Executive summary:

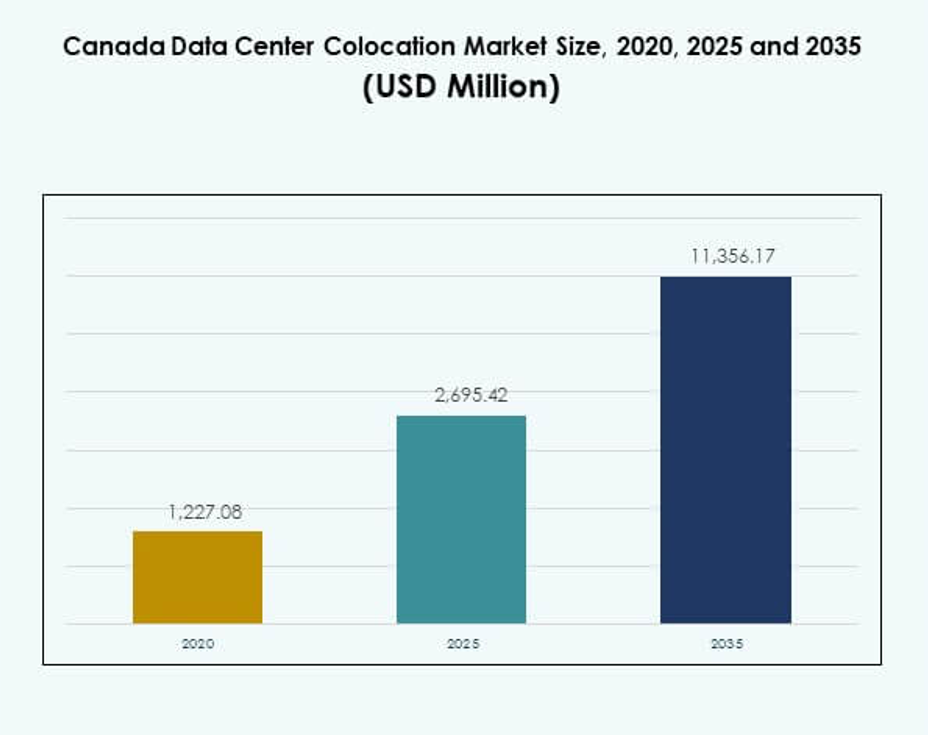

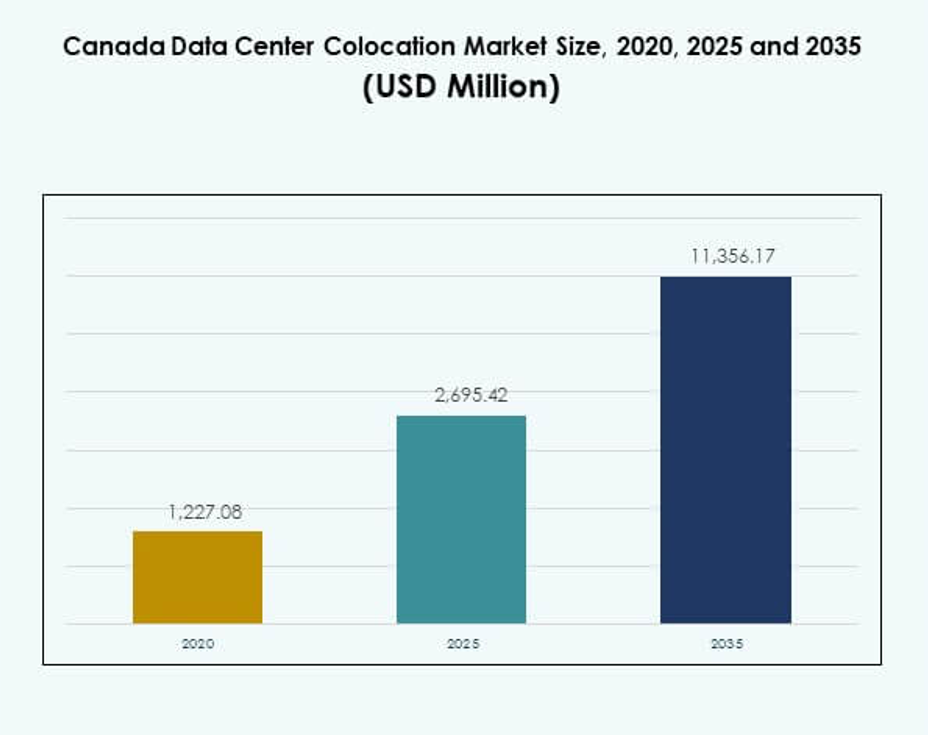

The Canada Data Center Colocation Market size was valued at USD 1,227.08 million in 2020 to USD 2,695.42 million in 2025 and is anticipated to reach USD 11,356.17 million by 2035, at a CAGR of 15.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Canada Data Center Colocation Market Size 2025 |

USD 2,695.42 Million |

| Canada Data Center Colocation Market, CAGR |

15.40% |

| Canada Data Center Colocation Market Size 2035 |

USD 11,356.17 Million |

The Canada Data Center Colocation Market is experiencing strong momentum driven by rapid technology adoption and infrastructure innovation. Enterprises are expanding AI, cloud, and edge computing capabilities, increasing demand for scalable colocation services. Hyperscalers are deploying modular and energy-efficient facilities to support hybrid cloud strategies. This shift is strengthening national digital infrastructure, creating attractive opportunities for investors seeking long-term returns in critical connectivity and data resilience.

Ontario leads the Canada Data Center Colocation Market due to its dense interconnection hubs and hyperscaler presence. Quebec is emerging strongly with abundant renewable energy and favorable operating conditions. Western Canada is growing as an edge deployment zone, supported by expanding telecom networks and rising enterprise demand. This regional diversity is shaping a balanced and resilient market structure across the country.

Market Drivers

Rising Digital Transformation and Expansion of Cloud Infrastructure Across Core Industries

The Canada Data Center Colocation Market is driven by rapid digitalization across major industries. Enterprises are migrating workloads to colocation facilities to reduce capital costs and improve operational efficiency. Cloud service providers are scaling their footprints to support hybrid and multi-cloud strategies. It is creating a strong backbone for enterprise applications, AI workloads, and IoT ecosystems. Government-backed digital initiatives are further boosting connectivity and edge computing adoption. High-speed networks and low-latency infrastructure are attracting global hyperscalers. Strategic investments are reinforcing data resilience and business continuity. Investors view these developments as critical for long-term digital infrastructure growth.

Strong Regulatory Framework Driving Local Data Hosting and Security Compliance

Stringent regulations on data residency are shaping deployment decisions for cloud and enterprise networks. Organizations are prioritizing domestic data storage to meet evolving privacy laws and cybersecurity standards. Colocation providers are integrating advanced compliance protocols and zero-trust architectures to align with regulatory demands. It supports industries like BFSI, healthcare, and government where security is critical. This regulatory push is increasing the need for Tier III and Tier IV certified facilities. Operators are enhancing transparency, auditability, and resilience of hosted environments. Growing cyber threats and strict governance are making compliant colocation sites essential infrastructure for national data protection.

- For instance, Cologix Montreal MTL10 data center holds multiple independent certifications including ISO/IEC 27001:2013 for information security, PCI DSS for payment card data, SOC 1/2, and HIPAA for healthcare compliance, with these accreditations validated by third-party audits, ensuring all Canadian facilities meet legal, operational, and governance standards as documented on Cologix’s certifications site and ESG materials as of August 2025.

Rising AI and High-Performance Computing Workloads Creating Demand for Scalable Capacity

Enterprises are adopting AI, ML, and analytics at scale, driving demand for dense compute colocation sites. HPC workloads need high power, efficient cooling, and low-latency interconnects. Colocation providers are modernizing facilities with liquid cooling, high-density racks, and redundant power to support AI infrastructure. It is enabling advanced modeling, real-time analytics, and edge deployments. Hyperscalers and AI developers are co-locating clusters for flexible capacity expansion. Enterprises prefer colocation over on-premise facilities to manage cost and complexity. This shift is accelerating capital inflows and transforming colocation into a strategic technology hub. Advanced digital workloads are anchoring future capacity planning.

Rising Investments by Global Hyperscalers and Telecom Providers

Hyperscale players are strategically entering Canadian cities to leverage favorable connectivity and renewable energy. Global providers are investing in scalable, modular facilities to meet rising demand for cloud storage, AI computing, and digital services. Telecom operators are extending fiber networks and integrating colocation for edge readiness. It is strengthening interconnection capabilities and improving nationwide coverage. Green energy adoption is improving sustainability and reducing operational costs. Investors are targeting metro hubs like Toronto, Montreal, and Vancouver for long-term capacity expansion. This influx of capital is positioning colocation as a core enabler of national digital competitiveness. The growth trajectory reflects strategic alignment with global cloud expansion trends.

- For instance, AWS was ranked the #1 global data center company in the 2025 Data Centre Magazine Top 100, with Canada’s campuses (notably Montreal and Quebec) running on renewable hydroelectric energy and supporting major hyperscale expansion, as independently tracked by Data Centre Magazine and industry reports, confirming AWS’s operational strategy throughout 2025.

Market Trends

Accelerating Shift Toward Green and Energy-Efficient Colocation Infrastructure

The Canada Data Center Colocation Market is witnessing rising adoption of renewable energy and sustainable designs. Operators are deploying energy-efficient cooling systems, advanced PUE metrics, and carbon-neutral technologies. Renewable power sourcing is gaining traction, reducing operational costs and environmental impact. It is driving large enterprises and hyperscalers to select facilities that align with net-zero goals. Developers are integrating solar, hydro, and wind-based energy into their infrastructure mix. Real-time energy monitoring systems are enhancing operational transparency. ESG-focused investments are becoming key differentiators. Sustainable colocation is shaping future procurement decisions for data-driven enterprises.

Increased Adoption of Edge Computing and Interconnection Ecosystems

Edge computing is expanding the scope of colocation facilities in emerging Canadian hubs. Enterprises are moving latency-sensitive workloads closer to users for real-time performance. Colocation providers are developing interconnection-rich campuses with direct cloud on-ramps and carrier-neutral ecosystems. It is enabling low-latency networks essential for AI, IoT, and critical applications. Metro hubs are becoming distributed computing nodes for national digital infrastructure. Telecom expansion and private 5G networks are reinforcing edge growth. Hybrid colocation models are supporting flexible capacity deployment. This trend is unlocking new market segments and broadening the digital infrastructure landscape.

Expansion of Modular and Prefabricated Data Center Designs

Colocation operators are increasingly investing in modular and prefabricated designs to shorten build times. These facilities offer scalability, faster deployment, and better cost control. It is enabling operators to meet the growing demand for flexible capacity across secondary cities. Prefabricated modules allow precise capacity expansion without significant construction delays. Telecom and cloud providers are leveraging this model for rapid deployment. Advanced power and cooling integration within modules is improving efficiency. Modular facilities support edge network expansion strategies. This architectural shift is enhancing market responsiveness to changing enterprise requirements.

Growing Role of Software-Defined Infrastructure and Automation

Software-defined architectures are transforming operational models in colocation facilities. Operators are automating network provisioning, power management, and workload orchestration. It is increasing resource efficiency and improving uptime for hosted tenants. Enterprises benefit from improved control over hybrid deployments. SDN and DCIM platforms enable real-time optimization and predictive maintenance. This shift is driving operational agility and cost savings for providers. Automation is supporting seamless scaling of AI and edge workloads. The growing use of AI-driven facility management tools is becoming a critical market trend for sustainable growth.

Market Challenges

Market Challenges

High Infrastructure Costs and Energy Price Volatility Impacting Profitability

The Canada Data Center Colocation Market faces significant cost pressures driven by energy-intensive operations. Building and operating Tier III and Tier IV facilities require heavy capital investment. Rising energy prices are impacting operational margins, especially for high-density AI and HPC workloads. It is creating long-term pricing pressure for both providers and tenants. Power sourcing from renewable grids requires substantial upfront expenditure. Cooling system modernization and redundancy infrastructure further increase cost structures. Operators must balance pricing strategies with efficiency improvements to stay competitive. This challenge is influencing investment timelines and scalability planning.

Complex Regulatory Environment and Evolving Cybersecurity Threat Landscape

The regulatory environment for data protection in Canada is becoming more demanding. Colocation providers must comply with multiple federal and provincial regulations related to privacy, energy use, and security standards. It is increasing the operational complexity of facility management. Growing cyber threats are adding another layer of risk for operators. Enterprises expect providers to deliver zero-trust security, advanced encryption, and resilient backup frameworks. Meeting these requirements requires high technical expertise and continuous investment. Failure to maintain compliance can lead to operational disruptions and reputational damage. This evolving landscape demands constant strategic and technical adaptation.

Market Opportunities

Strategic Expansion into Secondary Cities with Strong Connectivity Potential

The Canada Data Center Colocation Market holds strong potential in secondary metro areas. These cities offer lower land costs, reliable connectivity, and growing enterprise activity. Telecom fiber expansion is improving network performance and enabling edge deployments. It is opening new opportunities for providers to build scalable and modular facilities. Enterprises view these regions as cost-effective options for disaster recovery and regional expansion. Targeting these locations can help providers capture untapped demand and diversify their footprint. Investors are focusing on regional hubs with high growth potential.

Integration of AI-Driven Energy Optimization and Automation Platforms

Operators have opportunities to enhance competitiveness through AI-driven energy optimization and automation. Intelligent systems can reduce energy waste, improve cooling efficiency, and lower costs. It is enabling scalable operations with lower environmental impact. Enterprises prefer providers offering smart infrastructure capabilities for better performance visibility. AI integration strengthens resilience and improves power usage metrics. Adopting such solutions enhances long-term profitability and sustainability positioning. This shift can differentiate leading providers in a competitive market.

Market Segmentation

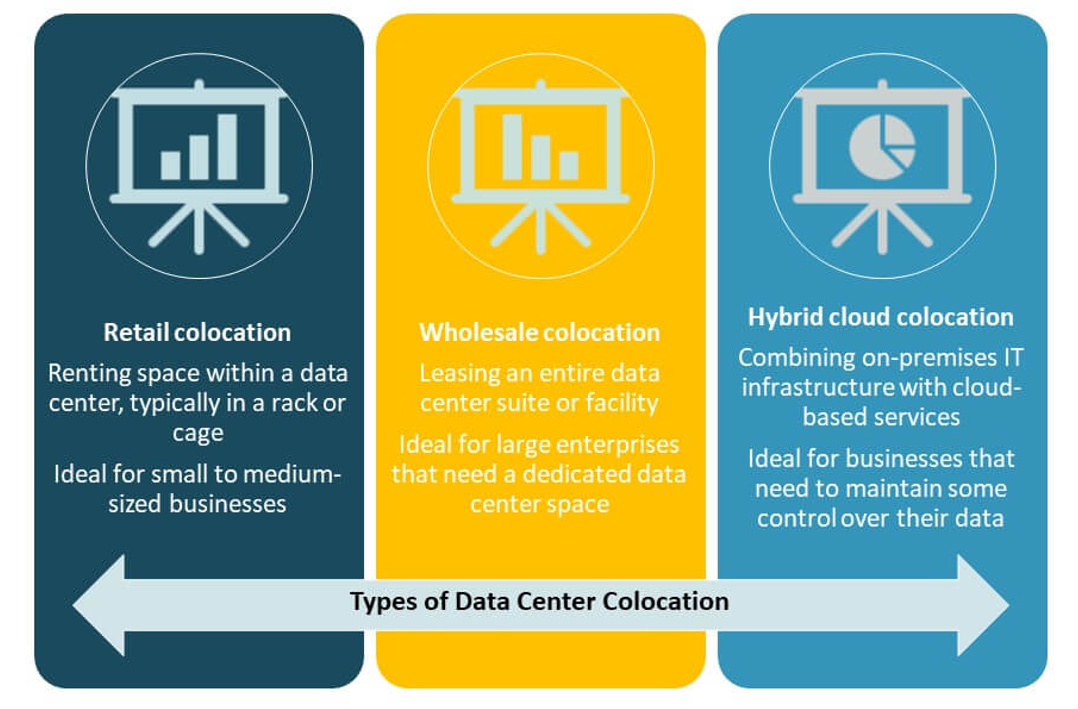

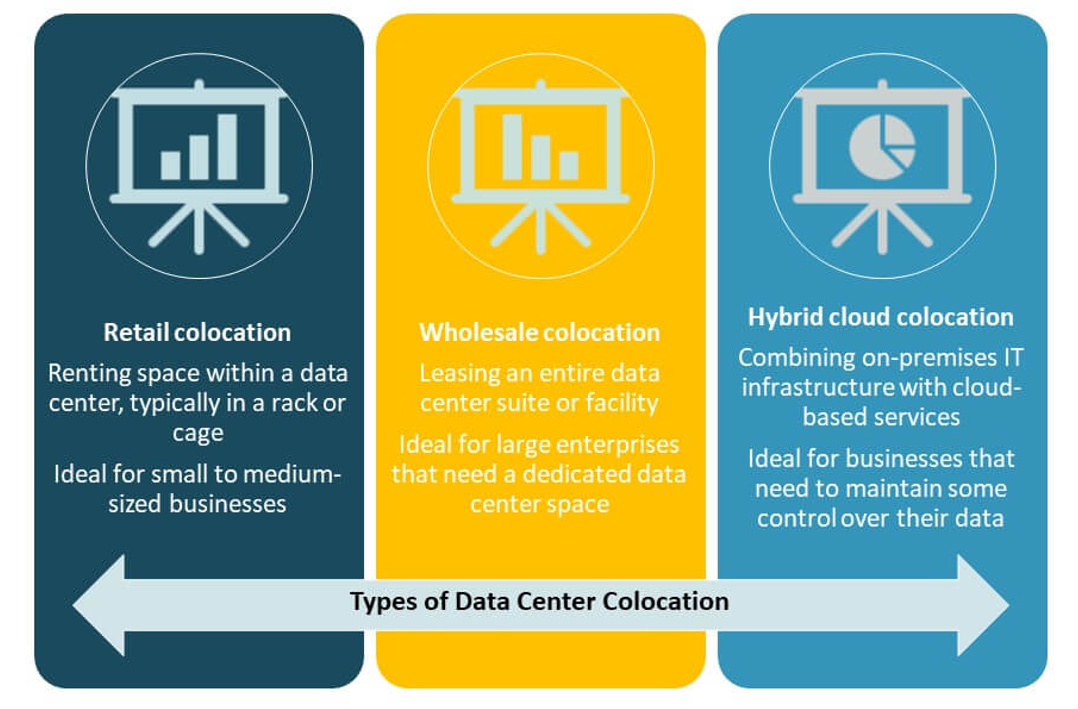

By Type

Retail colocation holds the largest market share due to strong enterprise demand for flexible capacity. SMEs and large organizations prefer retail models for scalability and lower upfront costs. It supports diverse workloads and allows tailored service agreements. Wholesale colocation is growing rapidly, driven by hyperscaler investments and cloud providers expanding infrastructure footprints. Hybrid cloud colocation is gaining traction with rising demand for integrated environments. The Canada Data Center Colocation Market benefits from a balanced mix of these models supporting hybrid strategies and distributed deployments.

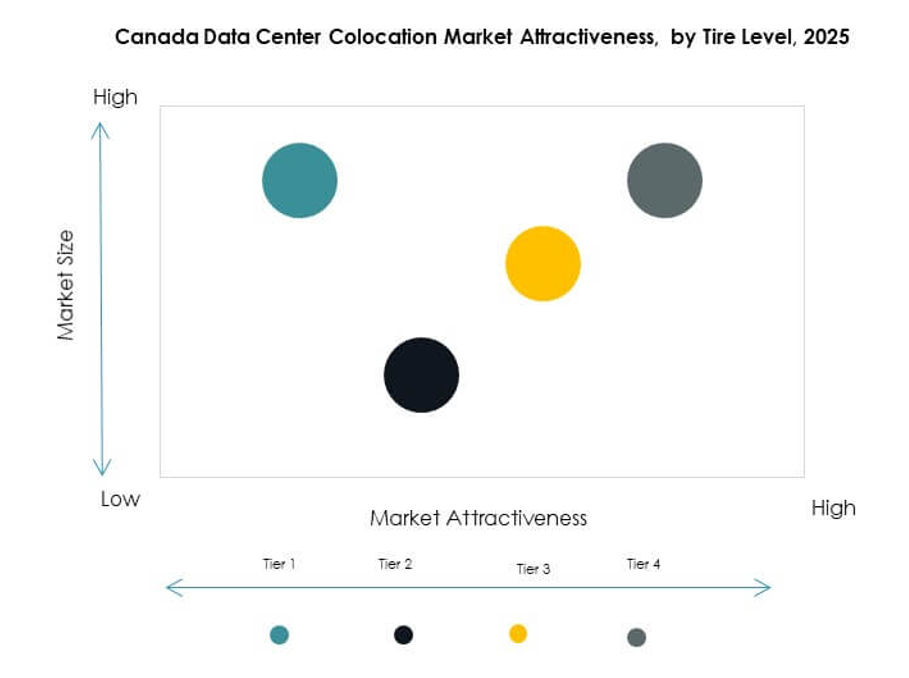

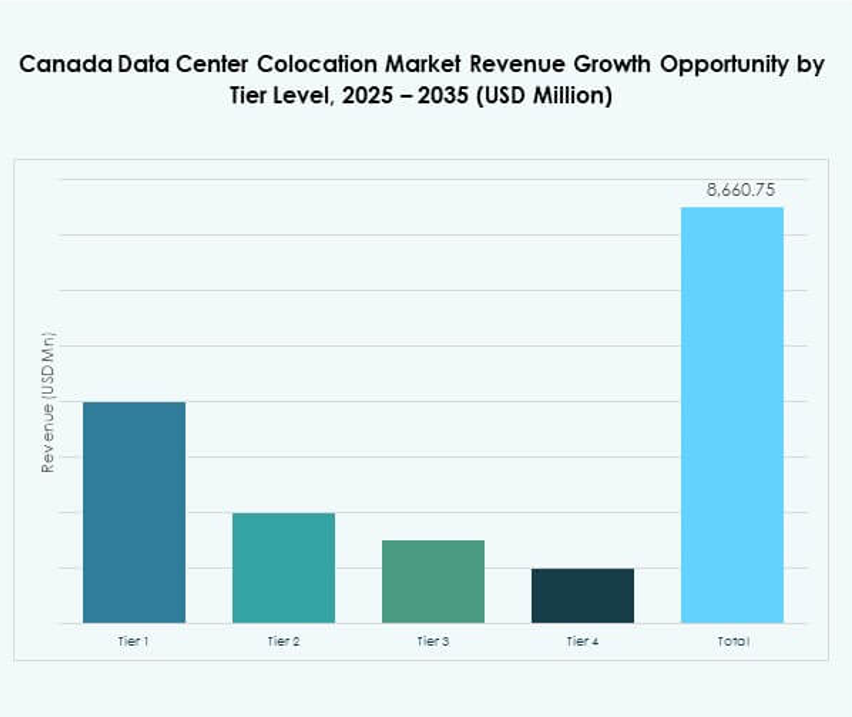

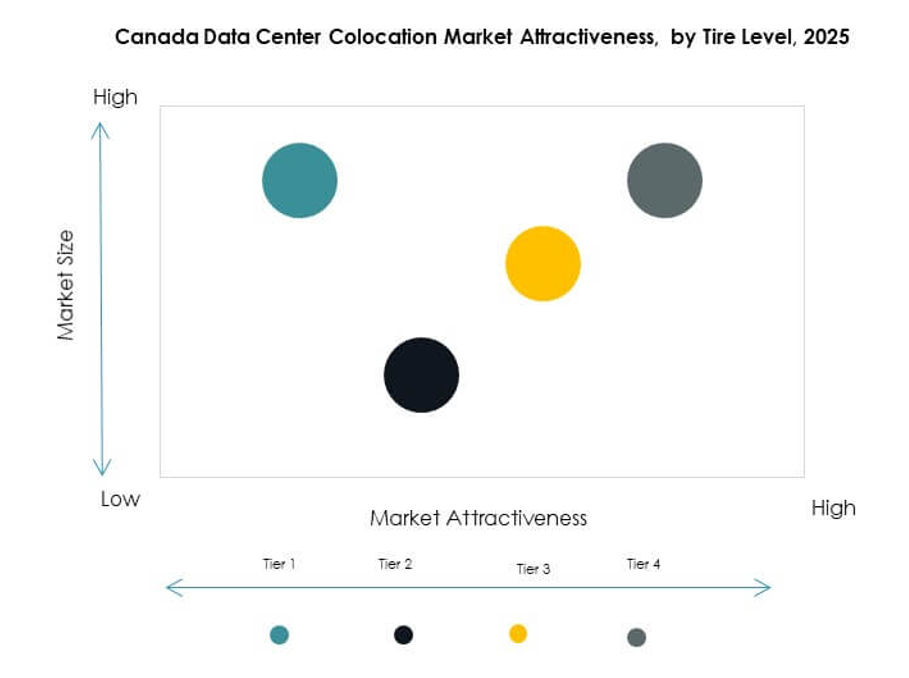

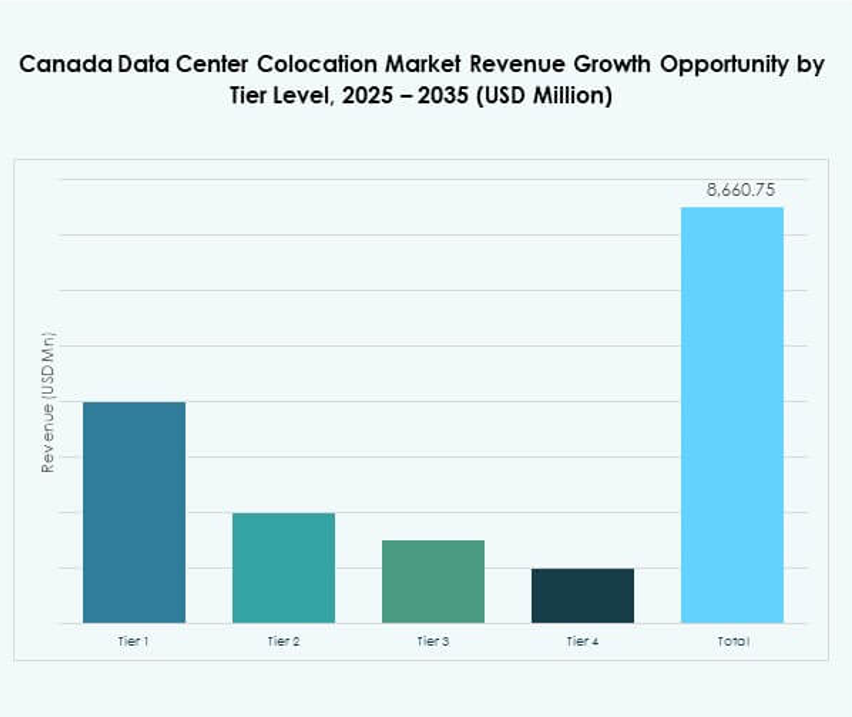

By Tier Level

Tier III facilities dominate the market with the highest adoption among enterprise customers. They offer an optimal balance between reliability, cost, and operational flexibility. Businesses prefer Tier III for hosting mission-critical applications with strong redundancy. Tier IV facilities are expanding in high-density AI and hyperscale environments requiring advanced resilience. Tier I and II facilities remain relevant for cost-sensitive and edge deployments. The Canada Data Center Colocation Market reflects a strategic shift toward higher-tier facilities aligning with strict SLA requirements.

By Enterprise Size

Large enterprises lead the market with a significant share due to large-scale workloads and compliance requirements. These organizations demand high-capacity racks, resilient power, and advanced security frameworks. SMEs are accelerating adoption through retail colocation models for cost efficiency. It allows them to access enterprise-grade infrastructure without heavy capital expenditure. The Canada Data Center Colocation Market is attracting a diverse customer base, driven by flexible deployment models and scalable service offerings.

By End User Industry

The IT and telecom segment dominates due to heavy data traffic, 5G rollout, and cloud service growth. BFSI is expanding rapidly with strict compliance and security demands. Healthcare is increasing adoption to support telemedicine and digital health initiatives. Retail, media, and entertainment are leveraging colocation for e-commerce and streaming workloads. The Canada Data Center Colocation Market is benefiting from strong digital transformation across industries, with IT and telecom setting the pace for capacity expansion.

Regional Insights

Ontario Leading with Strong Fiber Connectivity and Hyperscaler Investments (42% Share)

Ontario holds the largest market share driven by its role as a major digital hub. Toronto is a prime location for hyperscalers and cloud providers due to strong fiber connectivity and renewable energy availability. It is attracting enterprise tenants seeking reliable infrastructure for AI, cloud, and fintech workloads. Dense interconnection ecosystems are enhancing operational efficiency and uptime. Strong policy support and skilled workforce are reinforcing the region’s strategic role. Ontario remains a priority for investors focused on long-term colocation expansion.

- For instance, Bell Canada has deployed over 3.7 million fiber-to-the-premises (FTTP) connections nationwide and offers symmetric internet speeds up to 1 Gbps across Toronto through its fiber network, as confirmed in official company announcements and broadband infrastructure reports.

Quebec Emerging as a Renewable Energy Powerhouse for Sustainable Colocation (31% Share)

Quebec is gaining market prominence due to its abundant hydroelectric power and lower energy costs. The region is attracting global operators focused on sustainable data center strategies. It is enabling cost-efficient operations and meeting ESG requirements. Montreal is evolving as a key colocation hub supporting AI and HPC workloads. Government energy incentives are driving long-term investments. Quebec’s position strengthens the Canada Data Center Colocation Market through clean energy integration and strategic geographic location.

- For example, Vantage Data Centers is investing $500 million to expand its Quebec City QC24 campus, expected to add 32 MW of IT capacity and increase the campus total to 86 MW of computing power and 925,000 square feet all nearly entirely reliant on renewable hydroelectric power, per the company’s February 2025 update.

Western Canada Supporting Edge Expansion and Regional Connectivity (27% Share)

Western Canada is emerging as a growing hub for edge deployments and regional connectivity. Cities like Calgary and Vancouver are seeing rising investments in modular and retail colocation facilities. Telecom expansion and enterprise digitalization are fueling market growth. It is supporting low-latency applications for manufacturing, logistics, and media industries. Abundant land availability and lower latency routes to Asia-Pacific add strategic value. Western Canada offers investors attractive opportunities for network diversification and regional capacity expansion.

Competitive Insights:

- Amazon Web Services (AWS)

- Google Cloud

- China Telecom Corporation Limited

- Cologix

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Centersquare

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

- QTS Realty Trust, LLC

- Rackspace Technology

The Canada Data Center Colocation Market is characterized by strong competition among global hyperscalers and leading colocation service providers. It is witnessing strategic infrastructure investments, network expansion, and sustainable technology integration. Major players are strengthening interconnection ecosystems and expanding capacity in key metro hubs such as Toronto and Montreal. Hyperscalers focus on scaling AI and cloud infrastructure, while colocation operators emphasize modular build-outs and renewable energy integration. Strategic partnerships, acquisitions, and advanced automation tools are reinforcing market positions. Providers aim to differentiate through service flexibility, low latency networks, and regulatory compliance capabilities. Competitive intensity is driving rapid innovation, shaping market growth and infrastructure development.

Recent Developments:

- In October 2025, Centersquare, a Dallas-based colocation provider, completed the acquisition of 10 data centers across North America, including key facilities in Toronto and Montreal, Canada. This $1 billion transaction brings Centersquare’s total portfolio to 80 sites and strengthens its presence in high-demand digital infrastructure markets, marking an important expansion in Canadian colocation capacity.

- In October 2025, eStruxture, in partnership with ThinkOn, Hypertec, and Aptum, launched Canada’s first end-to-end sovereign, AI-ready government cloud platform. This offering is designed to support the government’s digital transformation needs and is significant for advancing secure, AI-enabled cloud services within Canadian borders.

- In September 2025, Cologix, one of Canada’s leading colocation and interconnection providers, took full ownership of two major data centers in Toronto by buying out its joint venture partner CIM Group. This move boosts Cologix’s capacity in Toronto and reinforces its control over critical infrastructure in one of Canada’s primary colocation markets.

- In August 2025, InfraRed Capital Partners, an international infrastructure asset manager, entered into a definitive agreement to acquire Rogers Communications’ data center business in Canada. The acquired business operates nine Tier 2 and 3 data centers in major Canadian cities, with up to 49 MW of colocation capacity.

Market Challenges

Market Challenges