Executive summary:

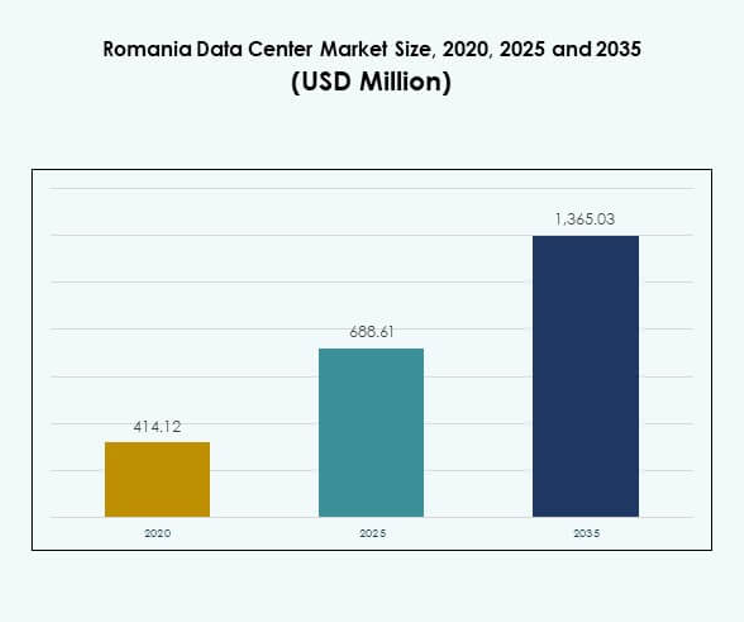

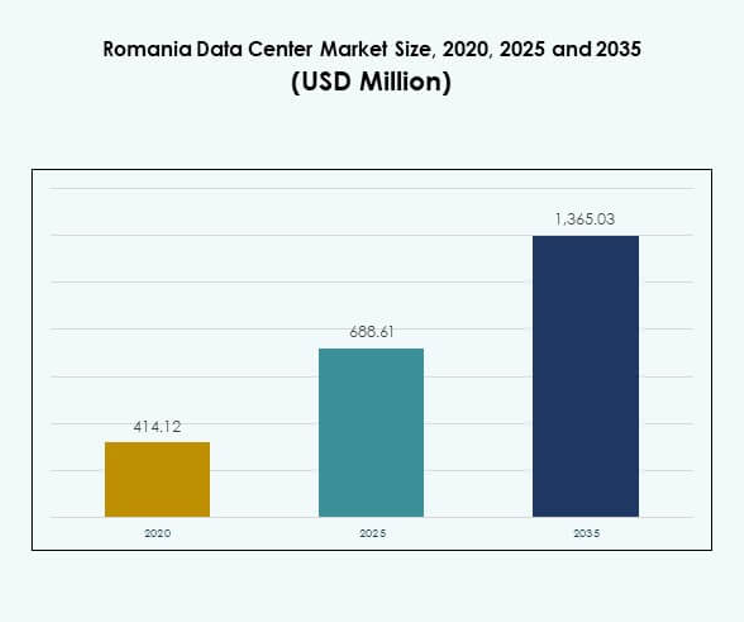

The Romania Data Center Market size was valued at USD 414.12 million in 2020 to USD 688.61 million in 2025 and is anticipated to reach USD 1,365.03 million by 2035, at a CAGR of 7.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Romania Data Center Market Size 2025 |

USD 688.61Million |

| Romania Data Center Market, CAGR |

7.04% |

| Romania Data Center Market Size 2035 |

USD 1,365.03 Million |

Growth in the Romania Data Center Market is driven by rising cloud adoption, enterprise digitalization, and demand for hybrid IT solutions. Businesses in telecom, banking, and government sectors invest in colocation and hyperscale infrastructure to enhance efficiency and security. The market benefits from renewable energy integration and EU compliance, positioning Romania as a sustainable and reliable hub. Investors view the country’s growing connectivity and strategic role in supporting AI-driven workloads as a critical advantage for long-term expansion.

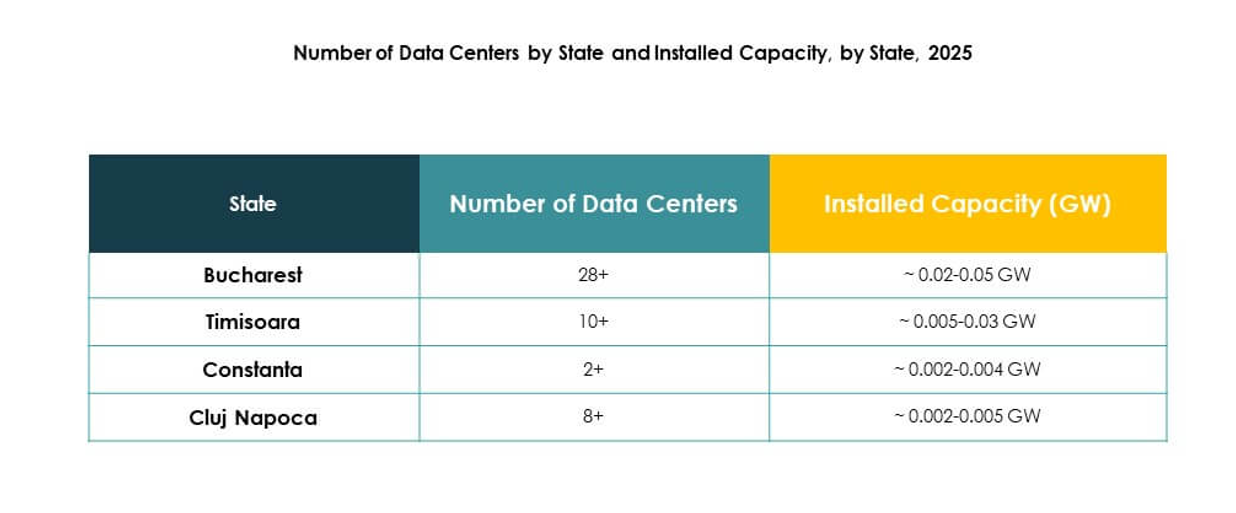

Regionally, Western and Central Romania lead due to strong connectivity, enterprise density, and Bucharest’s role as a digital hub. Eastern Romania is emerging with government-backed digital initiatives and SME-driven demand for colocation. Southern Romania is gaining traction with cross-border fiber projects and renewable energy integration, supporting sustainable operations. These dynamics establish Romania as a bridging point between Central Europe and Southeastern regions, making it a preferred location for expansion.

Market Drivers

Expanding Digital Transformation and Rising Demand for Secure Data Hosting

The Romania Data Center Market benefits from digital transformation initiatives across industries. Enterprises in banking, telecom, and government prioritize secure and scalable hosting. Cloud adoption continues to grow as businesses migrate workloads to hybrid and multi-cloud setups. The need for data sovereignty compliance supports demand for domestic facilities. It enables organizations to store and process sensitive information under EU regulations. Rising internet penetration and mobile usage add pressure for robust infrastructure. Investors view Romania as a strategic location bridging Central and Eastern Europe. This importance enhances capital inflow for infrastructure modernization.

- For instance, Microsoft bought a plot of land in Otopeni, near Bucharest, in July 2022 to host its first data center in Romania, and it already employs approximately 1,800 staff in the country.

Growing Enterprise Innovation and Integration of Hybrid IT Models

Hybrid IT adoption stands as a key driver for enterprises seeking efficiency and flexibility. Companies integrate private and public cloud with on-premises models to optimize operations. The Romania Data Center Market supports this shift through advanced colocation and hyperscale facilities. It offers enterprises cost optimization while maintaining compliance and agility. Businesses rely on automation, virtualization, and orchestration tools to streamline processes. Demand for scalable solutions supports integration of next-generation networking and monitoring systems. This technology adoption enables enterprises to compete regionally. The ability to scale securely attracts global investors and operators.

- For instance, ClusterPower officially launched its first hyperscale data center near Craiova, Romania, in April 2022, following an investment of €40 million and a six-month construction timeline, marking the country’s first large-scale facility of its kind.

Strengthening Role of Renewable Energy and Energy-Efficient Operations

Sustainability trends influence infrastructure development across the country. Operators adopt renewable energy sources such as hydropower and solar for long-term efficiency. The Romania Data Center Market leverages these resources to reduce carbon footprints. It aligns with EU climate goals, making Romania attractive for environmentally conscious investors. Advanced cooling and power management technologies improve efficiency. Enterprises value sustainability as a cost and brand differentiator. Government support for clean energy adoption creates favorable policies. These measures position Romania as a reliable hub for sustainable operations.

Strategic Geographic Position and Regional Connectivity Expansion

Romania’s location enhances its importance as a digital hub. Proximity to Central Europe, the Balkans, and the Black Sea supports cross-border connectivity. The Romania Data Center Market gains strength through subsea cable and fiber optic projects. It attracts hyperscale providers looking to serve regional enterprises efficiently. Colocation facilities thrive due to low-latency connections. Investors value the ability to reach emerging Southeastern European economies. Enterprises benefit from Romania’s position within EU regulatory frameworks. This geographic advantage drives long-term growth for the country’s digital infrastructure.

Market Trends

Increasing Deployment of Edge and Modular Data Centers

Edge and modular data centers are expanding rapidly across Romania. The Romania Data Center Market sees strong demand for low-latency processing closer to users. It enables enterprises in telecom, retail, and IoT-driven industries to enhance performance. Compact facilities reduce reliance on large centralized hubs. Modular designs allow quick scalability in urban and semi-urban regions. Operators invest in prefabricated solutions to lower deployment costs. Enterprises adopt these models to support AI and analytics applications. Edge infrastructure strengthens resilience and improves business continuity strategies.

Adoption of Automation and Artificial Intelligence in Operations

Data center operators integrate automation and AI tools to improve performance. The Romania Data Center Market adopts intelligent monitoring for power, cooling, and security. It reduces downtime risks by predicting maintenance requirements. AI-based orchestration enhances energy efficiency and resource allocation. Enterprises benefit from reduced operational costs and higher availability. These technologies support the increasing complexity of hybrid IT environments. It also strengthens cybersecurity protocols with real-time threat detection. Automation continues to reshape operational standards across data centers in Romania.

Rising Importance of Colocation Facilities Among Enterprises

Colocation centers gain traction due to their cost-effective and scalable models. Enterprises view them as alternatives to high-capital infrastructure investments. The Romania Data Center Market supports growth by offering advanced colocation services. It helps businesses focus on operations while outsourcing facility management. Demand comes strongly from SMEs seeking reliable infrastructure without heavy investment. Operators expand white space and connectivity options to attract enterprises. Colocation aligns with compliance requirements for secure data storage. This trend positions Romania as a competitive destination for regional colocation.

Integration of High-Density Infrastructure to Support AI and Cloud Workloads

High-density racks and advanced cooling systems see rising demand. The Romania Data Center Market adapts to workloads from AI, big data, and hyperscale cloud. It requires efficient designs to handle higher power usage per rack. Operators invest in liquid cooling and advanced airflow management systems. Enterprises adopt these facilities to support GPU-intensive applications. Demand for scalable capacity drives innovation in infrastructure. It reflects growing enterprise reliance on real-time analytics. This trend ensures Romania remains relevant in the competitive European data center landscape.

Market Challenges

High Infrastructure Costs and Limited Availability of Skilled Workforce

The Romania Data Center Market faces significant cost-related challenges. Capital requirements for advanced facilities increase due to high power and cooling needs. It creates barriers for smaller operators and local enterprises. Skilled workforce shortages limit the pace of deployment and operations. Enterprises struggle to find expertise in cloud, networking, and energy management. International players dominate, creating competitive pressure on local firms. Limited access to funding slows regional expansion. Rising construction costs add financial burden for new entrants and expansions.

Regulatory Complexities and Energy Supply Vulnerabilities

Operators face challenges related to evolving regulations and energy supply stability. The Romania Data Center Market requires compliance with EU data sovereignty and climate policies. It adds operational complexity for enterprises adopting hybrid models. Energy price fluctuations create unpredictability in long-term planning. Infrastructure projects depend heavily on grid reliability and renewable availability. Limited diversity of energy sources raises concerns for sustained growth. Operators must adapt to stricter reporting and sustainability requirements. These challenges shape investment strategies and risk assessments.

Market Opportunities

Expansion of Cloud and AI-Driven Services Across Enterprises

The Romania Data Center Market provides opportunities through rising demand for AI and cloud. Enterprises across BFSI, healthcare, and retail require scalable infrastructure for data-heavy workloads. It attracts investment from global cloud service providers. Local operators expand hybrid and managed service offerings. Businesses seek AI-enabled data processing closer to customers. Growing digital platforms strengthen reliance on cloud-native applications. Investors view this trend as an opportunity to establish long-term presence. Market potential lies in diversifying cloud ecosystems across industries.

Strengthening Regional Role in Cross-Border Connectivity

Romania’s position supports opportunities in connectivity-driven infrastructure. The Romania Data Center Market benefits from projects linking Central and Southeastern Europe. Subsea and fiber optic developments enable low-latency interconnections. It encourages enterprises to choose Romania for regional expansions. Colocation and hyperscale providers invest in cross-border infrastructure. Businesses view Romania as a cost-effective yet strategically positioned hub. This opportunity enhances partnerships with global carriers and cloud operators. Regional integration supports sustainable long-term growth for data infrastructure.

Market Segmentation

By Component

Hardware dominates the Romania Data Center Market, supported by high demand for servers, storage, and networking. Power and cooling systems remain critical due to rising energy efficiency requirements. Software solutions such as DCIM and orchestration tools expand alongside hybrid models. Services including consulting and managed support strengthen adoption among SMEs. Growth is driven by rising workloads from cloud and enterprise clients. Hardware maintains the largest share while services show increasing momentum. Enterprises seek end-to-end solutions combining hardware, software, and services.

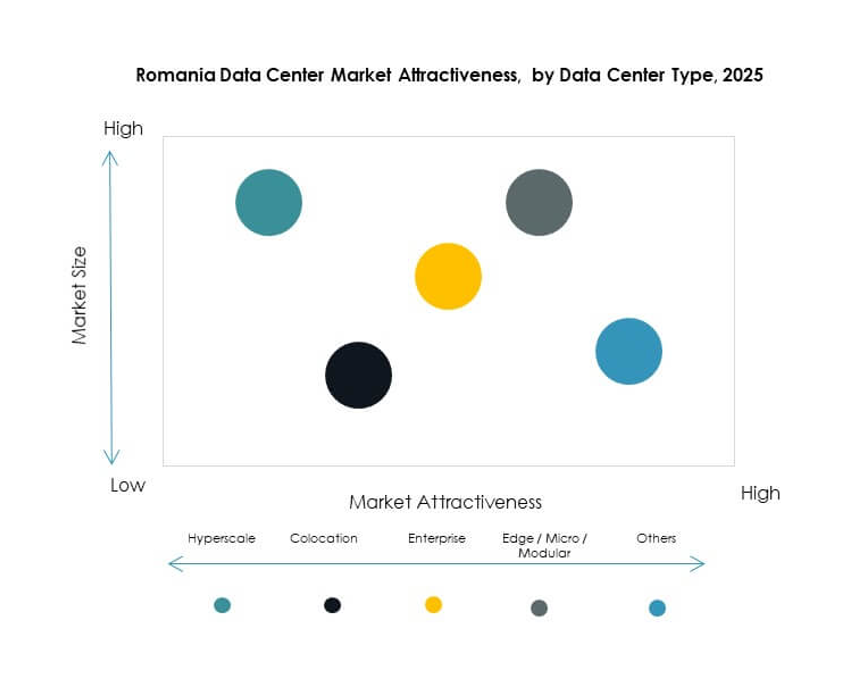

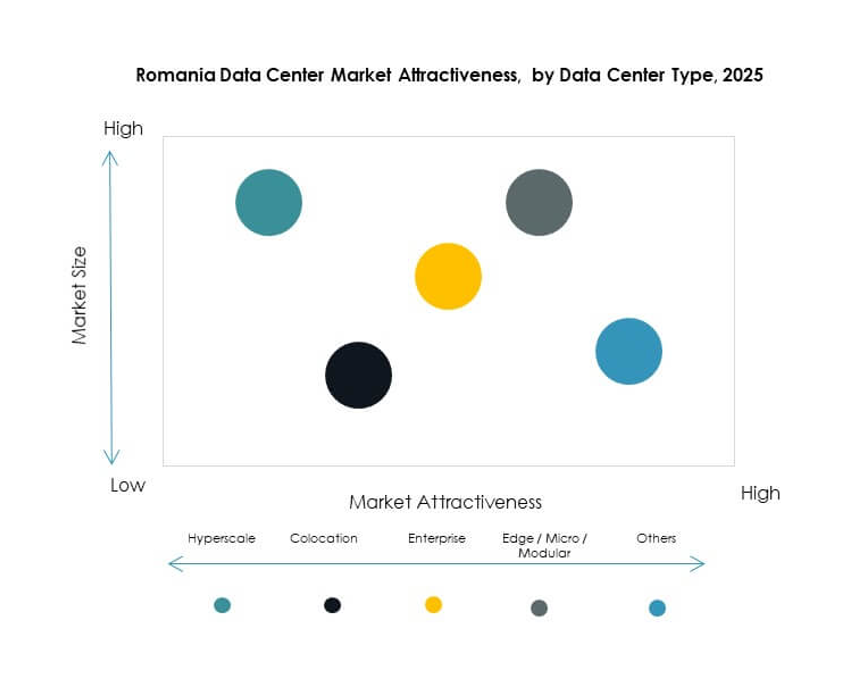

By Data Center Type

Colocation and hyperscale centers lead the Romania Data Center Market. Colocation thrives among SMEs seeking scalable and cost-efficient hosting. Hyperscale facilities attract global cloud providers investing in regional hubs. Enterprise data centers retain significance but face higher costs. Edge and modular centers rise to support IoT and real-time workloads. Cloud and IDC facilities strengthen hybrid adoption across industries. Mega data centers remain limited but offer potential for long-term investments. Colocation continues to dominate due to affordability and compliance alignment.

By Deployment Model

Hybrid deployment leads in the Romania Data Center Market. Enterprises value flexibility from combining on-premises, cloud, and colocation models. Cloud-based adoption rises strongly with enterprise reliance on SaaS and IaaS. On-premises retains importance for highly regulated industries. Hybrid adoption ensures compliance with EU data regulations while optimizing cost. Enterprises deploy hybrid to handle peak loads efficiently. Cloud-based services appeal to SMEs requiring scalability. Hybrid deployment maintains dominance due to its adaptability and resilience.

By Enterprise Size

Large enterprises dominate the Romania Data Center Market due to higher budgets and compliance needs. They adopt colocation and hybrid services to support global operations. SMEs rely on colocation and cloud-based models for affordability. Large enterprises invest in AI-ready infrastructure to remain competitive. SMEs contribute to demand for flexible and managed services. It creates opportunities for local providers targeting smaller businesses. Large enterprises hold stronger influence due to international expansion. SMEs drive diversification of service offerings and regional reach.

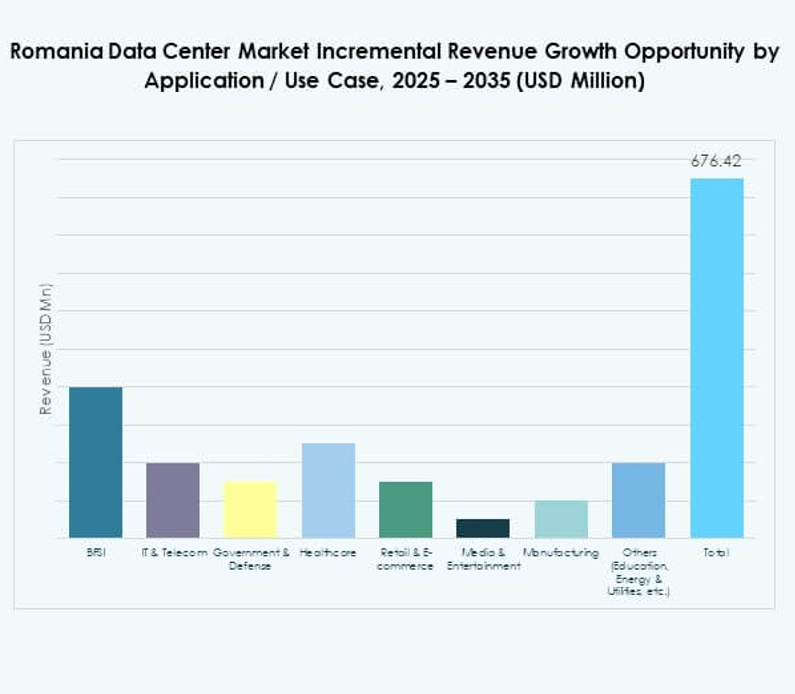

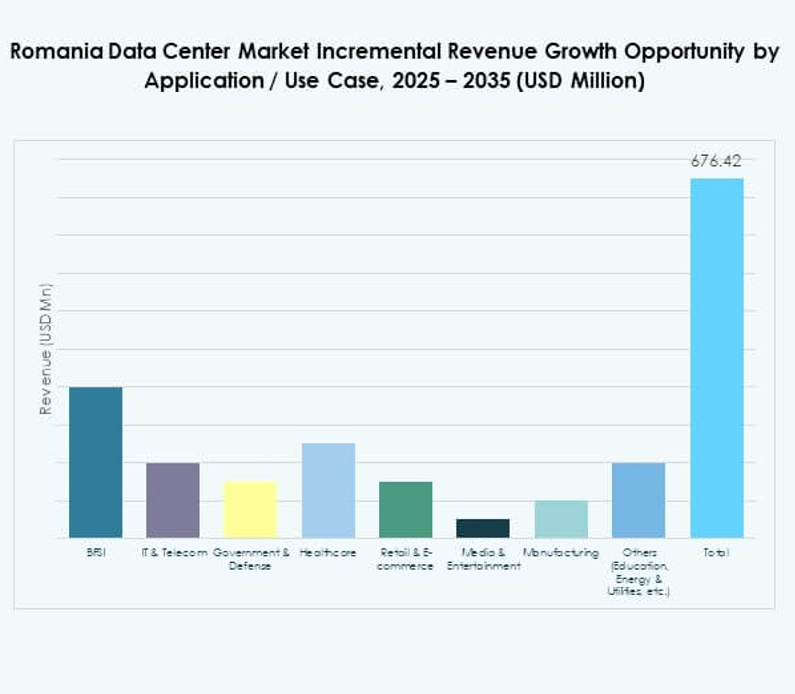

By Application / Use Case

IT & Telecom leads the Romania Data Center Market, supported by high data traffic. BFSI follows with strong adoption for secure financial operations. Government and defense sectors strengthen demand through digitalization initiatives. Healthcare expands rapidly due to telemedicine and patient data hosting. Retail and e-commerce adopt scalable infrastructure for digital platforms. Media and entertainment demand grows with streaming and gaming. Manufacturing adopts IoT-driven infrastructure for automation. Education and utilities add smaller yet steady contributions.

By End User Industry

Cloud service providers dominate the Romania Data Center Market, driven by hyperscale investments. Enterprises account for significant demand across hybrid models. Colocation providers benefit from SMEs requiring cost-effective hosting. Government agencies strengthen investments for compliance and sovereignty. Other end users such as telecom and utilities contribute to regional growth. Cloud service providers retain the largest share due to AI and analytics demand. Enterprises diversify adoption across industries. Colocation providers play an essential role in long-term growth.

Regional Insights

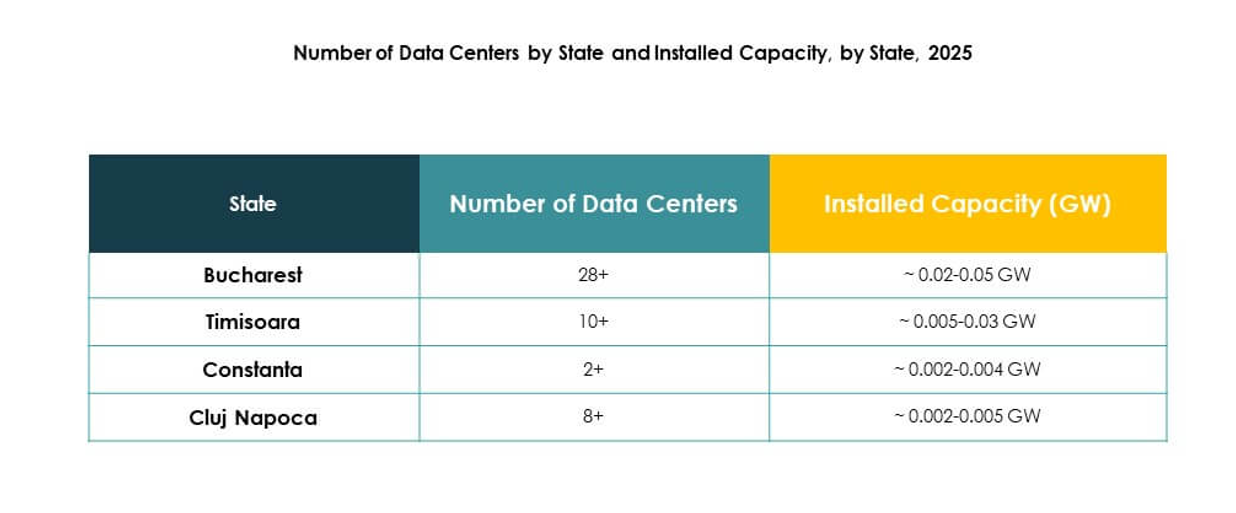

Western and Central Romania Leading with Largest Share in Market Revenue

Western and Central Romania account for 45% share of the Romania Data Center Market. Bucharest dominates due to strong connectivity, enterprise density, and hyperscale adoption. It attracts global providers establishing colocation and hybrid infrastructure. Regional enterprises benefit from reliable fiber and power availability. Western Romania also supports industrial clients seeking secure hosting. The dominance reflects urban infrastructure and international investments. It highlights the role of Bucharest as the national digital hub.

- For instance, ClusterPower’s Craiova campus achieved Uptime Institute Tier III Design accreditation and is designed for up to 4,500 racks and 200 MW capacity, positioning it as among Romania’s largest data centers.

Eastern Romania Emerging with Strong Regional Expansion Potential

Eastern Romania captures 30% share, reflecting growing enterprise adoption. The region attracts government projects focused on digitalization of healthcare and education. SMEs rely on modular and colocation facilities to scale cost-effectively. The Romania Data Center Market gains importance here with rising fiber investments. It strengthens national coverage by adding regional hosting capabilities. Enterprises adopt hybrid setups to align with regulatory requirements. Eastern Romania is emerging as a secondary hub for enterprise growth.

Southern Romania Developing Through Cross-Border Connectivity and Energy Integration

Southern Romania holds 25% share of the Romania Data Center Market. It benefits from proximity to the Balkans and Black Sea connectivity. Subsea and cross-border fiber projects enhance regional competitiveness. Energy integration from renewable projects supports sustainable infrastructure. Enterprises invest in colocation to serve cross-border clients. The region strengthens Romania’s role as a bridge between Southeastern and Central Europe. Southern Romania continues to attract investors focused on energy-efficient operations.

- For instance, Digi Communications N.V. expanded its Fiberlink 10 Gbps service to Constanța in 2022, following its earlier launch in Bucharest, making it the fastest fixed internet service available in Romania.

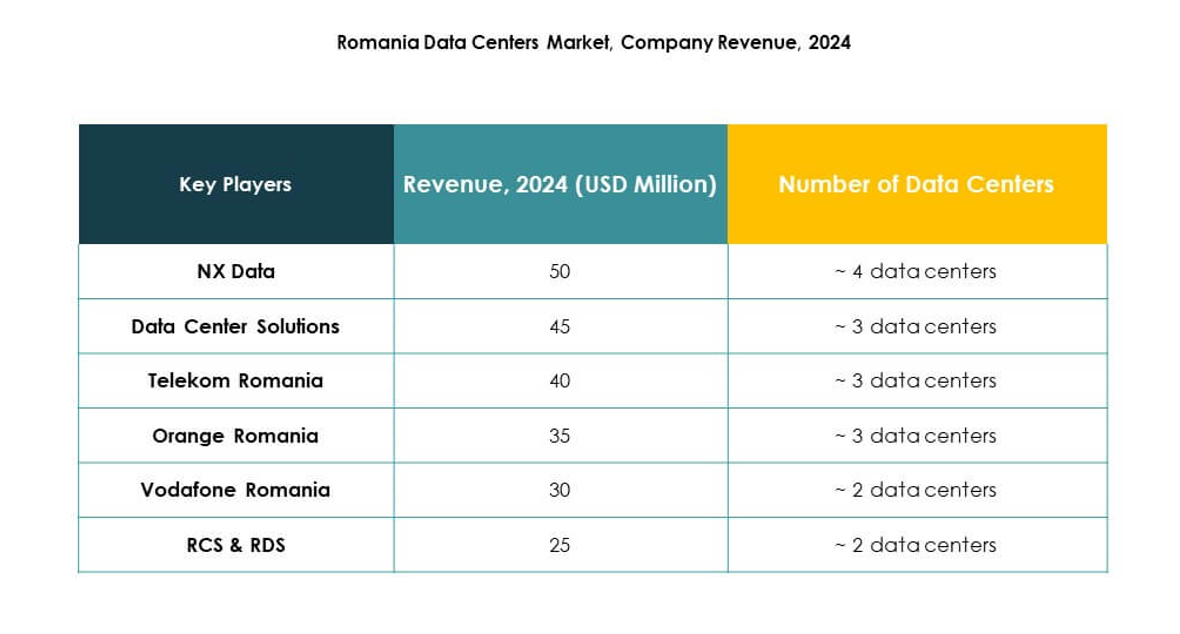

Competitive Insights:

- NX Data

- Data Center Solutions

- Telekom Romania

- Orange Romania

- RCS & RDS

- Vodafone Romania

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc.

- Google LLC (Alphabet Inc.)

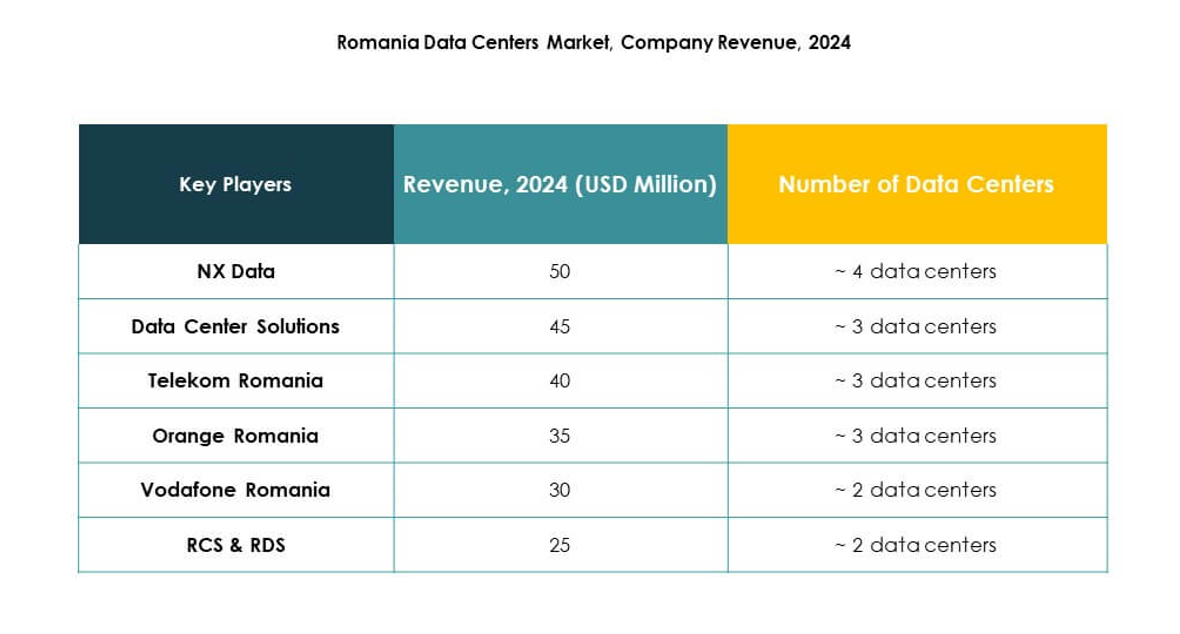

The Romania Data Center Market is shaped by a diverse mix of domestic and global players. Local firms such as NX Data and Data Center Solutions strengthen national infrastructure with colocation and connectivity services. Telecom operators including Telekom Romania, Orange Romania, RCS & RDS, and Vodafone Romania leverage existing customer bases to expand managed hosting and cloud offerings. Global leaders such as Digital Realty, NTT, Microsoft, Amazon Web Services, and Google focus on hyperscale growth, cloud integration, and AI-ready infrastructure. It creates a competitive balance where local providers emphasize cost efficiency and regional presence, while multinational companies invest heavily in scalable technologies and sustainability. This mix ensures customers gain access to both specialized local expertise and advanced global platforms.

Recent Developments:

- In September 2025, Vodafone and Digi finalized agreements to acquire significant assets of Telekom Romania, marking a pivotal acquisition in the Romania data center and telecom market. This deal includes the transfer of a substantial portion of Telekom Romania’s post-paid and business customer base, strengthening Vodafone and Digi’s positioning in digital infrastructure and managed data services across the country.

- In June 2025, Knight Frank reported that two new data centers, with a combined planned capacity of 40–45 MW, are under consideration for construction in Romania. The total investment for these projects is estimated near 500 million euros, reflecting expanding AI, cloud, and data capacity across the region.