Executive summary:

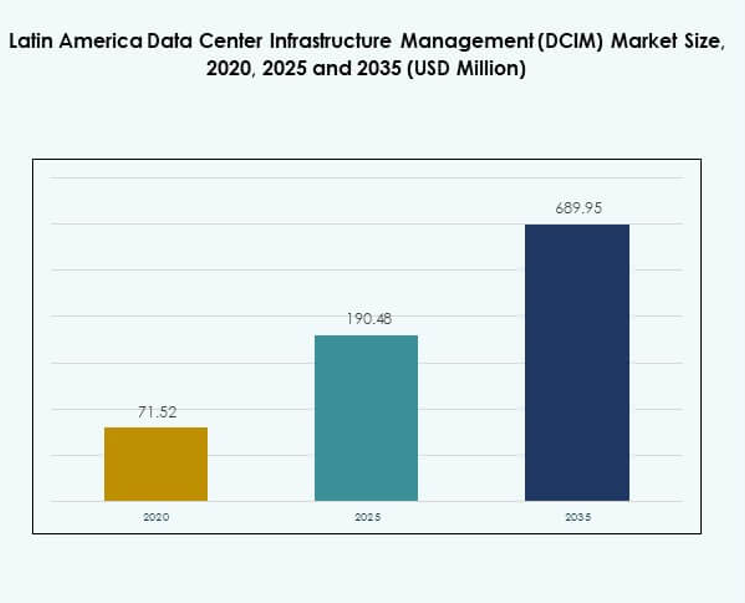

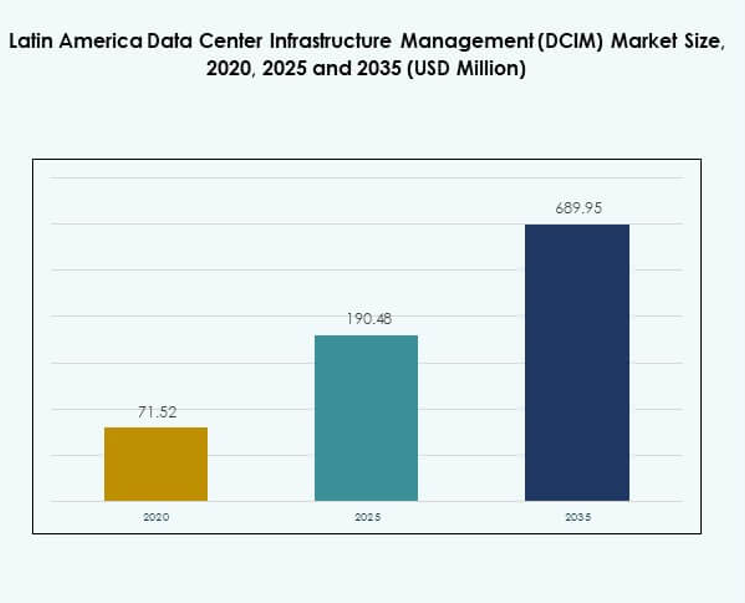

The Latin America Data Center Infrastructure Management (DCIM) Market size was valued at USD 71.52 million in 2020, reached USD 190.48 million in 2025, and is anticipated to attain USD 689.95 million by 2035, registering a CAGR of 15.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Latin America Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 190.48 Million |

| Latin America Data Center Infrastructure Management (DCIM) Market, CAGR |

15.51% |

| Latin America Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 689.95 Million |

Market expansion is driven by the rising adoption of AI, IoT, and automation technologies across data centers. Growing demand for efficient power, cooling, and asset management solutions is transforming operational practices. It supports enterprises in reducing downtime, improving energy utilization, and ensuring data reliability. Businesses and investors view the market as a strategic enabler for sustainability, scalability, and cost-efficient digital transformation.

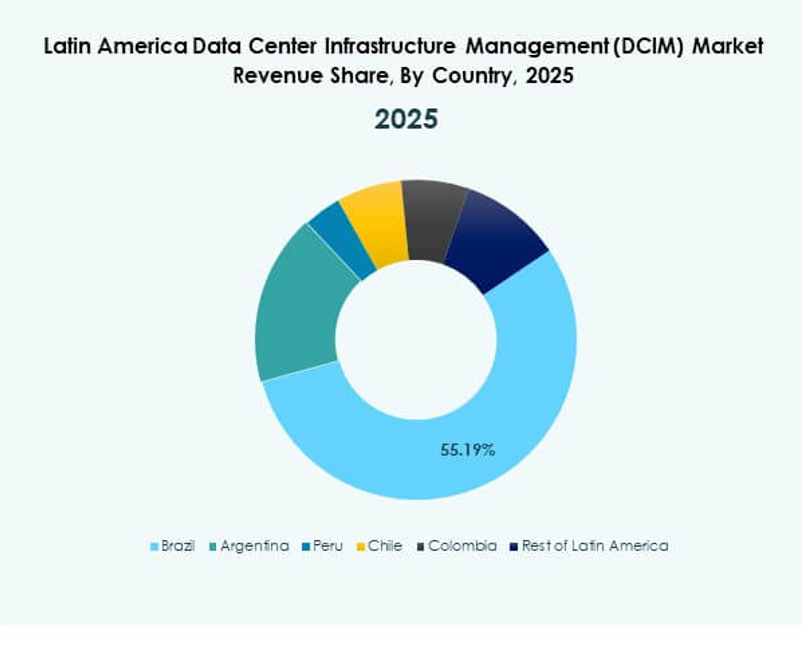

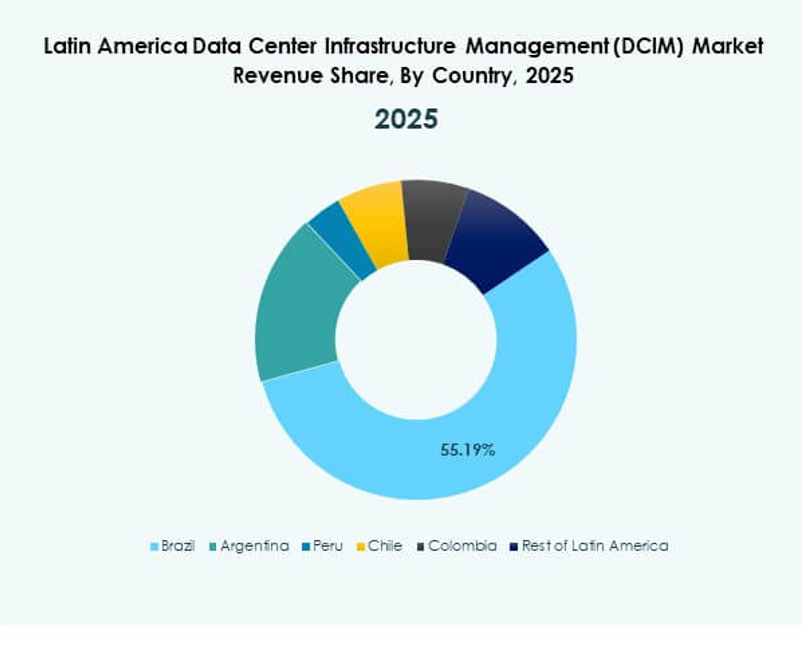

Brazil leads the regional landscape, supported by hyperscale data center investments and advanced cloud adoption. Mexico and Chile are emerging markets with strong colocation and hybrid IT developments. Argentina, Peru, and Colombia show growing interest due to connectivity upgrades and digitalization programs. The region’s focus on renewable energy integration and infrastructure modernization continues to strengthen Latin America’s position in the global data center ecosystem.

Market Drivers

Rising Digital Transformation and Cloud Integration Across Industries

The Latin America Data Center Infrastructure Management (DCIM) Market is expanding with enterprises shifting to digital-first strategies and cloud adoption. Growing use of multi-cloud and hybrid environments demands better visibility and control of IT assets. Businesses are prioritizing DCIM solutions to manage complex infrastructure and ensure uptime. It provides integrated analytics for power, cooling, and space optimization. This technology supports faster decision-making and operational efficiency. Cloud service providers are deploying DCIM tools to enhance energy management. The market’s strategic importance lies in cost reduction and sustainability. Investors recognize its potential to modernize regional digital infrastructure.

- For instance, Schneider Electric’s EcoStruxure IT DCIM solution is widely implemented across Latin American data centers. As stated in its 2024 sustainability reports, the company’s internal Green IT project met major sustainability reporting standards, enabling customers to monitor energy consumption and meet evolving regulatory compliance goals efficiently.

Adoption of IoT, AI, and Automation Enhancing Data Center Efficiency

IoT and AI technologies are strengthening the automation capabilities of DCIM platforms. Predictive maintenance and real-time performance monitoring are becoming key differentiators. It enables operators to prevent downtime and optimize energy consumption through intelligent insights. Automation reduces manual errors and enhances resource planning. DCIM adoption helps enterprises align with Industry 4.0 standards. Data centers across Latin America are upgrading to smart monitoring systems. These systems enhance reliability and scalability. Businesses view this integration as vital for maintaining competitiveness and operational excellence.

Growing Focus on Energy Efficiency and Sustainability Standards

Energy management is becoming a top priority for data center operators in Latin America. The DCIM market benefits from sustainability goals and government support for green IT infrastructure. Companies are adopting renewable energy and efficient cooling technologies. It aids in tracking power usage effectiveness (PUE) and carbon emissions. Organizations use DCIM tools to comply with environmental regulations. Energy-efficient operations lower costs and improve resilience. This shift strengthens the value proposition for enterprises focusing on long-term digital sustainability. The growing alignment with ESG standards attracts global investors.

- For instance, ODATA committed to powering all its Brazilian data centers, including the upcoming 48 MW DC SP04 facility, entirely with renewable energy through its partnership with Casa dos Ventos. The project employs Aligned Data Centers’ Delta³ cooling technology, supporting high-density racks up to 50 kW and reducing energy use, as confirmed in ODATA’s 2025 press releases.

Strategic Importance for Businesses and Long-Term Investment Potential

Businesses and investors view DCIM as a strategic enabler of operational excellence and profitability. The technology provides centralized visibility into complex infrastructure networks. It supports scalability and future-readiness through flexible deployment models. Businesses can manage data growth and risk through analytics-driven insights. It enables better asset utilization and lowers downtime. Investors find the sector appealing due to its recurring revenue potential. Latin America’s digitalization wave is fueling investment in smart infrastructure. This long-term growth potential ensures DCIM remains critical to data-driven enterprises.

Market Trends

Emergence of AI-Driven Predictive Analytics for Infrastructure Optimization

The Latin America Data Center Infrastructure Management (DCIM) Market is witnessing growing adoption of AI-driven predictive analytics. Operators are using AI to anticipate failures and improve system reliability. This approach enhances equipment lifespan and operational planning. Predictive analytics helps manage workloads efficiently during power or cooling fluctuations. It enables proactive risk mitigation and performance tuning. The integration of machine learning models strengthens data center intelligence. Businesses are investing in AI-based DCIM to achieve higher automation levels. The trend is reshaping maintenance and energy optimization strategies across Latin America.

Increased Adoption of Modular and Scalable Infrastructure Models

Modular DCIM designs are gaining traction due to their flexibility and speed of deployment. It allows operators to scale capacity without disrupting existing operations. Businesses are investing in prefabricated modules with integrated monitoring systems. This trend supports growing edge and cloud infrastructure projects. Modular frameworks reduce operational risks and installation time. The scalability ensures smooth adaptation to demand fluctuations. Investors prefer modular data centers for their quick ROI and operational agility. The model promotes faster modernization of Latin America’s digital ecosystem.

Integration of Edge Computing and 5G Infrastructure Management

Edge computing and 5G deployments are transforming data center operations in Latin America. The DCIM market is aligning with these technologies to support distributed architectures. It enables real-time monitoring of remote and micro data centers. Businesses use edge-enabled DCIM to optimize latency-sensitive workloads. 5G rollouts are pushing demand for localized data management and network control. This shift increases the need for energy-efficient monitoring solutions. Operators are using integrated platforms to maintain performance consistency. The trend is accelerating smart connectivity and hybrid IT adoption.

Growing Emphasis on Cybersecurity and Data Governance in Operations

Cybersecurity integration is becoming a key trend within DCIM solutions. Operators face increased threats due to interconnected data center environments. The Latin America Data Center Infrastructure Management (DCIM) Market is evolving to include embedded threat detection and compliance controls. It strengthens data governance and operational integrity. Secure authentication frameworks and encryption are now standard in DCIM platforms. This advancement builds trust among enterprises managing sensitive workloads. The focus on security-driven DCIM enhances resilience and investor confidence. Businesses are prioritizing risk mitigation through unified, secure infrastructure monitoring.

Market Challenges

High Implementation Cost and Limited Technical Expertise Across Regions

The Latin America Data Center Infrastructure Management (DCIM) Market faces challenges due to high deployment costs and skill shortages. Many enterprises struggle to justify initial investments in automation and advanced analytics tools. Limited local expertise in DCIM integration restricts adoption across smaller firms. It creates reliance on global vendors and external consultants, raising expenses further. Infrastructure modernization remains uneven across countries, slowing scalability. The lack of regional training programs affects workforce readiness. Businesses must overcome these challenges through partnerships and knowledge sharing. Strategic collaboration can bridge technical gaps and improve DCIM utilization.

Complex Legacy Systems and Fragmented Infrastructure Ecosystems

Legacy data centers across Latin America hinder full integration of DCIM solutions. Outdated systems lack compatibility with modern monitoring tools. This fragmentation leads to data silos and inefficient workflows. It limits real-time visibility, affecting decision-making accuracy. Organizations often face integration delays during migration to hybrid or cloud models. The absence of unified standards complicates cross-platform deployment. Addressing these issues requires structured modernization and open architecture adoption. It will enable smoother digital transformation and reduce operational risks for data center operators.

Market Opportunities

Expansion of Hyperscale and Edge Data Centers Creating Demand for DCIM

Rapid investment in hyperscale and edge data centers presents major growth opportunities. The Latin America Data Center Infrastructure Management (DCIM) Market benefits from strong hyperscale expansion by global and regional players. These projects require advanced infrastructure visibility and automation tools. It enables seamless management of distributed assets and workloads. Edge deployment enhances responsiveness for critical applications. DCIM solutions are becoming essential for controlling power, cooling, and security. Businesses can leverage this opportunity to enhance infrastructure agility and reliability. Investors see this as a long-term enabler for smart data ecosystems.

Growing Sustainability Mandates and Green Data Initiatives

Sustainability goals are creating fresh opportunities for innovation in DCIM. Operators aim to meet energy efficiency targets and reduce carbon emissions. The market supports green IT adoption through intelligent power and resource management. It assists enterprises in reporting ESG metrics and achieving compliance. Governments and corporations are funding eco-friendly infrastructure modernization. The shift toward renewable energy integration is boosting demand for efficient monitoring tools. Businesses focusing on sustainable data management will gain strategic advantage. This trend aligns with regional commitments to digital and environmental transformation.

Market Segmentation

By Component

In the Latin America Data Center Infrastructure Management (DCIM) Market, the solution segment dominates with over 62% share, driven by demand for integrated analytics and real-time monitoring software. These solutions improve visibility across IT and facility layers. The service segment is growing due to increasing outsourcing of system integration, consulting, and maintenance. Rising complexity in data center environments encourages enterprises to rely on expert-managed DCIM operations. Vendors offering hybrid service frameworks are gaining traction among hyperscale providers.

By Data Center Type

The cloud and edge data center segment holds the largest share, supported by rapid adoption of distributed computing and hybrid environments. It enables scalable data processing closer to users. Colocation and managed data centers are expanding with rising enterprise outsourcing demand. The enterprise data center segment continues to serve critical on-premise workloads in regulated sectors. Regional data center construction is driving market expansion, supported by government and private investments in digital infrastructure modernization.

By Deployment Model

The cloud-based segment leads the Latin America Data Center Infrastructure Management (DCIM) Market with strong demand from flexible IT environments. It offers remote accessibility, scalability, and faster deployment. The hybrid model is gaining traction as organizations balance on-premise control and cloud efficiency. The on-premises model remains relevant for industries with strict data security needs. Businesses are shifting to modular cloud-native frameworks that support unified management. These models allow cost optimization and simplified scalability across multi-location operations.

By Enterprise Size

Large enterprises dominate the market due to higher investment capacity and established IT infrastructure. They deploy DCIM platforms to manage complex and large-scale data environments efficiently. SMEs are increasingly adopting lightweight cloud-based DCIM tools to enhance resource visibility. It helps smaller firms improve uptime and reduce operational expenses. The availability of subscription-based DCIM services encourages broader adoption. The segment diversification supports inclusive market penetration across industries in Latin America.

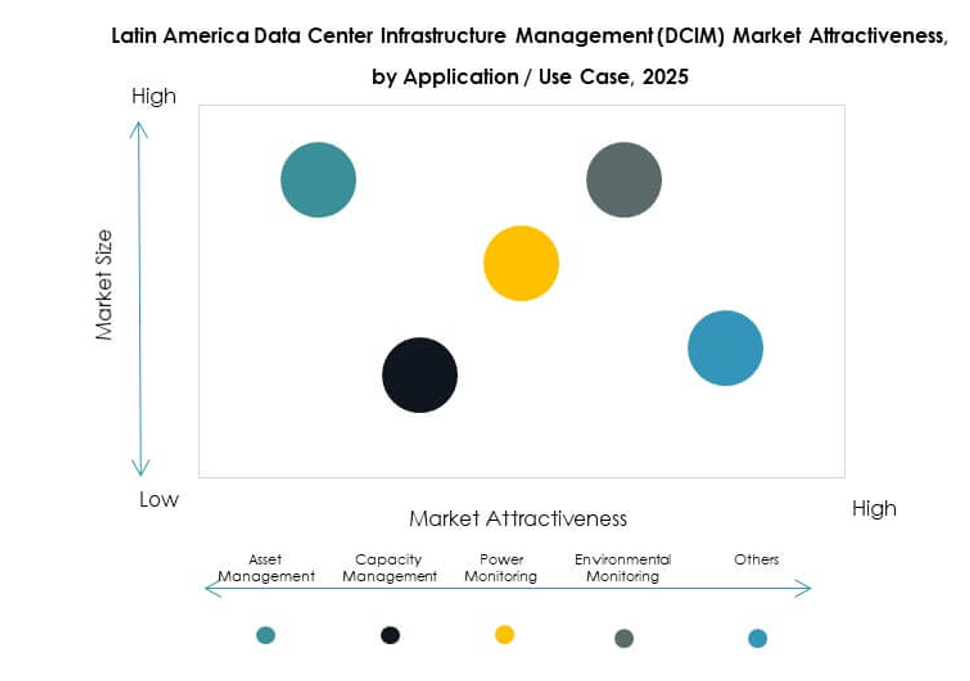

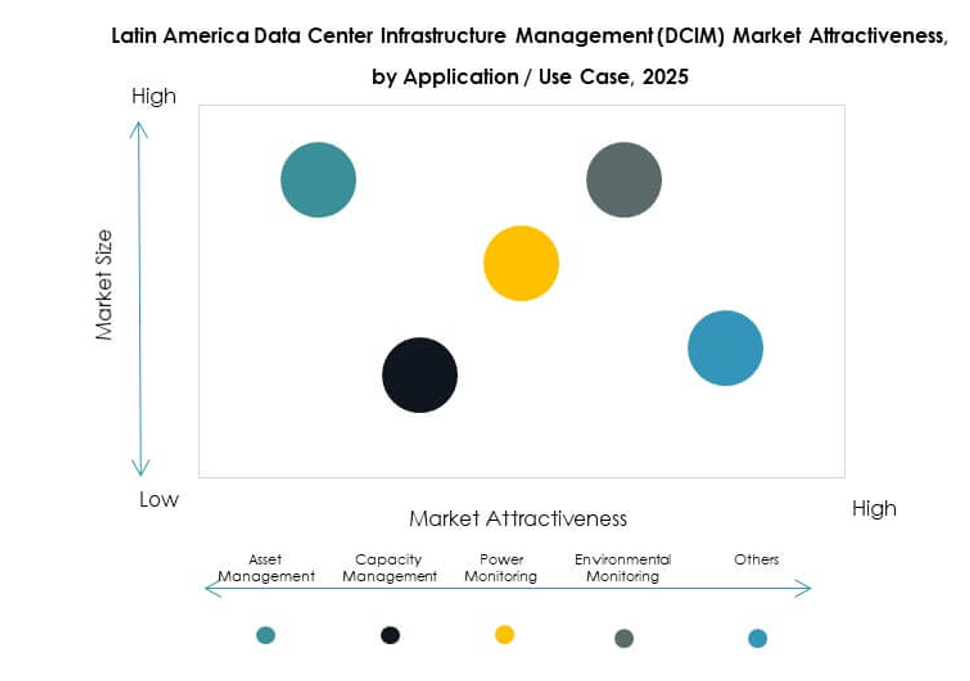

By Application / Use Case

The power monitoring segment holds the leading share owing to its critical role in energy optimization and sustainability management. It allows operators to control consumption and reduce costs effectively. Asset management and capacity management follow, driven by infrastructure scaling needs. Environmental monitoring ensures temperature and humidity control for equipment protection. BI and analysis tools are supporting data-driven operational strategies. Enterprises seek comprehensive systems that unify these use cases for improved performance visibility.

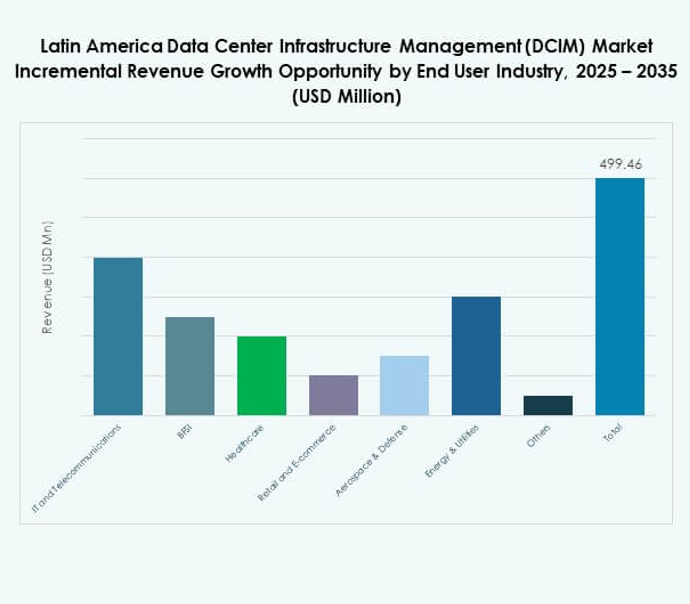

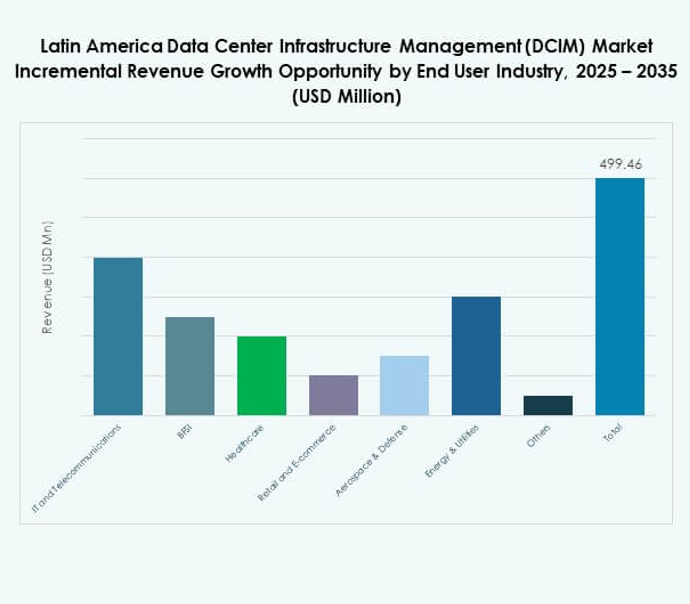

By End User Industry

The IT and telecommunications sector dominates the Latin America Data Center Infrastructure Management (DCIM) Market with the largest share, supported by ongoing network expansion and digital transformation. BFSI and healthcare industries are expanding adoption for compliance and data integrity. Retail and e-commerce benefit from improved uptime and scalable infrastructure. The energy and utilities sector invests in DCIM to enhance grid and facility monitoring. These industries drive demand for reliable and automated data management platforms.

Regional Insights

Brazil Leading with Strong Digital Infrastructure and 38.2% Market Share

Brazil leads the Latin America Data Center Infrastructure Management (DCIM) Market, holding a 38.2% share. The country’s robust digital ecosystem and hyperscale investments drive demand for advanced monitoring platforms. Cloud providers like AWS, Microsoft, and Google are expanding local infrastructure. It enhances Brazil’s position as a digital hub for Latin America. Government-led digital policies and renewable energy integration further support DCIM adoption. Continuous growth in colocation and edge facilities strengthens national competitiveness in digital transformation.

Mexico and Chile Emerging as Secondary Hubs with 27.5% Combined Share

Mexico and Chile collectively represent 27.5% of the regional DCIM market. Mexico benefits from rising industrial digitalization and strategic proximity to North American data flows. Chile’s market expansion is supported by international connectivity and green energy initiatives. Both countries attract global hyperscale operators seeking energy-efficient environments. It accelerates modernization and regulatory compliance efforts. Increased focus on hybrid infrastructure is creating new opportunities for DCIM vendors. These nations are becoming central nodes in Latin America’s connected data ecosystem.

- For example, Equinix Mexico’s MO1 Monterrey IBX Data Center is fully operational and recognized for carrier-neutral colocation and connectivity. As of November 2023, this facility operates 25,000 square feet of data center space, supports ISO 22301 and PCI DSS certifications, and is identified by Equinix and industry sources as a major gateway for Mexican data flows.

Argentina, Colombia, and Peru Gaining Momentum with 21.3% Regional Share

Argentina, Colombia, and Peru together account for 21.3% of the Latin American DCIM market. Economic reforms and ICT expansion policies encourage investments in local data centers. Regional governments are supporting digital infrastructure projects to boost connectivity. It drives adoption of automation and analytics within mid-sized facilities. Growing cloud penetration supports broader adoption across enterprise sectors. Competitive cost structures make these markets attractive for international investors. The subregion is evolving into a key frontier for next-generation DCIM deployments.

- For example, Grupo Gtd inaugurated a 20MW Tier III-certified data center in Lurín, Peru in October 2024, investing $50 million for 960 cabinets across 2,100 sqm of white space, with full operations supported by renewable energy and direct fiber optic connectivity to existing GTD facilities. GTD additionally operates more than 11 data centers across Chile, Colombia, and Peru, totaling a capacity of 17MW, as officially disclosed.

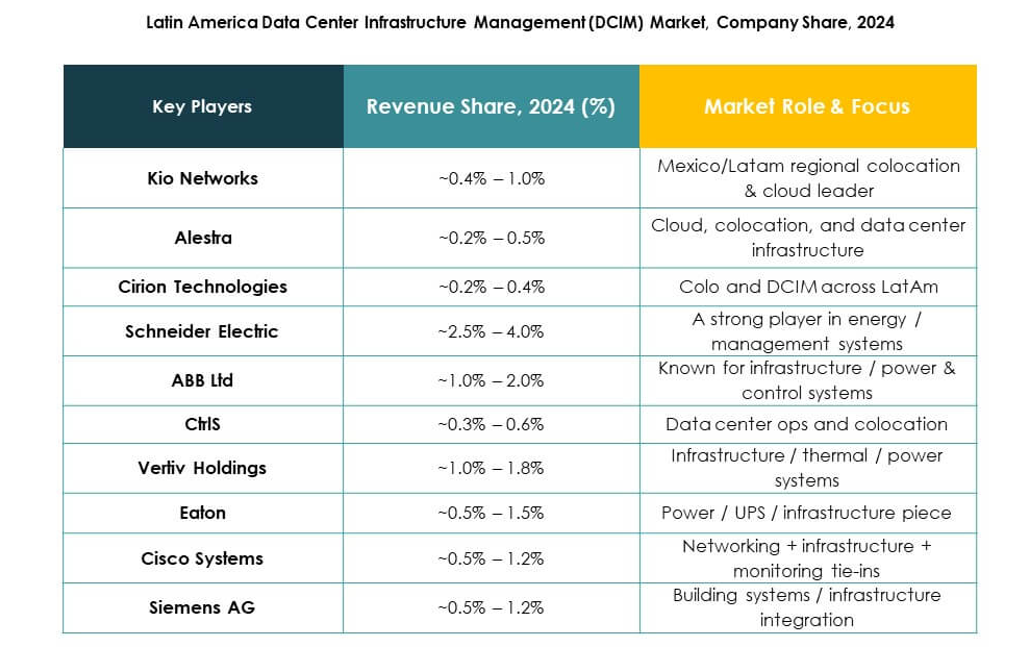

Competitive Insights:

- Kio Networks

- Alestra

- Cirion Technologies

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd

- IBM

- Schneider Electric SE

- Siemens AG

- Hewlett Packard Enterprise (HPE)

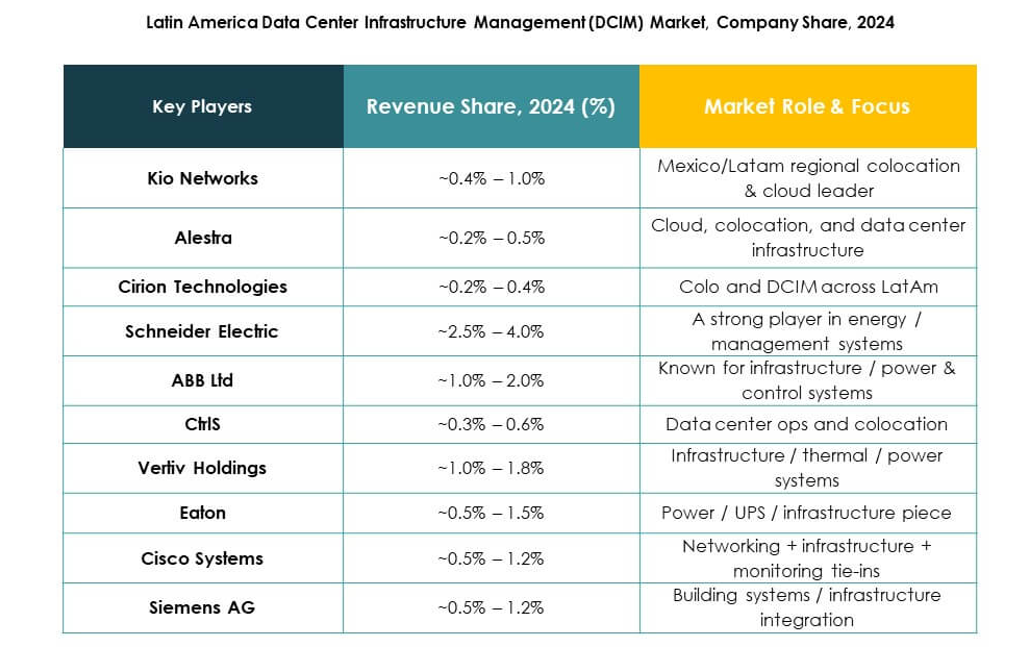

- Vertiv Holdings

The Latin America Data Center Infrastructure Management (DCIM) Market is highly competitive, with global and regional players focusing on innovation, scalability, and efficiency. It features established technology leaders like Schneider Electric, Vertiv, and Huawei offering integrated DCIM platforms that combine automation, analytics, and sustainability features. Local firms such as Kio Networks and Alestra strengthen market presence through region-specific services and partnerships. Global vendors like IBM, Cisco, and Siemens emphasize AI-based monitoring and hybrid infrastructure control. Continuous investment in energy-efficient systems and modular designs enhances differentiation. The market’s competitiveness centers on operational intelligence, interoperability, and sustainability-driven solutions catering to Latin America’s digital transformation demands.

Recent Developments:

- In September 2025, KIO Networks announced the construction of a second data center in Guatemala, expanding its operational footprint in the region to meet rising data demand and bolster regional connectivity in Latin America. Earlier, in September 2025, KIO Networks entered a landmark strategic alliance with Lonestar Data Holdings, becoming the first entity in Latin America to connect terrestrial digital infrastructure with space-based data storage, establishing a secure hybrid data ecosystem that represents a new frontier in data resilience and sovereignty.

- In May 2025, Cirion Technologies cemented a partnership with Megaport to enhance digital ecosystem integration across Brazil by offering direct, scalable access to over 280 cloud on-ramps and 410+ service providers, enabling rapid enterprise connectivity for hybrid cloud and AI workloads.

- In October 2024, ODATA (Aligned Data Centers) signed a supply agreement with Casa dos Ventos in Brazil to expand its sustainable data center operations through renewable energy, supporting the rising emphasis on eco-friendly DCIM strategies in Latin America.

- In August 2024, Google announced the construction commencement of a new data center in Canelones, Uruguay, investing approximately USD 850 million, signaling further expansion of high-performance and sustainable DCIM capabilities in the region.