Executive summary:

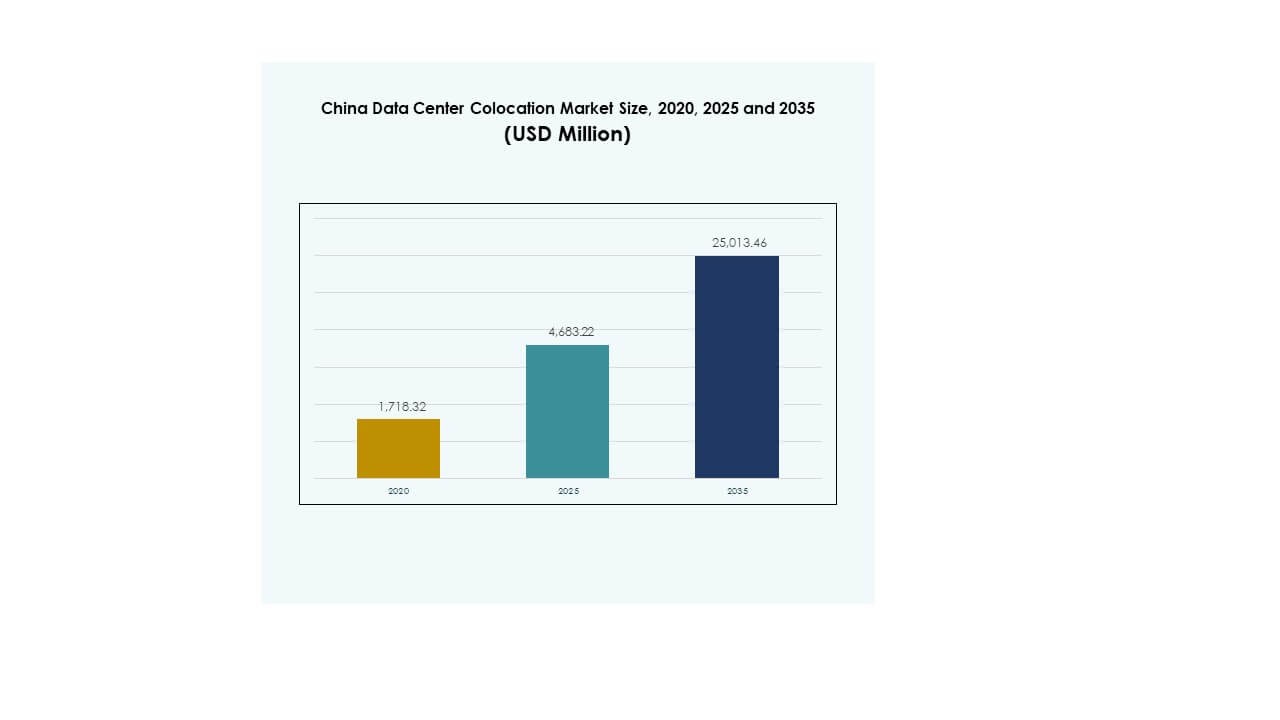

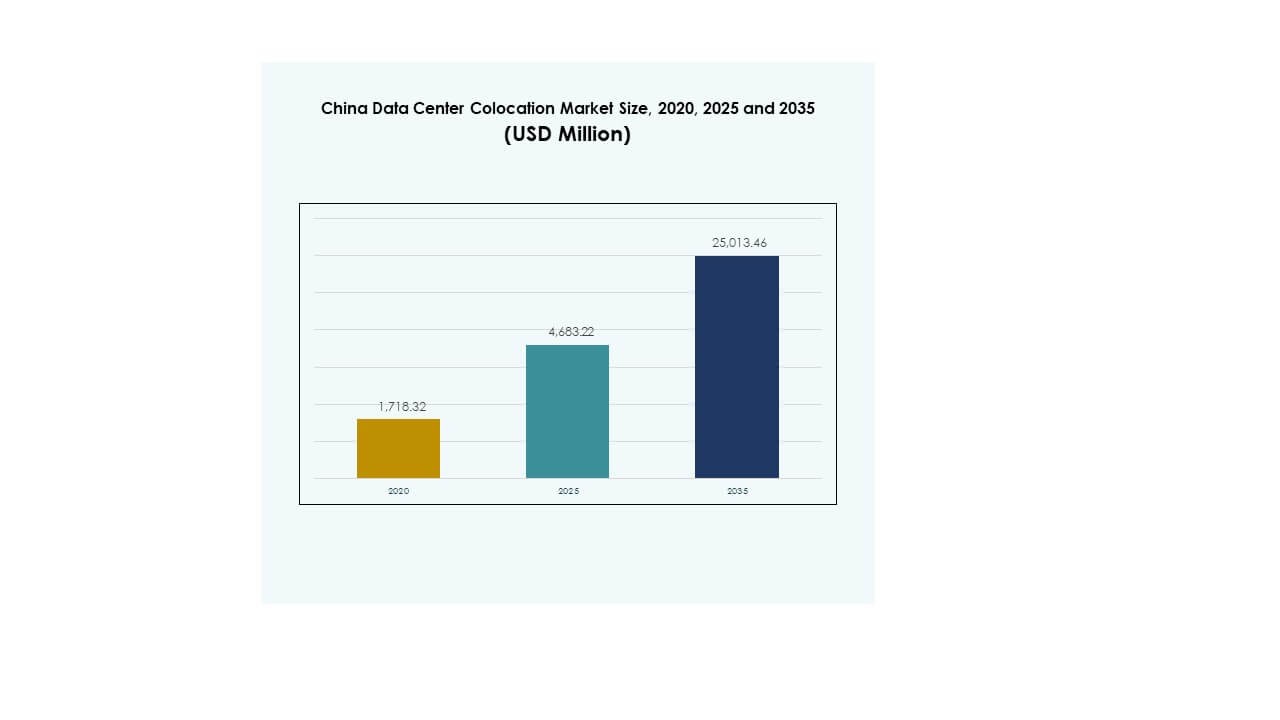

The China Data Center Colocation Market size was valued at USD 1,718.32 million in 2020 to USD 4,683.22 million in 2025 and is anticipated to reach USD 25,013.46 million by 2035, at a CAGR of 18.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| China Data Center Colocation Market Size 2025 |

USD 4,683.22 Million |

| China Data Center Colocation Market, CAGR |

18.06% |

| China Data Center Colocation Market Size 2035 |

USD 25,013.46 Million |

China Data Center Colocation Market is growing due to rapid technology adoption, AI-driven workloads, and rising enterprise cloud migration. Companies are shifting to colocation facilities to enhance operational efficiency, improve latency performance, and strengthen security infrastructure. Innovation in power and cooling technologies supports sustainable operations, while hybrid cloud models expand enterprise flexibility. Investors view this sector as strategically significant for supporting national digitalization and business transformation across multiple industries.

Eastern China leads due to its strong connectivity, hyperscale infrastructure, and dense enterprise clusters. Northern China is emerging, supported by favorable policies and abundant energy resources. Southern China is expanding rapidly through industrial growth and global connectivity. Together, these regions form a balanced colocation ecosystem, positioning China as one of the most competitive digital infrastructure markets globally.

Market Drivers

Rapid Cloud Adoption and Strong Digital Transformation Strategies Across Enterprise Sectors

China Data Center Colocation Market is expanding due to the strong shift toward cloud adoption and rapid digital transformation strategies across industries. Enterprises are migrating workloads to colocation sites to improve operational efficiency and secure critical data. Growing demand from BFSI, retail, and telecom is creating large-scale deployment opportunities. Companies view colocation as a cost-effective model compared to building their own facilities. It enables seamless connectivity, high uptime, and disaster recovery support. Businesses use colocation facilities to integrate advanced security and hybrid cloud capabilities. The market offers investors a scalable, resilient infrastructure model with strong returns. These factors make it a strategic backbone for national digital growth.

Strong Momentum from AI Workloads, Edge Computing, and High-Performance Infrastructure Integration

The market benefits from increasing deployment of AI and edge computing workloads across enterprises. Data-intensive applications in smart manufacturing, autonomous mobility, and real-time analytics require low latency and high processing power. Colocation facilities provide optimized environments for GPU clusters, dense racks, and modular expansion. Enterprises integrate HPC infrastructure to improve processing capacity and reliability. It drives strong demand for energy-efficient and interconnected facilities. Investors view these capabilities as essential to capture future growth in digital ecosystems. Companies use colocation to avoid high capital costs and focus on operational agility. This momentum strengthens the long-term technology backbone of the market.

Expansion of Hyperscale Ecosystems and Growing Preference for Hybrid Infrastructure Models

A rapid increase in hyperscale ecosystem investments is creating new opportunities for colocation providers. Hyperscalers use third-party colocation sites to extend reach and accelerate deployment. This collaboration reduces lead time and optimizes capacity allocation. Enterprises prefer hybrid models to balance control, compliance, and scalability. Colocation facilities enable integration with public and private clouds to support diverse workloads. It improves business continuity while lowering operational risks. Investors benefit from strong leasing demand and multi-tenant contracts. This shift positions the market as a critical enabler of national cloud infrastructure.

- For instance, Equinix operates the SH6 data center campus in Shanghai, which supports hybrid cloud connectivity and AWS service adjacency. The facility is publicly recognized for enabling enterprise access to AWS services through secure interconnection and localized infrastructure.

Strategic Government Initiatives and Expanding Connectivity Infrastructure Nationwide

Government programs supporting digital infrastructure and connectivity expansion are driving market acceleration. Policy frameworks promote energy-efficient, secure, and compliant data center operations. Expanding fiber networks and renewable integration create strong foundations for growth. Enterprises depend on these facilities for secure data exchange and critical service delivery. It supports economic digitization and improves cross-sector interoperability. Public-private partnerships encourage investments from both domestic and global players. Colocation enables quick deployment in strategic locations and supports national technology priorities. This alignment strengthens market resilience and investor confidence in future capacity growth.

- For instance, according to GDS Holdings’ ESG Report released July 2025, the company’s China data center operations reached a 40% renewable energy usage rate, with a 100% increase in directly purchased green power and an improved average PUE of 1.24, lowering carbon intensity by 15.8%. These official sustainability results were achieved under government-aligned infrastructure priorities.

Market Trends

Rising Integration of Renewable Energy Sources into Data Center Colocation Operations

China Data Center Colocation Market is experiencing strong interest in integrating renewable energy sources to reduce carbon footprints. Operators are aligning facility operations with sustainability mandates and net-zero targets. Solar, hydro, and wind energy integration supports long-term energy resilience. Data centers focus on Power Usage Effectiveness optimization and energy recovery solutions. Investors favor operators with certified green facilities and transparent ESG metrics. It helps enterprises meet compliance obligations and enhance brand reputation. Renewable energy integration improves operational stability during peak grid demand. This trend is redefining future investment strategies in digital infrastructure.

Increased Deployment of Modular and Prefabricated Infrastructure for Faster Scalability

The growing adoption of modular and prefabricated data center infrastructure accelerates deployment timelines. Enterprises prefer modular builds to address unpredictable capacity growth and reduce capital expenditure. Modular solutions offer flexible scaling, lower risk, and faster site readiness. Colocation operators use this strategy to expand into secondary cities with minimal delays. It ensures standardization, better thermal management, and reduced maintenance costs. Investors see modular models as cost-efficient and low-risk opportunities. It improves time-to-market and supports high-density compute environments. This trend is reshaping construction and expansion strategies across the sector.

Growing Shift Toward AI-Driven Data Center Operations and Automation Tools

Operators are using AI-driven tools to automate power, cooling, and capacity management systems. Intelligent monitoring enables predictive maintenance and lowers operational overhead. It supports higher efficiency and consistent service quality. Enterprises adopt AI-enabled colocation environments to ensure workload resilience and data security. The use of digital twins enhances operational planning and uptime assurance. Investors support facilities adopting intelligent automation due to their cost savings and competitive edge. AI integration improves asset utilization and supports sustainability goals. This trend is driving the evolution of next-generation colocation sites.

Evolving Enterprise Strategies Toward Multi-Cloud and Interconnection Ecosystems

A growing number of enterprises are adopting multi-cloud strategies for workload optimization. Colocation facilities act as neutral hubs for connecting multiple cloud platforms securely. Interconnection ecosystems provide low-latency access to critical applications. It helps companies manage data sovereignty while maintaining flexibility and agility. Colocation also supports compliance in regulated industries like finance and healthcare. Investors are attracted to strong interconnection ecosystems due to stable demand and long-term contracts. This trend strengthens the role of colocation facilities in hybrid cloud deployment. It reinforces the strategic value of carrier-neutral environments.

Market Challenges

Intensifying Power Supply Constraints and Energy Efficiency Pressure

China Data Center Colocation Market faces growing challenges from limited power availability and energy constraints. Rapid hyperscale and edge expansion is straining local grid infrastructure in major hubs. Operators must secure long-term power agreements to ensure stable capacity. Rising energy costs impact operational margins and long-term sustainability targets. Meeting green energy goals adds complexity to deployment strategies. Enterprises face pressure to comply with stringent environmental regulations and reporting standards. The high cost of energy-efficient retrofits increases financial risk. These factors make power planning a critical operational bottleneck for providers.

Regulatory Compliance Complexity and Infrastructure Security Concerns

Tightening data sovereignty rules and cybersecurity regulations pose strong operational challenges for providers. Operators must comply with multiple layers of national and regional regulations. Infrastructure must meet strict security protocols to safeguard sensitive enterprise data. This requires continuous investment in physical and digital security frameworks. Enterprises must manage complex compliance reporting, increasing cost burdens. Security concerns slow down market entry for smaller providers. Investors evaluate operational resilience carefully before committing capital. These regulatory and security complexities influence strategic location and investment decisions across the sector.

Market Opportunities

Strong Edge Expansion in Tier 2 and Tier 3 Cities Creates New Growth Corridors

China Data Center Colocation Market holds significant potential in emerging Tier 2 and Tier 3 cities. Growing enterprise digitization in regional hubs is creating demand for low-latency infrastructure. Operators can expand capacity closer to industrial clusters and manufacturing zones. It reduces network congestion and improves operational agility for enterprises. Investors can benefit from early entry advantages in these high-growth corridors. Edge nodes support Industry 4.0, smart city, and connected infrastructure initiatives. This opportunity diversifies market concentration beyond traditional hyperscale regions.

Rising Demand for Industry-Specific Colocation and High-Density Workload Optimization

Strong demand for industry-specific colocation solutions is opening new vertical opportunities. Enterprises in finance, healthcare, and media seek custom infrastructure for compliance and performance. High-density workloads require advanced cooling and power optimization solutions. It enables operators to differentiate through service capabilities. Investors favor specialized facilities due to longer contract cycles and higher margins. This shift toward vertical-specific solutions expands market diversification and value creation potential.

Market Segmentation

By Type

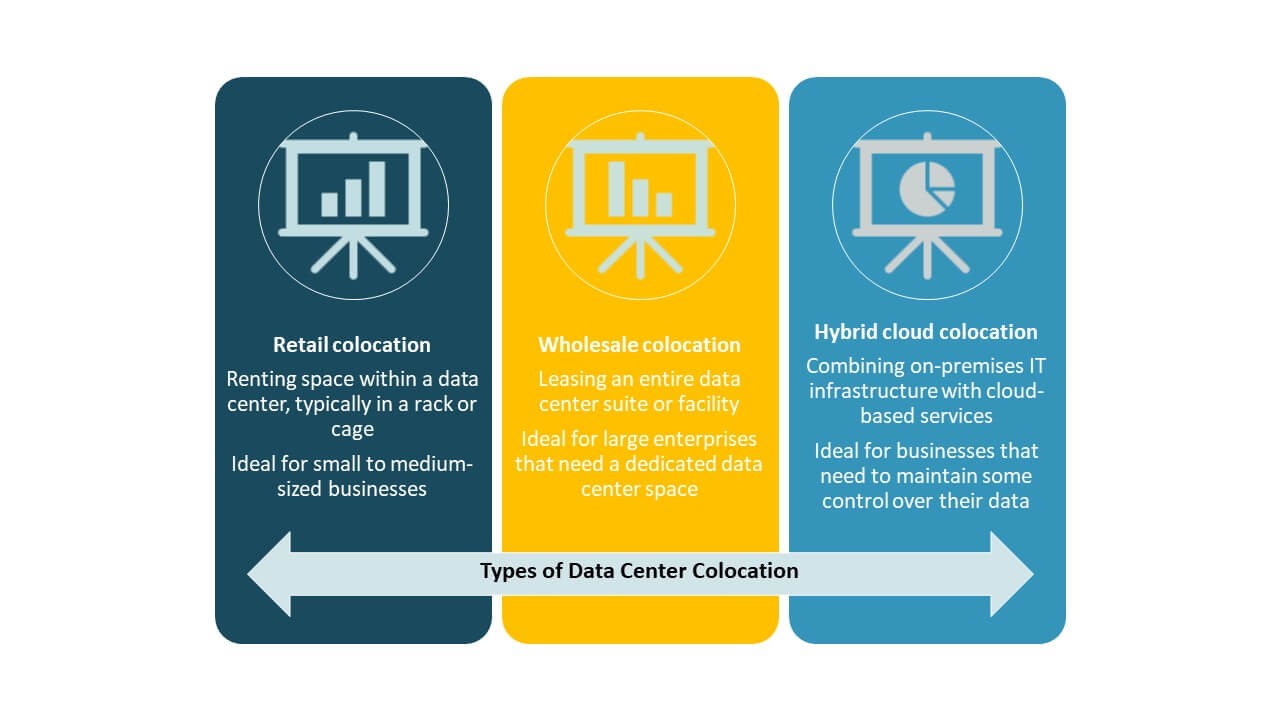

Retail colocation dominates the China Data Center Colocation Market due to strong enterprise adoption for flexible capacity needs. Retail models offer high control, security, and tailored service contracts, making them ideal for BFSI and IT industries. Wholesale colocation is gaining traction from hyperscalers seeking scalable deployments. Hybrid cloud colocation supports hybrid infrastructure integration for digital transformation strategies. Retail remains the leading segment supported by steady enterprise leasing and regulatory alignment.

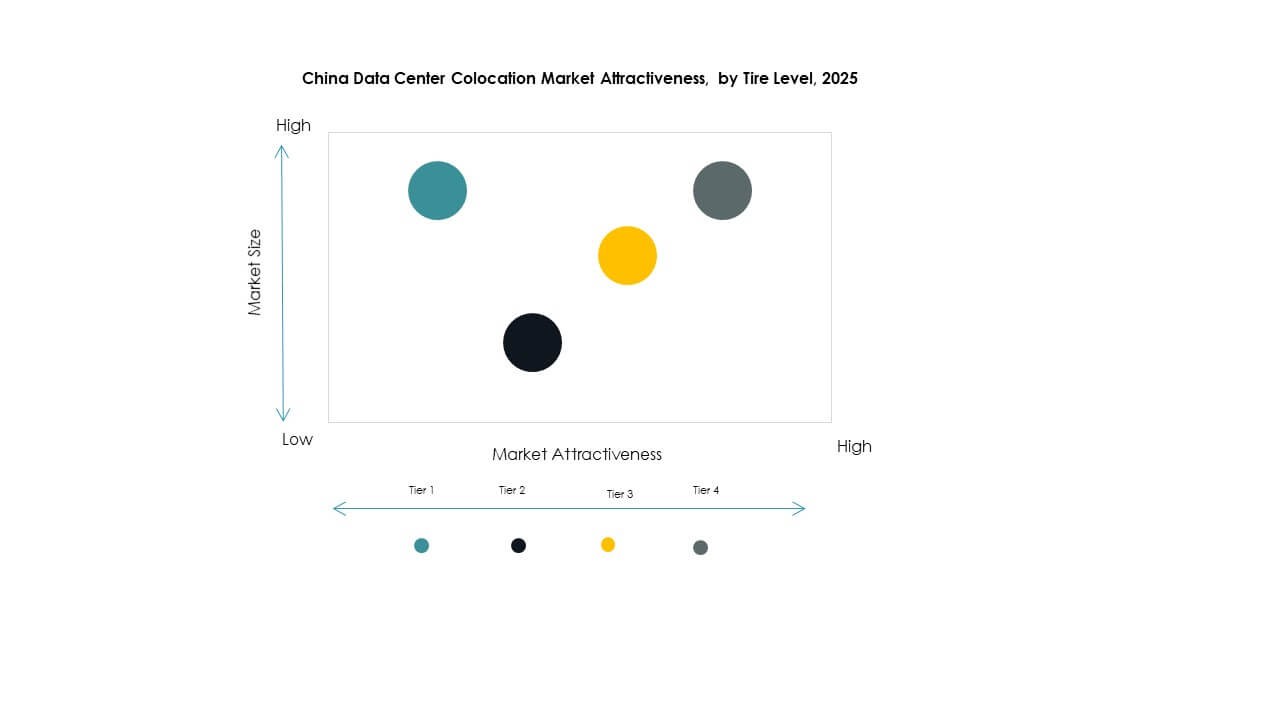

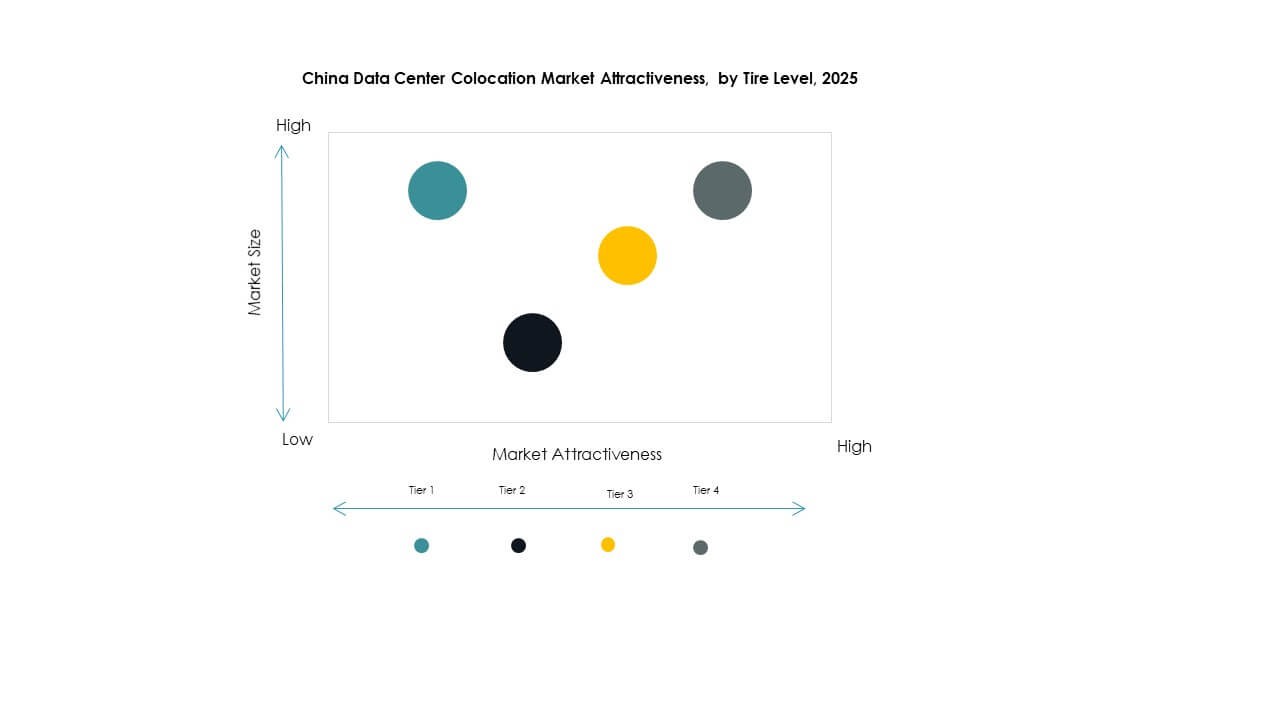

By Tier Level

Tier 3 holds the largest market share due to its balance between high availability and cost efficiency. Tier 3 facilities deliver 99.982% uptime and support critical enterprise workloads. Tier 4 is growing due to hyperscaler demand for fault-tolerant and fully redundant systems. Tier 1 and Tier 2 segments serve smaller enterprises and edge deployments. The growing focus on SLA compliance and sustainability drives Tier 3 investments across major regions.

By Enterprise Size

Large enterprises lead the market due to their higher data processing requirements and strong capital allocation. Colocation supports digital transformation initiatives in banking, manufacturing, and e-commerce sectors. SMEs are increasing their adoption to reduce infrastructure costs and improve operational agility. It enables resource optimization without large upfront investments. Large enterprises remain the primary drivers of leasing demand across key urban hubs.

By End User Industry

IT and Telecom holds the dominant market share supported by rapid cloud adoption and 5G deployment. BFSI follows closely with strong demand for secure and compliant hosting environments. Retail and healthcare sectors are investing in colocation to support omnichannel operations and digital records. Media and entertainment rely on low-latency networks for streaming and content delivery. These industries are shaping long-term capacity expansion strategies in major colocation hubs.

Regional Insights

Eastern China Leads with Strong Hyperscale Deployments and 42% Market Share

Eastern China holds 42% share of the China Data Center Colocation Market. It leads due to strong network connectivity, high concentration of hyperscale facilities, and advanced infrastructure. Major cities like Shanghai and Hangzhou drive large leasing volumes from technology, finance, and retail sectors. The region benefits from strong energy availability and stable grid connectivity. Strategic policy support encourages investment in sustainable infrastructure. Eastern China remains the core hub for enterprise digital operations.

- For instance, in August 2025, Shanghai announced plans to launch five new hyperscale data centers to push its AI computing capacity above 100 exaFLOPS, according to the Shanghai Communications Administration. This initiative aligns with the city’s broader strategy to strengthen national AI infrastructure.

Northern China Expands Rapidly with 33% Market Share Supported by Policy and Power Access

Northern China holds 33% share, driven by supportive government policies and strong power infrastructure. Beijing and Tianjin host key hyperscale deployments serving both private and public sectors. Low land costs and renewable integration strengthen its growth potential. The region attracts both domestic and foreign investors focused on high-density compute environments. Northern China is emerging as a strategic colocation corridor for cloud providers and enterprises targeting low-latency connectivity.

- For instance, in early 2025, Tencent procured large volumes of NVIDIA H20 chips to support DeepSeek integration and optimize AI infrastructure. The company also adjusted its GPU deployment strategy in response to efficiency gains achieved through DeepSeek’s model architecture.

Southern China Emerges as a Growth Hub with 25% Market Share and Strategic Connectivity

Southern China accounts for 25% share and is rapidly becoming a growth hub. Guangdong and Shenzhen host major industrial clusters requiring reliable and scalable infrastructure. Its strong international connectivity supports enterprise expansion into Southeast Asia. The region attracts data-intensive industries due to its favorable location and technology ecosystem. Southern China’s growth is driven by strong colocation demand from manufacturing and telecom industries. It strengthens national digital infrastructure diversity and resilience.

Competitive Insights:

- China Telecom

- China Mobile

- China Unicom

- Sinnet

- Amazon Web Services (AWS)

- Google Cloud

- Colt Technology Services Group Limited

- CoreSite

- Digital Realty Trust

- Equinix, Inc.

The China Data Center Colocation Market features strong competition between state-owned operators, global hyperscalers, and neutral colocation providers. It is defined by large-scale infrastructure investments, advanced network interconnection, and rapid service expansion. State-owned leaders such as China Telecom, China Mobile, and China Unicom dominate due to nationwide coverage and regulatory support. Global players like Equinix, Digital Realty Trust, and AWS strengthen their presence through strategic partnerships and scalable facilities. Neutral operators offer flexible service models for enterprises seeking hybrid cloud integration. Competition focuses on latency optimization, green power adoption, and advanced interconnect services. Companies pursue capacity expansion and sustainability compliance to secure long-term contracts with hyperscalers and enterprise customers.

Recent Developments:

- In October 2025, China Telecom made headlines at GITEX Global 2025 in Dubai, presenting advancements in digital infrastructure, intelligent connectivity, and future-focused ecosystem collaborations underpinning their involvement in China’s data center colocation market.

- In September 2025, China Unicom completed a significant milestone by launching a $390 million AI data center in Xining, Qinghai province. The center is powered almost entirely by domestically manufactured AI processors sourced from Alibaba and other Chinese tech firms. This move is a direct response to Beijing’s strategy for reducing the reliance on foreign technology in critical digital infrastructure.

- In July 2024, China Mobile announced the launch of its “computing center” data center in Beijing, equipped with 4,000 AI accelerator cards, and emphasized investment in domestic AI computing capabilities.