Executive summary:

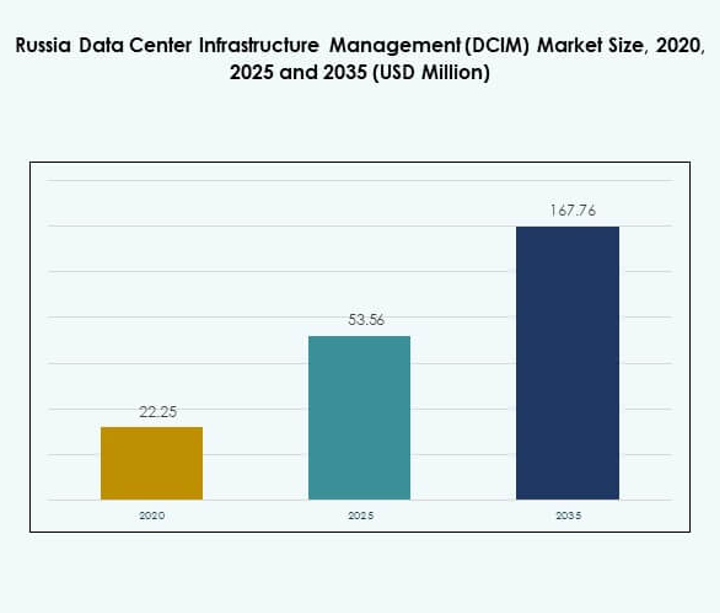

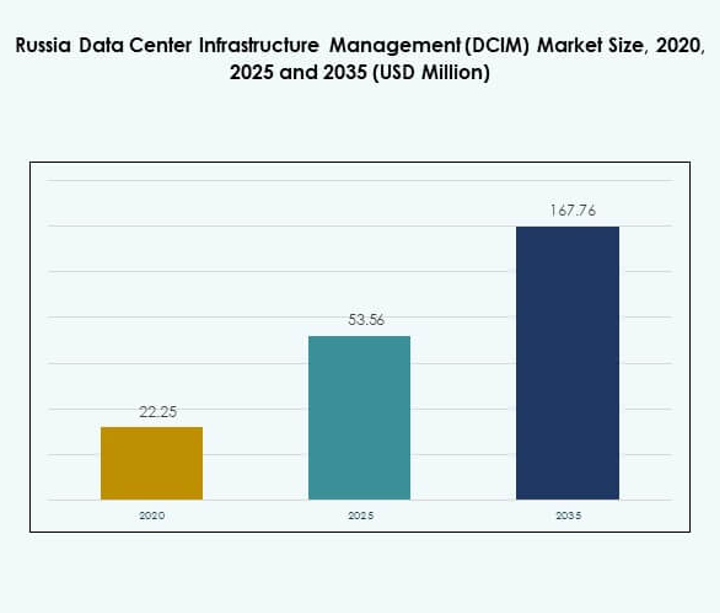

The Russia Data Center Infrastructure Management (DCIM) Market size was valued at USD 22.25 million in 2020 to USD 53.56 million in 2025 and is anticipated to reach USD 167.76 million by 2035, at a CAGR of 13.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Russia Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 53.56 Million |

| Russia Data Center Infrastructure Management (DCIM) Market, CAGR |

13.85% |

| Russia Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 167.76 Million |

Market growth is driven by increasing adoption of AI-driven monitoring, IoT-enabled sensors, and predictive analytics that enhance visibility and operational control. Innovation in energy optimization and automated capacity management strengthens resilience while aligning with sustainability requirements. Businesses prioritize DCIM platforms to minimize downtime and ensure regulatory compliance. For investors, the sector holds strategic importance as enterprises modernize digital infrastructure to maintain competitiveness in a rapidly evolving economy.

Regionally, Western Russia leads the market due to major hubs such as Moscow and St. Petersburg, where advanced data centers and strong enterprise demand support large-scale deployments. Central Russia is emerging as a strong growth contributor, driven by industrial modernization and cloud adoption. Eastern Russia is gradually gaining importance with expanding edge facilities that serve remote industries and support wider national connectivity.

Market Drivers

Adoption of Intelligent Infrastructure Management and Advanced Monitoring Platforms

The Russia Data Center Infrastructure Management (DCIM) Market is witnessing strong growth due to the adoption of advanced monitoring platforms. Organizations implement AI-driven solutions to improve asset tracking and enhance predictive maintenance capabilities. Intelligent infrastructure management enables enterprises to reduce downtime and achieve higher operational efficiency. Businesses are focusing on IoT-enabled sensors for real-time performance visibility and resource optimization. Automation supports sustainability goals and compliance with environmental standards. The adoption of such platforms improves resilience and reliability of critical IT infrastructure. Investors recognize these advancements as key to operational competitiveness. The integration of analytics strengthens decision-making and boosts long-term value creation.

- For instance, IXcellerate a major Russian data center operator reported that in 2024, the average requested power per rack space at its Moscow facilities reached 11.6 kW, with installations exceeding 20 kW per rack becoming the norm, signaling a substantial shift towards high-density intelligent infrastructure and advanced monitoring for operational resilience.

Innovation Through Energy Efficiency and Sustainable Operations in Data Centers

The market is strongly driven by the need for energy-efficient operations and sustainable infrastructure management. Enterprises deploy smart cooling systems and energy optimization solutions to lower power consumption. It supports compliance with regulatory requirements and reduces carbon footprints of facilities. The Russia Data Center Infrastructure Management (DCIM) Market benefits from green technology adoption that drives cost efficiency. Companies integrate automation to maintain seamless energy monitoring and capacity management. The emphasis on sustainability enhances brand reputation and strengthens enterprise value. Organizations also leverage analytics to identify energy hotspots and improve facility performance. Growing investment in clean technology drives strategic importance for stakeholders.

- For instance, Huawei’s iCooling@AI technology has been documented to reduce Power Usage Effectiveness (PUE) by 8% to 15% across large-scale data centers, delivering measurable energy savings and lowering carbon emissions in real-world deployments.

Strategic Importance of Hybrid and Cloud-Based DCIM Deployment Models

Organizations are increasingly moving to hybrid and cloud-based deployment models to optimize workload management. Businesses combine on-premises assets with scalable cloud resources for flexibility and resilience. It enables unified control and improves operational transparency across complex environments. The Russia Data Center Infrastructure Management (DCIM) Market sees strategic growth in cloud integration for data center modernization. Hybrid deployment models provide seamless scalability for enterprises balancing legacy and modern IT systems. Investors view this shift as critical for cost optimization and operational agility. Enterprises rely on predictive analytics and automation for dynamic resource allocation. The move toward hybrid adoption defines new competitive advantages in the market.

Growing Relevance of Data-Driven Decision Making and Predictive Capabilities

The demand for predictive analytics within DCIM platforms drives adoption across enterprises. It enables organizations to proactively manage resources, minimize downtime, and ensure continuity of operations. Businesses integrate machine learning for improved asset forecasting and lifecycle management. The Russia Data Center Infrastructure Management (DCIM) Market benefits from enterprises prioritizing data-driven decision-making frameworks. Predictive analytics supports compliance with industry regulations and boosts investor confidence. It helps businesses align IT strategy with long-term growth objectives. Enterprises reduce operational risks while enhancing infrastructure scalability. Investors consider data-driven management essential for sustainable returns in the digital economy.

Market Trends

Shift Toward Edge Computing Integration with Infrastructure Management Platforms

The adoption of edge computing drives demand for localized DCIM integration in Russia. Enterprises deploy edge facilities to support latency-sensitive workloads and regional expansion. The Russia Data Center Infrastructure Management (DCIM) Market benefits from integration of DCIM platforms at distributed sites. It provides visibility, power monitoring, and capacity optimization across multiple edge nodes. This trend supports industries such as telecommunications and retail requiring fast response times. Edge-enabled DCIM ensures consistent performance across geographically dispersed centers. Enterprises enhance resilience while balancing cloud and edge environments. Investors recognize edge deployment as a strong long-term growth opportunity.

Expansion of AI and Machine Learning Use Cases for Operational Control

AI and machine learning continue to shape operational efficiency within infrastructure management platforms. Companies utilize these technologies for intelligent cooling, predictive maintenance, and workload optimization. The Russia Data Center Infrastructure Management (DCIM) Market is aligning with AI-driven capabilities for operational agility. It strengthens automation by providing real-time recommendations and performance insights. Enterprises improve energy consumption forecasting and enhance compliance accuracy. AI supports capacity planning while reducing risks of unplanned outages. Businesses integrate machine learning to enhance proactive decision-making. Industry adoption of these technologies positions DCIM platforms as essential for future-ready data centers.

Emphasis on Cybersecurity and Integration with IT Management Systems

Security integration emerges as a dominant trend in infrastructure management. Enterprises demand platforms that combine physical and digital security oversight. The Russia Data Center Infrastructure Management (DCIM) Market incorporates unified security solutions with IT management systems. It helps organizations mitigate risks associated with rising cyberattacks on data infrastructure. Security-driven DCIM adoption includes monitoring, access control, and threat detection features. Companies align operations with national security standards and compliance frameworks. Businesses view integrated cybersecurity as a competitive differentiator. The rising demand for secure infrastructure strengthens the role of DCIM in risk management.

Increased Investment in Modular and Prefabricated Infrastructure Solutions

Modular data center construction is driving adoption of scalable DCIM platforms. Enterprises implement prefabricated infrastructure for faster deployment and simplified monitoring. The Russia Data Center Infrastructure Management (DCIM) Market integrates DCIM systems into modular facilities to enhance control. It allows businesses to expand capacity quickly and adapt to digital transformation. Modular design supports hybrid and multi-cloud ecosystems with flexibility. Investors prefer modular investments for their cost efficiency and shorter deployment cycles. DCIM ensures these modular environments remain efficient and secure. Market adoption of prefabricated designs reflects a broader shift toward adaptable infrastructure.

Market Challenges

High Implementation Costs and Complexity of DCIM Integration Across Facilities

The Russia Data Center Infrastructure Management (DCIM) Market faces cost barriers linked to implementation and integration. Many enterprises struggle with high upfront investments required for software, hardware, and automation. It limits adoption among small and medium enterprises with constrained budgets. Complexity of integrating DCIM with legacy IT systems poses further challenges. Businesses often require skilled professionals for deployment, adding to operational costs. Limited awareness among traditional operators slows adoption in emerging industries. Investors evaluate these risks before committing capital. Market growth is tempered by financial and technical hurdles impacting smaller enterprises.

Regulatory Pressures, Talent Shortages, and Rising Security Threats Across Digital Assets

Enterprises must comply with strict regulations on energy usage and data protection, creating challenges for adoption. The Russia Data Center Infrastructure Management (DCIM) Market faces pressure from evolving cybersecurity threats targeting data centers. It compels businesses to adopt advanced monitoring while increasing investment costs. Shortage of skilled professionals in AI, cloud, and automation slows deployment. Organizations struggle with balancing compliance, cost, and performance objectives. Cyber risks elevate concerns for investors evaluating long-term returns. The challenge lies in creating scalable frameworks that address regulatory, security, and workforce constraints. Market participants must navigate these barriers to sustain growth momentum.

Market Opportunities

Expanding Cloud Ecosystem and Growing Role of Hybrid Deployment Models

The Russia Data Center Infrastructure Management (DCIM) Market presents strong opportunities through hybrid adoption. Businesses expand workloads across on-premises, cloud, and edge platforms. It creates demand for unified monitoring and resource optimization. Enterprises adopt hybrid DCIM to enhance scalability and cost efficiency. Cloud adoption by BFSI, healthcare, and retail supports this trend. It improves workload visibility and strengthens compliance frameworks. Investors recognize hybrid expansion as a growth catalyst. Hybrid solutions open avenues for digital transformation in Russian enterprises.

Advancing Edge Infrastructure and Smart Automation Platforms Driving Growth Potential

The growth of edge facilities in Russia opens new market opportunities for DCIM solutions. Enterprises integrate smart automation and IoT-enabled sensors for localized efficiency. The Russia Data Center Infrastructure Management (DCIM) Market benefits from these opportunities across industries. Edge DCIM adoption supports 5G expansion, AI-driven workloads, and retail modernization. It improves resilience and ensures uptime in distributed environments. Investors find edge automation investments attractive for long-term scalability. Smart platforms reinforce Russia’s role in digital transformation. Market growth aligns with future infrastructure needs across multiple sectors.

Market Segmentation

By Component

Solutions dominate the Russia Data Center Infrastructure Management (DCIM) Market, supported by strong demand for asset management, energy monitoring, and predictive analytics. Enterprises adopt advanced software platforms to optimize resources and improve efficiency. Services segment grows steadily as businesses require integration, training, and support. Vendors provide customized services for hybrid and multi-cloud environments. Organizations benefit from consulting and managed support offerings. Adoption of solution platforms reflects a focus on digital modernization. Services create ongoing revenue streams for providers. Market dynamics highlight solutions as the leading segment.

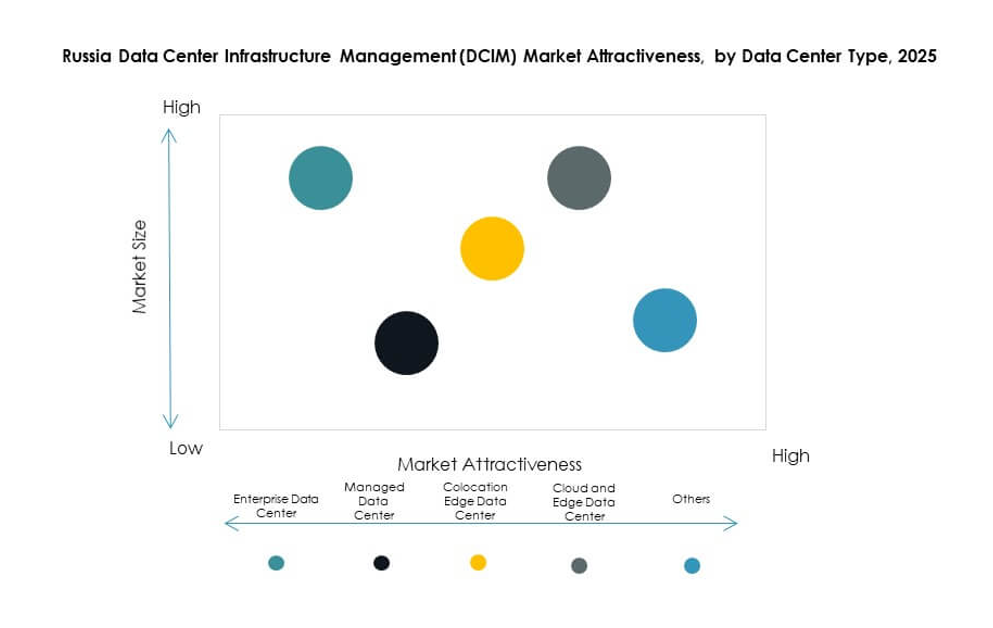

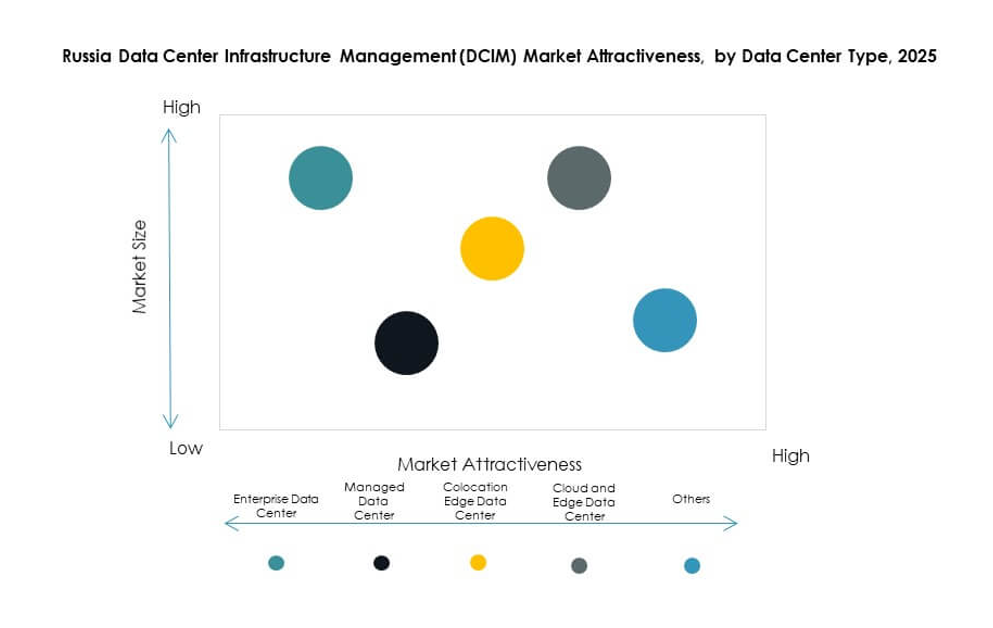

By Data Center Type

Enterprise data centers represent a leading share, driven by internal modernization efforts of large organizations. Managed data centers gain adoption from enterprises outsourcing infrastructure oversight. Colocation edge data centers expand rapidly due to rising demand for flexible capacity. The Russia Data Center Infrastructure Management (DCIM) Market highlights strong growth in cloud and edge facilities, driven by digital transformation. Colocation supports industries like BFSI and telecommunications needing scalable solutions. Others segment remains smaller but supports niche deployments. Market dominance lies with enterprise and colocation facilities.

By Deployment Model

On-premises deployment retains significance due to security and compliance requirements in Russia. However, cloud-based DCIM adoption grows with enterprises moving toward flexible infrastructure models. Hybrid deployment emerges as the fastest-growing approach, balancing control and scalability. The Russia Data Center Infrastructure Management (DCIM) Market sees hybrid adoption supporting enterprises managing multi-site operations. Hybrid models integrate AI, automation, and analytics for greater transparency. Large enterprises lead adoption due to budget flexibility. SMEs increasingly explore cloud-based DCIM due to lower upfront costs. Hybrid deployment marks a clear growth trend in the market.

By Enterprise Size

Large enterprises dominate the market due to extensive infrastructure and investment capacity. They prioritize predictive analytics, hybrid deployment, and sustainability-driven DCIM adoption. Small and medium enterprises (SMEs) are emerging adopters, supported by affordable cloud-based solutions. The Russia Data Center Infrastructure Management (DCIM) Market shows strong interest from SMEs in scaling operations efficiently. SMEs face adoption challenges linked to costs and awareness but benefit from modular solutions. Large enterprises remain leaders due to demand for operational visibility and compliance. Market segmentation by enterprise size reflects a dual growth path.

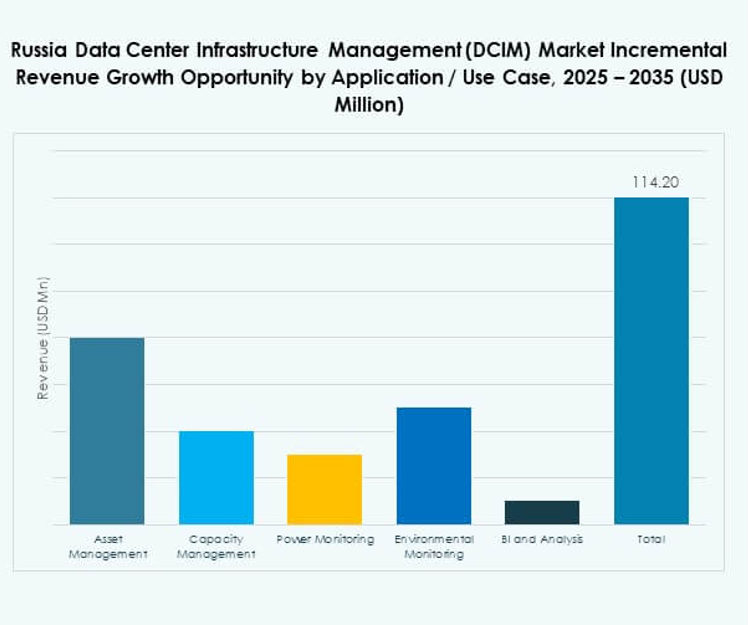

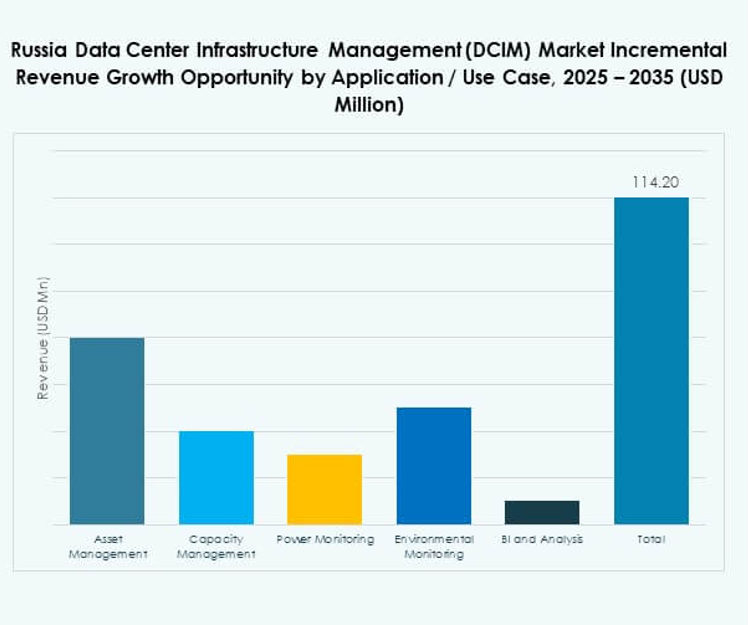

By Application / Use Case

Asset management leads adoption across enterprises managing large infrastructure portfolios. Power monitoring and environmental monitoring also see rapid uptake to ensure operational resilience. Capacity management supports optimization of IT and physical resources. Business intelligence (BI) and analysis features enhance predictive decision-making. The Russia Data Center Infrastructure Management (DCIM) Market benefits from multi-use case adoption for operational visibility. Applications vary by enterprise type, but asset management remains dominant. Industry adoption highlights the value of predictive and real-time data insights.

By End User Industry

IT and telecommunications sector leads adoption due to extensive infrastructure requirements. BFSI sector follows, leveraging DCIM for security, compliance, and workload visibility. Healthcare invests strongly to ensure data reliability and patient information security. Retail and e-commerce integrate DCIM to optimize digital platforms. Aerospace and defense utilize DCIM for mission-critical operations. Energy and utilities focus on sustainability and predictive monitoring. The Russia Data Center Infrastructure Management (DCIM) Market highlights IT, BFSI, and healthcare as the most influential adopters. Industry diversification supports broader adoption across sectors.

Regional Insights

Western Russia Leading with Dominant Market Share

Western Russia holds the largest share of the Russia Data Center Infrastructure Management (DCIM) Market, accounting for 46%. It benefits from major economic hubs like Moscow and St. Petersburg hosting advanced data centers. Enterprises in this region prioritize hybrid and cloud deployments to support digital services. It leads adoption of AI-driven monitoring and sustainable infrastructure. Investors focus capital here due to strong connectivity and enterprise demand. The region maintains dominance through infrastructure modernization and regulatory compliance.

- For instance, Rostelecom launched its Tier III-certified NORD-6 data center in Moscow in October 2021, featuring 207 racks across two halls with 5MW total power capacity, as part of its existing NORD campus of over 3,700 racks.

Central Russia Emerging as a Strong Growth Region

Central Russia accounts for 34% of the Russia Data Center Infrastructure Management (DCIM) Market. Industrial expansion, rising cloud adoption, and investment in enterprise modernization drive this growth. Enterprises integrate DCIM solutions to improve resilience and cost efficiency. The region shows strong adoption by BFSI, energy, and healthcare sectors. It supports hybrid deployment models to meet industry-specific needs. Investors find opportunities due to strong digital adoption rates. Market strength in this region reflects balanced industry diversification.

Eastern Russia Gaining Momentum with Rising Edge Deployments

Eastern Russia captures 20% share of the Russia Data Center Infrastructure Management (DCIM) Market. It experiences growth driven by edge data centers supporting remote industries. Enterprises adopt DCIM to manage distributed workloads and environmental monitoring. The region benefits from government digital initiatives and connectivity investments. Telecommunications and energy sectors drive adoption due to regional coverage needs. Investors explore opportunities in edge deployments to expand market presence. Eastern Russia emerges as an important contributor to national DCIM growth.

- For instance, Key Point launched a Tier III-certified data center in Primorsky Krai in February 2023, with an initial 440-rack capacity expandable to 880 racks and 10MW power, backed by 1.5 billion rubles in investment.

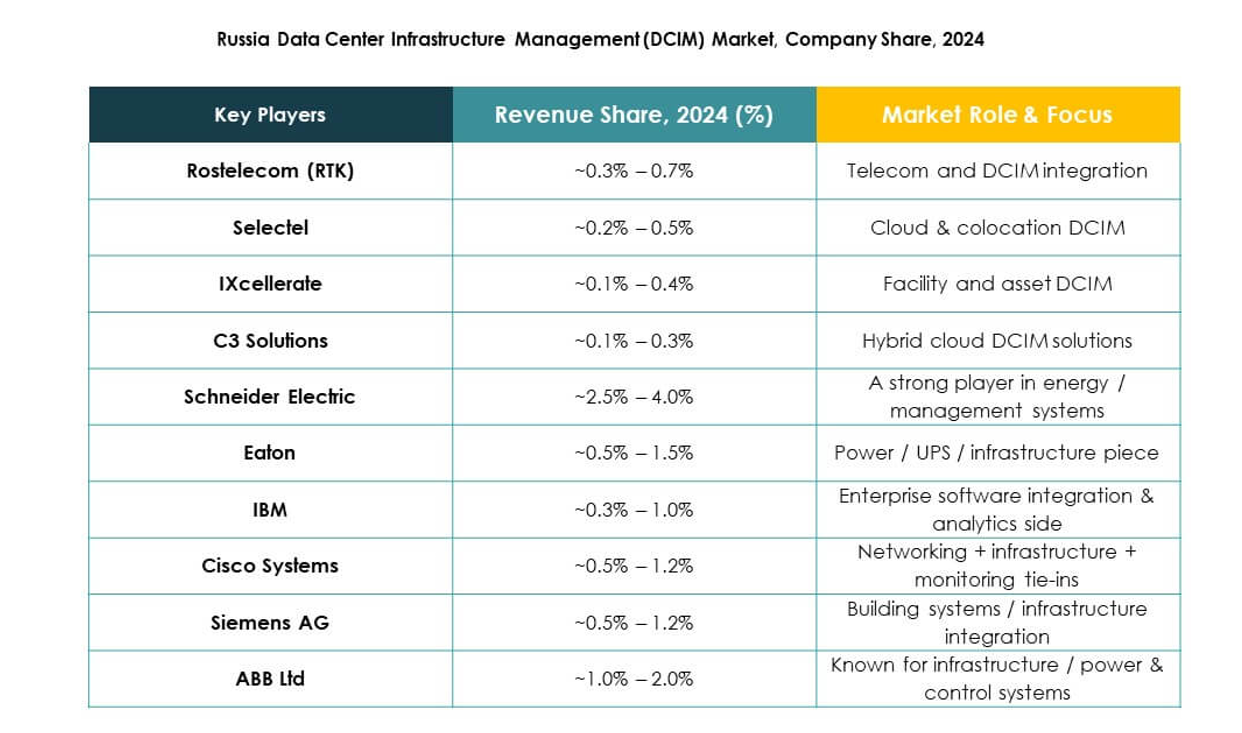

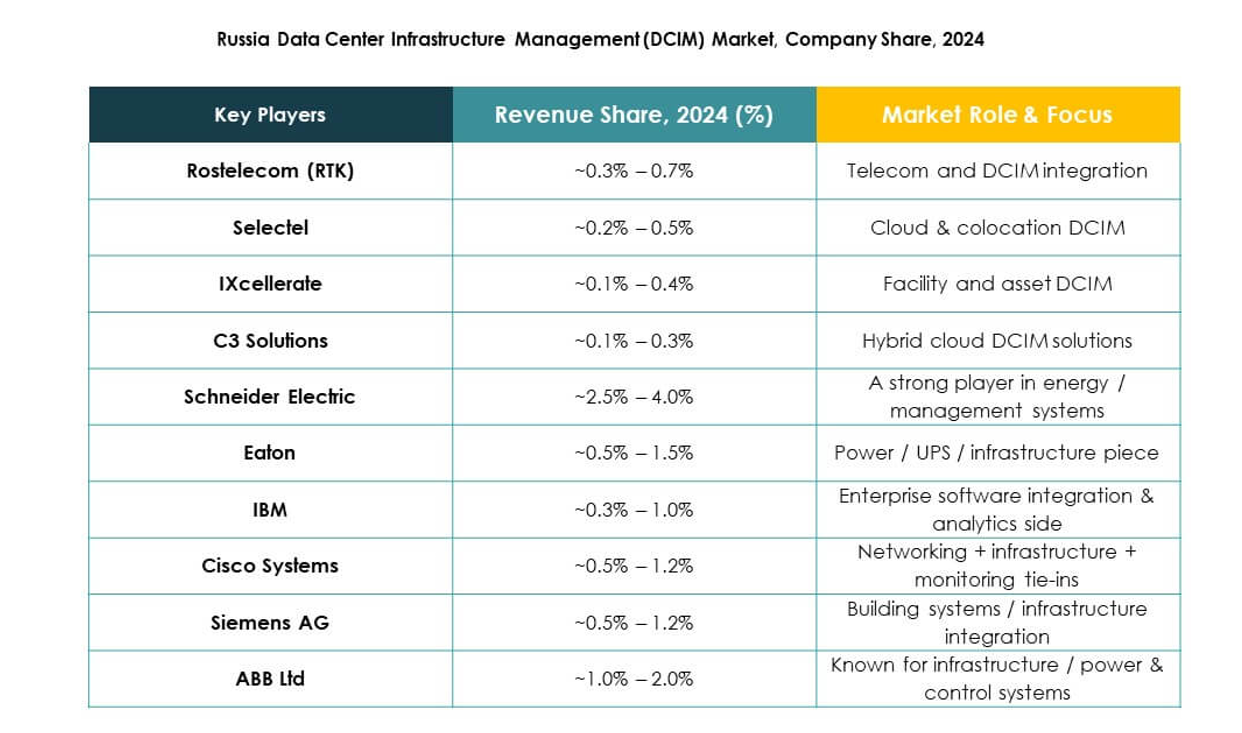

Competitive Insights:

- Rostelecom (RTK)

- Selectel

- IXcellerate

- C3 Solutions

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- IBM

- Schneider Electric SE

- Siemens AG

- HPE (Hewlett Packard Enterprise)

- Delta Electronics

The competitive landscape of the Russia Data Center Infrastructure Management (DCIM) Market features a mix of domestic and global players driving growth through technology leadership and strategic partnerships. Rostelecom, Selectel, and IXcellerate strengthen their positions with large-scale data center investments and managed services tailored to local enterprises. Global technology leaders such as Schneider Electric, Huawei, and Cisco focus on intelligent monitoring, automation, and sustainability solutions to capture market share. It remains highly dynamic, with companies emphasizing hybrid deployment support, AI-driven analytics, and energy efficiency. Strategic collaborations, service expansions, and advanced product launches define the competitive strategies shaping future opportunities across the Russian DCIM ecosystem.

Recent Developments:

- In July 2025, Megafon announced the launch of new data centers in Yekaterinburg and Tver, each offering 1MW of capacity, with the development forming part of its broader expansion efforts to strengthen digital infrastructure across Russia.

- In June 2025, Rostelecom’s subsidiary RTK-TsOD inaugurated a new data center facility in the Nizhny Novgorod region of Russia, further strengthening its position in the country’s data center infrastructure market while rolling out a new mobile data processing service to meet evolving digital requirements.