Executive summary:

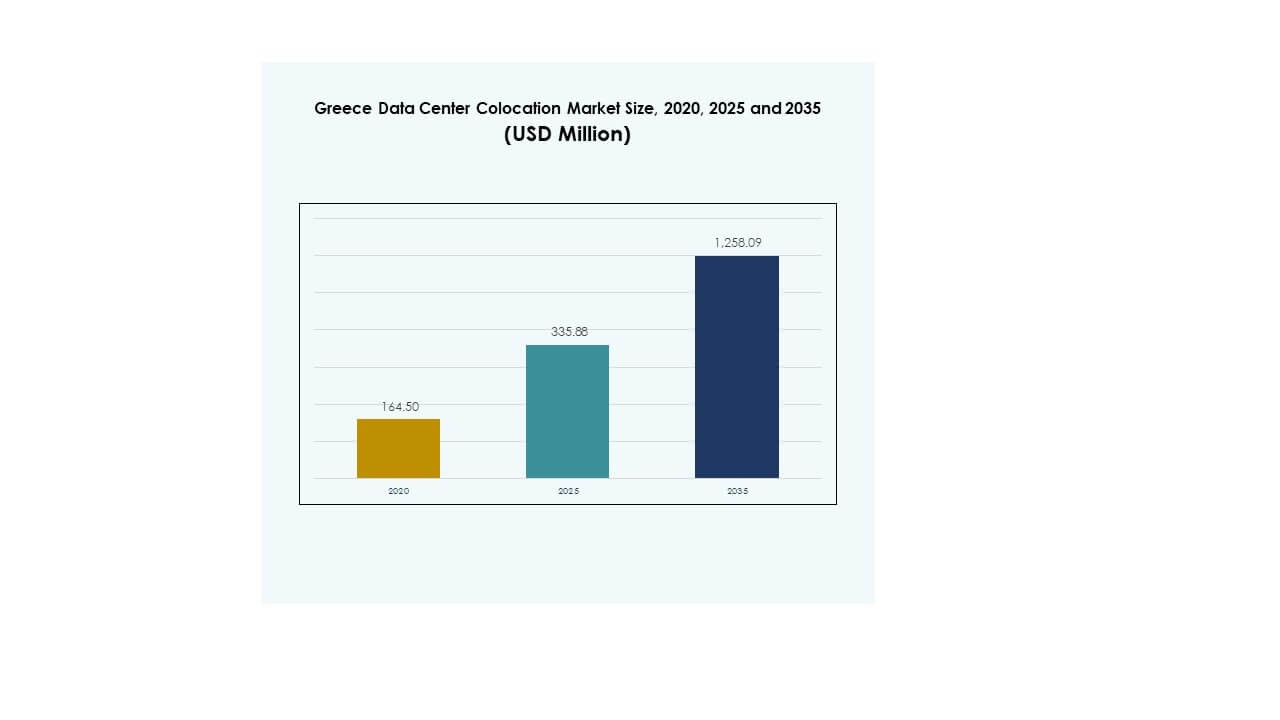

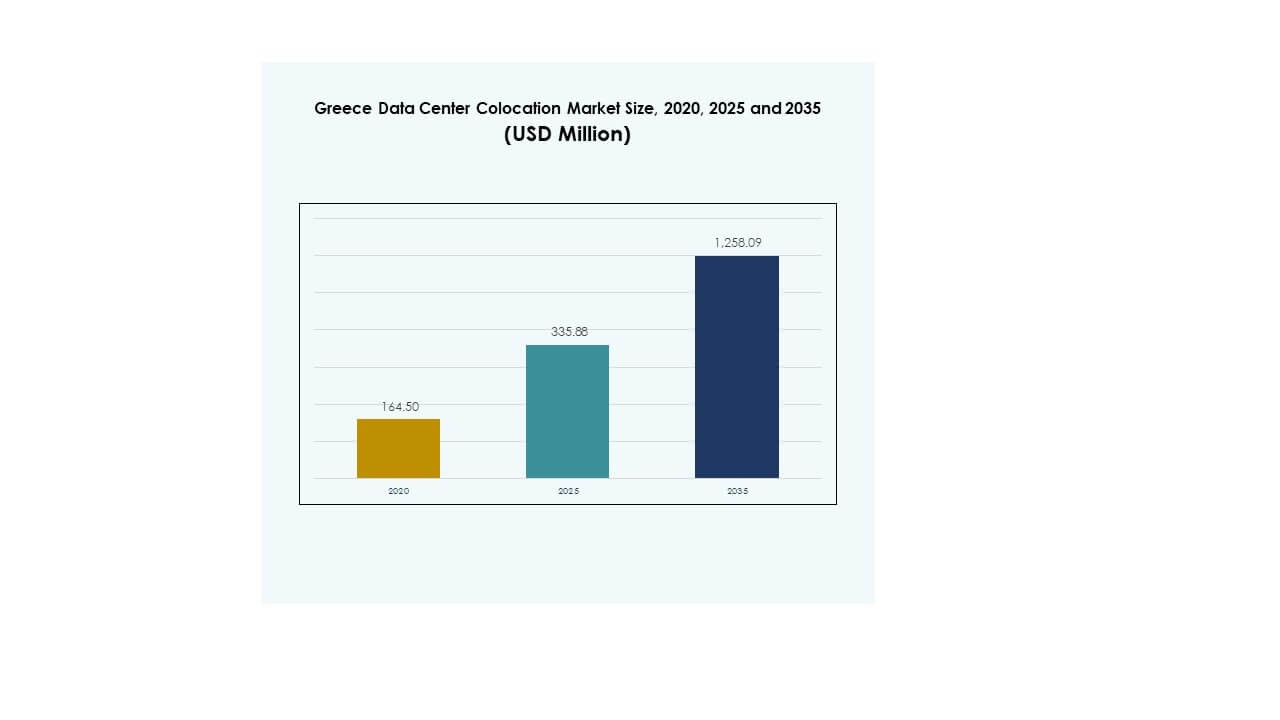

The Greece Data Center Colocation Market size was valued at USD 164.50 million in 2020, reached USD 335.88 million in 2025, and is anticipated to reach USD 1,258.09 million by 2035, at a CAGR of 14.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Greece Data Center Colocation Market Size 2025 |

USD 335.88 Million |

| Greece Data Center Colocation Market, CAGR |

14.06% |

| Greece Data Center Colocation Market Size 2035 |

USD 1,258.09 Million |

The market is expanding due to rapid cloud adoption, increasing AI and IoT deployment, and strong foreign investment. Enterprises are shifting toward secure, scalable, and energy-efficient infrastructure to support digital transformation. Global hyperscale providers are enhancing their presence through collaborations and network expansion. It plays a strategic role in supporting enterprise modernization and attracting investors focused on digital infrastructure assets.

Southern Europe leads in colocation activity, with Greece emerging as a key regional hub due to its geographic advantage and growing connectivity infrastructure. Strong fiber networks, new hyperscale data centers, and favorable regulatory conditions support its rise. Northern Europe remains a mature market, while Eastern Europe is emerging as an expansion zone due to rapid digital acceleration.

Market Drivers

Rising Cloud Adoption and Digital Infrastructure Expansion

The Greece Data Center Colocation Market is expanding due to rapid cloud integration by enterprises and public institutions. Businesses are shifting workloads to colocation facilities to reduce infrastructure costs and improve flexibility. Government programs promoting digital transformation have boosted investments in secure data environments. Telecom operators are modernizing networks to support high-capacity data flows. This modernization creates demand for scalable colocation hubs. The growing adoption of AI and IoT requires stronger computing power and low-latency networks. It strengthens the country’s role in regional digital connectivity. Investors view the market as a strategic entry point into Southern Europe.

Increased Foreign Investment and Hyperscale Growth

Strong foreign investment drives market maturity and operational excellence. Major hyperscale providers are expanding footprints to leverage Greece’s geographic location. It benefits from being a natural bridge between Europe, Asia, and Africa. International partnerships bring advanced design standards and energy-efficient technologies. Colocation providers are deploying smart cooling and power optimization systems to cut operational costs. These upgrades align with global sustainability and ESG goals. Enterprises prefer hyperscale-grade facilities for security and scalability. This strategic positioning enhances the country’s competitiveness in the European digital infrastructure landscape.

- For instance, Microsoft announced plans to establish a new cloud region in Athens, marking its first data center region in Greece. The company committed to operating all data centers on 100% renewable energy by 2025 and aims to achieve carbon negative status by 2030.

Accelerating Digitalization of Enterprises and Critical Sectors

Rapid digitalization of financial services, healthcare, and media is creating new colocation needs. Many enterprises are modernizing IT infrastructure to support real-time services. High data security and regulatory compliance make colocation attractive for sensitive workloads. It allows companies to expand without large upfront capital investments. Cloud-native startups are also contributing to the demand surge. Telecom, BFSI, and healthcare sectors lead adoption, driving capacity expansion across key urban areas. These shifts highlight the market’s growing role in supporting Greece’s broader digital economy strategy. Investors see long-term potential in stable enterprise contracts.

- For instance, the Athens Exchange Group (ATHEX Group) launched a new Linux OASIS trading system in 2024, featuring latency under 1 millisecond and capacity to process over 2,500 messages per second, and holds ISO 27001 certification for its information security management system.

Favorable Government Initiatives and Policy Support

Government incentives and infrastructure policies are enhancing market growth. Tax benefits, simplified permit procedures, and digital funding programs are attracting global operators. National strategies promoting 5G and fiber networks are strengthening the colocation ecosystem. Public-private partnerships are improving energy reliability for data facilities. It encourages sustainable and efficient operational models. Regional integration projects are increasing cross-border data flows. These efforts position Greece as a digital hub for Southeast Europe. This policy-driven environment enhances investor confidence and accelerates new data center construction.

Market Trends

Integration of Green Energy and Sustainability Standards

The Greece Data Center Colocation Market is experiencing a strong shift toward renewable integration. Operators are adopting energy-efficient cooling systems to reduce carbon footprints. Solar and wind energy partnerships support facility power demands. Colocation providers aim to align with EU Green Deal standards. This alignment improves energy resilience and ESG performance. Tenants increasingly favor data centers with sustainability certifications. Advanced monitoring systems help optimize PUE and reduce waste. This environmental focus improves competitiveness and attracts green-focused investors.

Growing Demand for Edge Computing and Low-Latency Solutions

Rising IoT applications and 5G rollout are creating new edge deployment opportunities. Enterprises seek edge colocation to reduce latency and improve service reliability. It enhances performance for AI workloads, smart cities, and media streaming. Providers are expanding modular micro data centers in strategic locations. This trend allows decentralized computing closer to end users. Hybrid deployments combining central and edge infrastructure are gaining traction. Telecom operators play a crucial role in enabling edge ecosystems. The trend strengthens Greece’s position in advanced data infrastructure.

Increasing Focus on Security and Compliance Upgrades

Data protection and compliance are becoming central to operational strategies. New EU directives are pushing providers to adopt robust security frameworks. Operators are integrating advanced encryption, zero-trust architecture, and real-time monitoring. It strengthens confidence among BFSI, government, and healthcare clients. Compliance with ISO and GDPR enhances global credibility. Demand for certified facilities is rising across all enterprise sizes. Security investments are driving long-term contracts with sensitive industries. This shift elevates market maturity and competitive positioning.

Technological Integration and Smart Infrastructure Deployment

Automation and AI integration are transforming colocation facility operations. Providers are deploying intelligent energy management and predictive maintenance systems. These systems help minimize downtime and increase power efficiency. It improves overall performance and customer experience. AI-based monitoring enhances cooling optimization and resource allocation. Smart infrastructure supports dynamic workload management. This shift attracts large cloud providers and enterprises with high performance demands. Technological advancements are setting new operational benchmarks for the industry.

Market Challenges

High Energy Costs and Power Infrastructure Constraints

The Greece Data Center Colocation Market faces rising energy costs and grid limitations. Operators struggle with fluctuating energy prices that affect operational margins. Limited renewable capacity in some regions increases dependence on traditional sources. Power stability is critical to guarantee uptime and service reliability. Many providers invest in backup solutions to address these issues. It raises capital expenditure and operational complexity. Grid upgrades require time and significant investment, creating entry barriers. The challenge impacts long-term scalability and cost competitiveness in the regional market.

Regulatory Complexities and Skills Gap in Advanced Operations

Complex regulatory frameworks slow down deployment timelines for new facilities. Environmental approvals and zoning restrictions often extend project completion. Talent shortages in advanced data center engineering also limit operational efficiency. It makes it difficult for providers to scale or adopt next-gen technologies quickly. Operators face pressure to maintain compliance with multiple EU and local standards. Training programs for specialized roles are limited, delaying digital transformation speed. These regulatory and workforce gaps create uncertainty for investors. Overcoming them is essential for sustainable growth and competitiveness.

Market Opportunities

Strategic Geographic Position and Regional Connectivity Potential

The Greece Data Center Colocation Market benefits from its location at the intersection of three continents. Its strategic position supports submarine cable networks and global connectivity. This advantage attracts hyperscale players looking to extend European capacity. Growing investments in telecom infrastructure strengthen its role as a regional hub. It enhances opportunities for cross-border services and cloud adoption. New undersea cable projects further improve connectivity reliability. This positioning makes Greece attractive for long-term digital infrastructure investments.

Expansion of Sustainable and Modular Infrastructure Solutions

Growing focus on sustainability is creating demand for green data centers. Modular infrastructure offers faster deployment and operational flexibility. It helps providers scale with lower capital costs and minimal land use. Renewable integration enhances energy resilience and meets EU compliance goals. This shift attracts environmentally focused enterprises seeking sustainable hosting solutions. It also supports emerging applications like edge computing and AI workloads. Modular and green technologies position providers to capture new market segments.

Market Segmentation

By Type

Retail colocation holds the largest share in the Greece Data Center Colocation Market due to its flexibility and cost-efficiency for enterprises. SMEs and digital-first businesses prefer retail setups for scalable and secure infrastructure. Wholesale colocation is growing as hyperscale providers expand capacity. Hybrid cloud colocation adoption is increasing with multi-cloud strategies. The mix of retail and wholesale models reflects evolving enterprise demand. The segment’s strong growth is supported by rising digital transformation and cloud adoption.

By Tier Level

Tier 3 facilities dominate the Greece Data Center Colocation Market, accounting for the highest market share. These facilities offer strong redundancy, high uptime, and scalability for enterprise operations. Tier 4 is gaining traction as hyperscale and financial sectors demand higher reliability. Tier 2 and Tier 1 remain relevant for cost-sensitive businesses with basic infrastructure needs. Rising enterprise demand for robust security and performance supports Tier 3 growth. It sets operational standards for future expansions and modernization.

By Enterprise Size

Large enterprises hold a major share of the Greece Data Center Colocation Market, driven by complex workloads and data security needs. They prioritize advanced facilities with high compliance standards. SMEs are expanding their adoption to reduce IT infrastructure costs. The availability of flexible pricing models and modular spaces supports SME participation. Increasing digital maturity in both segments drives continuous capacity expansion. This balance between large enterprises and SMEs fuels stable growth across the industry.

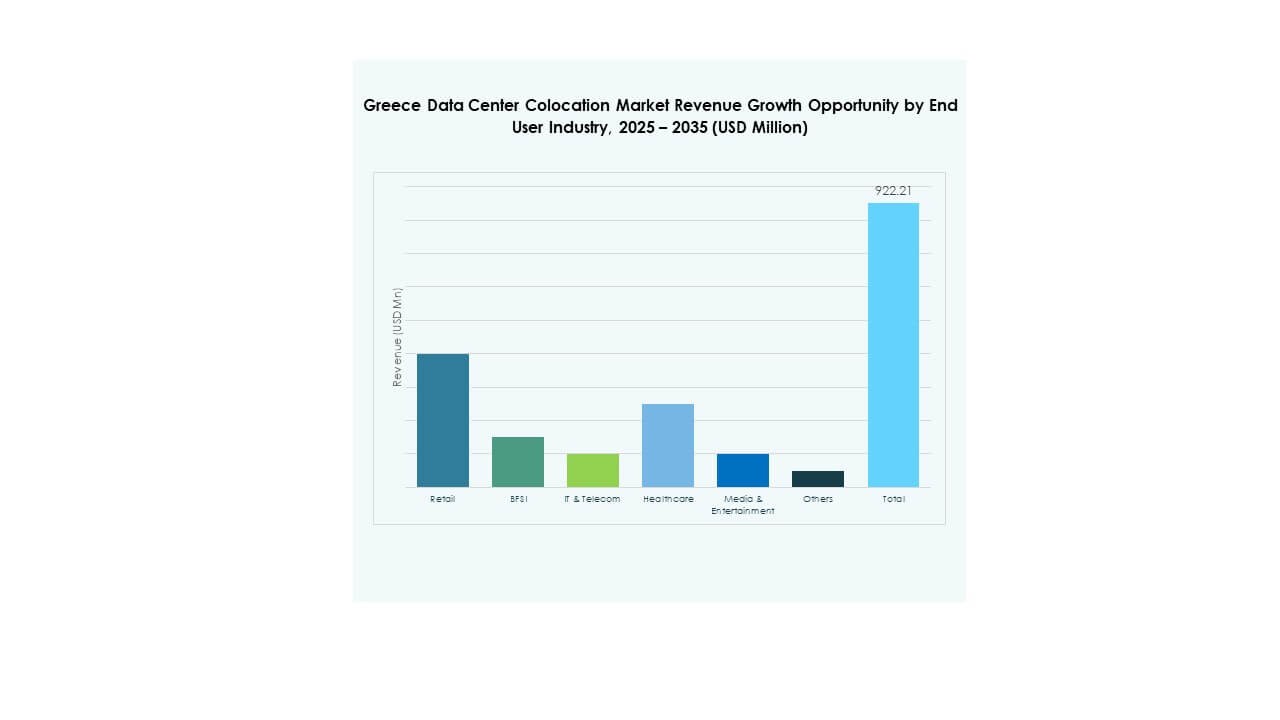

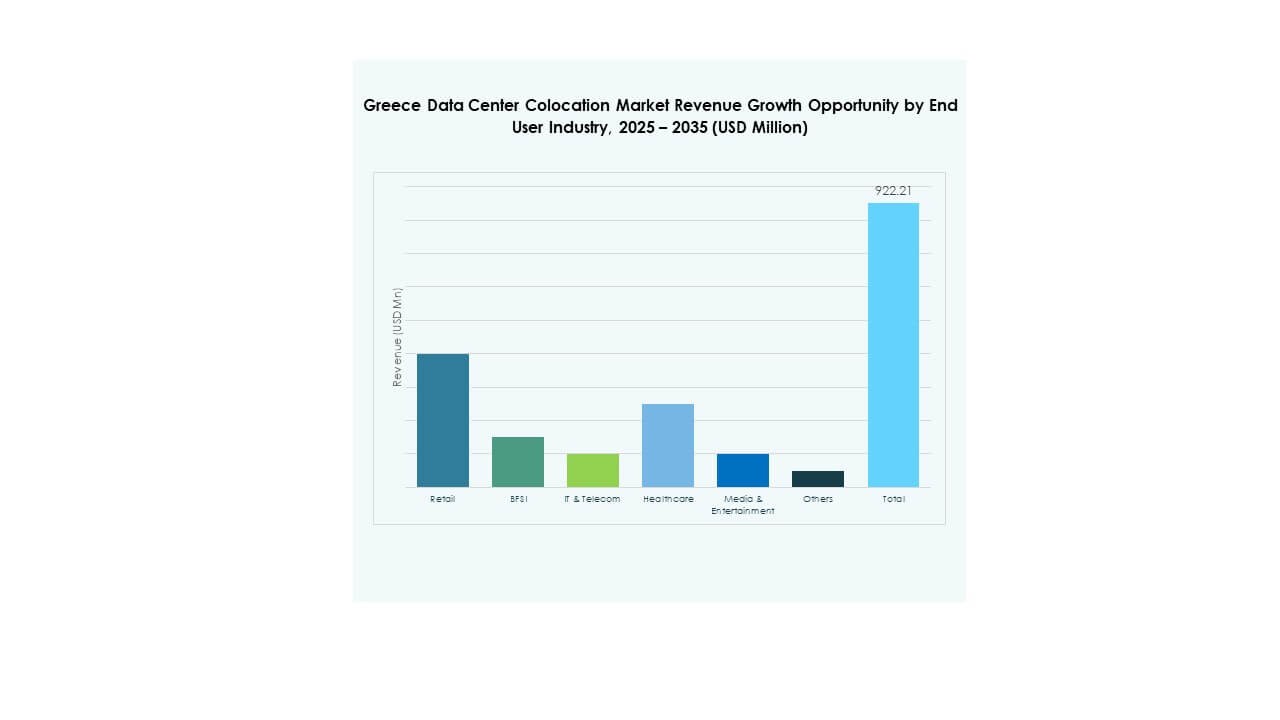

By End User Industry

IT & Telecom leads the Greece Data Center Colocation Market, supported by high data traffic and 5G expansion. BFSI follows due to strict data security and compliance requirements. Healthcare and media sectors are showing rapid adoption with digital service growth. Retail and other industries rely on colocation for e-commerce and analytics. Demand diversity across industries strengthens the market’s long-term outlook. Strong sectoral uptake also attracts international players looking for stable investments.

Regional Insights

Southern Greece: Strongest Market Share with Advanced Infrastructure

Southern Greece holds the largest share of the Greece Data Center Colocation Market at 42%, supported by robust connectivity and mature infrastructure. Athens leads with multiple hyperscale and retail facilities. The presence of submarine cables enhances its role in international connectivity. Energy supply stability and supportive regulations attract foreign investment. Many large enterprises prefer to locate in this region due to its strategic position. It strengthens its role as a primary colocation hub for Southeast Europe.

- For instance, Digital Realty’s Athens data center campus includes ATH1, ATH2, and ATH3, offering a total colocation footprint of over 10,600 m². ATH3 spans 28,215 ft² and features N+2 cooling redundancy along with ISO 27001, ISO 50001, and PCI-DSS certifications.

Central Greece: Rapidly Emerging with Expanding Mid-Tier Facilities

Central Greece accounts for 34% of the Greece Data Center Colocation Market, driven by mid-sized enterprise demand. This subregion benefits from expanding fiber networks and industrial growth. Second-tier cities are becoming attractive for edge deployments and retail colocation. Lower land costs and energy incentives support new facility construction. Its growth reflects a shift toward distributed infrastructure strategies. This trend enhances network resilience and broadens national coverage for colocation services.

- For instance, Lamda Hellix’s Athens Data Center Campus, certified by the Uptime Institute, offers 6,000 m² of operational space, hosts over 1,000 racks, and provides 11 MVA of power capacity to support enterprise and colocation clients.

Northern Greece: Growing Market with Strategic Cross-Border Links

Northern Greece represents 24% of the Greece Data Center Colocation Market, supported by proximity to the Balkans. Its position near key trade routes enhances cross-border connectivity potential. Infrastructure projects aim to improve fiber and power reliability in this subregion. Colocation providers target this area for future expansion to serve neighboring countries. Its strategic role is increasing as Balkan economies accelerate digital transformation. This regional diversification strengthens the national data infrastructure network.

Competitive Insights:

- Lamda Hellix

- OTE Group

- Forthnet

- Global Cloud Xchange

- Amazon Web Services (AWS)

- Google Cloud

- China Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- NTT Ltd. (NTT DATA)

The Greece Data Center Colocation Market features strong competition between global hyperscale operators and domestic providers. Lamda Hellix and OTE Group lead local expansion with advanced facilities and regional connectivity. Global players such as AWS, Google Cloud, Equinix, and Digital Realty strengthen their presence through capacity expansion and technology upgrades. It benefits from investments in green energy, high redundancy, and network security enhancements. Partnerships between telecom carriers and cloud providers are reshaping infrastructure strategies. Domestic operators focus on service customization and regulatory alignment, while global firms emphasize scalability and advanced service portfolios. This competitive mix is driving innovation, expanding capacity, and improving service reliability across the market.

Recent Developments:

- In October 2025, NTT DATA signed a strategic collaboration agreement with AWS to deliver AI-powered contact center solutions, enhancing global data center synergies and cloud service capacity for enterprise clients—including opportunities for the Greek market.

- In August 2025, AWS accelerated its support for European enterprises by planning to launch the AWS European Sovereign Cloud in Brandenburg, Germany by the end of 2025, backed by a €7.8 billion investment in infrastructure—with opportunities for Greek and regional customers to leverage secure AWS services once the new region opens.

- In August 2025, Digital Realty launched ATH3, Greece’s largest hyperscale data center in Koropi, Athens, serving cloud needs across Southeastern Europe. The campus, originally initiated by Lamda Hellix, now strengthens Digital Realty’s market-leading footprint in Greece.

- In July 2025, Vodafone Greeceformed a strategic infrastructure partnership with Digital Realty to construct additional fixed routes between Crete and major cities, among other plans to enhance Greece’s digital infrastructure connectivity. This partnership aims to strengthen the country’s position as a regional connectivity hub.

- In June 2025, Digital Realty’s Athens Data Center Campuswas selected by Amazon Web Services (AWS) for a new AWS Direct Connect location, enhancing the facility’s cloud connectivity offerings and positioning Athens as a key node in AWS’s European network infrastructure.