. The growing cloud adoption further increases infrastructure complexity, making DCIM essential for visibility and control.

- For instance, Dawiyat, part of the Saudi National Grid, deployed over 80 Huawei FusionDC1000A prefabricated modular data centers across Saudi Arabia, each integrated with Huawei’s NetEco6000 DCIM system for unified remote monitoring and efficient, unattended operation, supporting the Kingdom’s Vision 2030 digital infrastructure goals.

Integration of AI and Automation Enhancing Predictive Operations

AI-driven automation transforms the DCIM ecosystem by enabling predictive maintenance and proactive monitoring. Data center operators use machine learning to anticipate equipment failure and optimize resource utilization. It enhances system reliability while reducing human error in managing distributed assets. Smart automation improves response times to environmental fluctuations and critical alerts. Enterprises invest in AI-powered DCIM solutions for energy forecasting and workload balancing. This integration supports green initiatives and compliance with energy efficiency standards. The growing importance of sustainability encourages AI adoption for intelligent cooling and power management. The evolution from reactive to predictive operations marks a major technological leap for data centers.

Focus on Energy Efficiency and Green Data Center Initiatives

Rising energy costs and sustainability mandates drive demand for energy-optimized DCIM solutions. Governments promote carbon-neutral data centers to meet climate goals under national visions such as Saudi Vision 2030. It helps operators track and minimize energy consumption while improving Power Usage Effectiveness (PUE). Advanced DCIM platforms measure environmental metrics like temperature, humidity, and airflow in real-time. Cloud-based tools integrate renewable energy tracking and sustainability reporting. Global companies entering the region emphasize energy transparency in their operations. These solutions align with the growing environmental accountability of hyperscale operators. The push toward renewable energy integration reshapes long-term investment strategies in the region.

Strategic Role of DCIM in Infrastructure Scalability and Business Continuity

The DCIM ecosystem plays a critical role in ensuring operational continuity and scalability. Increasing reliance on digital services demands uninterrupted availability of computing infrastructure. It enables centralized control across hybrid and distributed architectures, ensuring consistent uptime and fault management. Data-driven insights from DCIM improve asset lifecycle management and infrastructure utilization. The adoption of modular and scalable solutions supports rapid capacity expansion. Enterprises and investors see DCIM as a core component of digital resilience. Its implementation enhances compliance with international standards such as ISO and Uptime Institute certifications. The convergence of automation, analytics, and energy efficiency positions DCIM as a strategic growth pillar.

- For instance, Saudi Arabia’s Vision 2030 digital transformation program, led by the Ministry of Communications and Information Technology (MCIT), includes major investments in national data infrastructure and smart city initiatives such as NEOM, emphasizing advanced data center management, automation, and integration of intelligent control systems across public and private sectors.

Market Trends

Growing Adoption of Cloud-Based and Hybrid DCIM Platforms

The Middle East Data Center Infrastructure Management (DCIM) Market experiences a major shift toward cloud and hybrid platforms. Enterprises are adopting scalable systems to manage assets across dispersed facilities. It enables seamless integration of on-premises and remote monitoring environments. Cloud-based DCIM tools offer real-time visibility, data analytics, and predictive alerts accessible through unified dashboards. Businesses leverage these models for flexibility and reduced capital expenditure. Managed service providers expand offerings to support multi-cloud environments. The trend strengthens data governance while improving cost transparency. Cloud and hybrid adoption ensures operational efficiency for enterprises handling diverse workloads.

Integration of Digital Twin and Simulation Technologies

Digital twin technology emerges as a significant trend in regional data center operations. It allows operators to simulate performance scenarios, test infrastructure resilience, and plan capacity expansions effectively. The Middle East Data Center Infrastructure Management (DCIM) Market benefits from predictive insights generated through simulation modeling. It enhances risk management by identifying system vulnerabilities before failures occur. Data-driven visualization of cooling, power, and space utilization enables proactive planning. The integration of 3D visualization tools improves infrastructure audits and design optimization. Organizations use simulation models to align with sustainability benchmarks. This approach leads to smarter decision-making across the infrastructure lifecycle.

Rising Focus on Edge Data Centers and Distributed Infrastructure

Edge computing expansion accelerates adoption of DCIM solutions capable of managing decentralized assets. The Middle East Data Center Infrastructure Management (DCIM) Market adapts to the growing presence of micro and edge data centers. It requires lightweight, remotely operated management systems to ensure uptime and security. Operators use compact DCIM modules for local monitoring and performance tracking. The deployment of 5G networks enhances edge data demand in sectors like retail, manufacturing, and defense. Real-time analytics support low-latency operations for AI and IoT applications. The regional shift toward distributed infrastructure strengthens edge DCIM integration. This trend reinforces resilience and scalability across smaller geographic zones.

Strengthening Regulatory Compliance and Cybersecurity Management

Governments implement strict regulations for data protection and operational transparency. It drives investments in DCIM solutions with integrated compliance and cybersecurity modules. The Middle East Data Center Infrastructure Management (DCIM) Market reflects a rising emphasis on data sovereignty and operational integrity. DCIM systems with advanced encryption and access control are increasingly preferred. Organizations implement multi-layered defense mechanisms to monitor cyber threats within power and cooling systems. Compliance with GDPR-like regional frameworks ensures secure data center management. Real-time auditing features enhance accountability and regulatory reporting. This trend fosters confidence among international investors expanding into the region.

Market Challenges

High Initial Investment and Limited Technical Expertise Slowing Deployment

The Middle East Data Center Infrastructure Management (DCIM) Market faces challenges due to high implementation costs and limited skilled professionals. Small and medium enterprises hesitate to invest in complex automation and monitoring platforms. It restricts scalability and delays digital transformation projects. Many operators lack trained staff capable of managing AI-based DCIM interfaces. High software licensing and integration costs increase total ownership expenses. The dependency on international vendors raises procurement challenges for regional firms. This cost barrier limits accessibility to advanced technologies. The market needs structured training programs and cost-optimized solutions to address the skill gap.

Data Integration Complexity and Interoperability Concerns Across Systems

Multiple vendors and legacy systems create data silos that hinder DCIM adoption. The Middle East Data Center Infrastructure Management (DCIM) Market struggles with compatibility between traditional infrastructure and modern analytics frameworks. It leads to inconsistent monitoring and fragmented insights. Integration across diverse power, cooling, and IT systems becomes technically demanding. Operators require standardized protocols to ensure interoperability. The lack of unified APIs complicates automation efforts. Maintenance of hybrid environments becomes resource-intensive without seamless data flow. These challenges slow large-scale adoption and reduce overall operational visibility for multi-site data centers.

Market Opportunities

Emerging Demand for AI-Driven Sustainability and Renewable Integration Solutions

The Middle East Data Center Infrastructure Management (DCIM) Market offers strong opportunities in AI-enabled green data centers. Governments and enterprises prioritize carbon neutrality through renewable integration. It encourages investments in AI-based DCIM systems that optimize cooling and power distribution. These platforms improve energy efficiency and automate sustainability reporting. Companies integrating renewable power sources gain long-term operational savings. Data-driven energy management becomes a competitive advantage. The demand for eco-efficient data centers will continue rising as environmental regulations strengthen across the region.

Strategic Expansion of Hyperscale and Colocation Facilities

Growing hyperscale investments open new opportunities for DCIM vendors. The Middle East Data Center Infrastructure Management (DCIM) Market benefits from partnerships between global operators and regional governments. It creates demand for scalable, multi-site monitoring platforms capable of supporting large workloads. Colocation providers adopt modular DCIM systems to attract enterprise clients. The rise of cross-border digital trade strengthens data management infrastructure. These trends position the region as a strategic hub for advanced, AI-ready data centers that require comprehensive DCIM deployment.

Market Segmentation

By Component

Solutions dominate the Middle East Data Center Infrastructure Management (DCIM) Market, supported by the integration of analytics, automation, and environmental monitoring tools. Service segments grow due to increased outsourcing of infrastructure management tasks. It reflects the growing focus on predictive maintenance and managed cloud operations. Vendors offering unified DCIM software suites with AI-driven insights gain competitive advantage. The shift toward end-to-end lifecycle management strengthens the market share of solution providers.

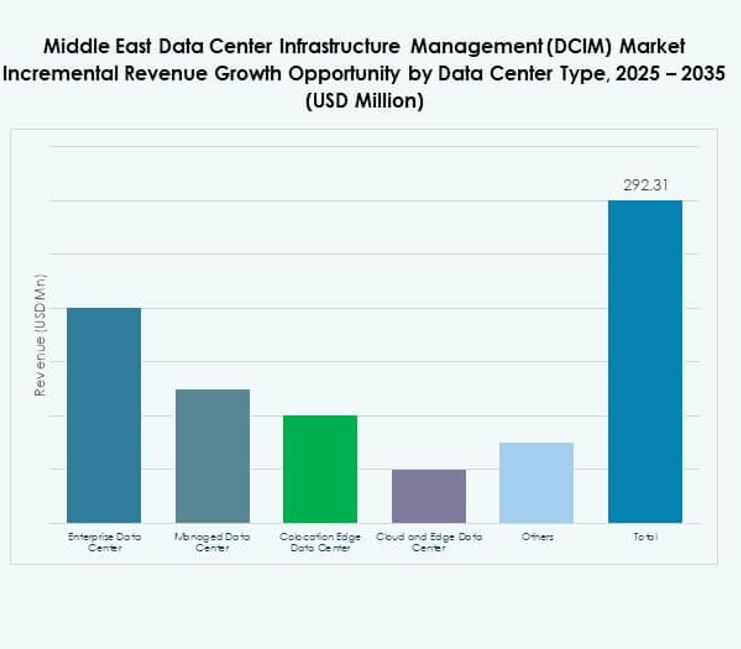

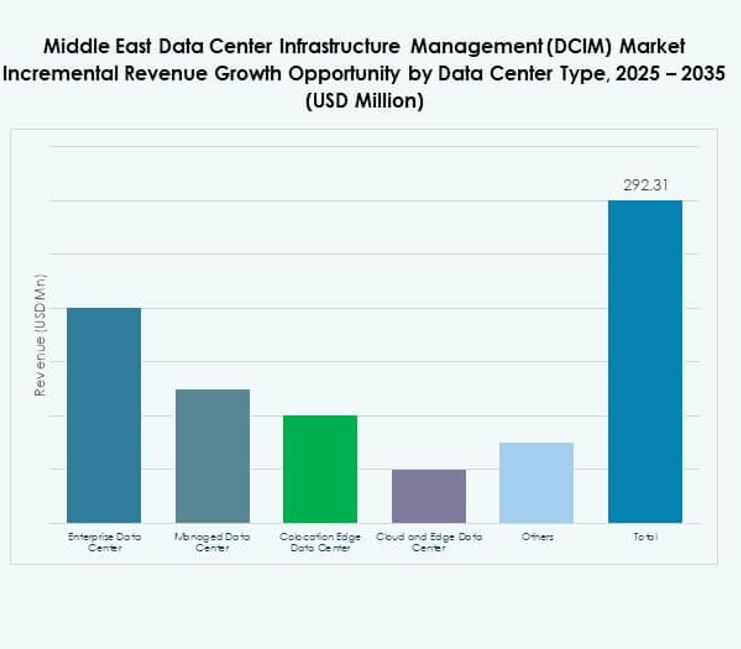

By Data Center Type

Colocation and cloud data centers hold the largest share in the Middle East Data Center Infrastructure Management (DCIM) Market. Their scalability and shared infrastructure appeal to enterprises seeking cost efficiency and operational agility. Managed data centers expand through partnerships with telecom and IT firms. Enterprise data centers remain essential for organizations requiring high-security environments. The rise of edge facilities increases DCIM demand for decentralized management.

By Deployment Model

Cloud-based deployment leads due to its flexibility and scalability in the Middle East Data Center Infrastructure Management (DCIM) Market. Hybrid models gain momentum for balancing security and remote management efficiency. On-premises systems remain relevant in sectors with strict data compliance rules. It ensures continuous monitoring of critical IT assets. The combination of hybrid and cloud-based models promotes seamless operations across multiple facilities.

By Enterprise Size

Large enterprises dominate the Middle East Data Center Infrastructure Management (DCIM) Market due to higher budgets and complex infrastructure needs. SMEs increasingly adopt modular, subscription-based platforms for efficiency. It supports resource optimization and cost control. Scalable DCIM tools allow SMEs to monitor assets without large capital investments. Growing digitalization among mid-sized firms enhances adoption rates in developing economies.

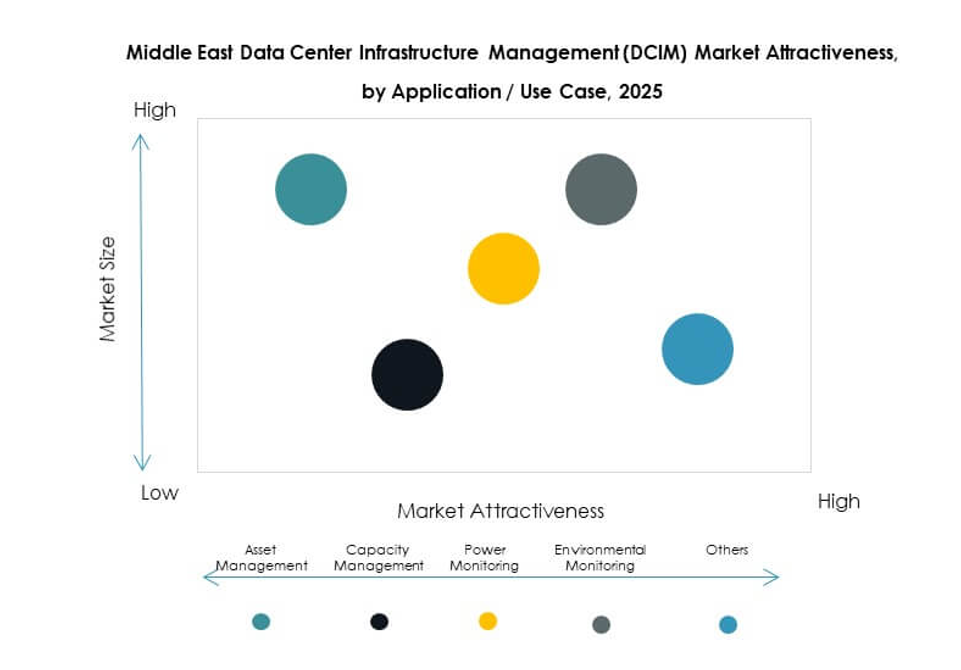

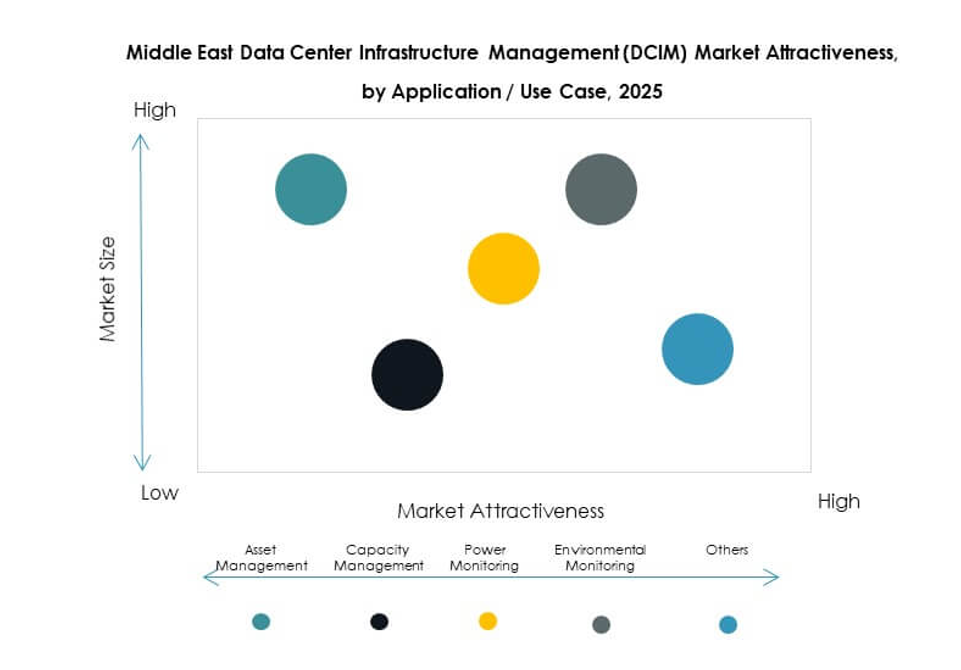

By Application / Use Case

Asset management remains the leading use case, ensuring visibility and control over physical and virtual resources in the Middle East Data Center Infrastructure Management (DCIM) Market. Power monitoring and environmental tracking follow closely, driven by sustainability mandates. Capacity management helps optimize utilization across data center components. Business intelligence and analytics functions enhance forecasting accuracy. It strengthens long-term infrastructure planning and resource distribution.

By End User Industry

The IT and telecommunications sector leads the Middle East Data Center Infrastructure Management (DCIM) Market due to strong digital infrastructure and hyperscale expansion. BFSI and healthcare sectors demand secure, high-availability systems for data-sensitive operations. Retail and e-commerce adopt DCIM for performance monitoring across distributed warehouses. The energy and defense sectors leverage DCIM for mission-critical applications. The growing diversity of use cases enhances market resilience and sectoral penetration.

Regional Insights

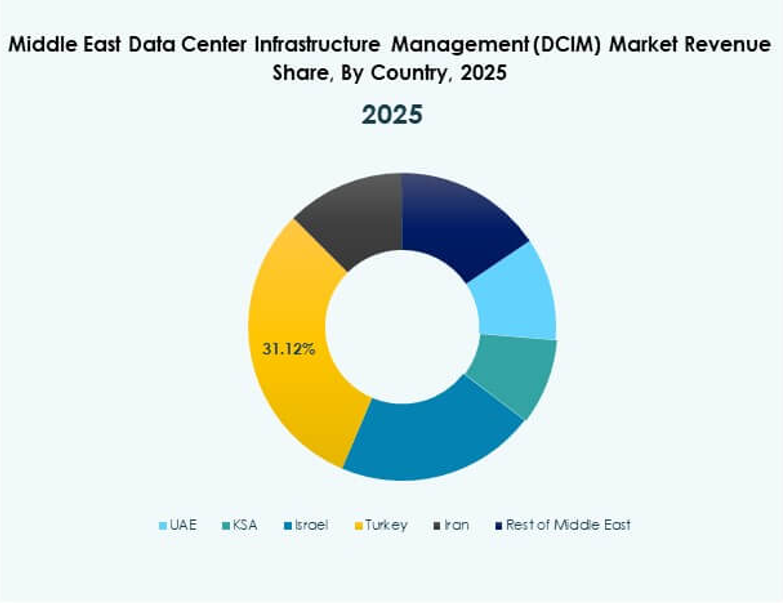

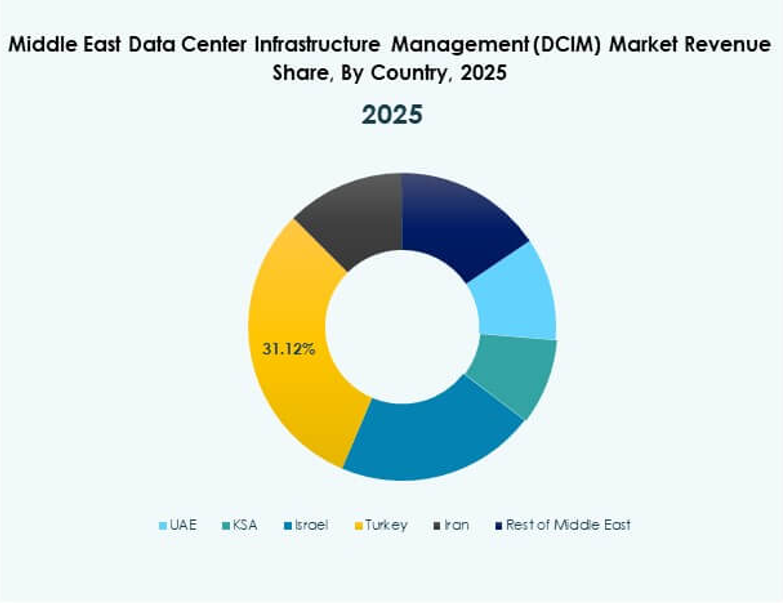

Gulf Cooperation Council (GCC) Leading with 58% Market Share

The GCC region, led by the UAE and Saudi Arabia, dominates the Middle East Data Center Infrastructure Management (DCIM) Market with 58% share. It benefits from strong digital transformation programs, renewable initiatives, and government-backed smart city projects. The UAE’s hyperscale infrastructure and Saudi Arabia’s Vision 2030 investments drive major adoption. It reflects rapid expansion in AI, cloud computing, and green data centers. Global vendors partner with local operators to expand automation and energy-efficient solutions. The GCC remains the innovation core for advanced DCIM deployment.

- For instance, Equinix opened its third data center in Dubai (DX3) in May 2023, expanding regional interconnection capabilities with an initial capacity of 900 racks and enhancing Dubai’s role as a key digital and colocation hub in the Middle East.

Levant Region Emerging Through Cloud and Telecom Partnerships

The Levant region accounts for 23% of the Middle East Data Center Infrastructure Management (DCIM) Market. Countries like Jordan and Lebanon focus on enhancing connectivity and cloud-based data ecosystems. It benefits from rising telecom-led data center investments and digital economy growth. The expansion of colocation hubs supports regional start-ups and fintech firms. Energy-efficient data center models are being developed to reduce power costs. The region’s strategic geographic position enables cross-border data exchange between Europe and Asia.

- For instance, Orange Jordan inaugurated its new data center in May 2025 at Ain Al-Basha, built to Tier III standards, with a 500-rack capacity and advanced security/compliance certifications, directly supporting fintech and enterprise digitalization across Jordan.

North Africa Expanding Infrastructure with 19% Market Share

North Africa holds 19% of the Middle East Data Center Infrastructure Management (DCIM) Market, driven by Egypt and Morocco. It witnesses strong investment in hyperscale and renewable-powered facilities. Egypt’s new technology parks attract foreign operators seeking lower energy costs. It strengthens connectivity between Mediterranean and Sub-Saharan Africa. Morocco advances DCIM adoption through national digitalization programs and public-private collaborations. This subregion evolves as a future growth frontier for sustainable data center management.

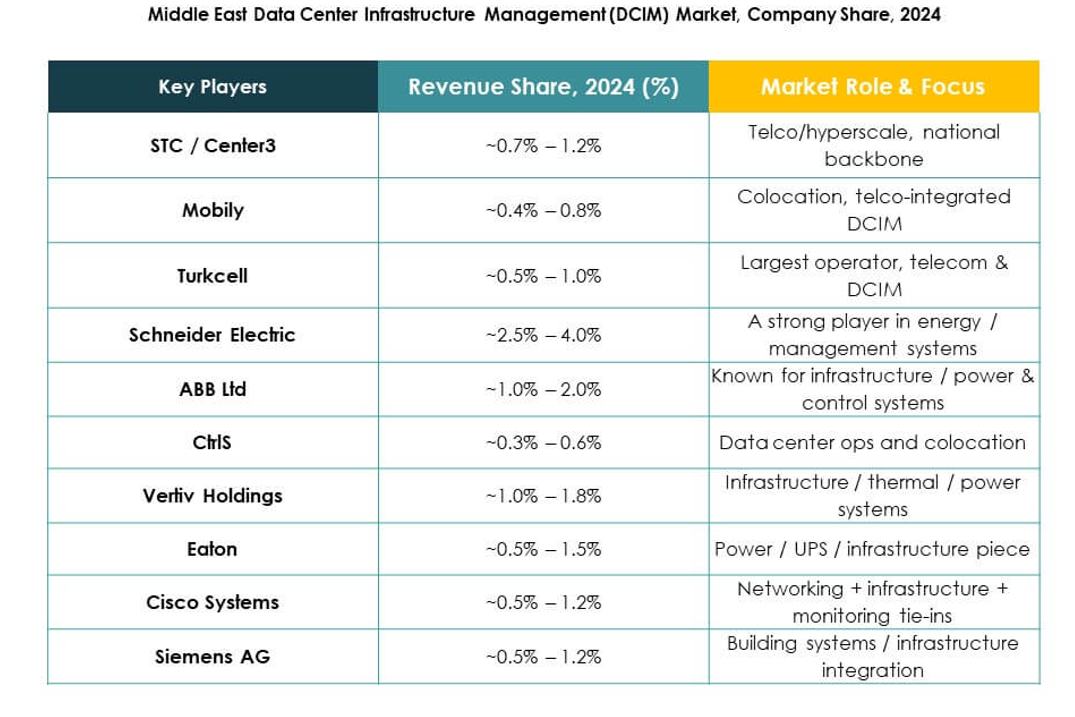

Competitive Insights:

- Khazna Data Centers

- Edgnex Data Centres by DAMAC

- Center3

- Mobily

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Schneider Electric SE

- Siemens AG

- HPE (Hewlett Packard Enterprise)

- Vertiv Holdings Co.

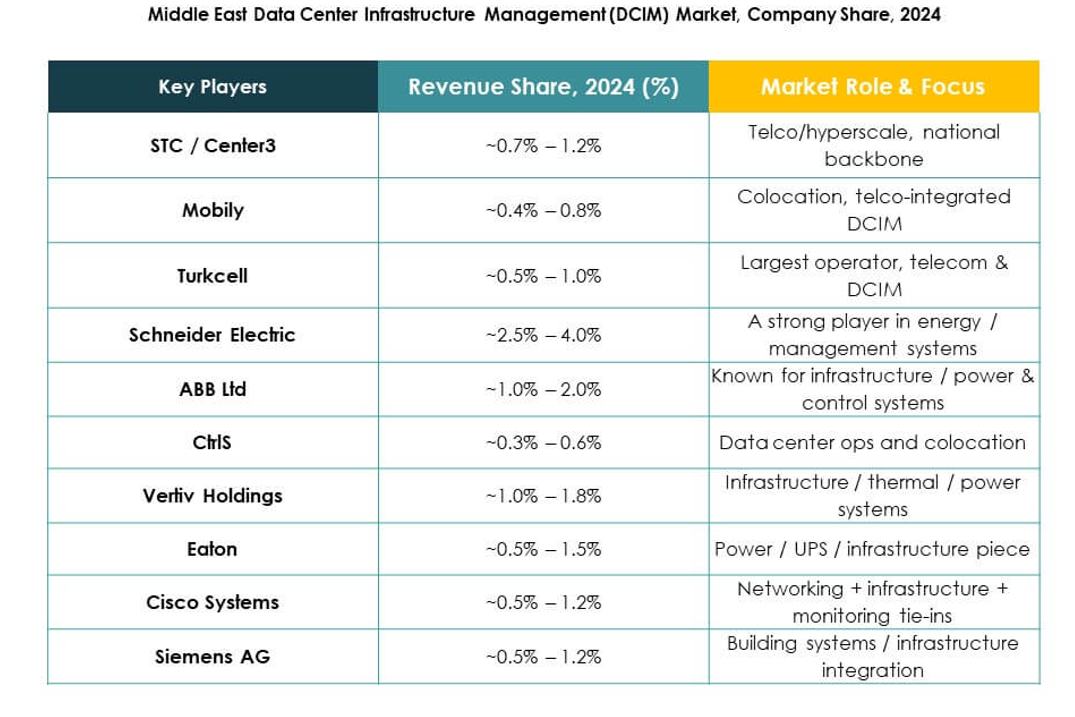

The Middle East Data Center Infrastructure Management (DCIM) Market features strong competition among global technology leaders and regional operators expanding digital infrastructure. It is defined by mergers, hyperscale partnerships, and rapid technology integration focused on AI, automation, and sustainability. Companies such as Schneider Electric, Huawei, and Vertiv lead with integrated power and cooling management systems. Khazna Data Centers and Center3 strengthen regional capacity with hyperscale facilities aligned with government digital agendas. Cisco, IBM, and HPE advance software-driven DCIM platforms offering analytics and hybrid monitoring. Emerging players focus on modular, energy-efficient designs to attract enterprise clients and investors.

Recent Developments:

- In September 2025, Khazna Data Centers announced the unlocking of a $2.62 billion facility through a landmark financing deal with Abu Dhabi Commercial Bank and First Abu Dhabi Bank, aimed at expanding its data center footprint across the Middle East and North Africa region, including several projects in Abu Dhabi, Dubai, and the first AI-enabled data center in Ajman.

- In August 2025, Center3 announced an ambitious $10 billion investment plan to extend its data center infrastructure, targeting 1 GW total capacity by 2030 to power AI and cloud growth across the MENA region. In the same period, Center3 also completed the acquisition of CMC Networks, strengthening its digital infrastructure services across Africa and the Middle East.

- In February 2025, Center3 formed a strategic partnership with TLS to provide multi-year hosting services, aimed at enhancing digital services and supporting digital transformation for businesses throughout Saudi Arabia.