Executive summary:

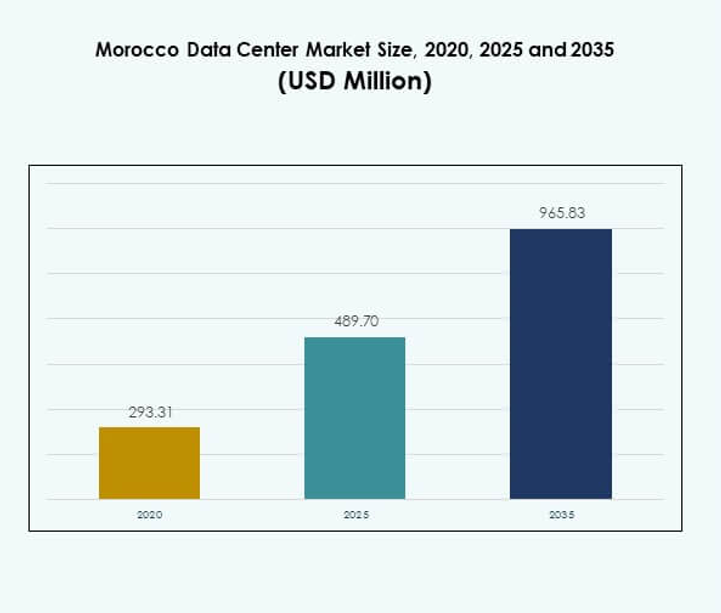

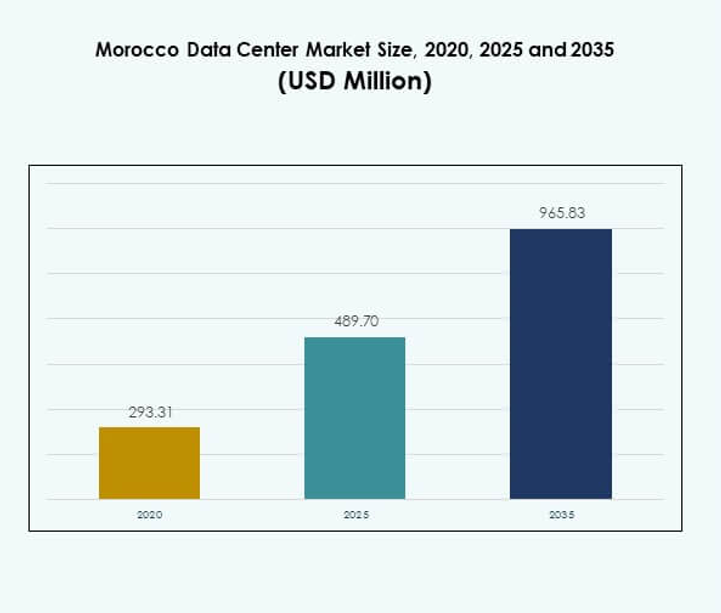

The Morocco Data Center Market size was valued at USD 293.31 million in 2020 to USD 489.70 million in 2025 and is anticipated to reach USD 965.83 million by 2035, at a CAGR of 6.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Morocco Data Center Market Size 2025 |

USD 489.70 Million |

| Morocco Data Center Market, CAGR |

6.93% |

| Morocco Data Center Market Size 2035 |

USD 965.83 Million |

The market is driven by rising adoption of cloud computing, artificial intelligence, and big data solutions. Innovation in energy-efficient infrastructure and government-backed digital programs are accelerating development. Telecom providers and global players are expanding capacity to meet enterprise and public sector needs. The Morocco Data Center Market holds strategic importance by ensuring data sovereignty, improving connectivity, and creating reliable platforms for digital business growth, making it an attractive investment sector.

Regionally, Morocco stands out as a leading hub in North Africa due to its strong connectivity with Europe and sub-Saharan Africa. Countries like Egypt and South Africa dominate with mature ecosystems, while Nigeria and Kenya are emerging with rising digital infrastructure investments. The Morocco Data Center Market is positioning itself as a regional bridge, supported by favorable policies, new hyperscale projects, and growing enterprise adoption, which strengthen its role in Africa’s digital transformation.

Market Drivers

Digital Transformation and Rising Cloud Demand

The Morocco Data Center Market benefits from the country’s rapid digital transformation across industries. Enterprises are shifting workloads to hybrid and cloud models to increase efficiency. Telecom operators and global providers are expanding infrastructure to match this demand. It is supported by a growing ecosystem of technology partners and integrators. The focus on reducing operational costs drives adoption of modern facilities. Increased use of AI, IoT, and big data reinforces the need for resilient capacity. Businesses see digital platforms as vital for competitiveness. Investors recognize the sector as a stable, growth-oriented asset.

Energy Efficiency and Green Infrastructure

Sustainability is becoming a central driver of the Morocco Data Center Market. Operators are investing in renewable energy and efficient cooling systems to reduce carbon emissions. Government programs encourage energy-conscious designs to align with global climate goals. It creates long-term value by attracting environmentally focused enterprises. Investors view energy-efficient infrastructure as vital to maintain competitiveness. Market participants are deploying innovative power management systems to control costs. Facilities emphasize modular solutions for scalability and reduced environmental footprint. Businesses with strong sustainability goals are aligning with these developments.

- For instance, in July 2025, Morocco announced the construction of a 500 MW data center in Dakhla powered entirely by renewable energy, as confirmed by Reuters and the Digital Transition Minister. This green facility is designed to bolster the nation’s cloud infrastructure while aligning with digital sovereignty goals; it marks Morocco’s largest and most ambitious green data center project to date.

Government Initiatives and Policy Support

Public policies are accelerating growth within the Morocco Data Center Market. The government promotes investment-friendly regulations and digital infrastructure strategies. Incentives for cloud adoption among enterprises and SMEs support broader market uptake. It attracts multinational players aiming to expand into North Africa. Strategic programs encourage public-private partnerships to strengthen local infrastructure. Cybersecurity regulations enhance trust and reliability of hosted services. Market development is also tied to investments in fiber networks and connectivity. This policy-driven environment makes the sector highly attractive for investors.

- For instance, in November 2024, Morocco enacted Decree No. 2-24-921, officially mandating the use of cloud computing and storage services by critical government entities, creating a verified regulatory foundation that directly supports the migration of key public services to the cloud sector.

Strategic Role for Enterprises and Investors

The Morocco Data Center Market serves as a cornerstone for regional digital growth. Enterprises gain reliable hosting solutions supporting digital innovation and business continuity. It allows global firms to reach local customers with improved latency and compliance. Investors find opportunities in colocation, hyperscale, and cloud data centers. The market’s geographic position makes it a regional hub for Africa and Europe. Rising demand from BFSI, healthcare, and government drives facility utilization. Market competitiveness is enhanced through innovation in modular and edge centers. This positions Morocco as a key gateway for technology-driven investments.

Market Trends

Expansion of Hyperscale and Colocation Facilities

The Morocco Data Center Market is experiencing a rapid shift toward hyperscale and colocation deployments. Global players are collaborating with local operators to build large-capacity sites. Enterprises prefer colocation for cost efficiency and scalability. It enables firms to deploy advanced workloads without major upfront investments. Hyperscale operators are targeting Morocco for regional cloud service expansion. Colocation demand grows from telecom, BFSI, and digital media sectors. Modular designs are being used for faster deployment. This trend reflects Morocco’s ambition to become a digital hub in Africa.

Adoption of Artificial Intelligence and Automation

AI and automation are reshaping operations within the Morocco Data Center Market. Operators deploy AI-driven monitoring tools for predictive maintenance. Automation improves resource management and ensures service reliability. It enhances efficiency across cooling, power distribution, and server utilization. Enterprises demand AI-ready facilities to handle big data workloads. Cloud providers also integrate machine learning to optimize capacity. Automation reduces human errors and improves uptime consistency. This trend strengthens investor interest in high-tech, future-proof facilities.

Edge and Modular Data Center Deployments

Edge and modular centers are gaining prominence in the Morocco Data Center Market. Rising demand for low-latency applications accelerates this shift. It supports industries like gaming, streaming, and smart city projects. Modular deployments reduce construction timelines while offering scalability. Edge facilities allow enterprises to serve remote regions with reliable connectivity. Growth in IoT adoption pushes enterprises to explore edge capabilities. Telecom providers are major enablers of this trend. Businesses recognize modular and edge setups as cost-effective strategies for expansion.

Increased Focus on Data Security and Compliance

The Morocco Data Center Market is witnessing rising emphasis on data protection. Operators strengthen cybersecurity protocols to meet industry regulations. It ensures compliance with financial, healthcare, and government standards. Data sovereignty remains a priority for enterprises. Cloud service providers emphasize local hosting to align with national policies. Investors value centers with advanced compliance certifications. Security solutions now include encryption, intrusion detection, and identity management. This trend improves trust in local and international partnerships.

Market Challenges

High Energy Costs and Infrastructure Limitations

The Morocco Data Center Market faces challenges related to high energy consumption and costs. Limited renewable energy integration increases reliance on traditional power. It raises operational expenses and impacts sustainability goals. Infrastructure gaps in some regions limit deployment speed. Enterprises may face latency issues due to network inconsistencies. Cooling systems contribute significantly to energy usage. Investment in advanced power management remains slow in some facilities. The market must overcome these issues to ensure stable growth.

Talent Shortage and Regulatory Complexities

A lack of skilled workforce poses another barrier to the Morocco Data Center Market. It slows adoption of complex systems like AI-driven automation. Limited availability of trained engineers impacts operations. Regulatory frameworks can be complex and create compliance burdens. Enterprises struggle to align with evolving cybersecurity standards. Import restrictions on advanced hardware slow down deployments. Competition for limited skilled professionals raises costs. The market requires strong policy reforms and training programs to address these issues.

Market Opportunities

Regional Hub Potential and Connectivity Expansion

The Morocco Data Center Market presents opportunities through its geographic advantage. Morocco serves as a gateway between Europe, Africa, and the Middle East. It attracts investments in hyperscale and cloud facilities. Growing submarine cable connections enhance global connectivity. Enterprises benefit from reduced latency and improved resilience. It enables Morocco to become a regional hub for digital trade. Investors see long-term opportunities in colocation and managed services. The expansion of telecom infrastructure further strengthens this position.

Rising Enterprise Adoption Across Key Sectors

Enterprises across BFSI, healthcare, and retail drive opportunities in the Morocco Data Center Market. Businesses seek modern hosting to support digital platforms. It creates demand for colocation, cloud, and edge deployments. SMEs are adopting cloud-based services for cost savings. Government digital programs also encourage private sector growth. Opportunities arise for vendors offering AI-ready and sustainable infrastructure. The integration of automation expands managed service prospects. These opportunities ensure long-term scalability and investor confidence.

Market Segmentation

By Component

In the Morocco Data Center Market, hardware dominates due to high demand for servers, racks, power, and cooling systems, accounting for the largest share. It ensures stable performance for enterprises and hyperscale providers. Software adoption is growing with DCIM and virtualization tools enabling automation. Services such as consulting and integration add value to enterprise operations. Hardware continues to lead due to its foundational role in data center stability and scalability.

By Data Center Type

The Morocco Data Center Market sees colocation and hyperscale data centers as dominant categories. Colocation provides cost savings and flexibility for enterprises and SMEs. Hyperscale facilities attract global cloud providers establishing regional presence. Edge and modular centers are expanding to support remote connectivity. Enterprise and mega centers serve government and regulated industries. Cloud-based internet data centers grow alongside SaaS adoption. Colocation remains the most widely adopted type due to affordability.

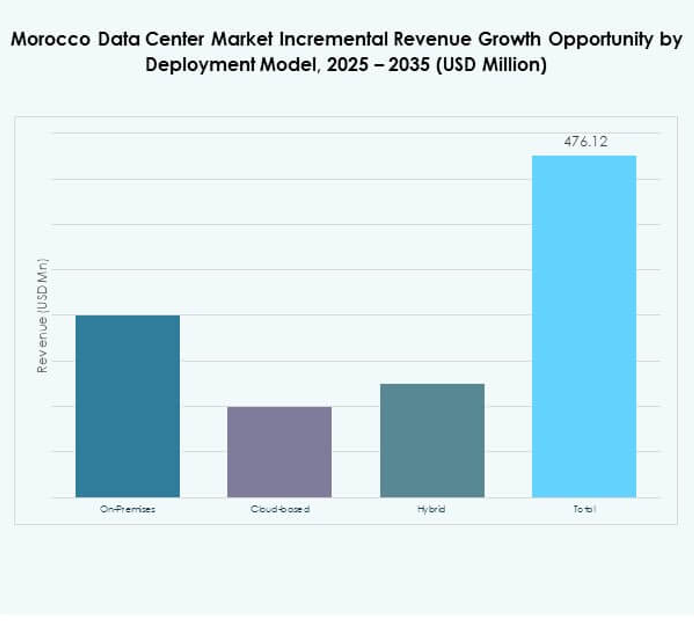

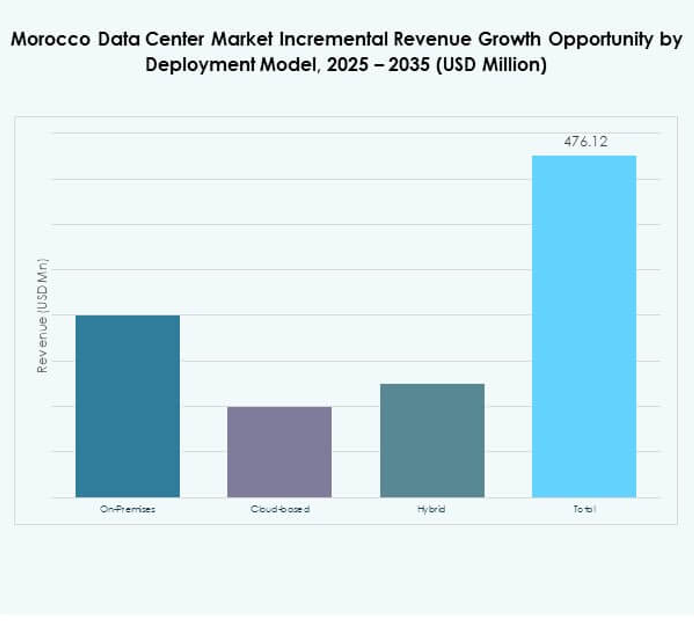

By Deployment Model

Cloud-based deployments hold the largest share in the Morocco Data Center Market. Enterprises prefer cloud for agility, scalability, and cost reduction. On-premises centers are still used by BFSI and government sectors for compliance. Hybrid models are gaining traction for balancing flexibility and security. It enables enterprises to manage critical data while accessing cloud resources. Cloud providers expand capacity to meet surging local demand. Hybrid adoption supports industries needing both control and scalability.

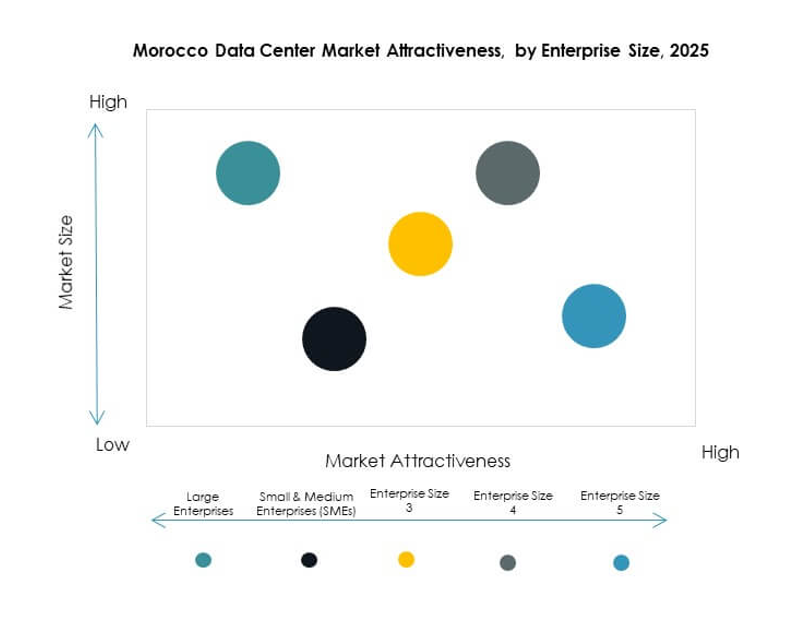

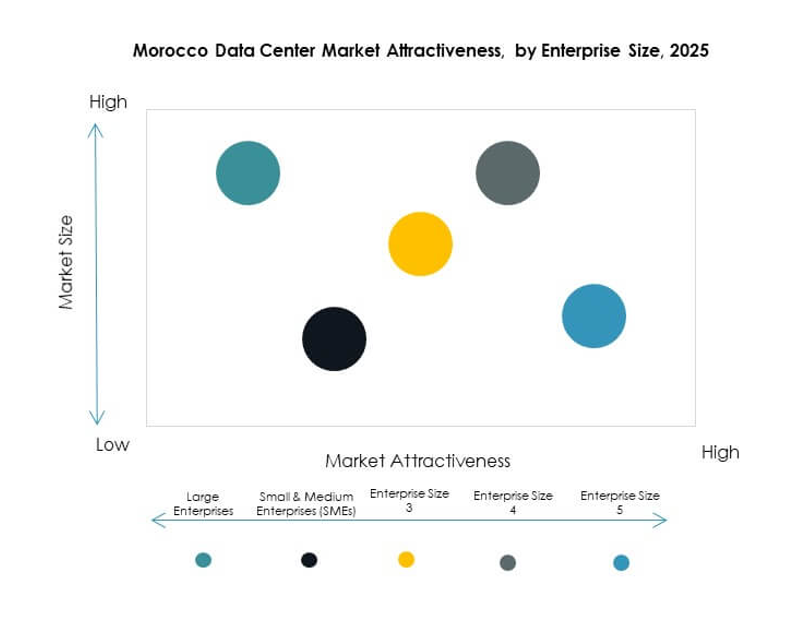

By Enterprise Size

Large enterprises dominate the Morocco Data Center Market due to greater investment capacity. They deploy advanced facilities for AI, big data, and IoT solutions. SMEs are rapidly increasing adoption of colocation and cloud services. It enables smaller firms to scale without high capital costs. Hybrid models support SME flexibility across multiple applications. Large enterprises continue to lead due to their role in driving innovation. Their adoption patterns set benchmarks for industry expansion.

By Application / Use Case

IT and telecom lead the Morocco Data Center Market, driving demand for connectivity and hosting. BFSI follows closely due to regulatory compliance and financial data needs. Healthcare expands usage for electronic health records and telemedicine platforms. Retail and e-commerce rely on digital infrastructure to support online sales. Government and defense agencies use secure centers for sensitive workloads. Media and entertainment also expand storage for digital streaming services. IT and telecom remain the dominant application area.

By End User Industry

Cloud service providers dominate the Morocco Data Center Market, reflecting demand for SaaS and IaaS. Enterprises rely on managed services for efficiency and scalability. Colocation providers serve SMEs and startups requiring flexible hosting. Government agencies continue to invest in secure infrastructure. Other users such as education and energy sectors also expand their presence. Cloud service providers hold the largest share due to continuous global investments. Their growth sustains the overall industry momentum.

Regional Insights

North Africa Market Position

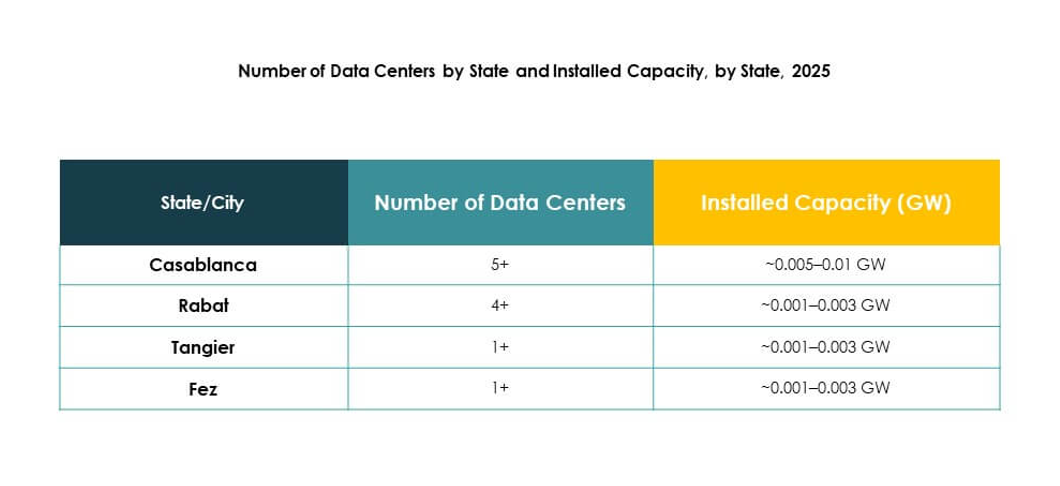

North Africa accounts for 45% of the Morocco Data Center Market share, led by Morocco’s infrastructure growth. It benefits from digital strategies and submarine cable connectivity with Europe. Enterprises in Morocco leverage this infrastructure for cloud and AI workloads. It positions the region as a preferred hub for North African digital expansion. Government policies reinforce Morocco’s leadership in this subregion. The strong ecosystem supports continuous investments from global and local firms.

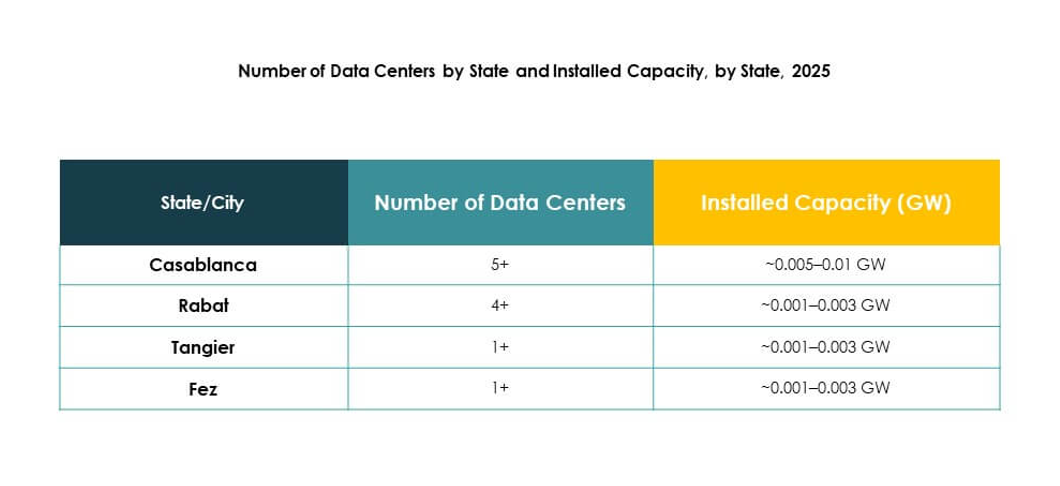

- For instance, N+ONE DATACENTERS, Morocco’s leading carrier-neutral operator, announced in January 2024 the development of a new 2,000 sqm Tier III data center facility in Casablanca’s Nouaceur district, which was operational by late 2024. The company currently operates multiple data centers serving major Moroccan enterprises and international clients with high-speed fiber and cutting-edge cloud infrastructure.

Sub-Saharan Africa Influence

Sub-Saharan Africa represents 35% of the Morocco Data Center Market share. South Africa leads with advanced hyperscale and colocation hubs. Nigeria and Kenya emerge as growing players with rapid cloud adoption. It reflects the expanding enterprise digital ecosystem across the region. Sub-Saharan demand supports cross-border collaborations with Moroccan providers. The subregion’s growth highlights the importance of regional connectivity and cloud penetration.

- For instance, Teraco Data Environments completed its 30 MW JB5 data center at the Isando campus in Johannesburg in June 2025. JB5 features twelve 1,000 sqm data halls designed with zero water usage free air cooling and robust 120MVA utility power supply, catering to hyperscalers and enterprise clients across Africa. The Isando campus now totals 70 MW capacity, reinforcing Teraco’s regional leadership.

Europe and Middle East Connectivity Impact

Europe and the Middle East contribute 20% of the Morocco Data Center Market share. Morocco’s geographic proximity to Southern Europe enhances interconnection opportunities. Middle Eastern cloud providers also use Moroccan facilities for African expansion. It strengthens trade and digital integration between regions. Enterprises benefit from low-latency links supporting financial, telecom, and content services. The market reflects Morocco’s role as a bridge between global digital ecosystems.

Competitive Insights:

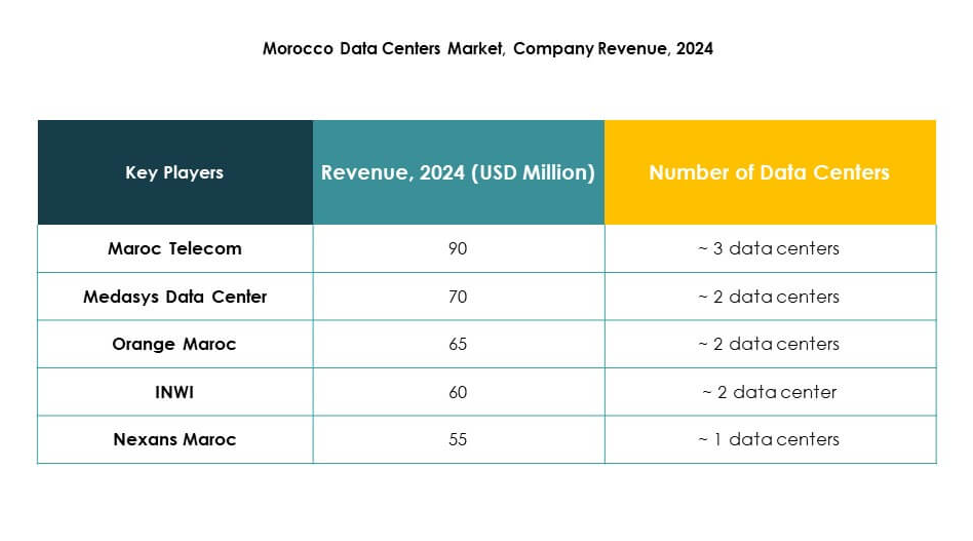

- Maroc Telecom

- Medasys Data Center

- Orange Maroc

- INWI

- Nexans Maroc

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

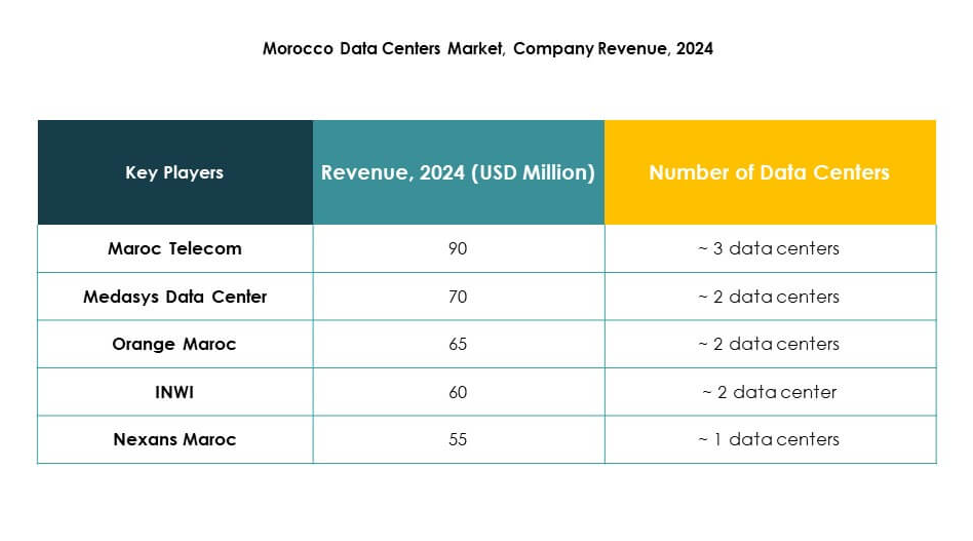

The Morocco Data Center Market features a diverse mix of local telecom operators, infrastructure providers, and global hyperscale leaders. It is characterized by strong domestic players such as Maroc Telecom, Orange Maroc, INWI, and Medasys Data Center, which drive colocation and enterprise services. Nexans Maroc enhances the ecosystem through cabling and infrastructure support. Global cloud providers including Microsoft, AWS, and Google are expanding regional footprints, offering scalable cloud platforms and advanced services. Competition is intensifying as enterprises demand low-latency solutions, robust cybersecurity, and hybrid models. Local operators leverage geographic presence and regulatory knowledge, while international firms bring capital and advanced technology. The market’s competitive balance highlights collaboration opportunities through partnerships, strategic alliances, and new facility investments that strengthen Morocco’s position as a regional digital hub.

Recent Developments:

- In January 2025, Morocco inaugurated its first data center offering hosting services to both public and private sector organizations at the Mohammed VI Polytechnic University, officially marking the nation’s entry into advanced cloud hosting and local infrastructure for digital modernization.

- In June 2025, Orange Maroc formed a key alliance with Ericsson to modernize its core network, laying the groundwork for the national rollout of standalone 5G services expected to begin in November 2025. This partnership supports Morocco’s digital strategy and envisions major advancements in mobile broadband, fixed wireless, and industrial connectivity in anticipation of the African Cup of Nations.

- In July 2025, Morocco announced plans to build a 500MW data center in Dakhla, powered entirely by renewable energy sources, as part of the country’s Digital Morocco 2030 roadmap aimed at boosting cloud infrastructure and digital sovereignty. The initiative was publicly disclosed by Amal El Fallah Seghrouchni, the nation’s digital transition minister, and this state-of-the-art facility is designed to support sensitive data storage and hybrid cloud services, strengthening Morocco’s positioning as a regional digital hub for Africa.