Executive summary:

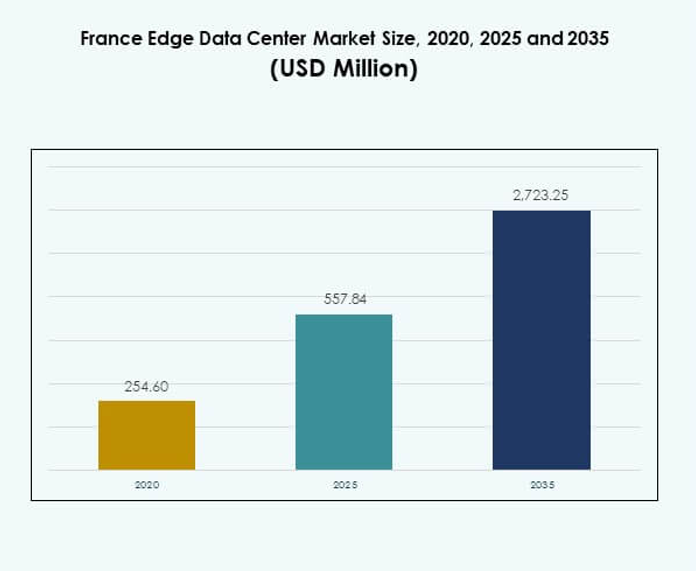

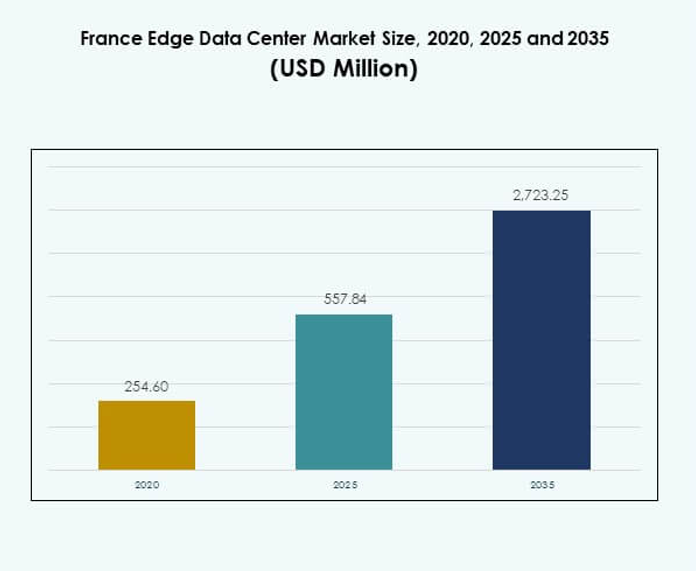

The France Edge Data Center Market size was valued at USD 254.60 million in 2020, reached USD 557.84 million in 2025, and is anticipated to reach USD 2,723.25 million by 2035, at a CAGR of 17.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| France Edge Data Center Market Size 2025 |

USD 557.84 Million |

| France Edge Data Center Market, CAGR |

17.04% |

| France Edge Data Center Market Size 2035 |

USD 2,723.25 Million |

The market growth is driven by rapid advancements in 5G connectivity, artificial intelligence, and IoT infrastructure. Enterprises are adopting edge data centers to reduce latency, enhance real-time analytics, and improve operational efficiency. Rising investments in sustainable infrastructure, modular designs, and AI-based automation highlight the strategic importance of this market for digital transformation, scalability, and long-term investor confidence across sectors.

Regionally, Paris dominates the France Edge Data Center Market due to its dense enterprise ecosystem, robust connectivity, and strong cloud infrastructure. Marseille and Lyon are emerging as key growth hubs supported by strategic subsea cable routes and industrial investments. These cities are fostering distributed data processing capabilities, strengthening France’s position as a leading European digital and edge connectivity hub.

Market Drivers

Rising Cloud and 5G Integration Driving Edge Infrastructure Expansion

The France Edge Data Center Market benefits from rapid 5G rollout and strong cloud adoption. Telecom operators and hyperscale providers are deploying edge facilities to reduce latency and enable real-time services. The integration of 5G networks supports autonomous vehicles, smart factories, and IoT-based logistics. Businesses gain faster data access and better operational agility. Cloud service providers are partnering with local firms to expand edge nodes. Enterprises rely on distributed computing for improved responsiveness and analytics. The combination of cloud flexibility and edge performance strengthens digital competitiveness. It positions France as a key hub for data-driven innovation in Europe.

Growing Focus on Data Sovereignty and Regulatory Compliance Enhancing Domestic Investments

Stricter European data protection rules are encouraging localized data storage and processing. France promotes digital sovereignty through policies that prioritize in-country infrastructure. Companies invest in local data centers to comply with GDPR and strengthen cybersecurity. These initiatives improve consumer trust and corporate transparency. Domestic and foreign investors view edge infrastructure as a low-risk, high-growth asset. The demand for secure, compliant edge facilities supports continuous capital inflows. Enterprises rely on regional hosting to protect sensitive data in regulated industries. The France Edge Data Center Market gains importance in aligning national data strategy with business continuity goals.

Sustainability and Green Energy Adoption Transforming Infrastructure Development

Sustainability remains a central focus for infrastructure modernization. Operators use renewable energy and energy-efficient cooling systems to reduce emissions. Government-backed green initiatives encourage the construction of carbon-neutral data centers. Firms adopt modular designs and liquid cooling technologies to lower power usage effectiveness (PUE). Sustainable investments improve brand reputation and attract eco-conscious clients. Energy reuse and waste heat recovery projects enhance operational efficiency. The market aligns with France’s carbon reduction targets and European Green Deal goals. It evolves toward an environmentally resilient digital ecosystem that supports responsible growth.

- For instance, in June 2025, Data4 Group deployed its first liquid-cooled data halls at the DC01 facility of its Marcoussis campus as part of a major retrofit, leveraging direct liquid cooling (DLC) and new Cooling Distribution Units (CDU) in partnership with Schneider and Danfoss, to reduce power usage effectiveness and energy consumption, as validated by industry sources and company press releases.

Increasing Demand for Low-Latency Services Driving Industrial and Enterprise Growth

The expansion of AI, AR/VR, and real-time analytics creates higher bandwidth demand. Enterprises need edge locations near users to process data instantly. Edge computing supports mission-critical sectors like finance, healthcare, and manufacturing. Businesses achieve faster decision-making and stronger customer experience. Smart city projects rely on local data processing for traffic, safety, and public services. Network providers focus on interconnectivity to ensure reliable edge-to-core data transfer. Industrial automation and robotics accelerate adoption across production hubs. The France Edge Data Center Market strengthens enterprise resilience by supporting next-generation digital operations.

- For instance, the Equinix PA10 data center in Saint-Denis, Paris, launched in 2023, utilizes 100% renewable energy and offers advanced electrical and cooling redundancy throughout its facility, supporting enterprise-grade, low-latency digital interconnections for more than 1,200 colocated clients and partners, verified through Equinix’s public data center specifications.

Market Trends

Hybrid Edge Architectures Enabling Seamless Cloud-Edge Integration

Organizations in France are adopting hybrid architectures combining edge and cloud platforms. This model provides flexibility in managing workloads between centralized and localized networks. Businesses optimize performance while maintaining security and scalability. The trend supports multi-access edge computing for real-time applications. Companies integrate APIs and orchestration tools for unified data control. Edge-cloud synergy helps enterprises deliver faster digital services. Technology providers introduce managed hybrid frameworks to simplify deployment. The France Edge Data Center Market reflects the shift toward distributed, cloud-native ecosystems.

Artificial Intelligence and Automation Revolutionizing Edge Operations

AI-driven systems are improving efficiency, predictive maintenance, and fault detection. Machine learning enhances energy optimization and resource allocation. Automation supports remote monitoring, reducing operational downtime. Enterprises use AI algorithms for workload distribution and capacity forecasting. This shift minimizes costs while improving service uptime. Intelligent control systems enable proactive fault management in dense networks. Vendors are integrating AI-based analytics to strengthen performance visibility. It transforms operational reliability in the France Edge Data Center Market.

Growing Deployment of Micro Edge Data Centers Across Urban Areas

The demand for micro data centers is increasing across metropolitan regions. Compact facilities support localized computing needs for e-commerce, media, and IoT. Enterprises deploy small edge units near consumers to improve latency. These installations reduce backhaul traffic and energy costs. Vendors design modular, portable data centers for flexible scaling. The model suits retail, telecom, and transport applications requiring instant processing. Urban digitalization accelerates adoption across France’s major cities. It highlights the decentralization trend in the France Edge Data Center Market.

Expansion of Strategic Partnerships Between Telecom Operators and Hyperscalers

Telecom firms and hyperscale cloud providers collaborate to build distributed edge ecosystems. These partnerships improve network coverage, computing capacity, and service innovation. Companies leverage shared infrastructure for reduced costs and better scalability. Cloud players expand presence through regional connectivity hubs. Telecom operators monetize edge infrastructure for enterprise applications. Cooperative models ensure faster rollouts and advanced user experiences. Such alliances strengthen France’s digital economy and network resilience. It defines a collaborative growth path in the France Edge Data Center Market.

Market Challenges

High Energy Consumption and Infrastructure Sustainability Concerns Impacting Long-Term Growth

Power demand from edge facilities remains a major challenge for scalability. Operators face rising electricity costs and environmental pressure. France’s decarbonization policies require greater efficiency and renewable integration. Managing thermal output in dense computing environments adds complexity. Developers must balance performance with sustainability targets. Limited availability of green power contracts affects expansion plans. Upgrading legacy data centers to modern, efficient systems demands significant investment. The France Edge Data Center Market must balance growth with energy and environmental priorities.

Shortage of Skilled Workforce and Complex Deployment Requirements Slowing Expansion

Edge data center deployment requires expertise in networking, cloud, and facility management. France faces a shortage of professionals trained in these technical fields. Project delays often occur due to limited skilled labor availability. Construction of edge sites demands precise engineering and compliance with safety standards. Complex integration with telecom and cloud systems increases deployment timelines. Enterprises must invest in upskilling and technical training. High operational complexity raises maintenance costs and reliability risks. It faces structural challenges in sustaining rapid infrastructure rollout across regions.

Market Opportunities

Integration of Edge and AI Technologies Creating New Service Models

Edge and AI convergence offers major innovation potential for businesses. Companies can process data locally, reducing latency for real-time analytics. AI-powered automation enhances predictive maintenance and customer personalization. Service providers are developing AI-as-a-service platforms through edge nodes. The shift improves responsiveness in industries like healthcare and retail. Startups gain investment opportunities in edge-based analytics tools. The France Edge Data Center Market supports scalable, intelligent data ecosystems for future growth.

Government and Private Sector Investments Accelerating Regional Edge Expansion

Public-private partnerships are financing digital infrastructure development. National programs encourage localized cloud infrastructure to improve data security. Telecom and IT firms collaborate on regional expansion projects. France’s emphasis on digital transformation drives network modernization. Local governments attract investors with tax incentives and energy-efficient zones. Enterprises benefit from proximity-based edge connectivity for critical operations. It positions France among Europe’s most advanced digital economies with strong infrastructure growth potential.

Market Segmentation

By Component

Solution dominates the France Edge Data Center Market with high demand for networking hardware, cooling systems, and modular racks. The rise in localized computing increases the need for scalable architecture. Service providers integrate advanced management and automation solutions. The service segment grows through consulting, deployment, and maintenance support. Solutions contribute major revenue due to hardware-driven expansion. Managed solutions enhance operational reliability for data-intensive sectors. Vendors prioritize interoperability and security within hybrid ecosystems. Growing automation adoption strengthens the market’s infrastructure backbone.

By Data Center Type

Colocation Edge Data Centers hold a significant share due to enterprise preference for shared facilities. Businesses seek scalable, cost-efficient hosting for low-latency operations. Managed and cloud-based centers follow with strong adoption in SMEs. Enterprises use colocation models to reduce CAPEX and ensure uptime. Cloud and Edge Data Centers enhance flexibility in resource utilization. The hybrid environment supports advanced computing needs in urban and industrial zones. The France Edge Data Center Market benefits from the diversity of operational models.

By Deployment Model

Cloud-based deployment dominates due to flexible scalability and reduced maintenance needs. Enterprises rely on virtualized infrastructure for better resource utilization. On-premises models remain relevant for regulated industries requiring high data security. Hybrid models gain traction by combining centralized and edge-based systems. The approach improves workload efficiency across distributed locations. Cloud service providers enhance integration through multi-cloud compatibility. Businesses value hybrid setups for agility and performance. The France Edge Data Center Market reflects this growing hybrid preference.

By Enterprise Size

Large enterprises lead market demand due to strong investment capabilities and complex data needs. They deploy private edge networks for analytics, automation, and customer engagement. SMEs adopt scalable edge solutions to improve operational efficiency. Service providers offer flexible subscription models tailored to smaller businesses. Enterprise-wide digital transformation supports market acceleration. Large organizations contribute substantial infrastructure growth across sectors. The SME segment expands with growing e-commerce and mobile app usage. It fosters balanced growth across diverse user categories.

By Application / Use Case

Power Monitoring and Environmental Monitoring applications dominate due to operational efficiency requirements. Real-time monitoring enhances energy control and system reliability. BI and Analysis gain traction for improving business insights and data-driven strategies. Asset Management solutions support predictive maintenance in industrial environments. Capacity Management optimizes workload distribution across edge networks. Enterprises integrate monitoring tools for reduced downtime and risk control. Smart automation improves performance in distributed systems. The France Edge Data Center Market supports data visibility and sustainability goals.

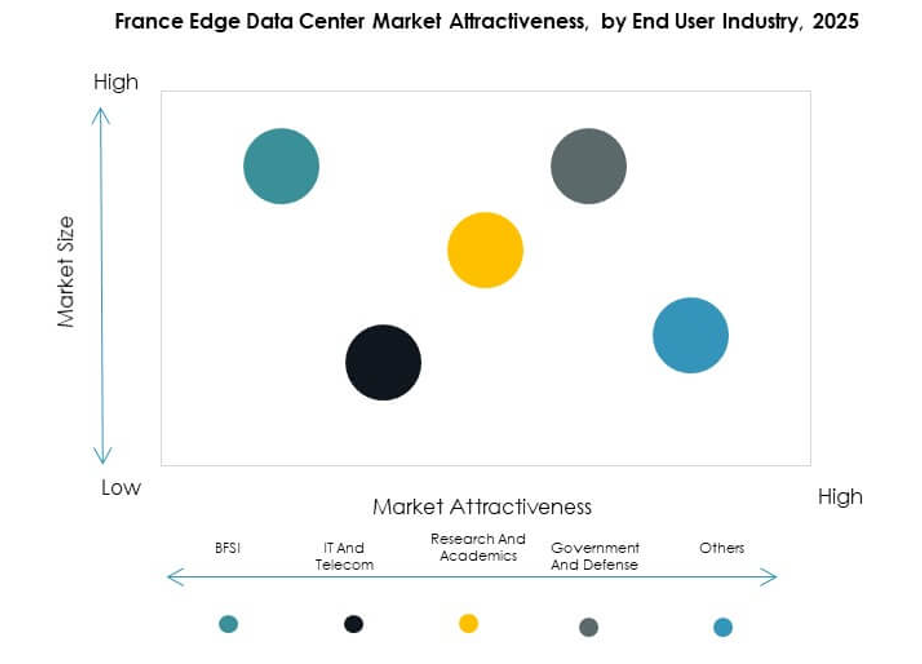

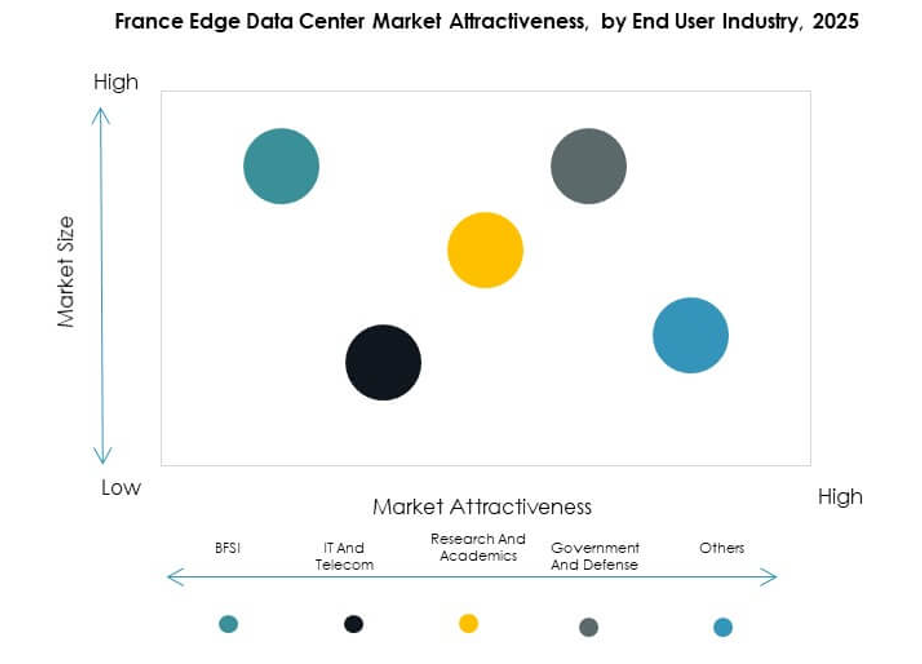

By End User Industry

IT and Telecommunications hold the largest share driven by the rapid growth of digital networks. BFSI and healthcare sectors follow due to data security and compliance requirements. Retail and e-commerce use edge centers to optimize transaction speed and analytics. Aerospace and defense sectors rely on secure data handling for mission-critical operations. Energy and utilities leverage edge processing for smart grid management. Emerging industries explore AI integration for enhanced service delivery. The France Edge Data Center Market supports vertical-specific innovation across digital sectors.

Regional Insights

Paris Region Holding Leading Market Share Due to Dense Enterprise Presence

The Île-de-France region, led by Paris, accounts for 46% of the France Edge Data Center Market. Strong enterprise concentration and digital infrastructure create high deployment rates. Proximity to government, telecom, and finance sectors strengthens data demands. The city’s connectivity with European fiber routes enhances data transfer efficiency. Leading providers expand multi-tenant edge hubs around Paris for reliability. It remains the central hub supporting France’s cloud-to-edge transition and enterprise digitalization.

Southern and Western France Emerging as Secondary Growth Corridors

Regions like Marseille and Lyon contribute 32% of the national share through port connectivity and industrial growth. Marseille benefits from international subsea cable routes linking Europe, Africa, and the Middle East. Lyon hosts growing clusters of cloud and IT service providers. The zones attract investors for their energy access and transport networks. Edge facilities in these regions serve logistics, retail, and energy companies. It drives balanced regional expansion beyond Paris in the France Edge Data Center Market.

- For instance, Interxion, a Digital Realty company, launched the MRS3 data center in Marseille, providing 7,100 square meters of equipped IT space, with a total planned power capacity of up to 16.5 MW. MRS3 connects to 14 subsea cables, including SEA-ME-WE 5 and Africa Coast to Europe, supporting high-density global cloud and logistics workloads and enhancing Marseille’s reputation as Europe’s top interconnection hub for three continents.

Northern and Eastern France Witnessing Early-Stage Development and Infrastructure Modernization

Northern and eastern areas collectively hold 22% market share with growing public-private initiatives. Lille and Strasbourg lead deployments focusing on cross-border connectivity and data redundancy. The presence of industrial and logistics companies drives demand for regional computing. Infrastructure programs enhance power stability and digital corridor links. Local governments support projects promoting data decentralization and sustainability. It strengthens national resilience through evenly distributed data center capacity across France.

- For instance, OVHcloud opened its fifth Strasbourg data center (SBG5) in September 2022, deploying a new modular hall with capacity for 1,800 server racks. This facility leverages advanced fire prevention and direct fiber links to bordering countries, decreasing network latency by up to 25% for enterprise and public clients in the region as part of OVHcloud’s hyper-resilience infrastructure program.

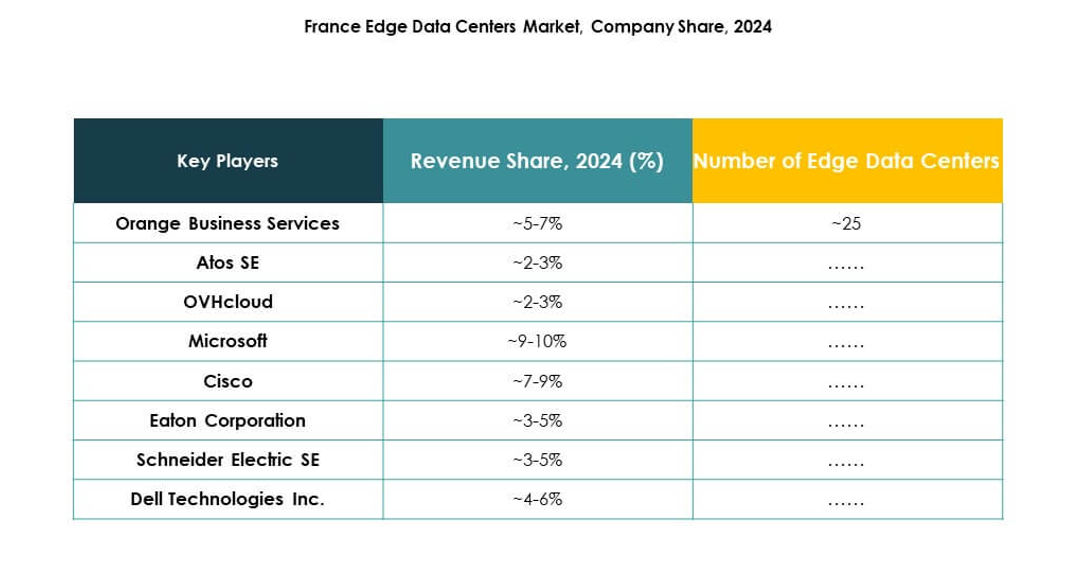

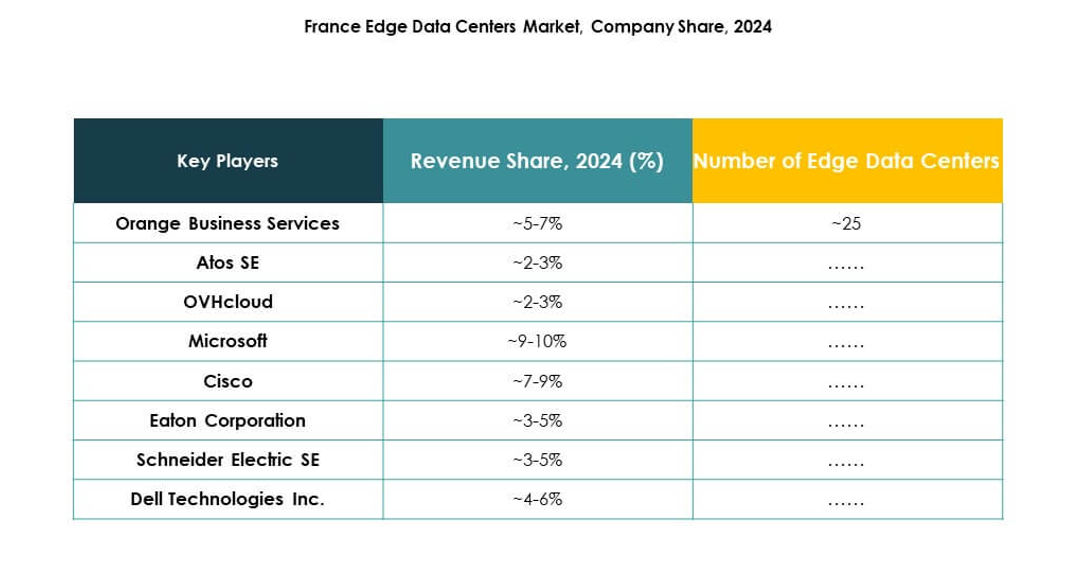

Competitive Insights:

- Orange Business Services

• Atos SE

• OVHcloud

• Nexylan

• EdgeConneX

• Eaton Corporation

• Dell Technologies Inc.

• Fujitsu

• Cisco

• SixSq

• Microsoft

• VMware

• Schneider Electric SE

• Rittal GmbH & Co. KG

• Others

The France Edge Data Center Market features intense competition among global and domestic players expanding their infrastructure and service portfolios. Companies focus on localized edge deployments, green power integration, and modular designs to enhance efficiency. Strategic collaborations with telecom operators and cloud providers drive scalability and network reach. Firms like OVHcloud, Atos SE, and Orange Business Services invest in hybrid edge-cloud solutions to support low-latency enterprise applications. Schneider Electric and Rittal emphasize sustainable power systems and intelligent cooling technologies. It continues to evolve through innovation-led competition, strong ecosystem partnerships, and investments in AI-driven automation to strengthen service reliability and market differentiation.

Recent Developments:

- In October 2025, Dell Technologies launched the PowerEdge XR8720t server, the market’s first single-server solution for Open RAN and Cloud RAN at the edge, significantly advancing edge AI infrastructure for telecom and data center customers in France and Europe.

- In September 2025, Fujitsu entered a major partnership agreement with Arrcus and 1Finity to strengthen AI networking solutions for data centers, covering scalable, cost-effective connectivity from the edge to the cloud and enhancing AI adoption for French and European operators.

- In May 2025, Cisco unveiled a series of strategic initiatives in France, culminating in the creation of a Global AI Hub to support digital upskilling, energy-efficient AI-ready infrastructure, and next-generation edge data center solutions, reinforcing Cisco’s 36-year partnership with France.

- In February 2025, Brookfield Infrastructure Partners, in collaboration with Data4, announced plans to invest €20 billion ($20.7bn) over five years to accelerate AI data infrastructure development in France. The partnership will focus on constructing next-generation edge data centers, driving digital transformation and supporting the country’s ambitions in AI and high-performance computing.