Executive summary:

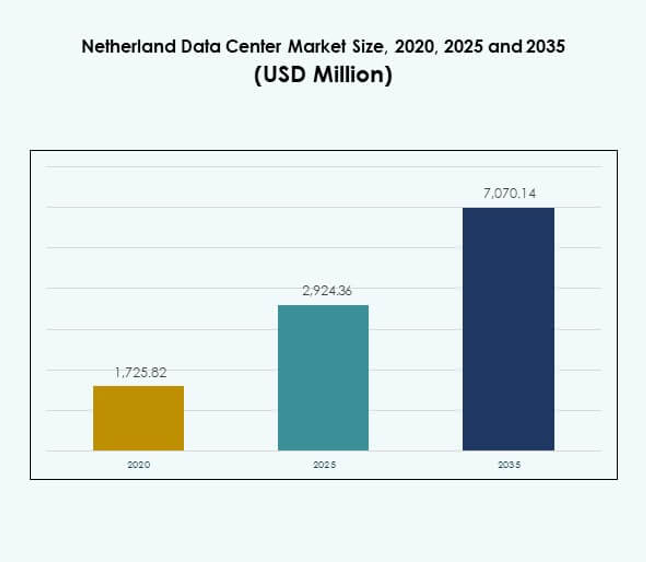

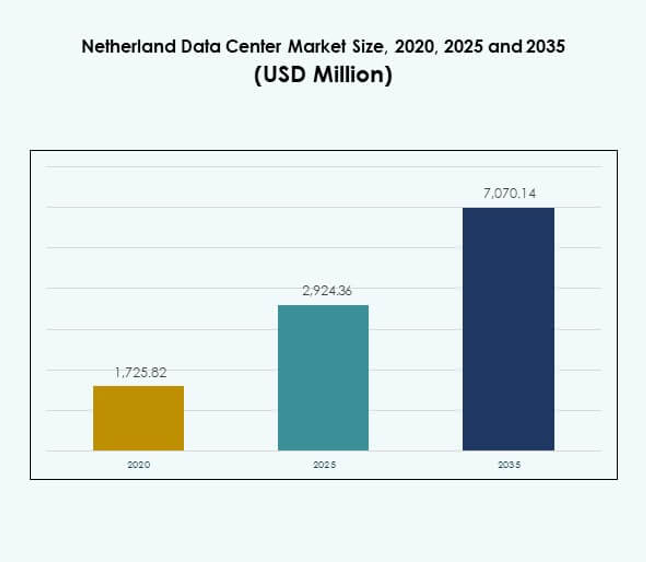

The Netherland Data Center Market size was valued at USD 1,725.82 million in 2020 to USD 2,924.36 million in 2025 and is anticipated to reach USD 7,070.14 million by 2035, at a CAGR of 9.19% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Netherland Data Center Market Size 2025 |

USD 2,924.36 Million |

| Netherland Data Center Market, CAGR |

9.19% |

| Netherland Data Center Market Size 2035 |

USD 7,070.14 Million |

The Netherland Data Center Market is driven by rapid adoption of cloud computing, AI, IoT, and digital platforms, pushing enterprises to demand high-performance and scalable infrastructure. Innovation in energy-efficient design, automation, and advanced connectivity strengthens competitiveness. It serves as a strategic hub for global businesses, offering low latency, compliance benefits, and secure digital infrastructure. Investors find long-term value in the market’s ability to align technology adoption with sustainable practices.

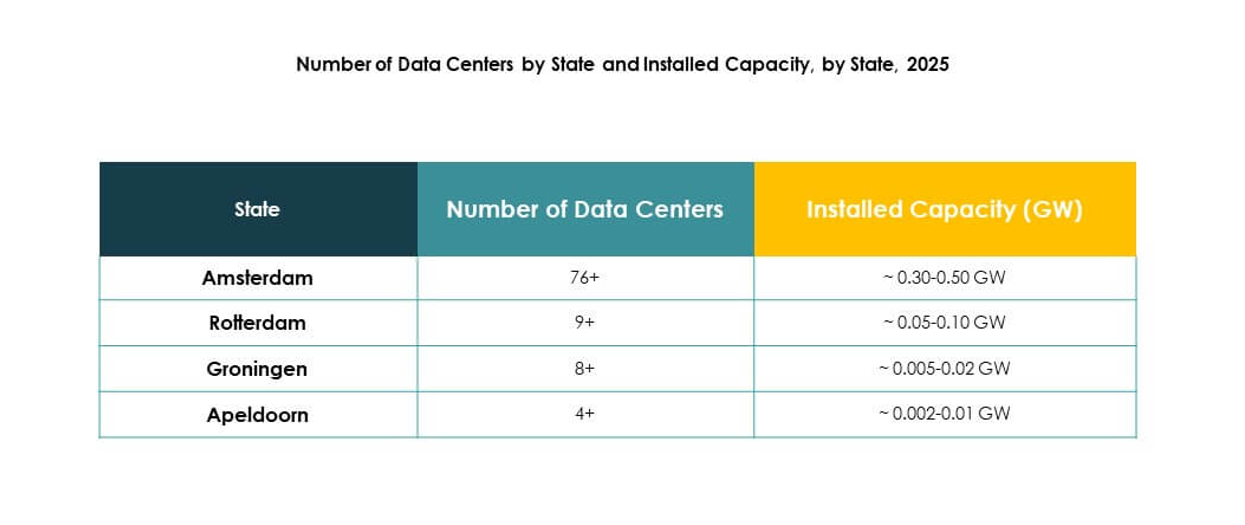

The Netherland Data Center Market shows strong regional dominance in Western Netherlands, supported by Amsterdam’s global connectivity and robust digital ecosystem. Northern regions are emerging as competitive hubs due to renewable energy availability and lower operational costs. Southern and Eastern regions gain traction by offering cost-efficient colocation and modular facilities. Geographic diversity ensures resilience, making the Netherlands a balanced and strategically vital data center market.

Market Drivers

Growing Demand for Cloud Computing and Advanced Workloads

The Netherland Data Center Market is expanding due to surging demand for cloud computing and high-performance workloads. Businesses adopt cloud-first strategies, leading to increased reliance on colocation and hyperscale facilities. Enterprises require data centers to support big data, IoT, and AI-driven operations. The government encourages digitalization, reinforcing infrastructure growth. Companies need scalable infrastructure for competitive advantage. Investors see long-term opportunities supported by stable demand. Technology adoption continues to reshape enterprise operations. Innovation in workload management makes the country a digital hub.

- For example, Equinix Netherlands signed a Letter of Intent in August 2025 to source up to 250 MWe of next-generation nuclear power through a partnership with ULC-Energy, supporting sustainable, high-density AI and cloud workloads in its Amsterdam data centers.

Rising Importance of Energy Efficiency and Green Data Centers

Energy efficiency drives investment, with operators designing facilities around renewable energy and advanced cooling. The Netherland Data Center Market highlights sustainability due to strict EU environmental policies. Operators deploy liquid cooling, modular infrastructure, and AI-enabled systems to manage consumption. These practices reduce costs and improve reliability. Global enterprises consider the Netherlands a preferred hub due to its energy-focused ecosystem. It offers scalability with lower carbon footprints. Strategic innovation in green data centers attracts investors. Companies benefit from lower operating risks and improved compliance.

Technological Innovation and Strategic Investment Shaping the Sector

Continuous innovation in data center architecture fuels competitiveness and industry growth. The Netherland Data Center Market attracts strategic investments from global cloud providers and local colocation firms. Enterprises integrate AI-powered monitoring, software-defined networking, and next-generation orchestration tools. These developments improve resilience and scalability. Businesses increasingly choose the Netherlands due to its connectivity advantage. The market benefits from strong subsea cable infrastructure, improving global reach. Enterprises secure lower latency for mission-critical workloads. Investors target the region for long-term digital economy expansion.

Strategic Relevance of the Market for Enterprises and Global Investors

The Netherlands serves as a gateway for European and global digital connectivity. The Netherland Data Center Market offers strategic opportunities for enterprises expanding digital services. Its infrastructure attracts multinational corporations establishing data-driven operations. Colocation and hyperscale providers expand capacity to meet demand. Enterprises achieve better latency and compliance through this region. Strategic relevance supports investor confidence in long-term value. Businesses diversify footprints by selecting the Netherlands as a central hub. Innovation, efficiency, and resilience shape its appeal for stakeholders worldwide.

- For example, Iron Mountain announced in May 2025 that it will add 10 MW to its AMS-1 campus in Amsterdam, moving closer toward a total capacity of 60 MW.

Market Trends

Adoption of Edge and Modular Data Centers Across Key Sectors

The Netherland Data Center Market shows strong growth in edge and modular infrastructure. Enterprises prioritize distributed networks to support 5G-enabled applications and IoT devices. These facilities reduce latency and improve service delivery. Edge solutions serve industries such as telecom, healthcare, and manufacturing. Modular systems enhance scalability and speed of deployment. Enterprises select them to align with agile digital transformation strategies. Investors identify rising adoption as an opportunity. This approach supports rapid adaptation to evolving business models.

Integration of Artificial Intelligence and Automation in Operations

AI and automation transform operational management, shaping efficiency and performance standards. The Netherland Data Center Market integrates intelligent systems for predictive maintenance and optimized cooling. AI enables operators to detect anomalies in real time. Automation reduces reliance on manual monitoring, lowering costs and risks. Software-defined infrastructure creates agility in scaling workloads. Enterprises benefit from greater uptime and reliability. AI-driven management aligns with sustainability goals. Investors view this as a strong foundation for future growth.

Expansion of Hyperscale Facilities Supporting Digital Ecosystem Growth

Hyperscale investments create new benchmarks for capacity and connectivity. The Netherland Data Center Market experiences a surge in large-scale facilities catering to cloud providers. Enterprises use hyperscale data centers for mission-critical operations. Operators prioritize integration with global subsea cables, improving international reach. This development enhances the Netherlands’ position as a European hub. Cloud service providers drive adoption through hybrid and multicloud models. Capacity growth supports digital economy expansion. It creates long-term opportunities for regional competitiveness.

Growing Focus on Cybersecurity and Compliance Standards

Rising data volumes increase the importance of robust security and compliance frameworks. The Netherland Data Center Market emphasizes advanced cybersecurity measures to protect critical assets. Enterprises must comply with GDPR and other EU data protection rules. Providers deploy encryption, AI-based threat detection, and identity management tools. Security remains central to attracting multinational clients. Compliance improves customer trust and investor confidence. Enterprises leverage secure ecosystems to safeguard digital operations. Growth in cybersecurity standards strengthens the overall market appeal.

Market Challenges

High Energy Consumption and Rising Sustainability Pressures

The Netherland Data Center Market faces sustainability challenges due to high energy consumption. Operators must adapt to stricter EU regulations on emissions. Facilities require renewable integration and advanced cooling systems to reduce costs. Balancing demand with environmental compliance remains difficult. Energy prices add pressure on operating margins. Investors seek sustainable designs to mitigate risks. Enterprises demand eco-friendly solutions to align with corporate ESG goals. Addressing energy challenges is critical for long-term competitiveness.

Infrastructure Expansion Constraints and Rising Real Estate Costs

Operators struggle to expand due to limited urban land and rising real estate costs. The Netherland Data Center Market must balance demand with space limitations in high-demand zones. Land scarcity around Amsterdam challenges hyperscale expansion. Regulatory bottlenecks further delay construction timelines. Investors evaluate risk carefully before committing capital. Enterprises may face higher costs due to constrained supply. Expansion into emerging subregions becomes a key focus. Addressing infrastructure challenges will define future growth opportunities.

Market Opportunities

Expansion of Hybrid and Multicloud Solutions for Enterprises

The Netherland Data Center Market offers growth opportunities through hybrid and multicloud adoption. Enterprises require flexibility in managing workloads across platforms. Cloud-native strategies benefit from strong regional infrastructure. Providers deliver managed services, enhancing reliability and compliance. Businesses achieve resilience through diversification. Investors target hybrid solutions due to rising enterprise demand. This opportunity enhances long-term competitiveness. Strong growth potential supports digital-first corporate strategies.

Rising Demand from Emerging Industries and Global Investors

New industries adopt advanced infrastructure to support digital transformation. The Netherland Data Center Market supports healthcare, retail, and media through high-performance data services. Investors identify opportunities in expanding colocation and modular systems. Emerging industries seek secure and scalable platforms. Demand aligns with rising data-driven innovation. Providers benefit from expanding regional and global partnerships. Growth opportunities encourage continuous investment. This expansion supports wider ecosystem development.

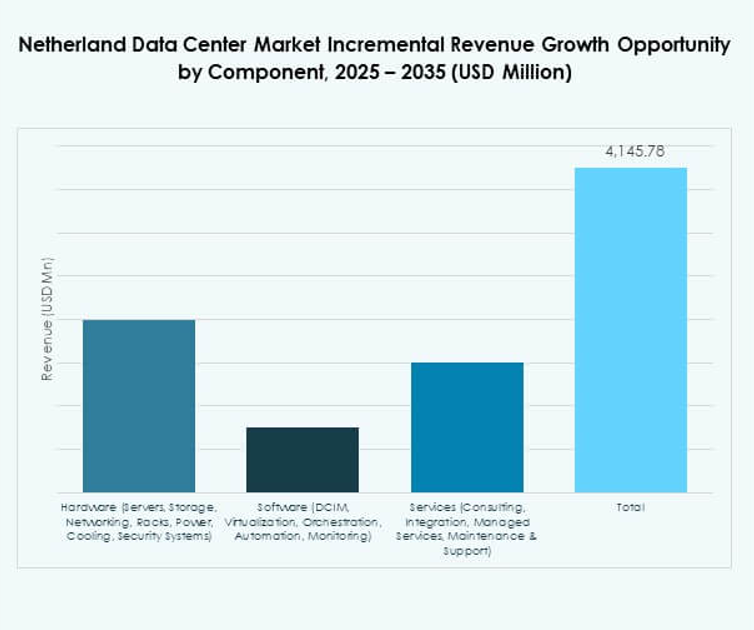

Market Segmentation

By Component

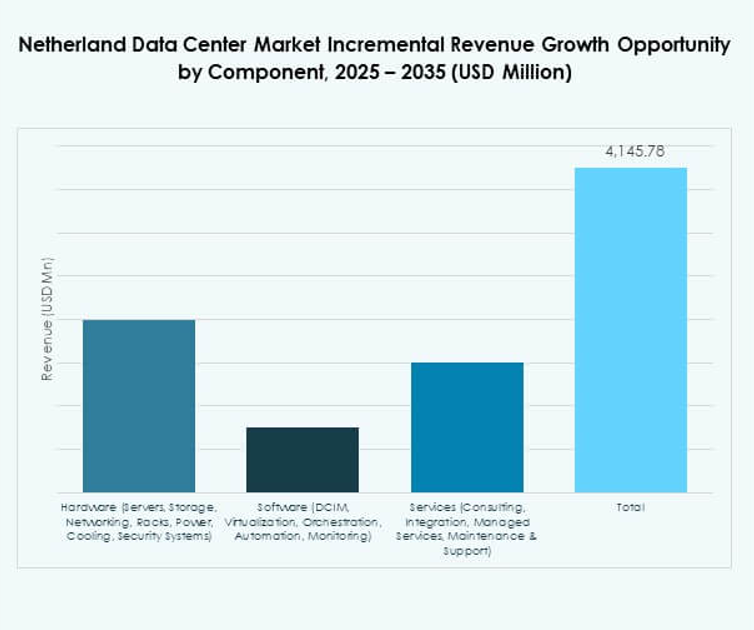

Hardware dominates the Netherland Data Center Market with the largest share due to servers, storage, and power systems forming its backbone. Enterprises rely on efficient hardware to support cloud and AI-driven workloads. Networking and cooling technologies secure higher demand as operators improve resilience. Software segments such as DCIM and orchestration gain traction with increasing automation needs. Services grow steadily with consulting and managed offerings. Hardware remains central to scalability and performance. Enterprises prioritize efficiency in mission-critical operations. Hardware continues to attract the highest investment.

By Data Center Type

Hyperscale data centers dominate the Netherland Data Center Market due to strong adoption by global cloud providers. These facilities enable enterprises to manage large workloads efficiently. Colocation services remain a key choice for medium-sized enterprises seeking cost savings. Edge and modular data centers expand with demand for 5G and IoT support. Cloud-based IDC facilities also register strong momentum. Enterprise data centers face slower growth compared to hyperscale models. Mega data centers support global digital operations. Hyperscale leads due to unmatched scalability.

By Deployment Model

Cloud-based deployment leads the Netherland Data Center Market due to growing enterprise preference for flexibility. On-premises solutions remain relevant for regulated industries like government and defense. Hybrid models expand as businesses combine cloud scalability with on-premises security. Enterprises demand agility and lower costs through cloud-based models. Cloud adoption supports multicloud integration strategies. Hybrid models ensure compliance with local regulations. Providers expand services across industries to meet demand. Cloud deployment secures the highest growth rate.

By Enterprise Size

Large enterprises dominate the Netherland Data Center Market due to their reliance on hyperscale and hybrid models. These firms require high-capacity systems to support AI, IoT, and advanced workloads. SMEs adopt colocation and cloud-based solutions to lower costs. Cloud-native applications drive growth among smaller enterprises. Large enterprises invest in secure and scalable designs. SMEs leverage flexible pricing and managed services. Market growth aligns with both enterprise scales. Large enterprises retain the largest market share.

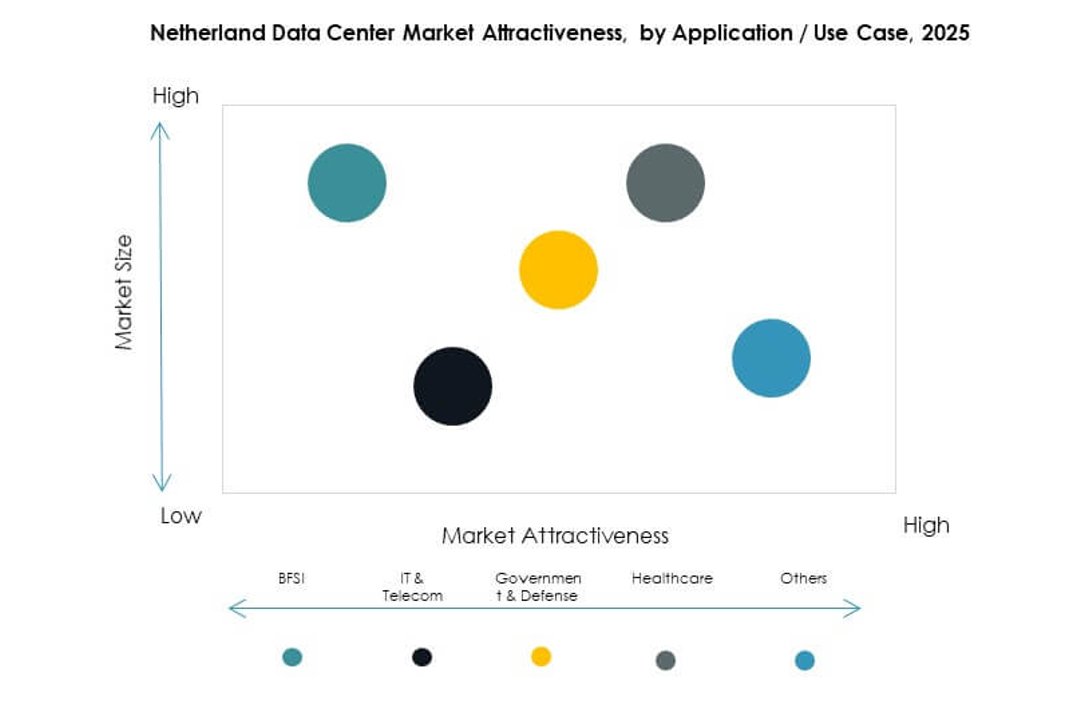

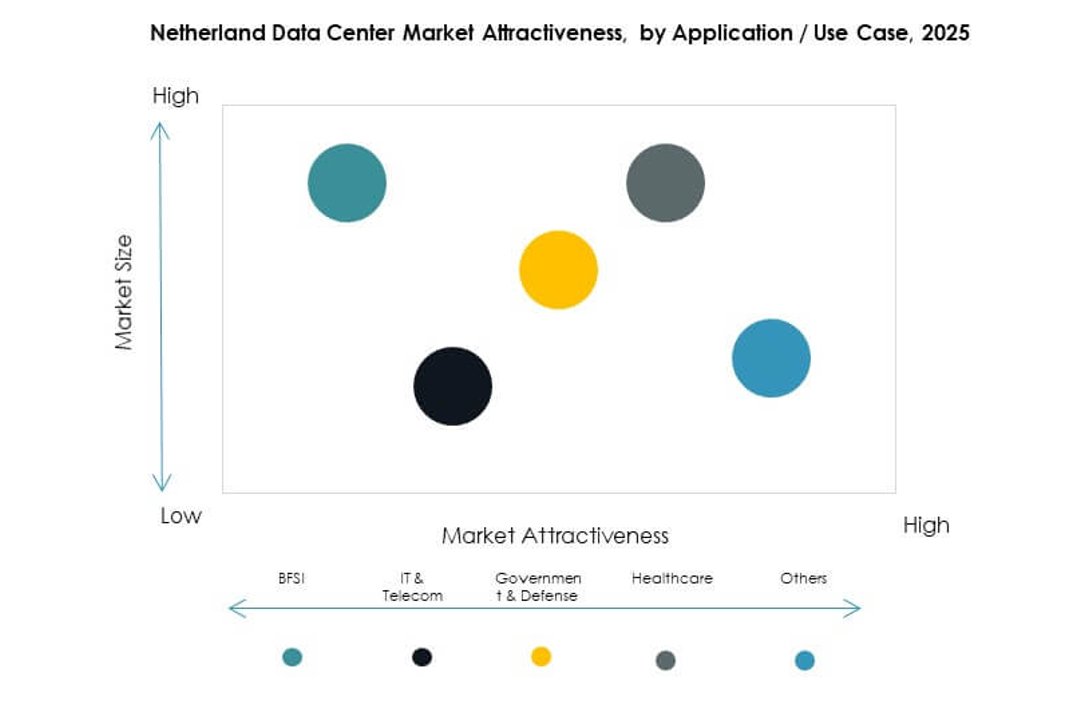

By Application / Use Case

IT and telecom lead the Netherland Data Center Market, holding the largest share due to digital adoption. BFSI follows, driven by secure and high-performance computing needs. Healthcare and retail accelerate adoption due to data-driven services. Media and entertainment rely on cloud solutions for streaming. Government and defense emphasize security and compliance. Manufacturing and energy sectors adopt edge solutions. Education and utilities form smaller but rising segments. IT and telecom maintain dominance in adoption scale.

By End User Industry

Cloud service providers dominate the Netherland Data Center Market, holding the largest share. Enterprises form the second-largest segment with continuous reliance on secure facilities. Colocation providers attract SMEs with cost-efficient infrastructure. Government agencies demand secure, compliant, and resilient systems. Other users including education and utilities create niche demand. Cloud providers invest in large hyperscale facilities to lead the market. Enterprises benefit from diversified services. Cloud service providers retain leadership through continuous capacity expansion.

Regional Insights

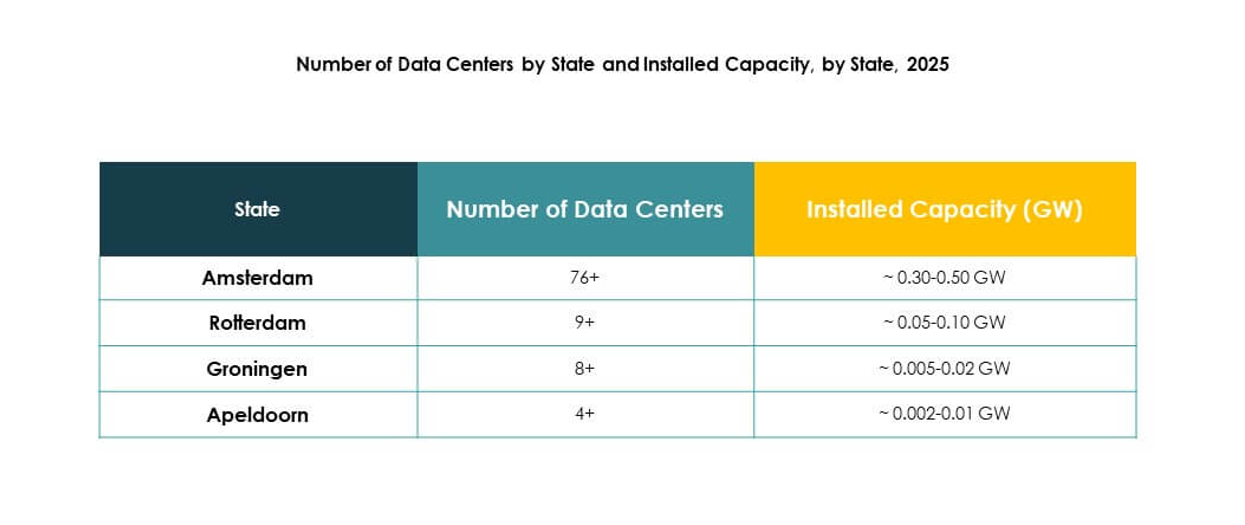

Western Netherlands Leading with Strong Digital Infrastructure

Western Netherlands leads the Netherland Data Center Market with a 55% share due to Amsterdam’s AMS-IX and global connectivity. This region serves as the digital gateway for Europe. Strong infrastructure attracts hyperscale investments and cloud providers. Enterprises prefer Western Netherlands for scalability and efficiency. Real estate constraints limit further capacity expansion. Providers innovate with modular and vertical designs. Strategic importance sustains its leadership.

Northern Netherlands Emerging as a Competitive Subregion

Northern Netherlands secures a 25% share of the Netherland Data Center Market. It benefits from renewable energy resources and cooler climates. Operators expand capacity to reduce energy costs and achieve sustainability. Enterprises invest in this subregion to manage workloads outside crowded hubs. It develops as a secondary hub for colocation and edge facilities. Regional policies encourage new investment. Sustainability advantage strengthens its competitiveness.

- For instance, in March 2020, QTS Data Centers’ Groningen facility secured 100% renewable energy through a European Guarantees of Origin agreement, covering over 20 gigawatt hours annually to fully power its 10MW site. This initiative supports QTS’s commitment to source all electricity for its global data centers from renewables.

Southern and Eastern Netherlands Contributing to Balanced Growth

Southern and Eastern Netherlands hold a combined 20% share of the Netherland Data Center Market. These regions attract SMEs and enterprises seeking lower-cost alternatives. Colocation and modular data centers expand in these zones. Geographic diversification reduces risks of concentration. Enterprises in retail and healthcare adopt facilities in these regions. Government support enables infrastructure expansion. Balanced growth ensures these regions maintain steady contribution.

- For instance, Interconnect expanded its data center facilities in Den Bosch to 10,000 m², offering white label data center space for cloud partners. Since 2021, residual heat from the center has been reused through local partnerships, supplying nearby buildings and improving regional energy efficiency.

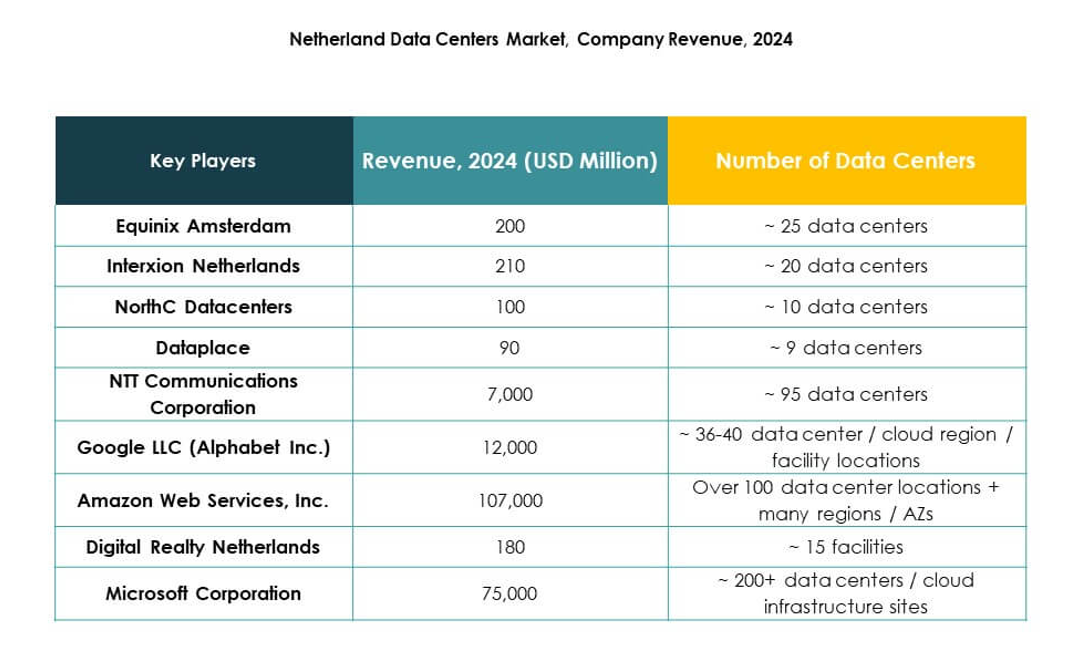

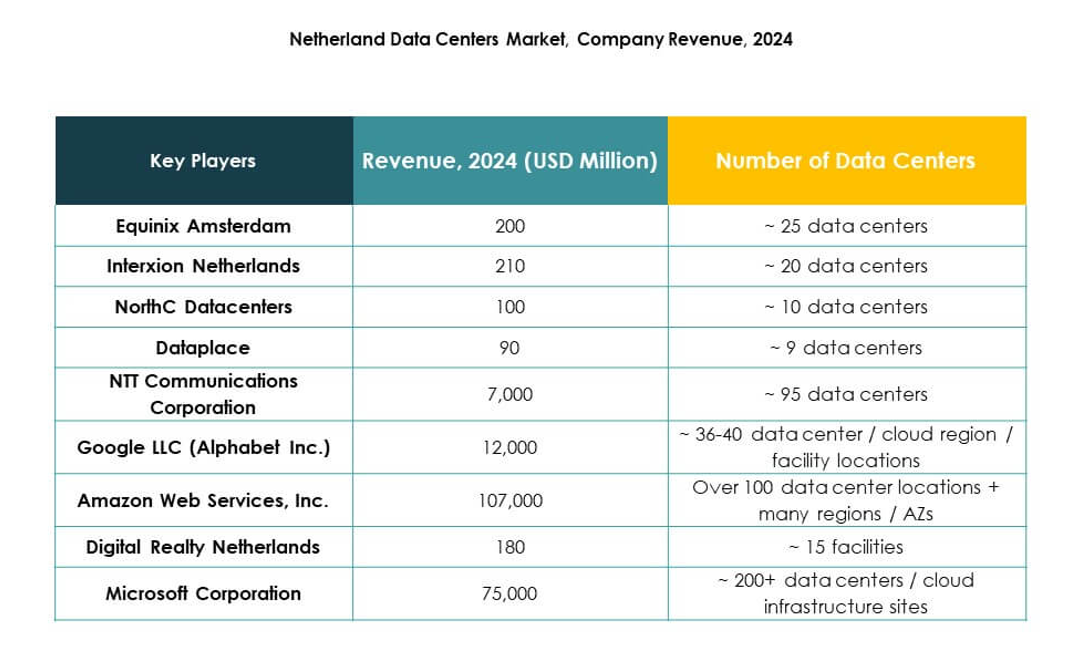

Competitive Insights:

- Equinix Amsterdam

- Interxion Netherlands

- NorthC Datacenters

- Dataplace

- NTT Communications Corporation

- Digital Realty Netherlands

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Netherland Data Center Market features intense competition between global cloud providers and local colocation operators. It is defined by strong investments in hyperscale facilities, sustainable infrastructure, and advanced connectivity. Equinix and Interxion dominate colocation services, while NorthC and Dataplace strengthen regional coverage. Global players such as Microsoft, AWS, and Google expand hyperscale capacity to support cloud adoption. Digital Realty and NTT Communications drive innovation in design and efficiency. Local operators focus on modular and edge solutions to remain competitive. Strategic partnerships, mergers, and facility expansions shape the evolving landscape. The balance between global scale and local expertise creates a dynamic ecosystem that continues to attract new investment.

Recent Developments:

Recent Developments:

- In September 2025, Microsoft Corporation acquired 50 hectares of land in Middenmeer, Netherlands, to expand its data center campus, responding to surging demand for AI-driven compute resources and secure, sovereign data storage for over 300,000 customers. The expansion features sustainable initiatives such as rainwater cooling and solar panel proposals, as well as collaboration with local authorities to create a publicly accessible landscape around the center.

- In September 2025, NorthC, a regional data center leader in Northwest Europe, completed the acquisition of six data centers from Colt Technology Services, including a major expansion in the Amsterdam metropolitan area of the Netherlands. This strategic acquisition strengthens NorthC’s platform by adding more than 25 megawatts of capacity and enhances national coverage as well as regional connectivity for organizations with cross-border and metropolitan requirements.

- In August 2025, Equinix Amsterdam announced a strategic collaboration with ULC-Energy to secure up to 250 MWe of next-generation nuclear power through Rolls-Royce SMR technology, aiming to create sustainable energy solutions for data centers in the Netherlands. This partnership supports Equinix’s ongoing efforts to ensure resilient digital infrastructure and reduce environmental impact in the region.

- In July 2025, NTT DATA and Eurofiber announced a strategic partnership to deliver a managed Mobile Private Network service based on 5G, branded as Connected Workspace, with operations available in the Netherlands starting September 2025. This collaboration allows business clients to access private 5G networks hosted on Eurofiber’s data centers, unlocking secure, scalable, and high-speed wireless connectivity without substantial upfront investment, which supports digital growth across Dutch enterprises.

Recent Developments:

Recent Developments: