Executive summary:

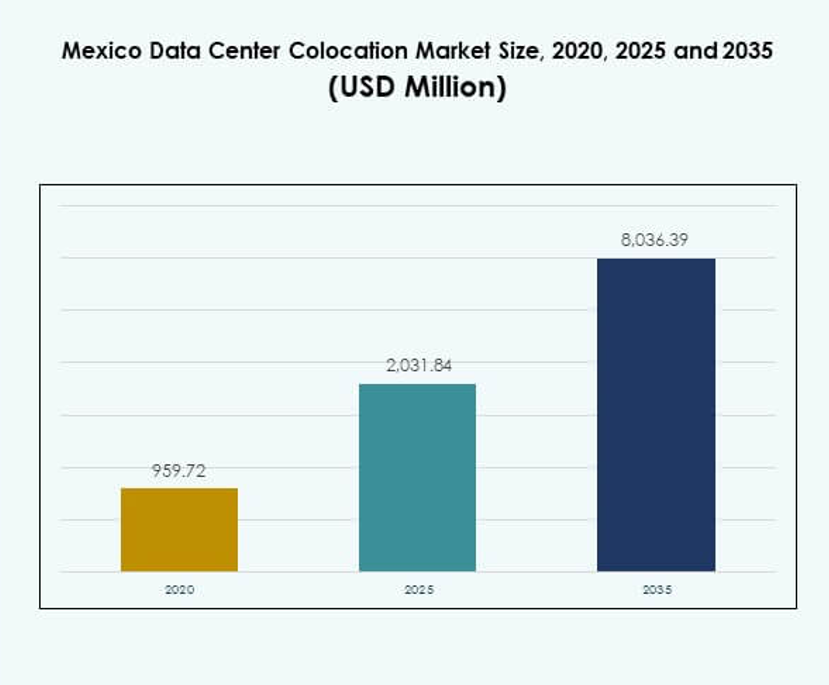

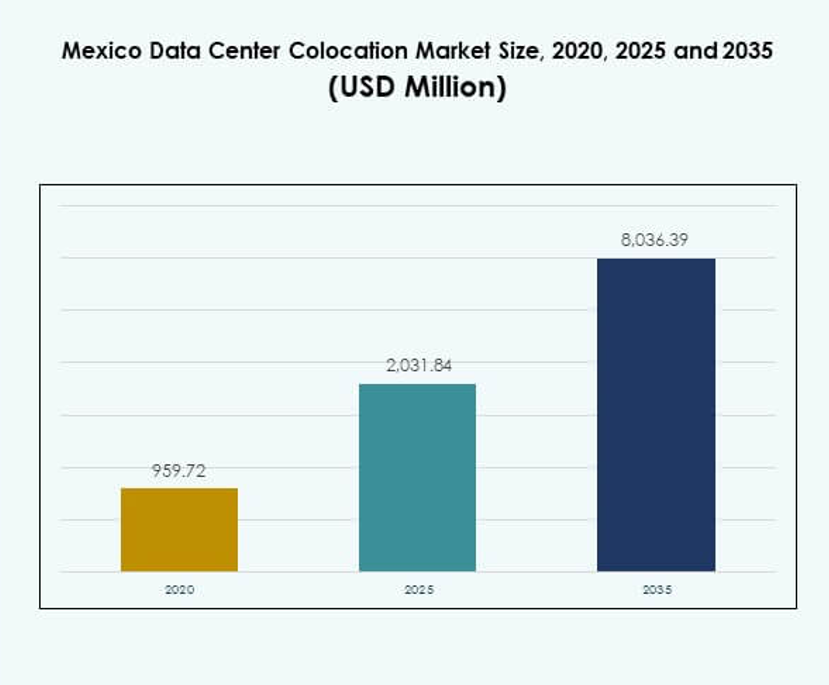

The Mexico Data Center Colocation Market size was valued at USD 959.72 million in 2020 to USD 2,031.84 million in 2025 and is anticipated to reach USD 8,036.39 million by 2035, at a CAGR of 14.68% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Mexico Data Center Colocation Market Size 2025 |

USD 2,031.84 Million |

| Mexico Data Center Colocation Market, CAGR |

14.68% |

| Mexico Data Center Colocation Market Size 2035 |

USD 8,036.39 Million |

Rising cloud adoption, digital transformation, and AI-driven infrastructure are fueling strong growth momentum. Enterprises are modernizing IT environments to improve scalability, performance, and regulatory compliance. Strategic investments by hyperscalers and telecom operators are accelerating capacity expansion and strengthening connectivity. The Mexico Data Center Colocation Market plays a key role in enabling low-latency infrastructure and hybrid deployments, making it a priority destination for investors and global operators.

Northern Mexico leads the market due to its strategic proximity to the U.S., strong fiber backbone, and large-scale deployments. Central Mexico is emerging as a major hub driven by digital policies and enterprise demand. Southern Mexico is gaining momentum as an attractive edge deployment corridor supported by renewable energy potential and urban expansion.

Market Drivers

Rising Cloud Adoption and Strategic Enterprise Digitalization Initiatives

Enterprises are accelerating digital transformation to achieve operational agility and scalability. Demand for colocation facilities is expanding due to hybrid cloud strategies and rapid migration of enterprise workloads. Global hyperscalers and regional businesses view Mexico as a key hub for low-latency infrastructure. Investments in advanced interconnection platforms strengthen business continuity strategies. The Mexico Data Center Colocation Market is gaining traction among financial, manufacturing, and technology firms. It enables secure, flexible, and scalable deployment of cloud services. Enterprises aim to minimize capital expenditure while improving IT performance. These dynamics drive demand across both public and private sectors.

Infrastructure Modernization Through High-Density and Edge Deployments

Growing data traffic and latency-sensitive applications are fueling the need for advanced colocation designs. Enterprises are modernizing infrastructure through high-density deployments that support AI, IoT, and real-time analytics. Edge nodes are being integrated to enhance resilience and performance across urban and regional networks. Data center operators are focusing on modular builds and energy-efficient systems to meet enterprise demand. It strengthens digital infrastructure for mission-critical workloads. The Mexico Data Center Colocation Market is becoming vital for enterprises seeking resilient connectivity. Telecom operators and cloud providers are aligning investments with national infrastructure goals. This modernization trend is reshaping operational models.

- For instance, in April 2025, ODATA energized the first phase of its DC QR03 campus in Querétaro with 200 MW capacity. The initial building provides 75 MW of IT power and is designed to support hyperscale and AI workloads. This campus is positioned among the largest data center developments in Mexico.

Regulatory Support and Favorable Investment Climate Strengthening Sector Growth

Supportive regulatory frameworks are accelerating infrastructure deployment and investor participation. Policies favoring data localization, energy efficiency, and renewable integration are driving confidence in the market. International operators are partnering with local firms to expand capacity and build hyperscale-ready environments. Renewable power availability supports sustainability goals, attracting ESG-focused investors. It encourages strategic capital flows and long-term commitments. The Mexico Data Center Colocation Market benefits from stable macroeconomic conditions and growing cross-border connectivity. Regulatory clarity helps reduce operational risks for operators. These favorable conditions are enhancing investor confidence and accelerating market expansion.

Integration of Automation, AI, and Energy Optimization Technologies

Operators are integrating AI-driven monitoring, smart cooling, and automated workload management systems. These technologies improve energy efficiency, operational transparency, and cost control. Enterprises demand intelligent infrastructure that adapts to dynamic workload demands. AI-enabled solutions support predictive maintenance and reduce downtime risks. It boosts operational efficiency and long-term sustainability. The Mexico Data Center Colocation Market aligns with global digital transformation priorities. Automation reduces overheads while increasing network resilience. These advancements support both hyperscale and enterprise-grade deployments.

- For instance, KIO Data Centers operates major facilities in Querétaro and Monterrey to support Mexico’s growing digital infrastructure. The company has invested in next-generation colocation and interconnection capabilities to meet rising enterprise and cloud demand. These locations are positioned as strategic hubs for regional digital transformation.

Market Trends

Growing Interconnection Ecosystems Through Carrier-Neutral Facilities

Carrier-neutral ecosystems are expanding rapidly, providing greater network flexibility and competitive pricing. Interconnection-rich hubs are enabling enterprises to connect with multiple cloud and network providers through a single platform. This trend enhances scalability and improves user experience for mission-critical workloads. It supports multi-cloud strategies and seamless global integration. The Mexico Data Center Colocation Market benefits from growing partnerships among telecom, hyperscalers, and colocation operators. Enterprises are prioritizing facilities with rich peering ecosystems. Neutral interconnection hubs are becoming central to digital strategies. Their growth is driving new infrastructure builds across key metro regions.

Accelerating Deployment of Sustainable and Energy-Efficient Data Centers

Sustainability initiatives are becoming integral to infrastructure strategies. Operators are shifting toward renewable energy sources to reduce carbon footprints. Green cooling systems and smart power management solutions are being deployed at scale. It supports regulatory compliance and corporate sustainability goals. The Mexico Data Center Colocation Market reflects this shift with multiple renewable-powered campuses. Energy-efficient architectures improve operational margins and attract environmentally conscious customers. Facilities with advanced efficiency metrics are gaining a competitive advantage. Sustainability is evolving from an option to a market requirement.

Expansion of AI, IoT, and Edge Computing Driving Facility Upgrades

Emerging applications in AI, IoT, and 5G are reshaping infrastructure requirements. Operators are upgrading facilities to support high-density racks, low-latency routing, and real-time data analytics. Edge deployments near population centers are expanding to address latency-sensitive workloads. It is driving innovation in network design and power optimization. The Mexico Data Center Colocation Market is adapting to these technology shifts through capacity upgrades. Enterprises are investing in colocation facilities to scale AI-driven workloads efficiently. Edge-ready infrastructure is emerging as a competitive differentiator for operators.

Strengthening Regional Connectivity Through Cross-Border Infrastructure Partnerships

International collaborations are expanding cross-border connectivity. Operators are investing in submarine cables, terrestrial fiber routes, and integrated network backbones. These partnerships enhance redundancy and reduce latency for global enterprises. It positions Mexico as a strategic gateway for North and Latin America. The Mexico Data Center Colocation Market benefits from infrastructure integration with U.S. networks. Enterprises gain access to robust connectivity for hybrid workloads. Cross-border partnerships are shaping future infrastructure strategies and enhancing market competitiveness.

Market Challenges

High Energy Demand and Infrastructure Constraints Increasing Operational Complexity

Energy consumption remains a significant challenge for operators. High power demand from AI and cloud workloads strains grid capacity in several regions. Limited renewable generation infrastructure further intensifies operational pressures. It forces operators to invest in backup systems and power efficiency technologies. The Mexico Data Center Colocation Market faces constraints in ensuring uninterrupted power supply. Expanding capacity requires navigating energy pricing, regulatory limits, and infrastructure reliability issues. These challenges can delay expansions and affect operational cost structures. Addressing power efficiency is crucial for maintaining competitive service delivery.

Talent Shortages, Regulatory Uncertainties, and Latency Barriers Affecting Market Growth

Shortages of skilled technical talent increase deployment costs and operational risks. Regulatory uncertainties around data localization and energy policies create strategic planning gaps. Latency in certain regions impacts performance for global workloads. It restricts expansion for operators targeting ultra-low-latency services. The Mexico Data Center Colocation Market must address skill development and clarity in compliance frameworks. Operators are facing longer project timelines and resource constraints. These factors pose structural challenges to scaling operations. Overcoming them will define long-term competitiveness and market growth trajectories.

Market Opportunities

Expanding Hyperscale Investments and Digital Transformation Creating New Growth Avenues

Rising hyperscale activity is driving capacity expansion across metro and secondary cities. Enterprises and cloud providers are adopting colocation to reduce capital costs. It strengthens the ecosystem through large-scale, multi-tenant deployments. The Mexico Data Center Colocation Market is positioned to capture rising cloud adoption. Growing enterprise digital strategies present strong investment opportunities. Advanced infrastructure attracts cross-border partnerships.

Emerging Edge Ecosystems and Sustainability Goals Driving Future Expansion

Edge computing deployments are accelerating to meet the demand for low-latency applications. Sustainability initiatives align with enterprise strategies and government energy goals. It enhances infrastructure resilience and future-proofs operational models. The Mexico Data Center Colocation Market is gaining traction among sustainability-focused investors. These opportunities support the development of advanced, distributed, and energy-efficient ecosystems.

Market Segmentation

By Type

Retail colocation dominates the Mexico Data Center Colocation Market, holding a major market share. This dominance stems from its flexibility, lower entry costs, and scalability benefits for enterprises. It serves startups, SMEs, and global firms seeking secure connectivity without heavy capital investment. Wholesale colocation is expanding through hyperscale partnerships. Hybrid cloud colocation is emerging as enterprises adopt hybrid infrastructure for strategic agility and performance.

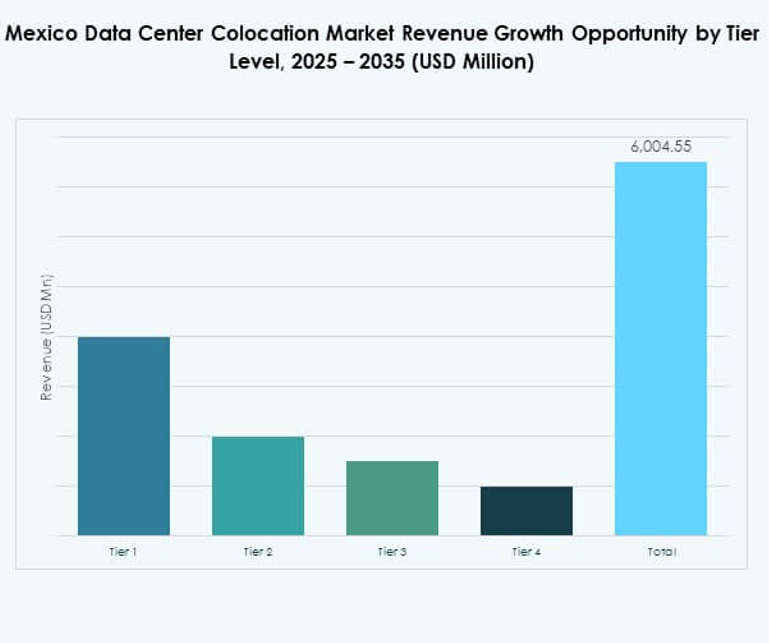

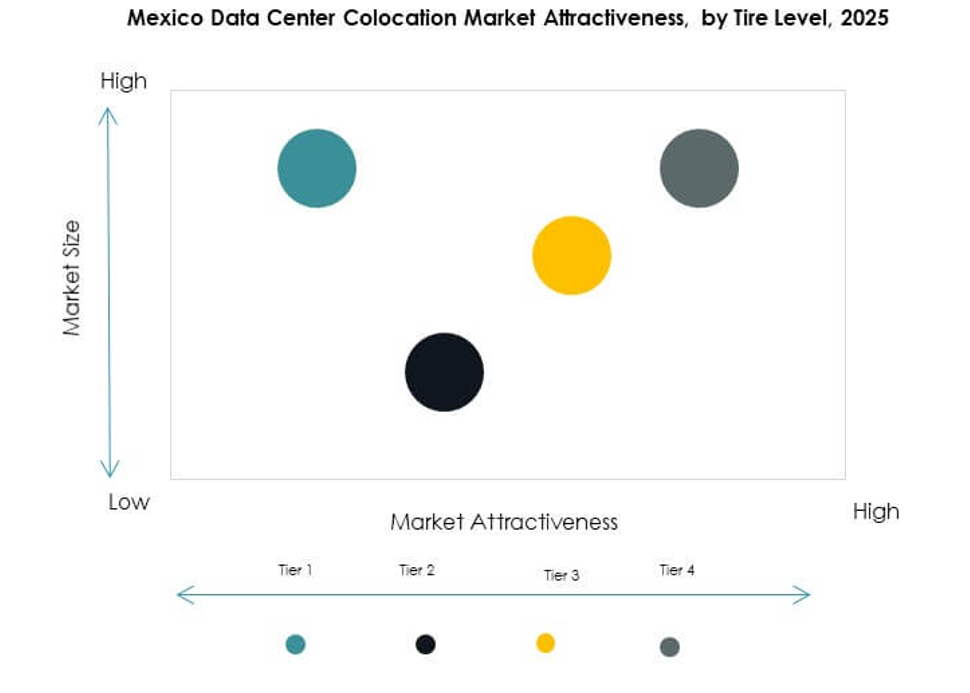

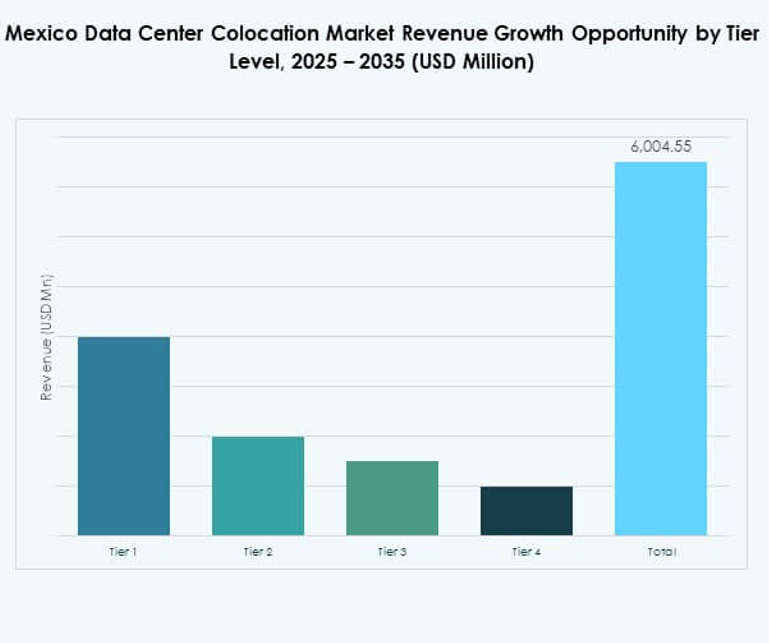

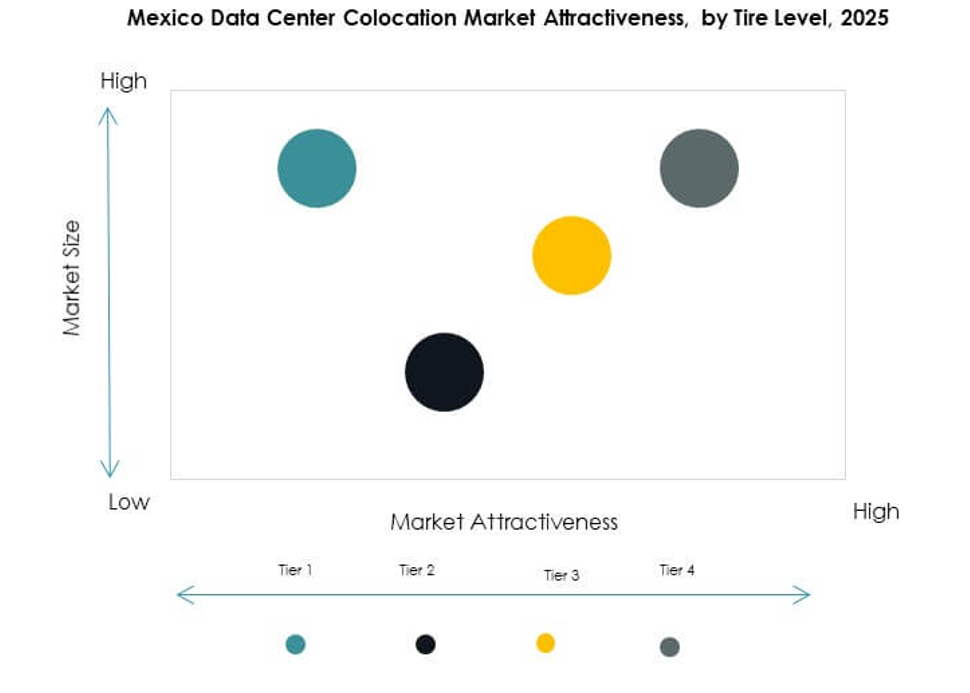

By Tier Level

Tier 3 facilities lead the Mexico Data Center Colocation Market, accounting for a large share due to their balance of reliability and cost efficiency. These facilities offer high availability, redundant components, and scalable capacity. Tier 4 facilities are growing in adoption due to demand for mission-critical workloads. Tier 1 and Tier 2 are used for less critical applications with limited redundancy. Tier 3’s dominance is reinforced by cloud providers and enterprises seeking dependable performance.

By Enterprise Size

Large enterprises dominate the Mexico Data Center Colocation Market with the highest market share. These organizations prioritize secure infrastructure, regulatory compliance, and seamless multi-cloud integrations. They deploy large workloads that require high-density racks and advanced interconnection. SMEs are expanding adoption due to flexible pricing models and growing digital transformation goals. Their segment is expected to grow faster, supported by retail colocation and cloud-native services.

By End User Industry

IT & Telecom holds the dominant share in the Mexico Data Center Colocation Market due to high bandwidth and low-latency requirements. This sector drives adoption of advanced colocation solutions to support 5G, IoT, and AI workloads. BFSI follows due to strict regulatory compliance needs. Healthcare and media are expanding usage to support telemedicine and streaming. Retail is gaining traction through e-commerce growth. Other industries show steady adoption through cloud-first strategies.

Regional Insights

Northern Mexico: Leading Regional Hub With 47% Market Share

Northern Mexico leads the Mexico Data Center Colocation Market with 47% share. Its proximity to the U.S. border provides a strategic advantage for hyperscalers and global enterprises. The region benefits from robust fiber connectivity, established energy infrastructure, and strong industrial activity. Major metro cities are hosting carrier-neutral facilities that support hybrid cloud and AI workloads. Investments from multinational providers are expanding capacity to meet cross-border demand. Northern Mexico is set to remain the dominant hub for large-scale deployments.

- For instance, MDC Data Centers operates seven carrier-neutral data centers along the U.S.-Mexico border, including key facilities in Laredo and El Paso, providing direct interconnection to U.S. and Mexican networks for cloud, OTT, and SaaS providers.

Central Mexico: Rapid Growth Driven by Infrastructure and Urban Expansion (34% Share)

Central Mexico holds 34% share and is witnessing rapid capacity expansion. Growing urbanization, government digital policies, and enterprise adoption support its growth. The region benefits from data localization initiatives and expanding cloud adoption among domestic firms. Operators are investing in modern Tier 3 and Tier 4 facilities to meet rising demand. It supports mission-critical applications and strengthens enterprise connectivity. Central Mexico is becoming a strong alternative to northern hubs for strategic deployments.

Southern Mexico: Emerging Growth Corridor With 19% Market Share

Southern Mexico accounts for 19% share and represents an emerging investment zone. Its growing digital infrastructure and rising enterprise activity are attracting colocation operators. Renewable energy availability strengthens its appeal for sustainability-focused projects. It offers untapped potential for edge deployments and secondary market expansion. The Mexico Data Center Colocation Market is witnessing increasing interest in this subregion. Strategic investments and infrastructure upgrades will support long-term growth in southern markets.

- For instance, in August 2025, MTP launched the second phase of its edge data center in Mérida to expand modular capacity in key urban areas, reinforcing local connectivity and supporting decentralized infrastructure strategies.

Competitive Insights:

- Amazon Web Services (AWS)

- Google Cloud

- China Telecom Corporation Limited

- Cologix

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Centersquare

- Digital Realty Trust

- Equinix, Inc.

The Mexico Data Center Colocation Market features strong competition among global hyperscalers, regional operators, and connectivity providers. It is shaped by infrastructure scale, power availability, interconnection capabilities, and cloud ecosystem integration. Equinix and Digital Realty Trust lead with extensive facility networks and strong cross-border connectivity. AWS and Google Cloud are expanding through hybrid solutions and edge infrastructure. Regional firms like Cologix and Centersquare strengthen their position through carrier-neutral facilities and strategic alliances. NTT DATA and Colt Technology enhance competitiveness through global reach and service diversification. Operators focus on sustainability, power efficiency, and automation to win enterprise and hyperscale clients. This dynamic landscape is driving rapid infrastructure development and advanced service offerings.

Recent Developments:

- In October 2025, MTP, a key player in Mexico’s data center industry, launched the second phase of its Edge data center in Mérida, Mexico. This expansion responds to the increasing demand for modular, locally-situated data center capacity in key urban centers. By enhancing its footprint in Mérida,

- In September 2025, U.S. tech firm CloudHQ announced a major investment initiative, committing $4.8 billion to build six data centers in Mexico’s central Querétaro state. This significant project is planned to support the region’s expanding cloud computing and artificial intelligence (AI) infrastructure, positioning Querétaro as a hub for digital transformation in Latin America.

- In August 2025, ODATA, an Aligned Data Centers company, inaugurated its fourth hyperscale data center, QR04, located near San Miguel de Allende in the Querétaro region of Mexico. This launch marks a strategic milestone for ODATA, completing a network of four interconnected hyperscale data centers in Mexico, thereby solidifying its leadership in the market.

- In January 2025, Amazon Web Services (AWS) launched its new AWS Mexico (Central) Region, marking the company’s first dedicated cloud region in Mexico. This strategic expansion—centered in Querétaro—represents a cumulative planned investment of over $5 billion for the next 15 years. The launch delivers advanced cloud infrastructure and services, including AI and machine learning capabilities, enabling Mexican organizations to benefit from reduced latency, local data residency, and global innovation.

- In December 2024, Google Cloud announced the opening of its new cloud region in Querétaro, Mexico, its 41st globally and a major step toward providing generative AI and advanced cloud services across the country. Google Cloud aims to serve both public sector and business organizations and further the digital transformation of Mexico with this launch.