Executive summary:

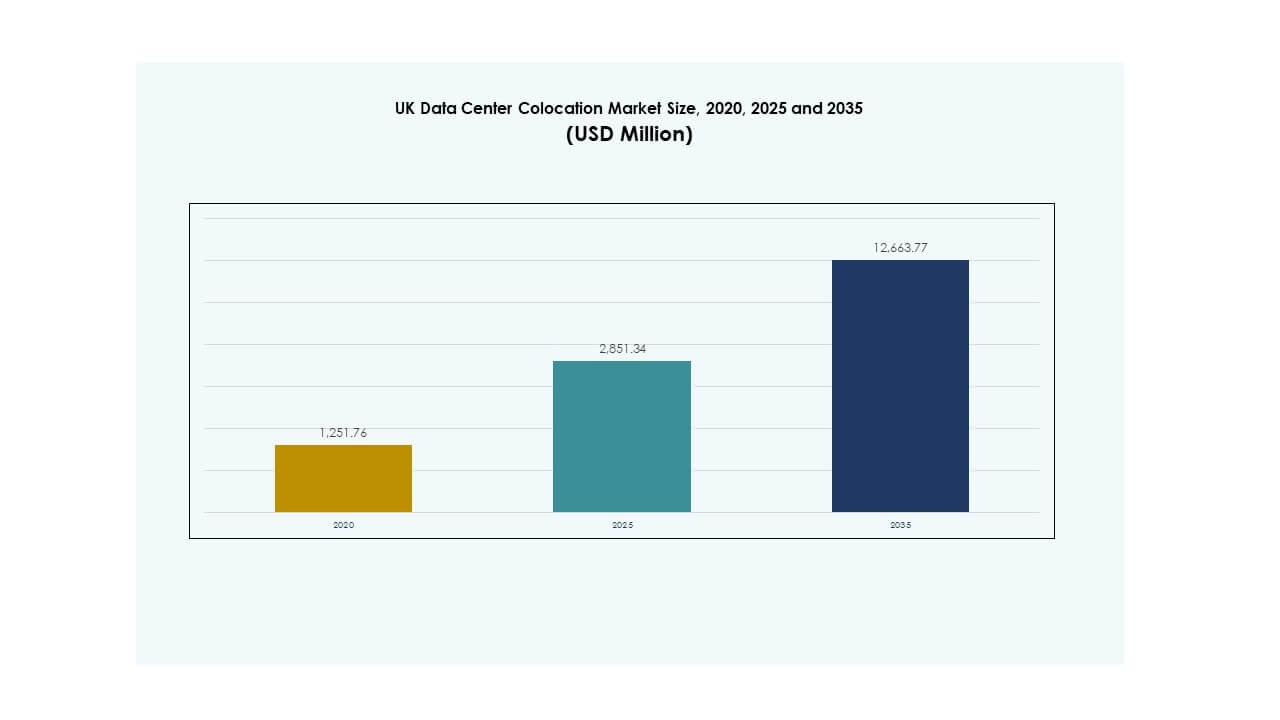

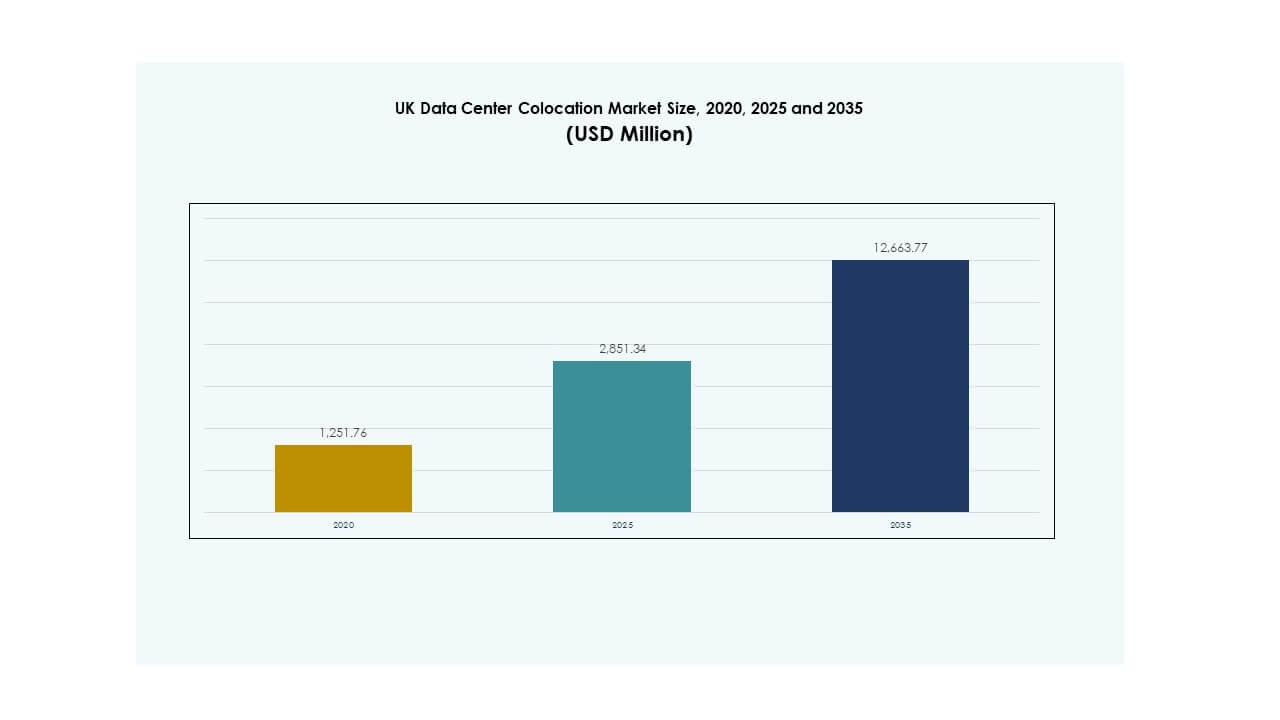

The UK Data Center Colocation Market size was valued at USD 1,251.76 million in 2020 to USD 2,851.34 million in 2025 and is anticipated to reach USD 12,663.77 million by 2035, at a CAGR of 16.00% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| UK Data Center Colocation Market Size 2025 |

USD 2,851.34 Million |

| UK Data Center Colocation Market, CAGR |

16.00% |

| UK Data Center Colocation Market Size 2035 |

USD 12,663.77 Million |

The market is expanding rapidly due to rising cloud adoption, hyperscale deployments, and increasing AI-driven workloads. Companies are shifting from traditional infrastructure to advanced colocation facilities to enhance efficiency and reduce costs. Technological innovation, sustainable energy integration, and edge computing expansion are transforming operational models. The market holds strategic importance for businesses and investors seeking secure, scalable, and energy-efficient digital infrastructure.

London and the South East remain the leading regional hubs, driven by their robust digital infrastructure and hyperscale presence. Secondary regions such as the Midlands and Northern England are emerging as attractive investment destinations due to improved power availability and growing enterprise demand. This regional diversification strengthens national capacity and supports a balanced growth ecosystem.

Market Drivers

Rising Demand for Digital Infrastructure and Hyperscale Deployments

The UK Data Center Colocation Market is expanding due to the surge in cloud adoption and hyperscale infrastructure demand. Enterprises are shifting from on-premises data centers to shared facilities to gain scalability and lower operational costs. London’s position as a financial and technological hub attracts global providers seeking efficient colocation spaces. Hyperscale operators are driving capacity additions to support AI workloads, IoT ecosystems, and high-performance computing. Advanced power distribution systems are enabling facilities to achieve higher energy efficiency and uptime. Enterprises prefer colocation for flexibility, reduced capital expenditure, and access to advanced infrastructure. Investment in next-generation network architecture is increasing rapidly. The strong digital ecosystem reinforces the UK’s status as a data center hub.

- For instance, the Equinix Slough campus, which includes LD4, LD5, LD6, and LD10 facilities, is one of Europe’s most interconnected colocation hubs, serving a large concentration of financial services firms and offering extensive fiber connectivity between its sites.

Accelerating AI Workloads and Edge Computing Adoption

The expansion of AI applications is intensifying demand for high-capacity data center environments. Colocation providers are deploying advanced cooling systems and dense power configurations to meet AI infrastructure needs. Edge computing adoption is improving latency performance and supporting real-time applications across critical industries. The UK’s robust fiber connectivity strengthens its ability to host advanced AI clusters efficiently. Global enterprises are leveraging colocation to access resilient infrastructure without heavy upfront investments. AI-driven automation is enhancing resource utilization, power efficiency, and facility management. This evolution is reshaping operational strategies for enterprises. It creates an environment where scalability aligns with innovation.

Growing Emphasis on Sustainability and Green Energy Integration

Sustainability goals are transforming data center investment strategies. Operators are incorporating renewable energy, waste-heat recovery systems, and efficient water-cooling techniques. Many providers are pursuing carbon-neutral operations through power purchase agreements and energy optimization platforms. The integration of solar, wind, and district heating networks is strengthening environmental performance. Enterprises view sustainable colocation as a strategic advantage in meeting corporate ESG goals. Government regulations on energy efficiency are encouraging rapid modernization of existing facilities. This shift aligns business growth with environmental responsibility. It establishes a competitive edge in international colocation markets.

Increasing Strategic Investments from Global Operators and Cloud Providers

International hyperscale providers are investing in new facilities to expand regional capacity. These investments are strengthening the UK’s position as a major European data center hub. Strategic partnerships between cloud providers and colocation operators are accelerating hybrid IT adoption. High-capacity builds support critical applications across BFSI, retail, healthcare, and government sectors. Providers are expanding to meet enterprise demand for secure and low-latency infrastructure. The UK’s regulatory environment and stable power supply attract long-term investors. AI and automation enhance operational efficiency and uptime. It creates a strong foundation for sustained digital infrastructure growth.

- For instance, in September 2025, Microsoft announced a $30 billion investment over four years to expand its UK cloud and AI infrastructure, including $15 billion dedicated to data center capacity. The initiative focuses on strengthening its national footprint and supporting advanced AI infrastructure through its partnership with Nscale, without naming specific hyperscale campuses.

Market Trends

Expansion of AI-Optimized and High-Density Colocation Facilities

The demand for AI-ready colocation facilities is reshaping investment priorities. Operators are designing data centers with higher power densities, advanced liquid cooling, and modular layouts. These developments are supporting workloads like large language models and real-time analytics. Edge networks and private cloud environments are increasing reliance on localized processing. Investors are focusing on future-proof designs that enable seamless scalability. Integration of intelligent power management systems improves performance predictability and reliability. Providers are aligning infrastructure with evolving enterprise computing needs. It positions the UK as a leader in AI-driven colocation strategies.

Integration of Renewable Energy to Meet ESG and Compliance Standards

The push toward carbon-neutral operations is driving major infrastructure shifts. Colocation operators are integrating renewable energy sources to meet corporate sustainability targets. Green energy adoption reduces operational costs while enhancing environmental reputation. Providers are forming long-term energy partnerships to ensure supply stability. New designs focus on energy-efficient cooling and reduced water usage. This trend is redefining operational standards in the colocation sector. Government incentives are accelerating the adoption of clean energy practices. It strengthens the sector’s alignment with ESG mandates.

Deployment of Modular and Scalable Infrastructure Models

Modular infrastructure is becoming a preferred approach for faster expansion and lower capital risk. Prefabricated modules enable flexible design and faster deployment in high-demand zones. Operators are adopting scalable designs to match rising AI and IoT requirements. Modular facilities support incremental investment strategies, improving return on capital. Enterprises benefit from faster deployment and better power utilization. This approach allows rapid capacity upgrades without major disruptions. Standardization improves interoperability across multi-site deployments. It drives cost efficiency and operational agility in the colocation market.

Strengthening Security and Compliance Frameworks for Enterprise Demand

Regulatory compliance and security frameworks are evolving rapidly. Operators are implementing zero-trust architectures and AI-powered threat detection to secure assets. Enterprises are demanding advanced compliance features to meet industry-specific requirements. Providers are adopting multi-layer security strategies including biometric access, video surveillance, and network segmentation. These frameworks enhance resilience and reduce cyber risk. Global operators are aligning with GDPR and other strict data governance rules. Enhanced compliance improves trust among enterprise customers. It reinforces the strategic importance of secure colocation environments.

Market Challenges

High Energy Consumption and Infrastructure Modernization Complexity

The UK Data Center Colocation Market faces rising energy costs and modernization challenges. High power consumption increases operational expenses and complicates grid stability. Many facilities require significant investment to adopt efficient cooling and renewable energy systems. Integrating new power management solutions involves high capital outlays. Operators struggle to balance sustainability goals with profitability targets. Legacy data centers often need structural redesigns to handle AI and edge computing workloads. This complexity delays capacity expansion and impacts competitiveness. It creates barriers for smaller providers seeking to scale operations sustainably.

Land, Connectivity, and Regulatory Constraints Impacting Expansion

Securing suitable land for large-scale deployments is becoming difficult in urban areas. Limited availability of power grid connections further slows project timelines. Strict planning regulations extend construction schedules and increase compliance costs. High real estate prices in key locations like London add further pressure. Connectivity infrastructure must expand to meet future demand but involves complex coordination. Providers face challenges in aligning expansion with environmental and zoning rules. These barriers reduce flexibility and raise investment risks. It forces operators to rethink long-term growth strategies.

Market Opportunities

Emerging Edge Ecosystems and AI Infrastructure Growth

The rapid expansion of AI-driven applications creates strong opportunities for edge colocation. New deployments near urban centers reduce latency and enhance performance for real-time use cases. Operators can offer specialized services for autonomous vehicles, telemedicine, and financial trading platforms. Enterprises are looking for flexible colocation partners to support hybrid AI strategies. This emerging demand drives new investments in high-density, distributed facilities. It enables long-term revenue opportunities for providers focused on innovation and speed.

Green Energy Transition and Sustainable Facility Development

The growing emphasis on sustainability is opening investment avenues in renewable-powered colocation facilities. Providers can differentiate through low-carbon operations and energy-efficient designs. Green investments align with global ESG mandates, attracting institutional capital. Renewable integration helps secure competitive power pricing over time. It supports operational resilience and brand reputation in a competitive market. The focus on sustainable colocation creates a strategic advantage for early movers.

Market Segmentation

By Type

Retail colocation holds the dominant share in the UK Data Center Colocation Market due to high demand from enterprises requiring flexible, scalable, and secure infrastructure. This segment benefits from growing adoption among mid-sized businesses seeking cost-efficient solutions without heavy capital investments. Wholesale colocation serves hyperscale clients with large capacity needs, while hybrid cloud colocation is gaining traction for integrated cloud strategies. The mix of flexible retail services and scalable wholesale facilities strengthens overall market maturity.

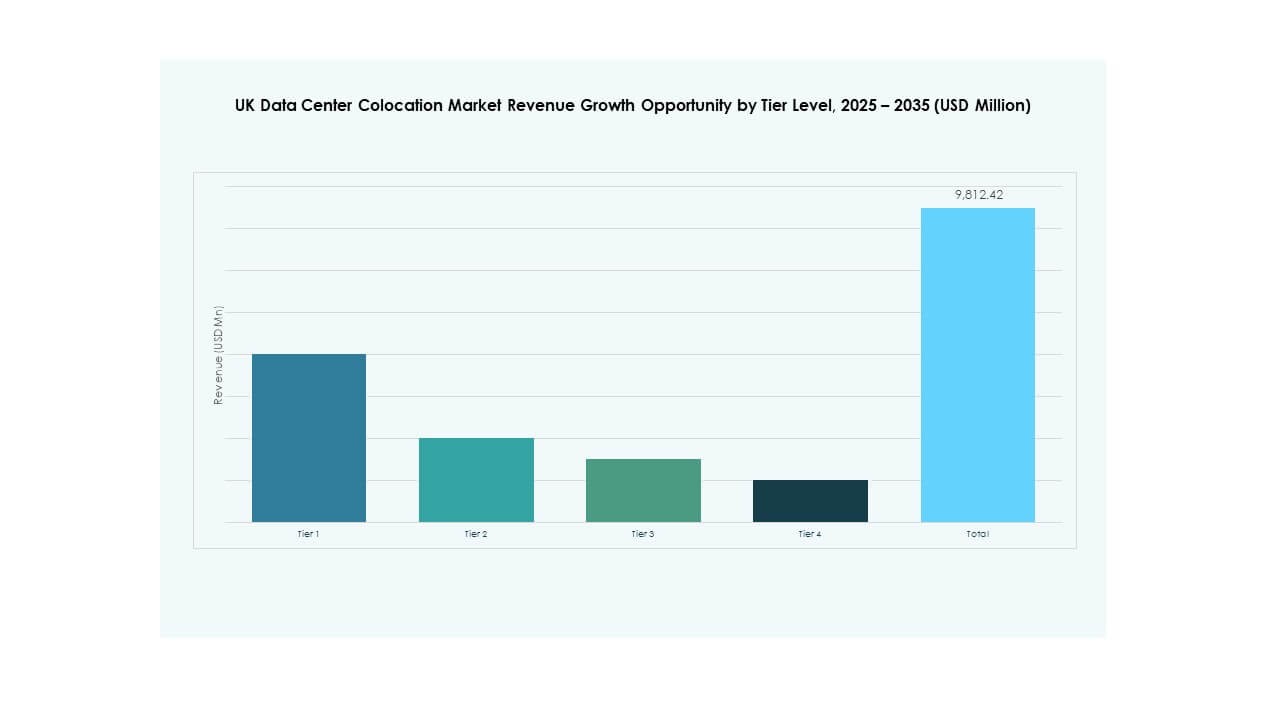

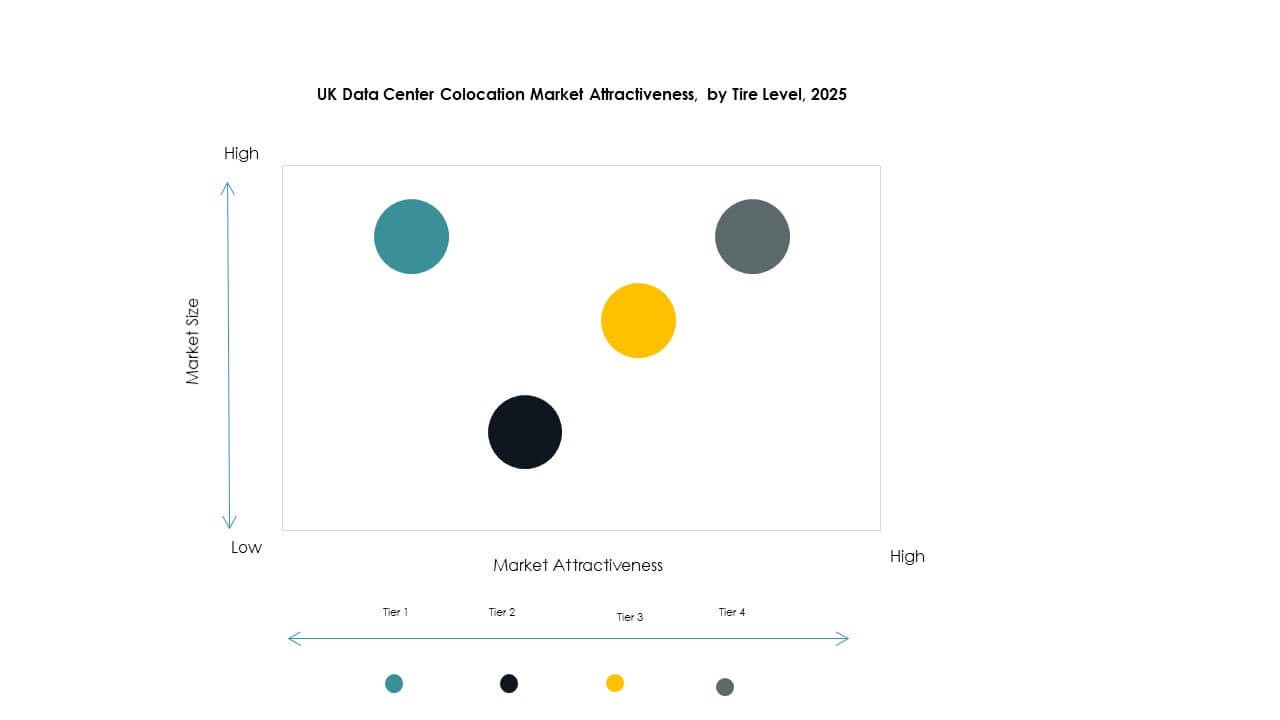

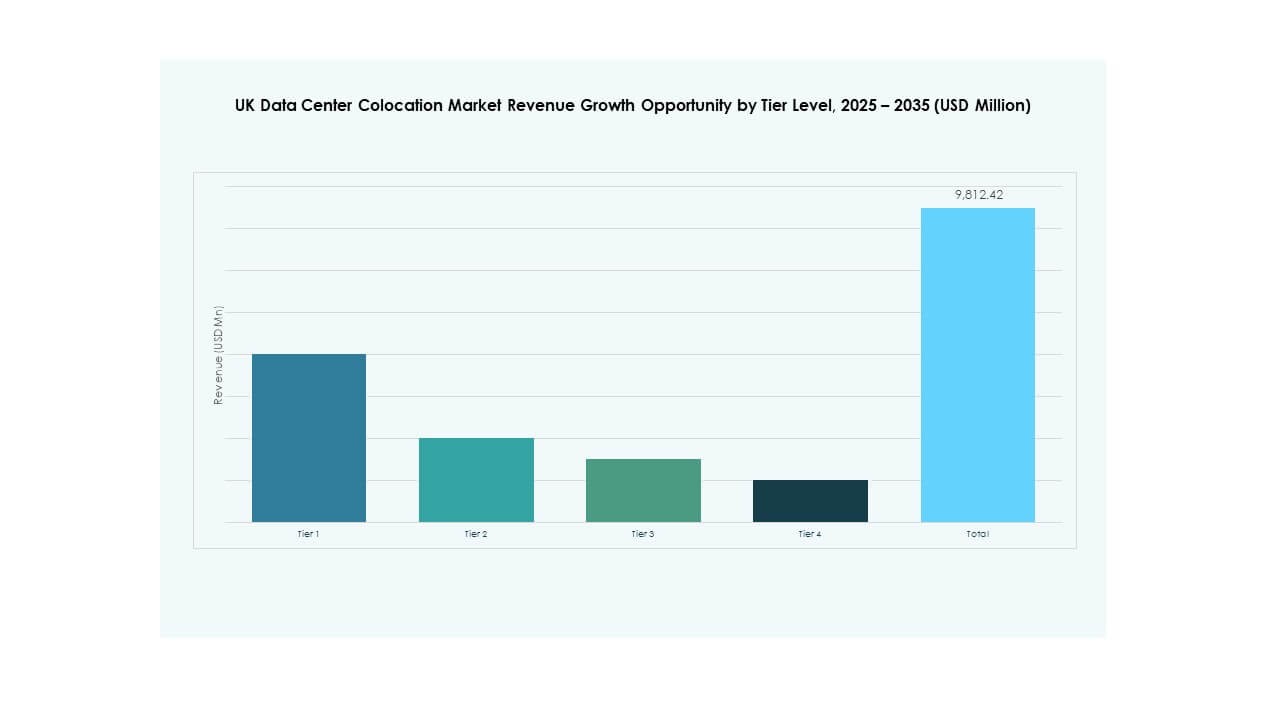

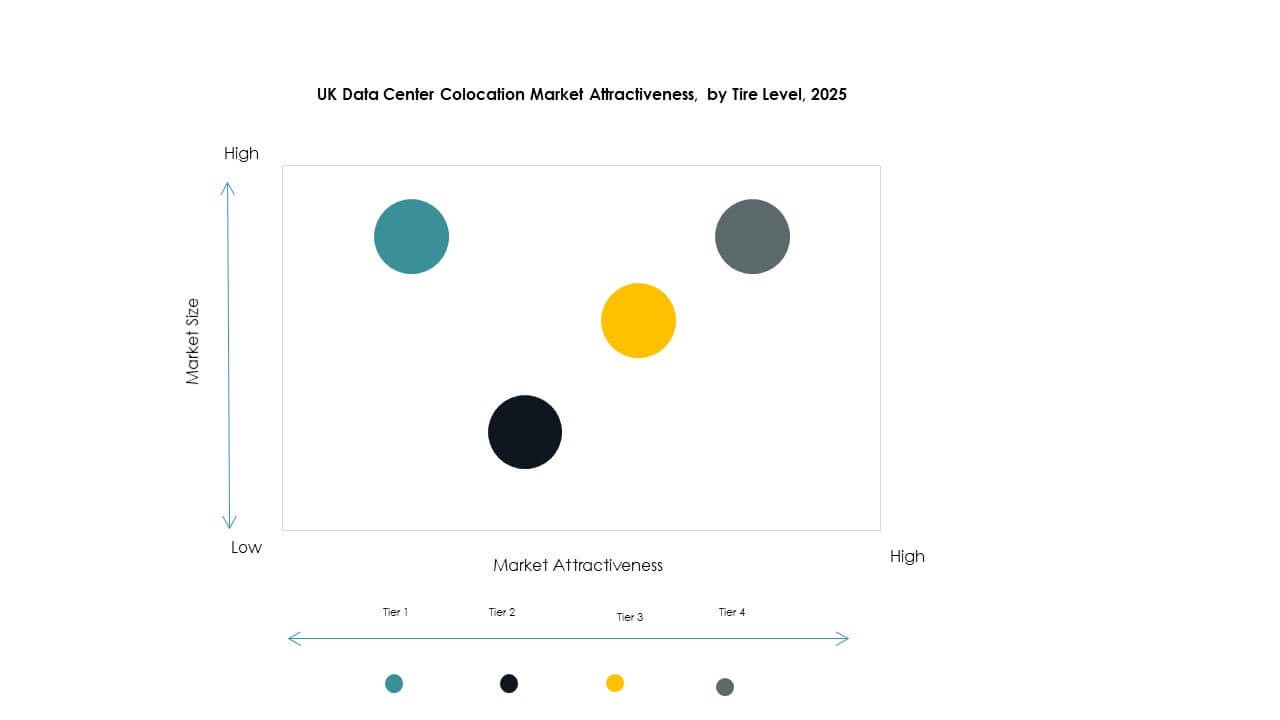

By Tier Level

Tier 3 dominates the market with strong demand for high uptime and fault tolerance. These facilities provide redundancy and operational resilience suited for enterprise workloads. Tier 4 facilities are gaining traction in critical industries requiring maximum reliability. Tier 1 and Tier 2 cater to smaller deployments and edge nodes. The growing need for mission-critical infrastructure is pushing investments toward Tier 3 and Tier 4. This structure reflects the UK’s advanced digital maturity and performance expectations from data centers.

By Enterprise Size

Large enterprises lead the market, leveraging colocation to optimize resource utilization and meet global service delivery standards. They prefer colocation to maintain control over infrastructure while reducing capital expenditure. SMEs are adopting retail colocation due to its cost-effective and scalable nature. This shift is strengthening digital competitiveness among smaller players. Growing demand from both segments is fueling new investments in regional and hyperscale facilities. It also creates balanced growth opportunities across the ecosystem.

By End User Industry

IT & Telecom represents the leading end-user segment with the largest share in the UK Data Center Colocation Market. Its growth is fueled by expanding cloud adoption, 5G rollout, and edge computing deployment. BFSI follows closely, requiring secure, low-latency infrastructure for critical operations. Healthcare and media sectors are accelerating adoption to support digital services. Retail and other industries contribute steadily, driven by e-commerce and digital transformation. This diversified demand base strengthens overall market stability.

Regional Insights

London and South East – Core Colocation Hub

London and the South East hold 52% of the UK Data Center Colocation Market, driven by hyperscale investments and dense connectivity infrastructure. The region hosts major cloud providers and financial institutions, creating steady demand for low-latency facilities. Strong fiber connectivity and international links enhance its strategic position in the European market. London’s mature digital ecosystem attracts both domestic and global enterprises. The region benefits from reliable power availability and proximity to global exchange points. It remains the central growth engine for colocation expansion.

- For instance, Equinix’s Slough data center campus, which includes the LD6 facility, is a major interconnection hub offering low-latency connectivity of approximately 4 milliseconds to Frankfurt and 30 milliseconds to New York, supported by a robust dark fiber network linking multiple buildings on the site.

Midlands and Northern England – Emerging Growth Corridors

The Midlands and Northern England account for 31% of the market share, with rising investments in edge and enterprise colocation. Cities like Manchester, Birmingham, and Leeds are becoming strategic nodes for secondary deployments. Affordable land and supportive government policies are encouraging new builds. Improved power availability and connectivity infrastructure enhance their appeal. Providers are targeting these regions to balance capacity across the country. It strengthens overall network resilience and supports distributed infrastructure strategies.

Scotland, Wales, and Other Regions – Strategic Edge Nodes

Scotland, Wales, and other regions hold 17% of the market, focusing on niche deployments and edge computing. These areas are attracting data center investments through renewable energy availability and lower land costs. Government incentives are fostering growth in sustainable colocation projects. Operators see these regions as critical for improving geographic diversity. The strategic placement of facilities enhances coverage for latency-sensitive applications. It complements major hubs and creates a more balanced national infrastructure network.

- For instance, the Vantage CWL1 campus in Cardiff, Wales, offers up to 148 MW of IT power and is powered by 100% renewable energy, serving major hyperscale and enterprise customers.

Competitive Insights:

- Virtus Data Centres

- Global Switch Holdings Limited

- Kao Data Ltd

- Ark Data Centres

- Amazon Web Services (AWS)

- Google Cloud

- China Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The UK Data Center Colocation Market features a mix of global hyperscale providers and established domestic operators competing through capacity expansion, advanced infrastructure, and sustainable energy strategies. Equinix, Digital Realty Trust, and Global Switch dominate with extensive interconnection ecosystems and strong network density. Virtus, Ark Data Centres, and Kao Data strengthen domestic capacity through high-efficiency facilities and strategic land acquisitions. Hyperscalers like AWS and Google Cloud focus on hybrid and edge deployments to serve enterprise and AI workloads. Telecom operators and infrastructure specialists are expanding through strategic partnerships and modular buildouts. It is defined by intense competition, technological upgrades, and growing emphasis on energy efficiency.

Recent Developments:

- In October 2025, Colt Data Centre Services (Colt DCS) announced its plans to develop three new data centers in Hayes, UK, on a land parcel that was previously occupied by a retail park, marking a significant expansion of its colocation footprint in the region.

- In September 2025, Kao Data unveiled plans for the development of two new data centers at its Harlow campus, directly responding to rising demand for AI and cloud-ready infrastructure in the UK. The company has also expanded its strategic footprint with new projects in Manchester and by securing a major customer contract with UK cloud provider 20i earlier in March.

- In September 2025, BlackRock Inc. revealed its intention to invest $678 million in a new venture targeting the UK data center market, adding substantial financial muscle for new colocation builds and upgrades within the country.

- In August 2025, private equity firm Warburg Pincus joined SC Capital Partners as they pursued a potential acquisition of Global Switch Holdings. The proposed deal, valued between $6 billion and $7 billion including debt, comes as Global Switch’s owners seek new opportunities for their extensive European data center portfolio, which includes UK facilities.