Executive summary:

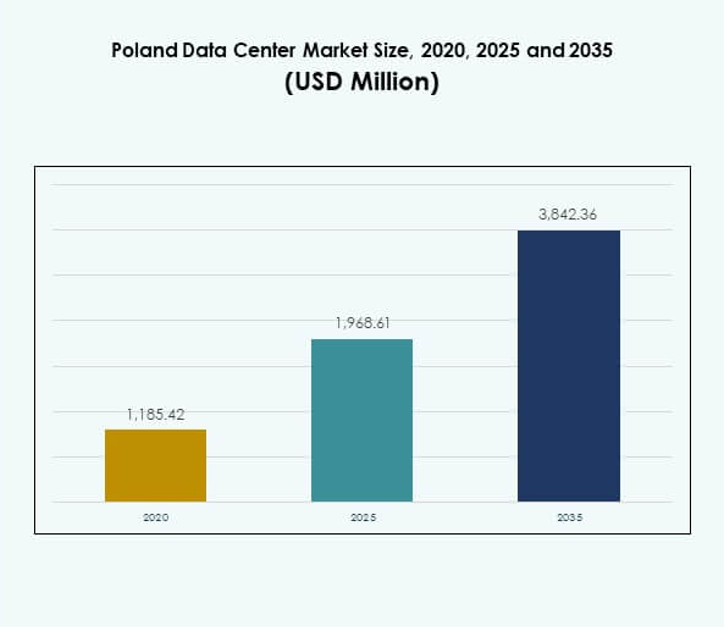

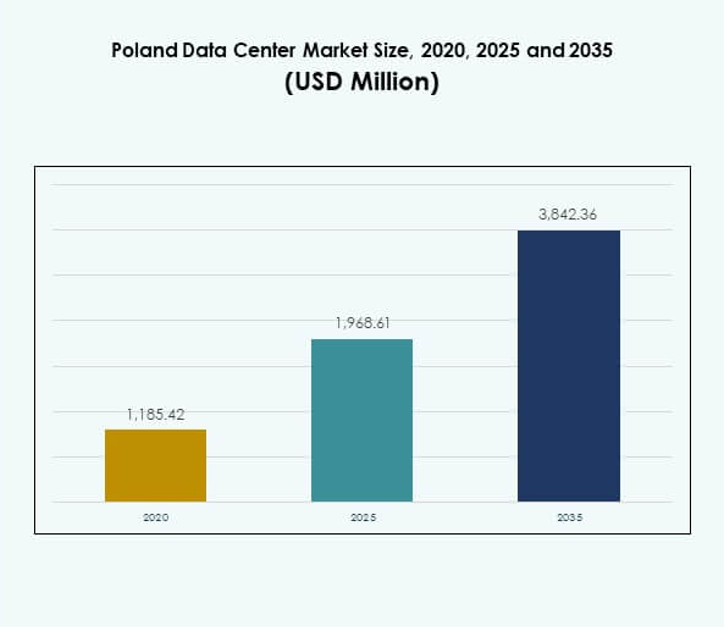

The Poland Data Center Market size was valued at USD 1,185.42 million in 2020 to USD 1,968.61 million in 2025 and is anticipated to reach USD 3,842.36 million by 2035, at a CAGR of 6.87% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Poland Data Center Market Size 2025 |

USD 1,968.61 Million |

| Poland Data Center Market, CAGR |

6.87% |

| Poland Data Center Market Size 2035 |

USD 3,842.36 Million |

Growth in the market is driven by widespread cloud adoption, expanding digital transformation, and rising demand for scalable IT infrastructure. Enterprises embrace innovation through AI, IoT, and big data, requiring reliable high-capacity facilities. Sustainability and energy-efficient technologies are reshaping operations, while advanced colocation services support SMEs. The market plays a strategic role in boosting business competitiveness, attracting investors, and establishing Poland as a regional hub for digital growth.

Central Poland dominates due to Warsaw’s role as the primary data center hub, supported by strong connectivity and enterprise concentration. Southern Poland emerges as a growth region with industrial clusters in Kraków and Katowice, creating demand for advanced digital infrastructure. Northern and Eastern areas expand with edge deployments and EU-backed digital projects. Together, these regions strengthen national capacity and position Poland as a competitive player in Europe’s data landscape.

Market Drivers

Rising Demand for Cloud Computing and Colocation Services

The Poland Data Center Market is witnessing strong growth fueled by increasing adoption of cloud services across enterprises of all sizes. Global and domestic cloud providers are investing heavily to expand their footprint and meet rising storage needs. Demand for colocation facilities is driven by SMEs seeking scalable and cost-efficient solutions. The sector benefits from the country’s growing role as a digital hub in Central Europe. Enterprises see local hosting as an opportunity to ensure compliance and low latency. Connectivity advancements strengthen market positioning. Investors recognize the sector’s strategic relevance. Businesses are increasingly prioritizing flexible and secure hosting environments.

- For instance, the first phase of Atman’s Warsaw WAW-3 data center campus launched in September 2025, delivering 14.4 MW of IT power capacity and 6,324 m² of data hall space, directly supporting the surging demand for high-density colocation and scalable cloud infrastructure services in Poland.

Expanding Digitalization and Enterprise Technology Integration

Digital transformation across industries drives the Poland Data Center Market forward with rapid adoption of advanced IT infrastructure. Enterprises integrate big data, IoT, and artificial intelligence into their operations, requiring high-performance computing capabilities. Strong growth in e-commerce, healthcare, and finance accelerates demand for advanced digital infrastructure. The government’s push for smart economy initiatives boosts investments in data-driven systems. Edge computing further supports real-time processing needs. The market gains importance as enterprises adopt hybrid strategies. Technology integration drives efficiency across multiple verticals. Businesses and investors see it as critical for long-term competitiveness.

Innovation in Energy Efficiency and Sustainable Operations

Sustainability becomes a decisive driver in shaping the Poland Data Center Market, as operators adopt energy-efficient technologies and renewable energy sources. Modern cooling systems and power optimization methods lower operating costs. Enterprises demand greener solutions to align with environmental regulations. Global investors prioritize facilities that reduce carbon footprint. Operators invest in advanced monitoring and automation to manage energy loads. Edge facilities also incorporate renewable power systems. Green certifications increase credibility with stakeholders. The market evolves with a strong focus on long-term sustainable practices.

- For instance, Beyond.pl’s Data Center 2 in Poznań maintains a Power Usage Effectiveness (PUE) of 1.2 at full capacity, making it one of the most energy-efficient facilities in Europe; the site is fully powered by renewable energy and operates at low water usage levels as confirmed in 2025.

Strategic Importance in Regional Connectivity and Business Growth

The Poland Data Center Market plays a vital role in linking Western and Eastern Europe. Its geographical location enhances cross-border data exchange, strengthening Poland’s role in regional connectivity. Enterprises establish operations here to benefit from lower costs and reliable infrastructure. Global firms view it as a gateway to expanding markets. Local operators partner with international players to scale capacity. Growth in 5G and IoT boosts relevance for digital service providers. Investors focus on Warsaw and emerging secondary hubs. The market becomes essential for regional digital transformation.

Market Trends

Growth of Edge and Modular Data Centers Supporting Emerging Use Cases

The Poland Data Center Market is experiencing a notable trend with growing adoption of modular and edge facilities. Edge centers support low-latency applications including autonomous systems, industrial automation, and telemedicine. Modular designs allow faster deployment in regional cities. These facilities attract investments from enterprises focused on real-time operations. Telecom providers expand edge networks to enhance 5G coverage. Compact and scalable solutions appeal to SMEs. Investors recognize modular models as cost-efficient alternatives. The trend creates a diversified landscape beyond traditional hyperscale builds.

Increasing Investment in AI and High-Density Computing Infrastructure

AI adoption accelerates demand for high-density servers within the Poland Data Center Market. Enterprises deploy machine learning and data analytics workloads requiring greater computing power. Operators expand capacity to support intensive GPU clusters. Advanced networking systems enable seamless processing of large datasets. AI-powered monitoring tools improve efficiency and predictive maintenance. High-density racks reshape infrastructure planning. Data-driven sectors such as finance and healthcare push demand higher. Investors prioritize projects capable of supporting large-scale AI and HPC environments.

Rising Role of Automation and Intelligent Monitoring Solutions

Automation emerges as a key trend in the Poland Data Center Market with operators adopting intelligent software platforms. DCIM solutions streamline capacity planning and fault detection. Orchestration systems improve operational reliability. Automation lowers manual intervention, reducing downtime risks. Predictive analytics enhances workload management across facilities. Enterprises seek better visibility and control over infrastructure. AI-driven monitoring strengthens security and energy optimization. Investors value automation for ensuring long-term operational resilience.

Expansion of Cross-Border Connectivity and Interconnection Ecosystems

The Poland Data Center Market witnesses expansion in cross-border connectivity as international carriers enhance fiber routes. Interconnection services support enterprises managing global digital operations. Warsaw acts as a connectivity hub with multiple subsea and terrestrial links. Partnerships between local and global operators strengthen traffic flows. Enterprises demand robust peering options to reduce latency. Increased traffic from cloud platforms fuels interconnection demand. The trend boosts Poland’s appeal as a regional data distribution center.

Market Challenges

High Energy Consumption and Pressure for Sustainable Operations

The Poland Data Center Market faces challenges with rising energy consumption that increases operating costs and environmental concerns. Operators must balance expansion with sustainability goals. Energy-intensive cooling systems add pressure on profitability. Enterprises demand renewable-powered facilities, forcing operators to invest heavily in alternatives. Regulatory pressure on emissions intensifies the situation. Smaller providers struggle to afford green transitions. The industry must find efficient solutions without reducing performance. Sustainability remains a barrier for long-term competitiveness.

Regulatory Constraints and Rising Competition from Regional Hubs

The Poland Data Center Market encounters regulatory complexities around data protection, construction approvals, and energy compliance. Compliance with EU regulations requires significant investments. Competition from established hubs in Germany and the Netherlands intensifies market dynamics. Local operators must scale capacity while maintaining cost efficiency. Global entrants put pressure on pricing strategies. Investors weigh risks related to market maturity. The industry must adapt quickly to ensure growth. Regional competition makes differentiation critical for survival.

Market Opportunities

Expanding Role of 5G and IoT Applications Across Enterprises

The Poland Data Center Market presents opportunities through deployment of 5G networks and IoT-driven business models. Enterprises need real-time data processing close to end-users. Edge facilities expand to support these requirements. Operators explore partnerships with telecom providers to scale low-latency solutions. Growing IoT in healthcare, logistics, and manufacturing fuels demand. Investors recognize potential in supporting smart city initiatives. The ecosystem creates a favorable environment for infrastructure expansion. Opportunities grow across multiple industries.

Rising Demand for Hybrid Cloud and Managed Services Models

The Poland Data Center Market benefits from enterprises adopting hybrid strategies that blend on-premises and cloud systems. Demand for managed services increases as firms prioritize cost efficiency. Operators expand portfolios with consulting and integration offerings. SMEs look for scalable models with predictable pricing. Security-focused industries drive adoption of hybrid cloud setups. Investors see managed services as a value-driven growth avenue. Growth of hybrid deployment improves flexibility for enterprises. Providers capitalize on the demand for long-term solutions.

Market Segmentation

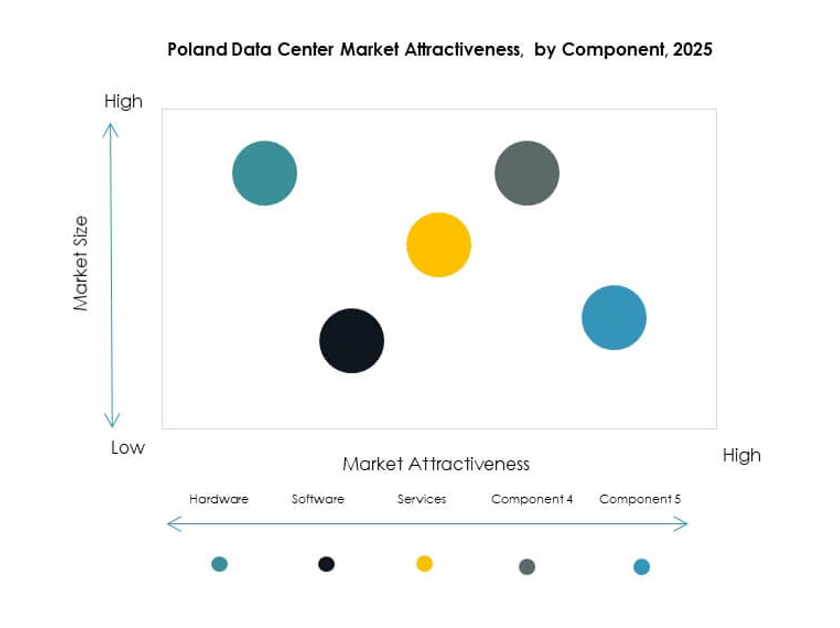

By Component

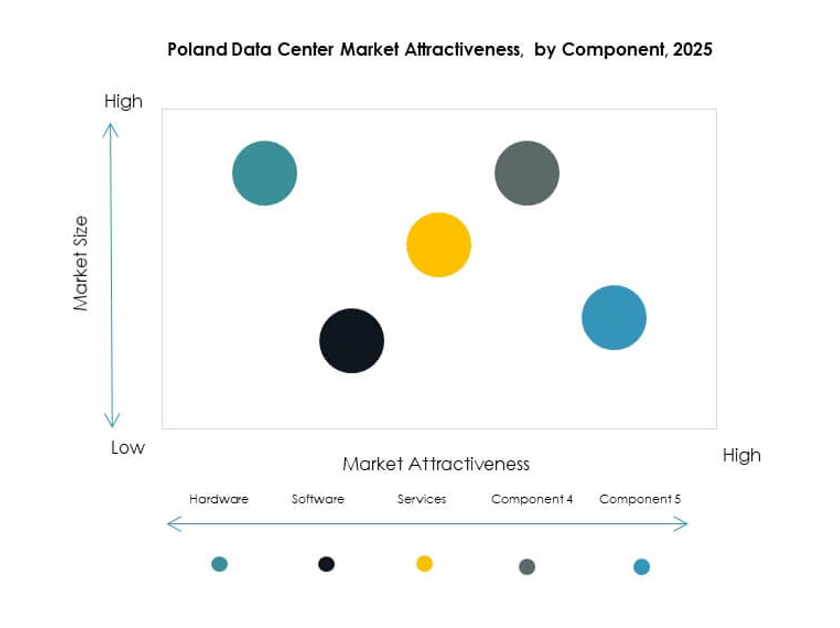

Hardware dominates the Poland Data Center Market with significant share led by servers, racks, and cooling systems. Storage and networking infrastructure also account for strong demand. Enterprises prioritize energy-efficient cooling and high-performance computing systems. Security systems gain relevance due to growing cyber risks. Software solutions including DCIM and virtualization see consistent growth. Services such as managed offerings strengthen revenue diversification. The component mix highlights hardware as the backbone of expansion.

By Data Center Type

Hyperscale facilities lead the Poland Data Center Market with the largest share due to cloud provider investments. Colocation centers follow closely, supporting enterprises seeking scalable hosting. Edge and modular designs gain traction in smaller cities. Enterprise centers cater to large corporations requiring secure setups. Cloud and internet data centers expand rapidly with global adoption. Mega centers remain limited but attract long-term investors. The type mix shows hyperscale and colocation as dominant.

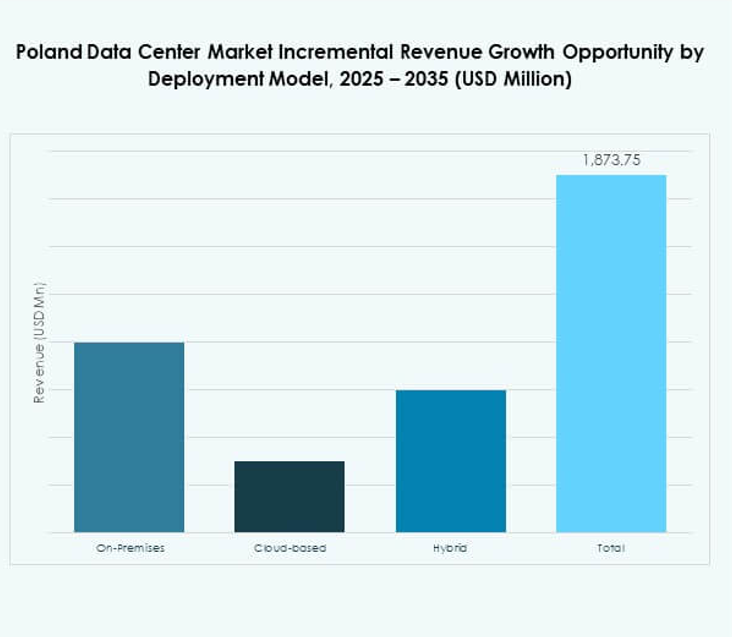

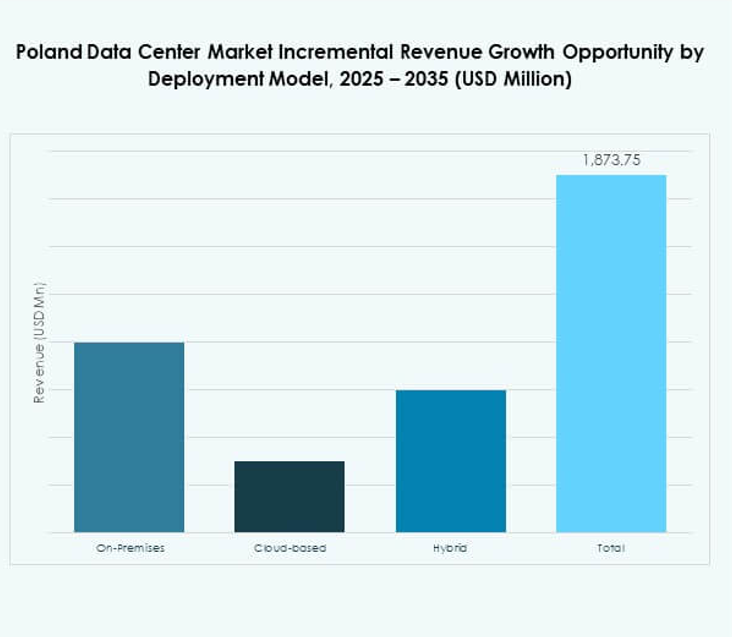

By Deployment Model

Cloud-based deployment holds the largest share in the Poland Data Center Market as enterprises move workloads to cloud platforms. Hybrid models gain traction among organizations seeking flexibility. On-premises setups remain relevant for industries with strict data regulations. SMEs adopt cloud-first strategies to reduce IT costs. Large enterprises integrate hybrid models for efficiency. Cloud platforms strengthen regional digital ecosystems. The deployment mix shows cloud-based dominance with hybrid as a fast-growing segment.

By Enterprise Size

Large enterprises dominate the Poland Data Center Market due to high IT budgets and complex infrastructure needs. SMEs contribute strongly to growth by adopting colocation and cloud-based models. Large corporations lead adoption of AI and IoT workloads. SMEs prefer scalable and affordable solutions. Both groups rely on managed services to optimize operations. Growth from SMEs diversifies demand patterns. The size mix highlights large enterprises as primary contributors.

By Application / Use Case

IT and telecom lead the Poland Data Center Market with the highest share, driven by rapid digital transformation. BFSI follows closely, requiring secure and high-performance systems. Healthcare adoption rises with telemedicine and digital records. Retail and e-commerce invest in scalable cloud infrastructure. Manufacturing requires real-time processing for automation. Media and entertainment adopt systems for content delivery. Education and utilities represent growing segments. The use case mix shows IT and telecom as dominant drivers.

By End User Industry

Cloud service providers dominate the Poland Data Center Market with large-scale investments in hyperscale facilities. Enterprises remain strong adopters of colocation and hybrid models. Colocation providers strengthen services through flexible pricing. Government agencies drive demand for secure infrastructure. Others such as educational institutions expand digital platforms. Growth is concentrated in CSP-led expansions. The end-user mix shows cloud service providers as the largest revenue source.

Regional Insights

Dominance of Central Poland with Warsaw as a Primary Hub

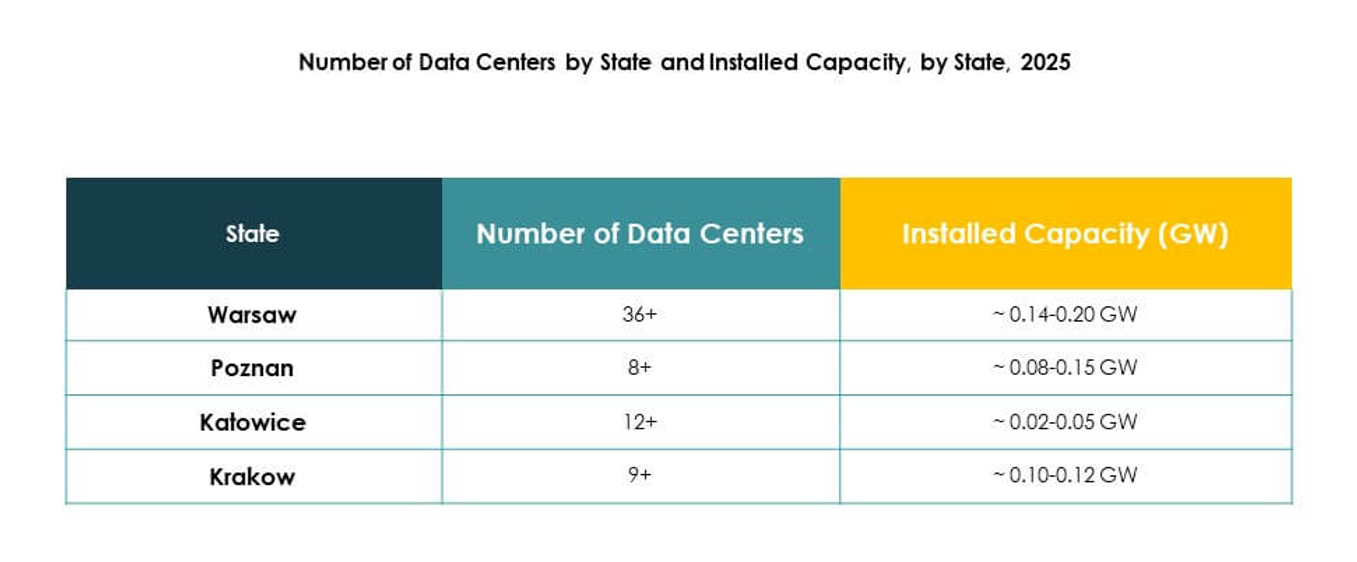

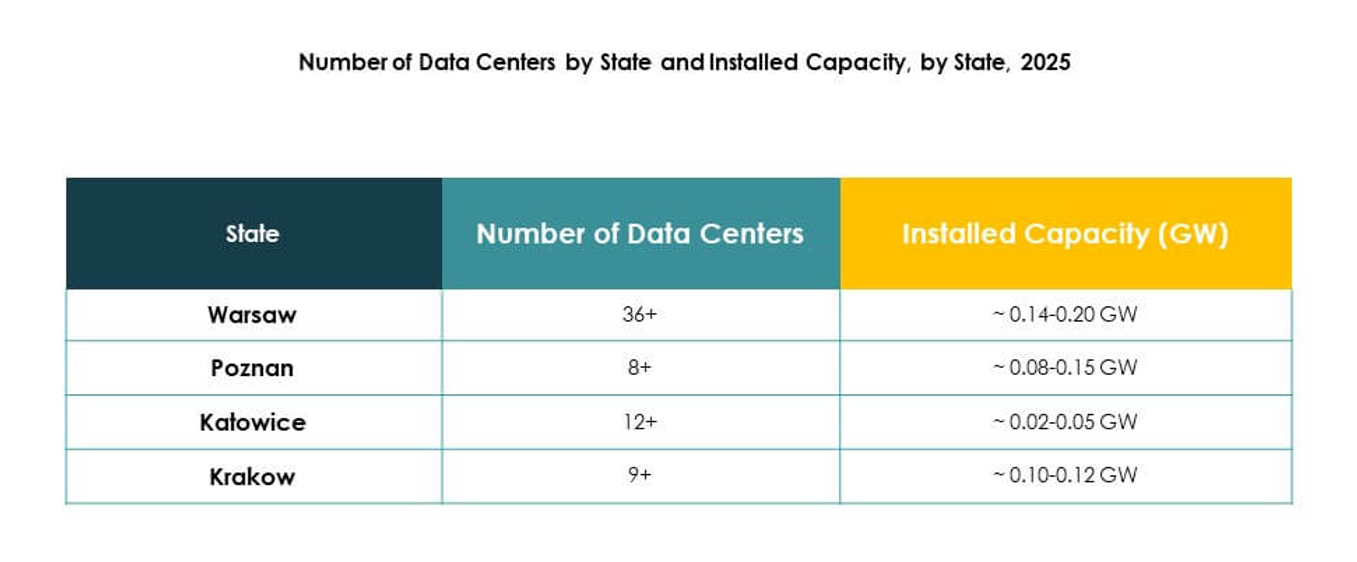

Central Poland holds 46% share of the Poland Data Center Market, with Warsaw serving as the key hub. Strong connectivity and concentration of enterprise demand drive regional growth. International operators choose Warsaw for its strategic position. Government support for digitalization strengthens the region’s infrastructure base. Enterprises rely on the capital for low-latency services. Investors prioritize Warsaw due to its established ecosystem. The region maintains leadership in overall market activity.

- For instance, Equinix operates three data centers in Warsaw, providing colocation and interconnection services, with the company confirming in its official filings that an additional facility opened in early 2025.

Emerging Growth in Southern Poland Driven by Industrial Expansion

Southern Poland accounts for 31% share of the Poland Data Center Market, driven by expanding industrial hubs. Cities like Kraków and Katowice attract investment due to enterprise clusters. Manufacturing and logistics industries require advanced digital infrastructure. Growth in IT outsourcing strengthens demand in the region. Secondary cities offer lower costs and access to skilled workforce. Investors expand capacity to meet industrial demand. Southern Poland emerges as a strong growth contributor.

Expanding Role of Northern and Eastern Poland in Connectivity

Northern and Eastern Poland together hold 23% share of the Poland Data Center Market. Gdańsk and Poznań in the north support regional connectivity through coastal and cross-border links. Eastern Poland benefits from EU-backed digital infrastructure projects. Enterprises explore edge deployments in these areas. Expansion improves regional balance and strengthens national capacity. Investors view these areas as emerging frontiers. The regions increase competitiveness within the European data landscape.

- For instance, in May 2025, Beyond.pl launched a sovereign AI Factory at its Poznań campus, built on a 100 MW data center campus platform and designed to support high-density AI infrastructure and state-of-the-art GPU computing.

Competitive Insights:

- Atman

- pl

- Data4 Group Poland

- Orange Polska

- Netia

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Poland Data Center Market features a competitive environment shaped by both local operators and global hyperscale providers. Atman, Beyond.pl, and Netia strengthen their positions through local expertise, robust colocation services, and strategic connectivity. Orange Polska leverages telecom infrastructure to deliver integrated solutions, while Data4 Group Poland expands capacity with advanced facilities. Global leaders including Digital Realty, NTT, Microsoft, AWS, and Google dominate hyperscale and cloud services, attracting large enterprises and government clients. It continues to evolve with investments in energy efficiency, interconnection ecosystems, and edge deployments. Competition intensifies as providers focus on expanding capacity, enhancing sustainability, and securing enterprise partnerships to gain market share in a rapidly growing digital economy.

Recent Developments:

- In September 2025, Atman launched its flagship WAW-3 data center campus just outside Warsaw, offering 14.4 MW of IT power capacity and 6,324 m² of colocation space, with a long-term target of reaching 43 MW across three buildings. This project marks a new high-water mark for scalable and sustainable data center technology in Poland, aimed at supporting AI workloads and cloud service growth.

- In September 2024, Beyond.pl announced plans to expand its Poznan campus to provide up to 150 MW of IT capacity, almost doubling its current capacity from 86 MW. This expansion is driven by surging cloud demand in Poland and positions Beyond.pl as the region’s first operator to deploy Azure Stack technology at scale.

- In June 2025, AWS unveiled plans to launch the AWS European Sovereign Cloud, with a new region scheduled for Poland by the end of 2025 as part of a €7.8 billion investment in European cloud infrastructure. The initiative will deliver enhanced sovereignty features and local governance for public sector and regulated enterprise customers in Poland and across Europe.

- In May 2025, NTT DATA accelerated its global data center expansion with land acquisitions in seven strategic markets including Poland, as part of a $10 billion investment for nearly 1GW of new capacity through 2027. This move supports AI-driven growth and brings scalable infrastructure to Poland.