Executive summary:

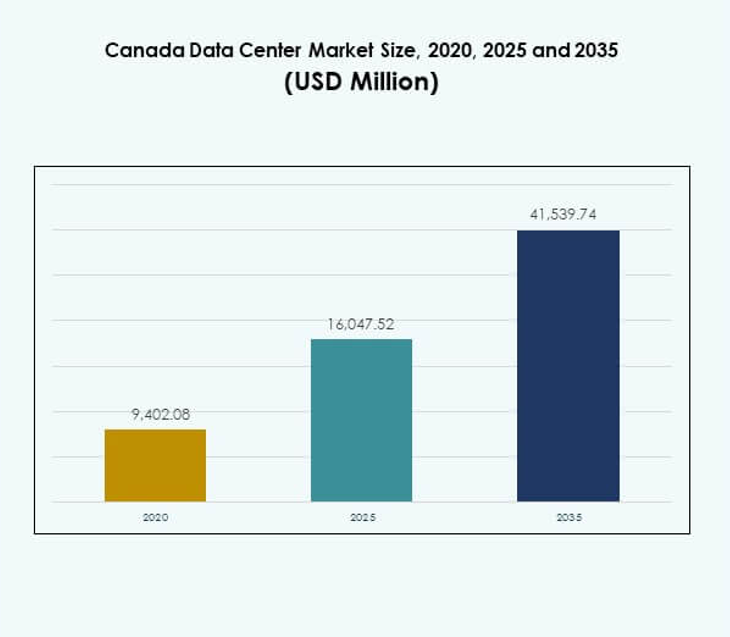

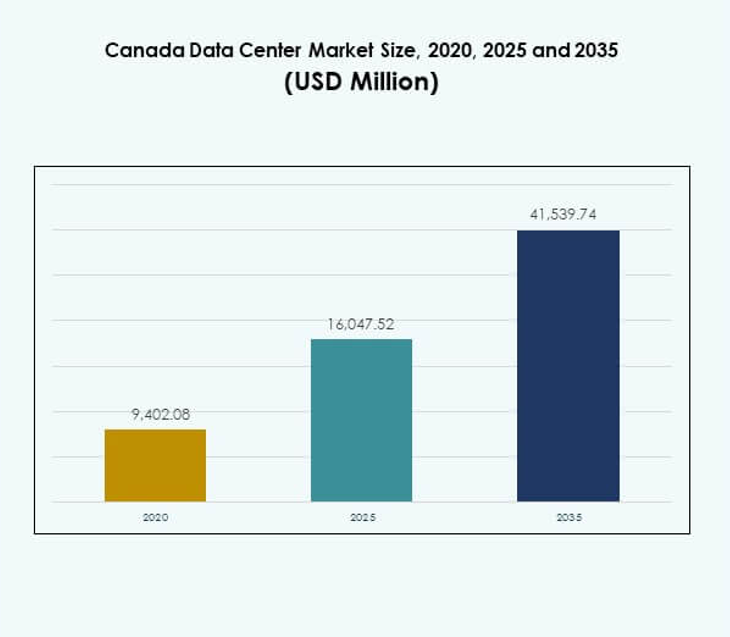

The Canada Data Center Market size was valued at USD 9,402.08 million in 2020 to USD 16,047.52 million in 2025 and is anticipated to reach USD 41,539.74 million by 2035, at a CAGR of 9.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Canada Data Center Market Size 2025 |

USD 16,047.52 Million |

| Canada Data Center Market, CAGR |

9.93% |

| Canada Data Center Market Size 2035 |

USD 41,539.74 Million |

The market is expanding with rising demand for cloud adoption, artificial intelligence, and advanced digital workloads. Businesses are investing in scalable, efficient, and secure infrastructure to support innovation and competitiveness. The shift toward automation, sustainability, and hybrid IT solutions is reshaping strategies for providers. It strengthens the market’s role as a vital hub for enterprises seeking reliable digital transformation platforms. Investors recognize it as an opportunity to capture growth from the nation’s evolving digital economy.

Regionally, Ontario and Quebec lead due to strong connectivity, skilled workforce, and renewable energy resources. British Columbia and Alberta are emerging with investments in modular and hyperscale projects to diversify infrastructure capacity. Eastern provinces contribute through government and enterprise deployments, while northern territories present niche opportunities for edge facilities. It creates a balanced growth path where central provinces dominate, western regions rise, and other areas add strategic depth.

Market Drivers

Growing Cloud Adoption and Digital Transformation Driving Core Investments

The Canada Data Center Market is expanding rapidly as enterprises accelerate cloud adoption and digital transformation. Businesses are moving critical workloads to cloud platforms that demand reliable, scalable, and secure infrastructure. Strong demand for hybrid cloud models has increased investments from hyperscale providers. Edge computing adoption is creating new opportunities for low-latency services in healthcare, telecom, and financial sectors. Enterprises view data centers as strategic assets to maintain business continuity and competitiveness. Investors are attracted to high growth prospects fueled by strong digital infrastructure needs. Innovation in service delivery and automation further strengthens market attractiveness.

Rising Integration of AI and Advanced Technologies Across Core Operations

Artificial intelligence, machine learning, and IoT integration are reshaping operational models in the Canada Data Center Market. Data centers require advanced processing power to handle AI workloads across industries. Energy-efficient GPUs and high-performance computing nodes support critical use cases. Real-time analytics and predictive modeling demand robust network capabilities. Enterprises increasingly value data centers for enabling innovation and smart automation. These advancements drive higher capacity expansion and foster demand for flexible architectures. Investors consider technology-driven centers a core part of digital economies. It positions the country as a regional leader in intelligent infrastructure adoption.

- For example, according to the International Energy Agency, global data centers could account for about 3% of worldwide electricity demand by 2030, with overall consumption nearly doubling to 945 TWh compared to 2022 levels. Rising adoption of artificial intelligence is identified as a key driver of this increase.

Sustainability and Energy Efficiency Becoming a Strategic Imperative for Operators

Green initiatives and renewable power integration are driving investment decisions in the Canada Data Center Market. Operators focus on reducing carbon emissions by adopting liquid cooling and modular energy systems. Provinces with abundant hydroelectric power attract hyperscale projects aiming for long-term sustainability. Enterprises also prioritize eco-friendly operations to align with ESG mandates. Investors support projects that integrate clean energy commitments and advanced efficiency measures. Sustainability enhances the market’s global competitiveness by drawing multinational corporations. It positions Canada as a leader in low-carbon digital infrastructure. Energy efficiency remains a decisive factor in site selection and expansion strategies.

- For example, Equinix reported achieving 96% renewable energy coverage across its global operations in 2024, supported by 1.2 gigawatts of contracted power purchase agreements for solar and wind. The company also confirmed signing 370 megawatts of new PPAs during 2024.

Government Policies and Regulatory Frameworks Shaping Industry Expansion

Supportive government initiatives and evolving data sovereignty regulations strengthen the Canada Data Center Market. Provincial authorities provide incentives for building new facilities in strategic locations. Policies mandating data localization encourage investment in secure storage within the country. This regulatory clarity reassures businesses seeking compliance with privacy laws. Enterprises benefit from reliable, regulated environments that ensure data protection. Investors gain confidence from a stable policy framework encouraging infrastructure development. It drives long-term commitments from global operators expanding local presence. Strategic collaboration between public and private sectors enhances competitiveness and accelerates infrastructure modernization.

Market Trends

Expansion of Hyperscale Data Centers to Meet Evolving Digital Demands

The Canada Data Center Market is witnessing large-scale development of hyperscale facilities by global players. Demand for cloud services and data-heavy applications is increasing reliance on hyperscale models. Operators are investing in massive capacities to serve enterprise and consumer requirements. Edge locations complement hyperscale hubs, creating a connected infrastructure ecosystem. Telecom firms and global service providers expand partnerships for advanced connectivity. Enterprises rely on hyperscale centers for agility and cost efficiency. Investors recognize these hubs as key drivers of economic and technological growth. It positions Canada as an essential hub for international digital ecosystems.

Rapid Uptake of Modular and Edge Facilities Supporting Emerging Use Cases

Enterprises require distributed, low-latency infrastructure, boosting modular and edge facility adoption in the Canada Data Center Market. Telecom rollouts of 5G networks further accelerate distributed infrastructure deployment. Edge centers play critical roles in healthcare diagnostics, IoT, and autonomous vehicle data processing. Modular designs allow flexible scaling with shorter build times. It enables businesses to respond quickly to market shifts and consumer needs. Providers integrate intelligent monitoring for greater reliability and responsiveness. These innovations enhance competitiveness across key sectors adopting real-time analytics. Investment opportunities expand in mid-sized urban hubs and remote industrial regions.

Increased Focus on Colocation and Shared Infrastructure for Cost Optimization

Enterprises are turning to colocation facilities in the Canada Data Center Market to reduce operational costs. Colocation services allow shared use of resources while maintaining high standards of security and redundancy. Smaller firms and startups benefit from scalable models that avoid heavy capital expenditures. Providers differentiate offerings with customizable power, cooling, and network packages. It drives stronger demand among retail, financial services, and digital media companies. Colocation supports enterprises seeking flexibility in hybrid and multi-cloud strategies. Investors back operators expanding regional footprints to address rising demand. Shared infrastructure remains a long-term solution for market scalability.

Adoption of Advanced Automation and Orchestration Tools Across Facilities

Operators in the Canada Data Center Market are integrating orchestration and automation platforms to boost efficiency. Automated monitoring reduces downtime risks and enhances predictive maintenance. Intelligent resource allocation improves performance across diverse workloads. Enterprises prefer facilities offering software-defined management tools. Automation allows operators to minimize human error and increase reliability. Investors view automation as a marker of future-ready infrastructure. It strengthens the industry’s position in delivering consistent service levels. Widespread adoption highlights the strategic evolution toward next-generation data center operations.

Market Challenges

High Capital Expenditure and Rising Operational Costs Restraining Expansion

The Canada Data Center Market faces challenges due to high capital intensity for building advanced facilities. Operators require significant funding for land, power, cooling, and connectivity infrastructure. Rising energy costs add pressure on margins, especially in regions with limited renewable sources. Smaller firms struggle to compete with hyperscale providers that benefit from economies of scale. It increases reliance on partnerships and joint ventures for growth. Balancing cost efficiency with technological innovation becomes difficult for mid-tier operators. Financial risk limits expansion in secondary regions. These dynamics create barriers for new entrants and delay infrastructure upgrades.

Complexity of Regulatory Compliance and Data Security Concerns Limiting Growth

Strict compliance with data sovereignty and cybersecurity regulations poses difficulties for the Canada Data Center Market. Operators must align with provincial rules that vary across jurisdictions. Ensuring adherence to privacy and security laws increases administrative and operational burdens. Enterprises demand high assurance of data protection, intensifying pressure on service providers. It challenges smaller operators lacking advanced compliance frameworks. Rising cyber threats further escalate the need for costly security upgrades. Global firms entering the market must adapt operations to local legal frameworks. Regulatory complexities extend project timelines and create uncertainty in investment planning.

Market Opportunities

Growing Role of Artificial Intelligence and Machine Learning in Service Models

The Canada Data Center Market presents opportunities with rising demand for AI and machine learning applications. Enterprises require advanced computational power and storage to process large-scale datasets. Operators can differentiate services by offering AI-optimized infrastructure. Edge integration supports real-time use cases in healthcare, manufacturing, and telecom. It positions data centers as key enablers of digital transformation strategies. Investors view AI-focused infrastructure as a high-growth avenue. Companies expanding AI-ready facilities will capture significant market potential. These opportunities reinforce Canada’s strategic position in global data economies.

Expansion of Renewable-Powered and Carbon-Neutral Facilities Creating Growth Pathways

Sustainability goals generate strong opportunities in the Canada Data Center Market through renewable and carbon-neutral operations. Hydro and wind resources provide competitive advantages for energy sourcing. Operators attract clients by aligning infrastructure with ESG priorities. Enterprises seek providers with credible commitments to low-carbon services. It fosters collaboration between governments and private firms for clean energy adoption. Investors prioritize projects integrating sustainability frameworks and cost efficiency. Growth in renewable-powered data centers enhances international competitiveness. This opens significant opportunities for long-term, responsible infrastructure investments.

Market Segmentation

By Component

Hardware dominates the Canada Data Center Market with the largest share due to rising demand for servers, storage, and networking equipment. High-performance racks, power systems, and cooling solutions drive continuous investment. Software solutions, including DCIM, orchestration, and monitoring, are gaining traction for automation. Services such as consulting and managed support expand alongside growing enterprise adoption. Hardware remains essential for scaling large facilities, while software enhances efficiency. Services play a critical role in integrating hybrid systems and ensuring operational continuity. Growth in all components reflects demand for flexible and efficient infrastructure.

By Data Center Type

Hyperscale data centers hold the dominant position in the Canada Data Center Market due to significant investments by global providers. Colocation centers support cost optimization for SMEs and enterprises adopting hybrid models. Enterprise data centers remain relevant for companies requiring control over sensitive workloads. Edge and modular facilities gain importance for low-latency services across urban and remote areas. Cloud and internet data centers expand with strong digital adoption. Mega centers deliver high capacity to meet surging AI-driven demands. Each type addresses diverse needs, but hyperscale leads due to unmatched scalability and efficiency.

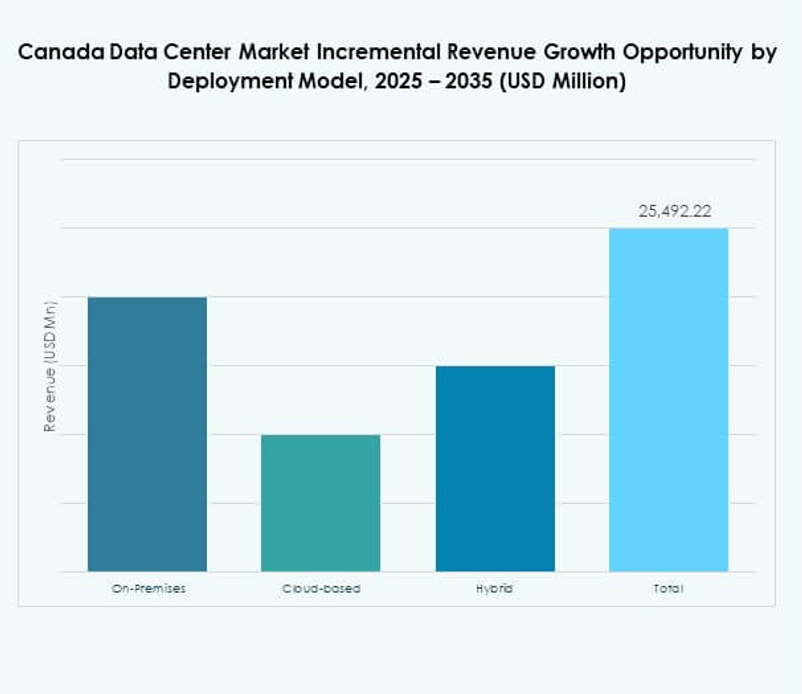

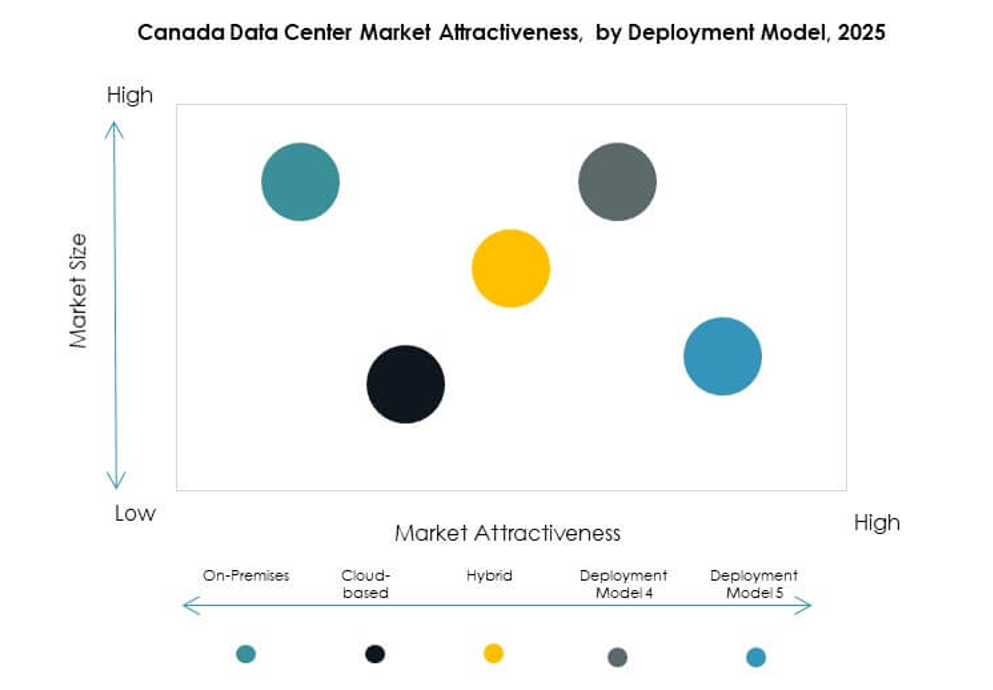

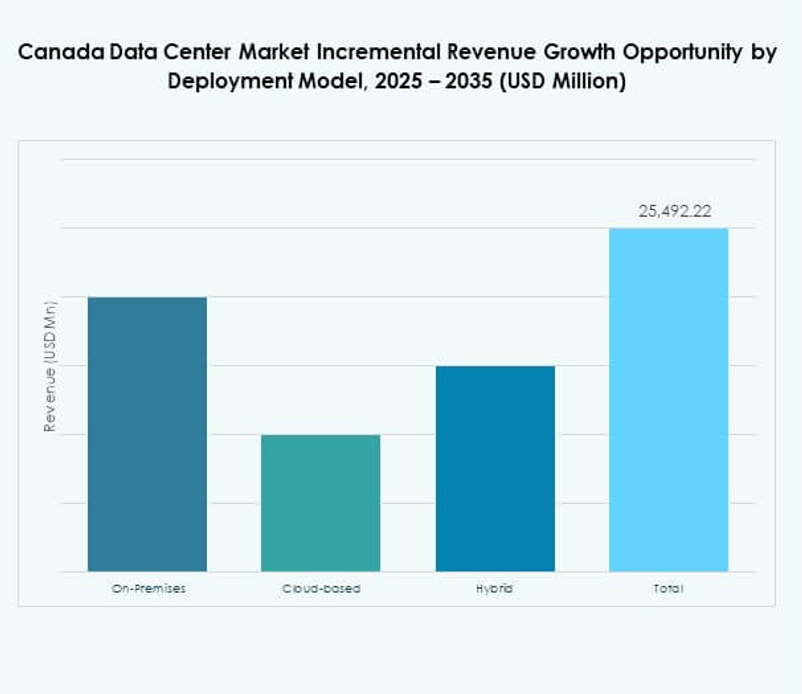

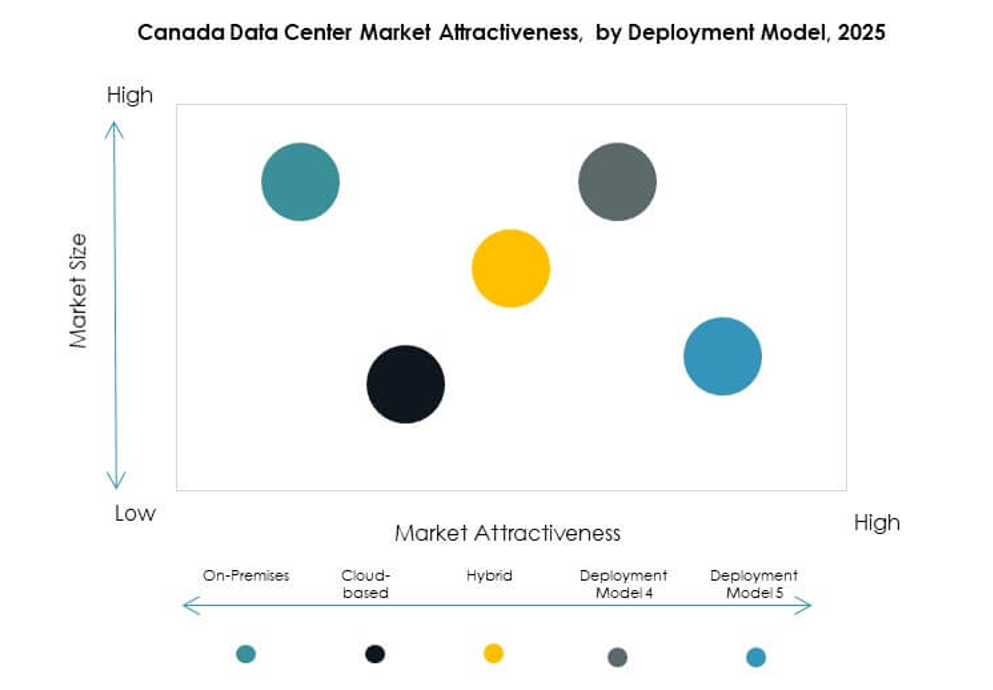

By Deployment Model

Cloud-based deployment leads the Canada Data Center Market, driven by demand for flexibility and scalability. Hybrid models are gaining strong momentum as enterprises combine on-premises control with cloud agility. On-premises facilities remain critical for sensitive industries such as government and defense. It reflects the balance between legacy investments and modern cloud-native strategies. Enterprises benefit from hybrid approaches to handle workloads across different environments. Service providers innovate to enhance migration and management capabilities. Cloud dominance reflects its alignment with digital-first business strategies. Strong hybrid growth ensures adaptability across multiple industries.

By Enterprise Size

Large enterprises dominate the Canada Data Center Market due to high resource requirements for global operations. These firms invest heavily in hyperscale and hybrid infrastructure for scalability. SMEs increasingly adopt colocation and cloud services for cost efficiency. It reflects the democratization of access to advanced digital infrastructure. Large corporations lead in AI, big data, and IoT adoption, driving capacity expansion. SMEs rely on flexible solutions to manage workloads without heavy upfront costs. Both segments contribute to market diversification. Large enterprises retain the highest share with sustained investment commitments.

By Application / Use Case

The IT and telecom sector dominates the Canada Data Center Market, reflecting its central role in digital connectivity. BFSI follows with rising demand for secure, compliant storage and transaction systems. Healthcare increasingly invests in data centers for digital diagnostics and telemedicine. Retail and e-commerce benefit from scalable infrastructure for online platforms. Media and entertainment rely on low-latency streaming supported by edge data centers. Manufacturing adopts advanced analytics and IoT, creating new capacity requirements. Government and defense demand secure facilities for national data sovereignty. Each vertical strengthens demand across diverse use cases.

By End User Industry

Cloud service providers hold the largest share in the Canada Data Center Market, driven by hyperscale expansion. Enterprises continue to invest in hybrid solutions combining cloud and on-premises capabilities. Colocation providers serve mid-sized firms and digital media companies requiring scalable models. Government agencies play a growing role in localized data storage and regulatory compliance. Other sectors, including education and energy, contribute steadily to demand. It reflects the wide adoption of digital-first strategies across industries. Cloud providers remain dominant due to sustained growth in cloud-native applications. Broader end-user diversity ensures long-term stability and expansion.

Regional Insights

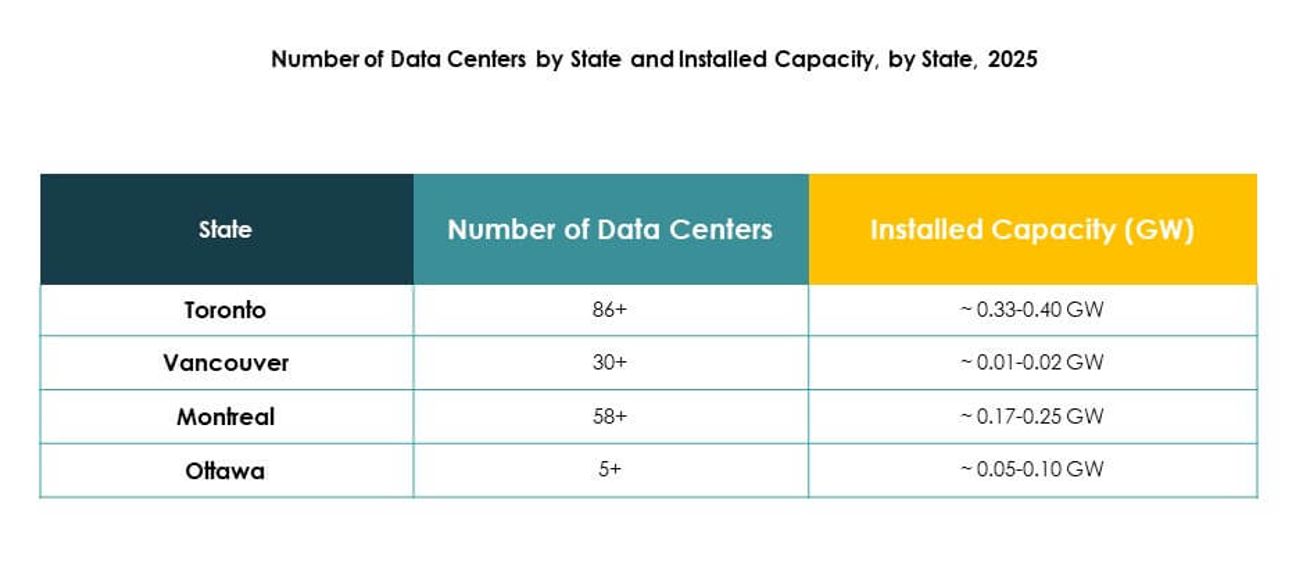

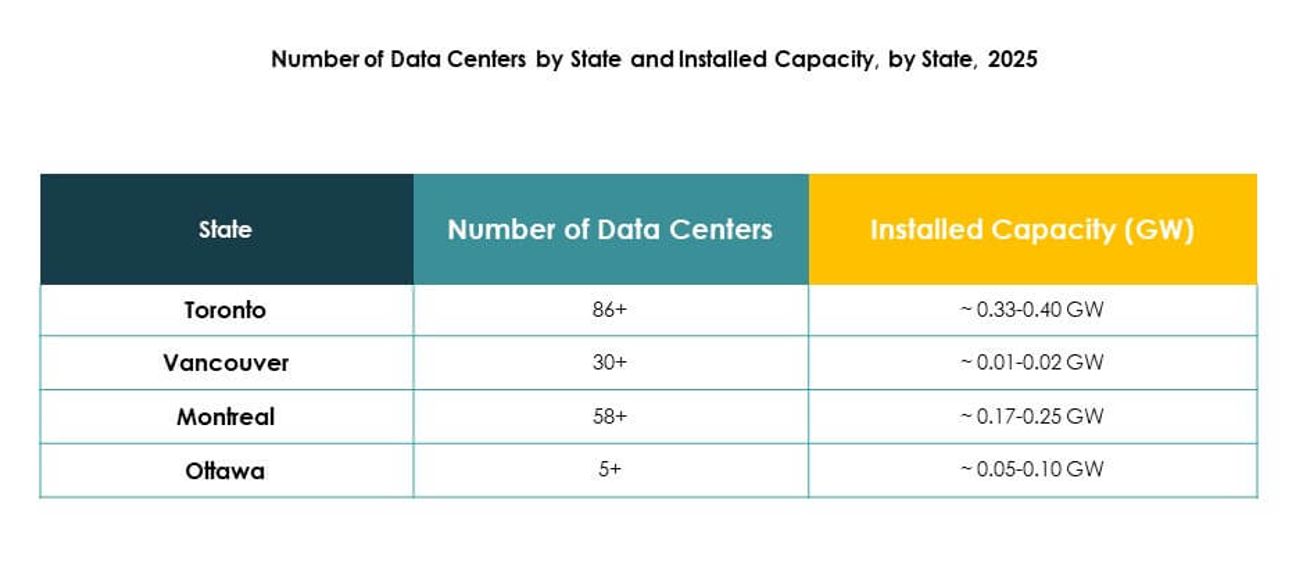

Dominance of Central Canada with Ontario and Quebec Leading the Market

Central Canada accounts for 48% share of the Canada Data Center Market, led by Ontario and Quebec. Ontario benefits from strong connectivity, skilled workforce, and major enterprise hubs. Quebec offers cost-effective hydroelectric power that attracts hyperscale operators. Both provinces serve as preferred locations for new projects due to supportive policies. It strengthens the region’s role as a central hub for North America. Investors view central provinces as the most secure and growth-ready areas. Strong infrastructure ensures the region maintains leadership in market expansion.

Emergence of Western Canada as a Growing Regional Data Hub

Western Canada holds 32% share of the Canada Data Center Market, with British Columbia and Alberta driving growth. British Columbia benefits from clean energy access and proximity to Asia-Pacific routes. Alberta leverages its large land availability and competitive energy prices for expansion. It attracts new projects from both hyperscale and modular providers. Regional governments support investment through favorable tax structures and infrastructure planning. Western provinces strengthen their role as secondary hubs complementing central Canada. Market growth in this subregion highlights diversification and distributed infrastructure resilience.

- For example, BC Hydro confirmed that the first 183 MW generating unit at the Site C Clean Energy Project entered service in October 2024. Once fully operational, the project will deliver about 1,100 MW of clean power, generating enough electricity to supply approximately 450,000 homes annually.

Steady Growth of Eastern Canada and Northern Territories in Niche Markets

Eastern Canada and northern territories together account for 20% share of the Canada Data Center Market. Eastern provinces contribute through government and enterprise projects, particularly in Nova Scotia and New Brunswick. Northern regions see limited but strategic growth due to lower land costs. It creates niche opportunities for modular and edge data centers supporting remote industries. These areas benefit from targeted investments by enterprises seeking distributed coverage. Regional growth is slower compared to central and western markets. Strategic initiatives in these regions enhance overall market stability and nationwide presence.

- For example, QScale’s Q01 Campus in Québec is North America’s first OCP Ready™ colocation facility, designed to support ultra-dense liquid-cooled workloads and leverage free cooling for about 80% of the year. The site is built to achieve a Power Usage Effectiveness (PUE) of under 1.2, reflecting its high-efficiency design.

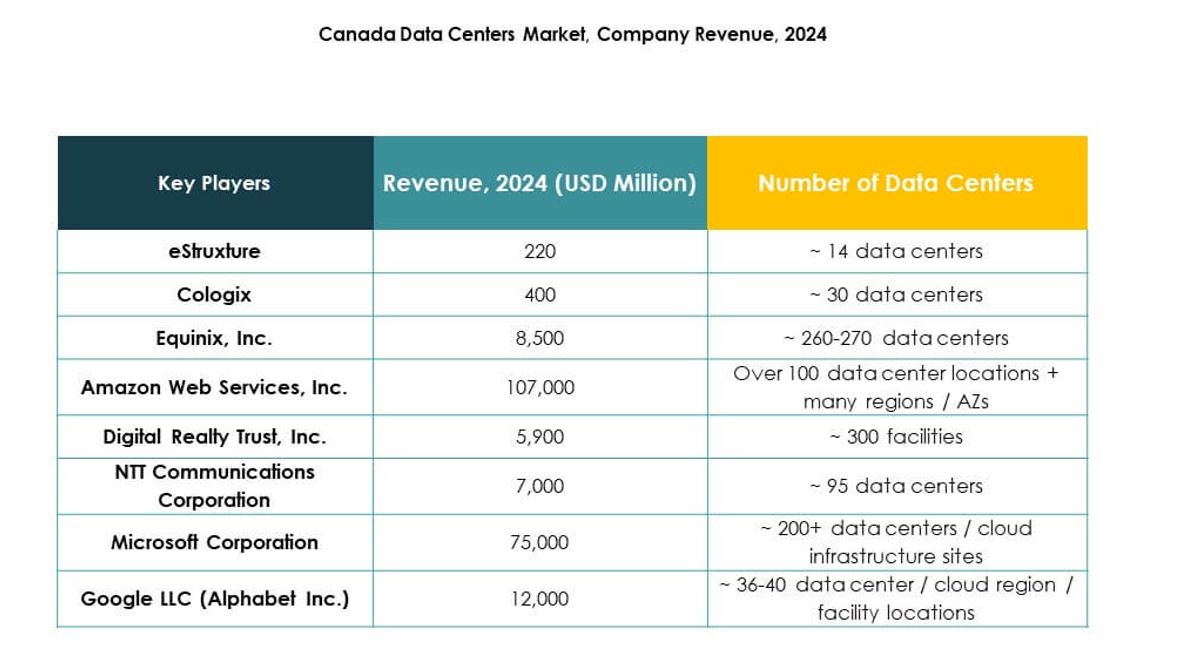

Competitive Insights:

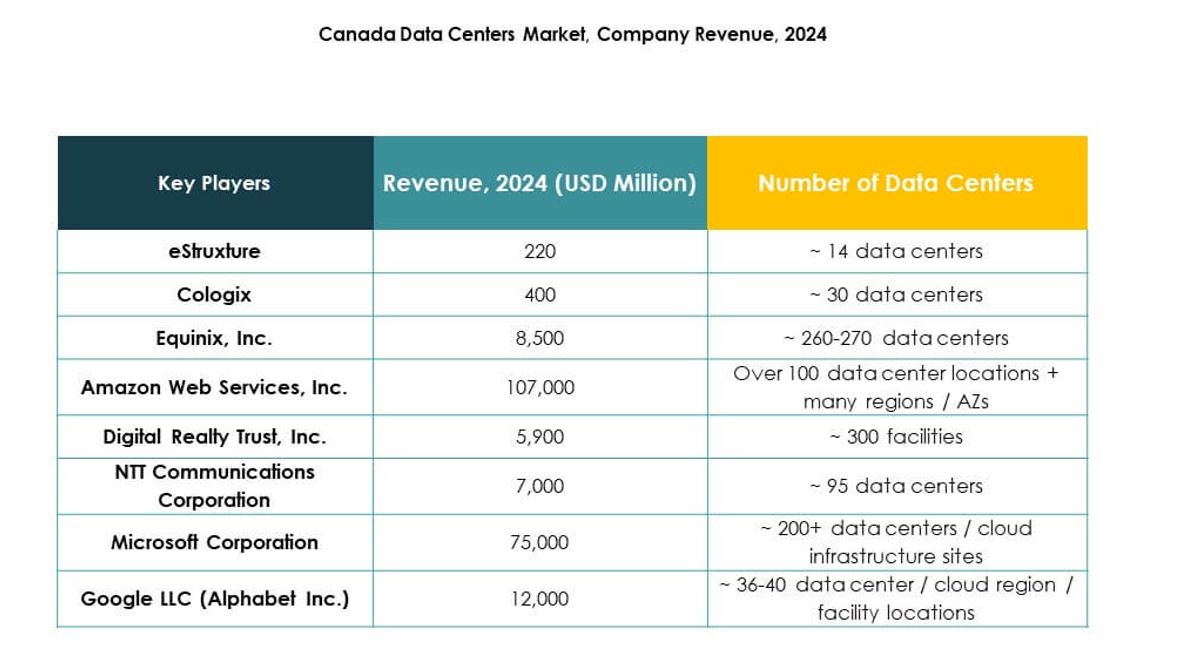

- Equinix, Inc.

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Digital Realty

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

- eStruxture

- Cologix

The competitive landscape of the Canada Data Center Market is shaped by global hyperscale leaders and strong regional operators. Equinix and Digital Realty expand their presence through large-scale facilities supported by high connectivity and efficiency standards. Cloud giants such as Microsoft, AWS, and Google drive significant growth with heavy investments in AI-ready and sustainable infrastructure. Regional providers like eStruxture and Cologix strengthen the ecosystem by offering flexible colocation and edge solutions tailored to local demand. It creates a balanced market where multinational corporations dominate capacity expansion while domestic firms enhance agility and accessibility. This mix of global and regional strengths positions Canada as a critical hub for digital infrastructure across North America.

Recent Developments:

- In September 2025, NTT Communications Corporation completed its acquisition of all remaining shares of NTT Data Group, leading to its delisting following shareholder approval. This move consolidates NTT’s presence and operational capacity for advanced IT and data center services, including a robust footprint in the Canadian market.

- In September 2025, Planisware announced the launch of two new data centers located in Montreal and Toronto, Canada, with the aim of providing enhanced localized digital infrastructure for clients across North America. These facilities are designed to deliver scalable solutions for software deployment, disaster recovery, and data security, strengthening Planisware’s presence in the Canadian market.

- In September 2025, BUZZ HPC completed the acquisition of a 7.2-megawatt data center site in the Greater Toronto Area, which will be developed into a Tier III+ facility specifically optimized for artificial intelligence workloads. This newly acquired center will support both colocation services and accelerated computing clusters, and is being developed in partnership with Bell Canada to ensure secure, sovereign access to high-power GPU resources for local enterprises and research organizations.

- In July 2025, Digital Realty Trust, Inc. formed a partnership with Oracle to help organizations accelerate hybrid IT and AI adoption through global Oracle Solution Centers. This collaboration, leveraging Digital Realty’s Canadian facilities among others, enables customers to test, validate, and deploy data-driven hybrid IT and AI solutions faster, while streamlining operations via PlatformDIGITAL®.

- In May 2023, Amazon Web Services (AWS) partnered with Equinix Canada to launch AWS Direct Connect at the Equinix TR2 IBX data center in Toronto. This dedicated high-speed network connection enables Canadian businesses to efficiently manage cloud workloads and leverage advanced technologies, including AI and machine learning, while boosting application performance and security.