Executive summary:

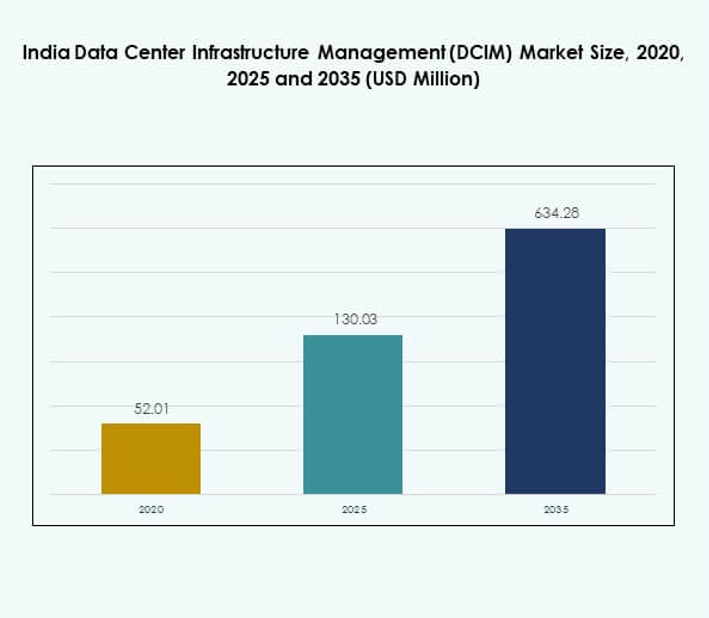

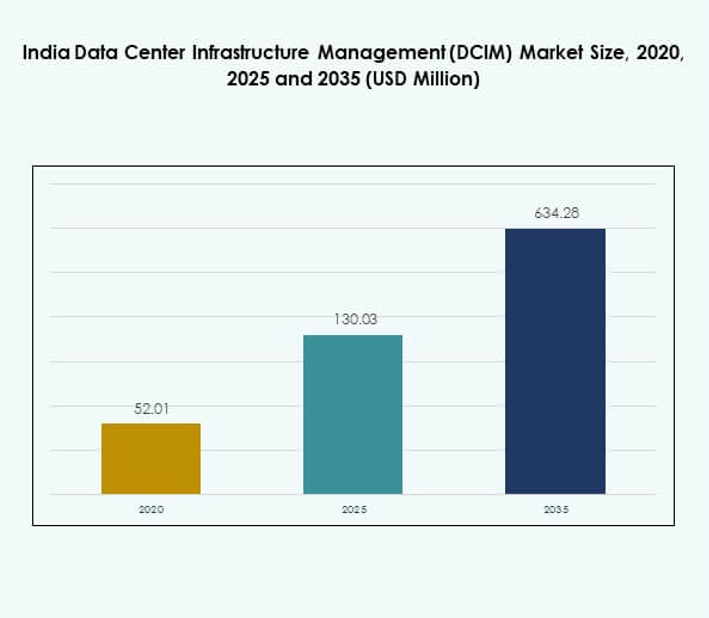

The India Data Center Infrastructure Management (DCIM) Market size was valued at USD 52.01 million in 2020 to USD 130.03 million in 2025 and is anticipated to reach USD 634.28 million by 2035, at a CAGR of 19.01% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| India Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 130.03 Million |

| India Data Center Infrastructure Management (DCIM) Market, CAGR |

19.01% |

| India Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 634.28 Million |

Growth in the India Data Center Infrastructure Management (DCIM) Market is fueled by rapid adoption of cloud, edge computing, and AI-enabled automation. Enterprises are deploying intelligent monitoring platforms to improve operational efficiency, enhance capacity planning, and optimize energy consumption. Innovation in sustainability-driven solutions is aligning with stricter compliance standards, while digital transformation across telecom, BFSI, and retail strengthens demand. The market holds strategic importance for businesses and investors due to its role in scaling digital infrastructure.

Regionally, North and Western India dominate the India Data Center Infrastructure Management (DCIM) Market, driven by hyperscale investments in Mumbai, Delhi NCR, and Pune. Southern India is emerging as a strong hub, supported by infrastructure growth in Chennai, Bengaluru, and Hyderabad. Eastern and Central regions are gaining attention due to cost advantages and government digital initiatives. This geographic spread highlights India’s potential as a diversified and resilient data center ecosystem.

Market Drivers

Rising Digital Transformation and Cloud Integration Across Indian Enterprises

The India Data Center Infrastructure Management (DCIM) Market is driven by rapid digital transformation across enterprises that increasingly adopt cloud-based services and virtualization technologies. Businesses are focusing on automation and software-defined infrastructure to manage growing data volumes efficiently. Adoption of AI-enabled tools allows predictive maintenance and proactive monitoring, reducing downtime. Innovation in edge computing strengthens DCIM adoption by enabling decentralized management of assets. It supports real-time data processing across critical industries like telecom and BFSI. Investors view the sector as a strategic opportunity due to consistent demand. Companies deploying hybrid models also enhance operational agility. This shift emphasizes the importance of scalable and flexible infrastructure management solutions.

- For instance, after deploying AI and automation, Nxtra targets a 10% increase in data center asset life, a 15% boost in equipment performance, and a 25% gain in overall productivity. Airtel integrates NVIDIA NeMo in its AI-led operations to analyze over 84% of 100 million annual calls, while its Xtelify cloud manages up to 1.4 billion transactions per minute for 360 million customers across India.

Growing Importance of Energy Efficiency and Sustainable Operations in Data Centers

Organizations are prioritizing sustainability, pushing adoption of energy-efficient DCIM solutions that optimize power usage and cooling operations. Rising electricity costs and strict environmental regulations are prompting operators to focus on energy savings. Automation helps track and reduce carbon emissions while maintaining reliability. The India Data Center Infrastructure Management (DCIM) Market benefits from AI-powered energy optimization tools. Telecom and hyperscale providers are integrating renewable energy into their operations to align with corporate ESG goals. Investors see value in platforms that offer measurable energy savings. Enterprises demand solutions that provide visibility into energy consumption patterns. It creates a market environment focused on sustainability-driven competitiveness.

Adoption of Advanced Security and Compliance Features in Infrastructure Management

Data security and compliance requirements are accelerating the demand for advanced DCIM platforms in India. Cyber risks are increasing, making it essential for organizations to secure their infrastructure. DCIM tools integrate monitoring, asset tracking, and compliance reporting into unified dashboards. The India Data Center Infrastructure Management (DCIM) Market responds to regulations around data sovereignty and industry-specific compliance frameworks. Companies are investing in encrypted monitoring and advanced auditing features. Financial institutions and healthcare providers drive this demand due to strict compliance needs. Businesses see strategic value in mitigating risks through intelligent platforms. It enables operators to safeguard mission-critical assets effectively.

Strategic Role of AI, IoT, and Automation in Driving Operational Excellence

The introduction of AI, IoT, and automation is transforming how enterprises manage infrastructure. Intelligent algorithms improve capacity planning and enhance workload management. Real-time insights enable faster decision-making and reduce downtime risks. The India Data Center Infrastructure Management (DCIM) Market is strengthened by integration with IoT devices that provide granular visibility. Investors recognize the potential of automated solutions for long-term cost reduction. Automation reduces human dependency in complex environments, boosting efficiency. Telecom and e-commerce firms adopt these technologies aggressively to scale operations. It positions DCIM as a foundation for the country’s digital economy.

- For instance, Shakti Cloud launched with 4,096 NVIDIA H100 GPUs in January 2024, scaled to 16,384 GPUs by June 2024, and targets 32,768 GPUs by end of 2025, with its NM1 facility supporting up to 50 MW IT load and offering AI supercomputing on a pay-per-use model for Indian enterprises.

Market Trends

Expansion of Hyperscale Data Centers and Colocation Services Across India

The India Data Center Infrastructure Management (DCIM) Market is witnessing rapid adoption of hyperscale facilities and colocation services. Enterprises prefer shared infrastructure models to optimize cost and efficiency. Colocation providers are investing in large-scale campuses supported by strong fiber connectivity. Hyperscale investments drive demand for advanced monitoring tools to manage complex workloads. DCIM solutions enable real-time insights into large, distributed environments. It supports performance optimization while reducing risks. Investors are channeling funds into projects focused on hyperscale scalability. The trend highlights growing dependence on advanced infrastructure ecosystems.

Integration of Renewable Energy and Green Initiatives in Data Center Operations

Operators are embedding renewable energy solutions to align with sustainability goals and regulatory frameworks. The India Data Center Infrastructure Management (DCIM) Market gains momentum through platforms that optimize energy consumption. Solar and wind projects integrated with data centers are becoming mainstream. Companies seek DCIM tools that enable precise monitoring of renewable power usage. Environmental accountability improves brand reputation and meets investor expectations. It strengthens long-term operational resilience by reducing reliance on conventional energy. Enterprises also benefit from significant cost reductions. The trend ensures India becomes a hub for eco-friendly infrastructure development.

Shift Toward Hybrid and Cloud-Enabled DCIM Deployments Among Enterprises

Businesses are embracing hybrid models to combine the benefits of on-premises and cloud-enabled deployments. The India Data Center Infrastructure Management (DCIM) Market reflects this shift as enterprises demand flexibility. Hybrid models provide scalability without compromising data sovereignty. Cloud platforms accelerate deployment and reduce upfront costs. Enterprises in healthcare, BFSI, and IT drive this adoption due to compliance and performance needs. It strengthens resilience while supporting workload diversity. Investors view hybrid approaches as growth accelerators for long-term adoption. The trend marks a balance between flexibility and regulatory compliance.

Focus on Real-Time Analytics and AI-Driven Decision Making

Organizations are adopting advanced analytics and AI to maximize data center efficiency. The India Data Center Infrastructure Management (DCIM) Market is evolving with predictive insights that minimize downtime risks. AI algorithms enhance power management, asset optimization, and security compliance. Businesses prioritize real-time dashboards to track infrastructure health. It empowers operators to prevent outages through proactive measures. Telecom and retail firms lead adoption to manage large transaction volumes. Investors recognize value in AI-led platforms that scale across multiple environments. This trend emphasizes data-driven operational excellence.

Market Challenges

Complexity in Integration and High Initial Costs for Enterprises

The India Data Center Infrastructure Management (DCIM) Market faces challenges due to high implementation costs and complexity in integration. Enterprises must align legacy systems with new DCIM platforms, requiring significant technical expertise. Many organizations struggle to allocate budgets for advanced tools. It slows adoption among SMEs despite strong demand. Vendor lock-in risks also discourage enterprises from switching platforms. Training requirements for staff add to the overall burden. Large enterprises can absorb costs, but smaller firms face difficulties. The complexity creates barriers for full-scale implementation across industries.

Regulatory Uncertainty and Shortage of Skilled Workforce

The sector experiences regulatory ambiguity, which slows down investments and deployment timelines. The India Data Center Infrastructure Management (DCIM) Market must adapt to evolving compliance frameworks, which differ across industries. Organizations face pressure to ensure data localization and maintain high security standards. It requires advanced technical expertise, which is limited in supply. The shortage of skilled professionals in DCIM technologies restricts scalability. Businesses often outsource, increasing operational dependencies. This shortage impacts innovation cycles and delays adoption. Investors seek clarity in policies to reduce risks.Market Opportunities

Rising Investments in Hyperscale Data Centers and Regional Expansion

The India Data Center Infrastructure Management (DCIM) Market offers opportunities through large-scale hyperscale investments across key cities. Telecom providers, global cloud players, and local firms are expanding data center footprints. It increases demand for intelligent infrastructure management tools. Emerging regions outside major metros present cost benefits and untapped growth. Enterprises seek reliable platforms to optimize operations across expanding networks. Investors consider regional diversification a strategic opportunity. The opportunity strengthens India’s position as a global digital hub.

Adoption of AI-Enabled and Sustainable DCIM Platforms for Future Growth

Sustainability and AI-enabled solutions create long-term growth potential in the India Data Center Infrastructure Management (DCIM) Market. Enterprises seek platforms that deliver real-time visibility, energy optimization, and predictive analytics. It aligns with ESG compliance and operational efficiency goals. AI enhances decision-making and supports automation-driven strategies. Investors recognize value in sustainable, data-driven tools that scale across industries. The opportunity lies in integrating renewable energy with AI-led DCIM platforms. This convergence builds a competitive edge for future-ready enterprises.

Market Segmentation

By Component

Solutions dominate the India Data Center Infrastructure Management (DCIM) Market, driven by demand for monitoring, capacity planning, and power optimization. Advanced solutions provide unified dashboards for real-time decision-making. Services follow with steady growth, offering consulting, training, and integration support. Businesses rely on services for tailored implementations. Solutions account for the majority market share, reflecting the industry’s focus on automation and visibility.

By Data Center Type

Cloud and edge data centers lead the India Data Center Infrastructure Management (DCIM) Market due to rising adoption of distributed computing. Hyperscale growth in metro cities drives demand for advanced tools. Colocation and managed data centers also contribute significantly by offering cost-effective shared infrastructure. Enterprise-owned facilities remain relevant in regulated industries. Edge deployments expand in secondary cities to support localized workloads. The cloud and edge segment remains the most dominant.

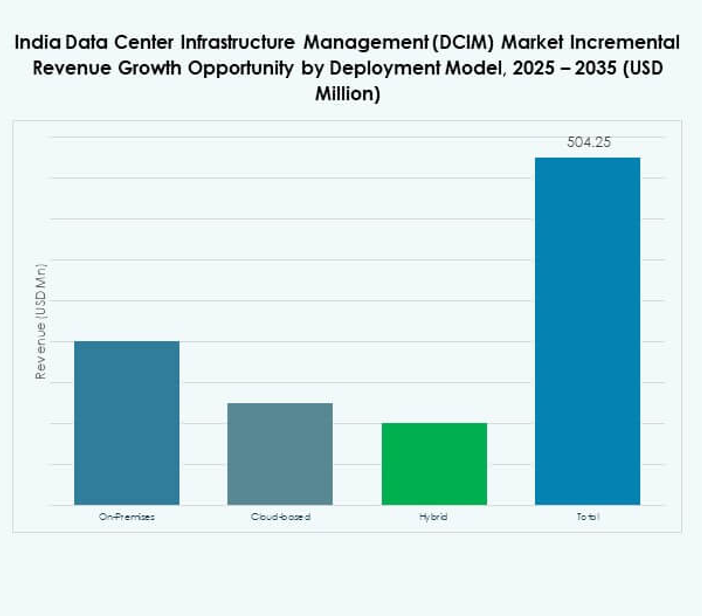

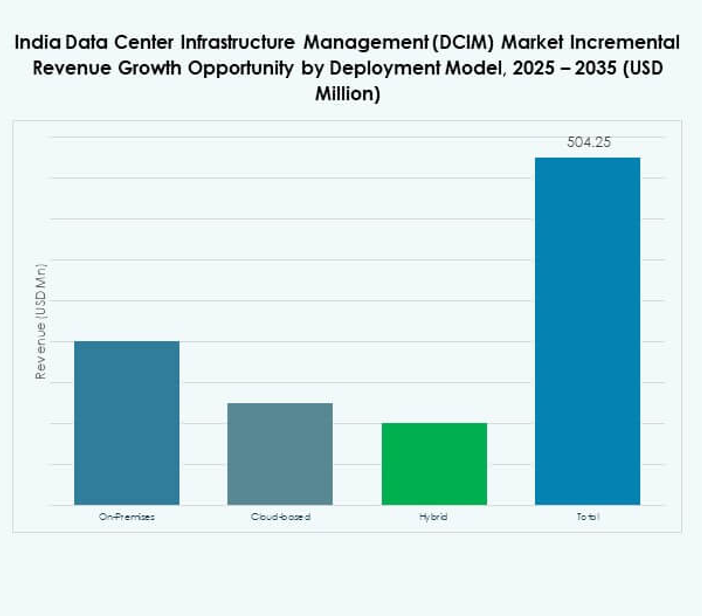

By Deployment Model

Cloud-based DCIM platforms lead adoption across enterprises due to scalability and lower upfront costs. The India Data Center Infrastructure Management (DCIM) Market reflects a strong demand for hybrid solutions balancing flexibility and compliance. On-premises remains critical for industries requiring full data control. SMEs prefer cloud deployments for affordability and ease of integration. Large firms adopt hybrid models to secure workloads across regions. The trend demonstrates growing reliance on cloud-native management tools.

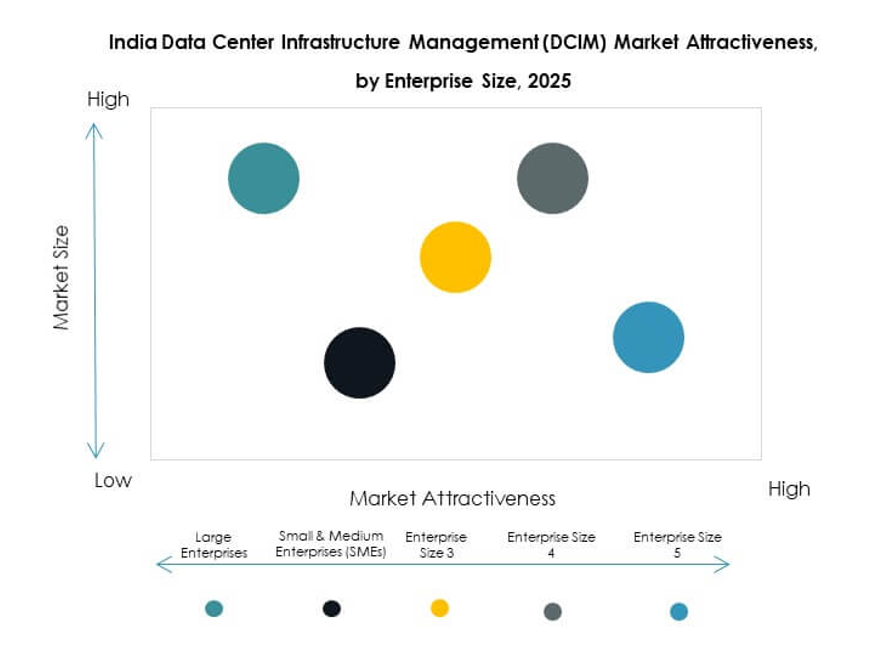

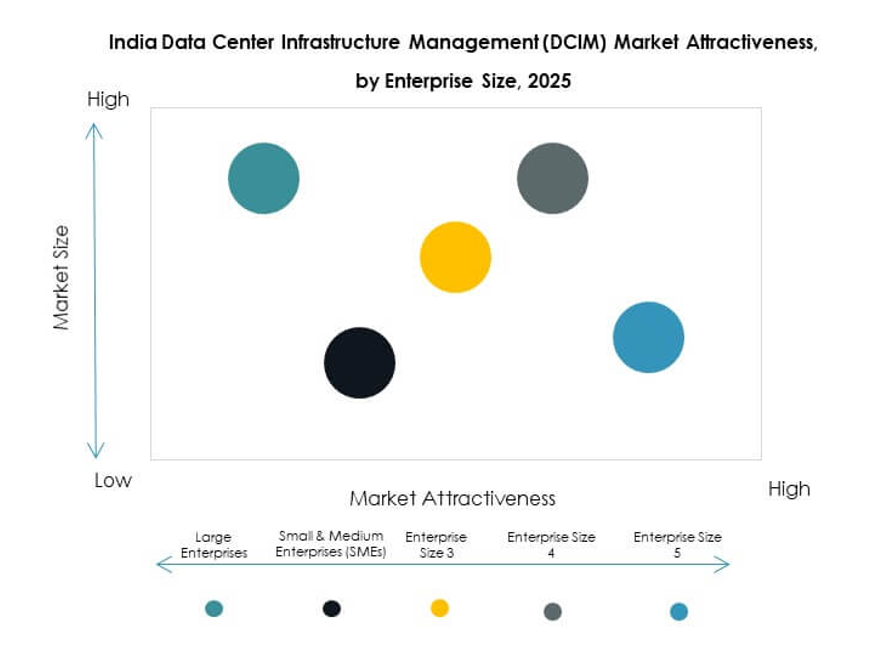

By Enterprise Size

Large enterprises dominate the India Data Center Infrastructure Management (DCIM) Market by driving adoption of advanced platforms. They invest in AI-driven capacity planning, energy optimization, and predictive tools. SMEs show rising adoption, encouraged by cost-effective cloud platforms. The segment benefits from government digitalization programs. Large enterprises hold the largest market share due to higher budgets and compliance needs. SMEs represent a fast-growing contributor with untapped potential.

By Application / Use Case

Asset management leads the India Data Center Infrastructure Management (DCIM) Market due to its role in monitoring and optimizing infrastructure utilization. Power monitoring follows, supporting operational efficiency and cost savings. Capacity and environmental monitoring gain traction with sustainability focus. Business intelligence and analytics enhance decision-making. Industries demand real-time dashboards for reliability and predictive insights. Asset management maintains the largest share with critical operational importance.

By End User Industry

IT and telecommunications dominate the India Data Center Infrastructure Management (DCIM) Market due to high data traffic and cloud reliance. BFSI follows with strong demand for secure and compliant platforms. Healthcare drives adoption to support digital health initiatives. Retail and e-commerce expand usage to manage transaction-heavy environments. Energy and utilities leverage DCIM for reliability in power-intensive operations. Aerospace and defense also integrate advanced systems for secure environments. IT and telecom remain the largest end-user group.

Regional Insights

North and Western India Leading Market Share

North and Western India account for nearly 42% share of the India Data Center Infrastructure Management (DCIM) Market. Delhi NCR, Mumbai, and Pune dominate with large hyperscale investments and robust telecom infrastructure. It benefits from strong fiber connectivity and regulatory support. These regions attract global cloud providers and colocation operators. High population density and demand for digital services fuel adoption. Enterprises consider these hubs critical for national digital transformation. Investors prioritize these regions due to consistent returns.

- For instance, CtrlS Datacenters announced plans to triple its portfolio from 8 to 25 data centers by 2025, including a 2 million square foot hyperscale data center park under construction in Navi Mumbai, as confirmed in company and industry reports.

Southern India Emerging as a Data Center Hub

Southern India contributes 37% share, led by Chennai, Bengaluru, and Hyderabad. The India Data Center Infrastructure Management (DCIM) Market thrives here due to strategic coastal connectivity and reliable power supply. Hyderabad emerges as a hyperscale hub with rapid expansion projects. Bengaluru leverages its strong IT ecosystem for adoption. Chennai remains a preferred location for disaster recovery sites. It drives growth in cloud and colocation services. Southern states are poised to strengthen their position further.

- For instance, Nxtra by Airtel operates a hyperscale data center in Bengaluru with capacity of up to 14 MW IT load and 2,800 racks, supported by multi-path fiber, AI-led operations, and IGBC-certified sustainable infrastructure as confirmed in August 2025.

Eastern and Central India as Fast-Growing Secondary Regions

Eastern and Central India represent 21% share of the India Data Center Infrastructure Management (DCIM) Market. Kolkata, Bhubaneswar, and Nagpur lead regional expansion due to cost advantages. Enterprises explore these markets for resilience and diversification. Government-backed digital programs accelerate adoption in tier-2 cities. It opens opportunities for affordable colocation and edge deployments. Investors view these areas as untapped growth corridors. Growth here supports balanced distribution of data center infrastructure across the country.

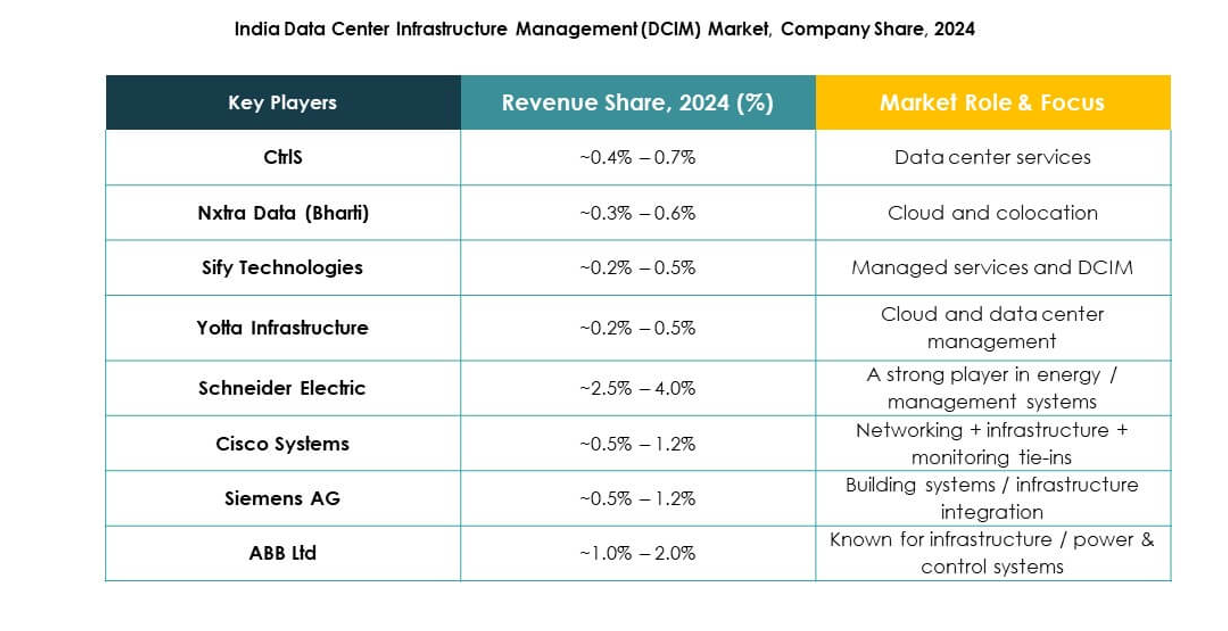

Competitive Insights:

- CtrlS

- Nxtra Data (Bharti)

- Sify Technologies

- Yotta Infrastructure

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- Schneider Electric SE

- Siemens AG

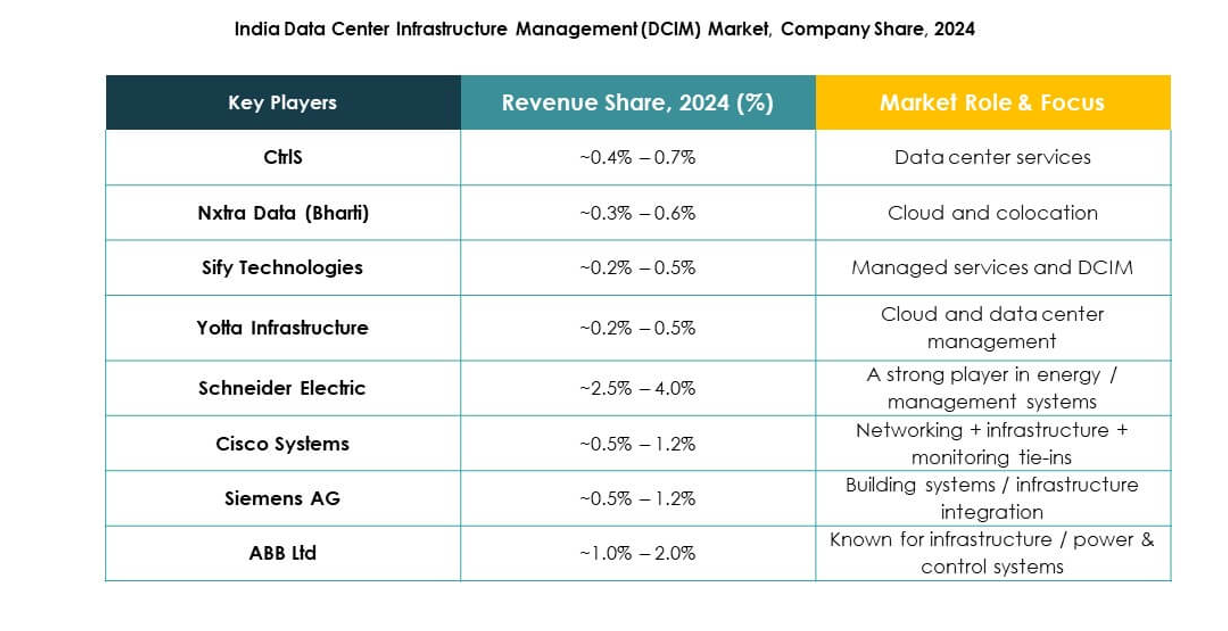

The India Data Center Infrastructure Management (DCIM) Market is shaped by strong competition between domestic and global players. CtrlS, Nxtra Data, Sify, and Yotta Infrastructure lead the local landscape by expanding hyperscale campuses and deploying advanced monitoring tools. Global technology providers such as Schneider Electric, Cisco, Huawei, and Siemens strengthen their presence through integrated solutions for power, automation, and network management. It creates a diverse ecosystem where domestic firms focus on regional expansion and global firms leverage innovation-driven portfolios. ABB and Eaton emphasize energy optimization, supporting the industry’s sustainability goals. Competitive strategies rely on mergers, partnerships, and digital platforms to secure long-term growth and address rising demand across multiple verticals.

Recent Developments:

- In July 2025, Google was reported to be in discussions with the Andhra Pradesh government to set up a major new data center facility with a planned capacity of 1 gigawatt. This move signals global tech giants’ growing interest in the Indian data center sector, reflecting the rapid expansion of the country’s digital infrastructure.

- In August 2024, CtrlS acquired land in Patna to develop a greenfield Edge data center with 10 MW IT load and approximately 1,000 racks.