Executive summary:

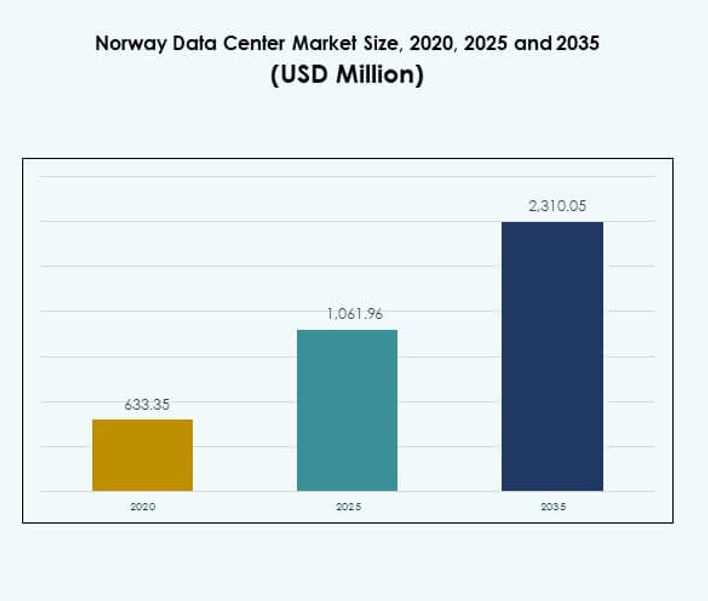

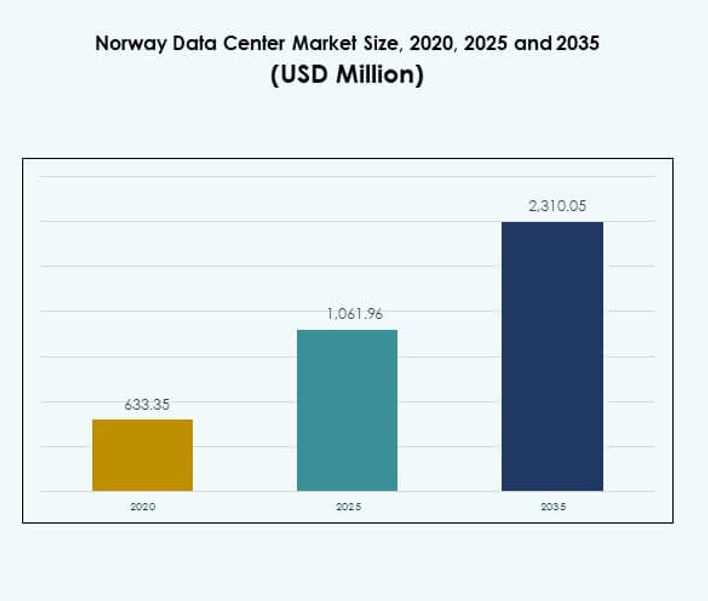

The Norway Data Center Market size was valued at USD 633.35 million in 2020 to USD 1,061.96 million in 2025 and is anticipated to reach USD 2,310.05 million by 2035, at a CAGR of 8.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Norway Data Center Market Size 2025 |

USD 1,061.96 Million |

| Norway Data Center Market, CAGR |

8.04% |

| Norway Data Center Market Size 2035 |

USD 2,310.05 Million |

The market is driven by rapid adoption of cloud computing, artificial intelligence, and digital transformation across industries. Enterprises and hyperscale operators focus on sustainability, deploying renewable-powered infrastructure and advanced cooling solutions. Innovation in automation and edge computing enhances efficiency, while demand for scalable and secure facilities strengthens investment flows. The Norway Data Center Market holds strategic importance by combining clean energy with advanced technology to attract global players and long-term investors.

Regionally, Western Norway leads with hydropower-backed infrastructure and large hyperscale projects. Eastern Norway follows with enterprise-driven demand and strong telecom presence. Northern and Central regions are emerging through government-backed projects and edge deployments. This balanced regional distribution ensures resilience and positions the Norway Data Center Market as a critical hub for sustainable and technologically advanced digital infrastructure in Europe.

Market Drivers

Adoption Of Cloud Computing And Digital Transformation Driving Infrastructure Investments

The demand for cloud computing is creating rapid infrastructure investments across enterprises and service providers. Businesses focus on scalability and efficiency, making cloud adoption central to IT strategies. The Norway Data Center Market is gaining attention from hyperscale operators due to its renewable power availability. It provides sustainable solutions aligned with environmental goals. The growth of remote working has accelerated the need for reliable data storage. Enterprises prioritize advanced computing capacity to handle AI and analytics workloads. Investors see long-term gains from stable demand in this market.

Innovation In Energy Efficiency And Renewable Power Integration Enhancing Growth Potential

Energy efficiency plays a decisive role in shaping the industry’s competitive landscape. Norway’s abundant hydropower supports clean operations, positioning the country as a sustainability leader. The Norway Data Center Market reflects this advantage, attracting operators focused on carbon neutrality. Companies deploy advanced cooling systems to minimize energy use. Strategic focus on low PUE metrics enhances credibility with global clients. Enterprises view it as an opportunity to align operations with ESG standards. These innovations reinforce confidence among both domestic and international stakeholders.

Shift Toward Artificial Intelligence And Big Data Applications Boosting Capacity Expansion

The rise of AI and big data is reshaping IT requirements across multiple industries. Organizations require faster processing speeds and massive storage to handle growing data. The Norway Data Center Market is adapting through continuous capacity expansion. Operators invest in high-performance computing clusters and automation solutions. Demand for AI-driven analytics in healthcare, finance, and telecom supports growth momentum. Businesses invest to maintain competitive advantage and ensure service reliability. Investors recognize its potential to drive steady revenue growth.

- For instance, Bulk Data Centers began construction in 2024 on a new 42 MW facility at its N01 campus, with direct liquid cooling technology supporting high-density AI workloads and the site connecting to 125 MVA of on-site, renewable substation capacity dedicated for scalable, high-performance computing.

Strategic Importance For Enterprises And Investors Ensuring Strong Market Attractiveness

This market holds strategic significance due to its alignment with digitalization goals. Enterprises rely on reliable infrastructure to support mission-critical workloads. The Norway Data Center Market ensures operational continuity while meeting regulatory compliance. Government support further strengthens investor confidence. Enterprises view it as a secure gateway to reach European markets. The market’s stability attracts long-term investments. Stronger emphasis on innovation and sustainability creates value for stakeholders. Investors continue expanding portfolios with future-focused projects.

- For instance, Statkraft initiated plans in 2025 to upgrade its Nore hydropower plants, aiming to increase the company’s total installed renewable capacity in Norway by over 20% (between 1,500 and 2,500 MW), ensuring expanded supply for mission-critical and sustainable industrial clients in the years ahead.

Market Trends

Expansion Of Hyperscale Facilities To Meet Global Cloud Demand

Hyperscale data centers are expanding to address increasing demand from global cloud providers. Large operators seek Norway for its renewable energy advantage. The Norway Data Center Market is seeing strong development of facilities with high scalability. Enterprises benefit from lower operational costs and stable supply chains. The availability of advanced fiber connectivity supports international expansion. Global tech companies prefer locations with strong sustainability commitments. Investors view hyperscale projects as long-term value drivers. This trend continues to define market strategies.

Rising Adoption Of Edge Data Centers For Real-Time Application Needs

Edge facilities are gaining importance with the growth of IoT, 5G, and smart cities. Enterprises prioritize low-latency processing for real-time applications. The Norway Data Center Market supports edge adoption by integrating modular and micro solutions. Operators deploy smaller facilities near users to reduce delays. Industries such as healthcare and retail demand localized processing capabilities. Edge models complement cloud infrastructure for better performance. Investors back edge growth to support evolving digital ecosystems. The shift strengthens Norway’s role in advanced connectivity.

Integration Of Automation And Artificial Intelligence For Operational Optimization

Automation and AI adoption are transforming data center operations. Operators deploy AI tools to optimize cooling, power, and security functions. The Norway Data Center Market leverages these tools to enhance efficiency. Automated monitoring ensures real-time insights into infrastructure performance. AI-driven predictive analytics supports proactive maintenance and reduces downtime risks. Businesses adopt automation to cut operational costs while increasing reliability. Investors favor AI integration as it drives sustainable returns. This trend highlights advanced operational strategies in the market.

Increasing Focus On Security And Compliance With Global Standards

Cybersecurity and compliance are critical as industries manage sensitive data. Enterprises prioritize facilities that meet GDPR and international certifications. The Norway Data Center Market reflects this need with advanced security frameworks. Operators adopt biometric controls, AI-driven threat detection, and layered defense systems. Compliance with strict regulations builds client trust. Businesses view secure infrastructure as essential for digital services. Investors consider compliance a key factor in sustainable growth. Security continues to influence expansion decisions.

Market Challenges

High Capital Requirements And Long Project Timelines Limiting Market Entry

Building large-scale facilities requires significant financial resources. Investors face challenges due to long construction timelines and rising equipment costs. The Norway Data Center Market reflects these barriers, slowing entry for smaller players. Operators balance upfront investments with long-term revenue streams. Complex permitting processes delay timely expansion. Businesses face uncertainty over cost recovery in early years. These financial hurdles restrict innovation adoption. Market leaders with capital strength dominate the competitive landscape.

Geographic And Climate-Related Constraints Affecting Infrastructure Deployment

Harsh climate conditions and limited site availability pose operational challenges. Remote areas require additional infrastructure for connectivity and logistics. The Norway Data Center Market must balance sustainability with practical deployment. Energy resources are abundant but grid reliability in remote zones is a concern. Operators must invest heavily in redundancy to ensure uptime. Environmental regulations complicate development near protected areas. Geographic constraints limit scalability in some regions. These challenges increase the complexity of expansion.

Market Opportunities

Growth In AI, IoT, And 5G Applications Opening New Investment Pathways

The market benefits from growth in AI, IoT, and 5G ecosystems. Enterprises require advanced computing to handle data-intensive tasks. The Norway Data Center Market positions itself as a hub for next-generation workloads. Operators explore modular and scalable solutions to attract global clients. Investors recognize opportunity in edge deployments. Demand for low-latency services across healthcare and telecom boosts momentum. The environment supports diversified revenue generation. Expansion of digital services creates ongoing opportunities.

Green Data Center Development Driving International Partnerships And Investments

Sustainability strategies encourage partnerships with global cloud providers and enterprises. Operators focus on low-carbon infrastructure powered by hydropower. The Norway Data Center Market gains attention for renewable-powered facilities. Global players collaborate to expand carbon-neutral projects. Investors align portfolios with ESG objectives to meet demand. Enterprises prefer providers offering strong environmental commitments. Green innovation enhances international competitiveness. These opportunities strengthen Norway’s role in the European digital economy.

Market Segmentation

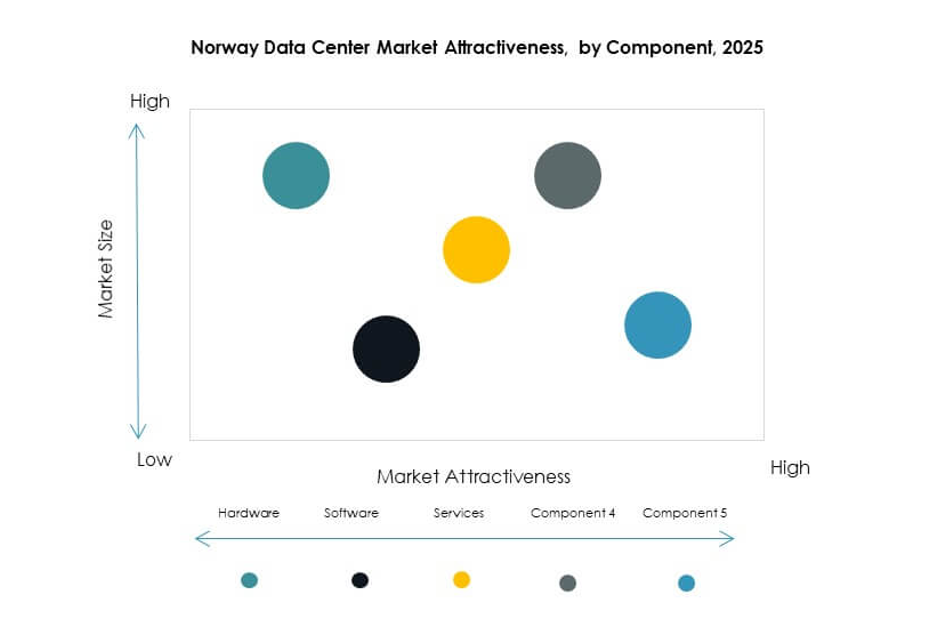

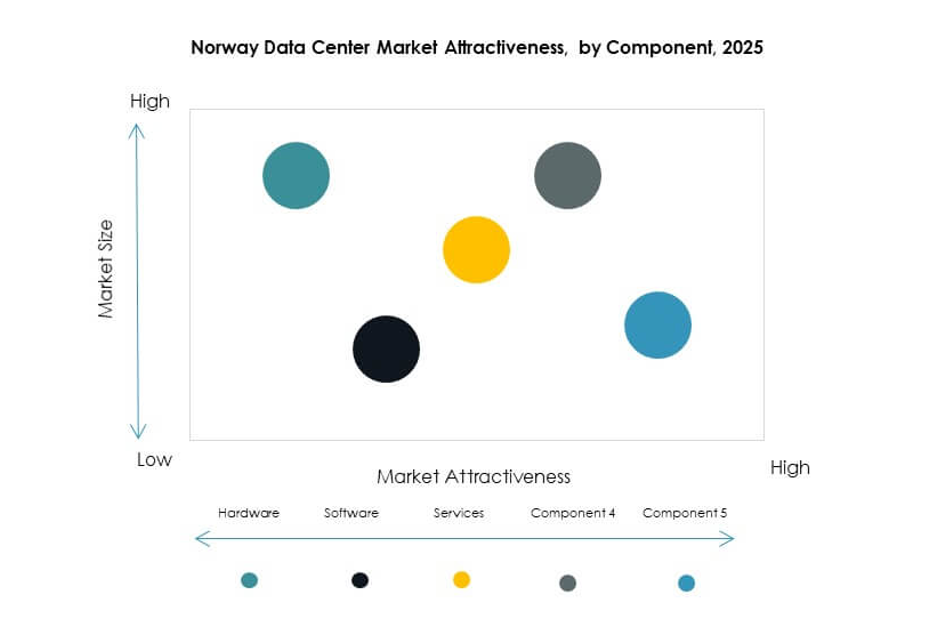

By Component

Hardware dominates with high share, driven by demand for servers, storage, and networking systems. Cooling and power systems attract investments to improve efficiency. The Norway Data Center Market sees rising adoption of DCIM software for monitoring and automation. Services such as managed and integration support enterprises with complex deployments. Enterprises combine hardware and software to ensure secure operations. Hardware remains critical as global workloads expand. Growth in services complements infrastructure buildout.

By Data Center Type

Hyperscale leads due to demand from international cloud providers. Colocation facilities attract enterprises seeking cost-effective hosting. The Norway Data Center Market also sees growth in modular and edge centers for localized needs. Enterprise facilities maintain relevance for corporate users. Mega data centers gain traction with global operators. Cloud-based Internet Data Centers provide flexibility and scalability. Diversity across types ensures a balanced industry ecosystem. Growth in hyperscale remains the strongest driver.

By Deployment Model

Cloud-based deployment dominates with strong adoption across industries. Enterprises rely on scalable infrastructure for digital operations. The Norway Data Center Market shows rising hybrid model adoption to balance flexibility and control. On-premises models continue in regulated sectors like government and defense. Cloud preference grows with expanding SaaS and AI applications. Hybrid models gain value for businesses managing sensitive data. Deployment diversity supports long-term industry growth. Cloud-based models remain at the forefront.

By Enterprise Size

Large enterprises dominate with significant investment capacity. They deploy advanced infrastructure to support high-volume workloads. The Norway Data Center Market shows rising adoption by SMEs seeking cost-efficient solutions. SMEs prefer colocation and cloud-based models for scalability. Growing digitalization in retail and healthcare boosts SME participation. Enterprises of all sizes rely on secure infrastructure. Growth in SME adoption broadens the client base. Large enterprises remain the largest revenue contributors.

By Application / Use Case

IT and telecom lead due to strong data generation and service demands. BFSI drives adoption for secure and compliant data storage. The Norway Data Center Market sees rising demand from healthcare, retail, and manufacturing. Media and entertainment require high-bandwidth capacity for streaming services. Government and defense ensure sovereign data control. E-commerce accelerates demand for scalable infrastructure. Education and utilities also adopt digital solutions. IT and telecom remain the most influential segment.

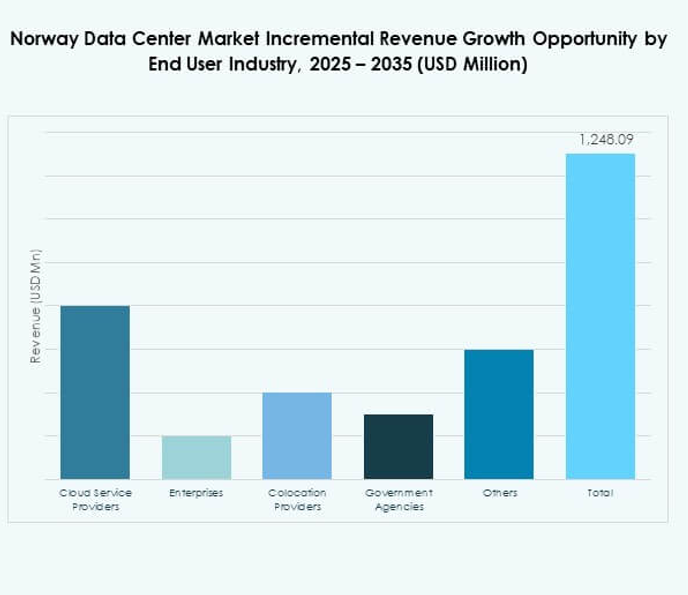

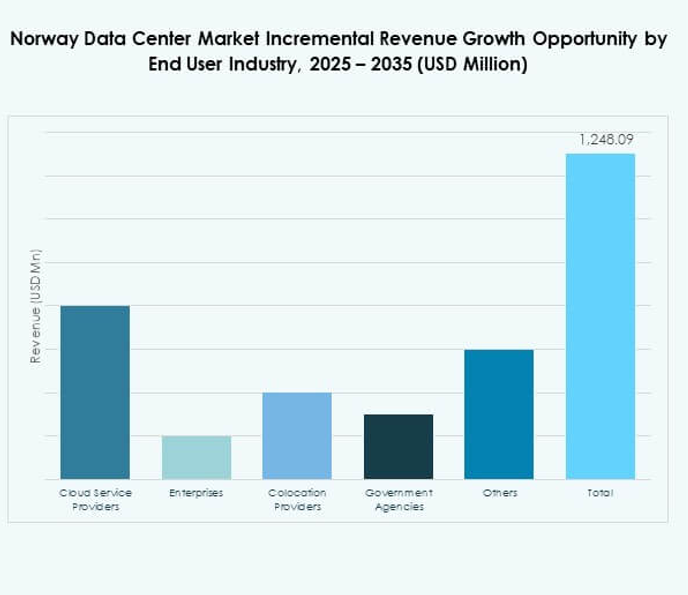

By End User Industry

Cloud service providers hold the largest market share. Enterprises contribute through direct investments in facilities. The Norway Data Center Market attracts colocation providers meeting SME and corporate needs. Government agencies emphasize security and compliance, driving demand. Global players prefer partnerships with local operators. Cloud service providers continue expanding capacity to support client needs. Enterprises diversify investments across industry verticals. Cloud remains the strongest end-user category.

Regional Insights

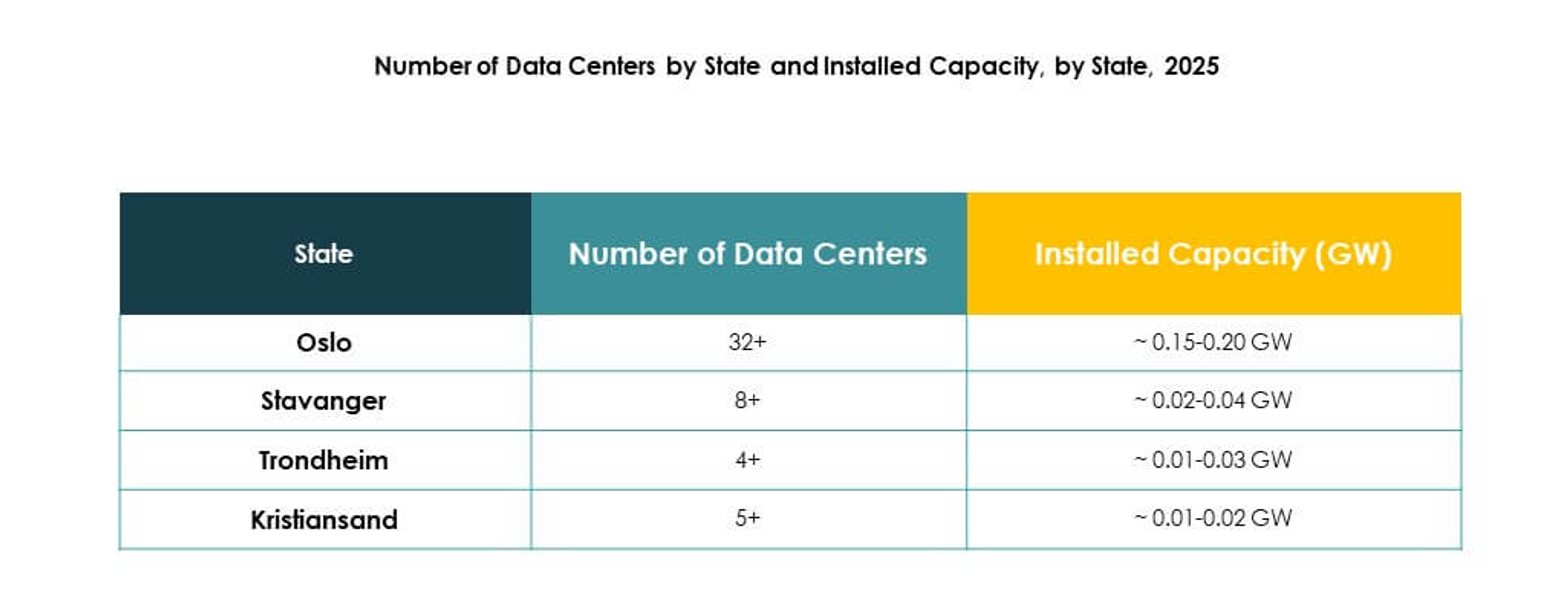

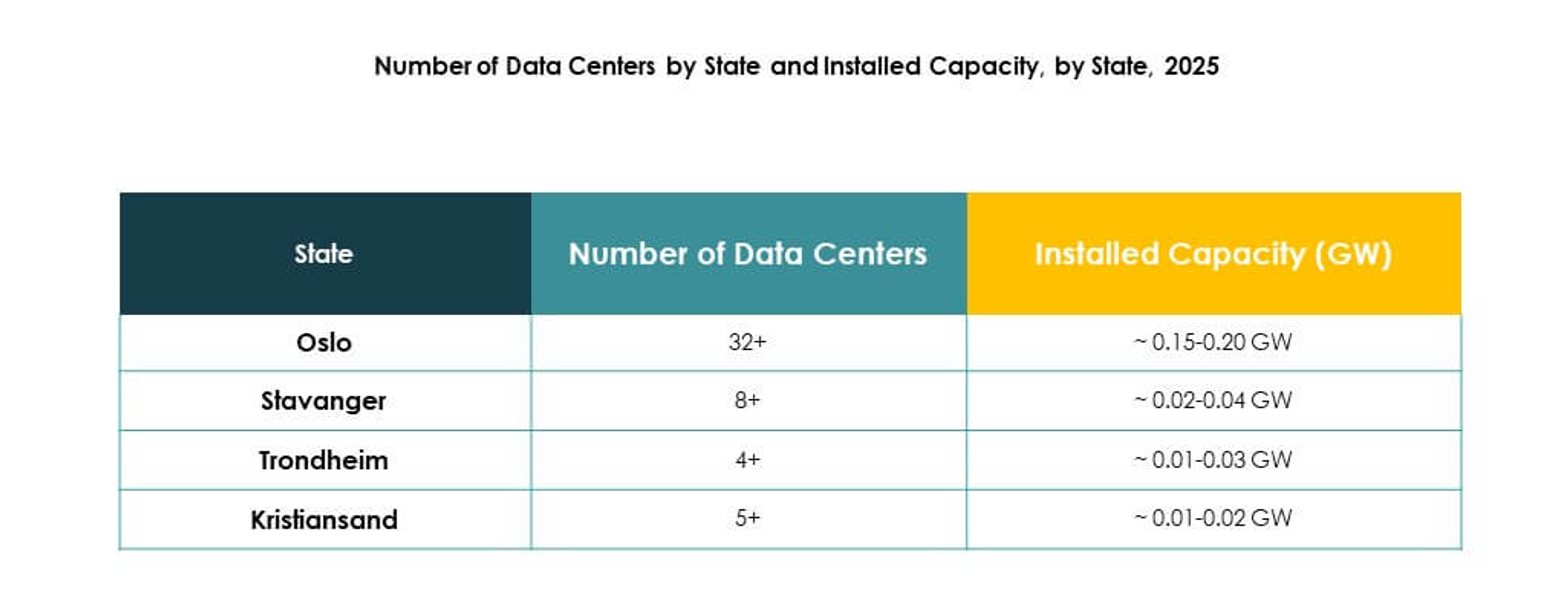

Western Norway Leading With 41% Market Share Driven By Renewable Energy Strength

Western Norway dominates with 41% share, supported by hydropower resources and advanced connectivity. The Norway Data Center Market benefits from its low-cost energy base. Enterprises prefer this subregion for sustainable operations. Major hyperscale projects continue expanding capacity. Government support for renewable integration strengthens growth potential. Investors view Western Norway as a hub for international hosting. It remains the primary driver of national market leadership.

- For instance, Green Mountain’s OSL-Hamar data center campus delivered an average Power Usage Effectiveness (PUE) of 1.2 in 2025, with TikTok committing to fully utilize 90 MW of renewable power capacity for their European storage expansion.

Eastern Norway Holding 34% Share Through Strong Business And Enterprise Ecosystem

Eastern Norway holds 34% share, driven by Oslo’s role as a corporate hub. The Norway Data Center Market benefits from enterprise proximity and telecom infrastructure. Strong presence of IT firms boosts demand for secure facilities. The region attracts colocation and enterprise deployments. Access to skilled workforce supports advanced operations. Investors view Eastern Norway as critical for enterprise-focused expansion. Its role ensures balanced market growth alongside Western dominance.

Northern And Central Norway Emerging With 25% Share Through New Investments

Northern and Central Norway hold 25% share, supported by government-backed projects. The Norway Data Center Market sees opportunities from modular and edge deployments. Harsh climates drive adoption of energy-efficient cooling solutions. Remote zones benefit from targeted connectivity upgrades. Investors support projects enhancing regional digitalization. The area positions itself as a growth frontier for future expansion. Its rising influence balances national market distribution.

- For instance, Green Edge Compute and Statkraft started construction of a new edge data center in Trondheim, with the facility designed to input up to 5 MW and plug directly into the local district heating scheme for heat reuse, beginning in 2021.

Competitive Insights:

- Green Mountain

- DigiPlex Norway

- Bulk Infrastructure

- Basefarm Data Center

- Lefdal Mine Data Center

- Equinix Norway

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Norway Data Center Market features strong competition among global hyperscale providers and domestic specialists. It benefits from a mix of sustainability-focused operators like Green Mountain and Lefdal Mine Data Center, along with global leaders such as AWS, Microsoft, and Google. Equinix and Digital Realty strengthen connectivity and colocation services, while Bulk Infrastructure focuses on large-scale industrial projects. NTT and DigiPlex reinforce enterprise solutions through reliable platforms and regional expertise. Basefarm supports mid-sized enterprises with managed services and hybrid models. Competition revolves around renewable integration, advanced cooling, and service diversity. It continues to attract investments due to Norway’s renewable energy base and growing demand for digital services, making the market highly attractive to both international and domestic players.

Recent Developments:

- In September 2025, the Net Zero Innovation Hub, Invest in Norway, and the Norwegian Datacenter Association entered into a strategic partnership to accelerate the zero-carbon transition in Norway’s data center sector. In the initial phase, the partners will launch a physical test site in Norway designed to demonstrate how surplus data center heat and renewable energy can be integrated in modular systems to capture carbon directly from ambient air, advancing Europe’s climate goals by showcasing datacenters’ energy flexibility and carbon-negative potential.