Executive summary:

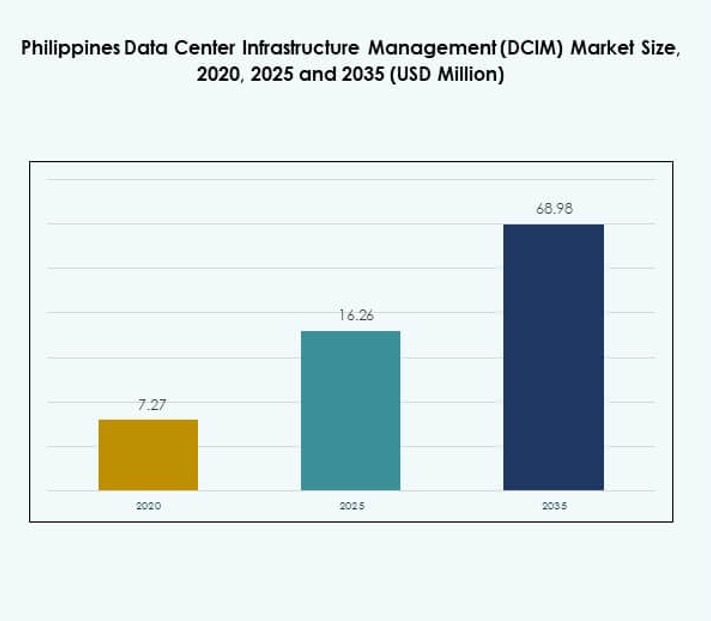

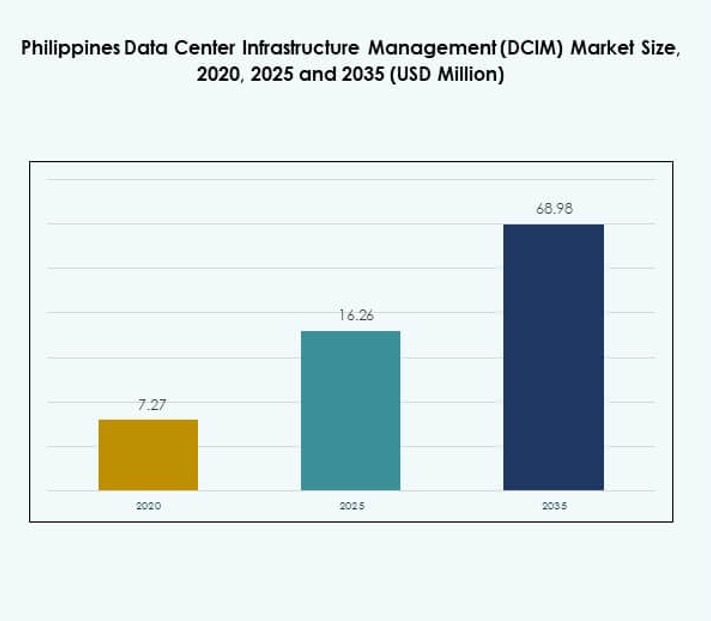

The Philippines Data Center Infrastructure Management (DCIM) Market size was valued at USD 7.27 million in 2020, increased to USD 16.26 million in 2025, and is anticipated to reach USD 68.98 million by 2035, growing at a CAGR of 17.32% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Philippines Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 16.26 Million |

| Philippines Data Center Infrastructure Management (DCIM) Market, CAGR |

17.32% |

| Philippines Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 68.98 Million |

The market is driven by the rapid expansion of digital infrastructure, cloud computing, and enterprise data centers. Businesses are investing in AI-driven monitoring, automation, and analytics to enhance operational efficiency and energy optimization. The growing demand for sustainable and intelligent data centers highlights the strategic importance of the market, making it a key area for investment and technological innovation across industries.

Metro Manila leads the market due to its strong digital ecosystem, advanced connectivity, and large enterprise concentration. Emerging regions such as Cebu and Davao are witnessing increasing investments in colocation and edge facilities. Favorable policies, renewable energy adoption, and expanding fiber networks are driving regional diversification and strengthening nationwide data management infrastructure.

Market Dynamics:

Market Dynamics:

Rising Cloud and Digital Infrastructure Investments Strengthening DCIM Demand

The Philippines Data Center Infrastructure Management (DCIM) Market is expanding due to rapid cloud adoption and digital infrastructure development. Businesses across banking, e-commerce, and telecom sectors are modernizing their data centers to enhance operational efficiency. Government-backed digitalization programs and foreign investments in hyperscale facilities accelerate this momentum. Companies are adopting DCIM tools for real-time monitoring, capacity planning, and performance optimization. These systems improve resilience against power outages and optimize resource usage. The growing demand for hybrid IT environments enhances market relevance. It enables organizations to balance cost, scalability, and security effectively, attracting strong investor interest.

- For instance, in August 2025, PLDT Inc. inaugurated its VITRO Sta. Rosa data center in Laguna, the country’s largest hyperscale facility with a design capacity of up to 50 MW. The site was developed through ePLDT to support cloud providers and enterprise clients, marking a major milestone in the Philippines’ expanding digital infrastructure ecosystem.

Integration of AI and Automation Enhancing Operational Efficiency

Artificial intelligence and automation play a critical role in transforming data center operations. AI-enabled DCIM platforms use predictive analytics to identify potential system failures and optimize energy usage. Automation ensures consistent uptime, reduces manual workload, and streamlines maintenance. The Philippines’ digital economy push motivates enterprises to adopt intelligent management systems. Integration with IoT sensors enables better temperature, power, and asset tracking. It allows operators to reduce downtime and improve system reliability. The market’s focus on operational intelligence strengthens its strategic position in Southeast Asia’s digital infrastructure landscape.

- For example, in August 2025, Schneider Electric launched new EcoStruxure Data Center Solutions and announced a global partnership with NVIDIA focused on sustainable, AI-ready data center infrastructure. The collaboration, unveiled globally in June 2025, provides scalable, energy-efficient solutions for high-density AI data centers, with relevance to the rapidly expanding market in the Philippines.

Growing Emphasis on Energy Efficiency and Sustainability Practices

Sustainability initiatives drive companies to adopt DCIM systems that reduce power usage and carbon footprint. Businesses are aligning with global standards for green data centers by integrating renewable energy sources. Advanced DCIM tools provide real-time insights into energy patterns, improving decision-making on cooling and power allocation. The Philippines government supports sustainability through policies encouraging renewable energy adoption. It promotes green infrastructure investments across IT and telecom sectors. Energy-efficient operations reduce total cost of ownership while supporting long-term resilience. The alignment of business goals with sustainability strengthens the country’s competitiveness in the regional data center market.

Increasing Importance of Regulatory Compliance and Security Management

The growing volume of sensitive digital data highlights the need for compliance and cybersecurity within data centers. DCIM platforms help businesses meet regulatory requirements by ensuring transparency in operations and system reliability. The National Cybersecurity Plan reinforces this trend by encouraging stronger infrastructure protection. Businesses are investing in secure monitoring tools that detect threats early. It helps prevent disruptions and enhances service continuity. Integration with global compliance standards like ISO 27001 promotes international partnerships. The focus on secure, compliant infrastructure positions the market as a strategic investment target for regional players.

Market Trends

Market Trends

Expansion of Edge and Colocation Data Centers Across Emerging Regions

The Philippines Data Center Infrastructure Management (DCIM) Market is witnessing strong growth in edge and colocation data centers. Enterprises are deploying DCIM tools to manage distributed infrastructures efficiently. Edge facilities support low-latency applications vital for 5G and IoT expansion. Rising data consumption in secondary cities creates new growth avenues. The integration of AI-based analytics improves workload distribution and energy control. It ensures seamless connectivity across distributed sites. Colocation providers are adopting modular DCIM solutions to optimize scalability. This trend strengthens the nation’s digital infrastructure and regional competitiveness.

Adoption of Hybrid Cloud Architectures Boosting Management Complexity

The rapid adoption of hybrid cloud models is reshaping data center operations. Businesses are deploying DCIM solutions to ensure visibility across multi-environment systems. Hybrid setups offer flexibility but demand advanced management capabilities. Real-time data integration between on-premises and cloud platforms enhances agility. It drives companies to adopt unified DCIM systems for consistent monitoring and control. Hybrid architectures support cost optimization and regulatory compliance simultaneously. Enterprises in sectors like finance and telecom are leading adoption. This trend enhances IT resilience and supports the country’s digital transformation journey.

Growing Shift Toward AI-Powered Predictive Maintenance Solutions

Growing Shift Toward AI-Powered Predictive Maintenance Solutions

AI-based predictive maintenance is transforming how operators manage critical infrastructure. Machine learning algorithms detect patterns in equipment behavior, reducing downtime risks. Real-time insights allow timely intervention before system failures occur. The Philippines’ growing AI ecosystem accelerates the use of intelligent monitoring systems. Predictive maintenance also optimizes cooling systems and energy consumption. It enhances efficiency while extending asset life cycles. The integration of analytics-driven alerts ensures operational consistency. This shift reflects a broader movement toward smarter, data-driven infrastructure management.

Increased Focus on Data Localization and Cyber Resilience

Regulatory emphasis on data sovereignty drives investment in local data centers. The Philippines Data Center Infrastructure Management (DCIM) Market aligns with these requirements through compliance-enabled systems. Localized data hosting supports national security and privacy standards. Enterprises are investing in resilient infrastructure capable of handling regional cybersecurity threats. It helps minimize risks from external attacks and operational disruptions. Data localization also encourages global cloud providers to expand local presence. The rise of secure, compliant infrastructure underscores the market’s maturity and strategic significance.

Market Challenges

High Implementation Costs and Limited Skilled Workforce Slowing Adoption

Implementing DCIM solutions demands significant investment in software, sensors, and integration. Small and medium enterprises struggle with high deployment and maintenance costs. The lack of skilled IT professionals limits effective system utilization. Many organizations rely on outdated infrastructure, creating compatibility challenges. The Philippines Data Center Infrastructure Management (DCIM) Market faces pressure from rising labor and training expenses. It must also address data center skill shortages through education and certification programs. Limited awareness about DCIM’s ROI among smaller firms restricts widespread adoption. Overcoming these constraints is essential to sustain market momentum.

Infrastructure Gaps and Power Reliability Issues Hindering Market Expansion

Unstable electricity supply and limited data center-grade facilities pose barriers to efficient operations. Frequent power interruptions increase the risk of downtime, reducing investor confidence. The archipelagic structure of the Philippines complicates connectivity between data center hubs. It challenges scalability and consistent performance across regions. Delays in infrastructure modernization limit the growth of hyperscale deployments. The market also faces regulatory hurdles affecting project execution speed. Coordinated government and private-sector collaboration can address these issues. Resolving infrastructure gaps is vital to ensure long-term reliability and growth.

Market Opportunities

Emerging Investments in Green and Modular Data Center Infrastructure

Sustainability trends create strong opportunities for eco-efficient infrastructure. Companies are adopting DCIM tools that reduce energy waste and support renewable power integration. Modular data centers are gaining preference for flexible scaling and faster deployment. The Philippines Data Center Infrastructure Management (DCIM) Market benefits from government-backed green energy programs. It enables enterprises to align business goals with environmental responsibility. International investors view this shift as a pathway to long-term operational savings. Sustainable infrastructure attracts funding from global technology firms expanding in Southeast Asia.

Rising Enterprise Demand for Cloud-Native and Automation-Driven Solutions

Enterprises are transitioning to cloud-native operations to improve agility and scalability. Automation-enabled DCIM systems allow real-time control of hybrid environments. The growing focus on AI and analytics improves asset visibility and system uptime. The Philippines’ expanding digital ecosystem supports adoption across industries. It encourages partnerships between local data centers and international technology providers. The demand for intelligent automation fosters competitive differentiation. The market’s transition toward smart management platforms will define its future growth trajectory.

Market Segmentation

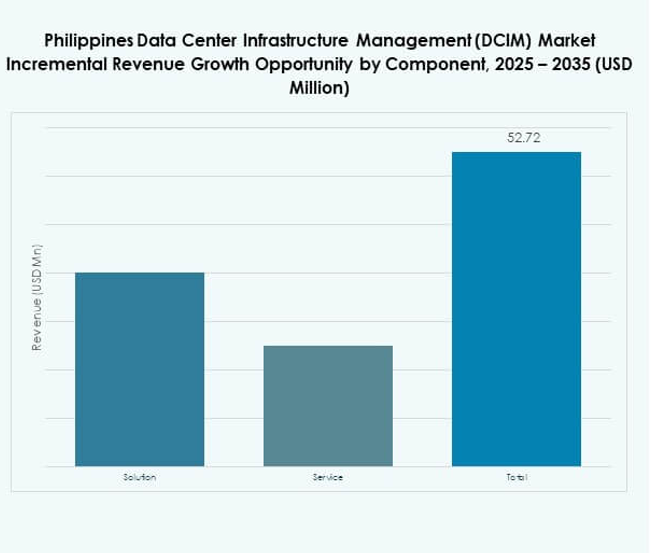

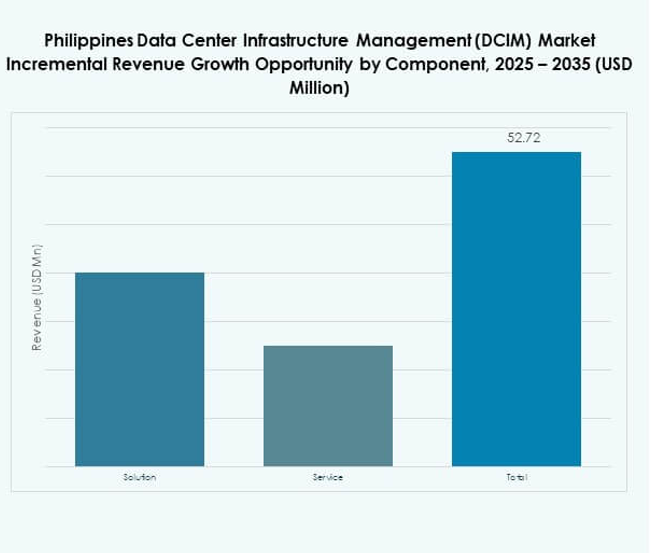

By Component

Solutions dominate the market, accounting for the largest share due to growing adoption of monitoring and analytics software. Businesses prefer integrated DCIM platforms for real-time data visualization and predictive performance tracking. Services such as consulting, integration, and support complement solution offerings, ensuring operational stability. The Philippines Data Center Infrastructure Management (DCIM) Market benefits from rising software-driven automation demand across both hyperscale and enterprise setups. Continuous innovation in AI-powered modules further strengthens the solutions segment’s leadership.

By Data Center Type

Enterprise data centers lead the segment due to rising modernization initiatives among financial, telecom, and IT enterprises. Colocation and edge data centers follow, supported by increasing digitalization in secondary cities. Managed and cloud-based facilities gain traction for their scalability and cost benefits. The Philippines Data Center Infrastructure Management (DCIM) Market sees growing hybrid deployments enhancing operational flexibility. Edge centers expand network coverage, improving latency performance and end-user experience.

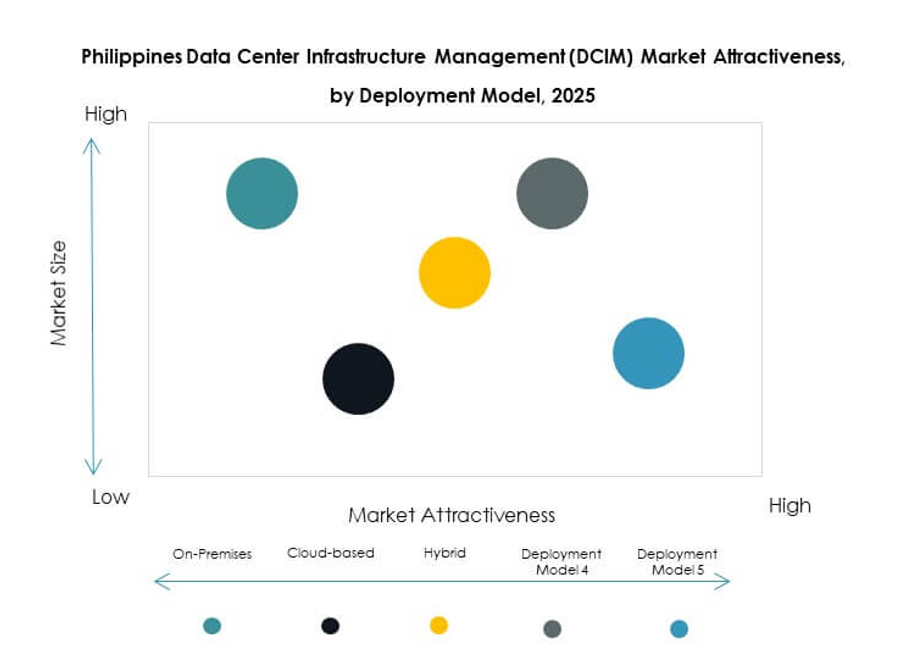

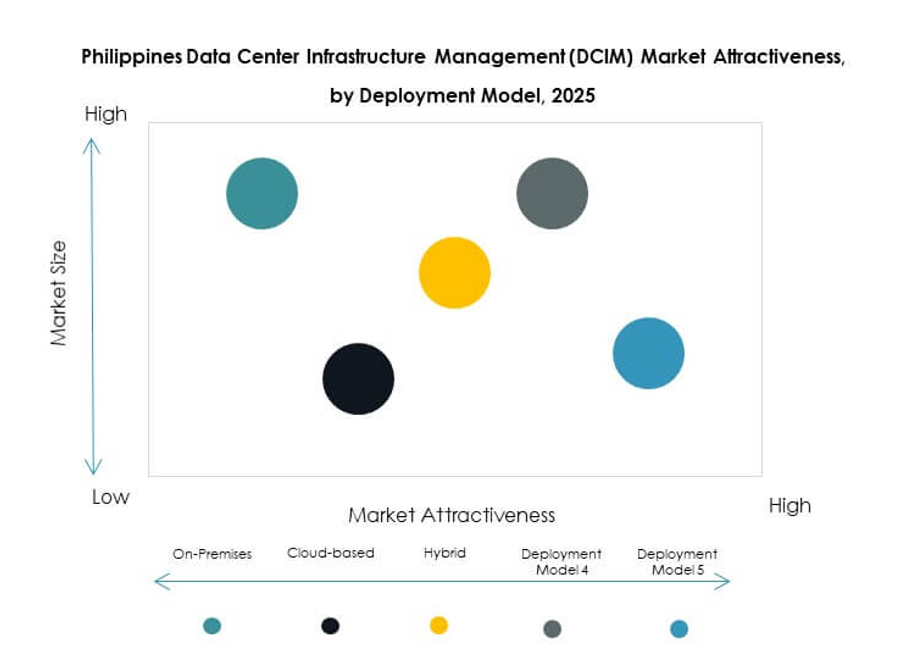

By Deployment Model

Cloud-based deployment holds a dominant position, driven by flexible access, reduced capital costs, and rapid implementation. Businesses prefer cloud platforms for scalability and simplified maintenance. On-premises models remain relevant in regulated industries requiring high security and control. Hybrid deployment continues gaining attention for combining both benefits effectively. The Philippines Data Center Infrastructure Management (DCIM) Market reflects this hybrid transition as organizations seek unified monitoring capabilities and faster service delivery.

By Enterprise Size

Large enterprises dominate adoption due to advanced IT infrastructure and higher investment capacity. These organizations deploy DCIM tools to monitor power, cooling, and asset utilization across global sites. Small and medium enterprises are adopting cost-effective cloud-based DCIM platforms to manage infrastructure efficiently. It provides affordable solutions without extensive hardware requirements. The Philippines Data Center Infrastructure Management (DCIM) Market benefits from digital transformation across sectors adopting scalable systems to improve efficiency.

By Application / Use Case

Asset and capacity management are key segments driving DCIM adoption. Businesses rely on these modules for equipment tracking and optimized space utilization. Power and environmental monitoring follow, helping maintain efficiency and reduce downtime. BI and analytics applications enable performance benchmarking and forecasting. The Philippines Data Center Infrastructure Management (DCIM) Market is growing with integrated use cases supporting smart, data-driven infrastructure management.

By End User Industry

IT and telecommunications hold the largest market share due to extensive digital network requirements. BFSI and retail sectors follow, adopting DCIM for reliability and compliance. Healthcare and energy utilities integrate DCIM for secure data and uninterrupted service delivery. Aerospace and defense sectors focus on mission-critical monitoring. The Philippines Data Center Infrastructure Management (DCIM) Market benefits from increasing digital service demand across all major industries.

Regional Insights

Metro Manila: The Core Data Center and DCIM Hub (Market Share: 58%)

Metro Manila leads the Philippines Data Center Infrastructure Management (DCIM) Market, accounting for 58% share. The region hosts major hyperscale and enterprise data centers due to its superior fiber connectivity and business infrastructure. Global players establish facilities here to leverage strong power grids and proximity to enterprise clients. Government projects promoting smart cities and e-governance also boost local demand. It remains the country’s technological and investment nucleus for data infrastructure innovation.

- For instance, PLDT launched its VITRO Sta. Rosa data center in April 2025, designed to deliver up to 50 MW of IT capacity and spanning around 13,000 square meters of white space. The facility is AI-ready, built to support GPU-based workloads and large-scale enterprise cloud operations across the Philippines.

Cebu and Davao: Emerging Growth Corridors (Market Share: 27%)

Cebu and Davao are gaining momentum through regional digitalization programs and improved power reliability. The regions attract cloud and colocation service providers expanding beyond Metro Manila. Strategic location and renewable energy integration make them attractive for new data center builds. The Philippines Data Center Infrastructure Management (DCIM) Market experiences regional diversification driven by corporate decentralization. Localized connectivity and government support encourage enterprise-grade facility investments across these cities.

Other Regions: Rising Opportunities Across Secondary Cities (Market Share: 15%)

Secondary cities like Clark, Iloilo, and Bacolod present new growth frontiers for the market. Infrastructure upgrades and the expansion of fiber optic networks enhance their appeal. Businesses seek DCIM integration to support smaller, distributed data centers. It enables regional IT resilience and improved service coverage. The growing number of tech parks and government incentives attract private investments. This regional diversification fosters a balanced, nationwide data management ecosystem.

- For instance, Converge ICT is constructing a 1,200-rack data center in Pampanga, which will support both its internal operations and enterprise clients. The facility is being designed with a 10 MW power load and is pursuing Tier III certification to ensure high reliability and redundancy.

Competitive Insights:

- ePLDT

- Globe Telecom

- Bayan Telecommunications

- Converge ICT

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- Schneider Electric SE

- Siemens AG

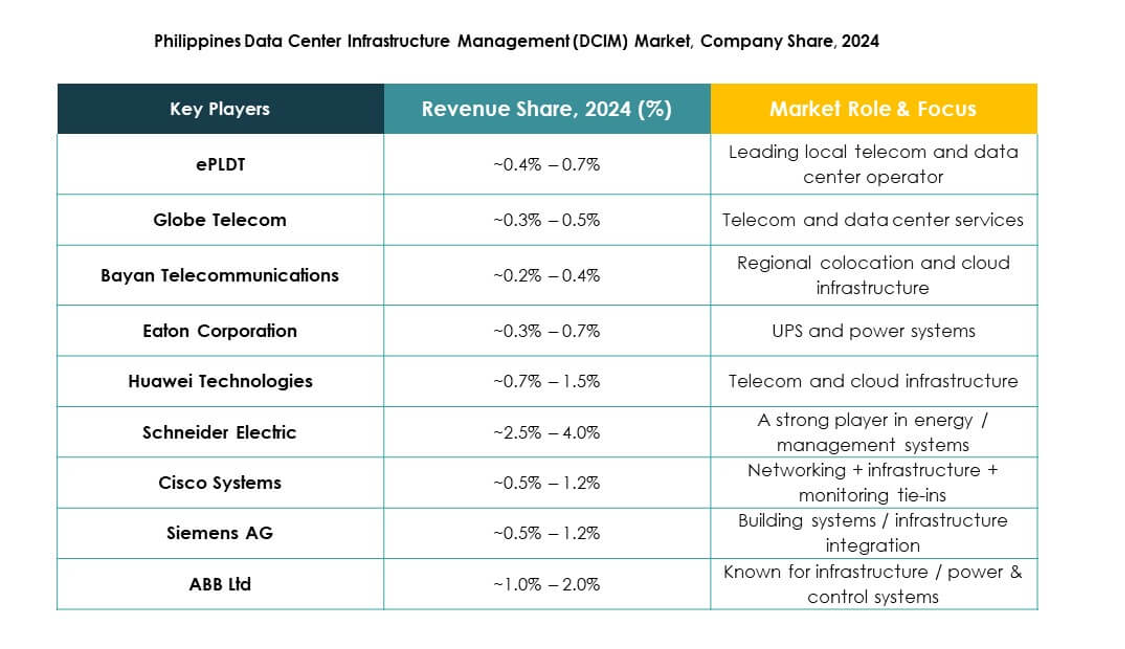

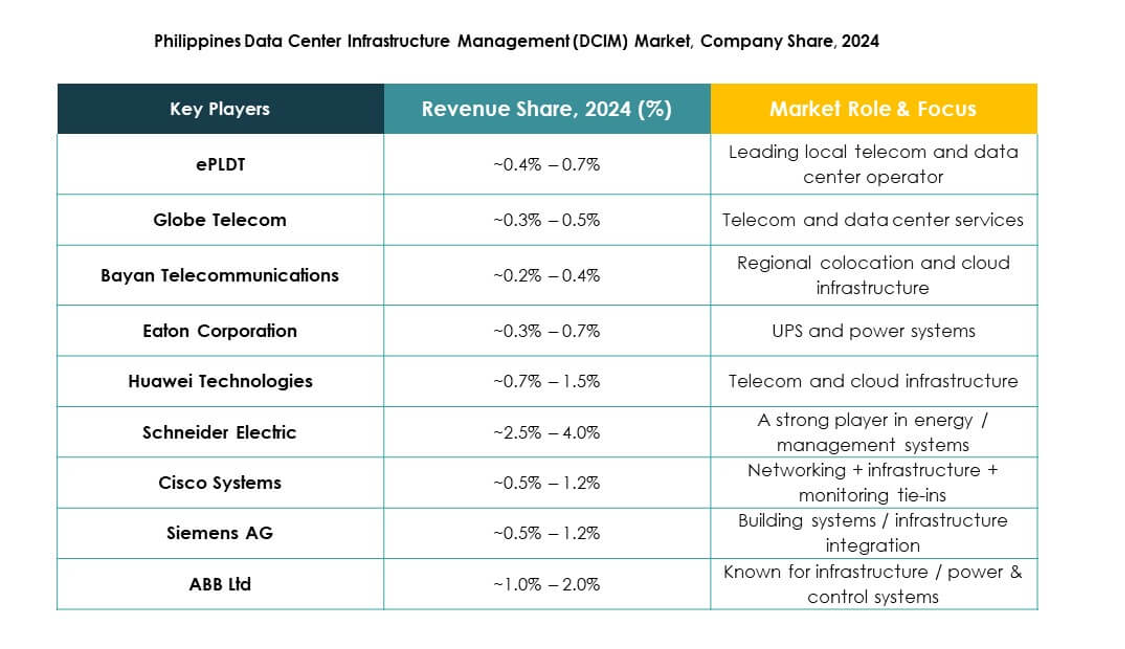

The Philippines Data Center Infrastructure Management (DCIM) Market features a competitive mix of local telecom leaders and global infrastructure solution providers. ePLDT and Globe Telecom dominate with large-scale facilities and cloud management capabilities, while Converge ICT and Bayan Telecommunications expand network-based DCIM solutions. Global players such as Huawei, Schneider Electric, and Siemens focus on automation, AI integration, and energy efficiency. Cisco and Eaton strengthen network visibility and power optimization segments. ABB emphasizes sustainability through smart power and monitoring systems. The market reflects intense competition where innovation, service quality, and sustainable operations determine leadership. It continues to evolve with partnerships between telecom operators and global DCIM technology providers to meet growing digital infrastructure demands.

Recent Developments:

- In September 2025, ePLDT introduced Pilipinas AI, the country’s first locally hosted artificial intelligence platform, developed in partnership with Dell Technologies and Katonic AI, and hosted at the VITRO Sta. Rosa data center to strengthen sovereign AI capabilities for Philippine enterprises.

- In June 2025, Schneider Electric launched new EcoStruxure Data Center Solutions and announced a global partnership with NVIDIA at Innovation Day Philippines, focusing on scalable, energy-efficient infrastructure specifically designed to meet the rising demand for high-density AI data centers in the country.

- In June 2025, Equinix announced the completion of the acquisition of three data centers in Manila from Total Information Management (TIM), marking its official entry into the Philippines’ data center market and significantly strengthening its digital infrastructure offerings in the country.

- In June 2025, Nokia entered a partnership with Converge ICT Solutions Inc. to future-proof new data centers in the Philippines with advanced DCIM and network technologies, aiming to bolster reliability and scalability for enterprise clients across the nation.

Market Dynamics:

Market Dynamics: Market Trends

Market Trends Growing Shift Toward AI-Powered Predictive Maintenance Solutions

Growing Shift Toward AI-Powered Predictive Maintenance Solutions