Executive summary:

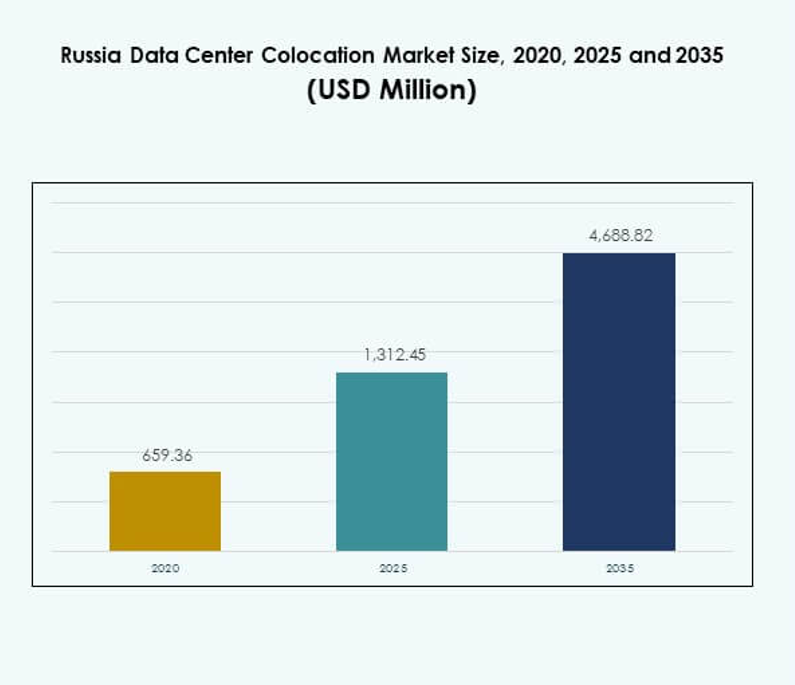

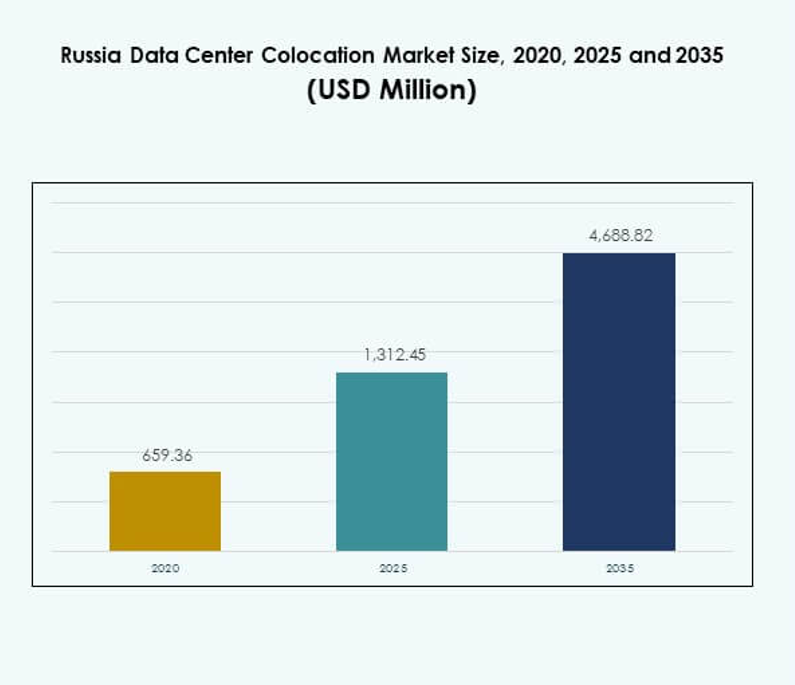

The Russia Data Center Colocation Market size was valued at USD 659.36 million in 2020 to USD 1,312.45 million in 2025 and is anticipated to reach USD 4,688.82 million by 2035, at a CAGR of 13.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Russia Data Center Colocation Market Size 2025 |

USD 1,312.45 Million |

| Russia Data Center Colocation Market, CAGR |

13.52% |

| Russia Data Center Colocation Market Size 2035 |

USD 4,688.82 Million |

Growing adoption of AI, edge computing, and hybrid cloud solutions is driving demand for advanced colocation services. Enterprises are focusing on scalable infrastructure to reduce capital costs and increase operational agility. The Russia Data Center Colocation Market is becoming strategically important for investors and hyperscalers aiming to secure a foothold in a rapidly digitalizing economy supported by domestic technology development and regulatory backing.

Western Russia, including Moscow and St. Petersburg, leads the market due to robust connectivity and enterprise concentration. Central regions are emerging as new hubs with favorable cost structures and improving power availability. Eastern Russia holds growth potential driven by industrial expansion, logistics infrastructure, and increasing investment in edge facilities to support regional digital transformation.

Market Drivers

Rising Demand for High-Density Computing Infrastructure and Cloud Migration

Russia is witnessing a significant increase in cloud adoption, digital transformation, and enterprise infrastructure modernization. Enterprises are moving workloads to colocation facilities to reduce capital expenditure and gain flexibility. The shift to hybrid cloud models drives the need for high-density computing and scalable power availability. Colocation providers are building Tier III and Tier IV facilities to meet enterprise-grade reliability. The Russia Data Center Colocation Market is strategically positioned to serve financial services, e-commerce, and manufacturing sectors. Businesses view it as a stable and secure environment to host mission-critical systems. This surge creates strong investment potential for both domestic and foreign investors.

- For instance, Yandex is building a 63 MW data center in Kaluga, designed to host over 3,800 server racks. The facility targets a PUE between 1.07 and 1.09, reflecting a strong focus on energy efficiency and large-scale cloud infrastructure.

Expansion of AI, IoT, and Edge Computing Driving Infrastructure Modernization

AI and IoT deployments are pushing infrastructure limits and increasing demand for low-latency processing. Colocation data centers offer proximity, scalability, and connectivity required to support these applications. Edge computing adoption is rising in industrial, retail, and logistics sectors, creating strong demand for regional data nodes. Providers are investing in efficient cooling systems and modular designs to support next-generation workloads. The Russia Data Center Colocation Market benefits from rapid enterprise modernization and increasing demand for processing power. Investors consider it a strategic sector for long-term growth. This infrastructure shift enhances operational resilience and service delivery speed.

- For instance, Selectel operates multiple Tier III data centers in St. Petersburg, offering colocation services with high-density power configurations. The company focuses on scalable infrastructure to support cloud and enterprise workloads across critical industries.

Strong Regulatory Push and Data Sovereignty Encouraging Local Infrastructure Growth

Regulatory requirements on data localization are driving enterprises to host data within national borders. Government mandates strengthen trust in local infrastructure and boost investment in certified colocation facilities. Enterprises in BFSI, telecom, and healthcare are expanding infrastructure footprints to comply with regulations. Providers are building new facilities with robust security frameworks and advanced energy systems. The Russia Data Center Colocation Market is gaining strategic importance in ensuring secure data residency. This regulatory push supports the development of a stronger domestic ecosystem. It creates favorable conditions for long-term infrastructure investments.

Growing Interest from Hyperscalers and Strategic Investors

Global and regional hyperscalers are showing growing interest in the Russian colocation landscape. They prefer partnerships to establish scalable infrastructure without full ownership. High energy availability and low operational costs make the market attractive. Colocation providers are expanding campuses near major metros to meet these demands. The Russia Data Center Colocation Market is becoming a hub for strategic alliances between enterprises and operators. This collaboration accelerates digitalization and improves network efficiency. It positions the market as a key digital infrastructure base in Eastern Europe.

Market Trends

Increased Deployment of Modular and Scalable Data Center Infrastructure

Operators are moving toward modular facility designs to meet rapidly changing enterprise demands. Modular systems enable fast capacity expansion with minimal operational disruption. This approach lowers construction time and operational risk for colocation providers. Enterprises prefer modular solutions for scalability and lower upfront investment. The Russia Data Center Colocation Market is embracing this shift to attract both large enterprises and SMEs. Providers focus on flexible capacity, better power management, and efficient cooling integration. This trend enhances infrastructure agility and drives sustained market growth.

Integration of Renewable Energy Solutions into Facility Design

Sustainability is gaining importance across digital infrastructure development. Operators are adopting energy-efficient systems and renewable energy sources to meet ESG goals. Colocation facilities are investing in advanced cooling technologies and power usage optimization. Renewable integration improves cost efficiency and aligns with corporate responsibility goals. The Russia Data Center Colocation Market reflects this shift through projects involving green energy partnerships. This change attracts environmentally conscious clients and investors. It strengthens long-term competitiveness and operational sustainability.

Rising Adoption of Carrier-Neutral Facilities to Enhance Connectivity Options

Enterprises increasingly seek carrier-neutral colocation facilities for better network flexibility. Carrier-neutral setups allow multiple telecom providers to operate within the same facility. This structure improves connectivity performance, redundancy, and cost efficiency. It supports low-latency applications for finance, cloud, and media sectors. The Russia Data Center Colocation Market is seeing increased investments in carrier-neutral sites near urban centers. These facilities serve diverse customer bases and reduce network dependency. This trend enhances market competitiveness and customer retention.

Growing Use of AI-Driven Monitoring and Automation Tools

Automation tools are transforming facility operations and energy management. AI systems monitor workloads, cooling efficiency, and power utilization in real time. Predictive maintenance reduces downtime and improves operational transparency. Colocation providers use AI to optimize space utilization and reduce energy costs. The Russia Data Center Colocation Market is adopting AI-driven platforms to strengthen service reliability. Automation enhances customer experience and operational resilience. This trend reflects the sector’s shift toward smart and efficient infrastructure.

Market Challenges

Regulatory Complexity and Geopolitical Environment Creating Investment Barriers

Compliance with data sovereignty laws and evolving regulatory frameworks creates operational complexity. Geopolitical uncertainties affect foreign investor confidence and limit funding channels. Providers must balance infrastructure expansion with compliance requirements. Energy availability remains stable but faces long-term sustainability and pricing concerns. The Russia Data Center Colocation Market is constrained by regulatory and diplomatic pressures. This environment makes financing and international partnerships more challenging. Investors and operators must adopt flexible strategies to mitigate these risks.

Limited Fiber Connectivity and Regional Infrastructure Gaps Slowing Expansion

Outside major urban hubs, network infrastructure remains underdeveloped. Limited fiber connectivity increases operational costs for facility operators. This gap restricts data traffic efficiency and discourages enterprise migration. Smaller cities face power grid limitations that hinder Tier III and Tier IV deployments. The Russia Data Center Colocation Market is affected by uneven infrastructure maturity across regions. Providers must invest heavily in network buildouts to reach emerging areas. This challenge impacts scalability and nationwide service availability.

Market Opportunities

Expansion of Edge Data Centers to Serve High-Growth Regional Hubs

Edge computing demand is creating strong growth potential outside Moscow and St. Petersburg. Colocation providers can build smaller, agile facilities to support local enterprises. These deployments reduce latency and enhance service reliability. The Russia Data Center Colocation Market can capture this demand to extend its geographic reach. Investors see strong potential in logistics, industrial, and smart city applications.

Strategic Partnerships with Hyperscalers and Renewable Energy Developers

Partnerships can accelerate infrastructure expansion while reducing upfront costs. Hyperscalers bring large-scale workloads, while renewable developers enable cost-efficient energy sourcing. This collaboration improves operational efficiency and ESG positioning. The Russia Data Center Colocation Market can leverage these partnerships to scale faster. It can become a preferred hub for sustainable digital infrastructure investment.

Market Segmentation

By Type

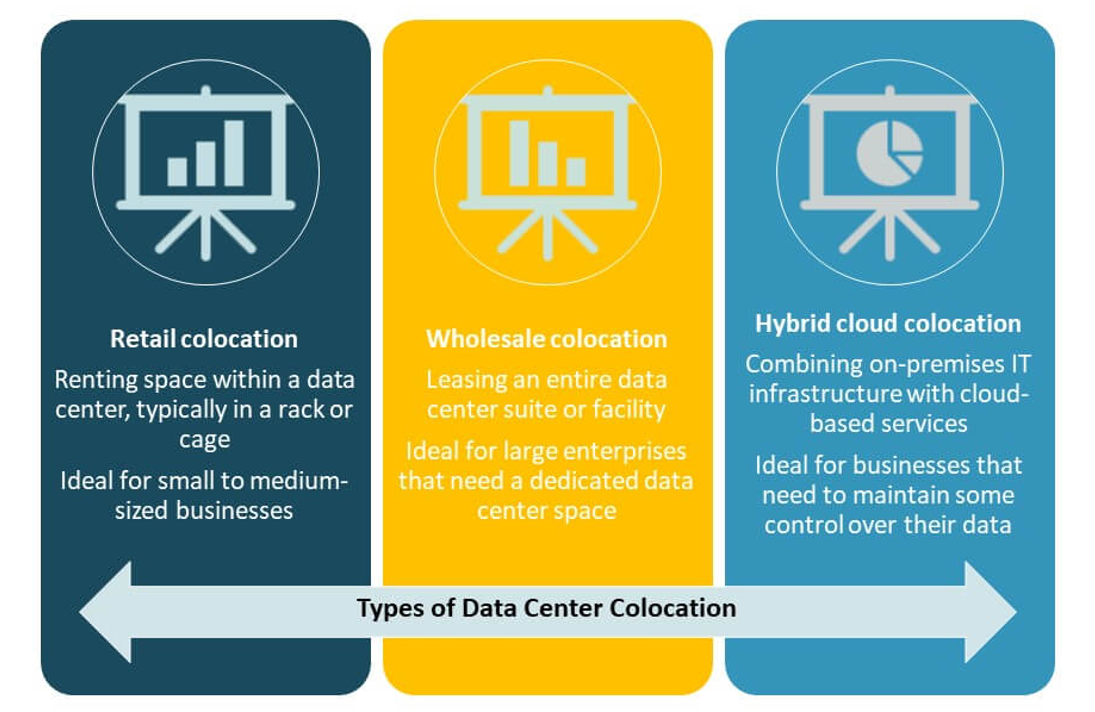

Retail colocation holds the dominant share due to strong demand from small and medium enterprises seeking cost-effective IT infrastructure. Wholesale colocation attracts hyperscalers aiming for large-scale capacity. Hybrid cloud colocation is rising with increased cloud migration and hybrid IT strategies. The Russia Data Center Colocation Market benefits from a mix of flexible and high-capacity service models that meet varying enterprise requirements and support scalable digital growth.

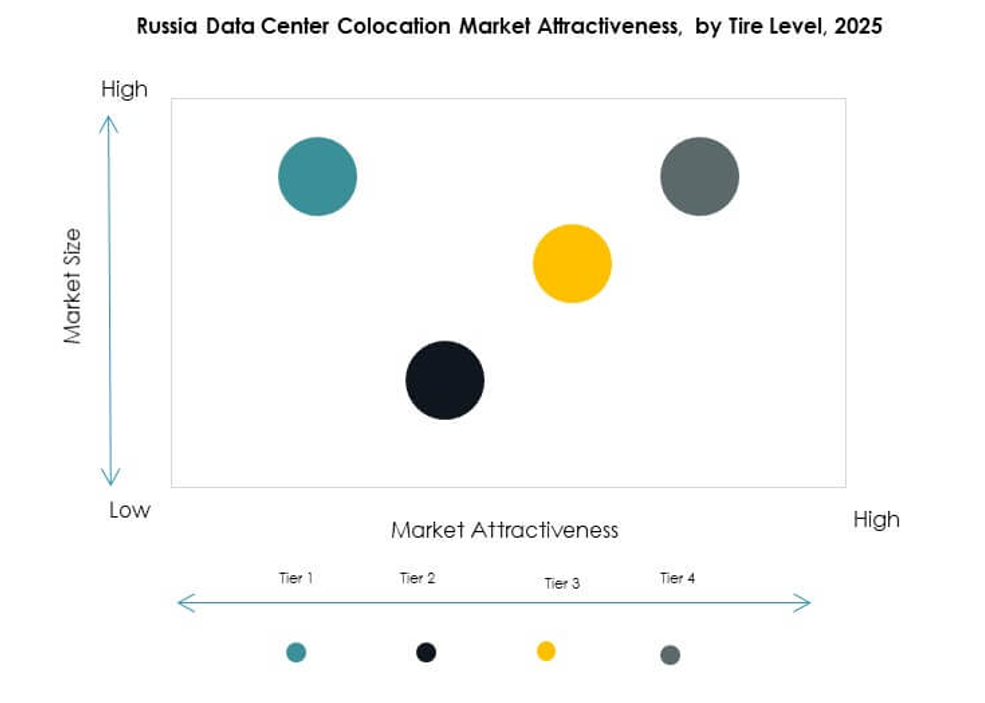

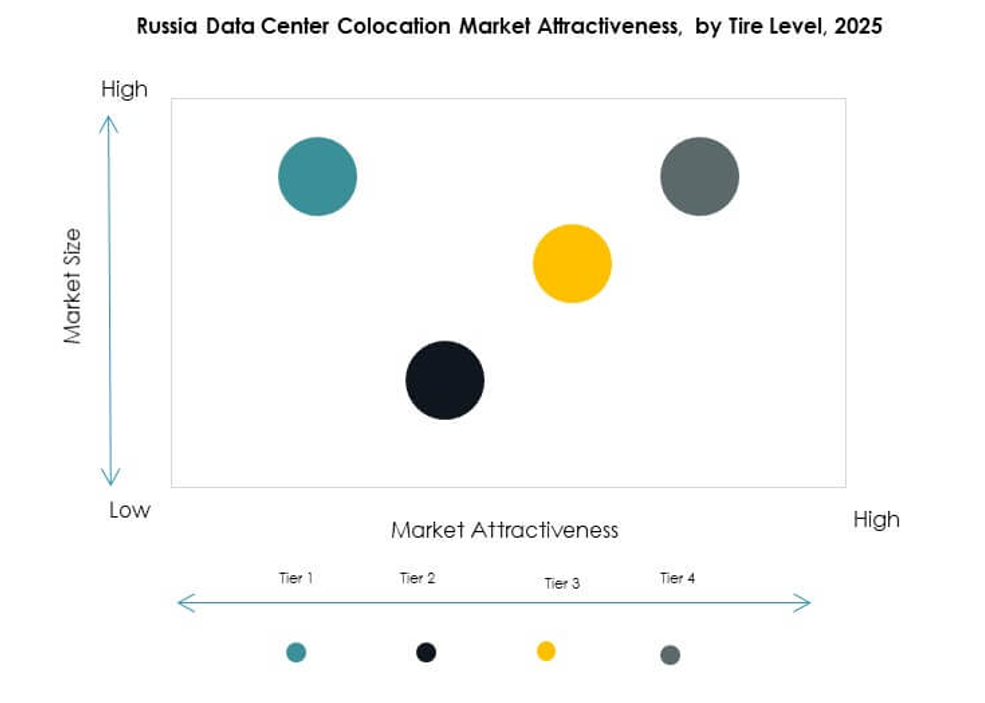

By Tier Level

Tier III dominates due to its balance of reliability and cost efficiency. It attracts enterprises requiring uptime guarantees and operational resilience. Tier IV facilities are gaining traction among BFSI and hyperscalers that prioritize maximum redundancy. Tier I and Tier II remain limited to non-critical workloads. The Russia Data Center Colocation Market shows strong investment in Tier III upgrades, ensuring compliance with service-level agreements and minimizing downtime risk.

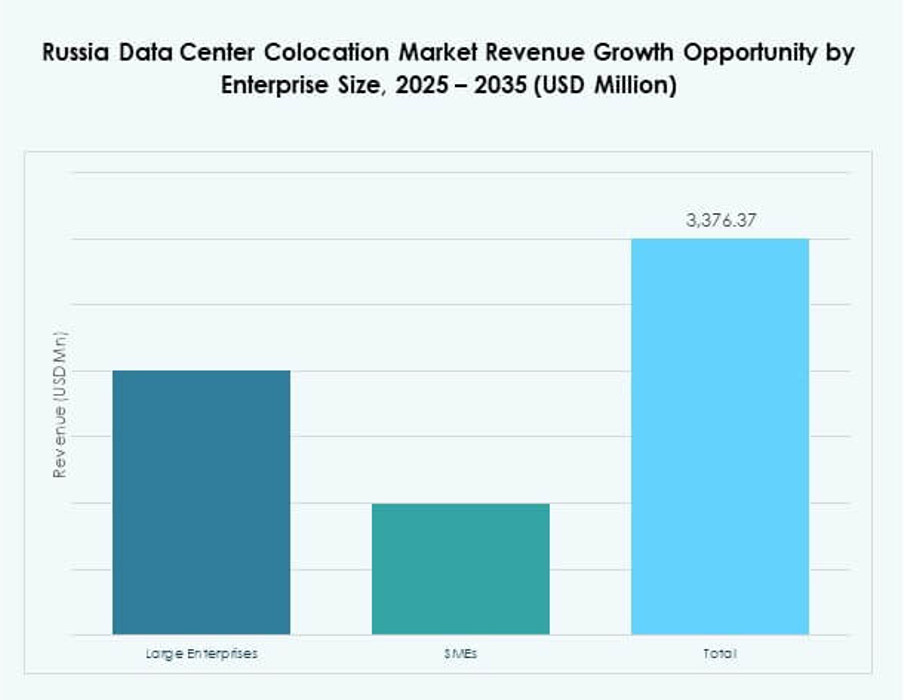

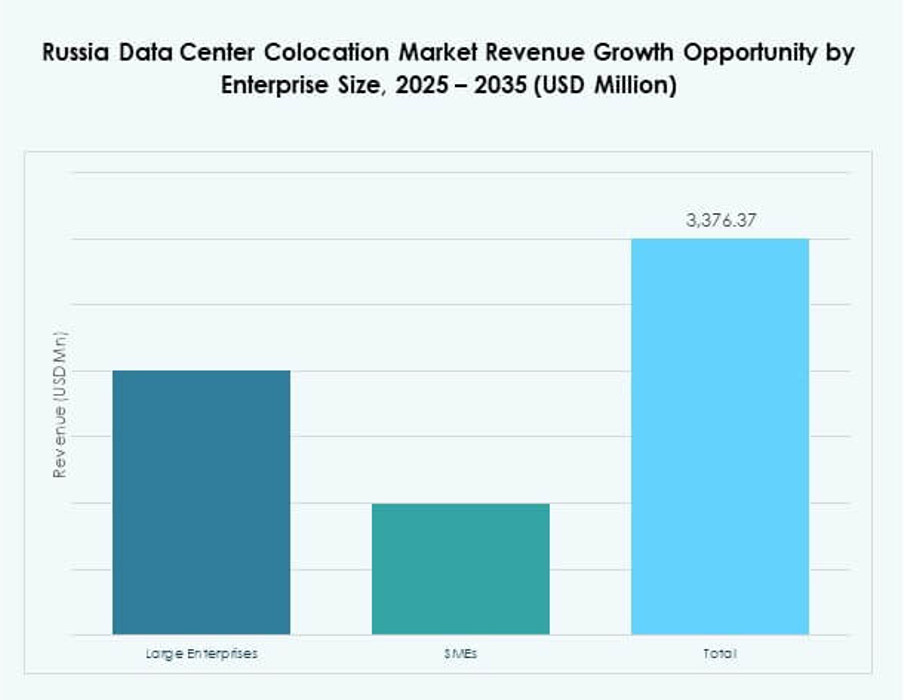

By Enterprise Size

Large enterprises lead the market with a strong focus on hybrid IT and compliance. They require secure, scalable infrastructure to support mission-critical operations. SMEs contribute significantly through retail colocation adoption, drawn by lower capital costs. The Russia Data Center Colocation Market reflects this dual demand from both large corporations and SMEs, enabling balanced market expansion and diverse service offerings.

By End User Industry

The BFSI sector holds a dominant share due to strict data residency and security needs. IT and telecom follow closely, driven by rising cloud adoption and AI integration. Retail, healthcare, and media sectors are expanding rapidly through digital service delivery. The Russia Data Center Colocation Market benefits from diversified industry participation, ensuring stable demand and long-term infrastructure utilization across sectors.

Regional Insights

Western Russia Leading the Market with Strong Urban and Enterprise Infrastructure (45% Share)

Western Russia leads the Russia Data Center Colocation Market with 45% share, supported by dense network infrastructure and enterprise concentration. Moscow and St. Petersburg host most Tier III and Tier IV facilities. High population density, strong fiber connectivity, and proximity to key business hubs drive demand. Colocation providers invest heavily in these regions to serve financial, telecom, and IT clients. Strategic location advantages and reliable power supply ensure sustained dominance.

- For instance, in 2024, IXcellerate reported an average requested rack power of 11.6 kW, with installations exceeding 20 kW per rack becoming common. The company’s Moscow North Campus is designed to support up to 3,000 racks, positioning it as a major high-density colocation hub in Russia.

Central Russia Emerging as a Strategic Secondary Hub (33% Share)

Central Russia holds 33% share and is becoming a critical growth region. Lower land costs and improving power availability attract new developments. Enterprises see value in locating secondary disaster recovery sites here. Colocation operators expand modular and edge facilities to meet regional needs. The Russia Data Center Colocation Market in this region benefits from balanced cost structures and rising connectivity investments.

- For example, RTK-TsOD, a Rostelecom subsidiary, launched a data center in Nizhny Novgorod in June 2025. The facility features 401 racks and 5 MW of IT capacity across 3,539 square meters, with the second phase of construction finished six months ahead of schedule.

Eastern Russia Developing as a High-Potential Edge Computing Zone (22% Share)

Eastern Russia accounts for 22% share and shows strong potential for future expansion. Infrastructure remains limited but is improving with state and private investment. The region’s strategic position for cross-border connectivity enhances its appeal. Colocation providers are planning edge data center deployments to support logistics and industrial clients. The Russia Data Center Colocation Market is expected to grow steadily here, driven by regional economic development and digitalization initiatives.

Competitive Insights:

- DataLine

- Rostelecom

- Selectel

- IXcellerate

- Amazon Web Services (AWS)

- Google Cloud

- China Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The Russia Data Center Colocation Market features a mix of domestic operators and global hyperscalers competing on capacity, connectivity, and service quality. Local firms such as DataLine, Rostelecom, and Selectel maintain a strong presence in Moscow and other urban hubs. Global leaders like AWS, Equinix, and Digital Realty strengthen their footprint through partnerships and scalable infrastructure deployments. It reflects high competition driven by advanced service offerings and strategic location expansion. Providers focus on Tier III and Tier IV facilities, low-latency connectivity, and energy-efficient designs to attract enterprise clients. Competitive differentiation relies on ecosystem strength, operational resilience, and technology integration.

Recent Developments:

- In October 2025, MegaFon—a major Russian telecommunications company—announced the launch of a new data center in St. Petersburg. According to the official statement, this facility uses equipment that is manufactured domestically, underscoring the company’s commitment to local technology development and supporting Russia’s broader push for digital sovereignty. This new center is set to enhance colocation capacity in the region, providing advanced infrastructure solutions for businesses seeking reliable hosting and connectivity options.

- In September 2025, Rostelecom announced plans to build a new data center for the Russian chemical firm PhosAgro, marking an expansion of the company’s presence in industrial-focused colocation services within Russia’s rapidly growing data center market.