Executive summary:

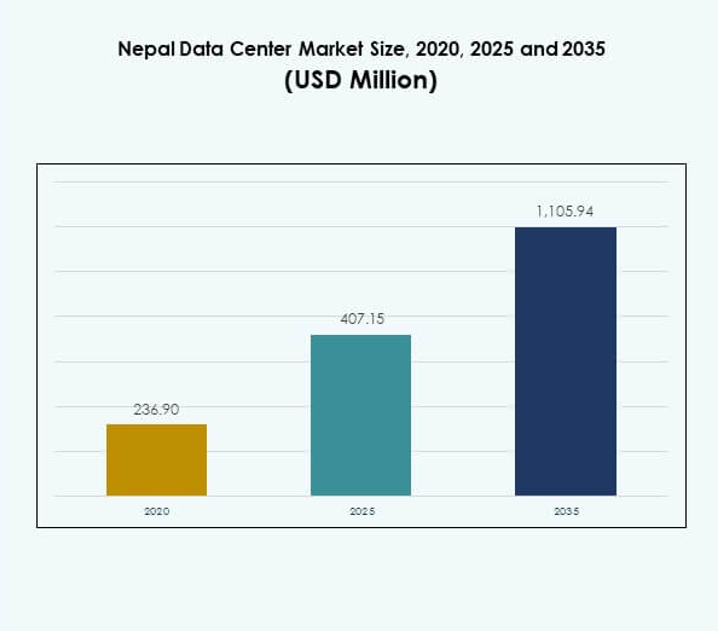

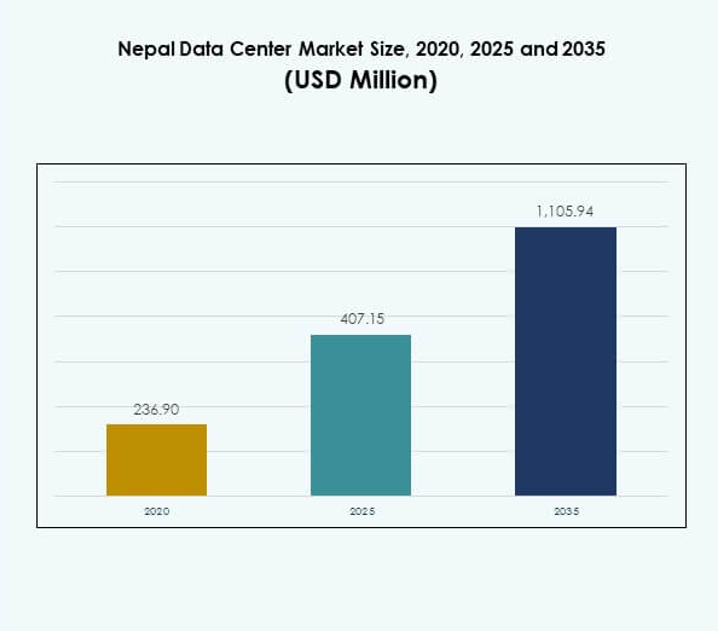

The Nepal Data Center Market size was valued at USD 236.90 million in 2020 to USD 407.15 million in 2025 and is anticipated to reach USD 1,105.94 million by 2035, at a CAGR of 10.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Nepal Data Center Market Size 2025 |

USD 407.15 Million |

| Nepal Data Center Market, CAGR |

10.44% |

| Nepal Data Center Market Size 2035 |

USD 1,105.94Million |

The market is driven by the rapid adoption of cloud computing, digital transformation, and data-intensive technologies across industries. Businesses increasingly rely on AI, IoT, and advanced analytics, creating demand for secure and scalable infrastructure. Innovation in green data centers and advanced cooling systems is reshaping operational efficiency. Government initiatives to boost digital infrastructure strengthen confidence for investors. The market holds strategic importance for enterprises seeking to modernize operations, improve service delivery, and achieve resilience in a competitive environment.

Regionally, Central Nepal leads with strong demand from government agencies, telecom hubs, and enterprises. Eastern Nepal emerges as a growing hub due to cross-border connectivity and expanding SME adoption of cloud and colocation solutions. Western Nepal shows potential with energy availability and investments in education and healthcare-related infrastructure. Each region contributes uniquely, positioning the country as a rising player in South Asia’s digital ecosystem and shaping a balanced, nationwide data center growth landscape.

Market Drivers

Growing Adoption of Cloud Infrastructure and Digital Transformation Across Enterprises

The Nepal Data Center Market is expanding with rapid cloud infrastructure adoption and strong digital transformation initiatives. Enterprises in banking, telecom, and e-commerce are shifting toward secure, scalable solutions to meet data demands. The rising focus on cloud-native platforms supports efficiency, agility, and resilience for businesses. Government-led digital projects accelerate adoption by enabling secure data storage within the country. Investors see clear opportunities in infrastructure that aligns with digital growth. The market gains traction as organizations migrate from legacy systems. It strengthens its role as a vital enabler for long-term innovation. Data center investments position enterprises to adapt quickly in a competitive landscape.

Increasing Role of Emerging Technologies and Their Impact on Data Processing Needs

Technologies like AI, IoT, and blockchain are reshaping operational demands in the Nepal Data Center Market. Companies deploy solutions to handle high data volumes and enable real-time decision-making. AI-driven analytics require powerful storage and processing, increasing demand for advanced infrastructure. IoT adoption across industries generates vast machine data, fueling capacity expansion. Blockchain adds security and transparency, reinforcing the need for resilient systems. Data centers act as the backbone for scaling these technologies. The market positions itself as a hub for next-generation applications. It supports both domestic industries and regional collaboration. The integration of such tools accelerates innovation across multiple sectors.

Strategic Importance of Energy Efficiency and Green Data Center Development

Sustainability has emerged as a priority in the Nepal Data Center Market, where energy efficiency plays a critical role. Operators deploy advanced cooling technologies and renewable energy sources to reduce environmental impact. Growing awareness of sustainability aligns with government climate goals. Investors focus on facilities with optimized power usage effectiveness metrics. Energy-efficient operations cut long-term costs while meeting global compliance standards. The market’s ability to balance growth with sustainability enhances its strategic appeal. It positions Nepal as an attractive destination for ethical investors. Green development also ensures competitiveness in international markets. Local innovation strengthens alignment with regional sustainability targets.

- For example, the Nepal Electricity Authority inaugurated a Tier-3 standard data center in Suchatar, Kathmandu, in June 2024, featuring 40 IT racks with 36 servers, two 300 kVA modular UPS units with lithium-ion batteries, and dual 1 MW backup generators to ensure uninterrupted operations.

Growing Strategic Value for Businesses and Investors in Regional Ecosystem Development

The Nepal Data Center Market creates strong business opportunities for enterprises and investors seeking regional expansion. Enterprises benefit from reliable infrastructure that supports scalability, compliance, and security. The government promotes digital-first policies, attracting foreign investments. Investors view the market as a bridge connecting South Asia’s digital economy. It holds strong potential for becoming a data transit hub. Demand for regional collaborations further enhances business value. Enhanced infrastructure lowers latency and improves digital service quality. It highlights Nepal’s position as a fast-emerging player in regional digital transformation.

- For instance, in July 2025, Nepal received a $29 million investment spearheaded by IFC and private sector partners to expand broadband and data infrastructure, directly supporting regional collaboration and digital connectivity for enterprises, as confirmed in public statements and project briefs

Market Trends

Rising Investment in Modular and Edge Data Center Infrastructure for Flexible Deployment

The Nepal Data Center Market shows rising interest in modular and edge deployments to ensure flexibility. Businesses favor modular setups for scalability and cost efficiency. Edge facilities reduce latency, enhancing digital experiences for users in remote areas. Enterprises adopt smaller, distributed facilities to expand closer to customers. The trend reflects the need for decentralized models to support IoT and real-time analytics. Colocation providers also integrate modular solutions to attract clients. It ensures faster deployment and lower upfront capital. Growing demand for low-latency applications supports the expansion of edge strategies.

Integration of Artificial Intelligence for Automation and Predictive Analytics in Operations

Automation powered by AI is emerging as a significant trend in the Nepal Data Center Market. Operators deploy AI-driven tools to optimize cooling systems and energy management. Predictive analytics allows proactive identification of faults and maintenance needs. Automated processes reduce operational costs and improve uptime reliability. AI also enhances capacity planning by predicting workload surges. Data centers gain improved efficiency while maintaining service quality. It strengthens resilience in mission-critical operations. Companies leverage automation to meet growing service expectations from enterprises and consumers.

Growing Security Investments Through Advanced Cybersecurity and Compliance Measures

Rising data threats and compliance requirements drive security-focused investments in the Nepal Data Center Market. Enterprises demand facilities that comply with international standards like ISO and PCI DSS. Providers integrate biometric access, encryption, and intrusion detection to strengthen security. Cybersecurity solutions protect sensitive financial, healthcare, and government data. Growing regulations enforce strict guidelines for handling critical information. Security-focused facilities become preferred choices for global firms outsourcing operations. It enhances trust and drives long-term client relationships. The trend emphasizes reliability as a competitive differentiator.

Adoption of Hybrid Deployment Models to Balance On-Premises and Cloud Capabilities

The Nepal Data Center Market is witnessing strong adoption of hybrid deployment models. Enterprises combine cloud-based services with on-premises infrastructure for greater flexibility. Hybrid systems offer scalability while ensuring control over sensitive workloads. Businesses use this model to meet compliance needs and reduce operational risk. Cloud providers partner with enterprises to deliver integrated hybrid solutions. The demand grows across BFSI, telecom, and healthcare. It improves business continuity while optimizing costs. Hybrid adoption reflects the strategic shift toward balanced infrastructure management.

Market Challenges

Market Challenges

High Infrastructure Costs and Energy Constraints Limiting Large-Scale Expansion

The Nepal Data Center Market faces high costs in deploying advanced infrastructure and securing reliable power. Building Tier III and Tier IV facilities demands heavy capital, which discourages small investors. Energy supply challenges increase operational risks and hinder scalability. Cooling and uninterrupted power systems add to expenses. It creates barriers for enterprises requiring high uptime performance. Limited renewable energy integration slows green transition efforts. Market players face pressure to balance affordability with efficiency. The cost-intensive nature of infrastructure remains a major growth restraint.

Shortage of Skilled Workforce and Limited Local Vendor Ecosystem for Advanced Solutions

A shortage of skilled professionals limits technical efficiency in the Nepal Data Center Market. Complex operations require expertise in cloud management, automation, and cybersecurity. Limited availability of trained engineers increases reliance on foreign support. The absence of strong local vendors slows adoption of cutting-edge solutions. It reduces competitiveness against regional peers with stronger ecosystems. Training programs remain insufficient for advanced data center skills. The gap challenges long-term sustainability of growth. Workforce and ecosystem constraints restrict scaling opportunities for operators.

Market Opportunities

Expansion of Cloud Services and Cross-Border Connectivity to Strengthen Regional Role

The Nepal Data Center Market presents growth opportunities in cloud adoption and regional connectivity. Enterprises accelerate digital migration, fueling demand for localized cloud services. Cross-border collaborations strengthen Nepal’s role as a bridge in South Asia. It creates potential for positioning as a regional data hub. Providers can expand services targeting SMEs and large firms alike. Enhanced connectivity ensures greater participation in regional digital economies. Cloud partnerships with global players can unlock new revenue streams.

Adoption of Green and Sustainable Technologies to Attract Global Investment Interest

The Nepal Data Center Market gains opportunities through sustainable technologies and renewable integration. Operators focus on energy-efficient cooling and solar-powered facilities. It enhances operational efficiency while lowering environmental impact. Green initiatives attract international investors aligned with ESG commitments. Facilities with low carbon footprints increase competitiveness globally. Enterprises prefer sustainable data centers for long-term contracts. The opportunity aligns with Nepal’s renewable energy potential. Adoption of eco-friendly models strengthens global partnerships.

Market Segmentation

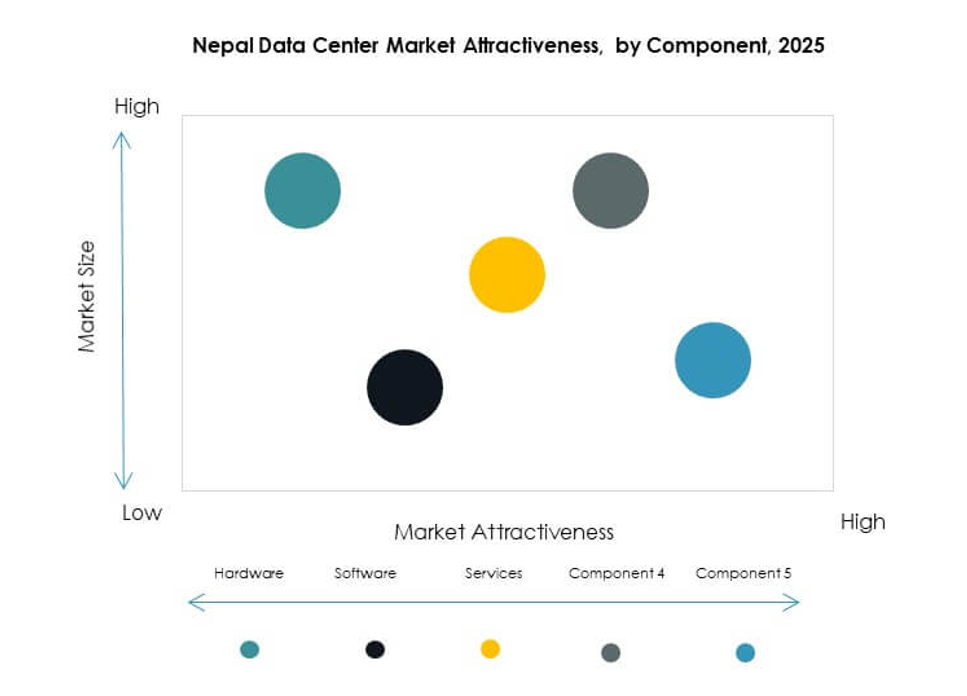

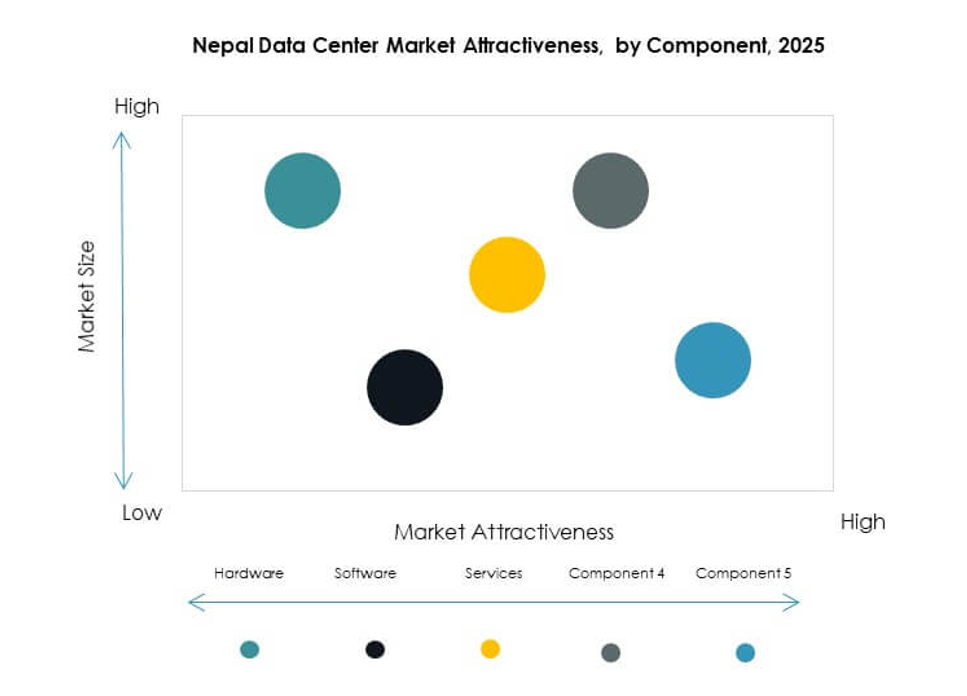

By Component

Hardware dominates the Nepal Data Center Market, supported by strong demand for servers, networking, and cooling systems. Storage upgrades drive investments as enterprises process higher data volumes. Software solutions like orchestration and monitoring are gaining adoption to optimize performance. Services, including consulting and managed solutions, continue to expand. It reflects rising enterprise needs for outsourced support. Hardware maintains the largest share, while software and services show steady growth.

By Data Center Type

Colocation centers hold a leading share of the Nepal Data Center Market, offering cost-effective solutions for enterprises. Hyperscale facilities are still limited but show long-term growth potential. Edge and modular centers gain demand for remote deployments. Cloud data centers expand as businesses embrace SaaS and IaaS models. Enterprise facilities remain relevant for industries with compliance needs. Colocation dominates due to affordability and scalability advantages.

By Deployment Model

Cloud-based deployments capture a rising share of the Nepal Data Center Market, driven by scalability and cost control. Enterprises adopt hybrid models for balancing flexibility and security. On-premises deployments remain relevant in government and defense for data sovereignty. Hybrid solutions attract BFSI and healthcare sectors requiring control with scalability. Cloud remains the fastest-growing deployment choice, transforming enterprise strategies.

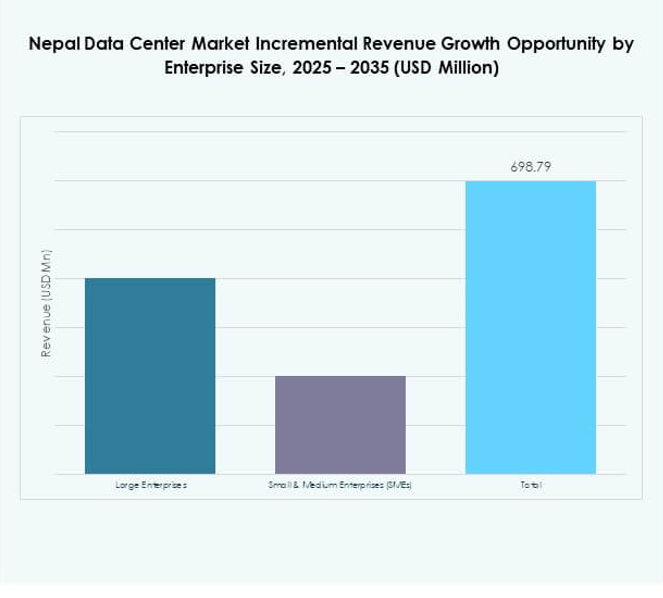

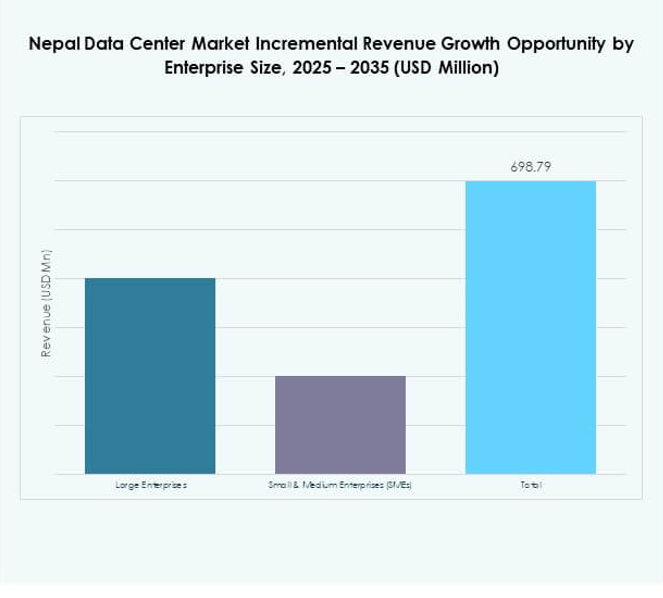

By Enterprise Size

Large enterprises dominate the Nepal Data Center Market, using advanced facilities to manage high workloads. SMEs are increasingly adopting colocation and cloud models to reduce costs. Demand from SMEs fuels growth in shared infrastructure solutions. It reflects rising digital adoption across industries. Large enterprises retain the largest share, while SMEs create strong incremental opportunities.

By Application / Use Case

BFSI leads the Nepal Data Center Market, driven by secure digital banking and transaction needs. IT and telecom hold significant demand for data storage and processing. Government digitization projects expand the sector’s scope. Healthcare, retail, and media industries also contribute strongly. BFSI maintains the dominant application share due to compliance and security priorities.

By End User Industry

Cloud service providers dominate the Nepal Data Center Market, fueling growth through rapid digital adoption. Enterprises contribute strongly with hybrid and cloud-based models. Colocation providers benefit from rising demand for cost-efficient hosting. Government agencies increase reliance on secure local infrastructure. Cloud service providers retain the highest share due to rapid SaaS and PaaS adoption.

Regional Insights

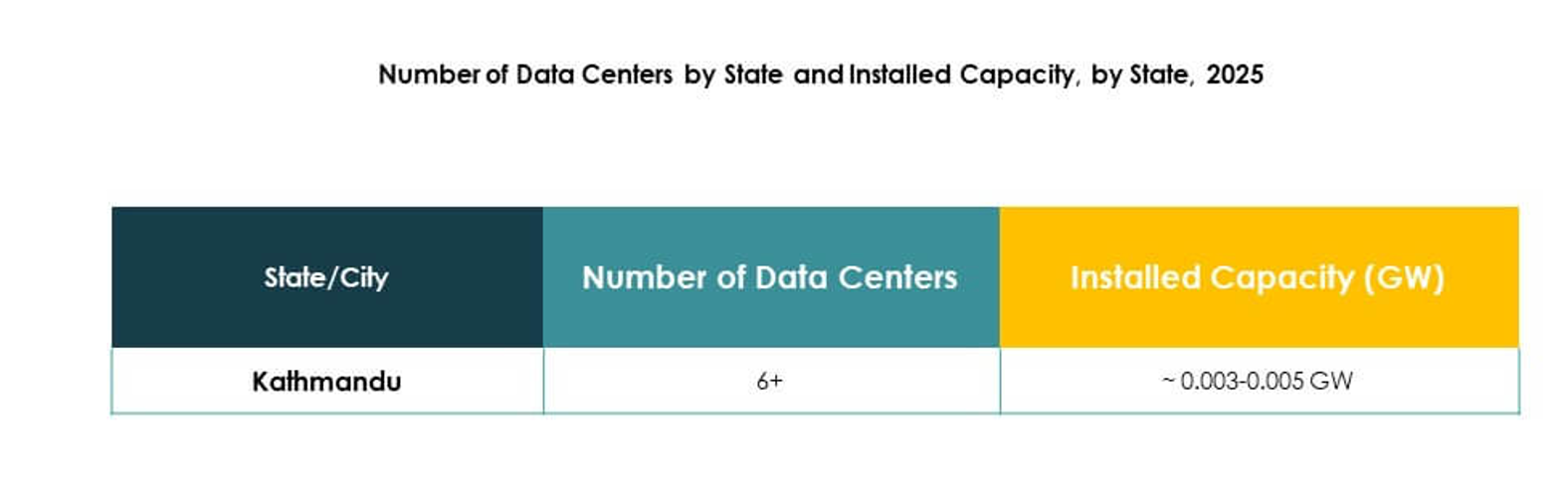

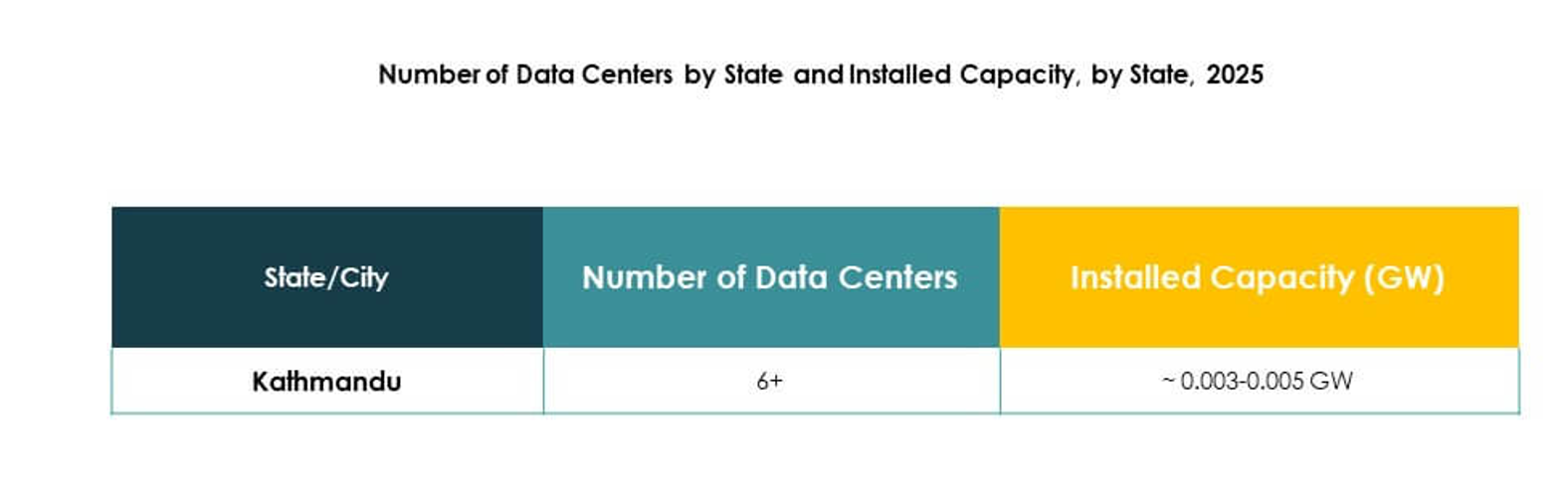

Dominance of Central Nepal with Strong Infrastructure and Enterprise Demand

Central Nepal holds the largest share of the Nepal Data Center Market at 46%. The region benefits from Kathmandu’s concentration of enterprises, government agencies, and telecom hubs. It attracts strong investment due to connectivity and business opportunities. Demand for colocation and hybrid deployments is particularly high. It remains the focal point for national data-driven projects. Central Nepal’s strategic importance continues to shape market growth.

- For instance, in February 2025, WorldLink Communications launched “Data World,” Nepal’s largest data center in Chandragiri, Kathmandu, featuring a 3.5-megawatt IT power capacity and 520 racks.

Steady Expansion in Eastern Nepal with Growing Cross-Border Collaborations

Eastern Nepal accounts for 32% share of the Nepal Data Center Market, supported by its proximity to India. Cross-border collaborations enhance its importance as a regional hub. Growing digital initiatives among SMEs fuel adoption of colocation and cloud models. Telecom and IT service providers invest in facilities to reduce latency. It strengthens regional connectivity and expands service reliability. Eastern Nepal is positioned for accelerated growth in the forecast period.

- For instance, Nepal Telecom has ongoing data center construction and disaster recovery infrastructure in Bhairahawa (near the Indian border) in partnership with Huawei, aiming to streamline highly available digital services and cross-border data flows, with facilities equipped for disaster recovery and robust uptime in 2025.

Emerging Opportunities in Western Nepal Through Energy and Infrastructure Investments

Western Nepal holds 22% share of the Nepal Data Center Market, supported by rising infrastructure projects. Energy availability and renewable integration boost its potential. Growing demand from education and healthcare institutions drives investments. It positions itself as an emerging hub for sustainable data centers. Infrastructure development supports long-term growth momentum. Western Nepal is gradually shaping its role as a competitive subregion.

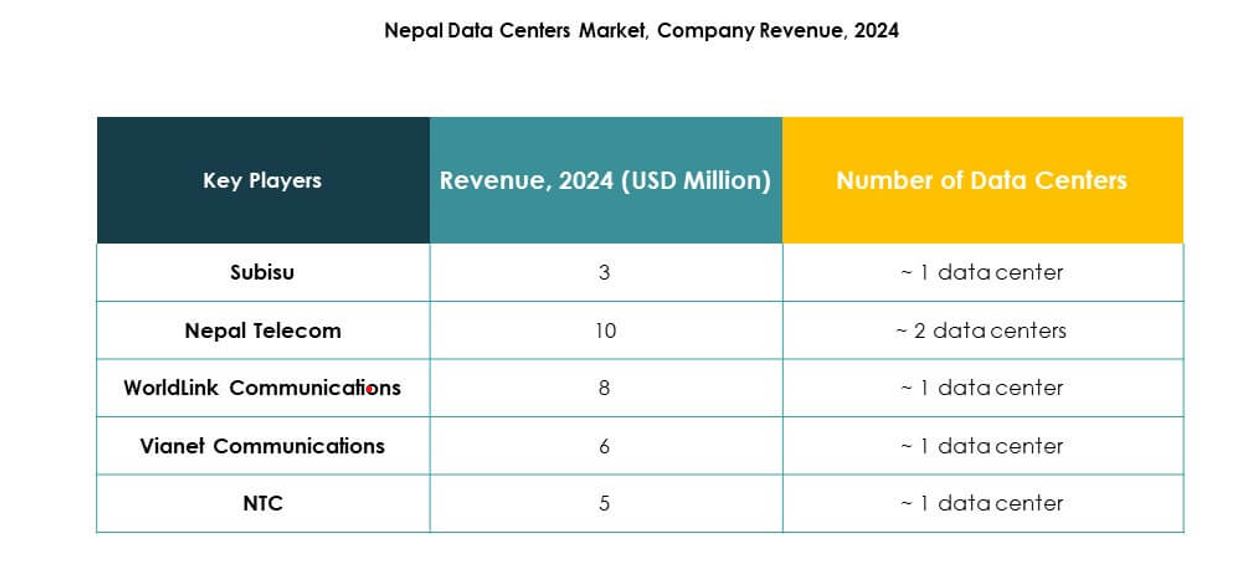

Competitive Insights:

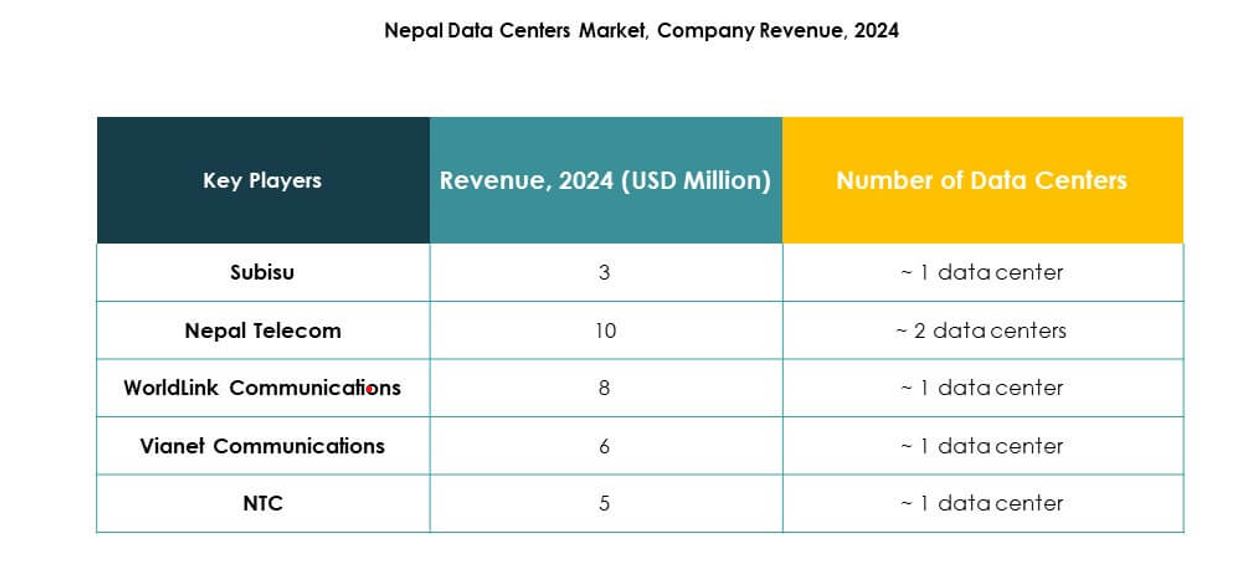

- Nepal Telecom

- WorldLink Communications

- United Telecom Nepal

- Google Cloud SE Asia

- NTC

- Vianet Communications

- Subisu

- Digital Realty Trust, Inc.

- NTT Communications Corporation

The Nepal Data Center Market features a mix of domestic telecom operators, regional service providers, and global technology leaders. Local firms like Nepal Telecom, WorldLink, and Vianet dominate through extensive fiber networks and growing colocation facilities. United Telecom Nepal and Subisu strengthen competitiveness with broadband expansion and managed services. NTC plays a dual role by supporting infrastructure and enterprise clients. Global players such as Google Cloud SE Asia, Digital Realty Trust, and NTT Communications increase market depth with advanced cloud and hyperscale solutions. It demonstrates strong growth potential where domestic expertise meets international investment. Partnerships, capacity expansion, and hybrid deployment strategies define the evolving competitive environment.

Recent Developments:

- In February 2025, WorldLink Communications launched a new 3.5MW data center in Chandragiri, Kathmandu. This carrier-neutral facility hosts 520 racks and is located near the Mata Tirtha substation, providing robust power supply for cloud computing, artificial intelligence, and machine learning operations, further elevating Nepal’s data infrastructure capabilities.

- In January 2025, Nepal Telecom partnered with Huawei to build a NPR 484 million ($3.5 million) primary data center in Kathmandu, along with a disaster recovery center in Bhairahawa. The project, based on a Letter of Intent, marks a significant step toward modernizing Nepal Telecom’s data handling and aims to boost operational efficiency and income generation for the telecom operator.

Market Challenges

Market Challenges