Executive summary:

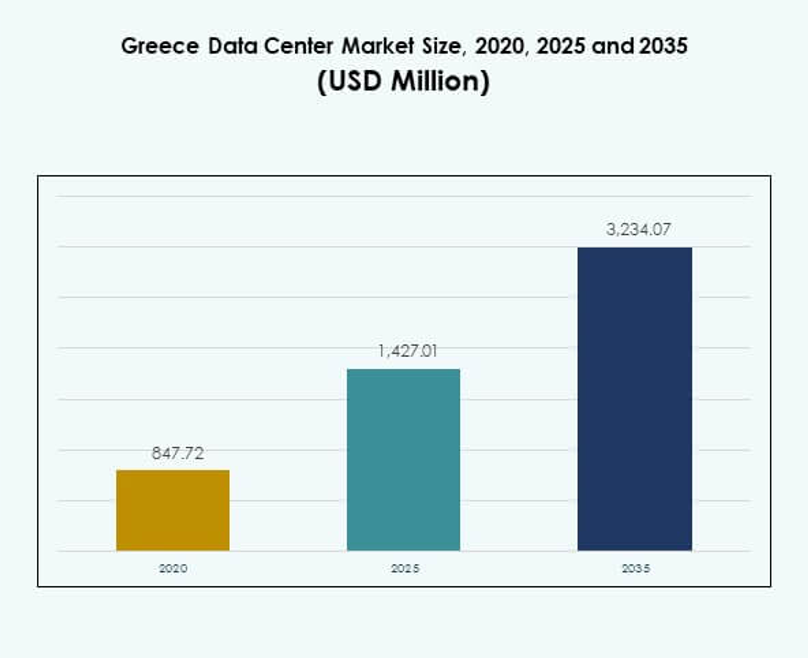

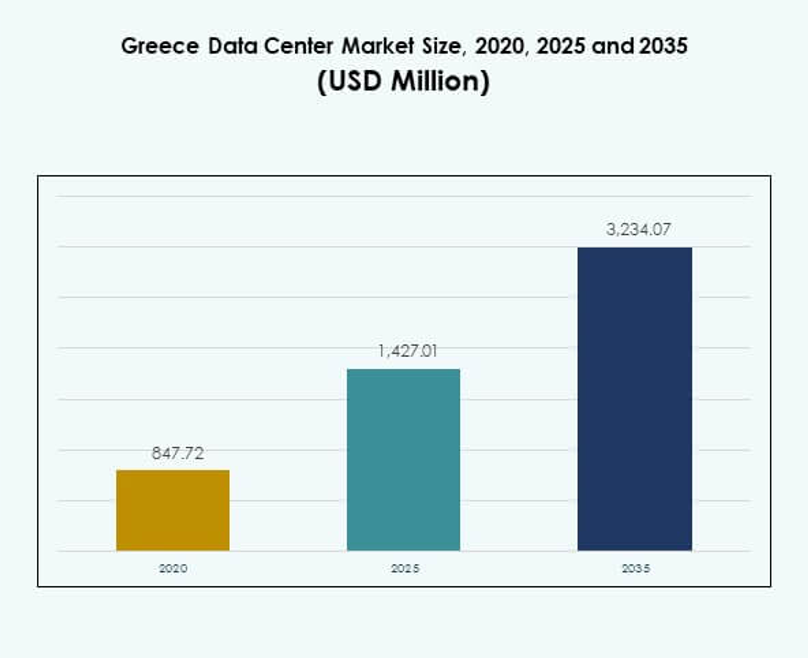

The Greece Data Center Market size was valued at USD 847.72 million in 2020 to USD 1,427.01 million in 2025 and is anticipated to reach USD 3,234.07 million by 2035, at a CAGR of 8.49% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Greece Data Center Market Size 2025 |

USD 1,427.01 Million |

| Greece Data Center Market, CAGR |

8.49% |

| Greece Data Center Market Size 2035 |

USD 3,234.07 Million |

The market is driven by increasing digital transformation, strong cloud adoption, and rising data storage needs across industries. Enterprises are modernizing IT systems with advanced colocation, edge, and hyperscale facilities to support AI, IoT, and 5G. Innovation in automation and energy-efficient infrastructure strengthens competitiveness. The Greece Data Center Market holds strategic importance for investors as it underpins business continuity, scalability, and cross-border digital connectivity.

Western Europe remains the leader due to advanced infrastructure and established hubs, while Southern Europe, including Greece, is emerging strongly as a regional digital services gateway. Greece benefits from its geographic position linking Europe, the Middle East, and Africa. Strategic investments in submarine cables, new colocation sites, and hyperscale projects position the country as a growing hub for digital and cloud ecosystems.

Market Drivers

Rising Adoption Of Cloud Services And Digital Transformation Initiatives Across Enterprises

The Greece Data Center Market is expanding due to strong adoption of cloud-based solutions. Enterprises and SMEs are transitioning from legacy IT systems to advanced cloud platforms. It creates demand for secure, scalable, and reliable data center infrastructure. Cloud migration enhances agility and operational efficiency for businesses across sectors. Companies seek advanced facilities to support big data and analytics. Strategic investments in modernization further accelerate demand. International providers are also establishing partnerships with local operators. Investors view this shift as a sign of long-term stability and profitability.

- For example, Microsoft announced the establishment of its cloud region in Greece as part of its “GR for GRowth” digital transformation initiative, with a commitment to train 100,000 people in digital technologies by 2025 and introduce secure Azure, Microsoft 365, and Dynamics 365 services for Greek enterprises. This is confirmed via official Microsoft announcements and press releases.

Growing Integration Of Artificial Intelligence And Internet Of Things In Enterprise Systems

Artificial intelligence and IoT are changing the operational dynamics of modern enterprises. The Greece Data Center Market benefits from rising investments in processing power and low-latency solutions. Organizations prioritize facilities that support machine learning, predictive analysis, and real-time monitoring. IoT adoption drives higher data storage and transmission needs. Edge data centers are becoming essential to support these connected ecosystems. AI accelerates automation within operations, reducing downtime and energy costs. It strengthens reliability and improves overall system performance. Businesses recognize the strategic importance of aligning data centers with AI-driven capabilities.

Strategic Importance Of Colocation Facilities For Businesses And International Connectivity

Colocation services play a central role in supporting enterprises with secure infrastructure. The Greece Data Center Market has seen increased interest from global providers in this segment. Businesses prefer colocation to reduce capital expenditure while maintaining access to advanced facilities. It provides better flexibility, scalability, and resilience compared to in-house setups. Enterprises view colocation as a foundation for hybrid IT strategies. Cross-border connectivity also boosts the relevance of such facilities. Greece’s location supports data traffic between Europe, Asia, and the Middle East. It positions the country as a growing hub for regional and global connectivity.

- For example, Digital Realty opened its Athens-3 (ATH3) Data Center campus in 2025, which is now the largest in Greece and provides advanced global cloud connectivity, including direct AWS Direct Connect on-ramp for low-latency, hybrid enterprise deployments. These developments are confirmed by corporate press releases and infrastructure partners.

Expansion Of Renewable Energy Use And Focus On Sustainable Data Center Infrastructure

Energy efficiency and sustainability remain critical drivers in shaping modern data centers. The Greece Data Center Market is influenced by the push toward renewable energy integration. Operators focus on reducing carbon footprints through advanced cooling and power optimization technologies. Businesses demand environmentally sustainable infrastructure to meet regulatory and corporate commitments. Green certifications and energy-efficient designs improve competitiveness in the market. It increases investor confidence in long-term projects. Governments also encourage initiatives supporting carbon-neutral infrastructure. The transition to greener data centers highlights the market’s alignment with global sustainability standards.

Market Trends

Increasing Deployment Of Edge Data Centers To Support Low-Latency Applications And Services

The Greece Data Center Market is witnessing strong momentum toward edge computing adoption. Demand is driven by 5G networks, IoT, and AI-based services. Businesses need distributed infrastructure to manage real-time workloads effectively. Edge facilities reduce latency, improve user experience, and support localized applications. They are particularly vital for healthcare, manufacturing, and smart city initiatives. It also helps enterprises expand operational efficiency in rural and urban areas. Cloud providers actively invest in micro and modular facilities. These deployments strengthen regional connectivity and broaden digital service availability.

Rise Of Hyperscale Data Centers To Accommodate Growing Cloud And Enterprise Workloads

Hyperscale facilities are emerging as a core trend in infrastructure development. The Greece Data Center Market is seeing global operators expand presence with hyperscale designs. Demand is led by enterprises requiring scalable computing and storage power. Hyperscale models improve energy management and operational efficiency. It creates opportunities for service providers offering cloud and AI integration. International partnerships are common in this trend. Hyperscale facilities also attract global investors seeking stable returns. This growth transforms the landscape and raises competitive standards in the market.

Wider Adoption Of Automation And Software-Defined Infrastructure To Optimize Operations

Automation has become central to streamlining data center management. The Greece Data Center Market is experiencing demand for DCIM, orchestration, and virtualization platforms. Software-defined infrastructure improves agility, monitoring, and cost efficiency. Enterprises gain control over resources, improving scalability and resilience. Automation reduces human error and strengthens security frameworks. It supports integration of AI-driven predictive analytics. Operators leverage these systems to meet growing customer requirements. It strengthens competitiveness while lowering operational complexity and risk exposure.

Expansion Of Cross-Border Connectivity And International Partnerships To Boost Digital Ecosystem

Cross-border collaborations are shaping the expansion of digital hubs in Southern Europe. The Greece Data Center Market benefits from global operators establishing alliances with local players. Strong connectivity routes enhance Greece’s role in regional data flows. International partnerships provide enterprises access to high-performance infrastructure. It supports growth in BFSI, telecom, and digital commerce sectors. Submarine cables and interconnection projects reinforce competitiveness. Operators prioritize Greece for its strategic geographic position. This trend positions the market as a gateway for Europe, Middle East, and Africa connectivity.

Market Challenges

High Infrastructure Costs And Energy Dependency Limiting Scalability Of Data Center Projects

The Greece Data Center Market faces challenges linked to high capital and operational costs. Developing modern facilities requires significant investment in advanced hardware and cooling systems. Rising energy prices in the region increase cost pressures for operators. Businesses face difficulty in managing long-term return on investments. Smaller enterprises are often unable to sustain large-scale infrastructure upgrades. It creates reliance on international providers with stronger financial backing. Limited energy diversification also affects competitiveness in the global arena. These challenges hinder faster adoption of advanced infrastructure at scale.

Regulatory Complexity And Shortage Of Skilled Workforce Affecting Market Expansion Efforts

Regulatory frameworks remain complex for companies planning data center projects. The Greece Data Center Market is impacted by lengthy approval processes and compliance requirements. Lack of standardization across different regions complicates project execution. The industry also faces a shortage of highly skilled IT and engineering professionals. Businesses struggle to find talent capable of managing advanced operations. It slows innovation adoption and creates dependency on external expertise. Operators are required to balance compliance with efficient service delivery. Addressing these issues remains essential for sustainable long-term growth.

Market Opportunities

Expanding Role Of Greece As A Regional Data Hub For Europe, Middle East, And Africa

The Greece Data Center Market holds significant potential due to its strategic geographic position. Connectivity to multiple regions increases its role as a digital hub. Enterprises and global providers are drawn by its proximity to major trade corridors. It enables growth in interconnection services and colocation demand. Investors recognize the country’s potential as an international gateway. Government initiatives also strengthen its infrastructure readiness. It creates strong opportunities for cross-border data exchange. Businesses see value in developing scalable and secure facilities in this environment.

Rising Demand For Managed Services And Hybrid Deployment Models Across Enterprises

The Greece Data Center Market is expected to grow through increased adoption of managed services. Enterprises focus on hybrid IT strategies that combine on-premises and cloud infrastructure. It creates demand for consulting, integration, and managed solutions. Managed services reduce operational burden for SMEs and large enterprises. Hybrid deployments improve flexibility and business continuity. Operators providing advanced service portfolios gain competitive advantage. It encourages long-term customer engagement and growth. Investors find opportunities in firms offering end-to-end service ecosystems.

Market Segmentation

By Component

Hardware dominates the Greece Data Center Market due to its critical role in infrastructure setup. Servers, storage, networking, and cooling systems form the backbone of facilities. Strong demand for racks, power, and security systems supports operational efficiency. Software solutions such as DCIM and virtualization are rising but hold smaller shares. Services such as consulting and managed offerings are expanding steadily. Hardware remains the largest contributor due to scalability needs. Global players continue upgrading hardware solutions for regional competitiveness.

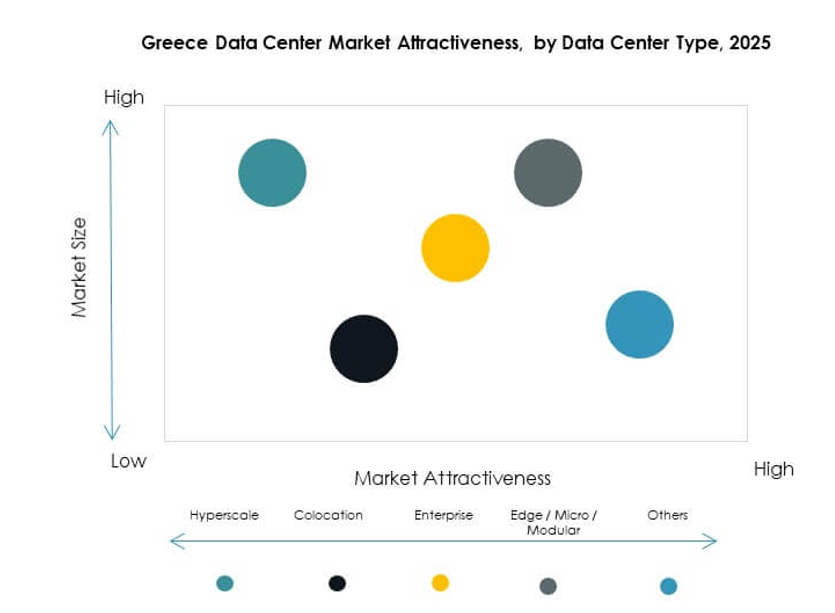

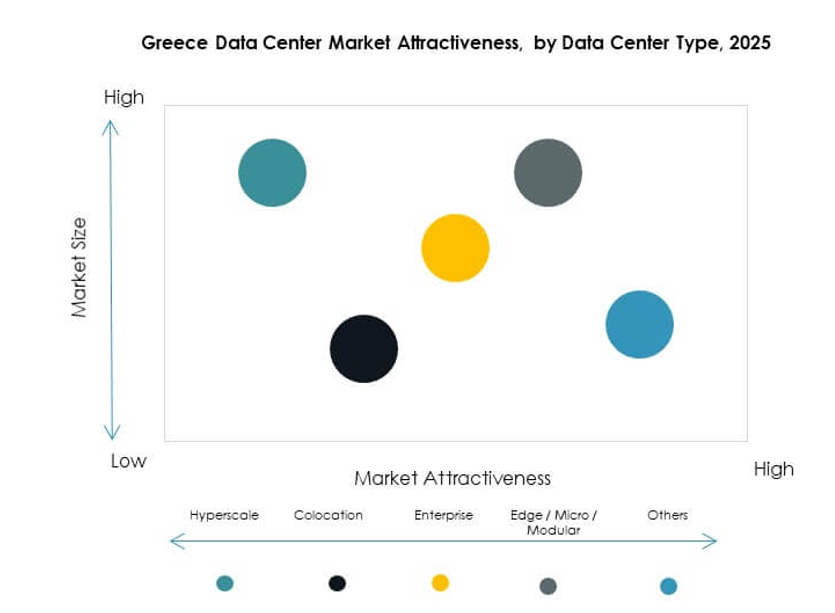

By Data Center Type

Colocation centers dominate the Greece Data Center Market due to enterprise demand for secure infrastructure. Hyperscale facilities are growing as global providers expand footprints. Edge and modular facilities also gain traction to support IoT and real-time applications. Cloud/IDC centers strengthen service delivery for IT and telecom sectors. Enterprise data centers retain importance for sensitive and regulated industries. Mega data centers are limited but emerging. Colocation remains the leader due to its scalability, flexibility, and cost efficiency.

By Deployment Model

Cloud-based deployment leads the Greece Data Center Market as enterprises shift toward agile solutions. Hybrid models gain traction as businesses balance compliance and flexibility. On-premises facilities maintain presence in government and defense. Cloud adoption remains dominant due to scalability and cost benefits. Enterprises prefer hybrid for mission-critical workloads. SMEs lean heavily toward cloud for lower infrastructure costs. The market shows rapid growth in cloud-driven infrastructure.

By Enterprise Size

Large enterprises dominate the Greece Data Center Market due to higher budgets and scalability needs. They prioritize colocation, cloud, and hyperscale solutions for operations. SMEs adopt managed services and cloud deployments for cost efficiency. SMEs drive demand for flexible, subscription-based models. Large enterprises support international connectivity and infrastructure growth. Both segments contribute to expansion, but large enterprises lead overall market share.

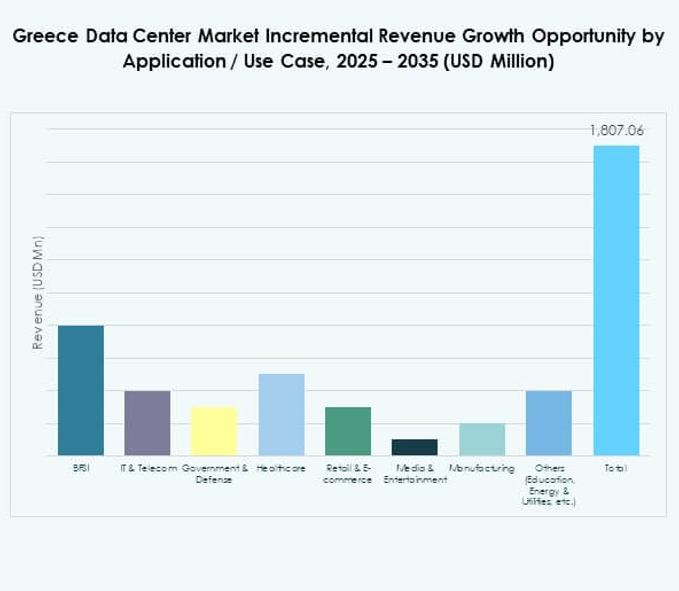

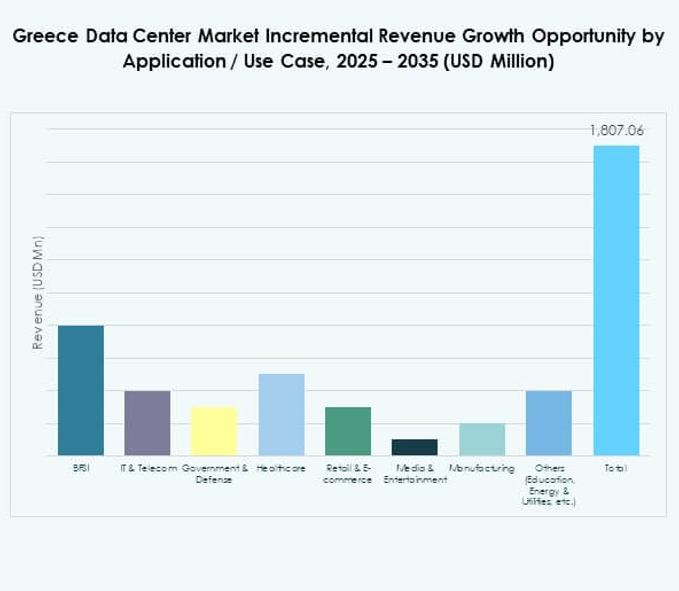

By Application / Use Case

IT and telecom lead the Greece Data Center Market due to rising demand for digital services. BFSI follows with strong requirements for secure and compliant infrastructure. Healthcare, retail, and e-commerce sectors show rapid adoption of colocation and cloud models. Media and entertainment expand demand for low-latency and scalable infrastructure. Manufacturing integrates IoT-driven solutions requiring edge facilities. Government and defense also account for significant adoption. Education and utilities contribute smaller shares but continue expanding.

By End User Industry

Cloud service providers dominate the Greece Data Center Market with growing investments. Enterprises follow with demand for private and hybrid facilities. Colocation providers support SMEs and global connectivity needs. Government agencies prioritize compliance-driven deployments. Others, including energy and education, adopt smaller but growing footprints. Cloud providers remain leaders due to the scale and scope of services delivered.

Regional Insights

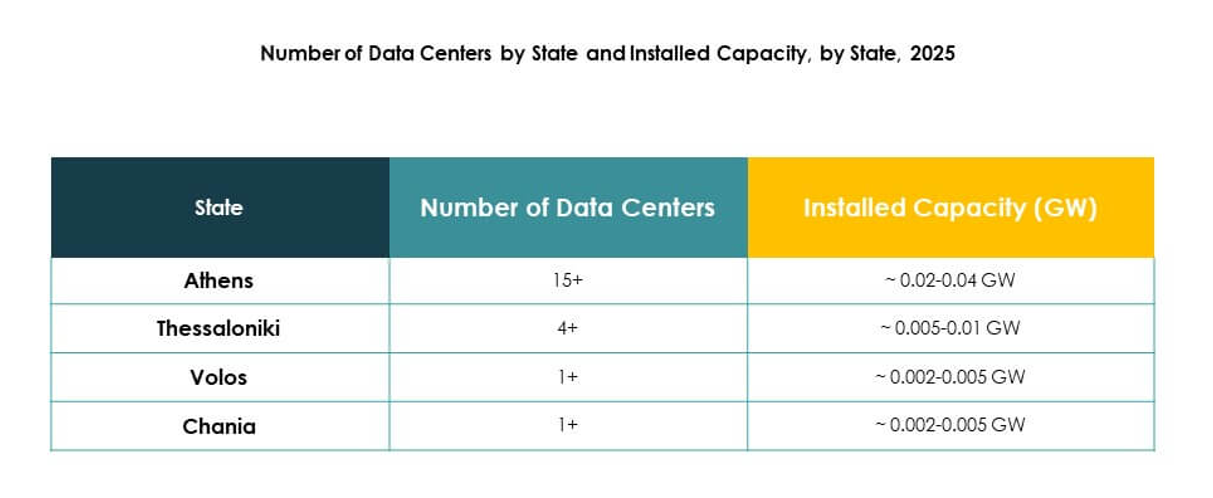

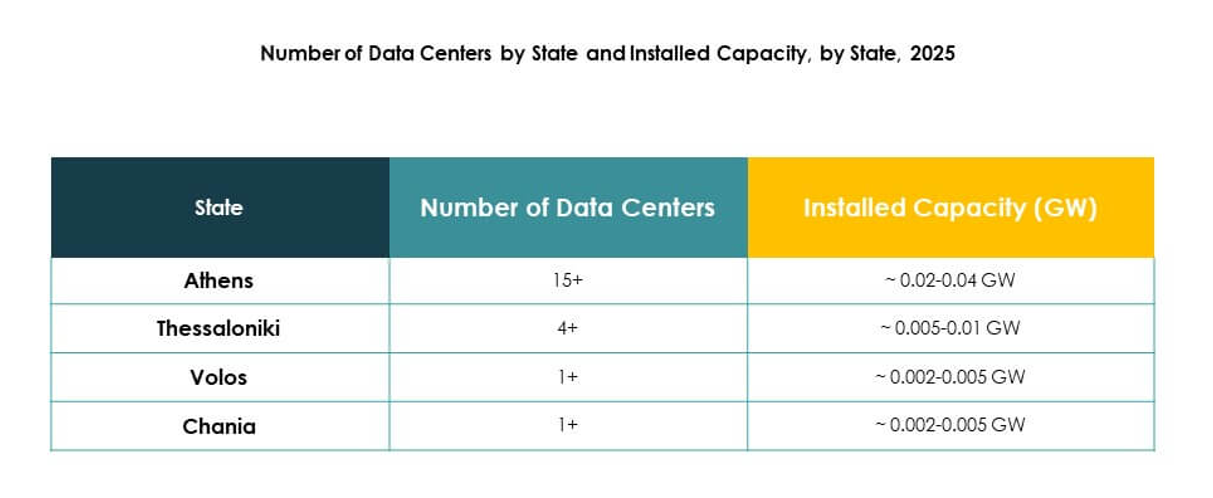

Western Greece Leading With Strong Share Supported By Infrastructure Investments

Western Greece leads the Greece Data Center Market with 38% share. Its growth is supported by advanced infrastructure and international connectivity projects. Strong investments from cloud providers enhance its position as a hub. Businesses in this subregion benefit from high-speed networks and colocation services. It is attractive to global investors seeking stable returns. Western Greece continues to strengthen its role in international data flows.

Central Greece Emerging As A Growing Subregion With Expanding Enterprise Demand

Central Greece holds 34% share in the Greece Data Center Market. The subregion is seeing increased adoption of hybrid and cloud-based deployments. Enterprises are driving growth through IT modernization and digital transformation strategies. Strong demand from BFSI, healthcare, and telecom supports expansion. It is developing into a critical hub for mid-sized and large enterprises. Central Greece is becoming an important part of the market’s growth path.

- For instance, Lamda Hellix (Digital Realty) launched construction of a new carrier-neutral data center in Heraklion, Crete scheduled for 2025 with projected capacity of up to 6.5MW, designed for intercontinental and subsea cable interconnection, officially announced in October 2022.

Eastern Greece Developing With Niche Growth Opportunities And Cross-Border Connectivity

Eastern Greece represents 28% share of the Greece Data Center Market. It benefits from geographic connectivity to regional and international routes. Businesses utilize data centers for manufacturing, retail, and logistics applications. Investment in edge and modular infrastructure supports local ecosystems. It is seen as an emerging destination for cross-border interconnection projects. Eastern Greece shows steady growth with long-term potential.

- For instance, Sparkle inaugurated a second Point-of-Presence (PoP) in Thessaloniki in July 2025, expanding secure, low-latency connectivity for Southeastern Europe and interconnecting Greece with the BlueMed submarine cable system, as confirmed in their press release dated July 16, 2025.

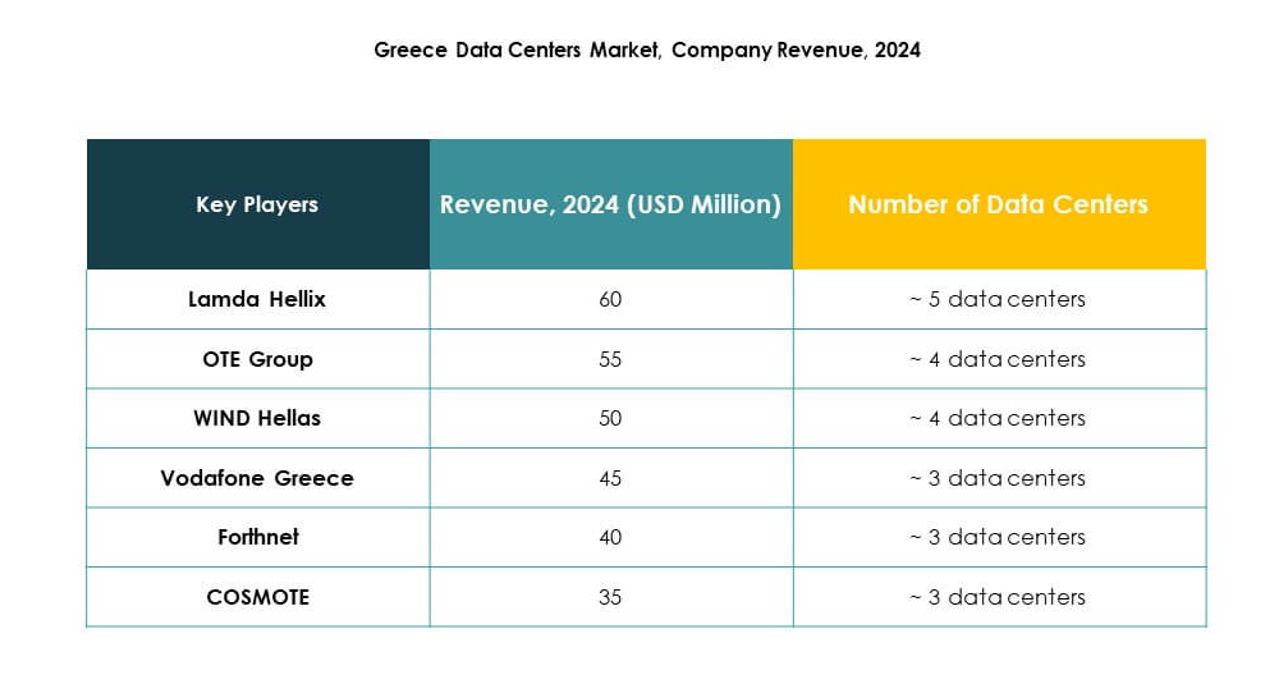

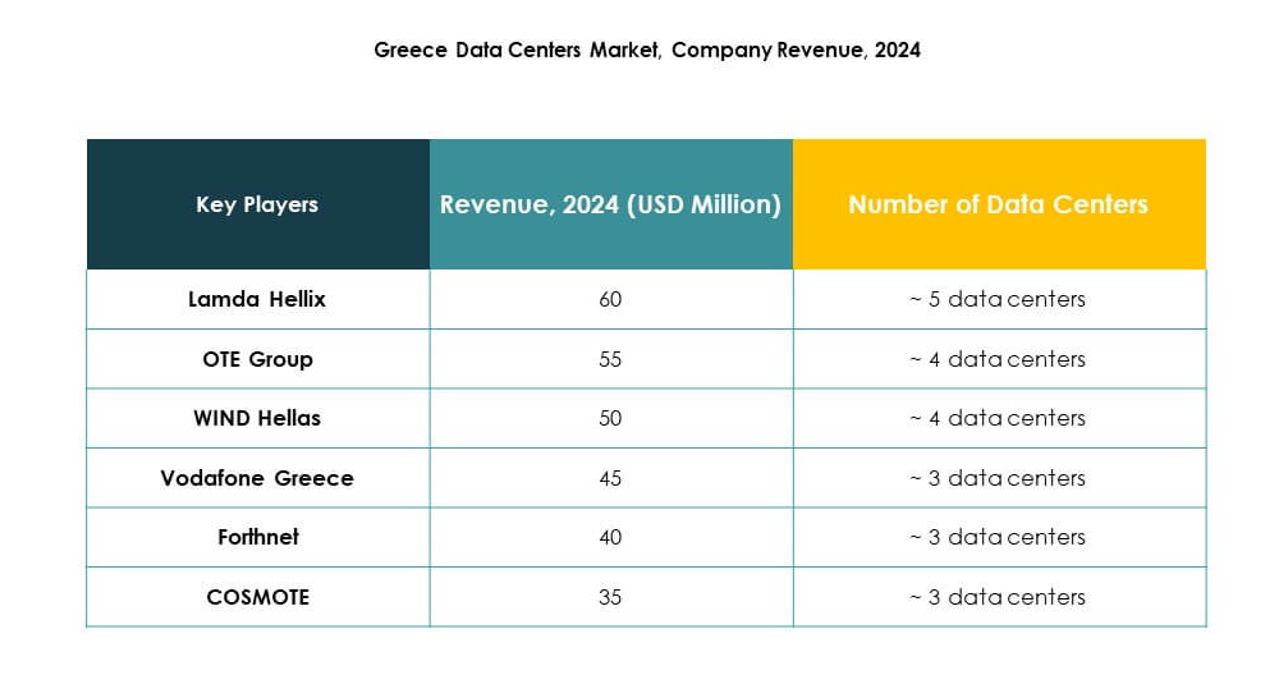

Competitive Insights:

- Lamda Hellix

- OTE Group

- WIND Hellas

- COSMOTE

- Forthnet

- Vodafone Greece

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Greece Data Center Market features strong competition between domestic telecom operators, global cloud providers, and colocation specialists. Local leaders such as Lamda Hellix, OTE Group, and COSMOTE invest in expanding infrastructure and energy efficiency to support digital transformation. International giants including Microsoft, AWS, and Google strengthen competitiveness by deploying cloud regions and hyperscale facilities. It benefits from strategic alliances, mergers, and new service launches that accelerate adoption of cloud and colocation models. Vodafone Greece, WIND Hellas, and Forthnet focus on integrated telecom-data services to capture enterprise clients. Digital Realty and NTT target global connectivity and enterprise-grade solutions, reinforcing Greece’s position as a growing regional hub.

Recent Developments:

- In August 2025, Metlen delivered the Athens-3 (ATH3) Data Center, managed by Digital Realty, marking it as the largest data center facility in Greece. This newly launched site in Koropi, Attica, provides modern data storage and global cloud connectivity services and is already attracting significant interest from leading international service providers, reinforcing Greece’s position as a growing hub for digital services in Southeastern Europe.

- In April 2025, Digital Realty officially launched the HER1 data center on the Greek island of Crete, expanding its capabilities with an advanced facility that supports a 1MW IT load and can scale up to 5MW. This investment amplifies Digital Realty’s presence, enabling Crete to serve as a submarine cable and digital connectivity gateway for East Europe, the Middle East, and North Africa.