Executive summary:

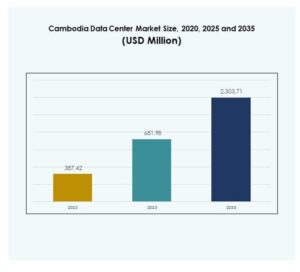

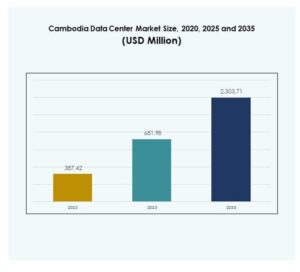

The Cambodia Data Center Market size was valued at USD 387.42 million in 2020 to USD 681.98 million in 2025 and is anticipated to reach USD 2,303.71 million by 2035, at a CAGR of 12.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Cambodia Data Center Market Size 2025 |

USD 681.98 Million |

| Cambodia Data Center Market, CAGR |

12.85% |

| Cambodia Data Center Market Size 2035 |

USD 2,303.71 Million |

Market growth is fueled by the adoption of cloud computing, AI, and IoT-driven infrastructure. Businesses are prioritizing secure data storage and faster processing capabilities to manage rising digital workloads. The government’s digital transformation agenda and foreign investments in ICT are accelerating the sector’s expansion. It plays a strategic role for enterprises by offering efficiency, cost optimization, and resilience. For investors, the market presents scalable opportunities in colocation, cloud services, and modular deployments.

Regionally, Southeast Asia leads with mature markets like Singapore and Malaysia driving advanced infrastructure and connectivity. Cambodia is emerging as a competitive hub due to growing investments in submarine cables, fiber networks, and colocation facilities. Neighboring economies strengthen demand for cross-border digital services, positioning Cambodia as a regional enabler. Its strategic location allows it to capture opportunities in cloud hosting, e-commerce, and digital trade within ASEAN markets.

Market Drivers

Rising Cloud Adoption and Digital Transformation Across Enterprises

The Cambodia Data Center Market benefits from strong demand for cloud-based services across multiple industries. Enterprises seek greater agility and scalability, pushing investments into modern cloud infrastructure. It is enabling companies to streamline operations, improve service delivery, and optimize IT costs. Cloud adoption supports business continuity, which is a critical need for sectors like BFSI, healthcare, and retail. The government’s digital economy roadmap strengthens this momentum. Rising data consumption through mobile and online platforms adds further support. Businesses view data centers as a strategic tool for innovation. Investors find the sector attractive for long-term growth.

- For instance, Huawei Cloud’s Kunpeng compute core capacity increased by 67% to 15 million in the past year, supporting over 25,000 compatible applications for cloud migration initiatives in Asia as of September 2025.

Rapid Deployment of Advanced Technologies and Infrastructure Modernization

The market is experiencing rapid integration of AI, big data, and IoT applications. It is increasing the requirement for data centers with higher computing power and reliability. Enterprises modernize IT infrastructure to manage workloads more efficiently. The government encourages foreign players to establish new facilities, boosting competition. Upgraded power and cooling systems improve energy efficiency. AI-driven monitoring tools enhance operational performance. These investments help meet international standards in security and reliability. Such modernization cements the strategic value of the Cambodia Data Center Market in regional ICT expansion.

Growing Demand for Secure Data Management and Compliance Standards

Security is a critical driver shaping the market’s future. Enterprises demand robust protection of sensitive customer and financial information. The Cambodia Data Center Market benefits from stricter compliance frameworks and regulatory oversight. It is prompting operators to adopt advanced firewalls, encryption, and intrusion detection systems. Demand for disaster recovery and backup solutions is expanding. Enterprises seek service providers who can assure business continuity under diverse conditions. Compliance with global standards enhances investor confidence. The adoption of secure and certified infrastructure drives sustainable growth.

Strategic Importance of Regional Connectivity and Business Competitiveness

Regional integration and improved connectivity elevate Cambodia’s role in Southeast Asia’s digital economy. The market provides enterprises with competitive hosting solutions closer to users. It is enabling businesses to reduce latency and improve digital service quality. Investment in submarine cables strengthens the nation’s role as a data hub. Businesses leverage Cambodia’s position for cross-border operations. Regional partnerships are supporting technology transfer and operational excellence. Enterprises use local facilities to gain competitive cost advantages. Investors see the Cambodia Data Center Market as a gateway to regional digital trade.

- For instance, the Cambodia-Hong Kong submarine optical fibre cable is scheduled for completion in July 2025, stretching 3,000 kilometers and marking the nation’s first state-owned international link, according to Cambodia’s Ministry of Posts and Telecommunications and Unicom Group.

Market Trends

Expansion of Edge and Modular Data Centers for Localized Services

The market is seeing rapid growth in modular and edge facilities. These data centers support real-time processing closer to end users. It is enabling faster service delivery in e-commerce, healthcare, and telecom sectors. Edge deployments reduce latency for cloud and IoT applications. Modular designs provide scalability for SMEs and startups. The Cambodia Data Center Market benefits from rising adoption of these cost-effective solutions. Enterprises choose them for quicker deployment and efficient resource utilization. This trend enhances service reach into regional and rural areas.

Increased Focus on Renewable Energy Integration and Sustainability Goals

Sustainability is a prominent trend influencing new investments. Operators invest in renewable energy sources to power facilities. It is reducing carbon footprints and aligning with global ESG goals. Solar-based solutions are gaining momentum in Cambodia’s energy mix. Data center operators deploy advanced cooling to minimize energy usage. The Cambodia Data Center Market aligns with corporate responsibility and green policies. Global investors favor providers adopting sustainable practices. This focus enhances brand reputation and long-term resilience.

Rising Investments in Hyperscale Facilities by Global Players

Large hyperscale facilities are gaining traction to meet expanding workloads. Global tech firms invest in Cambodia to capture regional demand. It is supporting the adoption of large-scale cloud, AI, and big data solutions. Hyperscale centers bring high computing capacity and advanced automation. Their presence boosts local digital ecosystems. The Cambodia Data Center Market is benefiting from rising foreign direct investments. Enterprises gain access to international-grade facilities and services. This strengthens the competitiveness of the national ICT infrastructure.

Shift Toward AI-Driven Automation and Predictive Operations

Automation plays a crucial role in operational optimization. AI-based solutions predict equipment failures and improve maintenance schedules. It is ensuring better uptime and cost efficiency. Automation reduces human error while improving system security. Enterprises benefit from higher reliability and data accuracy. The Cambodia Data Center Market incorporates AI to deliver smart infrastructure. Predictive analytics drive proactive capacity planning. This trend reshapes how service providers maintain operational excellence.

Market Challenges

Infrastructure Gaps and Limited Skilled Workforce in the Sector

The Cambodia Data Center Market faces challenges from underdeveloped infrastructure. Reliable power supply and high-quality fiber networks remain limited in some areas. It is restricting seamless operations of advanced facilities. The shortage of skilled professionals slows technology adoption. Recruiting experts in cybersecurity, cloud architecture, and facility management is difficult. Operators struggle with talent retention and training. These gaps hinder the ability to match regional leaders. Businesses face higher operational risks due to these constraints.

High Capital Investment and Regulatory Uncertainty in Emerging Market

Building modern data centers demands significant upfront investment. It is a challenge for local providers with limited financing. Unclear regulatory frameworks create risks for investors. Policy gaps around cybersecurity, data sovereignty, and taxation remain pressing. Operators hesitate to expand without stronger clarity. Rising costs of advanced power and cooling technologies add pressure. Competition from regional hubs like Singapore makes positioning difficult. The Cambodia Data Center Market must address these barriers to unlock full growth potential.

Market Opportunities

Rising Role of Cambodia as a Regional Digital Hub in Southeast Asia

The Cambodia Data Center Market holds opportunities from its emerging role as a regional hub. Connectivity improvements with submarine cables and cross-border partnerships support this vision. It is making the country attractive for regional cloud and colocation services. Enterprises explore Cambodia to expand closer to regional customers. Strategic location strengthens its appeal for e-commerce and gaming industries. Foreign investors recognize untapped demand. The market provides an entry point for digital trade across ASEAN.

Expansion of Managed Services and Hybrid Deployment for Enterprises

Hybrid deployment models present a major opportunity for growth. Enterprises need flexibility to combine cloud and on-premises solutions. It is driving demand for managed services that reduce IT burdens. SMEs rely on providers to support hybrid architecture efficiently. The Cambodia Data Center Market benefits from this transition. Consulting, monitoring, and automation services are gaining traction. Enterprises increasingly outsource management for cost efficiency. Service providers can capture new revenue streams by expanding these offerings.

Market Segmentation

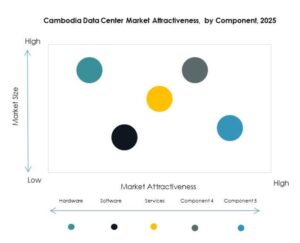

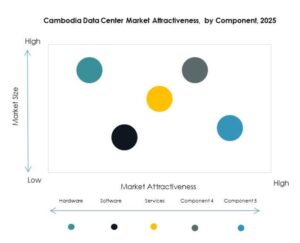

By Component

Hardware leads the segment, holding the largest share due to rising adoption of servers, networking, and cooling systems. Enterprises demand advanced racks and storage units for workload efficiency. The Cambodia Data Center Market benefits from continuous upgrades in hardware. Software solutions such as DCIM and automation tools also gain traction, enhancing performance monitoring. Services like consulting and integration expand opportunities for specialized providers. Managed services play a growing role, particularly among SMEs. Together, these components form the backbone of market development.

By Data Center Type

Hyperscale data centers dominate the market due to rising global investments. Colocation services also gain strong demand, supporting enterprises with shared infrastructure. The Cambodia Data Center Market expands through modular and edge deployments, offering scalability and low-latency services. Cloud and IDC facilities grow in relevance as more firms shift workloads online. Enterprise data centers retain a niche role in security-driven applications. Mega facilities remain limited but are gaining interest from global players. This diverse mix underpins market competitiveness.

By Deployment Model

Cloud-based deployment dominates as businesses prioritize scalability, agility, and reduced capital costs. On-premises deployment continues in industries with sensitive data like BFSI and government. The Cambodia Data Center Market also sees rapid growth in hybrid models. Enterprises adopt hybrid setups to balance compliance, cost, and flexibility. SMEs find hybrid models effective in handling evolving workloads. Cloud-native strategies drive partnerships with global providers. This mix ensures balanced growth across multiple enterprise profiles.

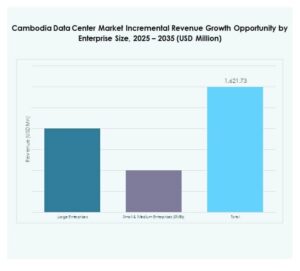

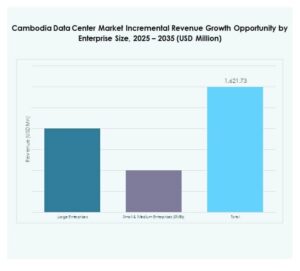

By Enterprise Size

Large enterprises hold the dominant share due to substantial IT budgets and international compliance needs. SMEs represent a high-growth segment, supported by digital adoption and affordable solutions. The Cambodia Data Center Market benefits from rising SME participation in cloud and managed services. Large enterprises invest in hyperscale and colocation centers, expanding capacity. SMEs embrace modular and hybrid deployment to meet operational requirements. Both segments contribute significantly to demand growth. Balanced adoption ensures a sustainable market outlook.

By Application / Use Case

IT and telecom dominate applications with high demand for robust data infrastructure. BFSI follows with strong need for secure and compliant services. The Cambodia Data Center Market sees retail, healthcare, and media expand their digital footprints. Manufacturing and e-commerce rely heavily on data-driven operations. Government and defense also accelerate adoption with secure and localized solutions. Education and utilities add to the market’s application diversity. This broad demand base drives continuous growth.

By End User Industry

Cloud service providers lead adoption, driving demand for hyperscale and colocation facilities. Enterprises follow closely with hybrid and modular solutions. The Cambodia Data Center Market benefits from colocation providers enabling SMEs and startups. Government agencies play an important role in public digitalization initiatives. Other users include education, research, and utilities. Growing end-user diversity enhances the resilience and attractiveness of the market. The balance of private and public demand supports sustained expansion.

Regional Insights

Southeast Asia Regional Leadership and Dominance in Market Share

Southeast Asia dominates the Cambodia Data Center Market with 46% share. Strong infrastructure in Singapore and Malaysia drives leadership. It is enabling these nations to host regional hubs for hyperscale providers. Cambodia benefits from knowledge transfer and connectivity links. Regional policies supporting data localization accelerate growth. Investors see Southeast Asia as the digital backbone of ASEAN. Cambodia strengthens its position through partnerships with established hubs.

Emerging Role of Cambodia in Strengthening ASEAN Digital Integration

Cambodia holds 28% market share, reflecting its emerging but fast-growing role. It is leveraging submarine cables and improved fiber connectivity to attract regional businesses. Local investments strengthen the presence of colocation and modular centers. Enterprises view Cambodia as a cost-effective alternative to saturated hubs. The Cambodia Data Center Market plays an essential role in bridging regional digital divides. Strategic location supports cross-border business expansion. This positioning enhances competitiveness within ASEAN’s digital ecosystem.

- For instance, ByteDC launched a new Phnom Penh data center in May 2023, achieving a built-up floor space of 81,040 square feet, a target Power Usage Effectiveness (PUE) of 1.8 or below, and becoming the nation’s first facility awarded Tier III Uptime Design Certification.

Global Partnerships and Rising Influence of International Investments

International players contribute to 26% of the regional growth share. It is driving investment in hyperscale, cloud, and hybrid infrastructure. Foreign firms view Cambodia as a strategic gateway for regional expansion. Partnerships with Japanese, Korean, and Chinese firms strengthen technical capacity. The Cambodia Data Center Market gains visibility on the global stage through such alliances. Cross-border collaborations accelerate technology transfer. This dynamic enhances Cambodia’s role in global data connectivity.

- For instance, in August 2024, Smart Axiata and CFOCN (Cambodia Fiber Optic Communication Network) announced a long-term partnership to boost fiber-optic coverage and capacity nationwide, directly supporting cross-border data transfer and setting new benchmarks for internet service quality and network reliability in Cambodia

Competitive Insights:

- EZECOM Data Center

- Microsoft Azure Cambodia

- Microsoft Azure SE Asia

- Google Cloud SE Asia

- AWS Operation Cambodia

- Telcotech

- MYTV

- Digital Realty Trust, Inc.

- NTT Communications Corporation

Competitive Insights

The Cambodia Data Center Market features a competitive mix of regional telecom operators and global cloud service providers. Local firms like EZECOM, Telcotech, and MYTV focus on colocation and connectivity services, strengthening domestic infrastructure. Global leaders including Microsoft Azure, Google Cloud, and AWS expand their reach through Cambodia to serve regional workloads and enterprise demands. Digital Realty and NTT Communications enhance competition by offering large-scale colocation and hyperscale solutions. It reflects a market where collaboration and competition coexist, with international players driving innovation while local firms address cost-sensitive enterprise needs. Strategic alliances, investments in green technologies, and deployment of modular centers define the next phase of competitive growth in the sector.

Recent Developments:

- In August 2025, Viettel IDC, Vietnam’s leading data center and cloud computing provider, officially launched its international cloud brand, Vcloudia, in Cambodia as part of its “Go Global” strategy. This launch allows Cambodian enterprises access to advanced cloud platforms and AI-based business solutions, with the first product roll-out on August 19, 2025.